Cloud Infrastructure Market by Type (Hardware: Server, Storage, Switch, Services: Platform as a Service, Infrastructure as a service, Content/Application Delivery Network, Managed Hosting, Colocation), End-User Industry & Geography - Global Forecast to 2022

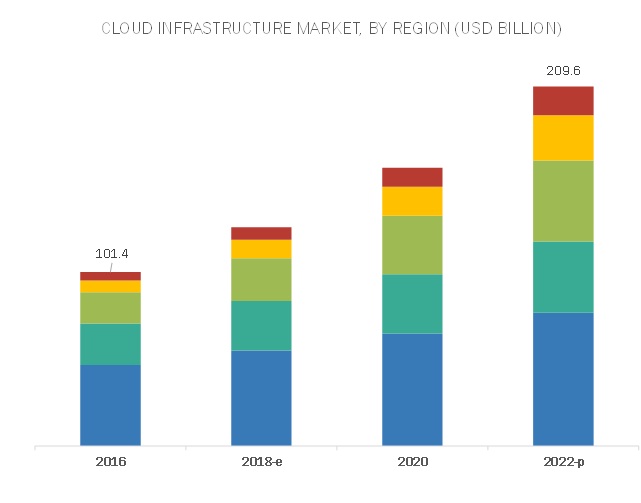

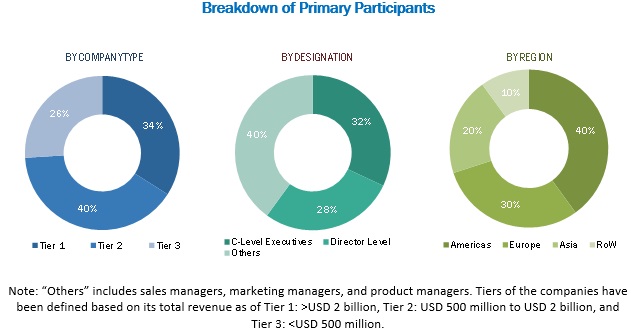

[190 Pages Report] The overall cloud infrastructure market is projected to reach USD 209.66 billion by 2022 from USD 101.42 billion in 2016, growing at a CAGR of 12.9% during 2016-2022. The study involved four major activities to estimate the current market size cloud infrastructure market. Exhaustive secondary research was done to collect information on market, peer market and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter market breakdown and data triangulation was used to estimate the market size of segments and subsegments.

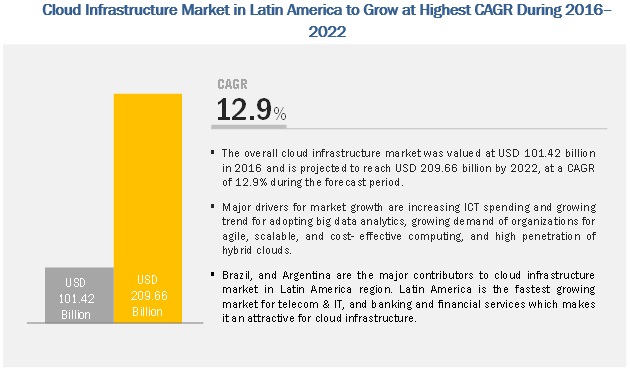

The overall cloud infrastructure market is projected to reach USD 209.66 billion by 2022 from USD 101.42 billion in 2016, growing at a CAGR of 12.9% during 2016-2022. Major drivers for market growth are increasing ICT spending and growing trend for adopting big data analytics, growing demand of organizations for agile, scalable, and cost- effective computing, and high penetration of hybrid clouds.

Attractive Opportunities in the Cloud Infrastructure Market

Banking, financial services and insurance (BFSI) is expected to hold the largest market during the forecast period

The demand for cloud infrastructure services is witnessing traction across all industries. Since cloud has become one of the key elements of IT infrastructures today, the demand for cloud related services is increasing. Enterprises require scalability and mobility, and thus, industries, such as BFSI, telecommunications & ITES and ITes, and retail adopted cloud at the early stage of cloud computing market evolution. Due to this, these industries are anticipated to account for a major share of the total cloud infrastructure market

The market for services is expected to register the highest CAGR during 2016-2022

Capital expenditure is one of the major reasons for organizations to increase the adoption of colocation services; these services are generally involved in setting up an entire data center space. Colocation allows companies to shift their focus from having capital-intensive data centers to predictable operating expenses are the major factors are leading to higher growth of the services market.

The market for Ethernet switches is expected to register the highest during 2016-2022

Ethernet switches are used to build a network connection between computers. Packet switching is used to receive, process, and forward data. This growth is mainly attributed to the continued infrastructure expansion by cloud service providers. Additionally, growth in this segment is primarily propelled by the expansion of the data center industry.

North America is expected to account for the largest market size during the forecast period

The large share is mainly attributed to the increasing IT capacity requirements and growing adoption of new data center technologies. The cloud infrastructure market in the US will also grow exponentially, owing to a significant number of organizations opting for cloud services to save their upfront cost of building new data centers for business continuity is the the major factor driving the market.

Key players in the cloud infrastructure market include Hewlett Packard Enterprise Co (US), Dell Inc. (US), Cisco Systems, Inc. (US), EMC Corporation (US), IBM Corporation (US), Amazon Web Services (US), Salesforce.com (US), Alphabet Inc. (US), NetApp, Inc. (US), Intel Corporation (US), Lenovo group Limited (China), AT&T, Inc. (US), Oracle Corporation (US), Quanta Computer Inc. (Taiwan), Foxconn Technology Group (Taiwan), and Rackspace Hosting, Inc. (US).

Recent Developments

- Hewlett Packard (HP) Enterprise launched Hyper Converged 380 (HC 380) all-in-one compute, software-defined storage, and intelligent virtualization appliances for mid-sized and remote office/branch office (ROBO) enterprises. Built on HPE ProLiant DL380 server, HC 380 helps organizations to develop cost effective hybrid IT infrastructure.

- Dell, Inc. (US) partnered with Securonix to provide advanced security analytics for active directory and enterprise applications.

- Cisco, in association with NetApp, Inc. (an American computer storage and data management company), introduced FlexPod with All Flash FAS (AFF) system, which is a high-speed data storage and data management version of FlexPod converged infrastructure (CI) solution, a technology jointly offered by Cisco and NetApp.

Critical questions the report answers:

- Where will all these developments take the various end-use industry in the mid to long term?

- What are the upcoming applications in banking, financial services, and insurance (BFSI) industry where the adoption rate for advanced solutions and services is expected to increase in near future?

- How is high cost of developing software and applications for on-premises influencing the deployment and market growth rate?

- How are the companies addressing the challenge of data transfer and interoperability issues?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Introduction

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Cloud Infrastructure Market Opportunities

4.2 Cloud Infrastructure Services Market, By Type, 2015

4.3 Geographic Snapshot of the Cloud Infrastructure Market

4.4 Market, By End-Use Industry, 2016–2022 (USD Billion)

4.5 Market, By Type, 2016–2022 (USD Billion)

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Cloud Infrastructure Market, By Type

5.2.2 Market, By End-Use Industry

5.2.3 Market, By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Ict Spending and Growing Trend for Adopting Big Data Analytics

5.3.1.2 Growing Demand of Organizations for Agile, Scalable, and Cost-Effective Computing

5.3.1.3 High Penetration of Hybrid Clouds

5.3.2 Restraints

5.3.2.1 Decline in Demand for Server Hardware Due to Consolidation and Virtualization of Servers

5.3.2.2 Concern Over Data Privacy and Security

5.3.3 Opportunities

5.3.3.1 High Adoption Rate in SMBS

5.3.3.2 Growth of the Analytics Market

5.3.4 Challenges

5.3.4.1 Workload Complexities in Cloud Environment

5.3.4.2 Data Transfer and Application Issues

6 Industry Trends (Page No. - 46)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Industry Trends

6.4 Porter’s Five Forces Analysis

6.4.1 Threat of New Entrants

6.4.2 Threat 0f Substitutes

6.4.3 Bargaining Power of Buyers

6.4.4 Bargaining Power of Suppliers

6.4.5 Degree of Competition

7 Cloud Infrastructure Market, By Type (Page No. - 56)

7.1 Introduction

7.2 Hardware

7.2.1 Server

7.2.1.1 Tower Server

7.2.1.2 Rack Server

7.2.1.3 Blade Server

7.2.1.4 Density-Optimized Server

7.2.2 Storage

7.2.3 Ethernet Switches

7.3 Services

7.3.1 Platform as A Service (PaaS)

7.3.2 Infrastructure as A Service (IaaS)

7.3.3 Content Delivery Network (CDN)/Application Delivery Network (ADN)

7.3.4 Managed Hosting

7.3.5 Colocation Services

8 Cloud Infrastructure Market, By End-Use Industry (Page No. - 73)

8.1 Introduction

8.2 Banking, Financial Services, and Insurance (BFSI)

8.3 Consumer Goods & Retail

8.4 Telecommunications & Ites

8.5 Healthcare

8.6 Energy

8.7 Government

8.8 Education & Research

8.9 Media & Entertainment

8.10 Manufacturing

8.11 Business & Consulting Services

8.12 Others

9 Regional Analysis (Page No. - 105)

9.1 Introduction

9.2 North America (NA)

9.2.1 U.S.

9.2.2 Canada

9.3 Europe

9.3.1 U.K.

9.3.2 Germany

9.3.3 France

9.3.4 Others

9.4 Asia-Pacific (APAC)

9.4.1 China

9.4.2 Japan

9.4.3 Others

9.5 Middle East & Africa (MEA)

9.5.1 Middle East

9.5.2 Africa

9.6 Latin America (LA)

10 Competitive Landscape (Page No. - 129)

10.1 Overview

10.2 Market Share Analysis of the Cloud Infrastructure Market, 2015

10.2.1 Market Share Analysis of the Cloud Infrastructure Hardware Market, 2015

10.2.2 Company Ranking Analysis of the Cloud Infrastructure Services Market, 2015

10.3 Competitive Situation and Trends

10.3.1 New Product/Service Launches

10.3.2 Partnerships, Agreements, Collaborations, and Alliances

10.3.3 Acquisitions

10.3.4 Expansions

11 Company Profiles (Page No. - 137)

(Overview, Products and Services, Financials, Strategy & Development)*

11.1 Introduction

11.2 Hewlett Packard Enterprise Co (HPE)

11.3 Dell, Inc.

11.4 Cisco Systems, Inc.

11.5 EMC Corporation

11.6 IBM Corporation

11.7 AWS (Amazon Web Services)

11.8 Salesforce.Com

11.9 Alphabet Inc. (Google)

11.10 Netapp, Inc.

11.11 Intel Corporation (U.S.)

11.12 Lenovo Group Limited

11.13 AT&T, Inc.

11.14 Rackspace

11.15 Oracle Corporation

11.16 Quanta Computer Inc.

11.17 Foxconn Technology Group (Hon Hai Precision Industry Co., Ltd.)

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

12 Appendix (Page No. - 182)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real Time Market Intelligence

12.5 Available Customizations

12.6 Related Report

List of Tables (93 Tables)

Table 1 Increasing Ict Spending and Growing Trend for Big Data Analytics is Driving the Cloud Infrastructure Market

Table 2 Decline in Demand for Server Hardware Due to Consolidation and Virtualization of Servers is A Major Restraint for the Cloud Infrastructure Market

Table 3 Mobility and Byod Offer Opportunities for Adoption of Cloud Infrastructure Services By Various Organizations

Table 4 Lack of Security Proves to Be A Major Challenge to the Market

Table 5 Cloud Infrastructure Market, By Type, 2013–2022 (USD Billion)

Table 6 Cloud Infrastructure Hardware Market, By Type, 2013–2022 (USD Billion)

Table 7 Cloud Infrastructure Server Market, By Type, 2013–2022 (USD Billion)

Table 8 Cloud Infrastructure Server Market, By End-Use Industry, 2013–2022 (USD Million)

Table 9 Disk Storage: Cloud Infrastructure Hardware Market, By End-Use Industry, 2013–2022 (USD Million)

Table 10 Ethernet Switches: Cloud Infrastructure Hardware Market, By End-Use Industry, 2013–2022 (USD Million)

Table 11 Cloud Infrastructure Services Market, By Type, 2013–2022 (USD Billion)

Table 12 PaaS: Cloud Infrastructure Services Market, By End-Use Industry, 2013–2022 (USD Million)

Table 13 IaaS: Cloud Infrastructure Services Market, By End-Use Industry, 2013–2022 (USD Million)

Table 14 CDN/ADN: Cloud Infrastructure Services Market, By End-Use Industry, 2013–2022 (USD Million)

Table 15 Managed Hosting: Cloud Infrastructure Services Market, By End-Use Industry, 2013–2022 (USD Million)

Table 16 Colocation: Cloud Infrastructure Services Market, By End-Use Industry, 2013–2022 (USD Million)

Table 17 Cloud Infrastructure Market, By End-Use Industry, 2013–2022 (USD Billion)

Table 18 Cloud Infrastructure Hardware Market, By End-Use Industry, 2013–2022 (USD Billion)

Table 19 Cloud Infrastructure Services Market, By End-Use Industry, 2013–2022 (USD Billion)

Table 20 BFSI: Cloud Infrastructure Hardware Market, By Type, 2013–2022 (USD Million)

Table 21 BFSI: Cloud Infrastructure Hardware Market, By Region, 2013–2022 (USD Million)

Table 22 BFSI: Cloud Infrastructure Services Market, By Type, 2013–2022 (USD Million)

Table 23 BFSI: Cloud Infrastructure Services Market, By Region, 2013–2022 (USD Million)

Table 24 Consumer Goods & Retail: Cloud Infrastructure Hardware Market, By Type, 2013–2022 (USD Billion)

Table 25 Consumer Goods & Retail: Cloud Infrastructure Hardware Market, By Region, 2013–2022 (USD Million)

Table 26 Consumer Goods & Retail: Cloud Infrastructure Services Market, By Type, 2013–2022 (USD Million)

Table 27 Consumer Goods & Retail: Cloud Infrastructure Services Market, By Region, 2013–2022 (USD Million)

Table 28 Telecommunications & Ites: Cloud Infrastructure Hardware Market, By Type, 2013–2022 (USD Million)

Table 29 Telecommunications & Ites: Cloud Infrastructure Hardware Market, By Region, 2013–2022 (USD Million)

Table 30 Telecommunications & Ites: Cloud Infrastructure Services Market, By Type, 2013–2022 (USD Million)

Table 31 Telecommunications & Ites: Cloud Infrastructure Services Market, By Region, 2013–2022 (USD Million)

Table 32 Healthcare: Cloud Infrastructure Hardware Market, By Type, 2013–2022 (USD Million)

Table 33 Healthcare: Cloud Infrastructure Hardware Market, By Region, 2013–2022 (USD Million)

Table 34 Healthcare: Cloud Infrastructure Services Market, By Type, 2013–2022 (USD Million)

Table 35 Healthcare: Cloud Infrastructure Services Market, By Region, 2013–2022 (USD Million)

Table 36 Energy: Cloud Infrastructure Hardware Market, By Type, 2013–2022 (USD Million)

Table 37 Energy: Cloud Infrastructure Hardware Market, By Region, 2013–2022 (USD Million)

Table 38 Energy: Cloud Infrastructure Services Market, By Type, 2013–2022 (USD Million)

Table 39 Energy: Cloud Infrastructure Services Market, By Region, 2013–2022 (USD Million)

Table 40 Government: Cloud Infrastructure Hardware Market, By Type, 2013–2022 (USD Million)

Table 41 Government: Cloud Infrastructure Hardware Market, By Region, 2013–2022 (USD Million)

Table 42 Government: Cloud Infrastructure Services Market, By Type, 2013–2022 (USD Million)

Table 43 Government: Cloud Infrastructure Services Market, By Region, 2013–2022 (USD Million)

Table 44 Education & Research: Cloud Infrastructure Hardware Market, By Type, 2013–2022 (USD Million)

Table 45 Education & Research: Cloud Infrastructure Hardware Market, By Region, 2013–2022 (USD Million)

Table 46 Education & Research: Cloud Infrastructure Services Market, By Type, 2013–2022 (USD Million)

Table 47 Education & Research: Cloud Infrastructure Services Market, By Region, 2013–2022 (USD Million)

Table 48 Media & Entertainment: Cloud Infrastructure Hardware Market, By Type, 2013–2022 (USD Million)

Table 49 Media & Entertainment: Cloud Infrastructure Hardware Market, By Region, 2013–2022 (USD Million)

Table 50 Media & Entertainment: Cloud Infrastructure Services Market, By Type, 2013–2022 (USD Million)

Table 51 Media & Entertainment: Cloud Infrastructure Services Market, By Region, 2013–2022 (USD Million)

Table 52 Manufacturing: Cloud Infrastructure Hardware Market, By Type, 2013–2022 (USD Million)

Table 53 Manufacturing: Cloud Infrastructure Hardware Market, By Region, 2013–2022 (USD Million)

Table 54 Manufacturing: Cloud Infrastructure Services Market, By Type, 2013–2022 (USD Million)

Table 55 Manufacturing: Cloud Infrastructure Services Market, By Region, 2013–2022 (USD Million)

Table 56 Business & Consulting Services: Cloud Infrastructure Hardware Market, By Type, 2013–2022 (USD Million)

Table 57 Business & Consulting Services: Cloud Infrastructure Hardware Market, By Region, 2013–2022 (USD Million)

Table 58 Business & Consulting Services: Cloud Infrastructure Services Market, By Type, 2013–2022 (USD Million)

Table 59 Business & Consulting Services: Cloud Infrastructure Services Market, By Region, 2013–2022 (USD Million)

Table 60 Others: Cloud Infrastructure Hardware Market, By Type, 2013–2022 (USD Million)

Table 61 Others: Cloud Infrastructure Hardware Market, By Region, 2013–2022 (USD Million)

Table 62 Others: Cloud Infrastructure Services Market, By Type, 2013–2022 (USD Million)

Table 63 Others: Cloud Infrastructure Services Market, By Region, 2013–2022 (USD Million)

Table 64 Cloud Infrastructure Market, By Region, 2013–2022 (USD Billion)

Table 65 Cloud Infrastructure Hardware Market, By Region, 2013–2022 (USD Billion)

Table 66 Cloud Infrastructure Services Market, By Region, 2013–2022 (USD Billion)

Table 67 North America Cloud Infrastructure Hardware Market, By End-Use Industry, 2013–2022 (USD Million)

Table 68 North America Cloud Infrastructure Services Market, By End-Use Industry, 2013–2022 (USD Million)

Table 69 North America Cloud Infrastructure Market, By Country, 2013–2022 (USD Billion)

Table 70 North America Cloud Infrastructure Hardware Market, By Country, 2013–2022 (USD Billion)

Table 71 North America Cloud Infrastructure Services Market, By Country, 2013–2022 (USD Billion)

Table 72 Europe Cloud Infrastructure Hardware Market, By End-Use Industry, 2013–2022 (USD Million)

Table 73 Europe Cloud Infrastructure Services Market, By End-Use Industry, 2013–2022 (USD Million)

Table 74 Europe Cloud Infrastructure Market, By Country, 2013–2022 (USD Billion)

Table 75 Europe Cloud Infrastructure Hardware Market, By Country, 2013–2022 (USD Billion)

Table 76 Europe Cloud Infrastructure Services Market, By Country, 2013–2022 (USD Billion)

Table 77 APAC Cloud Infrastructure Hardware Market, By End-Use Industry, 2013–2022 (USD Million)

Table 78 APAC Cloud Infrastructure Services Market, By End-Use Industry, 2013–2022 (USD Million)

Table 79 APAC Cloud Infrastructure Market, By Country, 2013–2022 (USD Billion)

Table 80 APAC Cloud Infrastructure Hardware Market, By Country, 2013–2022 (USD Billion)

Table 81 APAC Cloud Infrastructure Services Market, By Country, 2013–2022 (USD Billion)

Table 82 MEA Cloud Infrastructure Hardware Market, By End-Use Industry, 2013–2022 (USD Million)

Table 83 MEA Cloud Infrastructure Services Market, By End-Use Industry, 2013–2022 (USD Million)

Table 84 MEA Cloud Infrastructure Market, By Country, 2013–2022 (USD Billion)

Table 85 MEA Cloud Infrastructure Hardware Market, By Country, 2013–2022 (USD Billion)

Table 86 MEA Cloud Infrastructure Services Market, By Country, 2013–2022 (USD Billion)

Table 87 Latin America Cloud Infrastructure Hardware Market, By End-Use Industry, 2013–2022 (USD Million)

Table 88 Latin America Cloud Infrastructure Services Market, By End-Use Industry, 2013–2022 (USD Million)

Table 89 Company Ranking: Cloud Infrastructure Services, 2015

Table 90 New Product/Service Launches, 2015–2016

Table 91 Partnerships, Agreements, Collaborations, and Alliances, 2015–2016

Table 92 Acquisitions, 2015–2016

Table 93 Expansions, 2014–2016

List of Figures (67 Figures)

Figure 1 Market Segmentation

Figure 2 Cloud Infrastructure Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 The Ethernet Switch Segment of the Cloud Infrastructure Hardware Market is Expected to Grow at the Highest CAGR Between 2016 and 2022

Figure 7 The Density-Optimized Segment of the Cloud Infrastructure Server Market is Expected to Register Highest Growth During the Forecast Period

Figure 8 The PaaS Segment of the Cloud Infrastructure Services Market is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 9 North America Accounted for the Largest Market Share in 2015

Figure 10 Cloud Infrastructure Market to Provide Lucrative Growth Opportunities During the Forecast Period

Figure 11 The Colocation Segment Accounted for the Largest Share of the Cloud Infrastructure Services Market in 2015

Figure 12 The Market in Latin America is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 13 The Healthcare Segment is Projected to Exhibit the Highest Growth During the Forecast Period

Figure 14 The Hardware Segment of the Cloud Infrastructure Market is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 15 Regional Segmentation of the Market

Figure 16 Increasing ICT Spending and Growing Trend for Adopting Big Data and Analytics is Driving the Market

Figure 17 Hybrid Cloud Market, 2016 & 2021 (USD Billion)

Figure 18 Value Chain: Cloud Infrastructure Market

Figure 19 Key Industry Trends in the Cloud Infrastructure Market

Figure 20 The Porter’s Five Forces Analysis (2015)

Figure 21 Porter’s Five Forces Analysis for the Market, 2015

Figure 22 The Impact of Threat of New Entrants is Medium Since It Requires Sound Technical and Industrial Knowledge to Enter the Market

Figure 23 The Impact of Threat of Substitutes is Low Since There are No Direct Substitutes for Cloud Infrastructure Products

Figure 24 Bargaining Power of Buyers is High Due to Increasing Number of Suppliers and New Entrants in the Market

Figure 25 Bargaining Power of Suppliers is Low, Owing to Presence of Large Number of Suppliers in the Market

Figure 26 Degree of Competition in the Market is Medium, Owing to Presence of Leading Technology Companies in the Market

Figure 27 Cloud Infrastructure Market, By Type

Figure 28 Cloud Infrastructure Server Market, By Type

Figure 29 Density-Optimized Sub Segment of the Cloud Infrastructure Server Market is Estimated to Grow at the Highest Rate During the Forecast Period

Figure 30 Cloud Infrastructure Services Market, By Type

Figure 31 Colocation Segment of the Accounted for the Largest Share in the Cloud Infrastructure Services Market in 2015

Figure 32 Cloud Infrastructure Market, By End-Use Industry

Figure 33 Consumer Goods and Retail Segment of the Cloud Infrastructure Hardware Market to Grow at A Steady Rate During the Forecast Period

Figure 34 Server Segment is Estimated to Lead the Market During the Forecast Period

Figure 35 Ethernet Switches Segment of the Cloud Infrastructure Hardware Market in Energy to Grow at the Highest Rate During the Forecast Period

Figure 36 Latin America Cloud Infrastructure Services Market in Government is Estimated to Grow at the Highest Rate During the Forecast Period

Figure 37 APAC to Lead the Cloud Infrastructure Market By 2022

Figure 38 Latin America Cloud Infrastructure Services Market in Business & Consulting Services to Grow at the Highest CAGR During the Forecast Period

Figure 39 The Market in Latin America Expected to Grow at the Highest CAGR During the Forecast Period

Figure 40 North America: Cloud Infrastructure Market Snapshot

Figure 41 Europe: Market Snapshot

Figure 42 Asia-Pacific: Cloud Infrastructure Market Snapshot

Figure 43 MEA: Market Snapshot

Figure 44 Companies Adopted New Product Launches and Acquisitions as the Key Growth Strategies Over the Last Four Years (2013–2016)

Figure 45 Battle for Market Share: New Product/Service Launch has Been the Key Strategy

Figure 46 Geographic Revenue Mix of the Top Five Market Players

Figure 47 Hewlett Packard Enterprise Co: Company Snapshot

Figure 48 Hewlett Packard Enterprise Co: SWOT Analysis

Figure 49 Dell, Inc.: SWOT Analysis

Figure 50 Cisco Systems, Inc.: Company Snapshot

Figure 51 Cisco Systems, Inc.: SWOT Analysis

Figure 52 EMC Corporation: Company Snapshot

Figure 53 EMC Corporation : SWOT Analysis

Figure 54 IBM Corporation: Company Snapshot

Figure 55 IBM Corporation: SWOT Analysis

Figure 56 Amazon Web Services: SWOT Analysis

Figure 57 Salesforce.Com: Company Snapshot

Figure 58 Salesforce.Com: SWOT Analysis

Figure 59 Alphabet Inc.: Company Snapshot

Figure 60 Netapp, Inc.: Company Snapshot

Figure 61 Intel Corporation: Company Snapshot

Figure 62 Lenovo Group Limited: Company Snapshot

Figure 63 AT&T, Inc.: Company Snapshot

Figure 64 Rackspace: Company Snapshot

Figure 65 Oracle Corporation: Company Snapshot

Figure 66 Quanta Computer Inc.: Company Snapshot

Figure 67 Foxconn Technology Group: Company Snapshot

Secondary Research

Secondary sources referred for this study include corporate filings (annual reports, investor presentations, and financial statements) and trade, business, and professional associations. The secondary data has been collected and analyzed to arrive at the overall market size, which has further been validated through the primary research

Primary Research

Extensive primary research has been conducted after acquiring knowledge about the cloud infrastructure market scenario through secondary research. Several primary interviews have been conducted with experts from both demand and supply sides across four major regions, namely, the Americas, Europe, Asia- Pacific, and rest of the world (the Middle East & Africa). This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches have been used to estimate and validate the size of the global cloud infrastructure market and various dependent submarkets. Key players in the market have been identified through the secondary research and their market share in the respective regions has been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of top players and extensive interviews of industry leaders, such as CEOs, VPs, directors, and marketing executives.

- The key players in the markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both demand and supply sides. In addition to this, the market size has been validated using both top-down and bottom-up approaches.

The following are the major objectives of the study.

- To define, describe, and forecast the global cloud infrastructure market based on type, end-use industry, and region

- To forecast the market size, in terms of value, for various segments with respect to five regions, namely, North America, Europe, Asia-Pacific, and Middle East & Africa

- To provide detailed information regarding major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of cloud infrastructure, and provide details of the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their product portfolios, market share, and core competencies3

- To analyze strategic developments such as new product launches, acquisitions, expansions, and agreements in the global cloud infrastructure market

|

Report Metric |

Details |

|

Market size available for years |

2013-2022 |

|

Base year considered |

2015 |

|

Forecast period |

2016-2022 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, End-use Industry, and Geography |

|

Geographies covered |

North America, APAC, Europe, and Middle East & Africa, and, Latin America |

|

Companies covered |

Hewlett Packard Enterprise Co (US), Dell Inc. (US), Cisco Systems, Inc. (US), EMC Corporation (US), IBM Corporation (US), Amazon Web Services (US), Salesforce.com (US), Alphabet Inc. (US), NetApp, Inc. (US), Intel Corporation (US), Lenovo group Limited (China), AT&T, Inc. (US), Oracle Corporation (US), Quanta Computer Inc. (Taiwan), Foxconn Technology Group (Taiwan), and Rackspace Hosting, Inc. (US). |

This research report categorizes the cloud infrastructure market based on type, end-use industry, and geography.

By Type:

- Hardware

- Services

By End-use Industry:

- Banking, financial services, and insurance (BFSI)

- Consumer goods & retail

- Telecommunications & ITES

- Healthcare

- Energy

- Government

- Education & Research

- Media & Entertainment

- Manufacturing

- Business & Consulting Services

- Others

By Geography:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Geographic Analysis

- Further country-wise breakdown of the market for all 4 regions based on various application

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in Cloud Infrastructure Market