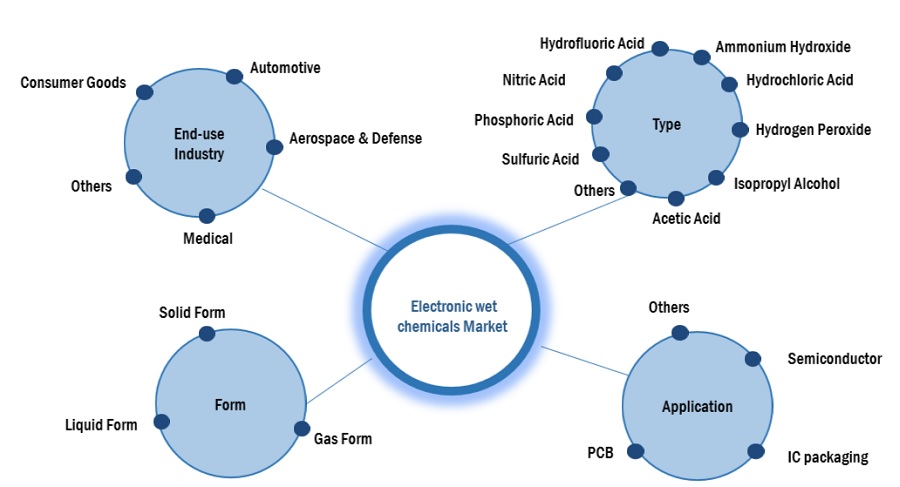

Electronic Wet Chemicals Market by Type (Acetic Acid, Isopropyl Alcohol, Phosphoric Acid) Form (Liquid Form, Solid Form, Gas Form) Application (Semiconductor, IC Packaging, PCB), End-use Industry, And Region - Global Forecast to 2028

Updated on : August 05, 2024

Electronic Wet Chemicals Market

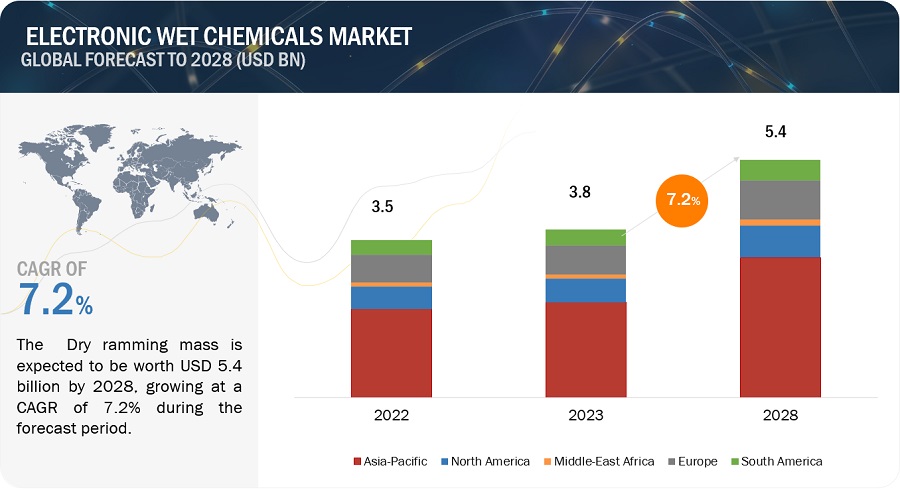

Electronic Wet Chemicals Market was valued at USD 3.8 billion in 2023 and is projected to reach USD 5.4 billion by 2028, growing at 7.2% cagr from 2023 to 2028. The market is mainly led by the significant usage of electronic wet chemicals in various end-use industries. The growing demand for hydrogen peroxide from the semiconductor industry is a major driver for the growth of the electronic wet chemicals market.

Attractive Opportunities in the Electronic Wet Chemicals Market

To know about the assumptions considered for the study, Request for Free Sample Report

Electronic Wet Chemicals Market Dynamics

Driver: Technological advancements in electronic industry.

Technological progress in the electronic industry significantly influences the demand and evolution of electronic wet chemicals, essential in various manufacturing processes like semiconductor production and PCB fabrication. As electronic devices continue to shrink in size due to advancements in miniaturization and nanotechnology, electronic wet chemicals become indispensable for precise processes like photolithography, crucial for creating intricate patterns on semiconductor wafers to produce smaller and more powerful components. Furthermore, the strides in advanced semiconductor manufacturing necessitate high-purity chemicals for cleaning, etching, and deposition, pivotal in processes like chemical-mechanical planarization (CMP) and atomic layer deposition (ALD), ensuring the precision required for contemporary semiconductor devices. The emergence of new materials, including advanced polymers and metal alloys, in electronic components prompts the adaptation and development of electronic wet chemicals to efficiently and precisely address specific fabrication requirements. Additionally, stringent environmental and safety regulations drive the industry towards greener practices, prompting electronic wet chemical suppliers to formulate eco-friendly solutions without compromising performance. The increasing complexity of electronic devices demands a diverse range of specialized chemicals in manufacturing processes, while innovations in packaging technologies, such as 3D packaging, present new challenges met by adapted electronic wet chemicals to ensure the integrity and reliability of packaged electronic devices. The rise of automation and Industry 4.0 underscores the need for electronic wet chemicals compatible with advanced manufacturing equipment, emphasizing their crucial role in ensuring efficient and consistent production in the evolving landscape of electronic manufacturing.

Driver: Rise in demand for hydrogen peroxide from the semiconductor industry.

The surge in hydrogen peroxide demand within semiconductor manufacturing serves as a pivotal catalyst for the electronic wet chemicals market. With its versatility, hydrogen peroxide is integral in cleaning and etching procedures, effectively eliminating organic and inorganic contaminants from semiconductor wafers. As semiconductor technology advances towards smaller nodes, like 7nm and 5nm, the precision demands escalate, propelling hydrogen peroxide's utilization in critical cleaning processes to attain the requisite cleanliness for advanced semiconductor nodes. Additionally, its role as an oxidizer in Chemical-Mechanical Planarization (CMP) slurries contributes to the effectiveness of the planarization process crucial for achieving a flat and smooth wafer surface. The environmentally friendly nature of hydrogen peroxide aligns with industry trends emphasizing sustainability and safety, potentially steering the semiconductor industry towards its increased adoption. Moreover, its compatibility with emerging materials and its reputation for cost-effectiveness and efficiency further position hydrogen peroxide as a strategic choice, emphasizing its pivotal role in the electronic wet chemicals market amid the evolving landscape of electronic manufacturing.

Restraint: Stringent health and environmental regulations for certain chemicals

Meeting stringent health and environmental standards may require significant research and development efforts to formulate alternative chemicals that comply with regulations. This can slow down the pace of innovation and the introduction of new electronic wet chemical products. Companies in the electronic wet chemicals market may face increased compliance costs associated with testing, monitoring, and ensuring that their products meet health and environmental standards. These costs can impact profit margins and make it challenging for smaller businesses to compete. Compliance with stringent regulations may involve changes in the supply chain, including sourcing raw materials that meet environmental and health standards. This can lead to supply chain disruptions and increase the complexity of managing and ensuring the compliance of the entire supply chain. Some electronic wet chemicals that are commonly used in manufacturing processes may be restricted or banned due to their adverse health or environmental effects. This limitation in material options can restrict manufacturers in choosing the most effective and cost-efficient solutions for their processes. Certain stringent regulations may limit the use of electronic wet chemicals in critical applications, such as medical devices or aerospace components. This restriction can impact market opportunities and the potential for growth in high-value segments

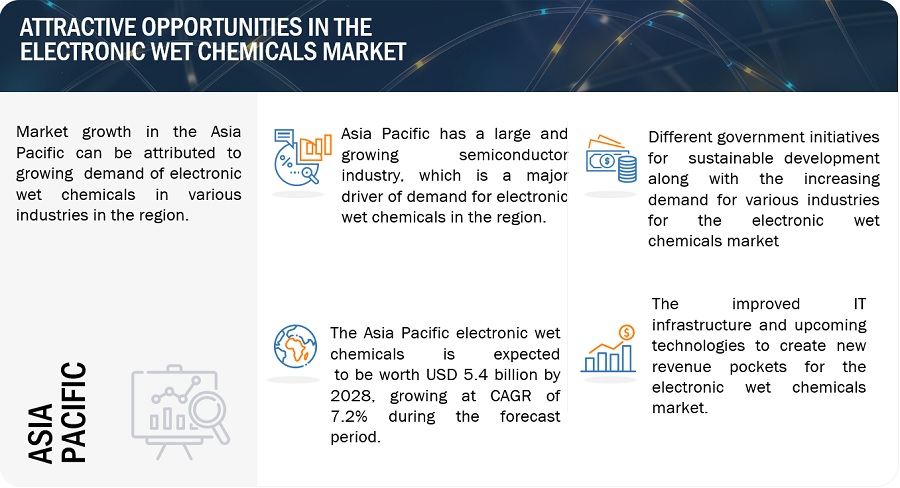

Opportunity: Improved IT infrastructure and upcoming technologies

The electronic wet chemicals market is poised for substantial growth, propelled by the transformative potential of improved IT infrastructure and upcoming technologies. With a robust IT backbone, the industry can leverage data-driven decision-making, enabling sophisticated collection, analysis, and management of real-time data. Integration with Industrial IoT facilitates seamless connectivity between electronic wet chemical processes and devices, fostering enhanced monitoring, predictive maintenance, and overall optimization. Upcoming technologies usher in advanced process control systems that utilize real-time data and algorithms, ensuring precision in applying electronic wet chemicals during semiconductor and electronics manufacturing. Automation and robotics, supported by improved IT infrastructure, enable precise handling of chemicals, minimizing human intervention and errors. Digital twin technology introduces virtual replicas of manufacturing processes, allowing for simulation, analysis, and optimization before implementation, enhancing formulation testing and quality improvement. The strengthened supply chain visibility facilitated by enhanced IT infrastructure is pivotal for ensuring quality, safety, and compliance throughout the manufacturing and distribution process. Blockchain technology contributes to transparency, reducing the risk of counterfeit products and ensuring regulatory adherence. Cloud computing provides scalable resources, supporting the growth of manufacturing operations and global collaboration. Machine learning and predictive analytics optimize electronic wet chemical formulation, forecasting demand, improving production schedules, and enhancing efficiency. The capability for remote monitoring and control, facilitated by improved IT infrastructure, empowers manufacturers to oversee processes in real-time, even from remote locations. Furthermore, advanced technologies enable customization and personalization of electronic wet chemical formulations, accommodating diverse materials and processes in the dynamic electronics industry. Embracing these opportunities promises to lead the electronic wet chemicals sector towards more efficient, sustainable, and technologically advanced manufacturing processes.

Challenge: Rapid decline in the use of old technologies.

A rapid decline in the use of old technologies presents challenges for the electronic wet chemicals market, including compatibility issues, reformulation challenges, disruptions in the supply chain, the need for additional R&D investments, market uncertainty, obsolete product lines, transition costs, customer resistance, regulatory compliance adjustments, and potential imbalances in market adaptation. Successfully navigating these challenges requires strategic planning, flexibility, and a proactive approach to innovation and market dynamics.

Electronic Wet Chemicals Market Ecosystem

A market ecosystem for electronic wet chemicals refers to the interconnected network of various entities, factors, and dynamics that collectively influence the production, distribution, and consumption of electronic wet chemicals in the market. This ecosystem involves a range of participants, both internal and external, and includes various components that interact with each other to shape the overall functioning of the market.Avantor Inc. (US), BASF SE (Germany), Cabot Microelectronics (US), and Kanto Chemical Co. Inc. (Japan), Honeywell International, Inc. (US), Eastman Chemical Company (US), Linde Plc (Ireland), Solvay (Belgium), Fujifilm Corporation (Japan), and Technic Inc. (US) etc.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

"Acetic acid is the largest sub-segment amongst the type segment in the electronic wet chemicals market in 2023, in terms of value."

Acetic acid's prominence and dominance in the electronic wet chemicals market are attributed to its remarkable versatility, advantageous properties, and several additional factors. Acting as a mild yet potent cleaning agent, acetic acid effectively removes impurities such as organic residues, inorganic salts, and metal oxides from electronic components, offering flexibility in usage based on cleaning needs. In controlled doses, acetic acid proves invaluable in etching specific materials like copper and aluminum oxide, crucial for precision in circuit board manufacturing. Its role as a weak acid enables precise pH control during various wet chemical processes, ensuring optimal results in etching and cleaning. Notably, acetic acid is safer to handle at lower concentrations compared to many other acids in electronics, reducing the risk of accidents for workers. Its moderate evaporation rate allows controlled cleaning and etching without rapid drying or residue buildup. Furthermore, its cost-effectiveness, biodegradability, and compatibility with a wide range of materials used in electronics contribute to its popularity. The long history of acetic acid's use in electronics has led to established protocols and available equipment, simplifying integration for manufacturers. Altogether, these factors position acetic acid as a versatile, safe, cost-effective, and environmentally friendly choice, underlining its longstanding and central role in electronic wet chemical processes.

Liquid form accounted for the largest by form share of the electronic wet chemicals market in 2023 in terms of value.

In the realm of electronic wet chemicals, liquid formulations are frequently favored due to their practical advantages in handling, dispersion, and application precision. Liquids, inherently easier to manage than solids or gases, play a pivotal role in coating, cleaning, and etching during electronic manufacturing. Their ability to achieve uniform dispersion ensures consistent coverage on electronic components, crucial for reliable outcomes. Liquids allow easy mixing and dilution for specific concentrations, offer convenient transportation and storage, and provide superior control over reaction parameters. Their adaptability to tool compatibility and precise measurement capabilities contribute to a safe, efficient, and accurate manufacturing environment, underscoring the prevalent use of liquid forms in electronic wet chemical processes.

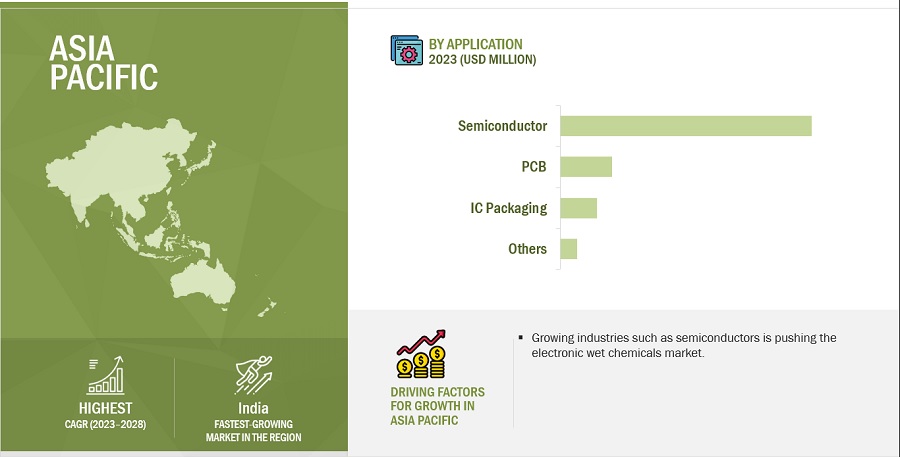

“Semiconductor accounted for the largest application of the electronic wet chemicals market in 2023” in terms of value.”

Semiconductor manufacturing commands the forefront in the utilization of electronic wet chemicals, primarily driven by their indispensable role in precision-oriented fabrication processes. The semiconductor industry heavily relies on electronic wet chemicals in critical processes such as photolithography, etching, and deposition, ensuring the meticulous creation of intricate circuit patterns on semiconductor wafers. Key steps like Chemical-Mechanical Planarization (CMP) employ electronic wet chemicals, crucial for achieving a flat and smooth wafer surface. From deposition processes like Chemical Vapor Deposition (CVD) to cleaning and surface preparation, these chemicals are integral in shaping semiconductor components with paramount cleanliness. As semiconductor technology advances to smaller nodes, demanding heightened precision and purity, electronic wet chemicals continually evolve to meet these stringent requirements. The industry's commitment to integrating new materials for enhanced performance underscores the pivotal role of electronic wet chemicals, solidifying the semiconductor sector's position as the foremost application in the electronic wet chemicals landscape within the electronics industry.

“Consumer goods accounted for the largest end-use industry for the electronic wet chemicals market, in terms of value in 2023”

The consumer goods industry emerges as the foremost consumer of electronic wet chemicals, primarily propelled by its high-volume production and diverse applications in electronics. Ranging from smartphones to home appliances, these goods require miniaturized components and advanced technologies, relying on intricate processes like photolithography and deposition where electronic wet chemicals play a vital role. Rapid technological advancements and the industry's cost sensitivity further underscore the essentiality of these chemicals in adapting to changes and ensuring cost-effective manufacturing. The compatibility of electronic wet chemicals with a diverse range of materials used in consumer electronics, coupled with their role in achieving high-quality finishes, aligns with the dynamic preferences and trends shaping the electronics market. The substantial global reach and size of the consumer electronics market reinforce the consumer goods industry's pivotal position as the largest end-user of electronic wet chemicals.

"Asia pacific is the largest market for electronic wet chemicals Market in 2023, in terms of value."

The Asia-Pacific region stands out as the foremost market for electronic wet chemicals due to a confluence of key factors. Serving as a global manufacturing hub, countries like China, Japan, South Korea, and Taiwan drive substantial demand for electronic wet chemicals in the production of semiconductors and consumer electronics. The region's dominance in semiconductor fabrication, marked by advanced facilities, contributes significantly to the demand for these chemicals, particularly in intricate processes like photolithography and deposition. The boom in consumer electronics, fueled by rapid economic growth and an expanding middle-class population, propels the extensive use of electronic wet chemicals in manufacturing smartphones, tablets, and smart appliances. Asia-Pacific's technological leadership, well-integrated electronics supply chain, ongoing investments in research and development, and status as a major global electronics exporter further solidify its position as a significant market for electronic wet chemicals. Supportive government policies in countries like China foster industry growth, and the densely populated urban centers drive demand for electronic products, creating a substantial market for electronic wet chemicals in manufacturing a diverse array of electronic components.

To know about the assumptions considered for the study, download the pdf brochure

Electronic Wet Chemicals Market Players

The key players in this market are Avantor Inc. (US), BASF SE (Germany), Cabot Microelectronics (US), and Kanto Chemical Co. Inc. (Japan), Honeywell International, Inc. (US), Eastman Chemical Company (US), Linde Plc (Ireland), Solvay (Belgium), Fujifilm Corporation (Japan), and Technic Inc. (US) etc. Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of electronic wet chemicals have opted for new product launches to sustain their market position.

Read More: Electronic Wet Chemicals Companies

Electronic Wet Chemicals Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2019-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Billion/Million) |

|

Segments |

Type, Application, Form, End-use industry and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Avantor Inc. (US), BASF SE (Germany), Cabot Microelectronics (US), and Kanto Chemical Co. Inc. (Japan), Honeywell International, Inc. (US), Eastman Chemical Company (US), Linde Plc (Ireland), Solvay (Belgium), Fujifilm Corporation (Japan), and Technic Inc. (US) |

Electronic Wet Chemicals Market Segmentation

This report categorizes the global electronic wet chemicals market based on type, application, form, end-use industry and region.

On the basis of type, the electronic wet chemicals market has been segmented as follows:

- Acetic acid

- Isopropyl alcohol

- Hydrogen peroxide

- Hydrochloric acid

- Ammonium hydroxide

- Hydrofluoric acid

- Nitric acid

- Phosphoric acid

- Sulfuric acid

- Others

On the basis of application, the electronic wet chemicals market has been segmented as follows:

- Semiconductor

- IC packaging

- PCB

- Others

On the basis of form, the electronic wet chemicals market has been segmented as follows:

- Liquid form

- Gas form

- Solid form

On the basis of end-use industry, the electronic wet chemicals market has been segmented as follows:

- Consumer goods

- Automotive

- Aerospace & defence

- Medical

- Others

On the basis of region, the electronic wet chemicals market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In December 2023, BASF SE (Germany)and Vattenfall (Netherland) are in advanced and exclusive discussions to partner on the Nordlicht 1 and 2 projects through a sale of 49% of the project shares to BASF. Both parties signed a Memorandum of Understanding to formally express their joint ambition. Vattenfall will use its share of the fossil free electricity to supply its German customers.

- In April 2023, Cabot Microelectronics Corporation (US) announced that it has acquired the Chiba solar farm (China).

- In January 2022, Honeywell International, Inc. (US) acquired 100% of the issued and outstanding shares of US Digital Designs, Inc.,(Us) a leading provider of technologies for first responders, for total consideration of $186 million. The business is included within the Honeywell Building Technologies reportable business segment.

- In June 2019, Kanto Chemical Co. Inc invested around USD 63.7 million to expand its production facility in Taiwan to meet the growing demand of major local clients from the semiconductors industry. This facility will increase the annual output of semiconductor products from 120,000 tons to 200,000 tons.

Frequently Asked Questions (FAQ):

What is the expected growth rate of the electronic wet chemicals market?

This study's forecast period for the electronic wet chemicals market is 2023-2028. The market is expected to grow at a CAGR of 7.2% in terms of value, during the forecast period.

Who are the major key players in the electronic wet chemicals market?

Avantor Inc. (US), BASF SE (Germany), Cabot Microelectronics (US), and Kanto Chemical Co. Inc. (Japan), Honeywell International, Inc. (US), Eastman Chemical Company (US), Linde Plc (Ireland), Solvay (Belgium), Fujifilm Corporation (Japan), and Technic Inc. (US) etc. are the leading manufacturers and service provider of electronic wet chemicals market.

What are the emerging trends in the Electronic wet chemicals market?

Emerging trends in the electronic wet chemicals industry include a focus on green chemistry, advancements in nanotechnology, integration of smart manufacturing and Industry 4.0 technologies, customization of solutions for diverse electronic components, development of selective deposition and etching techniques, exploration of ionic liquids and alternative solvents, innovations in conformal coating formulations, efforts to enhance supply chain resilience and localization, a strong emphasis on regulatory compliance, and the exploration of blockchain for traceability in the supply chain.

What are the drivers and opportunities for the electronic wet chemicals market?

Technological advancement in electronic industry coupled with rising demand for hydrogen peroxide from the semiconductor industry to drive the market for electronic wet chemicals. The opportunity being improved IT infrastructure and upcoming technologies.

What are the restraining factors in the electronic wet chemicals market?

Stringent health and environmental regulations for certain chemicals is a major restraining factor. .

How are supply chain disruptions impacting the availability of electronic wet chemicals in the U.S.?

Supply chain challenges, including raw material shortages and logistical delays, have impacted the availability of electronic wet chemicals in the U.S. Semiconductor manufacturers are seeking localized production and diversifying suppliers to mitigate risks. Government initiatives, like the CHIPS Act, aim to bolster domestic manufacturing, reducing reliance on international supply chains.

What role does the UK play in the European electronic wet chemicals market?

The UK serves as a key player in the European electronic wet chemicals market by focusing on R&D and high-value manufacturing for semiconductor and electronic applications. Its emphasis on innovation and collaborations with leading tech hubs positions the UK as a strategic contributor to the region's growth, despite post-Brexit challenges.

How is the UK electronic wet chemicals market adapting to regulatory changes?

In the UK, the electronic wet chemicals market is adapting to stringent regulatory changes aimed at ensuring safety and environmental protection. These regulations require manufacturers to comply with strict standards for chemical usage, labeling, and disposal. As a result, companies are investing in research and development to create safer and more sustainable chemical formulations that meet these regulatory demands. The push for compliance is also driving innovation, as firms explore alternative materials and processes that reduce environmental impact while still delivering high-quality results in electronic manufacturing.

What are the environmental impacts of electronic wet chemicals, and how is the industry addressing them?

In conclusion, while electronic wet chemicals pose significant environmental risks through contamination and pollution, ongoing industry efforts towards sustainable practices and regulatory compliance aim to mitigate these impacts effectively. Continued innovation and adherence to stringent environmental standards will be crucial for addressing the challenges posed by electronic waste.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Technological advancements in electronics industry- Increasing use of semiconductors and integrated chips- Rise in demand for hydrogen peroxide from semiconductor industryRESTRAINTS- Stringent health and environmental regulations for certain chemicalsOPPORTUNITIES- Improved IT infrastructure and upcoming technologies- Increasing demand for consumer goodsCHALLENGES- Rapid decline in use of certain technologies due to introduction of cloud-based storage

- 6.1 INTRODUCTION

-

6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR ELECTRONIC WET CHEMICAL MANUFACTURERS

-

6.3 VALUE CHAIN ANALYSISRAW MATERIAL SOURCINGRESEARCH & DEVELOPMENTAPPLICATORS/FORMULATORSEND-USE INDUSTRIES

-

6.4 PRICING ANALYSISAVERAGE SELLING PRICE TREND, BY REGIONAVERAGE SELLING PRICE TREND, BY TYPEAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TOP 3 TYPESAVERAGE SELLING PRICE TREND, BY FORMAVERAGE SELLING PRICE TREND, BY APPLICATION

-

6.5 ECOSYSTEM MAP

- 6.6 TECHNOLOGY ANALYSIS

-

6.7 PATENT ANALYSISMETHODOLOGYPATENTS GRANTED WORLDWIDE, 2013–2022- Publication trends over last ten yearsINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION ANALYSISTOP COMPANIES/APPLICANTSLIST OF MAJOR PATENTS

-

6.8 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

- 6.9 KEY CONFERENCES & EVENTS, 2023–2024

-

6.10 TARIFF AND REGULATORY LANDSCAPETARIFF AND REGULATIONS RELATED TO ELECTRONIC WET CHEMICALSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATIONS RELATED TO ELECTRONIC WET CHEMICALS MARKET

-

6.11 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREATS OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.13 MACROECONOMIC INDICATORSGDP TRENDS AND FORECASTS OF MAJOR ECONOMIES

-

6.14 CASE STUDIESWASTE GENERATION AND MANAGEMENT IN SEMICONDUCTOR INDUSTRYOCCEAN INSIGHT COLLABORATED WITH PROMINENT PIONEER IN PLASMA-ETCHING TECHNOLOGIES TO INVESTIGATE COMPREHENSIVE SPECTRUM PLASMA MONITORING SOLUTIONS TAILORED FOR IDENTIFICATION OF CRUCIAL WAFER ETCH ENDPOINTSSTRATEGIC INITIATIVE BY INTEL CORPORATION TO MINIMIZE ENVIRONMENTAL IMPACT OF PCB MANUFACTURING

- 7.1 INTRODUCTION

-

7.2 LIQUID FORMASIA PACIFIC TO BE LARGEST MARKET FOR LIQUID FORM WET CHEMICALS

-

7.3 GAS FORMINCREASING DEMAND FROM SEMICONDUCTORS INDUSTRY TO DRIVE GROWTH

-

7.4 SOLID FORMCLEANING AND ETCHING OF SEMICONDUCTORS TO DRIVE DEMAND

- 8.1 INTRODUCTION

-

8.2 ACETIC ACIDRISING USE OF ETCHING CHEMICALS TO DRIVE DEMAND

-

8.3 ISOPROPYL ALCOHOL (IPA)INCREASED DEMAND FROM VARIOUS END-USE INDUSTRIES

-

8.4 HYDROGEN PEROXIDEINCREASED DEMAND FROM ETCHING AND CLEANING PROCESSES

-

8.5 HYDROCHLORIC ACIDSGROWING DEMAND FROM SEMICONDUCTORS AND OIL & GAS INDUSTRIES

-

8.6 AMMONIUM HYDROXIDECLEANING PROPERTIES OF AMMONIUM HYDROXIDE TO DRIVE DEMAND

-

8.7 HYDROFLUORIC ACIDINCREASING SEMICONDUCTOR DEMAND TO BOOST MARKET

-

8.8 NITRIC ACIDGROWING DEMAND FROM FOOD PROCESSING AND SEMICONDUCTOR INDUSTRIES

-

8.9 PHOSPHORIC ACIDINCREASING DEMAND FROM DISPLAY PANELS TO BOOST MARKET

-

8.10 SULFURIC ACIDHIGH DEMAND FOR ICS AND PCBS FROM SEMICONDUCTOR INDUSTRY

- 8.11 OTHER TYPES

- 9.1 INTRODUCTION

-

9.2 SEMICONDUCTORADVANCES IN ELECTRONICS INDUSTRY TO BOOST DEMANDCLEANINGETCHING

-

9.3 IC PACKAGINGINCREASED COMPLEXITY OF SEMICONDUCTOR COMPONENTS TO BOOST MARKET

-

9.4 PCBINCREASE IN DEMAND FOR PCB FROM COMMUNICATION & INFORMATION TECHNOLOGY INDUSTRIES

- 9.5 OTHER APPLICATIONS

- 10.1 INTRODUCTION

-

10.2 CONSUMER GOODSGROWTH IN SMART TECHNOLOGIES TO DRIVE MARKET

-

10.3 AUTOMOTIVEGROWTH OF ELECTRIC & HYBRID VEHICLES TO DRIVE DEMAND

-

10.4 AEROSPACE & DEFENSEINCREASED DEMAND FOR FUEL-EFFICIENT AND TECHNOLOGICALLY ADVANCED AIRCRAFT TO DRIVE MARKET

-

10.5 MEDICALDISINFECTING PROPERTIES OF HYDROGEN PEROXIDE & ISOPROPYL ALCOHOL TO DRIVE DEMAND

- 10.6 OTHER END-USE INDUSTRIES

- 11.1 INTRODUCTION

-

11.2 ASIA PACIFICRECESSION IMPACT- China- Japan- India- South Korea- Taiwan- Rest of Asia Pacific

-

11.3 NORTH AMERICARECESSION IMPACT- US- Canada- Mexico

-

11.4 EUROPERECESSION IMPACT- Germany- Italy- France- UK- Spain- Rest of Europe

-

11.5 MIDDLE EAST & AFRICARECESSION IMPACTGCC COUNTRIES- Saudi Arabia- Israel- Rest of GCC countries- South Africa- Rest of Middle East & Africa

-

11.6 SOUTH AMERICARECESSION IMPACT- Brazil- Argentina- Rest of South America

- 12.1 INTRODUCTION

-

12.2 MARKET SHARE ANALYSISRANKING OF KEY MARKET PLAYERS, 2022MARKET SHARE OF KEY PLAYERS

- 12.3 REVENUE ANALYSIS

-

12.4 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

12.5 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

12.6 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

13.1 KEY PLAYERSAVANTOR INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBASF SE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCABOT MICROELECTRONICS CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHONEYWELL INTERNATIONAL INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKANTO CHEMICAL INDUSTRY CO. LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEASTMAN CHEMICAL COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSOLVAY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFUJIFILM HOLDINGS CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTECHNIC INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLINDE PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

13.2 OTHER PLAYERSMITSUBISHI CHEMICAL CORPORATIONAIR PRODUCTS AND CHEMICALS INC.ZHEJIANG KAISN FLUOROCHEMICAL CO. LTDKREDENCE PVT. LTD.SAREX CHEMICALS LTD.T.N.C. INDUSTRIAL CO. LTDTRANSENE COMPANY INC.PARKER DOMNICK HUNTERSONGWONENTEGRISALFA CHEMISTRYASIA UNION ELECTRONIC CHEMICAL CORP.TOKYO OHKA KOGYOJSR CORPORATIONSHIN-ETSU CHEMICAL CO., LTD.

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 AVERAGE SELLING PRICE, BY REGION, 2019–2028 (USD/TON)

- TABLE 2 AVERAGE SELLING PRICE, BY TYPE, 2019–2028 (USD/TON)

- TABLE 3 AVERAGE SELLING PRICE OF TOP 3 TYPES, BY KEY PLAYER, 2019–2028 (USD/TON)

- TABLE 4 AVERAGE SELLING PRICE, BY FORM, 2019–2028 (USD/TON)

- TABLE 5 AVERAGE SELLING PRICE, BY APPLICATION, 2019–2028 (USD/TON)

- TABLE 6 ELECTRONIC WET CHEMICALS MARKET: ECOSYSTEM

- TABLE 7 TECHNOLOGIES OFFERED IN ELECTRONIC WET CHEMICALS MARKET

- TABLE 8 TOTAL NUMBER OF PATENTS

- TABLE 9 LIST OF MAJOR PATENT OWNERS FOR ELECTRONIC WET CHEMICALS

- TABLE 10 MAJOR PATENTS FOR ELECTRONIC WET CHEMICALS

- TABLE 11 ELECTRONIC WET CHEMICALS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 12 TARIFFS RELATED TO ELECTRONIC WET CHEMICALS MARKET

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 LIST OF REGULATIONS FOR ELECTRONIC WET CHEMICALS MARKET

- TABLE 19 IMPACT OF PORTER’S FIVE FORCES ON ELECTRONIC WET CHEMICALS MARKET

- TABLE 20 INFLUENCE OF INSTITUTIONAL BUYERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 21 KEY BUYING CRITERIA FOR APPLICATIONS

- TABLE 23 ELECTRONIC WET CHEMICALS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 24 ELECTRONIC WET CHEMICALS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 25 ELECTRONIC WET CHEMICALS MARKET, BY FORM, 2019–2022 (KILOTON)

- TABLE 26 ELECTRONIC WET CHEMICALS MARKET, BY FORM, 2023–2028 (KILOTON)

- TABLE 27 ELECTRONIC WET CHEMICALS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 28 ELECTRONIC WET CHEMICALS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 29 ELECTRONIC WET CHEMICALS MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 30 ELECTRONIC WET CHEMICALS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 31 ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 32 ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 33 ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 34 ELECTRONIC WET CHEMICALS MARKET SIZE, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 35 ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 36 ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 37 ELECTRONIC WET CHEMICALS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 38 ELECTRONIC WET CHEMICALS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 ELECTRONIC WET CHEMICALS MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 40 ELECTRONIC WET CHEMICALS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 41 ASIA PACIFIC: ELECTRONIC WET CHEMICALS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 42 ASIA PACIFIC: ELECTRONIC WET CHEMICALS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 43 ASIA PACIFIC: ELECTRONIC WET CHEMICALS MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 44 ASIA PACIFIC: ELECTRONIC WET CHEMICALS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 45 ASIA PACIFIC: ELECTRONIC WET CHEMICALS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 46 ASIA PACIFIC: ELECTRONIC WET CHEMICALS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 47 ASIA PACIFIC: ELECTRONIC WET CHEMICALS MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 48 ASIA PACIFIC: ELECTRONIC WET CHEMICALS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 49 ASIA PACIFIC: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 50 ASIA PACIFIC: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 51 ASIA PACIFIC: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 52 ASIA PACIFIC: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 53 ASIA PACIFIC: ELECTRONIC WET CHEMICALS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 54 ASIA PACIFIC: ELECTRONIC WET CHEMICALS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 55 ASIA PACIFIC: ELECTRONIC WET CHEMICALS MARKET, BY FORM, 2019–2022 (KILOTON)

- TABLE 56 ASIA PACIFIC: ELECTRONIC WET CHEMICALS MARKET, BY FORM, 2023–2028 (KILOTON)

- TABLE 57 ASIA PACIFIC: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 58 ASIA PACIFIC: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 59 CHINA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 60 CHINA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 61 CHINA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 62 CHINA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 63 CHINA: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 64 CHINA: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 65 JAPAN: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 66 JAPAN: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 67 JAPAN: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 68 JAPAN: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 69 JAPAN: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 70 JAPAN: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 71 INDIA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 72 INDIA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 73 INDIA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 74 INDIA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 75 INDIA: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 76 INDIA: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 77 SOUTH KOREA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 78 SOUTH KOREA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 79 SOUTH KOREA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 80 SOUTH KOREA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 81 SOUTH KOREA: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 82 SOUTH KOREA: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 83 TAIWAN: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 84 TAIWAN: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 85 TAIWAN: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 86 TAIWAN: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 87 TAIWAN: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 88 TAIWAN: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 89 REST OF ASIA PACIFIC: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 90 REST OF ASIA PACIFIC: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 91 REST OF ASIA PACIFIC: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 92 REST OF ASIA PACIFIC: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 93 REST OF ASIA PACIFIC: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 94 REST OF ASIA PACIFIC: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 96 NORTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 98 NORTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 99 NORTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 100 NORTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 101 NORTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 102 NORTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 103 NORTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 104 NORTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 105 NORTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 106 NORTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 107 NORTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 108 NORTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 109 NORTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY FORM, 2019–2022 (KILOTON)

- TABLE 110 NORTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY FORM, 2023–2028 (KILOTON)

- TABLE 111 NORTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 112 NORTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 113 US: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 114 US: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 115 US: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 116 US: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 117 US: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 118 US: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 119 CANADA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 120 CANADA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 121 CANADA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 122 CANADA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 123 CANADA: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 124 CANADA: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 125 MEXICO: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 126 MEXICO: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 127 MEXICO: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 128 MEXICO: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 129 MEXICO: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 130 MEXICO: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 131 EUROPE: ELECTRONIC WET CHEMICALS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 132 EUROPE: ELECTRONIC WET CHEMICALS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 133 EUROPE: ELECTRONIC WET CHEMICALS MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 134 EUROPE: ELECTRONIC WET CHEMICALS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 135 EUROPE: ELECTRONIC WET CHEMICALS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 136 EUROPE: ELECTRONIC WET CHEMICALS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 137 EUROPE: ELECTRONIC WET CHEMICALS MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 138 EUROPE: ELECTRONIC WET CHEMICALS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 139 EUROPE: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 140 EUROPE: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 141 EUROPE: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 142 EUROPE: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 143 EUROPE: ELECTRONIC WET CHEMICALS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 144 EUROPE: ELECTRONIC WET CHEMICALS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 145 EUROPE: ELECTRONIC WET CHEMICALS MARKET, BY FORM, 2019–2022 (KILOTON)

- TABLE 146 EUROPE: ELECTRONIC WET CHEMICALS MARKET, BY FORM, 2023–2028 (KILOTON)

- TABLE 147 EUROPE: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 148 EUROPE: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 149 GERMANY: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 150 GERMANY: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 151 GERMANY: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 152 GERMANY: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 153 GERMANY: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 154 GERMANY: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 155 ITALY: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 156 ITALY: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 157 ITALY: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 158 ITALY: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 159 ITALY: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 160 ITALY: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 161 FRANCE: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 162 FRANCE: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 163 FRANCE: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 164 FRANCE: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 165 FRANCE: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 166 FRANCE: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 167 UK: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 168 UK: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 169 UK: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 170 UK: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 171 UK: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 172 UK: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 173 SPAIN: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 174 SPAIN: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 175 SPAIN: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 176 SPAIN: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 177 SPAIN: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 178 SPAIN: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 179 REST OF EUROPE: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 180 REST OF EUROPE: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 181 REST OF EUROPE: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 182 REST OF EUROPE: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 183 REST OF EUROPE: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 184 REST OF EUROPE: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 188 MIDDLE EAST & AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 189 MIDDLE EAST & AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 192 MIDDLE EAST & AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 193 MIDDLE EAST & AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 196 MIDDLE EAST & AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 197 MIDDLE EAST & AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY FORM, 2019–2022 (KILOTON)

- TABLE 200 MIDDLE EAST & AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY FORM, 2023–2028 (KILOTON)

- TABLE 201 MIDDLE EAST & AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 203 SAUDI ARABIA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 204 SAUDI ARABIA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 205 SAUDI ARABIA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 206 SAUDI ARABIA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 207 SAUDI ARABIA: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 208 SAUDI ARABIA: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 209 ISRAEL: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 210 ISRAEL: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 211 ISRAEL: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 212 ISRAEL: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 213 ISRAEL: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 214 ISRAEL: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 215 REST OF GCC COUNTRIES: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 216 REST OF GCC COUNTRIES: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 217 REST OF GCC COUNTRIES: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 218 REST OF GCC COUNTRIES: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 219 REST OF GCC COUNTRIES: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 220 REST OF GCC COUNTRIES: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 221 SOUTH AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 222 SOUTH AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 223 SOUTH AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 224 SOUTH AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 225 SOUTH AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 226 SOUTH AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 227 REST OF MIDDLE EAST & AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 228 REST OF MIDDLE EAST & AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 229 REST OF MIDDLE EAST & AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 230 REST OF MIDDLE EAST & AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 231 REST OF MIDDLE EAST & AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 232 REST OF MIDDLE EAST & AFRICA: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 233 SOUTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 234 SOUTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 235 SOUTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 236 SOUTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 237 SOUTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 238 SOUTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 239 SOUTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 240 SOUTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 241 SOUTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 242 SOUTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 243 SOUTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 244 SOUTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 245 SOUTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 246 SOUTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 247 SOUTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY FORM, 2019–2022 (KILOTON)

- TABLE 248 SOUTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY FORM, 2023–2028 (KILOTON)

- TABLE 249 SOUTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 250 SOUTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 251 BRAZIL: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 252 BRAZIL: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 253 BRAZIL: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 254 BRAZIL: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 255 BRAZIL: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 256 BRAZIL: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 257 ARGENTINA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 258 ARGENTINA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 259 ARGENTINA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 260 ARGENTINA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 261 ARGENTINA: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 262 ARGENTINA: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 263 REST OF SOUTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 264 REST OF SOUTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 265 REST OF SOUTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 266 REST OF SOUTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 267 REST OF SOUTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 268 REST OF SOUTH AMERICA: ELECTRONIC WET CHEMICALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 269 OVERVIEW OF STRATEGIES ADOPTED BY KEY ELECTRONIC WET CHEMICAL MANUFACTURERS

- TABLE 270 ELECTRONIC WET CHEMICALS MARKET: DEGREE OF COMPETITION

- TABLE 271 KEY COMPANY APPLICATION FOOTPRINT

- TABLE 272 KEY COMPANY TYPE FOOTPRINT

- TABLE 273 KEY COMPANY FORM FOOTPRINT

- TABLE 274 KEY COMPANY END-USE INDUSTRY FOOTPRINT

- TABLE 275 KEY COMPANY REGION FOOTPRINT

- TABLE 276 DETAILED LIST OF KEY START-UPS/SMES

- TABLE 277 SME APPLICATION FOOTPRINT

- TABLE 278 SME TYPE FOOTPRINT

- TABLE 279 SME FORM FOOTPRINT

- TABLE 280 SME END-USE INDUSTRY FOOTPRINT

- TABLE 281 SME REGION FOOTPRINT

- TABLE 282 ELECTRONIC WET CHEMICALS MARKET: PRODUCT LAUNCHES (2019–2023)

- TABLE 283 ELECTRONIC WET CHEMICALS MARKET: DEALS (2019–2023)

- TABLE 284 ELECTRONIC WET CHEMICALS MARKET: OTHER DEVELOPMENTS (2019–2023)

- TABLE 285 AVANTOR INC.: COMPANY OVERVIEW

- TABLE 286 AVANTOR INC.: PRODUCT OFFERINGS

- TABLE 287 AVANTOR INC.: DEALS

- TABLE 288 BASF SE: COMPANY OVERVIEW

- TABLE 289 BASF SE: PRODUCT OFFERINGS

- TABLE 290 BASF SE: PRODUCT LAUNCHES

- TABLE 291 BASF SE: DEALS

- TABLE 292 CABOT MICROELECTRONICS CORPORATION: COMPANY OVERVIEW

- TABLE 293 CABOT MICROELECTRONICS CORPORATION: PRODUCT OFFERINGS

- TABLE 294 CABOT MICROELECTRONICS CORPORATION: PRODUCT LAUNCHES

- TABLE 295 CABOT MICROELECTRONICS CORPORATION: DEALS

- TABLE 296 HONEYWELL INTERNATIONAL INC: COMPANY OVERVIEW

- TABLE 297 HONEYWELL INTERNATIONAL INC: PRODUCT OFFERINGS

- TABLE 298 HONEYWELL INTERNATIONAL INC: DEALS

- TABLE 299 KANTO CHEMICAL INDUSTRY CO. LTD.: COMPANY OVERVIEW

- TABLE 300 KANTO CHEMICAL INDUSTRY CO. LTD.: PRODUCT OFFERINGS

- TABLE 301 KANTO CHEMICAL INDUSTRY CO. LTD.: OTHER DEVELOPMENTS

- TABLE 302 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 303 EASTMAN CHEMICAL COMPANY: PRODUCT OFFERINGS

- TABLE 304 EASTMAN CHEMICAL CO.: OTHER DEVELOPMENTS

- TABLE 305 SOLVAY: COMPANY OVERVIEW

- TABLE 306 SOLVAY: PRODUCT OFFERINGS

- TABLE 307 SOLVAY: PRODUCT LAUNCH

- TABLE 308 SOLVAY: DEALS

- TABLE 309 SOLVAY: OTHERS

- TABLE 310 FUJIFILM HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 311 FUJIFILM HOLDINGS CORPORATION: PRODUCT OFFERINGS

- TABLE 312 FUJIFILM HOLDINGS CORPORATION: DEALS

- TABLE 313 FUJIFILM HOLDINGS CORPORATION: OTHERS

- TABLE 314 TECHNIC INC.: COMPANY OVERVIEW

- TABLE 315 TECHNIC INC.: PRODUCT OFFERINGS

- TABLE 316 TECHNIC INC.: PRODUCT LAUNCHES

- TABLE 317 TECHNIC INC.: DEALS

- TABLE 318 TECHNIC INC.: OTHER

- TABLE 319 LINDE PLC: COMPANY OVERVIEW

- TABLE 320 LINDE PLC: PRODUCT OFFERINGS

- TABLE 321 LINDE PLC: DEALS

- TABLE 322 LINDE PLC: OTHERS

- TABLE 323 MITSUBISHI CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 324 AIR PRODUCTS AND CHEMICALS INC.: COMPANY OVERVIEW

- TABLE 325 ZHEJIANG KAISN FLUOROCHEMICAL CO. LTD: COMPANY OVERVIEW

- TABLE 326 KREDENCE PVT. LTD.: COMPANY OVERVIEW

- TABLE 327 SAREX CHEMICALS LTD.: COMPANY OVERVIEW

- TABLE 328 T.N.C. INDUSTRIAL CO. LTD: COMPANY OVERVIEW

- TABLE 329 TRANSENE COMPANY INC.: COMPANY OVERVIEW

- TABLE 330 PARKER DOMNICK HUNTER: COMPANY OVERVIEW

- TABLE 331 SONGWON: COMPANY OVERVIEW

- TABLE 332 ENTEGRIS: COMPANY OVERVIEW

- TABLE 333 ALFA CHEMISTRY: COMPANY OVERVIEW

- TABLE 334 ASIA UNION ELECTRONIC CHEMICAL CORP.: COMPANY OVERVIEW

- TABLE 335 TOKYO OHKA KOGYO: COMPANY OVERVIEW

- TABLE 336 JSR CORPORATION: COMPANY OVERVIEW

- TABLE 337 SHIN-ETSU CHEMICAL CO., LTD.: COMPANY OVERVIEW

- FIGURE 1 ELECTRONIC WET CHEMICALS MARKET SEGMENTATION

- FIGURE 2 ELECTRONIC WET CHEMICALS MARKET: RESEARCH DESIGN

- FIGURE 3 ELECTRONIC WET CHEMICALS MARKET: DATA TRIANGULATION

- FIGURE 4 SEMICONDUCTOR APPLICATION TO DOMINATE ELECTRONIC WET CHEMICALS MARKET BETWEEN 2023 AND 2028

- FIGURE 5 ACETIC ACID SEGMENT TO LEAD ELECTRONIC WET CHEMICALS MARKET BETWEEN 2023 AND 2030

- FIGURE 6 LIQUID FORM SEGMENT TO DOMINATE ELECTRONIC WET CHEMICALS MARKET DURING FORECAST PERIOD

- FIGURE 7 CONSUMER GOODS SEGMENT TO LEAD ELECTRONIC WET CHEMICALS MARKET DURING FORECAST PERIOD

- FIGURE 8 ASIA PACIFIC ESTIMATED TO DOMINATE ELECTRONIC WET CHEMICALS MARKET IN 2023

- FIGURE 9 EXPANSION OF SEMICONDUCTOR INDUSTRY COUPLED WITH GROWTH OF CONSUMER GOODS SECTOR TO DRIVE MARKET

- FIGURE 10 SULFURIC ACID FASTEST-GROWING TYPE SEGMENT DURING FORECAST PERIOD

- FIGURE 11 SEMICONDUCTOR FASTEST-GROWING APPLICATION SEGMENT DURING FORECAST PERIOD

- FIGURE 12 LIQUID FORM FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO BE FASTEST-GROWING REGION IN ELECTRONIC WET CHEMICALS MARKET DURING FORECAST PERIOD

- FIGURE 14 INDIA TO BE FASTEST-GROWING MARKET FOR ELECTRONIC WET CHEMICALS DURING FORECAST PERIOD

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ELECTRONIC WET CHEMICALS MARKET

- FIGURE 16 REVENUE SHIFT OF ELECTRONIC WET CHEMICALS MARKET

- FIGURE 17 OVERVIEW OF ELECTRONIC WET CHEMICALS MARKET VALUE CHAIN

- FIGURE 18 ELECTRONIC WET CHEMICALS MARKET: AVERAGE SELLING PRICE TREND, BY REGION

- FIGURE 19 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TOP 3 TYPES

- FIGURE 20 NUMBER OF PATENTS GRANTED OVER LAST 10 YEARS

- FIGURE 21 PATENT ANALYSIS, BY LEGAL STATUS

- FIGURE 22 REGIONAL ANALYSIS OF PATENTS GRANTED FOR ELECTRONIC WET CHEMICALS MARKET, 2023

- FIGURE 23 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENTS IN LAST TEN YEARS

- FIGURE 24 IMPORTS OF ELECTRONIC WET CHEMICALS, BY COUNTRY, 2019–2022 (USD MILLION)

- FIGURE 25 EXPORTS OF ELECTRONIC WET CHEMICALS, BY COUNTRY, 2019–2022 (USD MILLION)

- FIGURE 26 PORTER’S FIVE FORCES ANALYSIS: ELECTRONIC WET CHEMICALS MARKET

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 28 KEY BUYING CRITERIA FOR APPLICATIONS

- FIGURE 29 LIQUID FORM SEGMENT TO DOMINATE ELECTRONIC WET CHEMICALS MARKET DURING FORECAST PERIOD

- FIGURE 30 ACETIC ACID SEGMENT TO LEAD ELECTRONIC WET CHEMICALS MARKET DURING FORECAST PERIOD

- FIGURE 31 SEMICONDUCTOR SEGMENT TO LEAD ELECTRONIC WET CHEMICALS MARKET DURING FORECAST PERIOD

- FIGURE 32 CONSUMER GOODS TO LEAD END-USE INDUSTRY SEGMENT

- FIGURE 33 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 34 ASIA PACIFIC: ELECTRONIC WET CHEMICALS MARKET SNAPSHOT

- FIGURE 35 NORTH AMERICA: ELECTRONIC WET CHEMICALS MARKET SNAPSHOT

- FIGURE 36 EUROPE: ELECTRONIC WET CHEMICALS MARKET SNAPSHOT

- FIGURE 37 RANKING OF TOP FIVE PLAYERS IN ELECTRONIC WET CHEMICALS MARKET, 2022

- FIGURE 38 ELECTRONIC WET CHEMICALS MARKET IN 2022

- FIGURE 39 REVENUE OF KEY PLAYERS, 2021–2024

- FIGURE 40 ELECTRONIC WET CHEMICALS MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 41 ELECTRONIC WET CHEMICALS MARKET: START-UPS/SMES EVALUATION MATRIX, 2022

- FIGURE 42 BUSINESS STRATEGY FOOTPRINT

- FIGURE 43 PRODUCT OFFERING STRATEGY

- FIGURE 44 AVANTOR INC.: COMPANY SNAPSHOT

- FIGURE 45 BASF SE.: COMPANY SNAPSHOT

- FIGURE 46 CABOT MICROELECTRONICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 47 HONEYWELL INTERNATIONAL INC: COMPANY SNAPSHOT

- FIGURE 48 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

- FIGURE 49 SOLVAY: COMPANY SNAPSHOT

- FIGURE 50 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT

The study involved four major activities in estimating the market size of the Electronic wet chemicals market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, the gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the monetary chain of the market, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The electronic wet chemicals market comprises several stakeholders in the value chain, which include raw material suppliers, research & development, fabricators/applicators, distribution and logistics, and end users. Various primary sources from the supply and demand sides of the electronic wet chemicals market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the electronic wet chemicals industry.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to form, type, application, end-use industry and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand the buyer’s perspective on the suppliers, products, fabricators, and their current usage of electronic wet chemicals and the outlook of their business, which will affect the overall market.

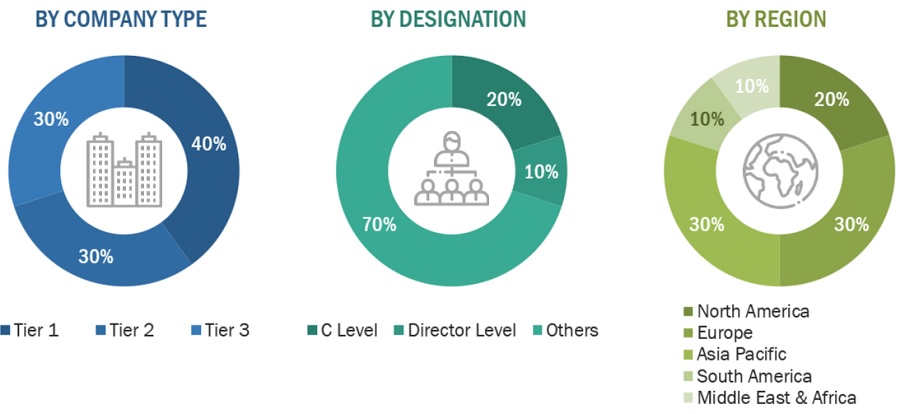

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company name |

Designation |

|

Avantor Inc.(US) |

Individual Industry Expert |

|

BASF SE (Germany) |

Sales Manager |

|

Cabot Microelectronics (US) |

Manager |

|

Kanto Chemical Co. Inc. (Japan) |

Marketing Manager |

|

Honeywell International, Inc. (US) |

Senior Scientist |

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the Electronic wet chemicals market.

- The key players in the industry have been identified through extensive secondary research.

- The industry's supply chain has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

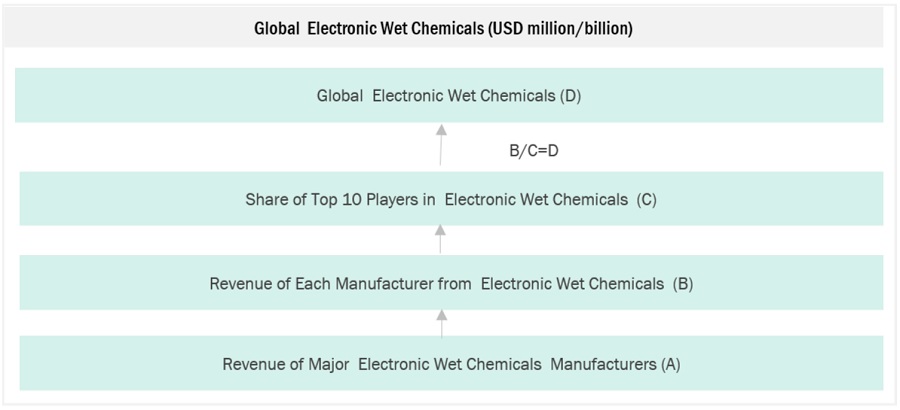

Electronic Wet Chemicals Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Electronic Wet Chemicals Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Electronic wet chemicals include the full range of acids, solvents, oxidizers, bases, mixed acids, and buffed oxide etchants. The electronics industry uses a broad range of highly sophisticated specialty chemicals in many processing steps in the manufacture of electronic components and products, in silicon wafers and integrated circuits, for packaging and printed circuit boards (PCBs), in the manufacture of compound semiconductors and optoelectronics, and in the production of flat panel display products.

Key Stakeholders

- Electronic wet Chemicals manufacturers

- Electronic wet Chemicals traders, distributors, and suppliers

- End-use industry participants of different segments of the electronic wet chemicals market

- Government and research organizations

- Associations and industrial bodies

- Research and consulting firms.

- Research & development (R&D) institutions.

- Environmental support agencies.

Report Objectives

- To define, describe, and forecast the size of the electronic wet chemicals market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on form, type, application, end-use industry and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Electronic Wet Chemicals Market