Hydrofluoric Acid Market

Hydrofluoric Acid Market by Grade (AHF, DHF (above 50% concentration), DHF (below 50% concentration)), Application, and Region (Asia Pacific, North America, Europe, South America, Middle East & Africa) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

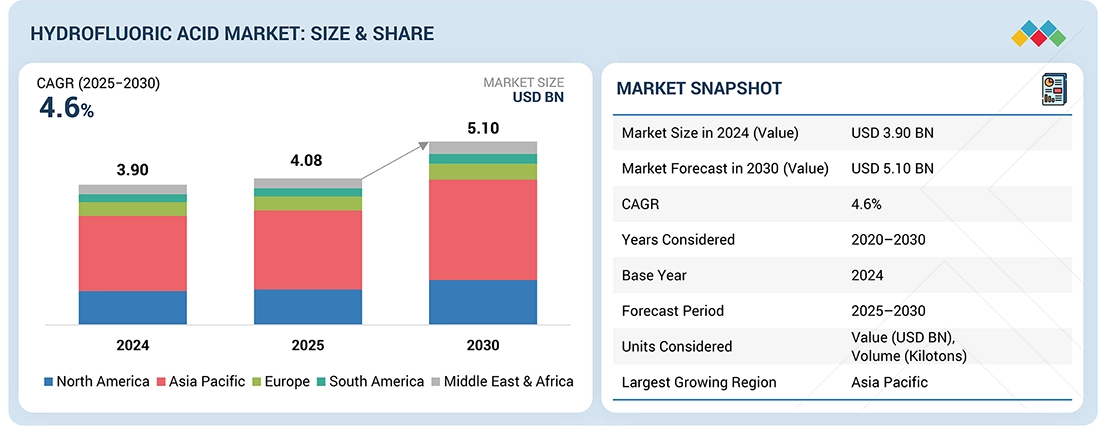

The hydrofluoric acid market is projected to reach USD 5.10 billion in 2030 from USD 4.08 billion in 2025 at a CAGR of 4.6%. The market’s growth is supported by the rising demand for fluorine compounds; the use of hydrofluoric acid in refrigerants, hydrofluorocarbons, and hydrofluoroolefins; and growing industrial applications of HF. Moreover, increasing demand from the semiconductor industry has helped drive the market.

KEY TAKEAWAYS

-

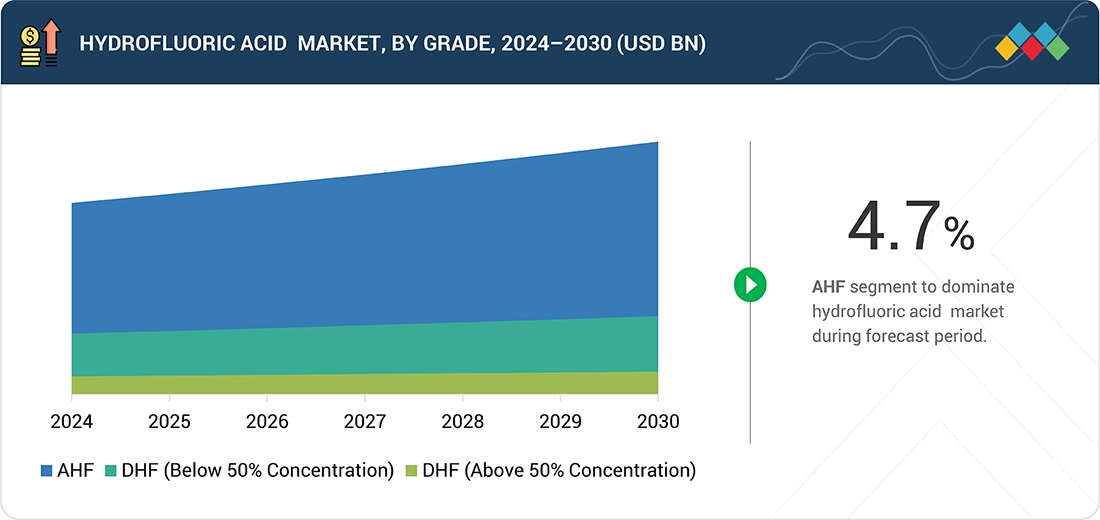

BY TYPEThe hydrofluoric acid market on the basis of grade includes AHF, DHF (Below 50% Concentration), and DHF (Above 50% Concentration).

-

BY APPLICATIONBy application, the market covers production of fluorocarbons, production of fluorinated derivatives, metal pickling, glass etching and cleaning, oil refining, production of uranium fuel, and other applications.

-

BY REGIONThe hydrofluoric acid market covers Europe, North America, Asia Pacific, South America, the Middle East, and Africa. Asia Pacific is expected to hold the largest market share, as the hydrofluoric acid use is growing due to electronics manufacturing and rising appliance sales.

-

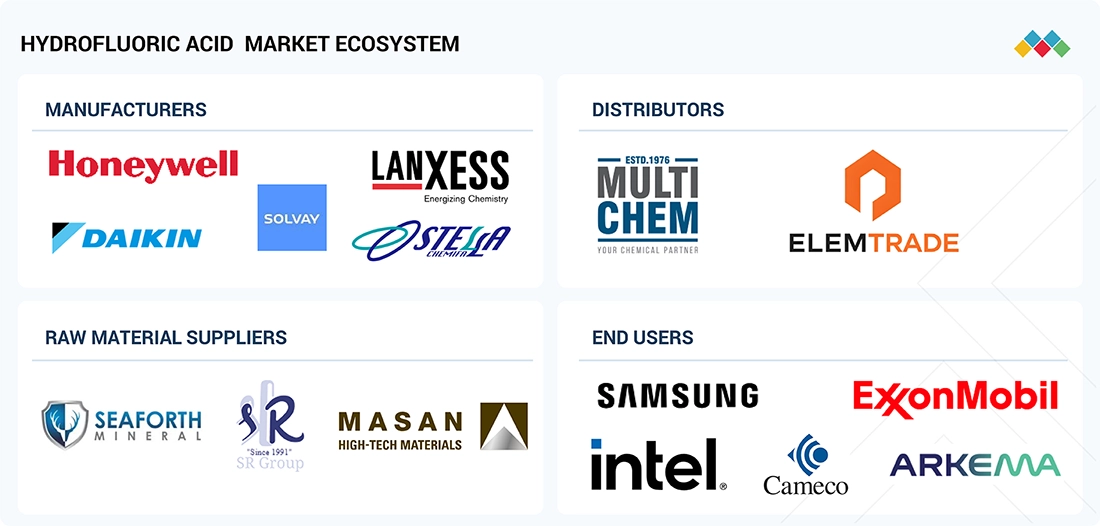

COMPETITIVE LANDSCAPEThe market is driven by strategic expansions and collaborations from leading players such as Honeywell International Inc. (US), Solvay (Belgium), Stella Chemifa Corporation (Japan).

The market of hydrofluoric acid market is expected to grow due to various factors. Rising EV adoption, an increase in healthcare expenditure, and demand for energy-efficient buildings are expected to drive market growth.

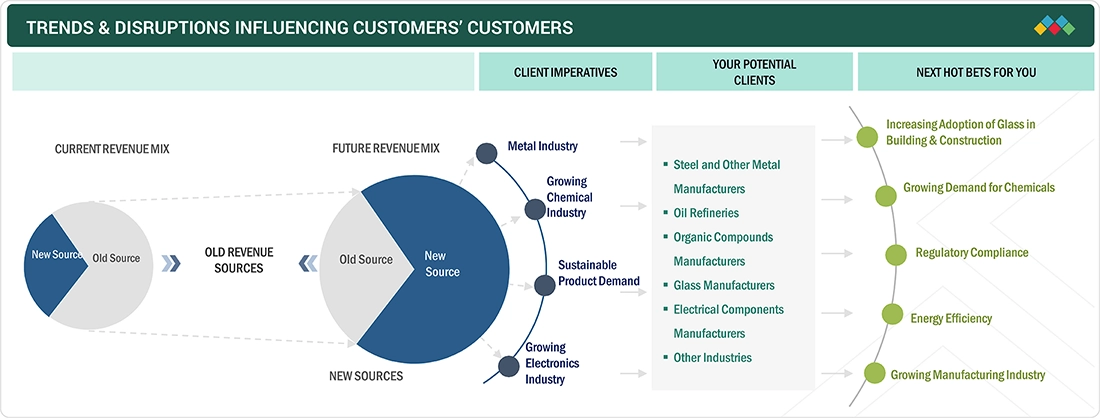

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hydrofluoric acid manufacturers, which will further affect the revenues of hydrofluoric acid end-users.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Extensive usage in refrigerants, hydrofluorocarbons, and hydrofluoroolefins

-

•Rising demand for fluorine compounds

Level

-

•Raw material price fluctuations

-

•Stringent regulations on use of fluorocarbon refrigerants

Level

-

•Use of hydrofluoric acid in glass etching and cleaning applications

-

•Rise of flexible and wearable electronics

Level

-

•Toxicity and hazardous effects of hydrofluoric acid

-

•High transportation cost

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Extensive usage in refrigerants, hydrofluorocarbons, and hydrofluoroolefins

Hydrofluoric acid (HF) is essential in producing various fluorocarbons like hydrochlorofluorocarbons (HCFCs), hydrofluorocarbons (HFCs), and hydrofluoroolefins (HFOs). These compounds mainly serve as industrial, commercial, and residential refrigerants. The shift toward environmentally safer refrigerants, such as low global warming potential HFOs, has increased HF usage. Besides refrigerants, hydrofluoric acid is crucial in synthesizing numerous fluorine-based chemicals. It is a primary raw material for manufacturing fluorocarbons, fluorides, and fluoropolymers, which find applications in electronics, pharmaceuticals, coatings, and plastics.

Restraint: Stringent regulations on the use of fluorocarbon refrigerants

Strict regulations on fluorocarbon refrigerants, like HCFCs and HFCs, impact the hydrofluoric acid market by damaging the ozone layer and driving global warming. Many countries have signed the Montreal Protocol to phase out these refrigerants, reducing demand and increasing compliance costs for companies. Raw material prices, such as fluorspar, also fluctuate, adding market uncertainty. These environmental restrictions and price volatility encourage companies to adopt cleaner alternatives and new technologies, gradually decreasing reliance on traditional fluorocarbon applications.

Opportunities: Use of hydrofluoric acid in glass etching & cleaning applications

The hydrofluoric acid market is expanding due to the growing semiconductor industry. This acid is vital for cleaning and etching silicon and glass surfaces during semiconductor manufacturing. As technology advances, more sophisticated chips and electronic devices are being developed, increasing the demand for hydrofluoric acid, especially since these new products require more precise and thorough cleaning. Many countries are investing in new semiconductor manufacturing plants to meet the rising demand for electronics like computers, smartphones, and electric vehicles. Consequently, companies are likely to increase their use of hydrofluoric acid to support higher production levels.

Challenges: Toxic and hazardous effects of hydrofluoric acid

Hydrofluoric acid is extremely dangerous and toxic, requiring strict handling and safety precautions. It can exist as a liquid or gas and damage the eyes, skin, and lungs. Spills can damage the environment, equipment, and workers. Companies need to invest in safety systems, specialized containers, and protective gear to prevent accidents. Many are reluctant to use it because of the risk of mistakes, which creates market challenges. Its transportation is also complicated, requiring trained personnel and durable, leak-proof containers, which increase costs. Despite its industrial usefulness, its toxicity makes working with hydrofluoric acid challenging.

Hydrofluoric Acid Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

A chemical company faced frequent equipment failures due to HF solution attacking high-nickel alloy components. Required a system resistant to chemical attack, high temperatures (230 °F), and abrasion. ECTFE lining was tested and selected for its durability. | ECTFE-lined reactor ran 6 months without damage. No signs of attack, discoloration, or wear. Reduced maintenance, extended life, and reliable continuous operation achieved. |

|

Optimization and controlled study of hydrofluoric acid (HF) etching for lithium disilicate glass ceramic bonding in a dental laboratory setting. The laboratory aimed to enhance the bond strength between resin luting agents and lithium disilicate (EMX) restorations by comparing different HF concentrations (5% vs. 10%), commercial brands, and the effect of an adhesive layer. | Significant increase in bond strength of resin luting agents to lithium disilicate ceramic when using 10% hydrofluoric acid compared to 5%, regardless of commercial brand. Improved surface characteristics confirmed by scanning electron microscopy, supporting stronger and more durable dental ceramic bonds. |

|

Application of hydrofluoric acid (HF) etching to optimize bonding of lithium disilicate ceramics by selectively removing interfering inorganic soil constituents such as aluminosilicates, amorphous silica, and iron oxides that complicate accurate analysis of humic acid properties. | The process enhances the characterization of humic acids by reducing inorganic interference, leading to more reliable measurements of functional groups and proton binding capacity. It maintains the natural distribution of these groups while lowering ash content, offering clearer insights into the chemical nature and environmental role of humic acids. This supports improved soil management and environmental assessments, especially in mineral-rich soils. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The hydrofluoric acid market ecosystem comprises raw material suppliers, manufacturers, and end-use applications. Hydrofluoric acid is produced using raw materials supplied to manufacturers. Once produced, it is sold to end-use applications directly or through distributors. End-use applications include the production of fluorocarbons, fluorinated derivatives, metal pickling, glass etching and cleaning, oil refining, uranium fuel production, and other uses.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Hydrofluoric Acid Market, By Grade

Due to its high purity and wide range of applications, anhydrous hydrofluoric acid (AHF) is experiencing increasing demand. AHF indicates that the acid is water-free, which is advantageous for certain procedures. The production of fluorocarbons, such as HFCs and HFOs, used in refrigerators and air conditioners as refrigerants, is a key factor driving its growth. Although some older refrigerants are being phased out, newer, environmentally safer alternatives still require AHF in their manufacturing. Another reason for the rising demand is the growth of the chemical and electronics industries. AHF is used to clean and etch surfaces, especially in the semiconductor industry, where computer chips are manufactured. As more people use smartphones, laptops, and electric vehicles, the need for chips increases, boosting demand for AHF.

Hydrofluoric Acid Market, By Technology

The use of hydrofluoric acid to produce hydrofluorocarbons is increasing for several reasons. First, many people and businesses worldwide use air conditioners, refrigerators, and freezers. These appliances require special gases called hydrofluorocarbons (HFCs) to operate. As more people purchase these appliances, the demand for HFCs rises, increasing the need for hydrofluoric acid. Second, outdated refrigerants such as CFCs and HCFCs are being banned because they harm the ozone layer. Many countries have decided to phase these out and replace them with safer alternatives. Compared to older gases, HFCs are considered more environmentally friendly. Therefore, businesses are switching to HFCs, leading to greater consumption of hydrofluoric acid.

REGION

Asia Pacific is projected to account for the highest CAGR in the hydrofluoric acid market during the forecast period

The use of hydrofluoric acid is rapidly increasing in the Asia-Pacific region for several reasons. This region has become the center for semiconductor and electronics manufacturing, with large-scale production of chips, screens, and other electronic components in countries like China, South Korea, Taiwan, and Japan. These industries rely on hydrofluoric acid for cleaning and etching processes. Manufacturing costs are also lower in Asia Pacific due to abundant and cheaper raw materials and significantly reduced labor and transportation expenses compared to Europe and North America. This cost advantage allows companies to produce more at lower prices, boosting hydrofluoric acid usage.

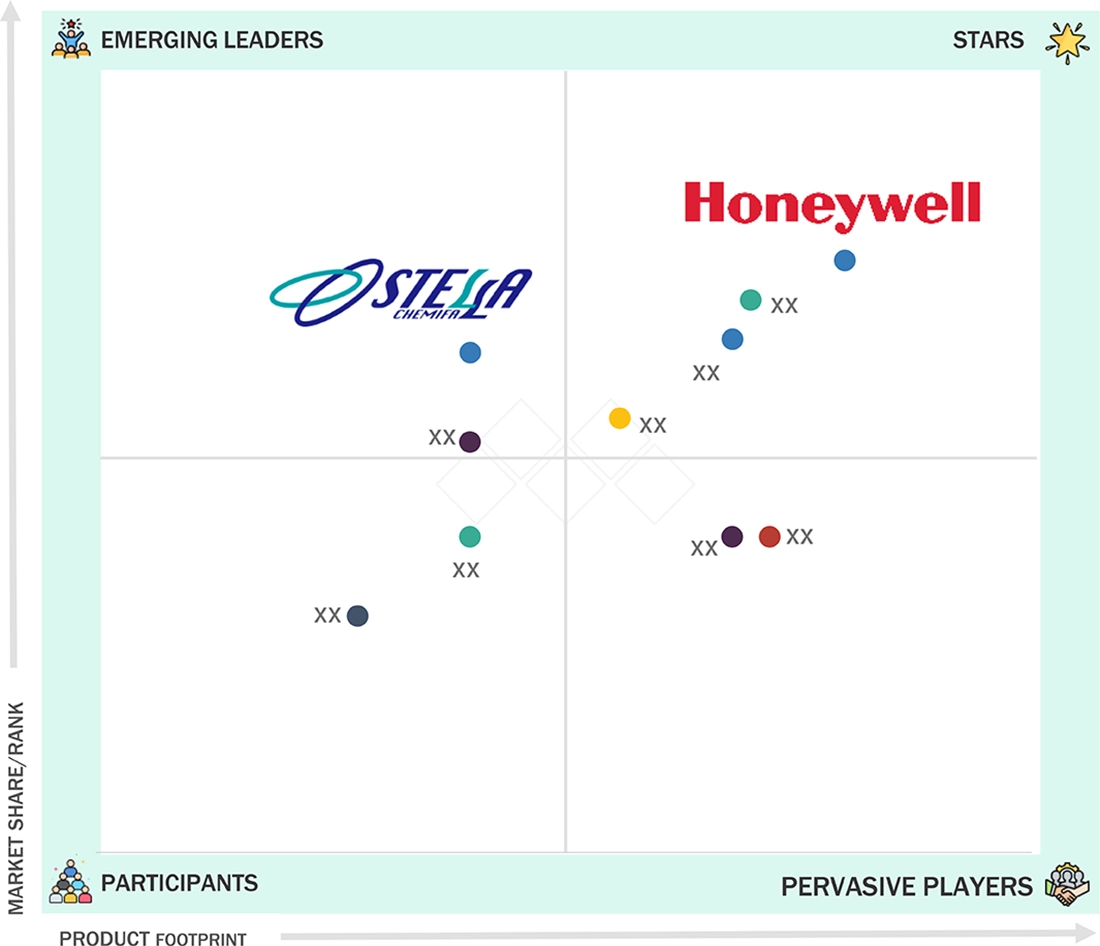

Hydrofluoric Acid Market: COMPANY EVALUATION MATRIX

In the hydrofluoric acid market matrix, Honeywell International Inc. (Star) is a technologically advanced company that designs and produces high-purity, high-quality performance chemicals, materials, and software-based systems. Stell Chemifa Corporation (Emerging Leader) manufactures, distributes, and sells chemicals, and supplies hydrofluoric acid for semiconductor manufacturing, a market that is highly sensitive to quality and rapidly expanding. While Honeywell International Inc. dominates with scale, Stell Chemifa Corporation shows strong growth potential to advance toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.90 BN |

| Market Forecast in 2030 (value) | USD 5.10 BN |

| Growth Rate | CAGR of 4.6% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered | Grade:AHF, DHF (Below 50% Concentration), DHF (Above 50% Concentration) Application: Production of Fluorocarbons, Production of Fluorinated Derivatives, Metal Pickling, Glass Etching and Cleaning, Oil Refining, Production of Uranium Fuel, Other Applications |

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

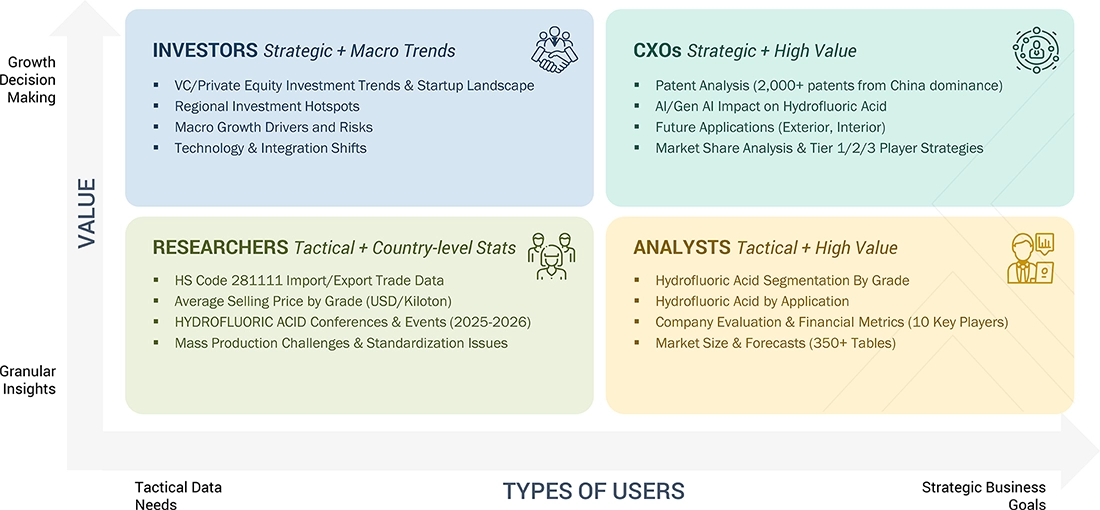

WHAT IS IN IT FOR YOU: Hydrofluoric Acid Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| To expand into Southeast Asia and needed insights on regional demand, regulations, and competitive dynamics. | Provided country-level demand forecasts for HF in Various applications Assessed regulatory and environmental compliance requirements in Indonesia, Vietnam, and Malaysia. Identified local distributors and JV partners for market entry. | Helped create a GTM strategy for high-growth markets (Vietnam & Indonesia) to enter via a joint venture, in order to achieve first-mover advantage in fluoropolymer-grade HF. |

RECENT DEVELOPMENTS

- June 2023 : Daikin (Japan) completed the first two phases of a large-scale fluorine chemicals production base in Changshu City, Jiangsu Province, China, which includes expanded capacity for products closely tied to hydrofluoric acid, such as PTFE and perfluoroalkoxy (PFA) resins.

- November 2022 : Solvay and Orbia (Mexico) entered a joint venture. Orbia’s fluorinated solutions business, Koura, and Polymer Solutions business, Vestolit, will supply hydrofluoric acid, vinyl chloride monomer (VCM), and chlorine for the project.

- March 2022 : the new Daikin technology was introduced. This technology reduces dependency on China for chip-making materials by using Mexican fluorite crystals, which are less pure than Chinese fluorite, to make hydrofluoric acid. This will diversify the acid supply chain.

- September 2021 : Honeywell International Inc. and Ultium Cells LLC (Ohio, US) collaborated on a battery project. Ultium Cells LLC will use Honeywell's quality control system (QCS) to guarantee the reliability of the lithium-ion batteries produced at its new facility in Lordstown, Ohio. These batteries require the use of hydrofluoric acid during production.

- March 2021 : LANXESS ventured into the field of battery chemistry. The Group started producing electrolyte formulations for lithium-ion batteries for the Chinese manufacturer Tinci. LANXESS announced it would start production in 2022 in a high-tech facility run by its affiliate Saltigo.

Table of Contents

Methodology

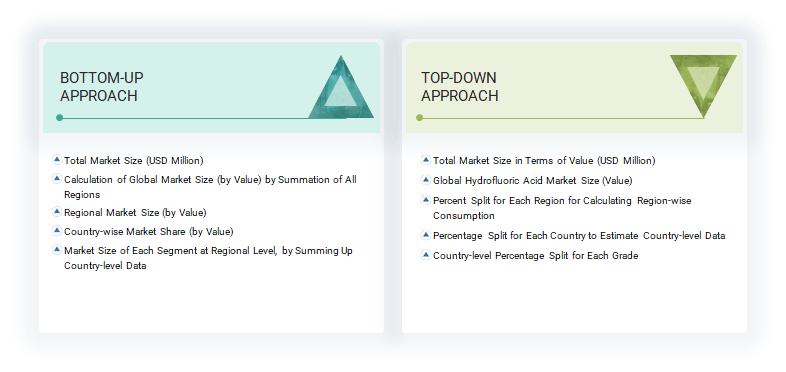

The study involved four key activities to determine the current size of the global hydrofluoric acid market. Comprehensive secondary research was conducted to gather information on the market, related product markets, and the broader product group. The next step was to validate these findings, assumptions, and estimates with industry experts across the hydrofluoric acid value chain through primary research. Both top-down and bottom-up approaches were used to estimate the overall market size. Following this, market segmentation and data triangulation processes were applied to define the size of various segments and sub-segments.

Secondary Research

The market for companies offering hydrofluoric acid is determined through secondary data from paid and free sources, analyzing the product portfolios of leading firms in the industry, and rating these companies by their performance and quality. Secondary sources such as Business Standard, Bloomberg, World Bank, and Factiva were used to gather information for this study on the hydrofluoric acid market. Multiple sources were consulted during the secondary research process to collect relevant data. These sources included annual reports, press releases, investor presentations of luxury vinyl tile vendors, forums, certified publications, and white papers. This secondary research provided essential insights into the industry’s value chain, the pool of key players, market classification, and segmentation from both market and technology perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to gather qualitative and quantitative information for this report. The supply-side sources included industry experts such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and other key executives from several leading companies and organizations operating in the Hydrofluoric acid market. After completing the market engineering process—which involved calculations for market statistics, market breakdowns, market size estimations, market forecasting, and data triangulation—extensive primary research was conducted to collect information and verify the critical figures obtained. Primary research also identified the segmentation types, industry trends, competitive landscape of Hydrofluoric acid offered by various market players, and key market dynamics, including drivers, restraints, opportunities, challenges, industry trends, and strategies of major players. Throughout the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to estimate and forecast market segments and subsegments listed in this report. In-depth qualitative and quantitative analysis was performed on the entire market engineering process to highlight key insights and information throughout the report.

The following is a breakdown of the primary respondents:

Notes: Others include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million–1 Billion; and Tier 3: < USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up methods were used to estimate and verify the size of the global hydrofluoric acid market. These methods were also widely employed to determine the size of various related market segments. The research approach for estimating the market size included the following:

Data Triangulation

After determining the overall market size through estimation methods, the market was divided into various segments and subsegments. Data triangulation and market breakdown procedures were used, where applicable, to complete the overall market analysis and determine precise statistics for each segment and subsegment. The data was triangulated by examining different factors and trends from both the demand and supply sides.

Market Definition

The reaction between a hydrogen atom and a fluorine atom produces hydrogen fluoride, a colorless, corrosive liquid or vapor with a strong, unpleasant, pungent odor. Hydrofluoric acid forms when hydrogen fluoride dissolves in water. The report divides the hydrofluoric acid market based on its grades, applications, and regions. It is available in different grades depending on the acid's concentration levels. In terms of its uses, hydrofluoric acid is employed in several industries, such as chemical manufacturing and glass etching.

Stakeholders

- Hydrofluoric Acid Manufacturers

- Raw Material Suppliers

- Traders and Distributors

- Industry Associations

- Research Organizations, Trade Associations, and Government Agencies

- Commercial R&D Institutes

- End-use Industries

Report Objectives

- To define, describe, and forecast the size of the global hydrofluoric acid market based on grade, application, and region in terms of value and volume

- To provide detailed information on the significant drivers, restraints, opportunities, and challenges influencing the market

- To strategically analyze micromarkets concerning individual growth trends, prospects, and their contribution to the market

- To assess the growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To forecast the market size of segments and subsegments for North America, Europe, the Asia Pacific, South America, and the Middle East & Africa

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments such as product launches, acquisitions, expansions, partnerships, and agreements in the hydrofluoric acid market

- To provide the impact of AI/Gen AI on the market

Key Questions Addressed by the Report

What are the major drivers driving the growth of the hydrofluoric acid market?

The major drivers influencing the growth of the market are the extensive usage in refrigerants, hydrofluorocarbons, and hydrofluoroolefins and the rising demand for fluorine compounds and derivatives.

Who are the key market players of the hydrofluoric acid market?

The key players in the hydrofluoric acid market are Honeywell International Inc., Solvay, Stella Chemifa Corporation, LANXESS, and Daikin.

Which region is the largest in the hydrofluoric acid market?

The Asia Pacific region is the largest market overall due to its production of semiconductors, fluorocarbons, and fluorinated chemicals.

What is the key opportunity in the hydrofluoric acid market?

The use of hydrofluoric acid in glass etching and cleaning applications presents a new opportunity for the hydrofluoric acid market.

What are the applications of hydrofluoric acid?

Hydrofluoric acid is mainly used in fluorocarbon production, fluorinated derivative production, metal pickling, oil refining, and uranium fuel production.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Hydrofluoric Acid Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Hydrofluoric Acid Market