Information Security Consulting Market by Security Type (Network Security, Application Security, Database Security, and Endpoint Security), Organization Size (SMES and Large Enterprises), Vertical, and Region - Global Forecast to 2021

[118 Pages Report] The overall information security consulting market is expected to grow from USD 14.31 billion in 2015 to USD 26.15 billion by 2021, at a CAGR of 10.2% from 2016 to 2021. The information security consulting services cover all security aspects of today’s borderless enterprises from basic compliance requirements to risk management, and traditional network layer security to advanced application layer security. Internet of Things (IoT), cloud, and Bring Your Own Device (BYOD) are some of the newest technologies and trends that demand high-level of security, which, in turn, help in the growth of the market. The information security consulting services being used in many industry verticals such as aerospace and defense; government and public utilities; BFSI; IT and telecom; healthcare; retail; manufacturing; and others (education, media and entertainment, and automotive). The base year considered for the study is 2015, and the forecast has been provided for the period between 2016 and 2021.

Market Dynamics

Drivers

- Rising network complexities due to third-party application deployment, merger & acquisition, and globalization of businesses

- Emerging trends of IoT and BYOD

- Increased sophistication in attacking

Restraints

- Budget constraints

Opportunities

- Rise in the adoption of information security consulting services across SMEs

- Increased digital transformation in developing economies

Challenges

- Lack of awareness about advanced cyber threats

Rising network complexities due to third-party application deployment, merger & acquisition, and globalization of businesses

In today’s business environment, the organizations are rapidly expanding their business by adopting cutting-edge technological solutions. There is growth in third-party application deployment through the partners to serve large customer base. The organizations are facing challenges in outsourcing applications to their partners, as the security policies of different organizations varies and thus the security management becomes a critical task. These third-party applications and plug-ins are becoming the prime targets for evolved cyber criminals. Thus, the organizations are demanding robust security solution in such situation and the standalone security solutions do not guarantee to deliver comprehensive security. The organizations are moving to information security consulting vendors to embed a strong security policy in the organization. Similarly, the mergers and acquisitions are creating security challenge among organizations in configuring two different technologies. Moreover, the globalization of businesses has given rise to network complexities and to secure these networks is becoming troublesome task for organizations. Thus, the demand for information security consulting is increasing due to such factors.

The following are the major objectives of the study.

- To define, describe, and forecast the global information security consulting market on the basis of security types, organization sizes, industry verticals, and regions

- To provide a detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the total market

- To analyze the opportunities in the market for the stakeholders and detail the competitive landscape for the market leaders

- To forecast the market size of the various market segments with respect to the regions of North America, Europe, Asia-Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To strategically profile key players and comprehensively analyze their growth strategies and core competencies2

- To track and analyze competitive developments, such as partnerships & collaborations, mergers & acquisitions, Research & Development (R&D) activities, and new product launches in the information security consulting market

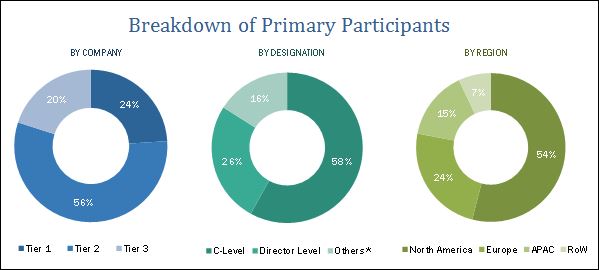

During this research study, major players operating in the information security consulting market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The information security consulting ecosystem comprises information security consulting services vendors, such as Ernst & Young (U.K.), IBM Corporation (U.S.), Accenture plc (Ireland), Atos SE (France), Deloitte (U.K.), KPMG (U.K.), PwC (U.K.), BAE Systems plc (U.K.), Hewlett Packard Enterprise (U.S.), and Wipro Limited (India); service providers; system integrators; and enterprises. Other stakeholders of the information security consulting market include security service providers, consulting service providers, IT service providers, resellers, enterprise users, and technology providers.

Major Market DevelopmentsInformation Security Consulting Market

- In March 2016, EY expanded its business in APAC by opening four Centers of Excellence (CoE) named the Asia Pacific Center of Excellence for Cybersecurity, Asia Pacific Advisory Center, Asia Pacific Center of Excellence for Manufacturing, and Asia-Pacific Center of Excellence for Analytics. Through this expansion, the company enhanced organization’s capabilities in cyber security, analytics, manufacturing, and transformation strategy.

- In August 2016, IBM launched a group of cyber security professionals and ethical hackers named IBM X-Force Red. The group is aimed at detecting the vulnerabilities in organization’s IT infrastructure and mitigating the cyber threats.

- In December 2016, Accenture acquired Defense Point Security LLC, a leading provider of information security services and solutions to private and public industries. The company enhanced the capabilities of cyber defense and response services with this acquisition.

The Key target audiences of the Information Security Consulting market report are given below:

- Information security solution/service providers

- Cloud service providers

- Managed service providers

- Software Developers

- System Integrators

- Resellers

- Enterprises

- Government

“The study answers several questions for the stakeholders, primarily, which market segments to focus in the next two to five years for prioritizing the efforts and investments.”

Scope of the Information Security Consulting Market research report

The research report categorizes the information security consulting market to forecast the revenues and analyze the trends in each of the following subsegments:

By Security Type

- Network security

- Application security

- Database Security

- Endpoint security

By Organization Size

- Small and Medium Enterprises (SMEs)

- Large enterprises

By Industry Vertical

- Aerospace and defense

- Government and public utilities

- Banking, Financial Services, and Insurance (BFSI)

- IT and telecom

- Healthcare

- Retail

- Manufacturing

- Others

By Region

- North America

- Europe

- Middle East and Africa (MEA)

- Asia Pacific (APAC)

- Latin America

Critical questions which the report answers

- What are new security types which the information security consulting companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the North American information security consulting market

- Further breakdown of the European information security consulting market

- Further breakdown of the APAC information security consulting market

- Further breakdown of the MEA information security consulting market

- Further breakdown of the Latin American information security consulting market

Company Information

- Detailed analysis and profiling of additional market players

The information security consulting market size is expected to grow from USD 16.12 billion in 2016 to USD 26.15 billion by 2021, at a Compound Annual Growth Rate (CAGR) of 10.2% during the forecast period. The major growth drivers of the information security consulting market include the increased network complexities due to 3rd party applications deployment and mergers and acquisitions across globe.

Information security consulting is one of the major segments in the cybersecurity services space. This includes highly qualified industry experts, domain experts, and security professionals, which help organizations to formulate cyber security strategies, prevent revenue losses, minimize risks, understand maturity of their cyber security solutions, and enhance security in the existing information system. Consulting service providers guide companies in setting up new cyber security infrastructure to address their specific security requirements in a way feasible for them. Consulting services are important for the companies because non-IT companies do not have the expertise to understand cyber security technologies and secure the organizational information.

Major security types in information security are network security, application security, database security, and endpoint security. The application security is expected to grow at the highest CAGR during the forecast period because of the growing trends of Internet of Things (IoT), Bring Your Own Device (BYOD), and connected devices.

Network security holds the largest share of the information security consulting market in 2016. The growth is fueled by the growing attacks on the critical network infrastructures of organizations. The BFSI vertical is expected to grow at the highest CAGR during the forecast period due to the increasing adoption of web and mobile-based business applications, which are susceptible to advanced cyber threats.

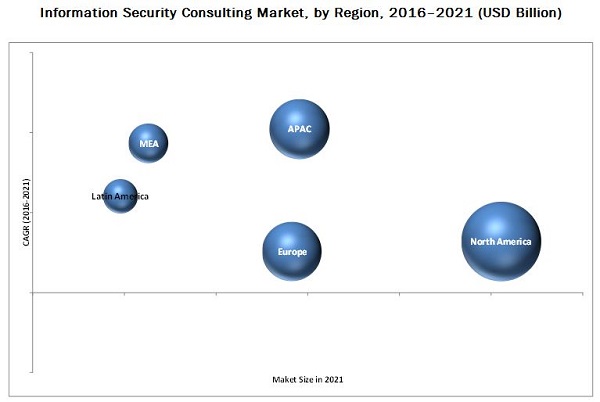

The global market has been segmented on the basis of regions into North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and Latin America to provide a region-specific analysis in the report. The North American region, followed by Europe, is expected to become the largest revenue generating region for information security consulting vendors in 2016. This is mainly because in the developed economies of the U.S. and Canada, there is a high focus on innovations obtained from research and development and technology. The APAC region is expected to be the fastest growing region in the information security consulting market. The growth in this region is primarily driven by the growing adoption of web and mobile based business applications.

The increasing adoption of information security consulting services in aerospace and defense, government and public utilities, banking, financial services, and insurance (BFSI), and IT and telecom is fuelling the growth of the market.

Aerospace and Defense

Security threats in the aerospace and defense vertical are increasing at an alarming rate. This sector is targeted with the purpose to extract highly confidential and sensitive data of critical sectors, including the government, prime contractors, and suppliers. The existence of big data and increased digitization in almost all the activities of the armed forces leads to high chances of being attacked by cybercriminals. Next-generation firewalls, intrusion prevention systems, anti-malware gateways, and endpoint security applications are capable of protecting data from known threats, but attackers have innovated many techniques to bypass these products and access confidential data. The information security consulting companies provide a wide range of security consulting services to the aerospace and defense vertical. The consultants provides robust information security policies and strategies to address potential cyber threats.

Government and Public Utilities

There has been strong adoption of advanced technologies in the government and public utilities vertical in the recent years. The governments in the emerging economies are deploying web and mobile applications to serve their citizens efficiently. These applications are becoming prime targets for the cybercriminals to access sensitive data. Thus, information security consulting has become one the most important aspects in the government sector. The concept of e-governance has led the government to focus more on information security threats. Moreover, as organizations are shifting toward real-time communication, threats from web browsing, email correspondence, peer to peer traffic, and file exchange have considerably increased. The information security consultants assess the security of the IT infrastructure used by government. In addition, they provide comprehensive security strategies and train the employees about maintaining a secure environment in the organization.

BFSI

BFSI sector is an early adopter of cutting-edge information security solutions due to the highly sensitive financial data. It faces different challenges related to stringent regulatory and security requirements, providing superior service to customers, and others. In addition, the industry is always on the lookout for security products and services that could protect the industry’s employees, customers, assets, offices, branches, and operations, and therefore holds a significant share of the total information security consulting market. The security consultants analyze the IT ecosystems and business processes in the organization and suggests effective security policies to mitigate the potential cyber risks and maintain secure environment.

IT and Telecom

IT and telecom sectors are rapidly growing in the key economies of APAC, MEA, and South America. This has expanded the networks and increased the network complexities. The companies often overlook the information security concerns due to increased focus on market share and cost reduction. This has resulted in increased attacks on the critical infrastructure used by the industry and also affected the financials of IT & telecom companies. The increased integration of Information and Communication Technology (ICT) into daily activities of industries, government, families, and consumers along with the rising sophistication levels of cyber-attacks have led the IT and telecom sector to focus more on their information security activities.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry trends in the information security consulting?

The information security consulting market faces challenges such as lack of awareness about advanced cyber threats. Advanced cyber threats are diverse in nature. They target particular vulnerabilities in the network and use these vulnerabilities to get an entry into the enterprise network. With higher sophistication levels of targeted attacks, dozens of new zero-day threats have emerged. The methods and techniques with which the attackers infiltrate into an organization’s network remain undetected. Due to less awareness towards advanced cyber threats, organizations do not spend sufficient money on their security infrastructure which results into massive loss of their information property and reputation. Furthermore, the companies with pressing cyber security needs are finding that there’s a major lack of qualified professionals to fill their positions, which makes them vulnerable to cyber-attacks.

Major vendors that offer information security consulting solutions across globe are Ernst & Young (U.K.), IBM Corporation (U.S.), Accenture plc (Ireland), Atos SE (France), Deloitte (U.K.), KPMG (U.K.), PwC (U.K.), BAE Systems plc (U.K.), Hewlett Packard Enterprise (U.S.), and Wipro Limited (India). These vendors have adopted different types of organic and inorganic growth strategies such as new product launches, partnerships & collaborations, and mergers & acquisitions to expand their offerings in the information security consulting market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Attractive Market Opportunities in the Market

4.2 Market By Security Type

4.3 Market By Region and Industry Vertical

4.4 Information Security Consulting Market Potential

4.5 Lifecycle Analysis, By Region, 2016

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Evolution

5.3 Market Segmentation

5.3.1 By Security Type

5.3.2 By Organization Size

5.3.3 By Industry Vertical

5.3.4 By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Rising Network Complexities Due to Third-Party Application Deployment, Merger & Acquisition, and Globalization of Business

5.4.1.2 Emerging Trends of IoT and BYOD

5.4.1.3 Increased Sophistication in Attacking

5.4.2 Restraints

5.4.2.1 Budget Constraints

5.4.3 Opportunities

5.4.3.1 Rise in the Adoption of Information Security Consulting Services Across Smes

5.4.3.2 Increased Digital Transformation in Developing Economies

5.4.4 Challenges

5.4.4.1 Less Awareness Towards Advanced Cyber Threats

6 Industry Trends (Page No. - 38)

6.1 Introduction

6.2 Architecture

6.3 Value Chain

6.4 Regulatory Implications

6.4.1 Payment Card Industry Data Security Standard (PCI–DSS)

6.4.2 Health Insurance Portability and Accountability Act (HIPAA)

6.4.3 Federal Information Security Management Act (FISMA)

6.4.4 Gramm-Leach-Bliley Act (GLB Act)

6.4.5 Sarbanes-Oxley Act (SOX)

6.4.6 The International Organization for Standardization (ISO) Standard 27001

7 Information Security Consulting Market Analysis, By Security Type (Page No. - 43)

7.1 Introduction

7.2 Network Security

7.3 Application Security

7.4 Database Security

7.5 Endpoint Security

8 Market Analysis, By Organization Size (Page No. - 49)

8.1 Introduction

8.2 Small and Medium Enterprises

8.3 Large Enterprises

9 Information Security Consulting Market Analysis, By Vertical (Page No. - 53)

9.1 Introduction

9.2 Aerospace and Defense

9.3 Government and Public Utilities

9.4 Banking, Financial Services, and Insurance

9.5 IT and Telecom

9.6 Healthcare

9.7 Retail

9.8 Manufacturing

9.9 Others

10 Geographic Analysis (Page No. - 62)

10.1 Introduction

10.2 North America

10.2.1 United States

10.2.2 Canada

10.3 Europe

10.3.1 United Kingdom

10.3.2 Germany

10.3.3 France

10.3.4 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 India

10.4.3 Rest of Asia-Pacific

10.5 Middle East and Africa

10.5.1 Middle East

10.5.2 Africa

10.6 Latin America

10.6.1 Brazil

10.6.2 Mexico

10.6.3 Rest of Latin America

11 Company Profiles (Page No. - 80)

11.1 Introduction

11.1.1 Vendor Analysis

(Overview, Financials, Products & Services, Strategy, and Developments)*

11.2 Ernst & Young

11.3 International Business Machines Corporation

11.4 Accenture PLC

11.5 ATOS SE

11.6 Deloitte Touche Tohmatsu Limited (DTTL)

11.7 KPMG

11.8 Pricewaterhousecoopers

11.9 BAE Systems PLC

11.10 Hewlett Packard Enterprise

11.11 Wipro Limited

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

12 Key Innovators (Page No. - 108)

12.1 Optiv Security Inc.

12.2 Aujas

13 Appendix (Page No. - 110)

13.1 Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introduction RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (39 Tables)

Table 1 Information Security Consulting Market Size and Growth Rate, 2014–2021 (USD Billion, Y-O-Y %)

Table 2 Market Size, By Security Type, 2014–2021 (USD Billion)

Table 3 Network Security: Market Size, By Region, 2014–2021 (USD Billion)

Table 4 Application Security: Market Size, By Region, 2014–2021 (USD Billion)

Table 5 Database Security: Market Size, By Region, 2014–2021 (USD Billion)

Table 6 Endpoint Security: Market Size, By Region, 2014–2021 (USD Billion)

Table 7 Information Security Consulting Market Size, By Organization Size, 2014–2021 (USD Billion)

Table 8 Small and Medium Enterprises: Market Size, By Region, 2014–2021 (USD Billion)

Table 9 Large Enterprises: Market Size, By Region, 2014–2021 (USD Billion)

Table 10 Market Size, By Vertical, 2014–2021 (USD Billion)

Table 11 Aerospace and Defense: Market Size, By Region, 2014–2021 (USD Billion)

Table 12 Government and Public Utilities: Market Size, By Region, 2014–2021 (USD Billion)

Table 13 Banking, Financial Services, and Insurance: Market Size, By Region, 2014–2021 (USD Billion)

Table 14 IT and Telecom: Market Size, By Region, 2014–2021 (USD Billion)

Table 15 Healthcare: Market Size, By Region, 2014–2021 (USD Billion)

Table 16 Retail: Market Size, By Region, 2014–2021 (USD Billion)

Table 17 Manufacturing: Market Size, By Region, 2014–2021 (USD Billion)

Table 18 Others: Market Size, By Region, 2014–2021 (USD Billion)

Table 19 Information Security Consulting Market Size, By Region, 2014–2021 (USD Billion)

Table 20 North America: Market Size, By Country, 2014–2021 (USD Billion)

Table 21 North America: Market Size, By Security Type, 2014–2021 (USD Billion)

Table 22 North America: Market Size, By Organization Size, 2014–2021 (USD Billion)

Table 23 North America: Market Size, By Vertical, 2014–2021 (USD Billion)

Table 24 Europe: Market Size, By Country, 2014–2021 (USD Billion)

Table 25 Europe: Market Size, By Security Type, 2014–2021 (USD Billion)

Table 26 Europe: Market Size, By Organization Size, 2014–2021 (USD Billion)

Table 27 Europe: Information Security Consulting Market Size, By Vertical, 2014–2021 (USD Billion)

Table 28 Asia-Pacific: Market Size, By Country, 2014–2021 (USD Billion)

Table 29 Asia-Pacific: Market Size, By Security Type, 2014–2021 (USD Billion)

Table 30 Asia-Pacific: Market Size, By Organization Size, 2014–2021 (USD Billion)

Table 31 Asia-Pacific: Market Size, By Vertical, 2014–2021 (USD Billion)

Table 32 Middle East and Africa: Market Size, By Country, 2014–2021 (USD Billion)

Table 33 Middle East and Africa: Market Size, By Security Type, 2014–2021 (USD Billion)

Table 34 Middle East and Africa: Market Size, By Organization Size, 2014–2021 (USD Billion)

Table 35 Middle East and Africa: Market Size, By Vertical, 2014–2021 (USD Billion)

Table 36 Latin America: Market Size, By Country, 2014–2021 (USD Billion)

Table 37 Latin America: Market Size, By Security Type, 2014–2021 (USD Billion)

Table 38 Latin America: Market Size, By Organization Size, 2014–2021 (USD Billion)

Table 39 Latin America: Market Size, By Vertical, 2014–2021 (USD Billion)

List of Figures (43 Figures)

Figure 1 Information Security Consulting Market: Research Methodology

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Data Triangulation

Figure 5 Consulting Service for Application Security is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 6 North America is Expected to Hold the Largest Market Share in 2016

Figure 7 Information Security Consulting Market is Expected to Witness Remarkable Growth Opportunities Due to the Rising Complexities of Networks, Globalization, and Sophistication of Cyber-Attacks

Figure 8 Application Security is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 9 North America is Expected to Hold the Largest Market Share in the Market

Figure 10 Asia-Pacific is Expected to Witness the Highest Growth Rate During the Forecast Period

Figure 11 Regional Lifecycle: Asia-Pacific is Expected to Be in the Growth Phase in 2016

Figure 12 Evolution of Information Security Consulting Market

Figure 13 Market Segmentation: By Security Type

Figure 14 Market Segmentation: By Organization Size

Figure 15 Market Segmentation: By Industry Vertical

Figure 16 Market Segmentation: By Region

Figure 17 Market Drivers, Restraints, Opportunities, and Challenges

Figure 18 Information Security Consulting: Architecture

Figure 19 Information Security Consulting: Value Chain

Figure 20 Application Security Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 21 Small and Medium Enterprises Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 22 Banking, Financial Services, and Insurance Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 23 Asia-Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 24 Regional Snapshot: Asia-Pacific is the Emerging Region in the Information Security Consulting Market

Figure 25 North America Market Snapshot

Figure 26 Asia-Pacific Market Snapshot

Figure 27 Vendor Analysis for Information Security Consulting Services Offering

Figure 28 Vendor Analysis for Business Strategy

Figure 29 Geographic Revenue Mix of Top Players

Figure 30 Ernst & Young: Company Snapshot

Figure 31 Ernst & Young: SWOT Analysis

Figure 32 International Business Machines Corporation: Company Snapshot

Figure 33 International Business Machines Corporation: SWOT Analysis

Figure 34 Accenture PLC: Company Snapshot

Figure 35 Accenture PLC: SWOT Analysis

Figure 36 ATOS SE: Company Snapshot

Figure 37 ATOS SE: SWOT Analysis

Figure 38 Deloitte Touche Tohmatsu Limited: Company Snapshot

Figure 39 KPMG: Company Snapshot

Figure 40 Pricewaterhousecoopers: Company Snapshot

Figure 41 BAE Systems PLC: Company Snapshot

Figure 42 Hewlett Packard Enterprise: Company Snapshot

Figure 43 Wipro Limited: Company Snapshot

Growth opportunities and latent adjacency in Information Security Consulting Market

Gather insights into Information Security Service market for expansion of business in Sweden & European market.