Healthcare Consulting Services Market: Growth, Size, Share, and Trends

Healthcare Consulting Services Market by Service Type (IT & Digital Transformation, Strategy, Marketing, Commercialization, Financial), End User (Pharma & Biotech, Hospital, ASCs, Payers, Medical Device Companies, Government), Region- Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The healthcare consulting services market size is projected to reach USD 52.0 billion by 2030 from USD 32.2 billion in 2025, at a CAGR 10.1% during the forecast period. The market growth is mainly driven by the complexity of healthcare systems, changing regulations, and the move toward value-based care models, which are prompting providers, payers, and life sciences companies to seek expert guidance. Additionally, cost containment pressures, public health challenges, and the need for operational efficiency are encouraging healthcare organizations to outsource strategic, operational, and compliance-related functions to consultants.

KEY TAKEAWAYS

- North America held largest share of 45.6% of the global market in 2024.

- Strategy consulting segment accounted for largest share of 30.3% in 2024.

- Healthcare providers segment is expected to grow at 11.2% by 2030

- Company Accemture, Deloitte, and Cognizant were identified as some of the star players in the healthcare consulting services market (global), given their strong market share and product footprint.

- Blue Matter Consulting, ISOS Consulting Services Pvt. Ltd., Lucid Health Consulting, Quality Crest Healthcare Consultants Pvt. Ltd. among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The healthcare consulting services market is primarily driven by the complexity of healthcare systems, evolving regulations, the push toward value-based care models, cost containment pressures, and the rapid adoption of digital health technologies like telemedicine, AI diagnostics, and electronic health records (EHRs). These drivers propel healthcare providers, payers, pharmaceutical and MedTech companies to seek expert guidance for operational efficiency, regulatory compliance, digital transformation, strategic planning, financial management, and policy adherence. The market covers a variety of consulting services including strategic management, digital transformation advisory, organizational restructuring, compliance & risk management, financial optimization, and technology implementation support. Consulting services are delivered to end users such as healthcare providers (hospitals, clinics), pharmaceutical and biotech companies, healthcare payers (insurance), and MedTech firms, helping them navigate industry challenges, optimize workflows, adopt innovative technologies, and improve patient care outcomes

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The healthcare consulting services market is evolving rapidly due to new regulations, shifting treatment models, and technological breakthroughs. Major themes include digital health tools like EHRs and AI-powered analytics, the shift toward value-based care, the emphasis on data protection and regulatory compliance, and the need for workforce efficiency. Client goals and consulting methods are also transforming because of disruptions such as economic uncertainty, cybersecurity issues, talent shortages, and increased competition.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing adoption of big data analytics, IoT, and cloud deployment

-

Rising government support for HCIT solutions

Level

-

Data confidentiality concerns

-

Hidden costs of consulting services

Level

-

Increasing potential for healthcare consulting services in emerging markets

-

Consistent rise in mergers and acquisitions

Level

-

High cost of consulting services

-

Rising number of multi-sourcing approaches

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing adoption of big data analytics, IoT, and cloud deployment

The growing adoption of big data analytics, IoT, and cloud deployment in the healthcare industry is significantly increasing the demand for healthcare consulting services. Healthcare providers and life sciences companies use advanced technologies to improve patient care, streamline operations, and enable real-time decision-making; they face challenges related to data integration, security, infrastructure scalability, and compliance. Consulting firms play a crucial role in guiding organizations through strategic planning, implementation, and management of these technologies, ensuring alignment with clinical and regulatory standards. Many pharmaceutical companies have utilized consulting services. For example, Accenture Plc (Ireland) partnered with Novartis AG (Switzerland) to lead a digital transformation in life sciences, optimizing operations and accelerating innovation through data-driven strategies.

Restraint: Data confidentiality concerns

The increasing concerns about data confidentiality serve as a major barrier for the healthcare consulting services market. As healthcare organizations more and more adopt digital tools such as cloud computing, IoT devices, and big data analytics, the risk of data breaches and unauthorized access to sensitive patient data has risen significantly. For example, in January 2025, a major cyberattack targeted Change Healthcare (a key healthcare tech partner under UnitedHealth), exposing sensitive data of up to 190 million individuals. Hackers took advantage of a Citrix portal lacking multi-factor authentication (MFA), stole claims data, insurance information, and Social Security numbers, and then deployed ransomware. Regulatory frameworks like HIPAA, GDPR, and local data protection laws enforce strict rules for data management, making it difficult for consulting firms to implement and oversee IT systems. Organizations often hesitate to hire external consultants due to concerns about potential data leaks, compliance breaches, or losing control over sensitive information.

Opportunity: Increasing potential for healthcare consulting services in emerging markets

Emerging markets offer a significant opportunity for the healthcare consulting services market, fueled by rapid healthcare transformation and rising investments in healthcare infrastructure. Countries in regions such as Asia-Pacific, Latin America, and the Middle East are working to strengthen their healthcare systems. There is an increasing demand for strategic guidance and expertise in areas such as hospital operations, digital health implementation, regulatory compliance, and healthcare financing. The growth of public-private partnerships, along with initiatives like India’s Ayushman Bharat and Saudi Arabia’s Vision 2030, is creating a favorable environment for private consulting firms to support modernization efforts. Additionally, the expanded adoption of telehealth, cloud solutions, and AI-powered platforms in these regions has generated demand for specialized IT and digital consulting services.

Challenge: High cost of consulting services

The high cost of consulting services remains a major obstacle for the healthcare consulting market, especially in developing economies and among small to mid-sized healthcare providers. Hiring professional consulting firms often requires a large financial outlay, including not just service fees but also related implementation and technology expenses. This cost can be too much for organizations with limited budgets, limiting their ability to access expert advice needed for digital transformation, operational improvements, or regulatory compliance. Additionally, in cost-conscious healthcare settings, the return on investment (ROI) from consulting may not be immediately clear, making decision-makers reluctant to spend resources.

healthcare consulting services market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Accenture helps healthcare providers implement digital transformation strategies that include advanced analytics, cloud migration, and patient engagement platforms. | Accenture drives measurable improvements in patient outcomes, reduces costs through process optimization, and strengthens compliance while enabling providers to deliver personalized, value-based care. |

|

Cognizant partners with payers and providers to deploy AI-driven population health management solutions, integrating claims, clinical, and social data to predict risks and manage chronic diseases. | Cognizant helps reduce hospital readmissions, improve preventive care delivery, and optimize resource allocation, leading to better health outcomes and lower overall care costs. |

|

Deloitte works with healthcare organizations to design and implement enterprise-wide interoperability and data governance frameworks, ensuring secure and seamless exchange of health information. | Deloitte strengthens compliance with regulatory requirements, enhances care coordination, and improves clinical decision-making through reliable and real-time access to patient data. |

|

McKinsey supports healthcare organizations in harnessing advanced analytics and AI to improve hospital operations, forecast demand, and enhance workforce productivity. | McKinsey delivers greater operational efficiency, reduces clinician burnout, and ensures optimal resource utilization while maintaining high standards of patient care. |

|

BCG advises healthcare organizations to accelerate digital health adoption, including telemedicine platforms and virtual care models, and expand access and enhance patient engagement. | BCG increases care accessibility, drives patient satisfaction, and creates scalable, cost-effective delivery models that strengthen competitiveness in a rapidly evolving healthcare landscape. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The healthcare consulting services market is a complex ecosystem driven by a diverse range of interconnected stakeholders. At its center are the consulting firms, which include large, multidisciplinary companies like McKinsey, Deloitte, and Accenture, as well as boutique firms specializing in niche areas such as life sciences or revenue cycle management. These firms offer expert advice to various end-users, including healthcare providers (hospitals, clinics, and physician groups), payers (insurance companies), pharmaceutical and medical device companies, and government agencies.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Healthcare Consulting Services Market, By Service Type

Based on the type of service, the healthcare consulting services market is divided into IT and digital transformation consulting, strategy consulting, operations consulting, financial consulting, HR and talent consulting, marketing, sales and commercialization consulting, regulatory and compliance, R&D consulting, public health consulting, and other services. The strategy consulting segment is expected to hold the largest share in 2024. Strategy consulting involves advising on key issues such as strategic growth, entering new markets, mergers and acquisitions, compliance, and reimbursement strategies—areas vital for long-term competitiveness and sustainability. This demand is further driven by the increasing complexity of the healthcare environment, where organizations must continuously adapt to new regulations, consumer expectations, and technological innovations.

Healthcare Consulting Services Market, By End user

By end user, the Healthcare consulting services market is segmented into government bodies, healthcare providers, health insurance payers, pharmaceutical and biotechnological companies, medical device companies, and other end users. Healthcare providers represented the fastest-growing segment during the forecast period. Hospitals and clinics are undergoing extensive digital transformation, operational restructuring, and regulatory compliance efforts, all of which require specialized consulting support. They need comprehensive IT integration (EHR, telehealth, cybersecurity), process optimization (revenue cycle, supply chain), and a shift toward value-based care models. For example, in October 2023, Cura (Saudi Arabia) partnered with Saudi German Hospital Group to implement virtual care and remote monitoring across its hospitals, demonstrating that consulting firms are becoming vital in helping providers modernize infrastructure and enhance patient access.

REGION

North America is expected to hold a significant market share in the global healthcare consulting services market

Based on the region, the healthcare consulting services market is segmented into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest share of the healthcare consulting services market in 2024.

healthcare consulting services market: COMPANY EVALUATION MATRIX

The healthcare consulting services market matrix shows Accenture (Star) leading with a strong market share and extensive product footprint, driven by its deep healthcare industry expertise in technology, digital transformation, and analytics capabilities. EY (Emerging Leader) is gaining visibility with its strong presence in advisory, regulatory, and financial consulting, along with growing healthcare IT capabilities. While Accenture dominates through scale and a diversified portfolio, EY demonstrates significant potential to move toward the leaders’ quadrant as demand for high-strength alloys continues to increase.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 29.11 BN |

| Market Forecast in 2030 (value) | USD 51.95 BN |

| Growth Rate | 10.1% |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: healthcare consulting services market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Local Competitive Landscape | Profiles of key regional players, including market share, revenue, product portfolio, and strategic initiatives. | Supports healthcare organizations in benchmarking, vendor selection, and strategy development to meet national quality standards and achieve accreditation. |

| Regional Market Entry Strategy | Country- or region-specific consulting approaches, including regulatory barriers, compliance models, and competitive dynamics | Reduces market entry risks, accelerates deployment of consulting solutions, and adapts strategies to fit reimbursement and regulatory environments |

| Local Risk & Opportunity Assessment | Identification of regional risks, barriers, and untapped opportunities by market or sector | Enable proactive compliance support, risk mitigation, and direct investments toward emerging healthcare models and unmet client need |

| Technology Adoption by Region | Insights on digital health solutions, analytics, and integrated platforms in different geographies. | Guides consulting firms’ R&D, solution design, and market expansion strategies to improve client outcomes and operational efficiency |

RECENT DEVELOPMENTS

- December 2024 : Accenture plc (Ireland) partnered with HealthCare Global Enterprises Limited (India) to analyze multi-dimensional patient data for early cancer detection and personalized treatment, marking a first-of-its-kind AI-powered oncology program in South Asia

- November 2024 : Automation Anywhere, Inc. (US) partnered with PwC India to develop a generative AI-based automation solutions that will transform key business operations across various sectors, such as, Telecom, Media and Telecommunication (TMT), and Healthcare industries

- October 2024 : Accenture plc (Ireland) acquired consus.health (Germany) to strengthen its digital transformation and managed services. This acquisition will enhance Accenture ability to help healthcare providers and hospitals across Germany, Austria, and Switzerland in enhancing the quality of care

Table of Contents

Methodology

This market research study involved the extensive use of secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and financial study of the healthcare consulting services market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and assess market prospects. The size of the healthcare consulting services market was estimated through various secondary research approaches and triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Some non-exclusive secondary sources include the World Health Organization (WHO), the Organisation for Economic Co-operation and Development (OECD), the Healthcare Information and Management Systems Society (HIMSS), Centers for Disease Control and Prevention (CDC), United States Food and Drug Administration (US FDA), American Association of Healthcare Consultants (AAHC), Government Agencies Funding Medical R&D, Expert Interviews, and MarketsandMarkets Analysis. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the healthcare dispensing market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources are mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information and assess prospects.

Primary research was conducted to identify segmentation types, industry trends, key players, and key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies adopted by key players.

The following is the breakdown of primary respondents:

Note 1: Others include sales, marketing, and product managers.

Note 2: Tiers are defined based on a company’s total revenue. As of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

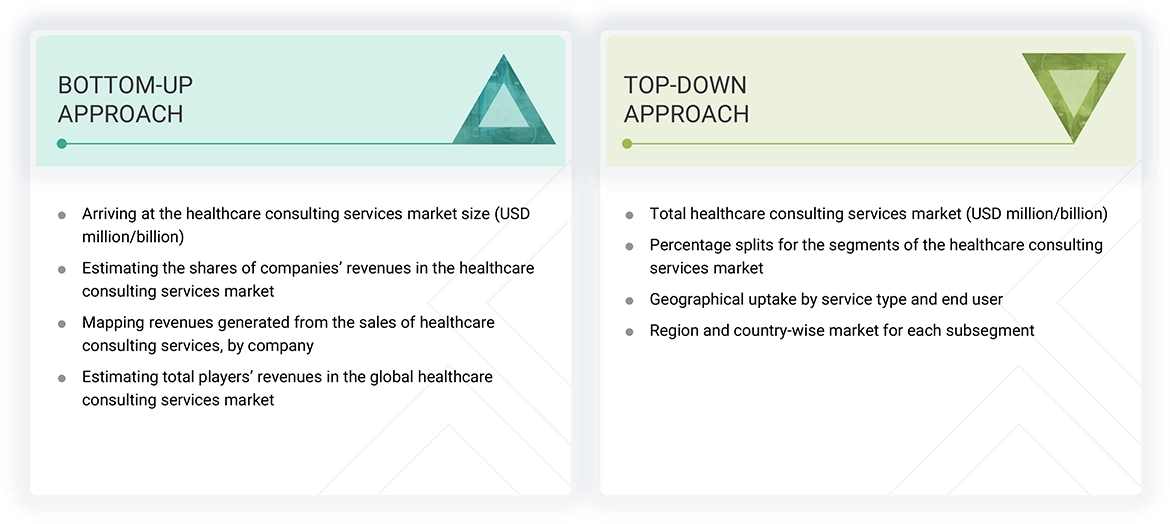

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through the bottom-up approach (revenue share analysis of leading players) and the top-down approach (assessment of utilization/adoption/penetration trends by service type, end user, and region).

Data Triangulation

After arriving at the overall market size, the healthcare consulting services market was split into segments and subsegments from the market size estimation process explained above. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides of the healthcare consulting services market.

Market Definition

Healthcare consulting, on a broad level, refers to professionals or firms that specialize in providing business consulting services to the healthcare industry in areas such as finance, accounting, marketing, insurance, healthcare management, billing, coding, regulations and compliance, and healthcare standards. These services enhance operational efficiency, ensure regulatory compliance, implement digital and technological solutions, manage costs, improve patient outcomes, and support strategic decision-making.

Stakeholders

- Healthcare consulting vendors

- Pharmaceutical & biotechnology companies

- Business research & consulting service providers

- Academic medical centers/universities/hospitals

- Government regulatory bodies

- Healthcare service providers

- Venture capitalists

- Advocacy groups

- Investors & financial institutions

- Medical device manufacturers

- Research & academic institutions

- Payers & insurance companies

Report Objectives

- To define, describe, and forecast the healthcare consulting services market by service type, end user, and region

- To provide detailed information regarding the primary drivers, restraints, opportunities, and challenges influencing market growth

- To strategically analyze micromarkets concerning individual growth trends, prospects, and contributions to the overall healthcare consulting services market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players.

- To forecast the size of the healthcare consulting services market in five regions (and their respective countries): North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To provide key industry insights, such as supply chain analysis, regulatory analysis, patent analysis, and US Trump Tariff analysis

- To profile the key players in the market and comprehensively analyze their core competencies

- To track & analyze competitive developments, such as product launches & enhancements, collaborations, partnerships, acquisitions, expansions, and agreements of the leading players in the market

- To benchmark players within the market using the company evaluation matrix, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Key Questions Addressed by the Report

Who are the leading industry players in the healthcare consulting services market?

Key players include Accenture Plc (Ireland), Cognizant Technology Solutions Corporation (US), Deloitte (UK), McKinsey & Company (UK), PwC (UK), and Ernst & Young Global Limited (EY) (UK), among others.

Who are the end users profiled in the market?

Government Bodies, Healthcare Providers, Health Insurance Payers, Pharmaceutical & Biotechnology Companies, Medical Device Companies, and Other End Users.

Which region is expected to grow at the highest CAGR during the forecast period?

The Asia Pacific region is expected to register the highest growth rate during the forecast period.

What are the opportunities for market growth in the healthcare consulting services market report?

Key opportunities include rising demand for digital transformation and AI integration, focus on value-based care models, and expanding healthcare infrastructure in emerging economies.

What is the total CAGR expected to be recorded for the healthcare consulting services market during the forecast period (2025–2030)?

The market is expected to grow at a CAGR of 10.1% from 2025 to 2030.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Healthcare Consulting Services Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Healthcare Consulting Services Market

victor

Nov, 2019

Hi, I would like to know if you have information about the Mexico market?.