ENT Devices Market by Product (Diagnostic (Endoscope, Hearing Screening Devices), Surgical Devices, (Powered Surgical Instruments, ENT Supplies, Ear Tubes), Hearing Aids, CO2 Lasers, End Users (Hospital & ASCs, ENT Clinics) & Region - Global Forecast to 2026

Market Growth Outlook Summary

The global ENT devices market growth forecasted to transform from USD 16.2 billion in 2021 to USD 22.3 billion by 2026, driven by a CAGR of 6.6%. Key factors driving market growth include the rising prevalence of sinusitis, a growing geriatric population, favorable reimbursements for ENT procedures in developed countries, and the adoption of minimally invasive techniques. Major opportunities exist in emerging markets like China and India due to improving healthcare infrastructure, aging populations, and growing purchasing power. Key players in the market include Medtronic, Stryker, Olympus, and Cochlear Limited. The largest segments by product include diagnostic devices, surgical devices, and hearing aids. North America leads in market share, primarily due to favorable reimbursement policies and the presence of leading companies. However, challenges such as pricing pressure and regulatory changes could impact market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

ENT Devices Market Dynamics

Driver: Favorable reimbursement scenario for ENT procedures in developed countries

In the developed countries, surgical procedures for ENT are reimbursed in most cases, such as balloon sinus dilation and endoscopic sinus surgery, computer-assisted surgical navigation, tongue suspension and hyoid suspension for the treatment of obstructive sleep apnea (OSA), and inferior turbinoplasty procedures. Only ENT surgeries performed mainly for snoring (considered as a cosmetic problem) are not reimbursed at all which include procedures such as pillar procedure, radio frequency ablation, injection snoreplasty, laser ear surgery, cosmetic rhinoplasty, and otoplasty.

As of December 2016, third-party payer insurance coverage for standalone balloon sinus dilation procedures is available for an estimated 230 million people in the US, which represents 80% of the covered people in the country. In the US, the standalone balloon sinus dilation procedure performed at the physician’s office is covered by various third-party payers, such as Medicare, United Healthcare, Aetna, Cigna, Humana, Kaiser Permanente, TRICARE, Health Net, Medicaid, and Blue Cross Blue Shield. Also, coverage of USD 180-USD 300 is provided for throat procedures such as tonsillectomies. For instance, the reimbursement for the tonsillectomy procedure within the state of Virginia is USD 200 (including follow-up care for 90 days after the procedure). Thus, favorable reimbursement scenario in developed countries provides the impetus for the growth of the market.

In the US, all major insurance providers provide reimbursement for sinus dilation procedures. For instance, Anthem, Inc. (the second-largest health benefits company with plans that cover over 40 million people in the US) covers balloon sinus dilation for the treatment of chronic and recurrent acute sinusitis. Other major payers offering coverage for standalone balloon sinus dilation procedures include Medicare, United Healthcare, Aetna, Anthem, Cigna, Humana, Kaiser, TRICARE, and Health Net. In the UK, the Medical Technologies Advisory Committee, under the National Institute for Health and Care Excellence (NICE), provided positive guidance for the use of the XprESS Multi-Sinus Dilation System (XprESS) for the treatment of chronic sinusitis and has recommended the device for consideration for reimbursement by the NHS. Such developments are expected to increase the demand and adoption of sinus dilation devices in major markets such as the UK.

Opportunity: Growing healthcare market in emerging economies

Developing economies such as China, India, and LATAM (Latin American) countries represent significant growth opportunities for players in the market. According to OECD, the global middle-class population is estimated to increase from 1.8 billion in 2009 to 4.9 billion in 2030. Asia is expected to account for 66% of the global middle-class population by 2030. In countries such as China and India, the growth in purchasing power is enabling people to purchase technologically advanced ENT devices, thereby fueling the growth of the market.

Moreover, factors such as less stringent regulatory policies, rapid urbanization, improving healthcare facilities, rising disposable income, and rapidly aging elderly population open an array of opportunities for the growth of this market in emerging economies. In order to leverage the growth opportunities in the market, various market players are focusing on expanding their market presence in developing nations. In this regard, in May 2021, Intersect ENT receives CE Mark Approval for PROPEL Contour for patients with chronic rhinosinusitis following frontal sinus surgery. Approval of such products will enable the market players to strengthen their product offerings in emerging markets. Owing to the abovementioned factors, emerging economies represent new revenue pockets for market players during the forecast period.

China’s one-child policy has significantly reduced the working-age population in the country and resulted in significant growth in its geriatric population. China’s Ministry of Civil Affairs estimated that in 2019, the geriatric population was ~12.5% (about 174-175 million) of China’s total population, which is expected to increase to 300 million by 2025. This will drive the incidence of target indications, such as Ear disorder and Deafness.

Challenge: Increasing pricing pressure on market players

Over the last decade, healthcare cost reduction has emerged as one of the major focus areas in healthcare systems. Price regulations, competitive pricing, bidding, tender mechanics, coverage and payment policies, the comparative effectiveness of therapies, technology assessments, and managed-care arrangements are implemented to achieve this. In response to the increasing pressure to reduce healthcare costs, healthcare providers have aligned themselves with group purchasing organizations and integrated health networks that negotiate for the bulk purchase of medical devices. The bulk purchasing trend increases the pricing pressure and decreases the profit margins for players, particularly for small and medium-sized manufacturers that offer a limited range of ENT devices.

Reforms on payments such as prospective payment systems for hospital care, preferential site of service payments, and value-based purchasing have added to the pressure on medical device companies. Furthermore, hospitals are consolidating, and large group purchasing organizations, hospital networks, and other groups continue to seek ways to aggregate purchasing power.

Due to BREXIT, economic conditions have been hit in the UK with volatility in currency exchange rates and a rising number of regulatory complexities. These outcomes may adversely affect businesses, financial conditions, or the results of operations in this market. Earlier, the EU would provide funds for scientific research and technological development of devices; post BREXIT, the EU is expected to cut research spending and discourage future investments. This will increase the manufacturing cost of devices, which will eventually be transferred to end users.

The implementation of taxes and duties on medical devices is also expected to affect the profitability of airway management device manufacturers. This includes the imposition of a 2.3% excise duty on the domestic sales of taxable medical devices in March 2010 in the US. Similarly, in its 2021 budget, the Indian government imposed a cess of 5% on the imported medical devices. According to the Medical Technological Association of India, the cess will increase the cost of imported products and reduce the affordability of healthcare in the country.

The Hearing Aids segment, of global ENT Devices Industry, is expected to grow at the highest CAGR during the forecast period

By product, the ENT devices market is segmented into Diagnostic Devices, Surgical Devices, Hearing Aids, Hearing Implants, Co2 Lasers, Image-Guided Surgery Systems. The Hearing Aids products segment accounted for the larger share of the global market. The high share of this segment is attributed to the high prevalence of hearing loss, rapidly growing elderly population, and technological advancements in hearing aids.

The Endoscopes segment of Diagnostic Devices accounted for the largest share of the ENT Devices Industry

Based on the Diagnostic Devices, the ENT devices market is segmented into Endoscopes and Hearing Screening Devices. The Endoscopes segment accounted for the largest share of the global market. The increasing demand for minimally invasive surgical procedures is a pivotal factor for the growth of the endoscopes market. In addition, the introduction of technologically advanced products is also contributing to the growth of this market.

Hospitals and Ambulatory Settings accounted for the largest share of the ENT Devices Industry

By end user, the ENT devices market is segmented into a Home Use, Hospitals and Ambulatory Settings, ENT Clinics. Hospitals and Ambulatory Settings segment accounted for the largest market share. The hospitals and Ambulatory Settings segment accounted for the largest market share in 2020. The increasing rise in disposable income and increasing affordability for ENT treatment, high prevalence of hearing loss, rapidly growing elderly population, and technological advancements in hearing aid are the major driving factors for this market.

To know about the assumptions considered for the study, download the pdf brochure

North America accounted for the largest share of the ENT Devices Industry

Based on the region, the ENT devices market is segmented into North America, Europe, Asia Pacific, and the Rest of the World (RoW). North America accounted for the largest share of the global market. The large share of North America can primarily be attributed to the increasing favorable reimbursement scenario for ENT procedures and the strong presence of major market players in this region.

Some of the major players operating in the ENT devices market are Karl Storz Gmbh & co. KG (Germany), Medtronic plc (Ireland), Stryker Corporation (US), Smith & Nephew plc (UK), Olympus Corporation (Japan), Acclarent, inc. (a subsidiary of Johnson & Johnson) (US), Cochlear Limited (Australia), Hoya Corporation (Japan), GN Store Nord (Denmark), Welch Allyn (Hill-Rom Holding Inc.) (Denmark), WS Audiology A/S (Denmark), Sonova Holding AG (Switzerland), Atos Medical AB (Sweden), William Demant holding a/s (Denmark), Rion Co. Ltd (US), Zounds Hearing Inc. (US), Starkey Hearing Technology (US), MED-EL GmbH (Austria), Narang Medical Limited (India), American Hearing Systems Inc. (US), Meril Life Sciences Pvt Ltd (India), SinuSys Corporation (US), Intersect ENT, Inc. (US), Audina Hearing Instruments (US), Horentek Systems (Italy), Richard Wolf GmbH (Germany), Lumenis (Israel), and Alma Lasers (Israel).

Scope of the ENT Devices Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2021 |

$16.2 billion |

|

Projected Revenue Size by 2026 |

$22.3 billion |

|

Industry Growth Rate |

Poised to grow at a CAGR of 6.6% |

|

Market Drivers |

Favorable reimbursement scenario for ENT procedures in developed countries |

|

Market Opportunities |

Growing healthcare market in emerging economies |

This research report categorizes the global ENT devices market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Diagnostic Devices

- Surgical Devices

- Hearing Aids

- Hearing Implants

- Co2 Lasers

- Image-Guided Surgery Systems

By Diagnostic Devices Type

- Endoscopes

- Hearing Screening Devices

By Surgical Devices Type

- Powered Surgical Instruments

- Radiofrequency (RF) Handpieces

- Handheld Instruments

- Balloon Sinus Dilation Devices

- ENT Supplies

- Ear Tubes

- Voice Prosthesis Devices

By End User

- Home Use

- Hospitals and Ambulatory Settings

- ENT Clinics

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Spain

- Italy

- RoE

-

Asia Pacific

- China

- India

- Japan

- RoAPAC

- Rest of the World

Recent Developments of ENT Devices Industry

- In 2020, Sonova holding AG expands its ENT product development and commercial manufacturing by setting up World of Hearing, which is a new store concept in the field of hearing solutions in the Netherlands Sonova holding AG launched new technology and enabled fully remote hearing aid fittings. In 2020, Sonova holding AG launched new technology and enabled fully remote hearing aid fittings.

- In 2020, William Demant holding A/S launched different products that include new premium audio brand EPOS, Oticon’s remote care solution offers a new tool to hearing care professionals, EPOS brings gamers ‘out of this world’ premium audio equipment to perfect the immersive gaming experience, greener hearing aid packaging, new ground-breaking hearing aid technology in all its four hearing aid brands, namely, Oticon, Philips HearLink, Bernafon, and Sonic.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global ENT devices market?

The global ENT devices market boasts a total revenue value of $22.3 billion by 2026.

What is the estimated growth rate (CAGR) of the global ENT devices market?

The global ENT devices market has an estimated compound annual growth rate (CAGR) of 6.6% and a revenue size in the region of $16.2 billion in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 ENT DEVICES INDUSTRY DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS OF THE STUDY

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

TABLE 1 EXCHANGE RATES UTILIZED FOR THE CONVERSION TO USD

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

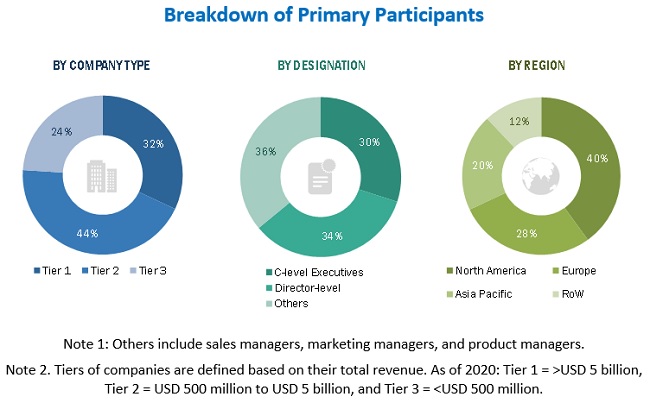

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 ENT DEVICES INDUSTRY SIZE ESTIMATION

FIGURE 4 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 6 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 COVID-19 HEALTH ASSESSMENT

2.7 COVID-19 ECONOMIC ASSESSMENT

2.8 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

FIGURE 8 CRITERIA IMPACTING THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 39)

FIGURE 10 HEARING AIDS SEGMENT TO DOMINATE THE ENT DEVICES MARKET DURING THE FORECAST PERIOD

FIGURE 11 ENDOSCOPES SEGMENT TO DOMINATE THE DIAGNOSTIC DEVICES SEGMENT OF GLOBAL MARKET DURING THE FORECAST PERIOD

FIGURE 12 BALLOON SINUS. DILATION DEVICES SEGMENT TO HOLD THE LARGEST SHARE OF SURGICAL DEVICES SEGMENT OF MARKET DURING THE FORECAST PERIOD (2021-2026)

FIGURE 13 GLOBAL ENT DEVICES INDUSTRY, BY END USER: HOSPITALS AND AMBULATORY SETTINGS TO OFFER SIGNIFICANT GROWTH OPPORTUNITIES DURING THE FORECAST PERIOD

FIGURE 14 GLOBAL ENT DEVICES INDUSTRY, BY REGION: ASIA PACIFIC TO WITNESS THE HIGHEST GROWTH IN THE FORECAST PERIOD

FIGURE 15 NEW PRODUCT LAUNCHES AND APPROVALS TO BE THE KEY STRATEGIES ADOPTED BY MARKET PLAYERS DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 ENT DEVICES MARKET OVERVIEW

FIGURE 16 RAPID GROWTH IN GERIATRIC POPULATION TO DRIVE THE MARKET GROWTH

4.2 GLOBAL ENT DEVICES INDUSTRY, BY PRODUCT

FIGURE 17 THE HEARING AIDS SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SHARE IN 2020

4.3 NORTH AMERICA: ENT DEVICES INDUSTRY, BY END USER AND COUNTRY, 2020

FIGURE 18 THE HOME USE SEGMENT AND THE US TO DOMINATE THE NORTH AMERICAN MARKET IN 2020

4.4 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL ENT DEVICES INDUSTRY

FIGURE 19 CHINA TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 ENT DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 High prevalence of ENT disorders or diseases

5.2.1.2 Rapidly growing aging population

TABLE 2 POPULATION AGED 65 YEARS AND OVER, BY REGION (IN MILLION)

5.2.1.3 Favorable reimbursement scenario for ENT procedures in developed countries

5.2.1.4 Growing adoption of minimally invasive ENT procedures such as Benefit of Balloon Sinuplasty/Sinus Dilation over Convention Sinus Surgeries

TABLE 3 DATA OF TONSILLECTOMY SURGICAL PROCEDURES PERFORMED IN DEVELOPED COUNTRIES IN 2018.

5.2.2 RESTRAINTS

5.2.2.1 High cost & lack of reimbursement policies for ENT Devices or procedures across developing countries

5.2.2.2 High cost of C02 lasers

5.2.3 OPPORTUNITIES

5.2.3.1 High demand for cosmetic ENT procedures

5.2.3.2 Growing healthcare market in emerging economies

5.2.4 CHALLENGES

5.2.4.1 Survival of small players and new entrants

5.2.4.2 Dearth of skilled otolaryngologists and ENT surgeons

5.2.4.3 Increasing pricing pressure on market players

5.3 COVID-19 IMPACT ANALYSIS

6 ENT DEVICES MARKET, BY PRODUCT (Page No. - 57)

6.1 INTRODUCTION

TABLE 4 GLOBAL ENT DEVICES INDUSTRY SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

6.2 DIAGNOSTIC DEVICES

TABLE 5 GLOBAL ENT DIAGNOSTIC DEVICES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 6 GLOBAL ENT DIAGNOSTIC DEVICES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.2.1 ENDOSCOPES

TABLE 7 GLOBAL ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 9 GLOBAL ENT ENDOSCOPES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.2.1.1 Rigid endoscopes

TABLE 10 GLOBAL ENT RIGID ENDOSCOPES MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 11 GLOBAL ENT RIGID ENDOSCOPES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.2.1.1.1 Otoscopes

TABLE 12 GLOBAL OTOSCOPES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.2.1.1.2 Sinuscopes

TABLE 13 GLOBAL SINUSCOPES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.2.1.2 Flexible endoscopes

TABLE 14 GLOBAL FLEXIBLE ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2021-2026 (USD MILLION )

TABLE 15 GLOBAL FLEXIBLE ENT ENDOSCOPES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.2.1.2.1 Rhinoscopes

TABLE 16 GLOBAL RHINOSCOPES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.2.1.2.2 Laryngoscopes

TABLE 17 GLOBAL LARYNGOSCOPES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.2.1.2.3 Pharyngoscopes

TABLE 18 GLOBAL PHARYNGOSCOPES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.2.1.2.4 Nasopharyngoscopes

TABLE 19 GLOBAL NASOPHARYNGOSCOPES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.2.2 HEARING SCREENING DEVICES

TABLE 20 GLOBAL HEARING SCREENING DEVICES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3 SURGICAL DEVICES

TABLE 21 GLOBAL ENT SURGICAL DEVICES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 22 GLOBAL ENT SURGICAL DEVICES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3.1 POWERED SURGICAL INSTRUMENTS

TABLE 23 GLOBAL ENT POWERED SURGICAL INSTRUMENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3.2 RADIOFREQUENCY (RF) HANDPIECES

TABLE 24 GLOBAL RADIOFREQUENCY HANDPIECES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3.3 HANDHELD INSTRUMENTS

TABLE 25 GLOBAL ENT HANDHELD INSTRUMENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 26 GLOBAL ENT HANDHELD INSTRUMENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3.3.1 Rhinology instruments

TABLE 27 GLOBAL RHINOLOGY INSTRUMENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3.3.2 Otology instruments

TABLE 28 GLOBAL OTOLOGY INSTRUMENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3.3.3 Laryngeal Instruments

TABLE 29 GLOBAL LARYNGEAL INSTRUMENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3.3.4 Head and neck surgery instruments

TABLE 30 GLOBAL HEAD AND NECK SURGERY INSTRUMENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3.3.5 Other handheld instruments

TABLE 31 OTHER ENT HANDHELD INSTRUMENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3.4 BALLOON SINUS DILATION DEVICES

TABLE 32 BALLOON SINUS DILATION DEVICES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3.5 ENT SUPPLIES

TABLE 33 GLOBAL ENT SUPPLIES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 34 GLOBAL ENT SUPPLIES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3.5.1 Packing material

TABLE 35 GLOBAL ENT PACKING MATERIAL MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3.5.2 Nasal stents & splints

TABLE 37 GLOBAL NASAL SPLINTS & STENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3.6 EAR TUBES

TABLE 38 GLOBAL EAR TUBES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3.7 VOICE PROSTHESIS DEVICES

TABLE 39 GLOBAL VOICE PROSTHESIS DEVICES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.4 HEARING AIDS

TABLE 40 GLOBAL HEARING AIDS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.5 HEARING IMPLANTS

TABLE 41 GLOBAL HEARING IMPLANTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.6 CO2 LASERS

TABLE 42 GLOBAL CO2 LASERS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.7 IMAGE-GUIDED SURGERY SYSTEMS

TABLE 43 GLOBAL IMAGE-GUIDED SURGERY MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7 ENT DEVICES MARKET, BY END USER (Page No. - 86)

7.1 INTRODUCTION

TABLE 44 ENT DEVICES INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

7.2 HOME USE

7.2.1 RISING AWARENESS AND ACCEPTANCE OF HOME CARE DRIVE MARKET GROWTH

TABLE 45 MARKET SIZE FOR HOME USE, BY REGION, 2019–2026 (USD MILLION)

7.3 HOSPITALS AND AMBULATORY SETTINGS

7.3.1 RISING SURGICAL VOLUME DRIVES DEMAND FOR MARKET IN THE HOSPITAL AND AMBULATORY SETTINGS

TABLE 46 GLOBAL ENT DEVICES MARKET SIZE FOR HOSPITALS AND AMBULATORY SETTINGS, BY REGION, 2019–2026 (USD MILLION)

7.3.2 ENT CLINICS

TABLE 47 GLOBAL MARKET SIZE FOR ENT CLINICS, BY REGION, 2019–2026 (USD MILLION)

8 ENT DEVICES MARKET SIZE, BY REGION (Page No. - 91)

8.1 INTRODUCTION

TABLE 48 ENT DEVICES INDUSTRY SIZE, BY REGION, 2019–2026 (USD MILLION)

8.2 NORTH AMERICA

FIGURE 21 NORTH AMERICA: ENT DEVICES MARKET SIZE SNAPSHOT

TABLE 49 NORTH AMERICA: MARKET SIZE, BY PRODUCT, –2026 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 51 NORTH AMERICA: ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 52 NORTH AMERICA: RIGID ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 53 NORTH AMERICA: FLEXIBLE ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 54 NORTH AMERICA: ENT SURGICAL DEVICES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 55 NORTH AMERICA: HANDHELD ENT INSTRUMENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 56 NORTH AMERICA: ENT SUPPLIES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 57 NORTH AMERICA: ENT DEVICES MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

8.2.1 US

8.2.1.1 US is the largest market for ENT Devices due to the high healthcare spending and favorable reimbursement policies for ENT Devices procedures in the country

TABLE 58 MEDICARE NATIONAL AVERAGE COVERAGE FOR OUTPATIENT PROCEDURES, 2019

TABLE 59 US: ENT DEVICES MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 60 US: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 61 US: ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 62 US: RIGID ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 63 US: FLEXIBLE ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 64 US: ENT SURGICAL DEVICES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 65 US: HANDHELD ENT INSTRUMENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 66 US: ENT SUPPLIES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 67 US: ENT DEVICES MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

8.2.2 CANADA

8.2.2.1 Unfavorable regulatory processes in Canada are a major restraint for the growth of the ENT Devices market

TABLE 68 CANADA: ENT DEVICES MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 69 CANADA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 70 CANADA: ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 71 CANADA: RIGID ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 72 CANADA: FLEXIBLE ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 73 CANADA: ENT SURGICAL DEVICES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 74 CANADA: HANDHELD ENT INSTRUMENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 75 CANADA: ENT SUPPLIES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 76 CANADA: ENT DEVICES MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

8.3 EUROPE

TABLE 77 EUROPE: ENT DEVICES MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 78 EUROPE: ENT DEVICES INDUSTRY SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 79 EUROPE: ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 80 EUROPE: RIGID ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 81 EUROPE: FLEXIBLE ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 82 EUROPE: ENT SURGICAL DEVICES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 83 EUROPE: HANDHELD ENT INSTRUMENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 84 EUROPE: ENT SUPPLIES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 85 EUROPE: ENT DEVICES MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

8.3.1 GERMANY

8.3.1.1 Germany to dominate the European market for endoscopy equipment during the forecast period

TABLE 86 GERMANY: ENT DEVICES MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 87 GERMANY: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 88 GERMANY: ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 89 GERMANY: RIGID ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 90 GERMANY: FLEXIBLE ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 91 GERMANY: ENT SURGICAL DEVICES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 92 GERMANY: HANDHELD ENT INSTRUMENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 93 GERMANY: ENT SUPPLIES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 94 GERMANY: ENT DEVICES MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

8.3.2 UK

8.3.2.1 Investments by hospitals in ENT Devices to drive market growth in the UK

TABLE 95 UK: ENT DEVICES MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 96 UK: ENT DEVICES INDUSTRY SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 97 UK : ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 98 UK: RIGID ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 99 UK: FLEXIBLE ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 100 UK: ENT SURGICAL DEVICES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 101 UK: HANDHELD ENT INSTRUMENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 102 UK: ENT SUPPLIES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 103 UK: ENT DEVICES MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

8.3.3 FRANCE

8.3.3.1 Favorable health insurance system to drive the market for ENT Devices in the coming years

TABLE 104 FRANCE: ENT DEVICES MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 105 FRANCE: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 106 FRANCE: ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 107 FRANCE: RIGID ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 108 FRANCE: FLEXIBLE ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 109 FRANCE: ENT SURGICAL DEVICES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 110 FRANCE: HANDHELD ENT INSTRUMENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 111 FRANCE: ENT SUPPLIES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 112 FRANCE: ENT DEVICES MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

8.3.4 ITALY

8.3.4.1 Reimbursement policies in Italy support market growth for ENT Device products

TABLE 113 ITALY: ENT DEVICES MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 114 ITALY: ENT DEVICES INDUSTRY SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 115 ITALY: ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 116 ITALY: RIGID ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 117 ITALY: FLEXIBLE ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 118 ITALY: ENT SURGICAL DEVICES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 119 ITALY: HANDHELD ENT INSTRUMENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 120 ITALY: ENT SUPPLIES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 121 ITALY: ENT DEVICES MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

8.3.5 SPAIN

8.3.5.1 Increasing health issues in old age boost the market growth in Spain

TABLE 122 SPAIN: ENT DEVICES MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 123 SPAIN: ENT DEVICE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 124 SPAIN: ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 125 SPAIN: RIGID ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 126 SPAIN: FLEXIBLE ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 127 SPAIN: ENT SURGICAL DEVICES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 128 SPAIN: HANDHELD ENT INSTRUMENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 129 SPAIN: ENT SUPPLIES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 130 SPAIN: ENT DEVICES MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

8.3.6 REST OF EUROPE

TABLE 131 ROE: ENT DEVICES MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 132 ROE: ENT DEVICES INDUSTRY SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 133 ROE: ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 134 ROE: RIGID ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 135 ROE: FLEXIBLE ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 136 ROE: ENT SURGICAL DEVICES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 137 ROE: HANDHELD ENT INSTRUMENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 138 ROE: ENT SUPPLIES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 139 ROE: ENT DEVICES MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

8.4 ASIA PACIFIC

FIGURE 22 ASIA PACIFIC: ENT DEVICES INDUSTRY SIZE SNAPSHOT

TABLE 140 ASIA PACIFIC: ENT DEVICE MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 141 ASIA PACIFIC: ENT DEVICE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 142 ASIA PACIFIC: ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 143 ASIA PACIFIC: RIGID ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 144 ASIA PACIFIC: FLEXIBLE ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 145 ASIA PACIFIC: ENT SURGICAL DEVICES MARKET SIZE, BY TYPE, –2026 (USD MILLION)

TABLE 146 ASIA PACIFIC: HANDHELD ENT INSTRUMENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 147 ASIA PACIFIC: ENT SUPPLIES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 148 ASIA PACIFIC: ENT DEVICES MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

8.4.1 JAPAN

8.4.1.1 Supportive reimbursement policies to drive market growth in Japan

TABLE 149 JAPAN: ENT DEVICE MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 150 JAPAN: ENT DEVICES INDUSTRY SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 151 JAPAN: ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 152 JAPAN: RIGID ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 153 JAPAN: FLEXIBLE ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 154 JAPAN: ENT SURGICAL DEVICES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 155 JAPAN: HANDHELD ENT INSTRUMENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 156 JAPAN: ENT SUPPLIES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 157 JAPAN: ENT DEVICES MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

8.4.2 CHINA

8.4.2.1 Large patient population and healthcare infrastructure improvements to drive market growth in China

TABLE 158 CHINA: ENT DEVICES INDUSTRY SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 159 CHINA: ENT DEVICE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 160 CHINA: ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 161 CHINA: RIGID ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 162 CHINA: FLEXIBLE ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 163 CHINA: ENT SURGICAL DEVICES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 164 CHINA: HANDHELD ENT INSTRUMENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 165 CHINA: ENT SUPPLIES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 166 CHINA: ENT DEVICES MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

8.4.3 INDIA

8.4.3.1 Healthcare infrastructure improvements and implementation of favorable government initiatives to support market growth in India

TABLE 167 INDIA: ENT DEVICE MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 168 INDIA: ENT DEVICE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 169 INDIA: ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 170 INDIA: RIGID ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 171 INDIA: FLEXIBLE ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 172 INDIA: ENT SURGICAL DEVICES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 173 INDIA: HANDHELD ENT INSTRUMENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 174 INDIA: ENT SUPPLIES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 175 INDIA: ENT DEVICES MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

8.4.4 REST OF ASIA PACIFIC

TABLE 176 ROAPAC: ENT DEVICE MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 177 ROAPAC: ENT DEVICES INDUSTRY SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 178 ROAPAC: ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 179 ROAPAC: RIGID ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 180 ROAPAC: FLEXIBLE ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 181 ROAPAC: ENT SURGICAL DEVICES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 182 ROAPAC: HANDHELD ENT INSTRUMENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 183 ROAPAC: ENT SUPPLIES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 184 ROAPAC: ENT DEVICES MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

8.5 REST OF THE WORLD (ROW)

TABLE 185 ROW: ENT DEVICES INDUSTRY SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 186 ROW: ENT DEVICE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 187 ROW: ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 188 ROW: RIGID ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 189 ROW: FLEXIBLE ENT ENDOSCOPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 190 ROW: ENT SURGICAL DEVICES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 191 ROW: HANDHELD ENT INSTRUMENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 192 ROW: ENT SUPPLIES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 193 ROW: ENT DEVICE MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 161)

9.1 OVERVIEW

FIGURE 23 KEY DEVELOPMENTS IN THE ENT DEVICES MARKET, JANUARY 2018–APRIL 2021

FIGURE 24 MARKET EVOLUTION MATRIX: JANUARY 2018 TO APRIL 2021

9.2 MARKET SHARE ANALYSIS

TABLE 194 GLOBAL ENT DEVICES INDUSTRY FOR (IMAGING-BASED): DEGREE OF COMPETITION

9.3 COMPANY EVALUATION MATRIX

FIGURE 25 VENDOR DIVE: ENT DEVICES MARKET

9.4 COMPETITIVE LEADERSHIP MAPPING (SMES/START-UPS)

FIGURE 26 VENDOR DIVE MATRIX FOR SMES & START-UPS: GLOBAL MARKET

9.5 COMPETITIVE SCENARIO

TABLE 195 KEY PRODUCT LAUNCHES & APPROVALS, JANUARY 2018–APRIL 2021

TABLE 196 KEY DEALS, JANUARY 2018–APRIL 2021

TABLE 197 OTHER KEY DEVELOPMENTS, JANUARY 2018–APRIL 2021

10 COMPANY PROFILES (Page No. - 170)

(Business overview, Products offered, Recent developments & MnM View)*

10.1 KEY PLAYERS

10.1.1 KARL STORZ GMBH & CO. KG

TABLE 198 KARL STORZ GMBH & CO. KG: BUSINESS OVERVIEW

10.1.2 MEDTRONIC PLC

FIGURE 27 MEDTRONIC PLC: COMPANY SNAPSHOT

TABLE 199 MEDTRONIC PLC: BUSINESS OVERVIEW

10.1.3 STRYKER CORPORATION

FIGURE 28 STRYKER CORPORATION: COMPANY SNAPSHOT

TABLE 200 STRYKER CORPORATION: BUSINESS OVERVIEW

10.1.4 SMITH & NEPHEW PLC

FIGURE 29 SMITH & NEPHEW PLC: COMPANY SNAPSHOT

TABLE 201 SMITH & NEPHEW PLC: BUSINESS OVERVIEW

10.1.5 OLYMPUS CORPORATION

FIGURE 30 OLYMPUS CORPORATION: COMPANY SNAPSHOT

TABLE 203 OLYMPUS CORPORATION: BUSINESS OVERVIEW

10.1.6 ACCLARENT, INC.

FIGURE 31 JOHNSON & JOHNSON: COMPANY SNAPSHOT

TABLE 204 JOHNSON & JOHNSON: BUSINESS OVERVIEW

10.1.7 COCHLEAR LIMITED

FIGURE 32 COCHLEAR LIMITED: COMPANY SNAPSHOT

TABLE 205 COCHLEAR LIMITED: BUSINESS OVERVIEW

10.1.8 HOYA CORPORATION

FIGURE 33 HOYA CORPORATION: COMPANY SNAPSHOT

TABLE 206 HOYA CORPORATION: BUSINESS OVERVIEW

10.1.9 SONOVA HOLDING AG

FIGURE 34 SONOVA HOLDING AG: COMPANY SNAPSHOT

TABLE 207 SONOVA HOLDING AG:BUSINESS OVERVIEW

10.1.10 WILLIAM DEMANT HOLDING A/S

FIGURE 35 WILLIAM DEMANT HOLDING A/S: COMPANY SNAPSHOT

TABLE 208 WILLIAM DEMANT HOLDING A/S: BUSINESS OVERVIEW

10.1.11 GN STORE NORD

FIGURE 36 GN STORE NORD: COMPANY SNAPSHOT

TABLE 209 GN STORE NORD: BUSINESS OVERVIEW

10.1.12 ATOS MEDICAL AB

FIGURE 37 ATOS MEDICAL AB: COMPANY SNAPSHOT

TABLE 210 ATOS MEDICAL AB: BUSINESS OVERVIEW

10.1.13 WELCH ALLYN (SUBSIDIARIES OF HILL-ROM HOLDINGS INC)

FIGURE 38 HILL-ROM HOLDINGS INC: COMPANY SNAPSHOT

TABLE 211 HILL-ROM HOLDINGS INC: BUSINESS OVERVIEW

10.1.14 STARKEY HEARING TECHNOLOGIES

TABLE 212 STARKEY HEARING TECHNOLOGIES: BUSINESS OVERVIEW

10.1.15 RION CO. LTD

TABLE 213 RION CO. LTD: BUSINESS OVERVIEW

10.1.16 AMERICAN HEARING SYSTEMS INC

TABLE 214 AMERICAN HEARING SYSTEMS INC: BUSINESS OVERVIEW

10.1.17 ZOUNDS HEARING INC.

TABLE 215 ZOUNDS HEARING INC.: BUSINESS OVERVIEW

10.1.18 NARANG MEDICAL LIMITED

TABLE 216 NARANG MEDICAL LIMITED: BUSINESS OVERVIEW

10.1.19 MED-EL GMBH

TABLE 217 MED-EL GMBH: BUSINESS OVERVIEW

10.1.20 WS AUDIOLOGY A/S

TABLE 218 WS AUDIOLOGY A/S: COMPANY OVERVIEW

10.1.21 HORENTEK SYSTEMS

TABLE 219 HORENTEK SYSTEMS: COMPANY OVERVIEW

10.1.22 AUDINA HEARING INSTRUMENTS

TABLE 220 AUDINA HEARING INSTRUMENTS: COMPANY OVERVIEW

10.1.23 MERIL LIFE SCIENCES PVT LTD

TABLE 221 MERIL LIFE SCIENCES PVT LTD: COMPANY OVERVIEW

10.1.24 INTERSECT ENT, INC.

TABLE 222 INTERSECT ENT, INC.: COMPANY OVERVIEW

10.1.25 SINUSYS CORPORATION

TABLE 223 SINUSYS CORPORATION: COMPANY OVERVIEW

10.1.26 RICHARD WOLF GMBH

TABLE 224 RICHARD WOLF GMBH: COMPANY OVERVIEW

10.1.27 LUMENIS

TABLE 225 LUMENIS: COMPANY OVERVIEW

10.1.28 ALMA LASERS

TABLE 226 ALMA LASERS: COMPANY OVERVIEW

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 312)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the ENT Devices market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

Extensive primary research was conducted after acquiring knowledge about the global market scenario through secondary research. Primary interviews were conducted from both the demand (Medical Practitioners, Otolaryngologist, Hospital Directors) and supply sides (Marketing Managers, Regional/Area Sales Managers, Product Managers/Technology Experts, Import/Export Heads, Distribution Channel Partners).

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the ENT Devices market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the ENT Devices industry.

Report Objectives

- To define, describe, and forecast the global ENT Devices market based on product, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments with respect to four main regions—North America, Europe, Asia Pacific and the Rest of the World (RoW)2

- To strategically profile key players and comprehensively analyze their product portfolios, market shares, and core competencies3

- To track and analyze competitive developments such as acquisitions, new product launches, expansions, regulatory approvals, and agreements in the ENT Devices market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Product matrix, which gives a detailed comparison of the product portfolios of each company

Geographic Analysis

Further breakdown of the Rest of the World ENT Devices market into Latin America, the Middle East, and Africa ENT Devices market into specific countries and further breakdown of the European ENT Devices market into specific countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in ENT Devices Market

What are the latest technological trends in ENT Devices Market?

Which segment to dominate the ENT Devices Market geographically?

What are the revenue expansion opportunities in upcoming years in ENT Devices Industry?