Fuel Cell Market

Fuel Cell Market by Type (PEMFC, SOFC, PAFC, MFC, DMFC, AFC), Application (Portable, Stationary, FCVs), End User (Residential, Commercial & Industrial, Transportation, Data Center, Military), Size, Fuel Type, Component and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

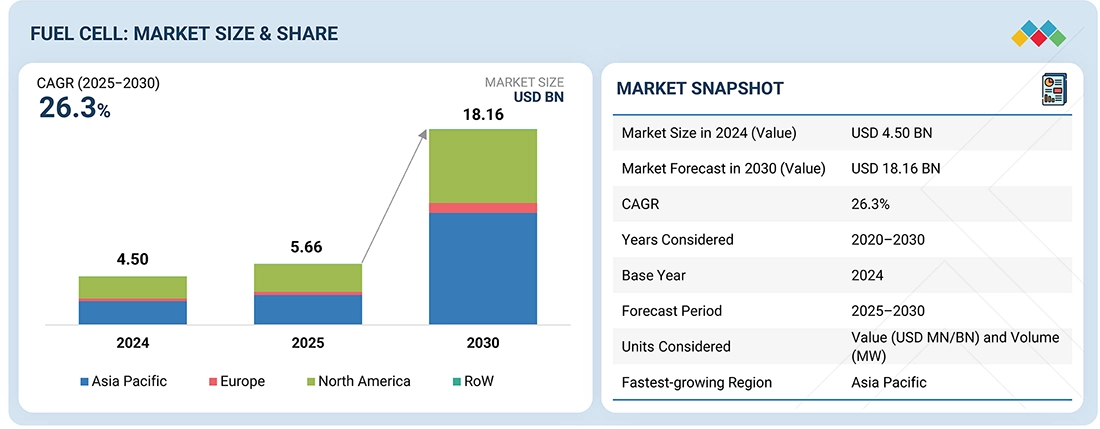

The global Fuel Cell market is projected to reach USD 18.16 billion by 2030 from USD 5.66 billion in 2025, registering a CAGR of 26.3%. The global Fuel Cell market is on a growth trajectory driven by the increasing trend of switching to low-emission and sustainable energy solutions for transportation, power generation, and industrial uses. The current supportive broader political environment, decarbonization targets, and hydrogen infrastructure are enabling expansion in the level of adoption. Fuel cell technology is developing with better efficiencies, new materials, and lower costs which will push past the industrialized nations of the world into areas of the world. Major organizations are furthering their global footprints via manufacturing, partnerships, and more integrated service options as demand increases.

KEY TAKEAWAYS

-

BY REGIONThe North American fuel cell market is projected to lead with a 45.1% share in 2024.

-

BY TYPEBy type, the solid oxide segment is expected to register the highest CAGR of 31.2% during the forecast period.

-

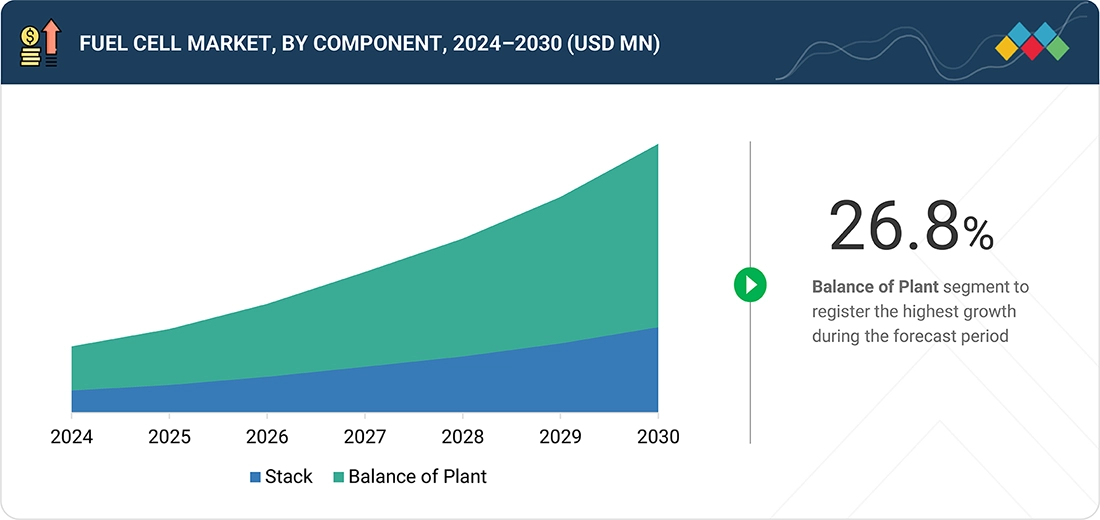

BY COMPONENTBy component, the balance of plant (BoP) segment hold the largest market share of 66.4% in 2024.

-

BY FUEL TYPEBy fuel type, the hydrogen segment is anticipated to register the highest CAGR of 26.8% during the forecast period, supported by increasing investments in green hydrogen infrastructure.

-

BY SIZEBy size, the small-scale (up to 200 kW) segment is projected to grow at the fastest rate due to rising adoption across microgrids, commercial buildings, and backup power systems.

-

BY APPLICATIONBy application, the stationary segment is expected to dominate the market, driven by demand for distributed and reliable power generation.

-

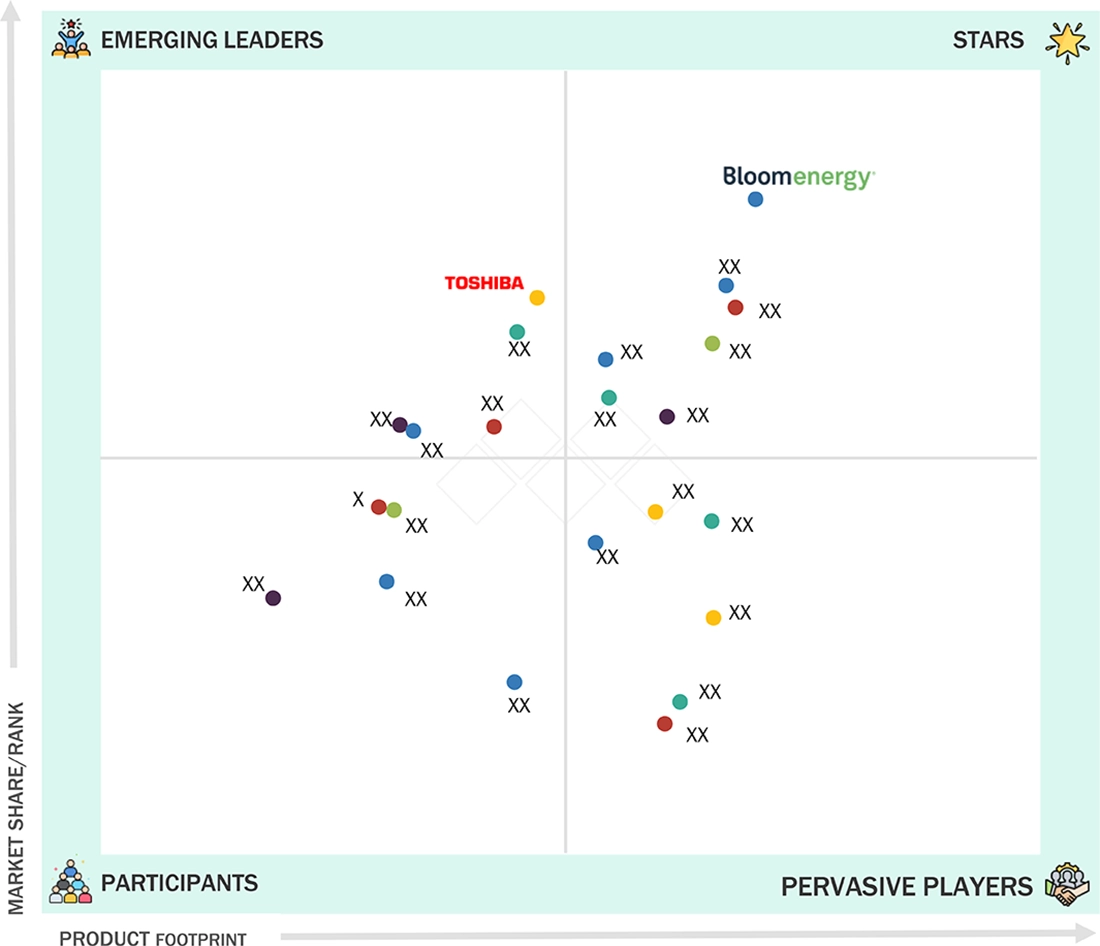

COMPETITIVE LANDSCAPEBloom Energy has been identified as a Star leader in the fuel cell market due to its technological innovation, strong global footprint, and large-scale deployment of solid oxide fuel cell systems.

The fuel cell market is driven by the rising demand for clean, efficient, and adaptable energy solutions, motivated by global initiatives for carbon neutrality and the push to decarbonize sectors such as transportation and power generation. Fuel cells emit no pollutants and offer scalability and high efficiency, making them an increasingly important technology in advancing the worldwide shift to cleaner energy. This trend has led to an increase in investments, faster development of fuel cell manufacturing facilities, pilot projects, and infrastructure expansion. While hydrogen usage remains concentrated in regions such as the Asia Pacific, Europe, and North America, growing investor interest, government support, policies, mandates, hydrogen strategies, and commitments to clean energy are reshaping the market.

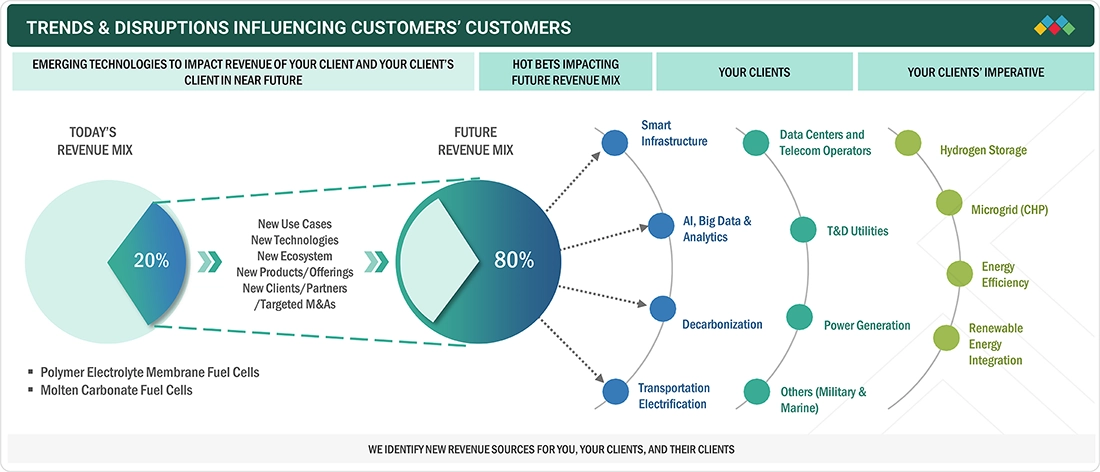

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The fuel cell market is driven by the push for clean energy and government efforts to reach net-zero emissions. Manufacturers must adopt digitalization, decarbonization, and adapt to regulatory changes to stay competitive and find new revenue sources. Modular and distributed systems challenge traditional power generation by offering more flexibility, faster deployment, and lower costs, expanding accessibility. A key challenge is the high cost and limited availability of green hydrogen, which impacts economic viability and scalability. Competition from advancing battery technologies, especially in transportation and storage, further hampers adoption. Infrastructure gaps for hydrogen production, storage, and distribution also slow deployment, notably in emerging regions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Burgeoning adoption of low-carbon vehicles to address climate change

-

Quicker refueling time and longer range of FCEVs than BEVs

Level

-

Requirement for expensive materials and complex manufacturing processes

-

High flammability of hydrogen

Level

-

Implementation of incentive programs to support distributed power generation

-

Governments’ focus on initiating hydrogen programs

Level

-

High adoption of BEVs with increasing investment in lithium-ion batteries

-

Supply chain bottlenecks and lack of infrastructure for hydrogen production and refueling

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Burgeoning adoption of low-carbon vehicles to address climate change

As discussions about the world’s environment and the use of limited resources grow more relevant, and given that vehicle emissions account for over 15% of global greenhouse gas (GHG) emissions, fuel cell vehicles (FCVs) are emerging as a significant mode of transportation. Governments around the world are seeking alternative and renewable energy sources for transport to reduce their carbon footprint and combat climate change. Since FCVs can produce zero CO2 emissions during operation, their use in the transportation sector is expected to increase. As a result, many companies are actively working on developing FCVs into viable, grid-ready products. In line with the global movement toward sustainable and eco-friendly transportation solutions, countries such as Canada, Finland, France, Japan, Mexico, the Netherlands, Norway, Sweden, and India are accelerating the deployment of electric vehicles, including fuel cell vehicles, through initiatives like the EV30@30 campaign. This campaign aims to achieve at least 30% of electric vehicle sales by 2030.

Restraint: High flammability of hydrogen

Hydrogen is highly flammable with an ignition energy of 0.02 millijoules (one 14th that of gasoline) and a flammability range in air of 4–75%. If it is exposed to a static discharge, the resulting spark can cause an explosion. These two issues create a much more complex and expensive domestic hydrogen economy. For instance, hydrogen must be stored at very high pressure (up to 700 bars) or at cryogenic (T = 20K, P < 10 bar) temperatures in heavy and costly containers. Hydrogen fires produce few visible cues during daylight hours, which can make detection and suppression of fires more challenging in the event of a leak or accident.

Opportunity: Implementation of incentive programs to support distributed power generation

The rise of renewable energy, like solar PV and wind, causes grid instability due to their fluctuating nature. Sometimes, the grid can't meet consumer demand. This is addressed by decentralized solutions such as distributed generation (DG). In the UK, firms are incentivized to generate their own electricity, especially using low-carbon fuels like natural gas. Incentives are also established for fuel cell-based DG systems as cleaner technologies like fuel cells and solar PV emerge. Hydrogen fuel cells are increasingly used with renewable sources to create hybrid systems. Excess solar and wind power can be converted into hydrogen, stored, and used to generate electricity as needed. This boosts energy security and offers a dispatchable, zero-emission power source, balancing renewable output with data center energy needs.

Challenge: High adoption of BEVs with increasing investment in lithium-ion batteries

Advancements in technology and rising demand for electric vehicles are reducing the cost of battery storage, making it cheaper than hydrogen for energy storage. Major suppliers in the Asia Pacific, Europe, and North America are increasing their lithium-ion battery investments mainly to meet growing demand for electric vehicles and other power needs. In 2024, the I.E.A. reported record-breaking global electric car sales despite pandemic challenges, helped by increased affordability. Electric vehicles sold over 17 million units globally in 2024, over 20% of total sales, with 3.5 million more sold than in 2023—more than total electric cars sold in 2020. China accounted for nearly 60% of new electric car registrations worldwide in 2023 and more than 35% of total car sales, up from 29% in 2022. In contrast, 2023 fuel cell EV sales were nearly 14,500, a 30.2% decrease from 2022. This highlights the difference between battery-electric and fuel-cell vehicles.

Fuel Cell Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Walmart aimed for 100% renewable energy while keeping costs low, needing reliable, continuous, and scalable clean energy that withstands outages and meets sustainability standards. Traditional power was carbon-heavy and unreliable, risking operations and safety. The solution had to be scalable across many facilities without major upgrades. | Walmart installed Bloom Energy Servers—solid oxide fuel cells—at many stores and distribution centers, mostly powered by biogas. These systems now provide 60–75% of their electricity, offering year-round, low-carbon, cost-effective power during grid failures. With over 40 Bloom units in California, their modular design allowed quick deployment and scalability. The system's reliable performance and predictable costs help Walmart with energy planning and budgeting. |

|

Southern Linc, a subsidiary of Southern Company, was deploying over 1,300 LTE Advanced cell sites to improve its network across the Southeast US. These sites needed reliable backup power for service during storms and outages. Diesel generators used at several sites also faced operational issues, including refueling, maintenance, noise, and emissions, which conflicted with Southern Linc's goal of a modern, efficient, and eco-friendly solution. | Southern Linc partnered with Plug Power to deploy 500 GenSure hydrogen fuel cell backup systems in outdoor-rated cabinets, combining fuel cell power, DC systems, and LTE in a compact, space-saving design needing up to 87% less site space than diesel or battery solutions. Plug Power also provided GenFuel hydrogen delivery, enabling automated, onsite fueling that eliminated manual refueling. The solution achieved 99.6% uptime, cut annual O&M costs by 64%, required less maintenance than traditional generators, and reduced environmental impact with silent, zero-emission operation. It also improved response times during weather crises, such as Hurricane Irma, showcasing resilience. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem analysis shows the interconnections affecting the fuel cell market, highlighting key industries and applications. It involves key players at different levels: raw material suppliers like Anglo American Platinum, Sibanye-Stillwater, and Tokai Carbon Co., Ltd.; component providers such as Johnson Matthey, Ballard Power Systems, and TORAY INDUSTRIES; system integrators like Bloom Energy, Plug Power Inc., Doosan Fuel Cell, and SFC Energy; and hydrogen infrastructure players including Linde PLC, Air Liquide, and Lhyfe Heroes. End-users, such as Toyota Kirloskar Motor, Hyundai Motor Company, and Intel, drive market growth, fostering innovation and expansion.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Fuel cell market, By Type

Proton Exchange Membrane Fuel Cells (PEMFCs), also known as Polymer Electrolyte Membrane Fuel Cells, are among the most widely adopted fuel cell technologies, particularly favored in transportation, portable power, and small-scale stationary power applications. They utilize a solid polymer electrolyte membrane—commonly made of Nafion—to conduct protons from the anode to the cathode while blocking electrons, which are forced through an external circuit to generate electricity.

Fuel cell market, By Component

A fuel cell stack is the core component of a fuel cell system, where electrochemical reactions occur to generate electricity. It is composed of several critical parts that work in unison to ensure efficient performance. The most fundamental elements of the stack are the individual cells, which consist of an anode, a cathode, and an electrolyte membrane. Each cell generates a small amount of voltage, and multiple cells are stacked together to achieve the desired power output. Interconnects are placed between the cells to electrically connect them in series while also distributing fuel and oxidant gases evenly.

Fuel cell market, By Size

In 2024, the small-scale (up to 200 kW) segment captured a significant share of the global fuel cell market, driven by its broad range of applications across various end-use industries. These systems offer power outputs ranging from just a few watts to several kilowatts and can be modularly stacked to exceed 200 kW, offering flexibility for both standalone and distributed power generation. Their compact footprint, efficient operation, and ability to function in off-grid or backup scenarios make them ideal for sectors such as residential, commercial, telecommunication, and light-duty mobility.

Fuel cell market, By Fuel

Hydrogen fuel cells are electrochemical devices that convert chemical energy from hydrogen into electricity through a clean and efficient process. The fundamental technology involves the reaction of hydrogen gas (H2) with oxygen (O2) from the air in the presence of a catalyst, typically platinum, within a fuel cell stack. This process produces electricity, water (H2O), and heat as byproducts, making it an environmentally friendly alternative to combustion-based power generation. The main components of a hydrogen fuel cell include an anode, cathode, and electrolyte membrane.

Fuel cell market, By Application

The stationary application segment in the fuel cells market refers to the use of fuel cell systems for fixed-site power generation, encompassing both primary and backup power applications across residential, commercial, and industrial sectors. Unlike portable or transport applications, stationary fuel cells are designed to be permanently installed in a specific location and provide continuous, reliable electricity and heat. These systems are increasingly being used for distributed generation, combined heat and power (CHP), and off-grid power solutions, especially in regions with aging grid infrastructure or high electricity costs.

Fuel cell market, By End user

Fuel cells are increasingly being adopted in the commercial and industrial (C&I) sectors, such as shopping malls, hospitals, hotels, office buildings, and sports centers, due to their high efficiency, low emissions, and ability to provide both electricity and heat (combined heat and power or CHP). These systems operate silently and can use a variety of fuels, including hydrogen, natural gas, and biogas, making them suitable for both on-grid and off-grid applications. SOFCs are preferred for larger installations, such as hospitals and shopping malls, due to their high efficiency and suitability for base-load power. Molten carbonate (MCFC) and phosphoric acid fuel cells (PAFC) are also used for industrial CHP applications.

REGION

Asia Pacific is expected to witness the highest CAGR in global fuel cell market during forecast period

The Asia Pacific (APAC) region is emerging as a key player in the global fuel cell market, driven by rising energy demand, government support for clean tech, and hydrogen infrastructure investment. Interest in decarbonizing transportation, processes, and distributed power is growing rapidly. Japan, South Korea, and China are developing national hydrogen strategies and fuel cell roadmaps to connect residential, mobility, and commercial sectors. Japan leads with widespread deployment in homes and its ENE-FARM program. South Korea plans to invest in utility-scale fuel cell power plants and hydrogen for use in public transportation. China is rolling out fuel cell vehicles with subsidies and pilot zones, positioning itself as a major manufacturing hub.

Fuel Cell Market: COMPANY EVALUATION MATRIX

Bloom Energy (Market Leader) dominates the fuel cell market, owing to its advanced fuel cell technology, strong global presence, and proven commercial deployments. The company’s SOFC systems deliver high electrical efficiency, fuel flexibility, and low emissions, making them ideal for both distributed power generation and grid support applications. Bloom Energy’s continuous innovation in stack design and system integration has significantly reduced costs while enhancing reliability and scalability. Its strategic partnerships with major corporations and governments further strengthen its position, enabling large-scale adoption across commercial, industrial, and utility sectors worldwide.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 4.50 Billion |

| Market Forecast in 2030 (Value) | USD 18.16 Billion |

| Growth Rate | CAGR of 26.3% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2030 |

| Units Considered | Value (USD Million/Billion) and Volume (MW) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, RoW |

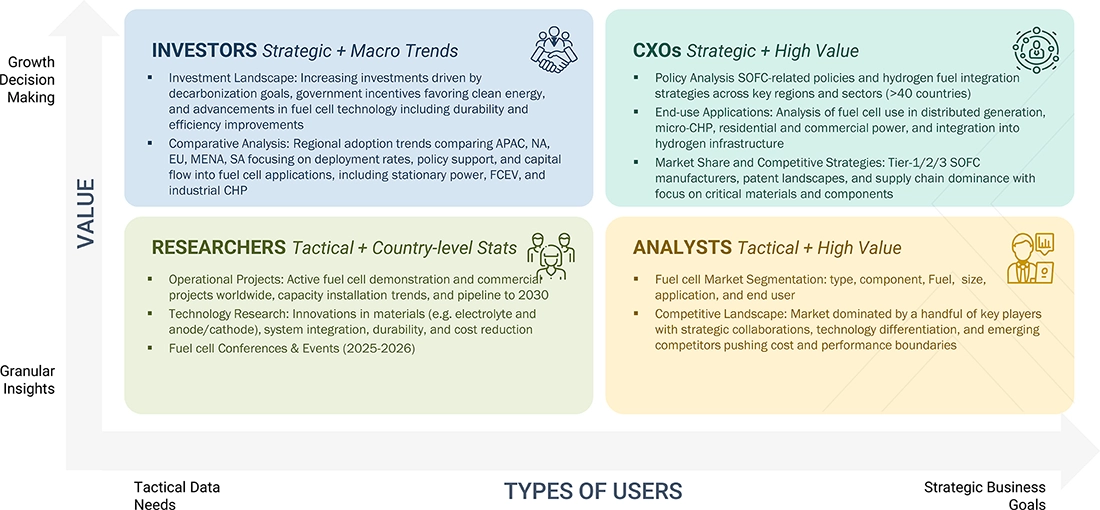

WHAT IS IN IT FOR YOU: Fuel Cell Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| North America-based fuel cell provider |

|

|

| North American client |

|

|

RECENT DEVELOPMENTS

- March 2025 : Doosan Fuel Cell Co., Ltd., in collaboration with Korea Hydro & Nuclear Power (KHNP), Airrane, and KECC, developed and demonstrated Korea’s first carbon capture technology specifically for hydrogen fuel cells, aiming to make hydrogen power generation more environmentally friendly. This project involved redesigning hydrogen fuel cells, integrating membrane capture systems, and installing these technologies at the Maritime Industry Cluster Harbor in Yeosu Gwangyang Port, with pilot operations completed by January 2025.

- December 2024 : Bloom Energy partnered with HPS Investment Partners and Industrial Development Funding to fund clean energy projects. Through this partnership, they secured around USD 125 million to support the deployment of Bloom’s Energy Servers and microgrid solutions. The goal is to provide reliable, low-emission power to customers through Power Purchase Agreements (PPAs), allowing them to access energy without upfront costs. This collaboration helps Bloom grow its project pipeline while giving HPS and IDF new opportunities to invest in clean energy solutions.

- October 2024 : SFC Energy AG completed the acquisition of Ballard Power Systems Europe A/S’s small stationary hydrogen fuel cell business, including intellectual property, customer contracts, and service agreements. This strategic move enhances SFC's portfolio with 1.7 kW and 5 kW PEM fuel cell solutions, expanding its presence in Northern Europe. The acquisition adds approximately 400 installed systems across Denmark, Norway, Sweden, and Finland, providing a solid foundation for market expansion.

- February 2024 : Plug Power Inc. and Uline partnered to enhance Uline’s material handling operations with hydrogen fuel cell technology. This USD 20 million expansion involves deploying Plug’s hydrogen infrastructure and fuel cell solutions at Uline’s new campus in Kenosha, Wisconsin. The project includes the installation of an 18,000-gallon hydrogen storage tank and 17 hydrogen dispensers to service four distribution centers within the campus. Additionally, 250 fuel cell forklifts will be added, bringing Uline’s total to 520 fuel cell-powered vehicles across ten facilities, supported by 34 hydrogen dispensers.

- November 2022 : Ballard Power Systems partnered with Fusion Fuel and successfully commissioned Fusion Fuel’s H2Évora plant. The demonstration project, comprising 15 HEVO-Solar units and their associated balance of plant equipment, produced 15 tons of green hydrogen per year and avoided the emission of 135 tons of carbon dioxide (CO2) annually. The facility featured a 200-kilowatt FCwaveTM fuel cell module supplied by Ballard Power, which converts green hydrogen into electricity.

Table of Contents

Methodology

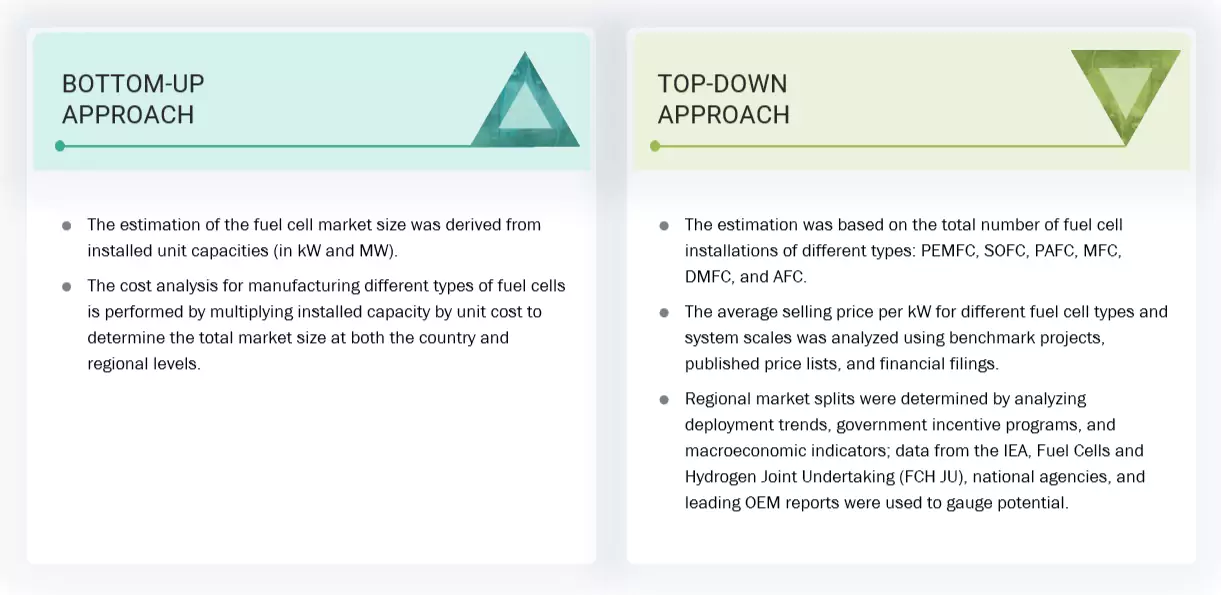

The study involved major activities in estimating the current size of the fuel cell market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation techniques were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the fuel cell market used extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg, Factiva, IRENA, International Energy Agency, and Statista Industry Journal, to collect and identify valuable information for a technical, market-oriented, and commercial study of the fuel cell market. Other secondary sources included annual reports, press releases, and investor presentations of companies; white papers; certified publications; and articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The fuel cell market comprises several stakeholders, such as raw material providers, component providers, and fuel cell integrators, in the supply chain. The rising demand for portable, stationary, and fuel cell vehicles characterizes the demand side of this market. The supply side is characterized by prominent players' increasing focus on securing contracts from industrial players. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is the breakdown of primary respondents.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market size estimations and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process and list key information/insights throughout the report.

Note: The tiers of the companies are defined based on their total revenues as of 2024.

Tier 1: >USD 1 billion, Tier 2: USD 500 million to USD 1 billion, and Tier 3:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the fuel cell market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following.

Fuel Cell Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the total market was split into several segments and subsegments. Data triangulation and market breakdown processes were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. In addition, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Fuel cells are electrochemical devices that convert different fuel types into electrical energy using chemical reactions rather than combustion. They operate in two terminals that consist of an anode and a cathode separated by an electrolyte and membrane. They are noted for their quiet operation, clean, reliable, and highly efficient power. As long as fuel is supplied, fuel cells will continuously generate electricity without occasionally recharging a battery. They are used in many applications, including propulsion or range extension in fuel cell-powdered vehicles and as primary or backup power sources for data centers and energy companies.

Stakeholders

- Ceramic and electrolyte manufacturers

- Energy & power consulting companies

- Environmental research institutes

- Fuel cell and stack manufacturers

- Government and research organizations

- Institutional investors/shareholders

- Power and energy associations

- Repair and maintenance service providers

- Fuel cell technology manufacturing companies

- Organizations, forums, alliances, and associations

- Clean energy generation research and consulting companies

- State and national regulatory authorities

Report Objectives

- To describe, segment, and forecast the fuel cell market, by type, component, fuel type, size, application, and end user, in terms of value

- To describe, segment, and forecast the fuel cell market, by type, in terms of volume

- To forecast the market across four key regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with country-level analysis, in terms of value and volume

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing the growth of the fuel cell market

- To give the supply chain analysis, trends/disruptions impacting customer business, ecosystem analysis, regulatory landscape, patent analysis, case study analysis, technology analysis, key conferences & events, the impact of AI/Gen AI, macroeconomic outlook, pricing analysis, porter’s five forces analysis, regulatory analysis, and the impact of 2025 US tariff on the fuel cell market

- To analyze opportunities for stakeholders and draw a competitive landscape of the fuel cell market

- To benchmark market players using the company evaluation matrix, which analyzes market players on broad categories of business and product strategies adopted by them

- To compare key market players for the market share, product specifications, and applications

- To strategically profile key players and comprehensively analyze their market ranking and core competencies.

- To analyze competitive developments, such as contracts, agreements, partnerships, and joint ventures, in the fuel cell market

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies using the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakdown of the fuel cell market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What was the size of the fuel cell market in 2024?

The fuel cell market will be worth USD 5.66 billion in 2025.

What are the major drivers for the fuel cell market?

Key factors driving the fuel cell market include faster refueling times, the more extended range of fuel cell electric vehicles (FCEVs) compared to battery electric vehicles (BEVs), and an increasing focus on decarbonizing the maritime industry.

Which will be the biggest market for fuel cells during the forecast period?

Asia Pacific is estimated to dominate the fuel cell market during the forecast period.

Which will be the largest segment, by type, in the fuel cell market during the forecast period?

The solid oxide segment is likely to account for the largest market share during the forecast period.

Which will be the fastest-growing segment, by size, in the fuel cell market during the forecast period?

The small-scale (up to 200 kW) segment is projected to register the highest CAGR during the forecast period.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Fuel Cell Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Fuel Cell Market

John

Jun, 2022

Who are the top vendors in the Fuel Cell Market? How is the competitive scenario among them?.

Kris

Jul, 2022

MarketsandMarkets provides competitive intelligence on the key players (3M, Dupont, VINATech, Kolon Industries, BASF, LG Chem, etc) in Membrane Electrode Assemblies market in South Korea as indicated Company Overview, Product Offerings, Financials, Geographical Presence, Recent Developments like new contracts, M&A activities, new product launches, R&D initiatives, Market Share Analysis, and SWOT Analysis for each company. Total Global market size by Revenue for all fuels combined (segmented by <600W, 600W-1kW, 1-5kW, 5-20kW & 20-50kW) generator market. From 2018 to projected 2027. .

Thomas

Jul, 2022

Who are the top vendors in the Fuel Cell Market and highlight the competitive scenario between them for the period 2022 to 2027..