Cell Analysis Market by Product & Service (Consumables, Instruments), Technique (Flow Cytometry, PCR, Microscopy), Process (Counting, Viability, Proliferation, Interaction, Single-cell Analysis), End User (Pharma, Biotech) - Global Forecast to 2028

Market Growth Outlook Summary

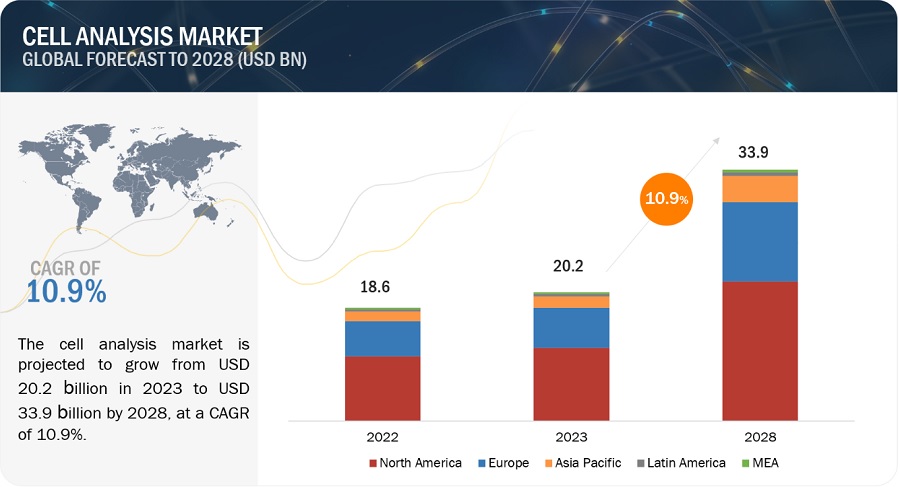

The global cell analysis market, valued at US$18.6 billion in 2022, stood at US$20.2 billion in 2023 and is projected to advance at a resilient CAGR of 10.9% from 2023 to 2028, culminating in a forecasted valuation of US$33.9 billion by the end of the period. Increase in the preference for cell-bsaed assays along with strong funding for cell-based research is expected to drive the market growth. The conventional methods of toxicity and drug safety assessment (involving animal testing) are expensive, time-consuming, and offer low-throughput. In this regard, modern cell-based assays merge the advantages of cell cultures and animal models to allow researchers to identify problems with lead compounds in early screening, ensuring greater efficiency in the drug discovery and development process.

Attractive Opportunities in the Cell Analysis Market

To know about the assumptions considered for the study, Request for Free Sample Report

Cell Analysis Market Dynamics

DRIVER: Growing number of drug discovery activities

Adoption of cell-based screening assays has increased in he drug discovery activities to understand associated complexities. Additionally, advances in cell biology, bioinformatics, molecular biology, genomics, and proteomics have generated large volumes of data, owing to which the use of cell-based assays in the drug development process has gained importance. Similarly, the Human Genome Project has generated a number of targets on which drug screening experiments can be carried out. This rapid expansion in drug targets and drug leads in recent years has accelerated the development of cell-based assays for primary and secondary screening in drug discovery.

RESTRAINT: High cost of instruments and restrictions on reagent use

The introduction of high-throughput screening (HTS) and high-content screening (HCS) technologies in cell analysis has increased their reliability. However, these technologies have also resulted in a significant increase in the cost of instruments. Moreover, the time and cost involved in each HTS process are directly proportional to the target molecule’s complexity; consequently, the higher the complexity, the greater the cost. In biopharmaceutical companies, the overall cost of production of biopharmaceuticals has increased considerably due to the use of these expensive systems.

OPPORTUNITY: Application of novel cell-based assays in cancer research

In the last few decades, the incidence and prevalence of cancer have increased significantly across the globe, and this trend is expected to continue in the coming years. In an effort to reduce cancer incidence and mortality, the demand for novel approaches that offer effective cancer diagnosis and treatment has increased in recent years. In this regard, some recent studies have been published that highlight the importance of cell-based assays in cancer research.

Global Cell Analysis Ecosystem Analysis

The cell analysis industry ecosystem comprises raw material suppliers, service providers, and end users such as pharmaceutical & biotechnology companies, CROs, hospitals, and diagnostic laboratories. Raw material suppliers & product manufacturers offer various supplies & products for different cell analysis processes. Cell analysis companies entered into partnerships with their clients, such as pharmaceutical companies, in order to design a strategy for the design and development of cell analysis products, including assays, reagents, instruments & accessories, and software solutions. This long-term relationship enables partners to develop cell-based research experiments successfully and bring new therapeutic and diagnostic solutions to the market. Also, as partners work together for a long time, the volume of work contracted out can expand, depending on how comfortable both the partners are in taking the partnership forward.

The software segment of the cell analysis industry is expected to grow at the highest rate during the forecast period

Based on product & service, the global cell analysis market is segmented into reagents & consumables, instruments, accessories, software, and services. The reagents & consumables segment accounted for the largest share of the market in 2022. Prominent companies are providing flow cytometry reagents as directly conjugated products. Companies are introducing high-quality reagents with an enhanced geographic reach contributing to the largest share of the reagents & consumables market. Innovative offerings addressing complex datasets with multiple analytical modalities for effective interpretation is the key contributing factor to the segment’s fastest growth.

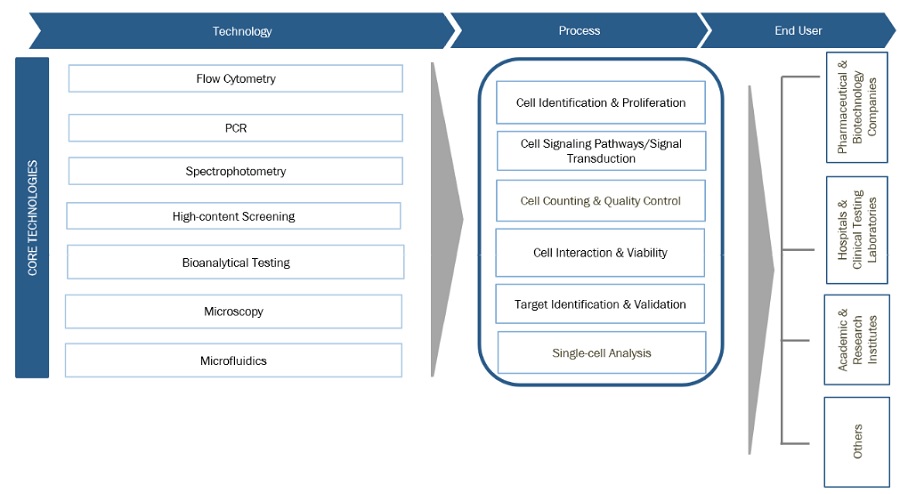

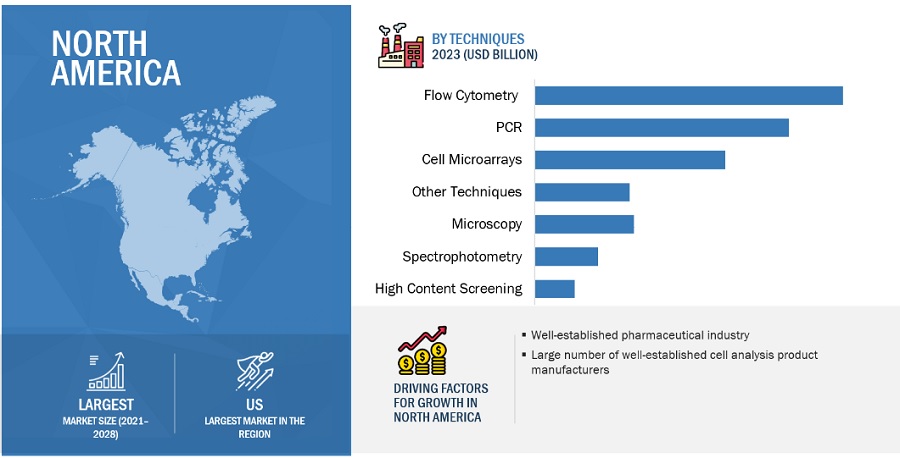

The flow cytometry technique dominated the cell analysis industry

Based on technique, the global cell analysis market is segmented into flow cytometry, PCR, cell microarrays, microscopy, spectrophotometry, high-content screening, and other techniques. The flow cytometry segment accounted for the largest market share in 2022. Increase in demand for flow cytometry in single-cell analysis studies to analyze multiple characteristics of the sample at single-cell level is the key driving factor of this segment. Additionally, high-content screening segment has registerd highest growth ratefrom 2023-2028, with high demand for HCS products in cell behavior studies.

The single-cell analysis segment of the cell analysis industry is expected to register the highest CAGR during the forecast period

Based on process, the global cell analysis market is segmented into cell identification, cell viability, cell signaling pathway/signal transduction, cell proliferation, cell counting & quality control, cell interaction, cell structure study, target identification & validation, and single-cell analysis. Cell identification accounted for the largest market share of in 2022. High adoption of cell identification products across industrial applications, including food and healthcare is a key contributing factor to the segment growth. Cell identification is crucial to drug discovery and high adoption of these products have propelled companies to introduce innovative products. On the other hand, single-cell analysis segment is expected to grow at the fastest pace during the forecast period. Single-cell analysis has gained significant traction over the years for assessment of individual cells at multi-parametric level, contributing to the segment growth.

The pharmaceutical & biotechnology companies accounted for the largest share in the cell analysis industry

Based on end user, the cell analysis market is segmented into pharmaceutical & biotechnology companies, hospitals & clinical testing laboratories, academic & research institutes, and other end users. The other end users are inclusive of forensic laboratories, blood banks, CROs, food & beverage manufacturers, and environmental monitoring organizations. The pharmaceutical & biotechnology companies segment accounted for the largest market share in 2022. Frequent adoption of consumables and instruments across different steps in drug discovery & development has led to the dominance of pharmaceutical & biotechnology end users. Additionally, hospitals and clinical testing laboratories segment is anticipated to grow at the fastest pace throughout the forecast period. Adoption of highly complex and specialized assays across this end user segment is expected to support its rapid growth.

North America was the largest regional market for cell analysis industry in 2022.

Geographically, the cell analysis market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America region is expected to dominate the market through 2021-2028, followed by Europe. The US pharmaceutical industry has witnessed tremendous growth due to the increasing approval of first-in-class drugs by the Food and Drugs Administration (FDA), rising R&D expenditure by pharmaceutical companies, and the establishment of startups focusing on developing promising drugs for rare diseases and neurological conditions. This has propelled cell-based research activities, offering lucrative opportunities for the growth of the market in the US. Asia Pacific market is expected to grow at the fastest pace through 2023 to 2028.

To know about the assumptions considered for the study, download the pdf brochure

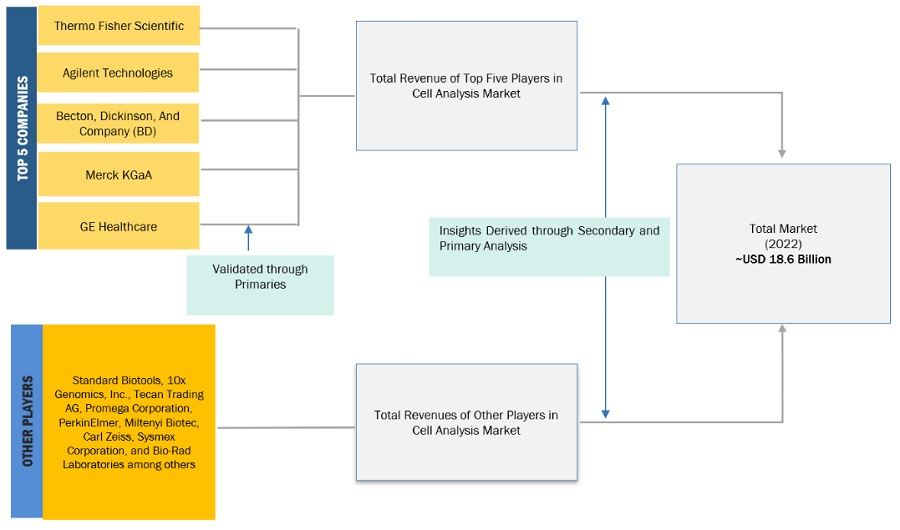

Key players in the global cell analysis market include Danaher (US), Thermo Fisher Scientific (US), Becton, Dickinson and Company (US), General Electric (US), Merck KGaA (US), Agilent Technologies (US), Olympus Corporation (Japan), Miltenyi Biotec (US), Bio-Rad Laboratories (US), BioStatus Limited (UK), Fluidigm Corporation (US), NanoCellect Biomedical (US), Cell Biolabs (US), Creative Bioarray (US), Meiji Techno (US), Promega Corporation (US), PerkinElmer (US), Tecan Trading AG (Switzerland), CELLINK (US), QIAGEN (Germany), Corning Incorporated (US), 10x Genomics (US), and Illumina (US).

Scope of the Cell Analysis Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$20.2 billion |

|

Projected Revenue by 2028 |

$33.9 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 10.9% |

|

Market Driver |

Growing number of drug discovery activities |

|

Market Opportunity |

Application of novel cell-based assays in cancer research |

This report categorizes the cell analysis market to forecast revenue and analyze trends in each of the following submarkets:

By Product & Service

- Reagents & Consumables

- Instruments

- Accessories

- Software

- Service

By Technique

- Flow Cytometry

- PCR

- Cell Microarrays

- Microscopy

- Spectrophotometry

- High Content Screening

- Other Techniques

By Process

- Cell Identification

- Cell Viability

- Cell Signaling Pathways/Signal Transduction

- Cell Proliferation

- Cell Counting and Quality Control

- Cell Interaction

- Cell Structure Study

- Target Identification and Validation

- Single-Cell Analysis

By End User

- Pharmaceutical & Biotechnology Companies

- Hospitals and Clinical Testing Laboratories

- Academic and Research Institutes

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- Italy

- Spain

- UK

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments of Cell Analysis Industry

- In 2023, Becton, Dickinson and Company (US) launched a Spectral Cell Sorter that is coupled with high-speed cell imaging. this product combines real-time imaging technology with spectral flow cytometry.

- In 2020, Miltenyi Biotec (Germany) launched MACS GMP Tyto Cartridge, a GMP-compliant cell sorter..

- In 2020, Bio-Rad Laboratories, Inc. (US) acquired Celsee, Inc., a provider of instruments and consumables for the isolation, detection, and analysis of single cells. This acquisition expanded the company’s product offerings in the flow cytometry market..

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global cell analysis market?

The global cell analysis market boasts a total revenue value of $33.9 billion by 2028.

What is the estimated growth rate (CAGR) of the global cell analysis market?

The global cell analysis market has an estimated compound annual growth rate (CAGR) of 10.9% and a revenue size in the region of $20.2 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing preference for cell-based assays in drug discovery- Increasing funding for cell-based research- Rising number of drug discovery activitiesRESTRAINTS- High cost of instruments and restrictions on reagent useOPPORTUNITIES- High growth potential of single-cell sequencing- Application scope of novel cell-based assays in cancer researchCHALLENGES- Standardization of protocols and data integration & quality control for developing cell therapies

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 ECOSYSTEM ANALYSIS

-

5.6 REGULATORY ANALYSIS (FLOW CYTOMETRY-BASED CELL ANALYSIS)STRINGENT FDA REQUIREMENTSSTRINGENT ANALYTE-SPECIFIC REAGENT RULELACK OF WELL-DEFINED VALIDATION PROTOCOLS FOR CELL-BASED ASSAYSABSENCE OF ESTABLISHED LABORATORY-DEVELOPED TEST GUIDELINES ON CELL-BASED FLUORESCENCE ASSAYSGREATER GLOBAL RECOGNITION FOR IVD CE MARK APPROVALSUS REIMBURSEMENT SCENARIO

- 5.7 TECHNOLOGY ANALYSIS

-

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSCELL ANALYSIS MARKET: BUYING CRITERIA

- 5.10 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.11 PRICING ANALYSISAVERAGE SELLING PRICES OF CELL ANALYSIS PRODUCTS & SERVICESAVERAGE SELLING PRICE TREND

- 6.1 INTRODUCTION

-

6.2 REAGENTS & CONSUMABLESDEVELOPMENT OF NOVEL CELL ANALYSIS KITS & REAGENTS FOR FLOW CYTOMETRY TO BOOST GROWTH

-

6.3 INSTRUMENTSINNOVATIONS IN CELL ANALYSIS INSTRUMENTS FOR DRUG DISCOVERY TO DRIVE MARKET

-

6.4 ACCESSORIESUSE OF ACCESSORIES TO CUSTOMIZE FLOW CYTOMETRY INSTRUMENTS TO BOOST SEGMENT GROWTH

-

6.5 SOFTWAREEXPANDING POOL OF KEY PLAYERS INTRODUCING UNIQUE DATA INTERPRETATION SOFTWARE TO DRIVE SEGMENT

-

6.6 SERVICESWORKFLOW CONTINUITY AND HIGH-PERFORMANCE ATTRIBUTES TO BOOST DEMAND FOR REMOTE SERVICES

- 7.1 INTRODUCTION

-

7.2 FLOW CYTOMETRYABILITY TO PERFORM MULTIPLE MEASUREMENTS ON SINGLE CELLS TO DRIVE SEGMENT

-

7.3 PCREFFECTIVE MEASUREMENT AND RARE SEQUENCE MONITORING BENEFITS TO DRIVE DIGITAL PCR DEMAND

-

7.4 CELL MICROARRAYSHIGH EXPERIMENTAL THROUGHPUT OF CELL MICROARRAYS OVER TRADITIONAL METHODS TO DRIVE SEGMENT

-

7.5 MICROSCOPYRISING INCIDENCE OF CANCER AND GROWING INVESTMENTS IN CELL BIOLOGY TO DRIVE SEGMENT

-

7.6 SPECTROPHOTOMETRYHIGH DEMAND FOR SPECTROPHOTOMETERS IN RESEARCH SETTINGS TO SUPPORT MARKET GROWTH

-

7.7 HIGH-CONTENT SCREENINGHIGH DEMAND FOR HCS IN DRUG DISCOVERY TO SUPPORT SEGMENT GROWTH

- 7.8 OTHER TECHNIQUES

- 8.1 INTRODUCTION

-

8.2 CELL IDENTIFICATIONINCREASING RESEARCH ACTIVITIES TO PROPEL SEGMENT GROWTH

-

8.3 CELL VIABILITYUSE OF CELL VIABILITY PROCESS TO CORRELATE CELL BEHAVIOR TO CELL NUMBERS

-

8.4 CELL SIGNALING PATHWAY/SIGNAL TRANSDUCTIONHIGH DEMAND FOR TOXICITY TESTING IN DRUG DEVELOPMENT TO DRIVE MARKET

-

8.5 CELL PROLIFERATIONMEASUREMENT OF CELL PROLIFERATION BASED ON AVERAGE DNA CONTENT TO DRIVE SEGMENT

-

8.6 CELL COUNTING AND QUALITY CONTROLUSE OF FLOW CYTOMETRY IN CELL COUNTING TO ENABLE EASY CELL DIFFERENTIATION VIA SCATTERING OR STAINING

-

8.7 CELL INTERACTIONADVANCEMENT IN CELL-CELL INTERACTIONS/COMMUNICATIONS TO BOOST MARKET GROWTH

-

8.8 CELL STRUCTURE STUDYADVANCEMENTS IN CELLULAR IMAGING TO SUPPORT MARKET GROWTH

-

8.9 TARGET IDENTIFICATION AND VALIDATIONADOPTION OF HIGH-CONTENT SCREENING IN TARGET IDENTIFICATION TO DRIVE MARKET

-

8.10 SINGLE-CELL ANALYSISEXPANDING APPLICATIONS OF SINGLE-CELL ANALYSIS IN CLINICAL RESEARCH TO PROPEL SEGMENT GROWTH

- 9.1 INTRODUCTION

-

9.2 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIESHIGH DEMAND FOR CELL-BASED RESEARCH IN DRUG DISCOVERY & DEVELOPMENT TO DRIVE SEGMENT

-

9.3 HOSPITALS AND CLINICAL TESTING LABORATORIESADOPTION OF ADVANCED TECHNOLOGIES TO SUPPORT MARKET GROWTH

-

9.4 ACADEMIC AND RESEARCH INSTITUTESGROWING NUMBER OF RESEARCH PROJECTS THROUGH INDUSTRY-ACADEMIA COLLABORATIONS TO DRIVE MARKET

- 9.5 OTHER END USERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Rising prevalence of cancer to drive cell analysis demand in USCANADA- Increasing government initiatives targeted toward stem cell research to drive market

-

10.3 EUROPEGERMANY- Strong R&D infrastructure, training, and awareness programs to drive market in GermanyFRANCE- Presence of large biotechnology industry to boost market growthUK- Growing acceptance of flow cytometry products for clinical diagnostics to drive marketITALY- Increasing research activities and conferences to support market growthSPAIN- Strong focus on cancer diagnosis to boost flow cytometry product usage in SpainREST OF EUROPE

-

10.4 ASIA PACIFICJAPAN- Easy access to technologically advanced cell analysis products to favor market growthCHINA- Strategic partnerships in cell therapy sector to support market growthINDIA- Government initiatives to drive market in IndiaREST OF ASIA PACIFIC

-

10.5 LATIN AMERICAGROWING PARTICIPATION OF ACADEMIC INSTITUTES IN RESEARCH TO ACCELERATE MARKET GROWTH

-

10.6 MIDDLE EAST & AFRICAGROWING RESEARCH ACTIVITIES TO FUEL DEMAND FOR CELL ANALYSIS PRODUCTS

- 11.1 INTRODUCTION

- 11.2 RIGHT-TO-WIN APPROACHES ADOPTED BY KEY PLAYERS

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE SHARE ANALYSIS (TOP 7 MARKET PLAYERS)

-

11.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 COMPETITIVE LEADERSHIP MAPPING FOR EMERGING COMPANIES/SMES/START-UPS (2022)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

-

11.7 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALS

-

12.1 KEY COMPANIESTHERMO FISHER SCIENTIFIC INC.- Business overview- Products offered- Recent developments- MnM viewDANAHER- Business overview- Products offered- Recent developments- MnM viewBECTON, DICKINSON AND COMPANY (BD)- Business overview- Products offered- Recent developments- MnM viewGENERAL ELECTRIC- Business overview- Products offered- MnM viewMERCK KGAA- Business overview- Products offered- MnM viewAGILENT TECHNOLOGIES, INC.- Business overview- Products offered- Recent developmentsBIO-RAD LABORATORIES, INC.- Business overview- Products offered- Recent developmentsSTANDARD BIOTOOLS- Business overview- Products offeredMILTENYI BIOTEC- Business overview- Products offered- Recent developmentsOLYMPUS CORPORATION- Business overview- Products offeredBIOSTATUS LIMITED- Business overview- Products offeredNANOCELLECT BIOMEDICAL- Business overview- Products offered- Recent developmentsCELL BIOLABS, INC.- Business overview- Products offeredCREATIVE BIOARRAY- Business overview- Services offeredMEIJI TECHNO- Business overview- Products offered

-

12.2 OTHER PLAYERSPROMEGA CORPORATIONPERKINELMER U.S. LLCTECAN TRADING AGCARL ZEISS AGSYSMEXCELLINKQIAGENILLUMINA, INC.CORNING INCORPORATED10X GENOMICS

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 AVAILABLE CUSTOMIZATIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 CELL ANALYSIS MARKET: IMPACT ANALYSIS

- TABLE 2 NIH FUNDING FOR CELL-BASED RESEARCH, 2019–2021 (USD MILLION)

- TABLE 3 CELL ANALYSIS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 CELL ANALYSIS CONFERENCES (2023–2024)

- TABLE 5 AVERAGE SELLING PRICES OF CELL ANALYSIS PRODUCTS & SERVICES (TOP 5 KEY PLAYERS)*

- TABLE 6 CELL ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 7 REAGENTS & CONSUMABLES: CELL ANALYSIS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 8 NORTH AMERICA: CELL ANALYSIS MARKET FOR REAGENTS & CONSUMABLES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 9 EUROPE: CELL ANALYSIS MARKET FOR REAGENTS & CONSUMABLES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 10 ASIA PACIFIC: CELL ANALYSIS MARKET FOR REAGENTS & CONSUMABLES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 11 INSTRUMENTS: CELL ANALYSIS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 12 NORTH AMERICA: CELL ANALYSIS MARKET FOR INSTRUMENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 13 EUROPE: CELL ANALYSIS MARKET FOR INSTRUMENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 14 ASIA PACIFIC: CELL ANALYSIS MARKET FOR INSTRUMENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 15 ACCESSORIES: CELL ANALYSIS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 16 NORTH AMERICA: CELL ANALYSIS MARKET FOR ACCESSORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 17 EUROPE: CELL ANALYSIS MARKET FOR ACCESSORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 18 ASIA PACIFIC: CELL ANALYSIS MARKET FOR ACCESSORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 19 SOFTWARE: CELL ANALYSIS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 20 NORTH AMERICA: CELL ANALYSIS MARKET FOR SOFTWARE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 21 EUROPE: CELL ANALYSIS MARKET FOR SOFTWARE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 22 ASIA PACIFIC: CELL ANALYSIS MARKET FOR SOFTWARE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 23 SERVICES: CELL ANALYSIS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 24 NORTH AMERICA: CELL ANALYSIS MARKET FOR SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 25 EUROPE: CELL ANALYSIS MARKET FOR SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 ASIA PACIFIC: CELL ANALYSIS MARKET FOR SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 27 CELL ANALYSIS MARKET, BY TECHNIQUE, 2021–2028 (USD MILLION)

- TABLE 28 FLOW CYTOMETRY: CELL ANALYSIS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 29 NORTH AMERICA: CELL ANALYSIS MARKET FOR FLOW CYTOMETRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 30 EUROPE: CELL ANALYSIS MARKET FOR FLOW CYTOMETRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 31 ASIA PACIFIC: CELL ANALYSIS MARKET FOR FLOW CYTOMETRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 32 PCR: CELL ANALYSIS MARKET FOR PCR, BY REGION, 2021–2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: CELL ANALYSIS MARKET FOR PCR, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 EUROPE: CELL ANALYSIS MARKET FOR PCR, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 35 ASIA PACIFIC: CELL ANALYSIS MARKET FOR PCR, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 36 CELL MICROARRAYS: CELL ANALYSIS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 37 NORTH AMERICA: CELL ANALYSIS MARKET FOR CELL MICROARRAYS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 EUROPE: CELL ANALYSIS MARKET FOR CELL MICROARRAYS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 39 ASIA PACIFIC: CELL ANALYSIS MARKET FOR CELL MICROARRAYS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 40 MICROSCOPY: CELL ANALYSIS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 41 NORTH AMERICA: CELL ANALYSIS MARKET FOR MICROSCOPY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 42 EUROPE: CELL ANALYSIS MARKET FOR MICROSCOPY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 43 ASIA PACIFIC: CELL ANALYSIS MARKET FOR MICROSCOPY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 SPECTROPHOTOMETRY: CELL ANALYSIS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: CELL ANALYSIS MARKET FOR SPECTROPHOTOMETRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 EUROPE: CELL ANALYSIS MARKET FOR SPECTROPHOTOMETRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 47 ASIA PACIFIC: CELL ANALYSIS MARKET FOR SPECTROPHOTOMETRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 48 HIGH-CONTENT SCREENING: CELL ANALYSIS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: CELL ANALYSIS MARKET FOR HIGH-CONTENT SCREENING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 50 EUROPE: CELL ANALYSIS MARKET FOR HIGH-CONTENT SCREENING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 51 ASIA PACIFIC: CELL ANALYSIS MARKET FOR HIGH-CONTENT SCREENING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 52 OTHER TECHNIQUES: CELL ANALYSIS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 53 NORTH AMERICA: CELL ANALYSIS MARKET FOR OTHER TECHNIQUES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 54 EUROPE: CELL ANALYSIS MARKET FOR OTHER TECHNIQUES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 55 ASIA PACIFIC: CELL ANALYSIS MARKET FOR OTHER TECHNIQUES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 56 CELL ANALYSIS MARKET, BY PROCESS, 2021–2028 (USD MILLION)

- TABLE 57 CELL IDENTIFICATION: CELL ANALYSIS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: CELL ANALYSIS MARKET FOR CELL IDENTIFICATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 59 EUROPE: CELL ANALYSIS MARKET FOR CELL IDENTIFICATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 60 ASIA PACIFIC: CELL ANALYSIS MARKET FOR CELL IDENTIFICATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 61 CELL VIABILITY: CELL ANALYSIS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: CELL ANALYSIS MARKET FOR CELL VIABILITY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 63 EUROPE: CELL ANALYSIS MARKET FOR CELL VIABILITY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 64 ASIA PACIFIC: CELL ANALYSIS MARKET FOR CELL VIABILITY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 65 CELL SIGNALING PATHWAY/SIGNAL TRANSDUCTION: CELL ANALYSIS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: CELL ANALYSIS MARKET FOR CELL SIGNALING PATHWAY/SIGNAL TRANSDUCTION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 67 EUROPE: CELL ANALYSIS MARKET FOR CELL SIGNALING PATHWAY/SIGNAL TRANSDUCTION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 68 ASIA PACIFIC: CELL ANALYSIS MARKET FOR CELL SIGNALING PATHWAY/ SIGNAL TRANSDUCTION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 69 CELL PROLIFERATION: CELL ANALYSIS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: CELL ANALYSIS MARKET FOR CELL PROLIFERATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 71 EUROPE: CELL ANALYSIS MARKET FOR CELL PROLIFERATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 72 ASIA PACIFIC: CELL ANALYSIS MARKET FOR CELL PROLIFERATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 73 CELL COUNTING AND QUALITY CONTROL: CELL ANALYSIS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: CELL ANALYSIS MARKET FOR CELL COUNTING AND QUALITY CONTROL, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 75 EUROPE: CELL ANALYSIS MARKET FOR CELL COUNTING AND QUALITY CONTROL, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 76 ASIA PACIFIC: CELL ANALYSIS MARKET FOR CELL COUNTING AND QUALITY CONTROL, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 77 CELL INTERACTION: CELL ANALYSIS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: CELL ANALYSIS MARKET FOR CELL INTERACTION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 79 EUROPE: CELL ANALYSIS MARKET FOR CELL INTERACTION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 80 ASIA PACIFIC: CELL ANALYSIS MARKET FOR CELL INTERACTION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 81 CELL STRUCTURE STUDY: CELL ANALYSIS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: CELL ANALYSIS MARKET FOR CELL STRUCTURE STUDY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 83 EUROPE: CELL ANALYSIS MARKET FOR CELL STRUCTURE STUDY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: CELL ANALYSIS MARKET FOR CELL STRUCTURE STUDY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 85 TARGET IDENTIFICATION AND VALIDATION: CELL ANALYSIS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: CELL ANALYSIS MARKET FOR TARGET IDENTIFICATION AND VALIDATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 87 EUROPE: CELL ANALYSIS MARKET FOR TARGET IDENTIFICATION AND VALIDATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 88 ASIA PACIFIC: CELL ANALYSIS MARKET FOR TARGET IDENTIFICATION AND VALIDATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 89 SINGLE-CELL ANALYSIS: CELL ANALYSIS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 90 NORTH AMERICA: CELL ANALYSIS MARKET FOR SINGLE-CELL ANALYSIS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 91 EUROPE: CELL ANALYSIS MARKET FOR SINGLE-CELL ANALYSIS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 92 ASIA PACIFIC: CELL ANALYSIS MARKET FOR SINGLE-CELL ANALYSIS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 93 CELL ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 94 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES: CELL ANALYSIS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: CELL ANALYSIS MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 96 EUROPE: CELL ANALYSIS MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: CELL ANALYSIS MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 98 HOSPITALS AND CLINICAL TESTING LABORATORIES: CELL ANALYSIS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 99 NORTH AMERICA: CELL ANALYSIS MARKET FOR HOSPITALS AND CLINICAL TESTING LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 100 EUROPE: CELL ANALYSIS MARKET FOR HOSPITALS AND CLINICAL TESTING LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 101 ASIA PACIFIC: CELL ANALYSIS MARKET FOR HOSPITALS AND CLINICAL TESTING LABORATORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 102 ACADEMIC AND RESEARCH INSTITUTES: CELL ANALYSIS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 103 NORTH AMERICA: CELL ANALYSIS MARKET FOR ACADEMIC AND RESEARCH INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 104 EUROPE: CELL ANALYSIS MARKET FOR ACADEMIC AND RESEARCH INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 105 ASIA PACIFIC: CELL ANALYSIS MARKET FOR ACADEMIC AND RESEARCH INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 106 OTHER END USERS: CELL ANALYSIS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 107 NORTH AMERICA: CELL ANALYSIS MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 108 EUROPE: CELL ANALYSIS MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 109 ASIA PACIFIC: CELL ANALYSIS MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 110 CELL ANALYSIS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 111 NORTH AMERICA: CELL ANALYSIS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 112 NORTH AMERICA: CELL ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 113 NORTH AMERICA: CELL ANALYSIS MARKET, BY TECHNIQUE, 2021–2028 (USD MILLION)

- TABLE 114 NORTH AMERICA: CELL ANALYSIS MARKET, BY PROCESS, 2021–2028 (USD MILLION)

- TABLE 115 NORTH AMERICA: CELL ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 116 US: CELL ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 117 US: CELL ANALYSIS MARKET, BY TECHNIQUE, 2021–2028 (USD MILLION)

- TABLE 118 US: CELL ANALYSIS MARKET, BY PROCESS, 2021–2028 (USD MILLION)

- TABLE 119 US: CELL ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 120 CANADA: CELL ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 121 CANADA: CELL ANALYSIS MARKET, BY TECHNIQUE, 2021–2028 (USD MILLION)

- TABLE 122 CANADA: CELL ANALYSIS MARKET, BY PROCESS, 2021–2028 (USD MILLION)

- TABLE 123 CANADA: CELL ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 124 EUROPE: CELL ANALYSIS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 125 EUROPE: CELL ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 126 EUROPE: CELL ANALYSIS MARKET, BY TECHNIQUE, 2021–2028 (USD MILLION)

- TABLE 127 EUROPE: CELL ANALYSIS MARKET, BY PROCESS, 2021–2028 (USD MILLION)

- TABLE 128 EUROPE: CELL ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 129 GERMANY: CELL ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 130 GERMANY: CELL ANALYSIS MARKET, BY TECHNIQUE, 2021–2028 (USD MILLION)

- TABLE 131 GERMANY: CELL ANALYSIS MARKET, BY PROCESS, 2021–2028 (USD MILLION)

- TABLE 132 GERMANY: CELL ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 133 FRANCE: CELL ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 134 FRANCE: CELL ANALYSIS MARKET, BY TECHNIQUE, 2021–2028 (USD MILLION)

- TABLE 135 FRANCE: CELL ANALYSIS MARKET, BY PROCESS, 2021–2028 (USD MILLION)

- TABLE 136 FRANCE: CELL ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 137 UK: CELL ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 138 UK: CELL ANALYSIS MARKET, BY TECHNIQUE, 2021–2028 (USD MILLION)

- TABLE 139 UK: CELL ANALYSIS MARKET, BY PROCESS, 2021–2028 (USD MILLION)

- TABLE 140 UK: CELL ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 141 ITALY: CELL ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 142 ITALY: CELL ANALYSIS MARKET, BY TECHNIQUE, 2021–2028 (USD MILLION)

- TABLE 143 ITALY: CELL ANALYSIS MARKET, BY PROCESS, 2021–2028 (USD MILLION)

- TABLE 144 ITALY: CELL ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 145 SPAIN: CELL ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 146 SPAIN: CELL ANALYSIS MARKET, BY TECHNIQUE, 2021–2028 (USD MILLION)

- TABLE 147 SPAIN: CELL ANALYSIS MARKET, BY PROCESS, 2021–2028 (USD MILLION)

- TABLE 148 SPAIN: CELL ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 149 REST OF EUROPE: CELL ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 150 REST OF EUROPE: CELL ANALYSIS MARKET, BY TECHNIQUE, 2021–2028 (USD MILLION)

- TABLE 151 REST OF EUROPE: CELL ANALYSIS MARKET, BY PROCESS, 2021–2028 (USD MILLION)

- TABLE 152 REST OF EUROPE: CELL ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 153 ASIA PACIFIC: CELL ANALYSIS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 154 ASIA PACIFIC: CELL ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 155 ASIA PACIFIC: CELL ANALYSIS MARKET, BY TECHNIQUE, 2021–2028 (USD MILLION)

- TABLE 156 ASIA PACIFIC: CELL ANALYSIS MARKET, BY PROCESS, 2021–2028 (USD MILLION)

- TABLE 157 ASIA PACIFIC: CELL ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 158 JAPAN: CELL ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 159 JAPAN: CELL ANALYSIS MARKET, BY TECHNIQUE, 2021–2028 (USD MILLION)

- TABLE 160 JAPAN: CELL ANALYSIS MARKET, BY PROCESS, 2021–2028 (USD MILLION)

- TABLE 161 JAPAN: CELL ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 162 CHINA: CELL ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 163 CHINA: CELL ANALYSIS MARKET, BY TECHNIQUE, 2021–2028 (USD MILLION)

- TABLE 164 CHINA: CELL ANALYSIS MARKET, BY PROCESS, 2021–2028 (USD MILLION)

- TABLE 165 CHINA: CELL ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 166 INDIA: CELL ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 167 INDIA: CELL ANALYSIS MARKET, BY TECHNIQUE, 2021–2028 (USD MILLION)

- TABLE 168 INDIA: CELL ANALYSIS MARKET, BY PROCESS, 2021–2028 (USD MILLION)

- TABLE 169 INDIA: CELL ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 170 REST OF ASIA PACIFIC: CELL ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: CELL ANALYSIS MARKET, BY TECHNIQUE, 2021–2028 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: CELL ANALYSIS MARKET, BY PROCESS, 2021–2028 (USD MILLION)

- TABLE 173 REST OF ASIA PACIFIC: CELL ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 174 LATIN AMERICA: CELL ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 175 LATIN AMERICA: CELL ANALYSIS MARKET, BY TECHNIQUE, 2021–2028 (USD MILLION)

- TABLE 176 LATIN AMERICA: CELL ANALYSIS MARKET, BY PROCESS, 2021–2028 (USD MILLION)

- TABLE 177 LATIN AMERICA: CELL ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: CELL ANALYSIS MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: CELL ANALYSIS MARKET, BY TECHNIQUE, 2021–2028 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: CELL ANALYSIS MARKET, BY PROCESS, 2021–2028 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: CELL ANALYSIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 182 CELL ANALYSIS MARKET: PRODUCT LAUNCHES

- TABLE 183 CELL ANALYSIS MARKET: DEALS

- TABLE 184 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 185 THERMO FISHER SCIENTIFIC INC.: PRODUCT OFFERINGS

- TABLE 186 THERMO FISHER SCIENTIFIC: PRODUCT LAUNCHES

- TABLE 187 THERMO FISHER SCIENTIFIC INC.: DEALS

- TABLE 188 DANAHER: COMPANY OVERVIEW

- TABLE 189 DANAHER: PRODUCT OFFERINGS

- TABLE 190 DANAHER: DEALS

- TABLE 191 DANAHER: OTHER DEVELOPMENTS

- TABLE 192 BECTON, DICKINSON AND COMPANY (BD): COMPANY OVERVIEW

- TABLE 193 BECTON, DICKINSON AND COMPANY (BD): PRODUCT OFFERINGS

- TABLE 194 BECTON, DICKINSON AND COMPANY (BD): PRODUCT LAUNCHES

- TABLE 195 GENERAL ELECTRIC: COMPANY OVERVIEW

- TABLE 196 GENERAL ELECTRIC: PRODUCT OFFERINGS

- TABLE 197 MERCK KGAA: BUSINESS OVERVIEW

- TABLE 198 MERCK KGAA: PRODUCT OFFERINGS

- TABLE 199 AGILENT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 200 AGILENT TECHNOLOGIES, INC.: PRODUCT OFFERINGS

- TABLE 201 AGILENT TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 202 BIO-RAD LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 203 BIO-RAD LABORATORIES, INC.: PRODUCT OFFERINGS

- TABLE 204 BIO-RAD LABORATORIES, INC.: DEALS

- TABLE 205 STANDARD BIOTOOLS: COMPANY OVERVIEW

- TABLE 206 STANDARD BIOTOOLS: PRODUCT OFFERINGS

- TABLE 207 MILTENYI BIOTEC: COMPANY OVERVIEW

- TABLE 208 MILTENYI BIOTEC: PRODUCT OFFERINGS

- TABLE 209 MILTENYI BIOTEC: PRODUCT LAUNCHES

- TABLE 210 OLYMPUS CORPORATION: BUSINESS OVERVIEW

- TABLE 211 OLYMPUS CORPORATION: PRODUCT OFFERINGS

- TABLE 212 BIOSTATUS LIMITED: COMPANY OVERVIEW

- TABLE 213 BIOSTATUS LIMITED: PRODUCT OFFERINGS

- TABLE 214 NANOCELLECT BIOMEDICAL: BUSINESS OVERVIEW

- TABLE 215 NANOCELLECT BIOMEDICAL: PRODUCT OFFERINGS

- TABLE 216 NANOCELLECT BIOMEDICAL: DEALS

- TABLE 217 NANOCELLECT BIOMEDICAL: PRODUCT LAUNCHES

- TABLE 218 CELL BIOLABS, INC.: COMPANY OVERVIEW

- TABLE 219 CELL BIOLABS, INC.: PRODUCT OFFERINGS

- TABLE 220 CREATIVE BIOARRAY: COMPANY OVERVIEW

- TABLE 221 CREATIVE BIOARRAY: SERVICE OFFERINGS

- TABLE 222 MEIJI TECHNO: COMPANY OVERVIEW

- TABLE 223 MEIJI TECHNO: PRODUCT OFFERINGS

- TABLE 224 PROMEGA CORPORATION: COMPANY OVERVIEW

- TABLE 225 PERKINELMER: COMPANY OVERVIEW

- TABLE 226 TECAN TRADING AG: COMPANY OVERVIEW

- TABLE 227 CARL ZEISS AG: COMPANY OVERVIEW

- TABLE 228 SYSMEX: COMPANY OVERVIEW

- TABLE 229 CELLINK: COMPANY OVERVIEW

- TABLE 230 QIAGEN: COMPANY OVERVIEW

- TABLE 231 ILLUMINA, INC.: COMPANY OVERVIEW

- TABLE 232 CORNING INCORPORATED: COMPANY OVERVIEW

- TABLE 233 10X GENOMICS: COMPANY OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 CELL ANALYSIS MARKET: BREAKDOWN OF PRIMARIES

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP (SUPPLY SIDE)

- FIGURE 4 ILLUSTRATIVE EXAMPLE OF THERMO FISHER SCIENTIFIC: REVENUE SHARE ANALYSIS, 2022

- FIGURE 5 AVERAGE MARKET SIZE ESTIMATION (2022)

- FIGURE 6 CELL ANALYSIS MARKET: CAGR PROJECTIONS (2023–2028)

- FIGURE 7 CELL ANALYSIS MARKET: ANALYSIS OF DRIVERS, RESTRAINTS, CHALLENGES, AND OPPORTUNITIES

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- FIGURE 9 MARKET VALIDATION FROM PRIMARY EXPERTS

- FIGURE 10 CELL ANALYSIS MARKET, BY PRODUCT & SERVICE, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 CELL ANALYSIS MARKET, BY TECHNIQUE, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 CELL ANALYSIS MARKET, BY PROCESS, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 CELL ANALYSIS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 CELL ANALYSIS MARKET: GEOGRAPHICAL SNAPSHOT

- FIGURE 15 INCREASING FUNDING FOR CELL-BASED RESEARCH TO DRIVE MARKET

- FIGURE 16 REAGENTS & CONSUMABLES SEGMENT HELD LARGEST MARKET SHARE IN 2022

- FIGURE 17 FLOW CYTOMETRY SEGMENT TO DOMINATE NORTH AMERICAN MARKET IN 2028

- FIGURE 18 CELL ANALYSIS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 CELL ANALYSIS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 CELL ANALYSIS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 21 TECHNOLOGY ANALYSIS: CELL ANALYSIS MARKET

- FIGURE 22 CELL ANALYSIS MARKET: INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 23 KEY BUYING CRITERIA OF CELL ANALYSIS PRODUCTS

- FIGURE 24 NORTH AMERICA: CELL ANALYSIS MARKET SNAPSHOT

- FIGURE 25 ASIA PACIFIC: CELL ANALYSIS MARKET SNAPSHOT

- FIGURE 26 CELL ANALYSIS MARKET: STRATEGIES ADOPTED BY KEY PLAYERS

- FIGURE 27 CELL ANALYSIS MARKET SHARE ANALYSIS (2022)

- FIGURE 28 REVENUE ANALYSIS FOR KEY COMPANIES, 2021–2022

- FIGURE 29 CELL ANALYSIS MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 30 CELL ANALYSIS MARKET: COMPETITIVE LEADERSHIP MAPPING FOR SMES/ START-UPS, 2022

- FIGURE 31 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2020)

- FIGURE 32 DANAHER: COMPANY SNAPSHOT (2022)

- FIGURE 33 BECTON, DICKINSON AND COMPANY (BD): COMPANY SNAPSHOT (2022)

- FIGURE 34 GENERAL ELECTRIC: COMPANY SNAPSHOT (2022)

- FIGURE 35 MERCK KGAA: COMPANY SNAPSHOT (2022)

- FIGURE 36 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 37 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 38 STANDARD BIOTOOLS: COMPANY SNAPSHOT (2022)

- FIGURE 39 OLYMPUS CORPORATION: COMPANY SNAPSHOT (2022)

This study involved four major activities in estimating the current size of the cell analysis market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the cell analysis market. The secondary sources used for this study include World Health Organization (WHO), Organisation for Economic Co-operation and Development (OECD), International Society for Advancement of Cytometry (ISAC), International Society for Stem Cell Research (ISSCR), International Agency for Research on Cancer (IARC), Centers for Disease Control and Prevention (CDC), Society for Laboratory Automation and Screening (SLAS), Centers for Medicare & Medicaid Services (CMS), National Cancer Institute (NCI), European Commission (EC), American Society for Cell Biology (ASCB), European Society for Toxicology In Vitro (ESTIV), European Federation of Pharmaceutical Industries and Associations (EFPIA), Japan Society for Cell Biology (JSCB), Shanghai Institute of Biochemistry and Cell Biology (SIBCB), Indian Society of Cell Biology (ISCB), Food and Drug Administration (FDA), Society of Biomolecular Imaging and Informatics (SBI2), Annual Reports, SEC Filings, Investor Presentations, Press Releases, Conferences, Journals, Expert Interviews, and MarketsandMarkets Analysis. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

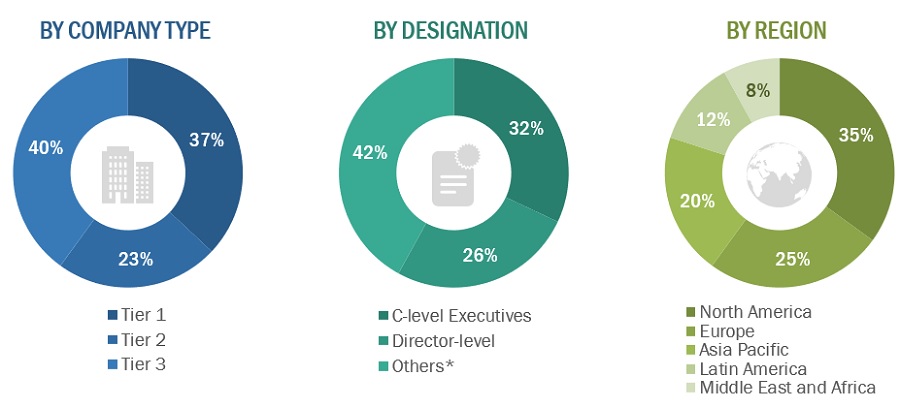

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue. As of 2021, Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the cell analysis market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the cell analysis business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Cell analysis is a technique used to study groups of cells and individual cells based on multiple parameters. It is used to measure cell properties such as size, shape, presence of specific proteins, proliferation, growth, morphology, porosity, and complexity.

Cell analysis products are used in various processes, which include cell identification, cell viability, cell proliferation, cell structure study, cell signaling pathway/signal transduction, cell counting & quality control, target identification & validation, cell interaction, and single-cell analysis. These processes are carried out by various end users such as hospitals & clinical testing laboratories, academic and research institutes, pharmaceutical & biotechnology companies, and other end users (CROs, cell culture collection repositories, food & beverage manufacturers, environmental monitoring organizations, forensic laboratories, and blood banks).

Key Stakeholders

- Pharmaceutical and biopharmaceutical companies

- Manufacturers of cell analysis equipment

- Contract research organizations (CROs)

- Life science research institutes

- Venture capitalists

- Research & consulting firms

Report Objectives

- To define, describe, and forecast the global cell analysis market based on the product & service, technique, process, end user and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, and opportunities)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall cell analysis market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa

- To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, partnerships, and R&D activities in the cell analysis market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

- An additional five company profiles

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cell Analysis Market