Hearing Aids Market Size, Growth, Share & Trends Analysis

Hearing Aids Market by Product (Devices (RITE, BTE, Canal, ITE), Implants (Cochlear, Bone-anchored)), Type of Hearing Loss (Sensorineural, Conductive), Patient (Adults, Pediatrics), Technology (Digital, Analog), Channel & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global hearing aids market is expected to grow from USD 10.35 billion in 2025 to USD 14.42 billion by 2030, registering a CAGR of 6.8% over the forecast period. This growth is primarily driven by the rising prevalence of hearing loss worldwide, an aging population, and the increasing adoption of smart hearing aids, particularly for noise-induced hearing impairments. Expanding insurance coverage and favorable reimbursement policies in several developed countries are also supporting market penetration. Additionally, the integration of hearing aids with digital health platforms and the untapped potential in emerging markets offer significant growth opportunities. Nevertheless, high device costs, limited accessibility in certain regions, and a shortage of skilled professionals could constrain the market from reaching its full potential.

KEY TAKEAWAYS

-

BY PRODUCTThe hearing aids market is segmented into hearing aid devices and hearing implants. Devices are non-invasive solutions equipped with microphones, amplifiers, and speakers to improve hearing, while implants are surgically placed for severe hearing loss.

-

BY TYPE OF HEARING LOSSThe hearing aids market is segmented into sensorineural hearing loss and conductive hearing loss. Sensorineural hearing loss stems from inner ear or auditory nerve damage, while conductive hearing loss arises from obstructions or dysfunction in the outer or middle ear.

-

BY PATIENT TYPEThe global hearing aids market is segmented by patient type into adult and pediatric groups. Adults typically experience hearing loss due to age-related factors, while pediatric cases are often linked to congenital conditions, infections, or early ear disorders.

-

BY TECHNOLOGYThe global hearing aids market is segmented into digital and analog devices, with digital hearing aids commanding the largest market share in 2024, followed by analog models. Digital aids convert sound into digital signals for advanced processing and personalization, whereas analog models amplify sound in a continuous wave format with limited customization.

-

BY DISTRIBUTION CHANNELThe hearing aids market is segmented by distribution channel into audiology and ENT hospitals & clinics, retail and pharmacy outlets, and online platforms, with hospitals and clinics representing the primary avenue for comprehensive hearing healthcare, followed by retail and pharmacy outlets and online platforms.

-

BY REGIONThe global hearing aids market is segmented into five regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Among these, Asia Pacific is expected to be the fastest-growing region.

-

COMPETITIVE LANDSCAPEThe hearing aids market is highly competitive, with major players such as Sonova (Switzerland), WS Audiology (Denmark), and Demant A/S (Denmark) adopting both organic and inorganic strategies, including product innovation, strategic partnerships, and acquisitions, to expand their market presence and strengthen technological capabilities.

The global hearing aids market is expected to experience steady growth over the forecast period. Expansion in this sector is primarily driven by the rising prevalence of hearing loss worldwide, an aging population, and increasing adoption of smart hearing aids, particularly for managing noise-induced hearing impairments. Greater insurance coverage and supportive reimbursement policies in several developed countries are further facilitating market penetration. In addition, the integration of hearing aids with digital health ecosystems and the growing opportunities in emerging markets offer significant potential for industry growth. However, challenges such as high device costs, limited accessibility in certain regions, and a shortage of trained professionals may constrain the market’s full growth potential.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The rising prevalence of hearing loss, particularly among the aging population and those exposed to high noise levels, is a major factor driving demand in the hearing aids market. Growing awareness about early detection and treatment is also encouraging adoption. Advances in implant design, such as smaller and more efficient devices, longer battery life, and enhanced sound processing algorithms, are significantly improving user comfort and hearing quality. In addition, the increasing integration of wireless connectivity and smartphone compatibility is making hearing aids more convenient and appealing to tech-savvy users. Over the next three to five years, these innovations are expected to reshape the business revenue mix, with premium, technology-driven devices capturing a larger share of the market and expanding the role of hearing aids from simple amplification tools to comprehensive hearing healthcare solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing global burden of hearing loss

-

Increase in aging population

Level

-

High cost of hearing aids and associated treatments

-

Risks, accessibility, and long post-surgery rehabilitation associated with hearing aids

Level

-

High-growth potential for hearing technologies in emerging economies

-

Integration with digital health platforms enhances hearing device care

Level

-

Shortage of skilled professionals performing ENT procedures

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing global burden of hearing loss

The growing prevalence of hearing loss highlights the need for early diagnosis and intervention. Untreated hearing impairments can affect children’s speech development and learning, and in older adults, they are linked to cognitive decline, social isolation, depression, and increased risk of falls. In 2024, over 1.5 billion people globally have some degree of hearing loss, with 430 million experiencing disabling impairment. Rising awareness and improved audiology infrastructure in countries like the US, China, and India are boosting adoption of hearing aids and rehabilitation services, driving market growth.

Restraint: High cost of hearing aids and associated treatments

Hearing aids and related therapies remain expensive, limiting adoption, especially where insurance coverage is insufficient. Prescription devices range from USD 1,000 to 6,000 per pair, while cochlear implants can exceed USD 34,000 excluding surgery and rehabilitation. Limited reimbursement and high out-of-pocket costs hinder access, particularly for lower-income and elderly populations, restricting market expansion despite technological advancements.

Opportunity: High-growth potential for hearing technologies in emerging economies

Emerging markets, including India, South Korea, Malaysia, Vietnam, and parts of the Middle East and Africa, offer significant growth potential. Improved healthcare infrastructure, regulatory support, competitive pricing, and medical tourism are increasing access to hearing solutions. International manufacturers are focusing on these regions to tap into growing demand and expand market presence.

Challenge: Shortage of skilled professionals performing ENT procedures

A shortage of qualified ENT specialists and audiologists, coupled with an aging workforce, limits access to essential services such as cochlear implantation. Rural areas face particularly low specialist density, hindering timely diagnosis and treatment. Addressing this workforce gap is critical for expanding the hearing aids market and ensuring equitable access to hearing care services.

Hearing Aids Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides a broad portfolio of hearing solutions across styles and channels, supporting in-clinic fittings, audiologist workflows, and consumer connectivity use cases. | Enables rapid, accurate fittings and personalized amplification; strong support for clinic workflows and patient follow-up; improved user uptake due to wide style choice and connectivity features. |

|

Offers a range of consumer and clinic-oriented hearing products with emphasis on discreet designs and scalable performance levels for diverse hearing losses. | Delivers cosmetic appeal and user acceptance, flexible performance tiers for different needs, and reliable in-clinic outcomes that reduce return rates and improve patient satisfaction. |

|

Focuses on clinically robust hearing solutions and professional support services aimed at audiology practices and integrated care pathways. | Provides dependable clinical performance, streamlined clinician fitting and verification, and scalable options for pediatric and adult care—improving clinical throughput and treatment outcomes. |

|

Specializes in implantable auditory systems for severe-to-profound hearing loss, supporting surgical and post-operative rehabilitation pathways. | Restores hearing capability where conventional aids fail, improves speech perception and safety, and enhances long-term quality of life through implanted solutions and rehabilitation support. |

|

Delivers consumer-friendly and clinic-compatible hearing devices with strong emphasis on wireless connectivity and mobile integration. | Enables seamless streaming and smartphone control, enhances everyday communication and convenience, and supports higher user engagement and adherence through connected features. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem market map of the hearing aids market outlines the key elements within this sector, along with the entities involved. It covers the types of products available, the categories of hearing loss, and the patient demographics. The product segment encompasses hearing aid devices and hearing implants used across various applications. Manufacturers are organizations engaged in research, product development, optimization, and market launch. Distributors include audiology and ENT hospitals and clinics, retail and pharmacy outlets, as well as online platforms associated with these organizations for marketing and sales. Patients, who adopt hearing aids following diagnosis, are central stakeholders in the hearing aids supply chain. Additionally, investors, funders, and health regulatory bodies serve as major influencers in the market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Hearing Aids Market, By Product

By product, the hearing aid devices segment commanded the largest share of the market in 2024. This dominance is fueled by the rising prevalence of age-related hearing loss among the growing elderly population, coupled with technological advancements that improve usability and performance. Modern devices feature compact designs, wireless connectivity with smartphones, and remote adjustment options that enhance convenience and user experience. Continuous innovation in sound processing has further improved clarity in complex environments, driving adoption across varying levels of impairment. As a result, hearing aid devices have become the primary solution for most patients, making them a consistent revenue generator in the hearing aids market. However, limited reimbursement in several regions remains a challenge, potentially constraining wider access and slowing market expansion.

Hearing Aids Market, By Type of Hearing Loss

By type of hearing loss, the sensorineural hearing loss segment held the largest market share in 2024. This dominance is largely driven by its rising prevalence among the aging population, with individuals between 50 and 65 years particularly affected. Hearing aids remain the primary treatment for mild to moderate bilateral cases, offering speech clarity through amplification and advanced digital processing. Features such as directional microphones, noise reduction, and smartphone connectivity have improved performance and patient outcomes, boosting adoption. For severe or profound cases, cochlear implants provide an alternative by bypassing damaged structures to directly stimulate the auditory nerve. The increasing incidence of sensorineural hearing loss, combined with expanding rehabilitation options, positions this segment as the key growth driver in the overall hearing healthcare market.

Hearing Aids Market, By Patient Type

In 2024, the adult segment accounted for the largest market share at 88.5%, primarily due to the high prevalence of presbycusis, or age-related hearing loss, among individuals over 50 years. Despite being the dominant group, adoption rates remain suboptimal, creating risks to communication, cognitive health, and overall quality of life. With nearly 2.5 billion people projected to be affected by hearing loss globally by 2050, the adult segment is expected to maintain its dominance, driven by both rising demand and the growing need for effective auditory rehabilitation solutions.

Hearing Aids Market, By Technology

Digital hearing commanded the largest share in the hearing aids technology market in 2024. Their dominance is attributed to superior functionalities such as adaptive sound processing, feedback suppression, and improved speech intelligibility. These devices are widely prescribed in hospitals and specialized hearing care centers, with many models featuring wireless connectivity for seamless smartphone integration and remote adjustments. The ability to automatically adapt to diverse acoustic environments further enhances user convenience, making digital solutions the preferred choice for most patients. In contrast, analog hearing aids are gradually losing market relevance, remaining limited to cost-sensitive settings in rural or low-resource regions where access to digital technology is restricted.

Hearing Aids Market, By Distribution Channel

Audiology and ENT hospitals & clinics were the leading distribution channel in 2024, holding the largest share of the hearing aids market. Their dominance stems from the availability of specialized professionals, diagnostic facilities, and integrated services that cover evaluation, device fitting, and post-fitting management in a single setting. These institutions are trusted for managing complex and progressive impairments, offering both non-surgical devices and implantable solutions. Equipped with soundproof testing environments and advanced apparatus, they deliver precise diagnostics and personalized care that enhance patient outcomes. Furthermore, frameworks such as unbundled pricing models have improved accessibility and adoption rates. This combination of expertise, infrastructure, and patient trust ensures hospitals and clinics remain the preeminent channel in the hearing aids market.

REGION

Asia Pacific to be fastest-growing region in global wearable healthcare devices market during forecast period

Asia Pacific is witnessing rapid expansion in the hearing aids market, driven by a growing elderly population, increased demand for otolaryngological services, and significant investments in healthcare infrastructure. Countries such as South Korea, Taiwan, and Singapore are experiencing a rising prevalence of hearing loss, fueling demand for audiological care. Government initiatives to improve healthcare access and expand hospital and clinic networks have enhanced the availability of hearing aids, while medical tourism in Thailand and Malaysia further supports adoption. These factors have enabled Asia Pacific to witness the highest CAGR in the global hearing aids market during the study period, establishing it as the fastest-growing regional market.

Hearing Aids Market: COMPANY EVALUATION MATRIX

In the hearing aids market matrix, Sonova (Switzerland) leads with a strong global presence, a diversified product portfolio, and advanced digital and wireless hearing solutions, driving widespread adoption across hospitals, clinics, and retail channels. WS Audiology (Denmark) and Demant A/S (Denmark) are established players, with WS Audiology leveraging strategic alliances and Demant expanding clinical networks to strengthen regional dominance. Cochlear Ltd. (Australia) holds a leadership position in the hearing implant segment, while GN Store Nord A/S (Denmark) demonstrates strong potential by integrating consumer electronics expertise with hearing care solutions. Together, these players shape a highly competitive landscape driven by technological innovation, rising demand for smart and self-optimizing devices, and evolving regulatory frameworks for over-the-counter hearing aids.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 9.74 Billion |

| Revenue Forecast in 2030 | USD 14.42 Billion |

| Growth Rate | CAGR of 6.8% from 2025-2030 |

| Actual data | 2023-2030 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Million), Volume (Million Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: Hearing Aids Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | ||

| Company Information | ||

| Geographic Analysis |

RECENT DEVELOPMENTS

- February, 2025 : Starkey (US) partnered with Stanford University (US) to validate its AI-powered balance assessment tool.

- March, 2024 : WS Audiology (Denmark) introduced Rexton Reach, a rechargeable hearing aid offering extended battery life and portable charging.

- March, 2023 : Demant A/S (Denmark) opened a diagnostics production facility in Sroda Wielkopolska, Poland.

- March, 2022 : Sonova (Switzerland) acquired Alpaca Audiology (US), expanding its US audiological care network.

Table of Contents

Methodology

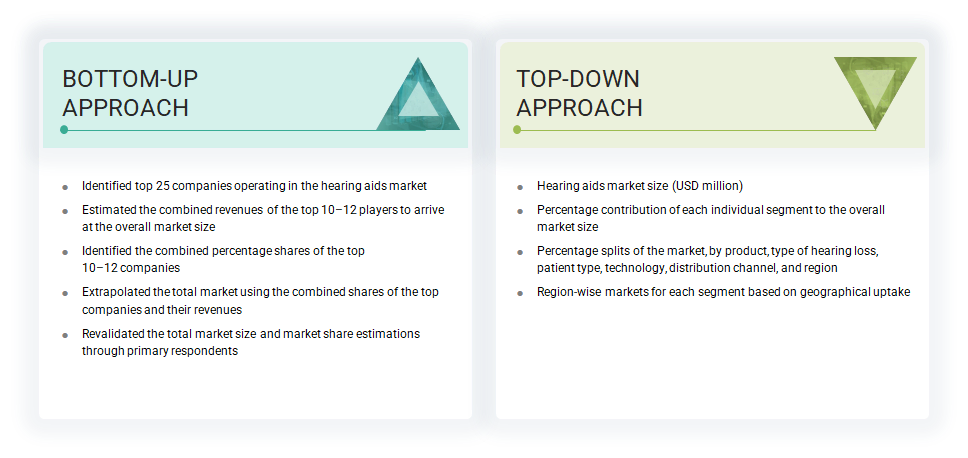

The study involved key activities in estimating the current market size for the hearing aids industry. Extensive secondary research was conducted to gather information on the hearing aids sector. The next step was to validate these findings, assumptions, and estimates with industry experts across the value chain through primary research. Different methods, such as top-down and bottom-up approaches, were used to determine the total market size. Subsequently, market segmentation and data triangulation techniques were applied to estimate the market sizes of the segments and subsegments within the hearing aids market.

The four steps involved in estimating the market size are:

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, investor presentations, SEC filings of companies and publications from government sources [such as National Institutes of Health (NIH), US FDA, US Census Bureau, World Health Organization (WHO), , Global Burden of Disease Study, and Centers for Medicare and Medicaid Services (CMS) were referred to identify and collect information for the global hearing aids market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends, to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

During the primary research phase, a detailed and structured approach was used, including interviews with sources from both the supply and demand sides of the hearing aids market. These interviews aimed to gather key qualitative and quantitative data for this report. Important sources included industry experts from core and related sectors, leading manufacturers, distributors, suppliers, technology innovators, and stakeholders across the value chain. A diverse group of respondents—such as senior executives, subject-matter experts, industry advisors, and key decision-makers—was interviewed in-depth to validate insights and evaluate future market opportunities.

The following is a breakdown of the primary respondents:

Note 1: Other designations include sales, marketing, and product managers.

Note 2: Companies are classified into tiers based on their total revenues. As of 2024, Tier 1 = >USD 100 million, Tier 2 = USD 10 million to USD 100 million, and Tier 3 = < USD 10 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The global market value was estimated by mapping the annual revenues of key product manufacturers and OEMs operating in the global hearing aids market. Major service providers were identified at the global, regional, and country levels. Revenue mapping was conducted for relevant business segments and subsegments of these leading players. This process involved:

- Identifying major players active in the hearing aids market across various regions and countries

- Mapping their product portfolios by region/country

- Analyzing annual revenues generated from hearing aids or the closest reported product categories

- Extrapolating these revenues to estimate the market value of each segment and sub-segment

- Aggregating all segment and sub-segment values to determine the total global market size of the hearing aids market

The above data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

The research methodology used to estimate the market size includes the following:

Data Triangulation

Once the overall market size was determined using the methodology described earlier, it was divided into multiple categories. A thorough market engineering process was followed to ensure accurate estimates for all segments and sub-segments, including data triangulation and market breakdown methods where applicable. Triangulation was accomplished by analyzing various influencing factors and trends from both the demand and supply sides.

Market Definition

Hearing aids are sophisticated, battery-operated sound amplification devices engineered to assist individuals with varying degrees of hearing loss, ranging from mild to profound. The efficacy of these devices is influenced by multiple factors, including the severity and etiology of the hearing impairment, the specific technology employed in the hearing aid and the precision of its fitting. Users often experience a range of benefits contingent upon these variables and the underlying characteristics of their auditory deficiencies.

Stakeholders

- Manufacturers and distributors of hearing aids

- Hospitals and clinics

- Audiology centers

- Research and development (R&D) companies

- Clinical research organizations

- Research laboratories and academic institutes

- Hearing aids service providers

- Government associations

- Venture capitalists and investors

Report Objectives

- To define, describe, segment, and forecast the global hearing aids market by product, type of hearing loss, patient type, technology, distribution channel, and region

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges

- To analyze the micromarkets1 concerning individual growth trends, prospects, and contributions to the overall wound care market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments concerning five regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies2

- To benchmark players within the market using the proprietary Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business and product excellence

- To study the impact of AI/Gen AI on the market, along with the macroeconomic outlook for each region

ends -->

Key Questions Addressed by the Report

What revenue strategies are leading hearing aid companies using to dominate the market by 2030?

Leading players such as Sonova, Demant, and WSAudiology are leveraging premium product portfolios with AI-powered features, bundling devices with digital health ecosystems, and expanding direct-to-consumer models. By 2030, revenue is further projected to grow from recurring subscription services, tele-audiology, and OTC channels.

Which overlooked markets are emerging as high-ROI zones in the hearing aids industry?

Countries like India, Vietnam, and the UAE are becoming high-ROI zones due to rising hearing loss prevalence, expanding ENT infrastructure, and government-backed healthcare investments. Medical tourism in India and Malaysia is further boosting adoption, making these underserved markets attractive for global players.

How are regulatory shifts driving early revenue for hearing aid players in North America?

The US FDA’s 2022 approval of over-the-counter (OTC) hearing aids has significantly shortened time-to-market, cutting patient costs and improving accessibility. This has opened new revenue streams for companies like Eargo and Starkey, who are capitalizing on self-fitting models.

What funding and partnerships signal the next big shift in the hearing aids market?

Notable collaborations include Starkey’s AI-driven balance tool partnership with Stanford (2025) and MED-EL’s audio-streaming alliance with Starkey (2025). Such R&D investments indicate a strong pivot toward integrated, AI-powered, and bimodal hearing solutions.

What key innovation gaps offer untapped revenue potential in the hearing aids market?

Major gaps remain in affordability, pediatric-focused devices, and AI-enabled early diagnostics. Addressing these could unlock revenue from younger demographics and underserved populations. Startups like Eargo and Audicus are already disrupting with low-cost and direct-to-consumer models.

Which reimbursement or pricing shifts are opening new growth paths in Europe and the US?

Expansion of private insurance coverage in Europe and OTC hearing aid availability in the US are reducing patient out-of-pocket costs, broadening market penetration. Leaders such as Sonova and Demant are aligning product portfolios to benefit from these changes

How are supply chain and workforce shortages affecting profitability in the hearing aids market?

Rising component costs and shortages of ENT specialists are pressuring margins and delaying interventions. Companies are mitigating risks through localized manufacturing hubs (Demant in Poland) and remote-care solutions that reduce dependency on in-clinic visits.

Which technologies are accelerating hearing aid adoption and market access?

Wireless connectivity, AI-based sound processing, and tele-audiology platforms are transforming user experience and driving faster adoption. Starkey and GN Store Nord are leading in integrating smartphones and wearables, enhancing accessibility at scale.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Hearing Aids Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Hearing Aids Market

Brian

Mar, 2022

What are the growth estimates for Hearing Aids Market till 2026?.

George

Mar, 2022

Which is the fastest growing market of Hearing Aids Market?.

Timothy

Mar, 2022

Can you enlighten us with your market intelligence to grow and sustain in Hearing Aids Market?.