5.3

TRENDS/DISRUPTIONS IMPACTING CUSTOMERS BUSINESS

5.4.1

AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PRODUCT

5.4.2

AVERAGE SELLING PRICE TREND, BY REGION

5.5

SUPPLY CHAIN ANALYSIS

5.9.2

COMPLEMENTARY TECHNOLOGIES

5.9.3

ADJACENT TECHNOLOGIES

5.11

REGULATORY LANDSCAPE

5.11.1

REGULATORY SCENARIO

5.11.2

REGULATORY BODIES, GOVERNMENT AGENCIES & OTHER ORGANIZATIONS

5.12

PORTER’S FIVE FORCES ANALYSIS

5.12.1

THREAT OF NEW ENTRANTS

5.12.2

THREAT OF SUBSTITUTE

5.12.3

BARGAINING POWER OF SUPPLIERS

5.12.4

BARGAINING POWER OF BUYERS

5.12.5

INTENSITY OF COMPETITION RIVALRY

5.13

KEY STAKEHOLDERS AND BUYING CRITERIA

5.13.1

KEY STAKEHOLDERS IN THE BUYING PROCESS

5.13.2

BUYING CRITERIA FOR END USERS

5.14

INVESTMENT AND FUNDING SCENARIO

6

HIGH CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2022-2029 (USD MILLION)

6.2.1

CELL IMAGING SYSTEMS

6.2.2

CELL DETECTION AND ANALYSIS SYSTEMS

6.2.3

HIGH CONTENT IMAGING PLATFORMS

6.3

CONSUMABLES & ACCESSORIES

6.3.1

REAGENTS & ASSAY KITS

6.3.3

OTHER CONSUMABLES & ACCESSORIES

7

HIGH CONTENT SCREENING MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

7.2

DRUG DISCOVERY AND DEVELOPMENT

7.2.1

TARGET IDENTIFICATION AND VALIDATION

7.2.2

PRIMARY SCREENING AND SECONDARY SCREENING

7.2.4

OTHER DRUG DISCOVERY AND DEVELOPMENT APPLICATIONS (IF ANY)

8

HIGH CONTENT SCREENING MARKET, BY END USER, 2022-2029 (USD MILLION)

8.2

PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

8.3

ACADEMIC AND GOVERNMENT INSTITUTES

8.4

CONTRACT RESEARCH ORGANIZATIONS AND CONTRACT DEVELOPMENT & MANUFACTURING ORGANIZATIONS

9

HIGH CONTENT SCREENING MARKET, BY REGION, 2022-2029 (USD MILLION)

9.2.1

MACROECONOMIC OUTLOOK FOR NORTH AMERICA

9.3.1

MACROECONOMIC OUTLOOK FOR EUROPE

9.4.1

MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

9.4.7

REST OF ASIA PACIFIC

9.5.1

MACROECONOMIC OUTLOOK FOR LATIN AMERICA

9.5.3

REST OF LATIN AMERICA

9.6.1

MACROECONOMIC OUTLOOK FOR MIDDLE EAST

9.6.2.1

UNITED ARAB EMIRATES (UAE)

9.6.2.2

KINGDOM OF SAUDI ARABIA (KSA)

9.6.2.3

REST OF GCC COUNTRIES

9.6.3

REST OF MIDDLE EAST

9.7.1

MACROECONOMIC OUTLOOK FOR AFRICA

10.2

KEY PLAYERS STRATEGIES/ RIGHT TO WIN

10.3

REVENUE SHARE ANALYSIS (TOP 4-5 PLAYERS)

10.4

MARKET SHARE ANALYSIS (TOP 4-5 PLAYERS)

10.5

COMPANY EVALUATION MATRIX: KEY PLAYERS

10.5.5

COMPANY FOOTPRINT: KEY PLAYERS

10.5.5.1

COMPANY FOOTPRINT

10.5.5.2

PRODUCT FOOTPRINT

10.5.5.3

SERVICE FOOTPRINT

10.5.5.4

APPLICATION FOOTPRINT

10.5.5.5

REGION FOOTPRINT

10.6

COMPANY EVALUATION MATRIX: START-UPS/SMES,

10.6.1

PROGRESSIVE COMPANIES

10.6.2

RESPONSIVE COMPANIES

10.6.5

COMPETITIVE BENCHMARKING: STARTUPS/SMES,

10.6.5.1

DETAILED LIST OF KEY STARTUPS/ SMES

10.6.5.2

COMPETITIVE BENCHMARKING OF KEY STARTUPS/ SMES

10.7

COMPETITIVE SCENARIO

10.7.2

OTHER DEVELOPMENTS

10.8

BRAND/ PRODUCT COMPARATIVE ANALYSIS

10.9

VENDOR VALUATION AND FINANCIAL METRICS OF THE RESIDUAL DNA TESTING MARKET

11.1.1

DANAHER CORPORATION

11.1.4

THERMO FISHER SCIENTIFIC INC.

11.1.5

AGILENT TECHNOLOGIES

11.1.7

BIO-RAD LABORATORIES, INC.

11.1.8

NIKON INSTRUMENTS INC.

11.1.11

YOKOGAWA ELECTRIC CORPORATION

11.1.13

CORNING INCORPORATED

11.1.14

CHARLES RIVER LABORATORIES

11.2.2

PROMEGA CORPORATION

11.2.4

SYSMEX CORPORATION

11.2.5

ENZO LIFE SCIENCES

11.2.6

STRATEDIGM CORPORATION

11.2.9

CREATIVE BIOSTRUCTURE

11.2.10

CREATIVE BIOARRAY

11.2.11

CELL SIGNALLING TECHNOLOGY

11.2.12

STANDARD BIOTOOLS

11.2.13

ARACELI BIOSCIENCES

12.2

KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3

INTRODUCING RT: REAL-TIME MARKET INTELLIGENCE

12.4

AVAILABLE CUSTOMIZATIONS

TABLE 1

IMPACT ANALYSIS OF SUPPLY-SIDE AND DEMAND-SIDE FACTORS

TABLE 2

HIGH-CONTENT SCREENING MARKET: RISK ANALYSIS

TABLE 3

IMPORT DATA FOR HS CODE 901190, 2019–2023 (USD)

TABLE 4

EXPORT DATA FOR HS CODE 901190, 2019–2023 (USD)

TABLE 5

HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 6

HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 7

HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 8

NORTH AMERICA: HIGH-CONTENT SCREENING MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 9

EUROPE: HIGH-CONTENT SCREENING MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 10

ASIA PACIFIC: HIGH-CONTENT SCREENING MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 11

LATIN AMERICA: HIGH-CONTENT SCREENING MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 12

MIDDLE EAST: HIGH-CONTENT SCREENING MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 13

GCC COUNTRIES: HIGH-CONTENT SCREENING MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 14

HIGH-CONTENT IMAGING PLATFORMS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 15

NORTH AMERICA: HIGH-CONTENT IMAGING PLATFORMS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 16

EUROPE: HIGH-CONTENT IMAGING PLATFORMS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 17

HIGH-CONTENT IMAGING PLATFORMS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 18

LATIN AMERICA: HIGH-CONTENT IMAGING PLATFORMS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 19

MIDDLE EAST: HIGH-CONTENT IMAGING PLATFORMS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 20

GCC COUNTRIES: HIGH-CONTENT IMAGING PLATFORMS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 21

GCC COUNTRIES: HIGH-CONTENT IMAGING PLATFORMS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 22

NORTH AMERICA: CELL IMAGING SYSTEMS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 23

EUROPE: CELL IMAGING SYSTEMS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 24

ASIA PACIFIC: CELL IMAGING SYSTEMS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 25

LATIN AMERICA: CELL IMAGING SYSTEMS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 26

MIDDLE EAST: CELL IMAGING SYSTEMS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 27

GCC COUNTRIES: CELL IMAGING SYSTEMS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 28

CELL DETECTION & ANALYSIS SYSTEMS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 29

NORTH AMERICA: CELL DETECTION & ANALYSIS SYSTEMS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 30

EUROPE: CELL DETECTION & ANALYSIS SYSTEMS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 31

ASIA PACIFIC: CELL DETECTION & ANALYSIS SYSTEMS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 32

LATIN AMERICA: CELL DETECTION & ANALYSIS SYSTEMS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 33

MIDDLE EAST: CELL DETECTION & ANALYSIS SYSTEMS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 34

GCC COUNTRIES: CELL DETECTION & ANALYSIS SYSTEMS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 35

HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 36

HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 37

NORTH AMERICA: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 38

EUROPE: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 39

ASIA PACIFIC: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 40

LATIN AMERICA: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 41

MIDDLE EAST: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 42

GCC COUNTRIES: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 43

REAGENTS & ASSAY KITS MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 44

NORTH AMERICA: REAGENTS & ASSAY KITS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 45

EUROPE: REAGENTS & ASSAY KITS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 46

ASIA PACIFIC: REAGENTS & ASSAY KITS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 47

LATIN AMERICA: REAGENTS & ASSAY KITS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 48

MIDDLE EAST: REAGENTS & ASSAY KITS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 49

GCC COUNTRIES: REAGENTS & ASSAY KITS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 50

MICROPLATES MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 51

NORTH AMERICA: MICROPLATES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 52

EUROPE: MICROPLATES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 53

ASIA PACIFIC: MICROPLATES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 54

LATIN AMERICA: MICROPLATES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 55

MIDDLE EAST: MICROPLATES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 56

GCC COUNTRIES: MICROPLATES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 57

OTHER CONSUMABLES & ACCESSORIES MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 58

NORTH AMERICA: OTHER CONSUMABLES & ACCESSORIES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 59

EUROPE: OTHER CONSUMABLES & ACCESSORIES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 60

ASIA PACIFIC: OTHER CONSUMABLES & ACCESSORIES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 61

LATIN AMERICA: OTHER CONSUMABLES & ACCESSORIES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 62

MIDDLE EAST: OTHER CONSUMABLES & ACCESSORIES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 63

GCC COUNTRIES: OTHER CONSUMABLES & ACCESSORIES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 64

HIGH-CONTENT SCREENING SOFTWARE MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 65

NORTH AMERICA: HIGH-CONTENT SCREENING SOFTWARE MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 66

EUROPE: HIGH-CONTENT SCREENING SOFTWARE MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 67

ASIA PACIFIC: HIGH-CONTENT SCREENING SOFTWARE MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 68

LATIN AMERICA: HIGH-CONTENT SCREENING SOFTWARE MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 69

MIDDLE EAST: HIGH-CONTENT SCREENING SOFTWARE MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 70

GCC COUNTRIES: HIGH-CONTENT SCREENING SOFTWARE MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 71

HIGH-CONTENT SCREENING SERVICES MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 72

NORTH AMERICA: HIGH-CONTENT SCREENING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 73

EUROPE: HIGH-CONTENT SCREENING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 74

ASIA PACIFIC: HIGH-CONTENT SCREENING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 75

LATIN AMERICA: HIGH-CONTENT SCREENING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 76

MIDDLE EAST: HIGH-CONTENT SCREENING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 77

GCC COUNTRIES: HIGH-CONTENT SCREENING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 78

HIGH-CONTENT SCREENING MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 79

HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY REGION, 2023–2030 (USD MILLION)

TABLE 80

NORTH AMERICA: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 81

EUROPE: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 82

ASIA PACIFIC: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 83

LATIN AMERICA: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 84

MIDDLE EAST: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 85

GCC COUNTRIES: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 86

HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 87

HIGH-CONTENT SCREENING MARKET FOR PRIMARY & SECONDARY SCREENING APPLICATIONS, BY REGION, 2023–2030 (USD MILLION)

TABLE 88

NORTH AMERICA: HIGH-CONTENT SCREENING MARKET FOR PRIMARY & SECONDARY SCREENING APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 89

EUROPE: HIGH-CONTENT SCREENING MARKET FOR PRIMARY & SECONDARY SCREENING APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 90

ASIA PACIFIC: HIGH-CONTENT SCREENING MARKET FOR PRIMARY & SECONDARY SCREENING APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 91

LATIN AMERICA: HIGH-CONTENT SCREENING MARKET FOR PRIMARY & SECONDARY SCREENING APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 92

MIDDLE EAST: HIGH-CONTENT SCREENING MARKET FOR PRIMARY & SECONDARY SCREENING APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 93

GCC COUNTRIES: HIGH-CONTENT SCREENING MARKET FOR PRIMARY & SECONDARY SCREENING APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 94

HIGH-CONTENT SCREENING MARKET FOR TARGET IDENTIFICATION & VALIDATION APPLICATIONS, BY REGION, 2023–2030 (USD MILLION)

TABLE 95

NORTH AMERICA: HIGH-CONTENT SCREENING MARKET FOR TARGET IDENTIFICATION & VALIDATION APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 96

EUROPE: HIGH-CONTENT SCREENING MARKET FOR TARGET IDENTIFICATION & VALIDATION APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 97

ASIA PACIFIC: HIGH-CONTENT SCREENING MARKET FOR TARGET IDENTIFICATION & VALIDATION APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 98

LATIN AMERICA: HIGH-CONTENT SCREENING MARKET FOR TARGET IDENTIFICATION & VALIDATION APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 99

MIDDLE EAST: HIGH-CONTENT SCREENING MARKET FOR TARGET IDENTIFICATION & VALIDATION APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 100

GCC COUNTRIES: HIGH-CONTENT SCREENING MARKET FOR TARGET IDENTIFICATION & VALIDATION APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 101

HIGH-CONTENT SCREENING MARKET FOR COMPOUND PROFILING APPLICATIONS, BY REGION, 2023–2030 (USD MILLION)

TABLE 102

NORTH AMERICA: HIGH-CONTENT SCREENING MARKET FOR COMPOUND PROFILING APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 103

EUROPE: HIGH-CONTENT SCREENING MARKET FOR COMPOUND PROFILING APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 104

ASIA PACIFIC: HIGH-CONTENT SCREENING MARKET FOR COMPOUND PROFILING APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 105

LATIN AMERICA: HIGH-CONTENT SCREENING MARKET FOR COMPOUND PROFILING APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 106

MIDDLE EAST: HIGH-CONTENT SCREENING MARKET FOR COMPOUND PROFILING APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 107

GCC COUNTRIES: HIGH-CONTENT SCREENING MARKET FOR COMPOUND PROFILING APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 108

HIGH-CONTENT SCREENING MARKET FOR OTHER DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY REGION, 2023–2030 (USD MILLION)

TABLE 109

NORTH AMERICA: HIGH-CONTENT SCREENING MARKET FOR OTHER DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 110

EUROPE: HIGH-CONTENT SCREENING MARKET FOR OTHER DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 111

ASIA PACIFIC: HIGH-CONTENT SCREENING MARKET FOR OTHER DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 112

LATIN AMERICA: HIGH-CONTENT SCREENING MARKET FOR OTHER DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 113

MIDDLE EAST: HIGH-CONTENT SCREENING MARKET FOR OTHER DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 114

GCC COUNTRIES: HIGH-CONTENT SCREENING MARKET FOR OTHER DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 115

HIGH-CONTENT SCREENING MARKET FOR TOXICOLOGY APPLICATIONS, BY REGION, 2023–2030 (USD MILLION)

TABLE 116

NORTH AMERICA: HIGH-CONTENT SCREENING MARKET FOR TOXICOLOGY APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 117

EUROPE: HIGH-CONTENT SCREENING MARKET FOR TOXICOLOGY APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 118

ASIA PACIFIC: HIGH-CONTENT SCREENING MARKET FOR TOXICOLOGY APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 119

LATIN AMERICA: HIGH-CONTENT SCREENING MARKET FOR TOXICOLOGY APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 120

MIDDLE EAST: HIGH-CONTENT SCREENING MARKET FOR TOXICOLOGY APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 121

GCC COUNTRIES: HIGH-CONTENT SCREENING MARKET FOR TOXICOLOGY APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 122

HIGH-CONTENT SCREENING MARKET FOR BASIC RESEARCH APPLICATIONS, BY REGION, 2023–2030 (USD MILLION)

TABLE 123

NORTH AMERICA: HIGH-CONTENT SCREENING MARKET FOR BASIC RESEARCH APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 124

EUROPE: HIGH-CONTENT SCREENING MARKET FOR BASIC RESEARCH APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 125

ASIA PACIFIC: HIGH-CONTENT SCREENING MARKET FOR BASIC RESEARCH APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 126

LATIN AMERICA: HIGH-CONTENT SCREENING MARKET FOR BASIC RESEARCH APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 127

MIDDLE EAST: HIGH-CONTENT SCREENING MARKET FOR BASIC RESEARCH APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 128

GCC COUNTRIES: HIGH-CONTENT SCREENING MARKET FOR BASIC RESEARCH APPLICATIONS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 129

HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 130

HIGH-CONTENT SCREENING MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2023–2030 (USD MILLION)

TABLE 131

NORTH AMERICA: HIGH-CONTENT SCREENING MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 132

EUROPE: HIGH-CONTENT SCREENING MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 133

ASIA PACIFIC: HIGH-CONTENT SCREENING MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 134

LATIN AMERICA: HIGH-CONTENT SCREENING MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 135

MIDDLE EAST: HIGH-CONTENT SCREENING MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 136

GCC COUNTRIES: HIGH-CONTENT SCREENING MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 137

HIGH-CONTENT SCREENING MARKET FOR ACADEMIC & GOVERNMENT INSTITUTES, BY REGION, 2023–2030 (USD MILLION)

TABLE 138

NORTH AMERICA: HIGH-CONTENT SCREENING MARKET FOR ACADEMIC & GOVERNMENT INSTITUTES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 139

NORTH AMERICA: HIGH-CONTENT SCREENING MARKET FOR ACADEMIC & GOVERNMENT INSTITUTES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 140

ASIA PACIFIC: HIGH-CONTENT SCREENING MARKET FOR ACADEMIC & GOVERNMENT INSTITUTES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 141

LATIN AMERICA: HIGH-CONTENT SCREENING MARKET FOR ACADEMIC & GOVERNMENT INSTITUTES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 142

MIDDLE EAST: HIGH-CONTENT SCREENING MARKET FOR ACADEMIC & GOVERNMENT INSTITUTES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 143

GCC COUNTRIES: HIGH-CONTENT SCREENING MARKET FOR ACADEMIC & GOVERNMENT INSTITUTES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 144

HIGH-CONTENT SCREENING MARKET FOR CROS & CDMOS, BY REGION, 2023–2030 (USD MILLION)

TABLE 145

NORTH AMERICA: HIGH-CONTENT SCREENING MARKET FOR CROS & CDMOS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 146

EUROPE: HIGH-CONTENT SCREENING MARKET FOR CROS & CDMOS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 147

ASIA PACIFIC: HIGH-CONTENT SCREENING MARKET FOR CROS & CDMOS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 148

LATIN AMERICA: HIGH-CONTENT SCREENING MARKET FOR CROS & CDMOS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 149

MIDDLE EAST: HIGH-CONTENT SCREENING MARKET FOR CROS & CDMOS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 150

GCC COUNTRIES: HIGH-CONTENT SCREENING MARKET FOR CROS & CDMOS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 151

HIGH-CONTENT SCREENING MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 152

NORTH AMERICA: HIGH-CONTENT SCREENING MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 153

NORTH AMERICA: HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 154

NORTH AMERICA: HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 155

NORTH AMERICA: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 156

NORTH AMERICA: HIGH-CONTENT SCREENING MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 157

NORTH AMERICA: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 158

NORTH AMERICA: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 159

US: HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 160

US: HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 161

US: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 162

US: HIGH-CONTENT SCREENING MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 163

US: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 164

US: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 165

CANADA: HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 166

CANADA: HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 167

CANADA: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 168

CANADA: HIGH-CONTENT SCREENING MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 169

CANADA: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 170

CANADA: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 171

EUROPE: HIGH-CONTENT SCREENING MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 172

EUROPE: HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 173

EUROPE: HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 174

EUROPE: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 175

EUROPE: HIGH-CONTENT SCREENING MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 176

EUROPE: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 177

EUROPE: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 178

EUROPE: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 179

GERMANY: HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 180

GERMANY: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 181

GERMANY: HIGH-CONTENT SCREENING MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 182

GERMANY: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 183

GERMANY: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 184

UK: HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 185

UK: HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 186

UK: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 187

UK: HIGH-CONTENT SCREENING MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 188

UK: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 189

UK: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 190

FRANCE: HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 191

FRANCE: HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 192

FRANCE: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 193

FRANCE: HIGH-CONTENT SCREENING MARKET, BY APPLICATION, 2023–2030 (USD MILLION

TABLE 194

FRANCE: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 195

FRANCE: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 196

ITALY: HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 197

ITALY: HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 198

ITALY: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 199

ITALY: HIGH-CONTENT SCREENING MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 200

ITALY: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 201

ITALY: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 202

SPAIN: HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 203

SPAIN: HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 204

SPAIN: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 205

SPAIN: HIGH-CONTENT SCREENING MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 206

SPAIN: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 207

SPAIN: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION

TABLE 208

REST OF EUROPE: HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 209

REST OF EUROPE: HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 210

REST OF EUROPE: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 211

REST OF EUROPE: HIGH-CONTENT SCREENING MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 212

REST OF EUROPE: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 213

REST OF EUROPE: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 214

ASIA PACIFIC: HIGH-CONTENT SCREENING MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 215

ASIA PACIFIC: HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 216

ASIA PACIFIC: HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 217

ASIA PACIFIC: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 218

ASIA PACIFIC: HIGH-CONTENT SCREENING MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 219

ASIA PACIFIC: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 220

ASIA PACIFIC: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 221

CHINA: HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 222

CHINA: HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 223

CHINA: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 224

CHINA: HIGH-CONTENT SCREENING MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 225

CHINA: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 226

CHINA: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 227

JAPAN: HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 228

JAPAN: HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 229

JAPAN: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 230

JAPAN: HIGH-CONTENT SCREENING MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 231

JAPAN: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 232

JAPAN: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 233

INDIA: HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 234

INDIA: HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 235

INDIA: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 236

INDIA: HIGH-CONTENT SCREENING MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 237

INDIA: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 238

INDIA: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 239

SOUTH KOREA: HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 240

SOUTH KOREA: HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY TYPE, 2023–2030 (USD MILLION

TABLE 241

SOUTH KOREA: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 242

SOUTH KOREA: HIGH-CONTENT SCREENING MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 243

SOUTH KOREA: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 244

SOUTH KOREA: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 245

AUSTRALIA: HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 246

AUSTRALIA: HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 247

AUSTRALIA: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 248

AUSTRALIA: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 249

AUSTRALIA: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 250

AUSTRALIA: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 251

REST OF ASIA PACIFIC: HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 252

REST OF ASIA PACIFIC: HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 253

REST OF ASIA PACIFIC: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 254

REST OF ASIA PACIFIC: HIGH-CONTENT SCREENING MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 255

REST OF ASIA PACIFIC: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 256

REST OF ASIA PACIFIC: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 257

LATIN AMERICA: HIGH-CONTENT SCREENING MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 258

LATIN AMERICA: HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 259

LATIN AMERICA: HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 260

LATIN AMERICA: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 261

LATIN AMERICA: HIGH-CONTENT SCREENING MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 262

LATIN AMERICA: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 263

LATIN AMERICA: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 264

BRAZIL: HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 265

BRAZIL: HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 266

BRAZIL: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 267

BRAZIL: HIGH-CONTENT SCREENING MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 268

BRAZIL: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 269

BRAZIL: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 270

MEXICO: HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 271

MEXICO: HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 272

MEXICO: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 273

MEXICO: HIGH-CONTENT SCREENING MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 274

MEXICO: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 275

MEXICO: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 276

REST OF LATIN AMERICA: HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 277

REST OF LATIN AMERICA: HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 278

REST OF LATIN AMERICA: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 279

REST OF LATIN AMERICA: HIGH-CONTENT SCREENING MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 280

REST OF LATIN AMERICA: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 281

REST OF LATIN AMERICA: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 282

MIDDLE EAST: HIGH-CONTENT SCREENING MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 283

MIDDLE EAST: HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 284

MIDDLE EAST: HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 285

MIDDLE EAST: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 286

MIDDLE EAST: HIGH-CONTENT SCREENING MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 287

MIDDLE EAST: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 288

MIDDLE EAST: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 289

GCC COUNTRIES: HIGH-CONTENT SCREENING MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 290

GCC COUNTRIES: HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 291

GCC COUNTRIES: HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 292

GCC COUNTRIES: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 293

GCC COUNTRIES: HIGH-CONTENT SCREENING MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 294

GCC COUNTRIES: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 295

GCC COUNTRIES: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 296

SAUDI ARABIA: HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 297

SAUDI ARABIA: HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 298

SAUDI ARABIA: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION

TABLE 299

SAUDI ARABIA: HIGH-CONTENT SCREENING MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 300

SAUDI ARABIA: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 301

SAUDI ARABIA: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 302

UAE: HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 303

UAE: HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 304

UAE: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 305

UAE: HIGH-CONTENT SCREENING MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 306

UAE: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 307

UAE: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 308

REST OF GCC COUNTRIES: HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 309

REST OF GCC COUNTRIES: HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 310

REST OF GCC COUNTRIES: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 311

REST OF GCC COUNTRIES: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 312

REST OF GCC COUNTRIES: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 313

REST OF GCC COUNTRIES: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 314

REST OF MIDDLE EAST: HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 315

REST OF MIDDLE EAST: HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 316

REST OF MIDDLE EAST: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 317

REST OF MIDDLE EAST: HIGH-CONTENT SCREENING MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 318

REST OF MIDDLE EAST: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 319

REST OF MIDDLE EAST: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 320

AFRICA: HIGH-CONTENT SCREENING MARKET, BY PRODUCT & SERVICE, 2023–2030 (USD MILLION)

TABLE 321

AFRICA: HIGH-CONTENT SCREENING INSTRUMENTS MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 322

AFRICA: HIGH-CONTENT SCREENING CONSUMABLES & ACCESSORIES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 323

AFRICA: HIGH-CONTENT SCREENING MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

TABLE 324

AFRICA: HIGH-CONTENT SCREENING MARKET FOR DRUG DISCOVERY & DEVELOPMENT APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 325

AFRICA: HIGH-CONTENT SCREENING MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 326

DANAHER CORPORATION: PRODUCTS/SERVICES OFFERED

TABLE 327

DANAHER CORPORATION: PRODUCT/SERVICE LAUNCHES, JANUARY 2022–FEBRUARY

TABLE 328

REVVITY: PRODUCTS/SERVICES OFFERED

TABLE 329

REVVITY: PRODUCT/SERVICE LAUNCHES, JANUARY 2022–FEBRUARY

TABLE 330

BD: PRODUCTS /SERVICES OFFERED

TABLE 331

BD: DEALS, JANUARY 2022–FEBRUARY

TABLE 332

THERMO FISHER SCIENTIFIC INC.: PRODUCTS/SERVICES OFFERED

TABLE 333

AGILENT TECHNOLOGIES: PRODUCTS/SERVICES OFFERED

TABLE 334

MERCK KGAA: PRODUCTS/SERVICES OFFERED

TABLE 335

BIO-RAD LABORATORIES: PRODUCTS/SERVICES OFFERED

TABLE 336

BIO-RAD LABORATORIES: DEALS, JANUARY 2022–FEBRUARY

TABLE 337

NIKON CORPORATION: PRODUCTS/SERVICES OFFERED

TABLE 338

NIKON CORPORATION: PRODUCT/SERVICE LAUNCHES, JANUARY 2022–FEBRUARY

TABLE 339

NIKON CORPORATION: EXPANSIONS, JANUARY 2022–FEBRUARY

TABLE 340

CARL ZEISS AG: PRODUCTS/SERVICES OFFERED

TABLE 341

CARL ZEISS AG: DEALS, JANUARY 2022–FEBRUARY

TABLE 342

SARTORIUS AG: PRODUCTS/SERVICES OFFERED

TABLE 343

SARTORIUS AG: DEALS, JANUARY 2022–FEBRUARY

TABLE 344

YOKOGAWA ELECTRIC CORPORATION: PRODUCTS/SERVICES OFFERED

TABLE 345

YOKOGAWA ELECTRIC CORPORATION: PRODUCT/SERVICE LAUNCHES, JANUARY 2022–FEBRUARY

TABLE 346

TECAN: PRODUCTS/SERVICES OFFERED

TABLE 347

CORNING INCORPORATED: PRODUCTS/SERVICES OFFERED

TABLE 348

CHARLES RIVER LABORATORIES: PRODUCTS/SERVICES OFFERED

TABLE 349

EVIDENT: PRODUCTS/SERVICES OFFERED

TABLE 350

PROMEGA CORPORATION: PRODUCTS/SERVICES OFFERED

TABLE 351

CREATIVE BIOLABS: PRODUCTS/SERVICES OFFERED

TABLE 352

SYSMEX CORPORATION: PRODUCTS/SERVICES OFFERED

TABLE 353

ENZO LIFE SCIENCES: PRODUCTS /SERVICES OFFERED

TABLE 354

STRATEDIGM: PRODUCTS/SERVICES OFFERED

TABLE 355

AKOYA BIOSCIENCES: PRODUCTS/SERVICES OFFERED

TABLE 356

SPHERE FLUIDICS: PRODUCTS/SERVICES OFFERED

TABLE 357

CREATIVE BIOSTRUCTURE: PRODUCTS/SERVICES OFFERED

TABLE 358

CREATIVE BIOARRAY: PRODUCTS/SERVICES OFFERED

TABLE 359

CELL SIGNALING TECHNOLOGY: PRODUCTS/SERVICES OFFERED

TABLE 360

STANDARD BIOTOOLS: PRODUCTS/SERVICES OFFERED

TABLE 361

ARACELI BIOSCIENCES: PRODUCTS/SERVICES OFFERED

FIGURE 1

HIGH-CONTENT SCREENING MARKET SEGMENTATION AND REGIONAL SCOPE

FIGURE 2

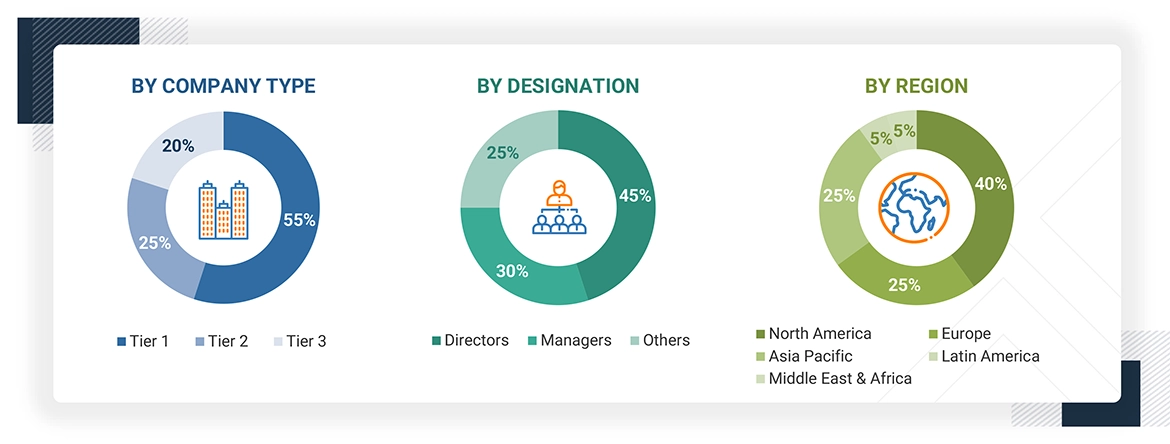

HIGH-CONTENT SCREENING MARKET: BREAKDOWN OF PRIMARY INTERVIEWS

FIGURE 3

HIGH-CONTENT SCREENING MARKET SIZE ESTIMATION,

FIGURE 4

APPROACH 1: COMPANY REVENUE ANALYSIS-BASED MARKET ESTIMATION,

FIGURE 5

ILLUSTRATIVE EXAMPLE OF DANAHER CORPORATION: REVENUE SHARE ANALYSIS (2024)

FIGURE 6

SEGMENTAL SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH (2024)

FIGURE 7

HIGH-CONTENT SCREENING MARKET: CAGR PROJECTIONS

FIGURE 8

HIGH-CONTENT SCREENING MARKET: CAGR PROJECTIONS

FIGURE 9

HIGH-CONTENT SCREENING MARKET: GEOGRAPHIC ANALYSIS

FIGURE 10

TECHNOLOGICAL ADVANCEMENTS IN HIGH-CONTENT SCREENING INSTRUMENTS TO DRIVE MARKET GROWTH

FIGURE 11

INSTRUMENTS ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN

FIGURE 12

CHINA LIKELY TO REGISTER HIGHEST GROWTH IN GLOBAL HIGH-CONTENT SCREENING MARKET OVER FORECAST PERIOD

FIGURE 13

HIGH-CONTENT SCREENING MARKET, BY END USER,

FIGURE 14

HIGH-CONTENT SCREENING MARKET: VALUE CHAIN ANALYSIS

FIGURE 15

HIGH-CONTENT SCREENING MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 16

KEY BUYING CRITERIA FOR HCS PRODUCTS, BY END USER

FIGURE 17

HIGH-CONTENT SCREENING MARKET: ECOSYSTEM ANALYSIS

FIGURE 18

IMPACT OF AI ON HIGH-CONTENT SCREENING ECOSYSTEM

FIGURE 19

HIGH-CONTENT SCREENING MARKET: INVESTMENT & FUNDING SCENARIO

FIGURE 20

HIGH-CONTENT SCREENING MARKET SHARE ANALYSIS,

FIGURE 21

EV/EBIDTA OF KEY VENDORS,

FIGURE 22

YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS,

Vasthi

Dec, 2019

Hydrogen Purity Analyzer : Vasthi Portable Hydrogen Purity Gas Analyzers Model VHP- 200 is a light weight, easy to handle, battery-powered analyzer, used to verify measurements and for spot-checking when other methods provide questionable results..

mahidigital

Dec, 2019

Thanks for sharing this article, it would be nice if you give detailed overview and market analysis about Hydrogen Purity Analyzer.