Fluoropolymer Films Market by Type (PTFE, PVDF, FEP, PFA, ETFE Films), Application (Electrical & Electronics, Industrial, Automotive & Aerospace, Medical & Pharmaceutical, Consumer Products), and Region - Global Forecast to 2022

[154 Pages Report] Fluoropolymer film is a base material with excellent characteristics, such as chemical resistance, high-temperature tolerance, low coefficient of friction, optical transparency, UV & weather resistance, fouling resistance, moisture resistance, high insulation, non-flammable properties, low surface energy, and low dielectric constant. Its unique capabilities make it preferable for many applications such as electrical & electronics, medical & pharmaceuticals, automotive & aerospace, and industrial.

are preferred in applications where long-term reliability cannot be assured by less expensive plastics and metal sheets. The selection of an appropriate film depends on the temperature requirements of the applications. It can be heat-sealed, metalized, laminated, thermoformed, and welded to a wide range of materials. It has superior dielectric properties across a wide temperature and frequency range.

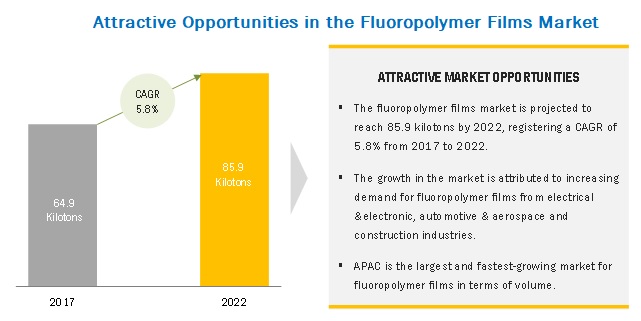

The market size of fluoropolymer films was USD 1,867.6 million in 2016 and is projected to register a CAGR of 5.9% between 2017 and 2022. These films are widely used as a raw material in the production of automobile parts, electronic components, machines, and semiconductors. Thus, the growth of the fluoropolymer films market is directly associated with the growing demand for semiconductors, consumer electronics, and industrial electronics.

PTFE films to be the largest type segment of the fluoropolymer films market.

The PTFE films segment is projected to lead the market during the forecast period, owing to the extensive use of these films in the electrical & electronics and automotive & aerospace applications because of their favorable properties and affordability.

Electrical & electronics to be the leading application of fluoropolymer films

These films are used extensively in the manufacturing of semiconductors, LCDs, OLEDs, laptops, computers, and smartphone displays.

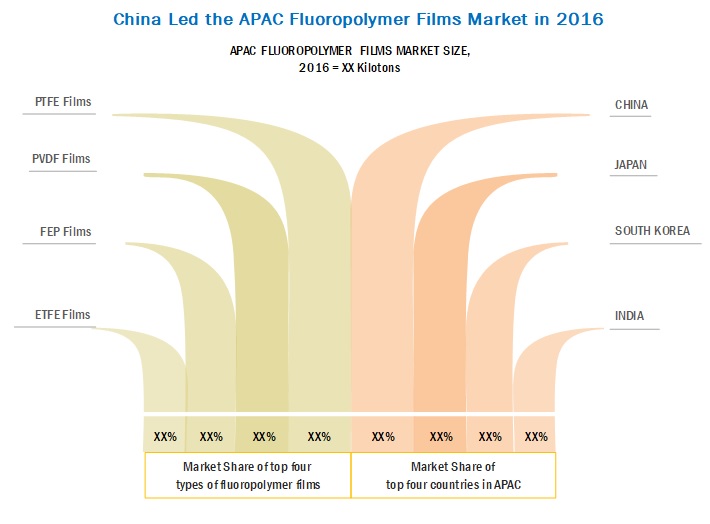

APAC to lead Fluoropolymer Films market during the forecast period.

APAC has emerged as the largest consumer of fluoropolymer films owing to the growth in the production of electronics, automobiles, and chemicals in countries such as China, Japan, India, South Korea, and Indonesia

Market Dynamics

Driver Rising preference of fluoropolymer films in medical & pharmaceutical applications

Fluoropolymer films are used in several medical & pharmaceutical applications such as cap liners, medical release liners, stoppers, surface protection laminates, plunger laminates, fluid bags, implants, orthopedics, and prosthetics. These films are being increasingly used in these applications because of their excellent chemical inertness, UV & weather resistance, and negligible moisture absorption in comparison to the conventional films such as nylon, polypropylene, and polyethylene.

The fluoropolymer films are biocompatible owing to their excellent chemical inertness and the ability to prevent adverse reactions when placed in contact with the human body. Also, these films are preferred in the manufacturing of blister packaging and fluid bags for biological liquids as they offer negligible moisture absorption, weather resistance, and do not show any chemical change or degradation by medical fluids. These factors, along with the technological advancements and rising demand for highly purified products in the medical and pharmaceutical industry, are expected to drive the fluoropolymer films market.

Restraint: High cost of technology development and manufacturing of fluoropolymer films

The cost of fluoropolymer films is directly proportional to the cost involved in their technology development, complex manufacturing process, and the cost of the raw materials used for manufacturing the films such as PTFE, PVDF, FEP, PFA, ETFE, ECTFE, and PCTFE. The key players in the industry have developed high-cost technologies to produce fluoropolymer films to meet customer demands. These technologies are patented and are difficult to be developed by small companies. This increases the cost of production and leads to the high price of fluoropolymer films. This high price may restrict the use of fluoropolymer films in different price-sensitive applications.

Opportunity: Increasing use of fluoropolymer films in construction and energy sectors

In the construction sector, these films are used in cladding applications such as roofing and facade construction. These films are considered as the material of choice for traditional skylight applications as well as long-span structures and building facades. Also, these films are used to protect a wide range of construction substrates from extreme corrosion, weather, fading, and cracking. Apart from these, these films are used in building greenhouses, as they are lightweight and energy-efficient than glass. As the fluoropolymer films are transparent, easy-to-clean, durable, and flexible, they are evolving as one of the premium materials in the construction sector.

ETFE films are most suitable for construction applications because of their flexibility. These films can be applied in a single, double, or triple-layered form. The ETFE films are used in prominent architectural projects and high profile international sports venues.

In the energy sector, the fluoropolymer films are gaining importance in wind turbines, photovoltaic front sheets, natural gas expansion joints, and hydrogen fuel cells. These films improve the efficiency of the manufacturing process, energy production efficiency, and service life of the equipment and machinery used in this sector. The advantages offered by these films are further expected to increase their use in different applications of the energy sector.

Hence, the construction and energy sectors are expected to be the potential markets for fluoropolymer films during the forecast period.

Challenge: Difficulty in processing

Fluoropolymer films are difficult to process, as the thickness of the film ranges from 0.0010.5 mm, which is very small in comparison to the conventional plastic films. In addition, the thickness of these films varies with application. The lesser thickness reduces the strength of the films and makes them prone to punctures by sharp edges. Therefore, these films need to be handled with precautions. Multi-layered fluoropolymer films can increase the strength of the films, but witness challenges pertaining to designing, as the layering needs to be done accurately. Moreover, this can increase the overall cost of processing.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

20152022 |

|

Base year considered |

2016 |

|

Forecast period |

20172022 |

|

Forecast units |

USD million and ton |

|

Segments covered |

Type, Application, and Region |

|

Geographies covered |

North America, South America, Europe, Asia Pacific (APAC) and the Middle East & Africa |

|

Companies covered |

The Chemours Company (US), Saint-Gobain (France), 3M (US), Nitto Denko (Japan), Daikin (Japan), Honeywell International (US), DUNMORE (US), Guarniflon (Italy), AGC Chemicals (Japan), Textiles Coated International (US), Rogers Corporation (US) |

This research report categorizes the fluoropolymer films market on the basis of type, application, and region.

Fluoropolymer Films Market On the basis of Type:

- Polytetrafluoroethylene (PTFE) films

- Polyvinylidene fluoride (PVDF) films

- Fluorinated Ethylene Propylene (FEP) films

- Perfluoroalkoxy Polymer (PFA) films

- Ethylene Tetrafluoroethylene (ETFE) films

- Others (Ethylene ChloroTriFluoroEthylene (ECTFE) films, Polychlorotrifluoroethylene (PCTFE) films, and Polyvinyl Fluoride (PVF) films)

Fluoropolymer Films Market On the basis of Application:

- Electrical & Electronics

- Industrial

- Automotive & Aerospace

- Medical & Pharmaceutical

- Consumer Products

- Others (Food & Beverage, Oil & Gas, and Construction)

Fluoropolymer Films Market On the basis of Region:

- North America

- South America

- Europe

- Asia-Pacific

- Middle East & Africa

Key Market Players

The Chemours Company (US), Saint-Gobain (France), 3M (US), Nitto Denko (Japan), Daikin (Japan)Recent Developments

- In August 2017, Daikin established a new subsidiary DAIKIN CHEMICAL SOUTHEAST ASIA in Thailand to increase the sales of fluoropolymer and fluoroelastomer products to the automotive industry. With this expansion, the company aims to expand its fluorochemical business in the Southeast Asian market.

- In January 2017, DUNMORE introduced adhesion-promoting technologies for fluoropolymer films. These technologies will help the company increase its use of fluoropolymer films in challenging applications.

- In November 2016, Saint-Gobain acquired 100% share of the Italian company, h-old, a subsidiary of Arcadia Small Cap. This acquisition is expected to benefit the high-performance plastics business and strengthen the companys presence in the European market.

Critical questions the report answers:

- Where will all these developments take the fluoropolymer films market in the long term?

- What are the upcoming trends for the fluoropolymer films market?

- Which segment in the fluoropolymer films market provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants in the fluoropolymer films market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Units Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the Fluoropolymer Films Market

4.2 Market of Fluoropolymer Films in APAC, By Type and Country

4.3 Market of Fluoropolymer Films, By Country

4.4 Market of Fluoropolymer Films, By Type

4.5 Market of Fluoropolymer Films, By Application

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High-Performance Properties of Fluoropolymer Films

5.2.1.2 Rising Preference of Fluoropolymer Films in Medical & Pharmaceutical Applications

5.2.2 Restraints

5.2.2.1 High Cost of Technology Development and Manufacturing of Fluoropolymer Films

5.2.3 Opportunities

5.2.3.1 Increasing Use of Fluoropolymer Films in Construction and Energy Sectors

5.2.4 Challenges

5.2.4.1 Difficulty in Processing

5.3 Porters Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Overview

5.4.1 Introduction

5.4.2 GDP Growth Rate and Forecast of Major Economies

5.4.3 Electronics Industry Analysis

5.4.4 Automotive Industry Analysis

5.4.5 Chemical Industry Analysis

6 Fluoropolymer Films Market, By Type (Page No. - 45)

6.1 Introduction

6.2 PTFE Films

6.3 PVDF Films

6.4 FEP Films

6.5 PFA Films

6.6 ETFE Films

6.7 Others

6.7.1 ECTFE Films

6.7.2 PCTFE Films

6.7.3 PVF Films

7 Fluoropolymer Films Market, By Application (Page No. - 58)

7.1 Introduction

7.2 Electrical & Electronics

7.3 Industrial

7.4 Automotive & Aerospace

7.5 Medical & Pharmaceutical

7.6 Consumer Products

7.7 Others

8 Fluoropolymer Films Market, By Region (Page No. - 71)

8.1 Introduction

8.2 APAC

8.2.1 China

8.2.2 Japan

8.2.3 India

8.2.4 South Korea

8.2.5 Indonesia

8.2.6 Thailand

8.2.7 Rest of APAC

8.3 North America

8.3.1 US

8.3.2 Canada

8.3.3 Mexico

8.4 Europe

8.4.1 Germany

8.4.2 France

8.4.3 UK

8.4.4 Italy

8.4.5 Russia

8.4.6 Netherlands

8.4.7 Rest of Europe

8.5 South America

8.5.1 Brazil

8.5.2 Argentina

8.5.3 Rest of South America

8.6 Middle East & Africa

8.6.1 Saudi Arabia

8.6.2 UAE

8.6.3 Egypt

8.6.4 Rest of Middle East & Africa

9 Competitive Landscape (Page No. - 123)

9.1 Overview

9.2 Market Ranking Analysis

9.2.1 The Chemours Company

9.2.2 Saint-Gobain

9.2.3 Nitto Denko

9.2.4 The 3M Company

9.2.5 Daikin

9.3 Competitive Scenario

9.3.1 Expansions

9.3.2 Acquisitions

9.3.3 New Product Developments

9.3.4 Partnerships

10 Company Profiles (Page No. - 128)

Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View

10.1 The Chemours Company

10.2 Saint-Gobain

10.3 Nitto Denko

10.4 The 3M Company

10.5 Daikin

10.6 Honeywell International

10.7 Dunmore

10.8 Guarniflon

10.9 AGC Chemicals

10.10 Textiles Coated International (TCI)

10.11 Other Market Players

10.11.1 Dowdupont

10.11.2 Rogers Corporation

10.11.3 Chukoh Chemical Industries

10.11.4 Polyflon Technology

10.11.5 Jiangxi Aidmer Seal and Packing

10.11.6 Lenzing Plastics

10.11.7 Jiangsu Taifulong Technology

10.11.8 Technetics Group

10.11.9 Plasticut

10.11.10 Cixi Rylion PTFE

10.11.11 J. V. Corporation

10.11.12 Merefsa

10.11.13 Enflo

10.11.14 Dalau

10.11.15 Biogeneral

*Details Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 147)

11.1 Insights From Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets Subscription Portal

11.4 Introducing RT: Real Time Market Intelligence

11.5 Available Customizations

11.6 Related Reports

11.7 Author Details

List of Tables (140 Tables)

Table 1 Trends and Forecast of GDP Growth Rates, By Country, 20152022

Table 2 Fluoropolymer Films Market Size, By Type, 20152022 (Kiloton)

Table 3 Market Size, By Type, 20152022 (USD Million)

Table 4 PTFE Films Market Size, By Region, 20152022 (Kiloton)

Table 5 PTFE Films Market Size, By Region, 20152022 (USD Million)

Table 6 PVDF Films Market Size, By Region, 20152022 (Kiloton)

Table 7 PVDF Films Market Size, By Region, 20152022 (USD Million)

Table 8 FEP Films Market Size, By Region, 20152022 (Kiloton)

Table 9 FEP Films Market Size, By Region, 20152022 (USD Million)

Table 10 Key Properties of PFA and Their Typical Application

Table 11 PFA Films Market Size, By Region, 20152022 (Kiloton)

Table 12 PFA Films Market Size, By Region, 20152022 (USD Million)

Table 13 Benefits of Using ETFE Films Over Glass in Construction Application

Table 14 ETFE Films Market Size, By Region, 20152022 (Kiloton)

Table 15 ETFE Films Market Size, By Region, 20152022 (USD Million)

Table 16 Other Fluoropolymer Films Market Size, By Region, 20152022 (Kiloton)

Table 17 Other Market Size, By Region, 20152022 (USD Million)

Table 18 Market Size, By Application, 20152022 (Kiloton)

Table 19 Market Size, By Application, 20152022 (USD Million)

Table 20 Market Size in Electrical & Electronics Application, By Region, 20152022 (Kiloton)

Table 21 Market Size in Electrical & Electronics Application, By Region, 20152022 (USD Million)

Table 22 Market Size in Industrial Application, By Region, 20152022 (Kiloton)

Table 23 Market Size in Industrial Application, By Region, 20152022 (USD Million)

Table 24 Market Size in Automotive & Aerospace Application, By Region, 20152022 (Kiloton)

Table 25 Market Size in Automotive & Aerospace Application, By Region, 20152022 (USD Million)

Table 26 Market Size in Medical & Pharmaceutical Application, By Region, 20152022 (Kilotons)

Table 27 Market Size in Medical & Pharmaceutical Application, By Region, 20152022 (USD Million)

Table 28 Market Size in Consumer Products Application By Region, 20152022 (Kiloton)

Table 29 Market Size in Consumer Products Application By Region, 20152022 (USD Million)

Table 30 Market Size in Other Applications, By Region, 20152022 (Kiloton)

Table 31 Market Size in Other Applications, By Region, 20152022 (USD Million)

Table 32 Market Size, By Region, 20152022 (Kiloton)

Table 33 Market Size, By Region, 20152022 (USD Million)

Table 34 APAC: Fluoropolymer Films Market Size, By Country, 20152022 (Kiloton)

Table 35 APAC: Market Size, By Country, 20152022 (USD Million)

Table 36 APAC: Market Size, By Type, 20152022 (Kiloton)

Table 37 APAC: Market Size, By Type, 20152022 (USD Million)

Table 38 APAC: Market Size, By Application, 20152022 (Kiloton)

Table 39 APAC: Market Size, By Application, 20152022 (USD Million)

Table 40 China: Market Size, By Type, 20152022 (Kiloton)

Table 41 China: Market Size, By Type, 20152022 (USD Million)

Table 42 China: Market Size, By Application, 20152022 (Kiloton)

Table 43 Japan: Market Size, By Type, 20152022 (Ton)

Table 44 Japan: Market Size, By Type, 20152022 (USD Million)

Table 45 Japan: Market Size, By Application, 20152022 (Ton)

Table 46 India: Market Size, By Type, 20152022 (Ton)

Table 47 India: Market Size, By Type, 20152022 (USD Million)

Table 48 India: Market Size, By Application, 20152022 (Ton)

Table 49 South Korea: Market Size, By Type, 20152022 (Ton)

Table 50 South Korea: Market Size, By Type, 20152022 (USD Million)

Table 51 South Korea: Market Size, By Application, 20152022 (Ton)

Table 52 Indonesia: Market Size, By Type, 20152022 (Ton)

Table 53 Indonesia: Market Size, By Type, 20152022 (USD Million)

Table 54 Indonesia: Market Size, By Application, 20152022 (Ton)

Table 55 Thailand: Market Size, By Type, 20152022 (Ton)

Table 56 Thailand: Market Size, By Type, 20152022 (USD Million)

Table 57 Thailand: Market Size, By Application, 20152022 (Ton)

Table 58 Rest of APAC: Market Size, By Type, 20152022 (Ton)

Table 59 Rest of APAC: Market Size, By Type, 20152022 (USD Million)

Table 60 Rest of APAC: Market Size, By Application, 20152022 (Ton)

Table 61 North America: Fluoropolymer Films Market Size, By Country, 20152022 (Kiloton)

Table 62 North America: Market Size, By Country, 20152022 (USD Million)

Table 63 North America: Market Size, By Type, 20152022 (Kiloton)

Table 64 North America: Market Size, By Type, 20152022 (USD Million)

Table 65 North America: Market Size, By Application, 20152022 (Kiloton)

Table 66 North America: Market Size, By Application, 20152022 (USD Million)

Table 67 US: Market Size, By Type, 20152022 (Kiloton)

Table 68 US: Market Size, By Type, 20152022 (USD Million)

Table 69 US: Market Size, By Application, 20152022 (Kiloton)

Table 70 Canada: Market Size, By Type, 20152022 (Kiloton)

Table 71 Canada: Market Size, By Type, 20152022 (USD Million)

Table 72 Canada: Market Size, By Application, 20152022 (Kiloton)

Table 73 Mexico: Market Size, By Type, 20152022 (Kiloton)

Table 74 Mexico: Market Size, By Type, 20152022 (USD Million)

Table 75 Mexico: Market Size, By Application, 20152022 (Kiloton)

Table 76 Europe: Fluoropolymer Films Market Size, By Country, 20152022 (Ton)

Table 77 Europe: Market Size, By Country, 20152022 (USD Million)

Table 78 Europe: Market Size, By Type, 20152022 (Ton)

Table 79 Europe: Market Size, By Type, 20152022 (USD Million)

Table 80 Europe: Market Size, By Application, 20152022 (Ton)

Table 81 Europe: Market Size, By Application, 20152022 (USD Million)

Table 82 Germany: Market Size, By Type, 20152022 (Ton)

Table 83 Germany: Market Size, By Type, 20152022 (USD Million)

Table 84 Germany: Market Size, By Application, 20152022 (Ton)

Table 85 France: Market Size, By Type, 20152022 (Ton)

Table 86 France: Market Size, By Type, 20152022 (USD Million)

Table 87 France: Market Size, By Application, 20152022 (Ton)

Table 88 UK: Market Size, By Type, 20152022 (Ton)

Table 89 UK: Market Size, By Type, 20152022 (USD Million)

Table 90 UK: Market Size, By Application, 20152022 (Ton)

Table 91 Italy: Market Size, By Type, 20152022 (Ton)

Table 92 Italy: Market Size, By Type, 20152022 (USD Million)

Table 93 Italy: Market Size, By Application, 20152022 (Ton)

Table 94 Russia: Market Size, By Type, 20152022 (Ton)

Table 95 Russia: Market Size, By Type, 20152022 (USD Million)

Table 96 Russia: Market Size, By Application, 20152022 (Ton)

Table 97 Netherlands: Market Size, By Type, 20152022 (Ton)

Table 98 Netherlands: Market Size, By Type, 20152022 (USD Million)

Table 99 Netherlands: Market Size, By Application, 20152022 (Ton)

Table 100 Rest of Europe: Market Size, By Type, 20152022 (Ton)

Table 101 Rest of Europe: Market Size, By Type, 20152022 (USD Million)

Table 102 Rest of Europe: Market Size, By Application, 20152022 (Ton)

Table 103 South America: Fluoropolymer Films Market Size, By Country, 20152022 (Ton)

Table 104 South America: Market Size, By Country, 20152022 (USD Million)

Table 105 South America: Market Size, By Type, 20152022 (Ton)

Table 106 South America: Market Size, By Type, 20152022 (USD Million)

Table 107 South America: Market Size, By Application, 20152022 (Ton)

Table 108 South America: Market Size, By Application, 20152022 (USD Million)

Table 109 Brazil: Market Size, By Type, 20152022 (Ton)

Table 110 Brazil: Market Size, By Type, 20152022 (USD Million)

Table 111 Brazil: Market Size, By Application, 20152022 (Ton)

Table 112 Argentina: Market Size, By Type, 20152022 (Ton)

Table 113 Argentina: Market Size, By Type, 20152022 (USD Million)

Table 114 Argentina: Market Size, By Application, 20152022 (Ton)

Table 115 Rest of South America: Market Size, By Type, 20152022 (Ton)

Table 116 Rest of South America: Market Size, By Type, 20152022 (USD Million)

Table 117 Rest of South America: Market Size, By Application, 20152022 (Ton)

Table 118 Middle East & Africa: Market Size, By Country, 20152022 (Ton)

Table 119 Middle East & Africa: Market Size, By Country, 20152022 (USD Million)

Table 120 Middle East & Africa: Market Size, By Type, 20152022 (Ton)

Table 121 Middle East & Africa: Market Size, By Type, 20152022 (USD Million)

Table 122 Middle East & Africa: Market Size, By Application, 20152022 (Ton)

Table 123 Middle East & Africa: Market Size, By Application, 20152022 (USD Million)

Table 124 Saudi Arabia: Market Size, By Type, 20152022 (Ton)

Table 125 Saudi Arabia: Market Size, By Type, 20152022 (USD Million)

Table 126 Saudi Arabia: Market Size, By Application, 20152022 (Ton)

Table 127 UAE: Market Size, By Type, 20152022 (Ton)

Table 128 UAE: Market Size, By Type, 20152022 (USD Million)

Table 129 UAE: Market Size, By Application, 20152022 (Ton)

Table 130 Egypt: Market Size, By Type, 20152022 (Ton)

Table 131 Egypt: Market Size, By Type, 20152022 (USD Million)

Table 132 Egypt: Market Size, By Application, 20152022 (Ton)

Table 133 Rest of Middle East & Africa: Market Size, By Type, 20152022 (Ton)

Table 134 Rest of Middle East & Africa: Market Size, By Type, 20152022 (USD Million)

Table 135 Rest of Middle East & Africa: Market Size, By Application, 20152022 (Ton)

Table 136 Ranking of Major Fluoropolymer Film Manufacturers, 2016

Table 137 Expansions, 20151017

Table 138 Acquisitions, 20151017

Table 139 New Product Developments, 20152017

Table 140 Partnerships, 20152017

List of Figures (47 Figures)

Figure 1 Fluoropolymer Films Market: Research Design

Figure 2 Market Size Estimation: Bottom-Up Approach

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Market: Data Triangulation

Figure 5 PTFE Films to Be the Largest Type Market Segment of the Fluoropolymer Films

Figure 6 Electrical & Electronics to Be the Leading Application of Fluoropolymer Films

Figure 7 APAC Was the Largest Market of Fluoropolymer Films in 2016

Figure 8 Increasing Demand From Various Applications to Drive the Market of Fluoropolymer Films

Figure 9 China Led the APAC Market of Fluoropolymer Films in 2016

Figure 10 India to Be the Fastest-Growing Market Between 2017 and 2022

Figure 11 PVDF Films to Be the Fastest-Growing Type Segment Between 2017 and 2022

Figure 12 Electrical & Electronics to Be the Largest Application Between 2017 and 2022

Figure 13 Drivers, Restraints, Opportunities, and Challenges in Fluoropolymer Films Market

Figure 14 Production of Global Electronics and It Industries, 20142017

Figure 15 Electronics Industry in Key Countries, 2015

Figure 16 Regional Production Share of Cars and Commercial Vehicles, 2016

Figure 17 China Was the Largest Producer of Cars and Commercial Vehicles in 2016

Figure 18 Global Chemical Sales, 2016

Figure 19 Chemical Industry Sales in Major Countries, 2016

Figure 20 Different Types of Fluoropolymer Films Optimal Product Property Combinations

Figure 21 PTFE Led the Market of Fluoropolymer Films in 2016 in Value Terms

Figure 22 APAC to Be the Largest PTFE Films Market

Figure 23 APAC to Be the Largest PVDF Films Market

Figure 24 APAC to Be the Fastest-Growing FEP Films Market

Figure 25 APAC to Be the Largest PFA Films Market

Figure 26 APAC to Be the Largest ETFE Films Market

Figure 27 APAC to Be the Largest Market for Other Fluoropolymer Films,

Figure 28 Electrical & Electronics Was the Leading Application of Fluoropolymer Films in 2016 in Value Terms

Figure 29 APAC to Be the Fastest-Growing Market of Fluoropolymer Films in Electrical & Electronics Application

Figure 30 APAC to Be the Largest Market of Fluoropolymer Films in Industrial Application

Figure 31 APAC to Be the Fastest-Growing Market of Fluoropolymer Films in Automotive & Aerospace Application

Figure 32 APAC to Be the Largest Market of Fluoropolymer Films in Medical & Pharmaceutical Application

Figure 33 APAC to Be the Largest Market of Fluoropolymer Films in Consumer Products Application

Figure 34 APAC to Be the Largest Market of Fluoropolymer Films in Other Applications

Figure 35 Regional Snapshot: Rapidly Growing Markets are Emerging as New Strategic Locations

Figure 36 APAC: Market Snapshot

Figure 37 China Market Snapshot, 2017 vs 2022

Figure 38 North American Market Snapshot

Figure 39 US Market Snapshot, 2017 vs 2022

Figure 40 Companies Adopted Expansion as the Key Growth Strategy Between 2015 and 2017

Figure 41 The Chemours Company: Company Snapshot

Figure 42 Saint-Gobain: Company Snapshot

Figure 43 Nitto Denko: Company Snapshot

Figure 44 The 3M Company: Company Snapshot

Figure 45 Daikin: Company Snapshot

Figure 46 Honeywell International: Company Snapshot

Figure 47 AGC Chemicals: Company Snapshot

Growth opportunities and latent adjacency in Fluoropolymer Films Market