Fuel Cell Powertrain Market by Component (Fuel Cell System, Drive System, Battery System, Hydrogen Storage System, and Gearbox), Vehicle Type (PC, LCV, Trucks, Buses), Power Output, Drive Type, H2 Fuel Station and Region - Global Forecast to 2027

[286 Pages Report] The global fuel cell powertrain market size is projected to grow from $512 million in 2022 to $3,629 million by 2027, at a CAGR of 47.9%. The fuel cell powertrain market has witnessed rapid development over the past few decades across the world due to the rising demand for low-emission vehicles and increasing vehicle range. During the past few years, various countries around the world have increased their focus on the growth of this industry. Rapid growth in technology and decreasing cost of fuel cells along with the rising prices of petrol and diesel have led to the rapid growth of this market. Governments around the world have started developing infrastructure for Fuel cell powertrain vehicles and are working with OEMs to increase the market for low-emission fuel vehicles. Increased demand for efficient, long range, and low-emission vehicles is expected to boost the market. Countries around the world are undertaking efforts to reduce emissions from vehicles in the coming decades. FCEVs offer a higher range on a single filling compared to other EVs and are convenient to fill. However, the lack of hydrogen fuelling infrastructure in various regions creates a hurdle to the growth of the market. To enable the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Better fuel efficiency and increased driving range

FCEVs offer better fuel economy than ICE vehicles. According to the US Department of Energy, the fuel economy of an FCEV is around 63 miles per gallon gasoline equivalent (MPGge), while that of an ICE vehicle is 29 MPGge on highways. Hybridization can improve the fuel economy of an FCEV by up to 3.2%. On urban roads, the fuel economy of an FCEV is around 55 MPGge as compared to 20 MPGge of ICE vehicles. Also, the energy density of diesel is 45.5 megajoules per kilogram (MJ/kg), which is lower than gasoline (45.8 MJ/kg). Hydrogen has an energy density of approximately 120 MJ/kg, which is approximately three times more than diesel or gasoline.

There is a significant difference in the driving range of FCEVs and BEVs on either a full tank or full charge. FCEVs can travel almost 300 miles without refuelling, while the average range of a BEV is around 110 miles with a fully charged battery. The Honda Clarity has the highest EPA driving rating for a zero-emission vehicle in the US. It has a driving range of up to 366 miles. Better fuel efficiency and increased driving range will boost the demand for FCEVs, which will, in turn, drive the fuel cell powertrain market.

Restraint: High flammability and challenges in detection of hydrogen leakage

Fuel cells use hydrogen and oxygen to produce electricity through a chemical reaction. Hydrogen is a highly flammable gas, while oxygen helps other substances burn at lower temperatures. If not handled with care, the fuel can catch fire; hydrogen flames are invisible and can explode. In FCEVs, fuel cells are installed inside the vehicle, and hydrogen gas is stored under pressure. If even a spark of electricity comes in contact with the hydrogen, it could catch fire. In fuel cells, though electricity is produced without combustion, which decreases the chances of a vehicle catching fire, there are several electronic and electrical components in the vehicle that could generate heat or electric sparks. The risk of fire is also high at hydrogen fuel stations.

Additionally, since hydrogen gas is lightweight, an odorant cannot be added to it to detect leaks instantly. The leaked gas is often wasted or could combust. For instance, in June 2019, a hydrogen refuelling station located in Bærum, a suburb of Norway exploded, following which, Toyota and Hyundai have halted the sales of FCVs in Norway. Hence, R&D is required to resolve this problem since it can be a major hurdle to the infrastructure of fuelling stations and fuel cell components. Hence, consumers are hesitant to invest in FCEVs, thus restraining market growth for fuel cell powertrain.

Opportunity: Government initiatives for hydrogen infrastructure

With the increasing levels of pollution around the globe, governments are increasingly investing in alternative sources of energy, such as fuel cells. According to the US EPA, in 2015, the transportation sector contributed to 27% of the greenhouse gas emissions in the US, making it the second-largest contributor to greenhouse gas emissions in the country. Governments are taking initiatives, making investments, and promoting the use of fuel cells. For instance, in March 2021, the Indian Ministry of Petroleum and Natural Gas (MoPNG) announced plans to set up solar hydrogen refueling stations at two locations for the demonstration of fuel cell vehicles at tourist sites - Delhi-Agra, Gujarat (Statue of Unity), etc. Along with the development of fuel cell technology, it is important to create a robust infrastructure that can cater to the needs of hydrogen-powered transportation.

Challenge: Increasing demand for BEVs and HEVs

The increasing demand for battery and hybrid electric vehicles is likely to be one of the major challenges for the growth of the fuel cell vehicles market, and by extension, the fuel cell powertrain market. Hatchbacks, sedans, and SUVs are all available in BEV and HEV variants and at lower costs than FCEVs. Customers can select a model as per their requirements and convenience from a number of BEV and HEV options. On the other hand, the number of FCEV models available is limited, with the unavailability of hydrogen fuelling stations another challenge. Moreover, many prominent automotive manufacturers, such as BYD, Tesla, and Volkswagen, are focusing more on the development of BEVs. Apart from this, the high cost of FEVs leads to further hurdles in the growth of their market. The cost of the fuel itself is high, which makes FCEVs costlier. However, the maintenance cost of fuel cells is lower than batteries. The price of the 2021 Toyota Mirai is almost USD 66,000 in the US, whereas the 2021 Tesla Model 3 costs USD 44,490. The huge price difference between battery electric and fuel cell vehicles is a major challenge for the growth of FCEV sales. However, manufacturers and government bodies are taking initiatives and carrying out R&D to decrease the cost of fuel cells further. For instance, according to the Ministry of Trade, Industry, and Energy, the South Korean government and businesses will invest around USD 2.33 billion over the next five years to accelerate the development of the country’s hydrogen fuel cell vehicle ecosystem. The investment will be made as a public-private partnership.

Fuel cell system will have a major share in the fuel cell powertrain market during the forecast period

A fuel cell system is the heart of a fuel cell powertrain system and constitutes parts such as the fuel cell stack, humidifier, air compressor, and fuel processor. The system converts oxygen and hydrogen gas to electricity, which is used to power the electric motor. A fuel cell stack comprises a multitude of single cells that are stacked in a way that the cathode and anode of the adjacent cell are electrically connected. A fuel cell stack produces direct current. The main components of a fuel cell stack are MEAs (membrane electrode assemblies), bipolar plates, gaskets, end plates with fluid connections, and bus plates with electrical connections. All these components form the core part in FEVs which is expected to drive the demand of fuel cell system.

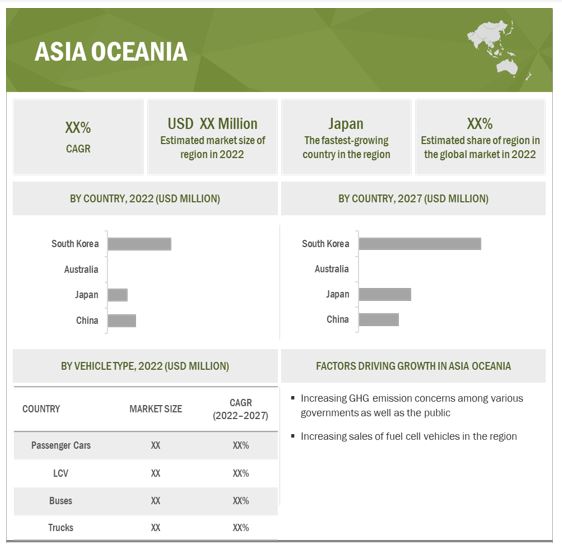

The Asia Oceania fuel cell powertrain market is projected to hold the largest share by 2027.

Asia Oceania is estimated to be the largest market due to growing demand for passenger cars and fuel-efficient vehicles over the years. This region is home to some of the key players in the fuel cell powertrain market, such as Denso Corporation, Shanghai Fuel Cell Vehicle Power System Co., Ltd, Doosan Corporation etc. Even though this region is home to fewer companies in the market compared to other regions such as North America and Europe, the highest number of fuel cell vehicles have been sold here. Among the top sold models are the Hyundai NEXO and the Toyota Mirai, which witnessed sales of 8,900 and 17,940 units respectively in 2021. Around 92% sales of the Hyundai NEXO in 2021 were accounted for by South Korea, while the majority of the Toyota Mirai were sold in Japan.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The global fuel cell powertrain market is dominated by major players such as Ballard Power Systems (Canada), Cummins Inc. (US), Denso Corporation (Japan), Robert Bosch GmbH (Germany), and FEV (Germany). These companies offer a wide variety of automotive motors fulfilling all major functions in a vehicle. The key strategies adopted by these companies to sustain their market position are new product developments, expansions, mergers &acquisitions, and partnerships & collaboration.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million) and Volume (Units) |

|

Segments covered |

Component, Drive Type, Vehicle Type, Power Output, H2 Fuel Station, and Region |

|

Geographies covered |

Asia Oceania, Europe, and North America |

|

Companies Covered |

Ballard Power Systems (Canada), Cummins Inc. (US), Denso Corporation (Japan), Robert Bosch GmbH (Germany), and FEV (Germany) |

This research report categorizes the fuel cell powertrain market based on component, drive type, vehicle type, power output, h2 fuel station, and region.

Based on the component:

- Fuel Cell System

- Battery System

- Drive System

- Hydrogen Storage System

- Others

Based on the Drive Type:

- Rear-Wheel Drive (RWD)

- Front-Wheel Drive (FWD)

- All-Wheel Drive (AWD)

Based on the vehicle type:

- Passenger Cars

- Light Commercial Vehicle (LCV)

- Buses

- Trucks

Based on the power output:

- <150 kW

- 150-250 kW

- >250kW

Based on the H2 fuel station:

- Asia Oceania

- Europe

- North Amercia

Based on the region:

-

Asia Pacific

- China

- Japan

- Australia

- South Korea

-

North America

- US

- Canada

- Mexico

-

Europe

- Belgium

- Denmark

- France

- Germany

- Italy

- Netherlands

- Norway

- Spain

- Sweden

- Switzerland

- United Kingdom

Recent Developments

- In May 2022, Cummins Inc. announced that they will supply PEM fuel cell system to Scania for use in 20 fuel cell electric heavy vehicle.

- In April 2022, Cummins Inc. announced to develop fuel cell for HyTruck project for that the company is leveraging PEM fuel cell system.

- In April 2022, Plug Power and Olin Corporation announced to create a joint venture (JV) to produce and market green hydrogen to support growing fuel cell demand in the global hydrogen economy. The first production plant in St. Gabriel, Louisiana will produce 15 tons per day (tpd) of green hydrogen.

- In April 2022, Nuvera Fuel Cells has received a purchase order and signed a memorandum of understanding with Hytech AS for the use of Nuvera® E-45 Fuel Cell Engines for stationary power uses.

- In September 2021, Ballard Power Systems announced new FCmove™-HD+, with a 100kW power output, is smaller, lighter, more efficient, and lower cost than previous generations, and has been designed to improve ease of vehicle integration. With its compact innovative design, it has been engineered for both engine bay and rooftop configurations, enabling optionality in truck and bus applications.

Frequently Asked Questions (FAQs):

What are different segments covered in report for fuel cell powertrain market?

The fuel cell powertrain market is covered for component (fuel cell system, drive system, battery system, hydrogen storage system, and others), vehicle type (passenger cars, LCV, buses, and trucks), drive type (FWD, RWD, and AWD), power output (<150 kW, 150-200 kW, and >250 kW), H2 fuel station (Asia Oceania, Europe, and North America), and region (Asia Oceania, Europe, and North America)

Who are the major players in the fuel cell powertrain market?

Major players in the fuel cell powertrain market are Ballard Power Systems (Canada), Cummins Inc. (US), Denso Corporation (Japan), Robert Bosch GmbH (Germany), and FEV EUROPE GMBH (Germany).

Which countries are considered in the European region?

The report includes the following European countries:

- Belgium

- Denmark

- France

- Germany

- Italy

- Netherlands

- Norway

- Spain

- Sweden

- Switzerland

- UK

We are interested in the regional fuel cell powertrain market for components. Does this report cover the component segment?

The fuel cell powertrain market for component is covered at a global level. However, regional level markets can be provided as separate customization.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 FUEL CELL POWERTRAIN MARKET DEFINITION, BY COMPONENT

1.2.2 MARKET DEFINITION, BY DRIVE TYPE

1.2.3 MARKET DEFINITION, BY VEHICLE TYPE

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION

1.4.1 YEARS CONSIDERED

1.5 PACKAGE SIZE

1.6 CURRENCY

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 2 FUEL CELL POWERTRAIN MARKET: RESEARCH DESIGN

FIGURE 3 RESEARCH DESIGN MODEL

2.1.1 SECONDARY DATA

2.1.1.1 Key secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Participants in primary research

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.1.3 PRIMARY PARTICIPANTS

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET: RESEARCH DESIGN & METHODOLOGY

FIGURE 6 MARKET: ILLUSTRATION OF SUPPLY- SIDE REVENUE ESTIMATION

2.3 FACTOR ANALYSIS

2.3.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.5 ASSUMPTIONS

2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 8 FUEL CELL POWERTRAIN: MARKET OVERVIEW

FIGURE 9 TIMELINE OF FUEL CELL SYSTEMS

FIGURE 10 FUEL CELL POWERTRAIN MARKET, BY REGION, 2022–2027

FIGURE 11 PASSENGER CARS PROJECTED TO DOMINATE DURING FORECAST PERIOD (2022–2027)

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 12 TECHNOLOGICAL ADVANCEMENTS IN AUTOMOTIVE INDUSTRY EXPECTED TO BOOST MARKET

4.2 MARKET, BY VEHICLE TYPE

FIGURE 13 PASSENGER CARS PROJECTED TO LEAD FUEL CELL POWERTRAIN MARKET (USD MILLION)

4.3 MARKET, BY COMPONENT

FIGURE 14 HYDROGEN STORAGE SYSTEM SEGMENT TO GROW FASTEST BY 2027 (USD MILLION)

4.4 MARKET, BY POWER OUTPUT

FIGURE 15 <150 KW POWER OUTPUT SEGMENT TO COMMAND LARGEST SHARE (UNITS)

4.5 MARKET, BY H2 FUEL STATION

FIGURE 16 ASIA OCEANIA PROJECTED TO BE LARGEST MARKET FOR H2 FUEL STATIONS (UNITS)

4.6 MARKET, BY REGION

FIGURE 17 MARKET IN EUROPE TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD (USD MILLION)

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

FIGURE 18 HYDROGEN FUEL CELL ELECTRIC VEHICLE SYSTEM

5.2 MARKET DYNAMICS

FIGURE 19 FUEL CELL POWERTRAIN MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Better fuel efficiency and increased driving range

5.2.1.2 Operational data

TABLE 2 US: FUEL CELL ELECTRIC VEHICLE MODEL COMPARISON

FIGURE 20 BEV VS. FCEV: NATURAL GAS REQUIREMENT FOR 300-MILE TRAVEL

TABLE 3 FCEV VS. BEV: 200- AND 300-MILE RANGE ATTRIBUTE COMPARISON

TABLE 4 BEV CHARGING VS. FCEV HYDROGEN FUELING OF ZERO-EMISSION LIGHT-DUTY VEHICLES

5.2.1.3 Decarbonized source of energy

5.2.1.4 Fast refueling

5.2.2 RESTRAINTS

5.2.2.1 High flammability and challenges in detection of hydrogen leakage

FIGURE 21 AUTO IGNITION TEMPERATURE OF DIFFERENT FUELS

FIGURE 22 MINIMUM IGNITION ENERGY FOR VARIOUS FUELS

5.2.3 OPPORTUNITIES

5.2.3.1 Low-weight alternative for heavy-duty trucks

5.2.3.2 Government initiatives for hydrogen infrastructure

FIGURE 23 INITIAL INVESTMENT FOR FUEL INFRASTRUCTURE

FIGURE 24 BEV AND FCEV COMPARISON

TABLE 5 POLICIES & INITIATIVES SUPPORTING HYDROGEN-POWERED VEHICLES & HYDROGEN INFRASTRUCTURE

TABLE 6 POLICY ANNOUNCEMENT FOR ICE VEHICLE BAN, BY COUNTRY

TABLE 7 US DEPARTMENT OF ENERGY FUNDING, 2021

5.2.4 CHALLENGES

5.2.4.1 Increasing demand for BEVs and HEVs

FIGURE 25 COST CONTRIBUTION OF FUEL CELL COMPONENTS: 1,000 UNITS/ YEAR VS. 500,000 UNITS/YEAR

5.2.4.2 Limited infrastructure for fuel cell vehicles

5.2.5 IMPACT OF MARKET DYNAMICS

TABLE 8 FUEL CELL POWERTRAIN: IMPACT OF MARKET DYNAMICS

5.3 TRENDS AND DISRUPTIONS: MARKET

FIGURE 26 TRENDS AND DISRUPTIONS: MARKET

6 INDUSTRY TRENDS (Page No. - 70)

6.1 TECHNOLOGY OVERVIEW

6.1.1 INTRODUCTION

FIGURE 27 KEY COMPONENTS OF FUEL CELL ELECTRIC VEHICLES

6.1.2 COMPONENTS OF FUEL CELL POWERTRAIN

6.1.2.1 Integrated e-axle

FIGURE 28 AVL INTEGRATED E-AXLE

6.1.2.2 Center drive

6.1.2.3 Wheel-selective drive

FIGURE 29 FUEL CELL POWERTRAIN APPLICATIONS

6.1.3 KEY TRENDS IN FUEL CELL TECHNOLOGY

6.1.3.1 Use of fuel cell technology in heavy load transportation

FIGURE 30 FUEL CELL MASS-MARKET ACCEPTABILITY IN TRANSPORTATION SECTOR, 2016–2050

6.1.3.2 Plug-in hybrid fuel cell vehicles

6.1.4 VALUE CHAIN ANALYSIS

FIGURE 31 VALUE CHAIN ANALYSIS

6.1.4.1 Fuel cell powertrain component suppliers

6.1.4.2 Fuel cell powertrain development

6.1.4.3 OEM

6.1.5 FUEL CELL SUBCLUSTER AND H2 SUBCLUSTER

6.2 PORTER'S FIVE FORCES ANALYSIS

FIGURE 32 PORTER'S FIVE FORCES ANALYSIS: MARKET

TABLE 9 MARKET: IMPACT OF PORTER'S FIVE FORCES

6.3 ECOSYSTEM ANALYSIS

FIGURE 33 MARKET: ECOSYSTEM ANALYSIS

6.3.1 HYDROGEN FUEL SUPPLIERS

6.3.2 TIER I SUPPLIERS (FUEL CELL AND RELATED COMPONENT PRODUCERS)

6.3.3 OEMS

6.3.4 END USERS

TABLE 10 MARKET: ROLE OF COMPANIES IN ECOSYSTEM

6.4 AVERAGE SELLING PRICE ANALYSIS

FIGURE 34 DECREASE IN COST OF FUEL CELL

FIGURE 35 FUEL CELL SYSTEM COST, 2006–2025

FIGURE 36 MARKET: AVERAGE SELLING PRICE ANALYSIS OF COMPONENTS (USD)

6.5 KEY MARKETS FOR EXPORT/IMPORT

6.5.1 EUROPE

TABLE 11 EUROPE: TOTAL IMPORT/EXPORT OF VEHICLES (UNITS)

6.5.2 JAPAN

TABLE 12 JAPAN: TOTAL IMPORT/EXPORT OF VEHICLES (UNITS)

6.5.3 CHINA

TABLE 13 CHINA: TOTAL IMPORT/EXPORT OF VEHICLES (UNITS)

6.5.4 US

TABLE 14 US: TOTAL IMPORT/EXPORT OF VEHICLES (UNITS)

6.6 PATENT ANALYSIS

6.6.1 PATENT OVERVIEW

6.6.2 PATENT APPLICATION TRENDS

FIGURE 37 PATENT APPLICATION TRENDS (2015–2021)

6.6.3 PATENTS BY OEMS, 2010–2020

FIGURE 38 COUNTRY-WISE PATENT ANALYSIS

FIGURE 39 TOP PATENT APPLICANTS, 2010–2020

6.7 CASE STUDY ANALYSIS

6.7.1 PLANS TO PILOT HYDROGEN FUEL CELL ELECTRIC POWERTRAIN IN BMW X5 IN 2022

6.7.2 HYUNDAI MOTOR AND H2 ENERGY PARTNER TO OFFER 1,000 HEAVY-DUTY FUEL CELL ELECTRIC TRUCKS

TABLE 15 TRUCK SPECIFICATIONS

6.7.3 NIKOLA AND BOSCH SHOWCASE HYDROGEN-ELECTRIC POWERED TRUCK

6.7.4 BALLARD POWER SYSTEM ANNOUNCES FCMOVE-HD+ FOR BUSES AND MEDIUM- AND HEAVY-DUTY TRUCKS

6.8 REGULATORY OVERVIEW

6.8.1 COUNTRY-WISE HYDROGEN FUEL CELL POWERTRAIN STANDARDS

7 FUEL CELL POWERTRAIN MARKET, BY COMPONENT (Page No. - 89)

7.1 INTRODUCTION

FIGURE 40 MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

TABLE 16 MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 17 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

7.2 OPERATIONAL DATA

7.2.1 ASSUMPTIONS

7.2.2 RESEARCH METHODOLOGY

7.3 FUEL CELL SYSTEM

7.3.1 NEED FOR SAFETY APPLICATIONS DRIVES SEGMENT

TABLE 18 FUEL CELL SYSTEM: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 19 FUEL CELL SYSTEM: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 BATTERY SYSTEM

7.4.1 INCREASED LIFE CYCLE AND SMOOTH OPERATION

TABLE 20 BATTERY SYSTEM: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 21 BATTERY SYSTEM: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 DRIVE SYSTEM

7.5.1 DC/DC CONVERTER

7.5.2 MOTOR

7.5.3 POWER CONTROL UNIT

7.5.4 COOLING SYSTEM

7.5.5 INVERTER

7.5.6 ENHANCED PERFORMANCE RENDERED BY DRIVE SYSTEMS

TABLE 22 DRIVE SYSTEM: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 23 DRIVE SYSTEM: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.6 HYDROGEN STORAGE SYSTEM

7.6.1 ADVANCEMENTS FOR SAFER MATERIALS WILL BOOST SEGMENT

TABLE 24 HYDROGEN STORAGE SYSTEM: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 25 HYDROGEN STORAGE SYSTEM: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.7 OTHERS

7.7.1 INITIATIVES BY KEY PLAYERS TO IMPROVE PERFORMANCE

TABLE 26 OTHER COMPONENTS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 27 OTHER COMPONENTS: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.8 KEY INDUSTRY INSIGHTS

8 FUEL CELL POWERTRAIN MARKET, BY DRIVE TYPE (Page No. - 99)

8.1 INTRODUCTION

8.1.1 OPERATIONAL DATA

TABLE 28 TOP OEM FUEL CELL MODELS AND DRIVE TYPES

8.1.2 ASSUMPTIONS

8.2 FRONT-WHEEL DRIVE (FWD) POWERTRAIN

8.3 REAR-WHEEL DRIVE (RWD) POWERTRAIN

8.4 ALL-WHEEL DRIVE (AWD) POWERTRAIN

8.5 KEY INDUSTRY INSIGHTS

9 FUEL CELL POWERTRAIN MARKET, BY POWER OUTPUT (Page No. - 101)

9.1 INTRODUCTION

FIGURE 41 MARKET, BY POWER OUTPUT, 2022 VS. 2027

TABLE 29 MARKET, BY POWER OUTPUT, 2018–2021 (UNITS)

TABLE 30 MARKET, BY POWER OUTPUT, 2022–2027 (UNITS)

9.1.1 OPERATIONAL DATA

TABLE 31 POWER OUTPUT OF FUEL CELL VEHICLE MODELS

9.1.2 ASSUMPTIONS

9.1.3 RESEARCH METHODOLOGY

9.2 <150 KW

9.2.1 GROWING DEMAND FOR FUEL CELL PASSENGER CARS

TABLE 32 <150 KW: MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 33 <150 KW: MARKET, BY REGION, 2022–2027 (UNITS)

9.3 150--250 KW

9.3.1 INCREASING USE OF HEAVY-DUTY TRUCKS AND BUSES

TABLE 34 150–250 KW: MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 35 150–250 KW: MARKET, BY REGION, 2022–2027 (UNITS)

9.4 >250 KW

9.4.1 HIGH POWER DEMAND IN COMMERCIAL VEHICLES

TABLE 36 >250 KW: MARKET, BY REGION, 2022–2027 (UNITS)

9.5 KEY INDUSTRY INSIGHTS

10 FUEL CELL POWERTRAIN MARKET, BY VEHICLE TYPE (Page No. - 108)

10.1 INTRODUCTION

FIGURE 42 MARKET, BY VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 37 MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 38 MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

10.1.1 OPERATIONAL DATA

TABLE 39 TOP OEM FUEL CELL MODELS AND VEHICLE TYPES

10.1.2 ASSUMPTIONS

10.1.3 RESEARCH METHODOLOGY

10.2 PASSENGER CARS

10.2.1 INCREASING ENVIRONMENTAL CONCERNS WILL DRIVE SEGMENT

TABLE 40 PASSENGER CARS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 41 PASSENGER CARS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 LCV

10.3.1 MAXIMUM USE OF LCV FOR GOODS TRANSFER

TABLE 42 LCV: MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 43 LCV: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 TRUCKS

TABLE 44 OVERVIEW OF WEIGHT CLASSES

TABLE 45 MASS DIFFERENCE BETWEEN BASELINE VEHICLE AND FUEL CELL TRUCK VERSION

TABLE 46 DEMONSTRATION PROJECTS/DEPLOYMENT OF FUEL CELL TRUCKS

TABLE 47 POWERTRAIN BENCHMARKING FOR TRUCKS >12 TONS

10.4.1 HEAVY LOAD TRANSPORT OF GOODS AND MATERIALS WILL BOOST DEMAND

TABLE 48 TRUCKS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 TRUCKS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 BUSES

TABLE 50 EXAMPLES OF BUS DEPLOYMENT PROJECTS

TABLE 51 POTENTIAL MARKET FOR NEW ZERO-EMISSION BUSES PER YEAR ACROSS EUROPE FROM 2022

10.5.1 DEVELOPMENT OF FUEL CELL POWERTRAIN FOR PUBLIC TRANSPORT OPERATORS

TABLE 52 BUSES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 53 BUSES: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 KEY INDUSTRY INSIGHTS

11 FUEL CELL POWERTRAIN MARKET, BY H2 FUEL STATION (Page No. - 120)

11.1 INTRODUCTION

11.2 RESEARCH METHODOLOGY

TABLE 54 AUTOMOTIVE HYDROGEN FUEL STATIONS AS OF DECEMBER 2021

TABLE 55 FUTURE PLANS FOR AUTOMOTIVE HYDROGEN FUEL STATIONS, 2019–2050 (UNITS)

FIGURE 43 MARKET, BY H2 FUEL STATION, 2022 VS. 2027 (UNITS)

11.2.1 RAPID DEVELOPMENTS IN FCEV AND EMISSION NORMS

TABLE 56 H2 STATIONS: MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 57 H2 STATIONS: MARKET, BY REGION, 2022–2027 (UNITS)

11.3 ASIA OCEANIA

11.3.1 JAPAN AND SOUTH KOREA TO PLAY KEY ROLE IN ASIA OCEANIA

TABLE 58 ASIA OCEANIA: H2 STATIONS MARKET, BY COUNTRY, 2018–2021 (UNITS)

TABLE 59 ASIA OCEANIA: H2 STATIONS MARKET, BY COUNTRY, 2022–2027 (UNITS)

11.4 EUROPE

11.4.1 GOVERNMENT POLICIES AND FUNDING BOOST H2 STATIONS IN EUROPE

TABLE 60 EUROPE: H2 STATIONS MARKET, BY COUNTRY, 2018–2021 (UNITS)

TABLE 61 EUROPE: H2 STATIONS MARKET, BY COUNTRY, 2022–2027 (UNITS)

11.5 NORTH AMERICA

11.5.1 DEVELOPMENTS IN FUEL CELL TECHNOLOGY TO BE FOCUSED ON CALIFORNIA

TABLE 62 NORTH AMERICA: H2 STATIONS MARKET, BY COUNTRY, 2018–2021 (UNITS)

TABLE 63 NORTH AMERICA: H2 STATIONS MARKET, BY COUNTRY, 2022–2027 (UNITS)

11.6 KEY INDUSTRY INSIGHTS

12 FUEL CELL POWERTRAIN MARKET, BY REGION (Page No. - 129)

12.1 INTRODUCTION

FIGURE 44 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

TABLE 64 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 65 MARKET, BY REGION, 2022–2027 (USD MILLION)

12.2 ASIA OCEANIA

FIGURE 45 ASIA OCEANIA: MARKET SNAPSHOT

TABLE 66 ASIA OCEANIA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 67 ASIA OCEANIA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.2.1 CHINA

TABLE 68 CHINA: TARGETS, VISIONS, AND PROJECTIONS

TABLE 69 CHINA: FUEL CELL POWERTRAIN PROJECTS

TABLE 70 CHINA: MARKET - POLICIES AND REGULATIONS

12.2.1.1 Increased R&D in China will boost market growth

TABLE 71 CHINA: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 72 CHINA: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.2.2 JAPAN

TABLE 73 JAPAN: TARGETS, VISIONS, AND PROJECTIONS

TABLE 74 JAPAN: FUEL CELL POWERTRAIN PROJECTS

TABLE 75 JAPAN: MARKET - POLICIES AND REGULATIONS

12.2.2.1 Government initiatives for fuel cell vehicle development

TABLE 76 JAPAN: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 77 JAPAN: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.2.3 SOUTH KOREA

TABLE 78 SOUTH KOREA: TARGETS, VISIONS, AND PROJECTIONS

FIGURE 46 SOUTH KOREA: PLANNED GOVERNMENT FUNDING FOR AUTOMOTIVE FUEL CELL, 2018–2021 (USD MILLION)

FIGURE 47 SOUTH KOREA: TARGET NUMBER OF FUEL CELL VEHICLES (2015–2040)

TABLE 79 SOUTH KOREA: MARKET - POLICIES AND REGULATIONS

12.2.3.1 Passenger cars segment estimated to be largest

TABLE 80 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 81 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.2.4 AUSTRALIA

12.2.4.1 Government investment in research and infrastructure

TABLE 82 AUSTRALIA: MARKET, BY VEHICLE TYPE, 2022–2027 (USD THOUSAND)

12.3 EUROPE

TABLE 83 EUROPE: RELEVANT EXPERIENCE/PRODUCTS OF OEMS

TABLE 84 EUROPE: TARGETS, VISIONS, AND PROJECTIONS

FIGURE 48 EUROPE: MARKET, 2022 VS. 2027 (USD MILLION)

TABLE 85 EUROPEAN UNION (EU): FUEL CELL POWERTRAIN PROJECTS

TABLE 86 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD THOUSAND)

TABLE 87 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.3.1 FRANCE

TABLE 88 FRANCE: FUEL CELL POWERTRAIN PROJECTS

TABLE 89 FRANCE: MARKET - POLICIES AND REGULATIONS

12.3.1.1 French market driven by government initiatives and funding

TABLE 90 FRANCE: MARKET, BY VEHICLE TYPE, 2018–2021 (USD THOUSAND)

TABLE 91 FRANCE: MARKET, BY VEHICLE TYPE, 2022–2027 (USD THOUSAND)

12.3.2 GERMANY

TABLE 92 GERMANY: FUEL CELL POWERTRAIN PROJECTS

TABLE 93 GERMANY: MARKET - POLICIES AND REGULATIONS

12.3.2.1 Fast-paced development of hydrogen infrastructure

TABLE 94 GERMANY: MARKET, BY VEHICLE TYPE, 2018–2021 (USD THOUSAND)

TABLE 95 GERMANY: MARKET, BY VEHICLE TYPE, 2022–2027 (USD THOUSAND)

12.3.3 ITALY

TABLE 96 ITALY: FUEL CELL POWERTRAIN PROJECTS

TABLE 97 ITALY: MARKET - POLICIES AND REGULATIONS

12.3.3.1 Focus on electrification of vehicles

TABLE 98 ITALY: MARKET, BY VEHICLE TYPE, 2018–2021 (USD THOUSAND)

TABLE 99 ITALY: MARKET, BY VEHICLE TYPE, 2022–2027 (USD THOUSAND)

12.3.4 NETHERLANDS

TABLE 100 NETHERLANDS: FUEL CELL POWERTRAIN PROJECTS

TABLE 101 NETHERLANDS: MARKET - POLICIES AND REGULATIONS

12.3.4.1 Government investments boost Dutch fuel cell powertrain market

TABLE 102 NETHERLANDS: MARKET, BY VEHICLE TYPE, 2018–2021 (USD THOUSAND)

TABLE 103 NETHERLANDS: MARKET, BY VEHICLE TYPE, 2022–2027 (USD THOUSAND)

12.3.5 NORWAY

TABLE 104 NORWAY: FUEL CELL POWERTRAIN PROJECTS

TABLE 105 NORWAY: MARKET - POLICIES AND REGULATIONS

12.3.5.1 Buses segment projected to grow fastest

TABLE 106 NORWAY: MARKET, BY VEHICLE TYPE, 2018–2021 (USD THOUSAND)

TABLE 107 NORWAY: MARKET, BY VEHICLE TYPE, 2022–2027 (USD THOUSAND)

12.3.6 SWEDEN

TABLE 108 SWEDEN: FUEL CELL POWERTRAIN PROJECTS

12.3.6.1 EU emission reduction goals will drive market

TABLE 109 SWEDEN: MARKET, BY VEHICLE TYPE, 2018–2021 (USD THOUSAND)

TABLE 110 SWEDEN: MARKET, BY VEHICLE TYPE, 2022–2027 (USD THOUSAND)

12.3.7 BELGIUM

TABLE 111 BELGIUM: FUEL CELL POWERTRAIN PROJECTS

TABLE 112 BELGIUM: MARKET - POLICIES AND REGULATIONS

12.3.7.1 Reforms and government initiatives can boost market

TABLE 113 BELGIUM: MARKET, BY VEHICLE TYPE, 2018–2021 (USD THOUSAND)

TABLE 114 BELGIUM: MARKET, BY VEHICLE TYPE, 2022–2027 (USD THOUSAND)

12.3.8 DENMARK

TABLE 115 DENMARK: FUEL CELL POWERTRAIN PROJECTS

12.3.8.1 Denmark to be key market for adoption of fuel cell buses

TABLE 116 DENMARK: MARKET, BY VEHICLE TYPE, 2018–2021 (USD THOUSAND)

TABLE 117 DENMARK: MARKET, BY VEHICLE TYPE, 2022–2027 (USD THOUSAND)

12.3.9 SPAIN

TABLE 118 SPAIN: FUEL CELL POWERTRAIN PROJECTS

TABLE 119 SPAIN: MARKET - POLICIES AND REGULATIONS

12.3.9.1 Government plans and investments propel Spanish market

TABLE 120 SPAIN: MARKET, BY VEHICLE TYPE, 2018–2021 (USD THOUSAND)

TABLE 121 SPAIN: MARKET, BY VEHICLE TYPE, 2022–2027 (USD THOUSAND)

12.3.10 SWITZERLAND

TABLE 122 SWITZERLAND: FUEL CELL POWERTRAIN PROJECTS

12.3.10.1 Trucks segment projected to hold significant market share

TABLE 123 SWITZERLAND: MARKET, BY VEHICLE TYPE, 2018–2021 (USD THOUSAND)

TABLE 124 SWITZERLAND: MARKET, BY VEHICLE TYPE, 2022–2027 (USD THOUSAND)

12.3.11 UK

TABLE 125 UK: FUEL CELL POWERTRAIN PROJECTS

TABLE 126 UK: MARKET - POLICIES AND REGULATIONS

12.3.11.1 Use of fuel cell double-deck buses likely to boost market

TABLE 127 UK: MARKET, BY VEHICLE TYPE, 2018–2021 (USD THOUSAND)

TABLE 128 UK: MARKET, BY VEHICLE TYPE, 2022–2027 (USD THOUSAND)

12.4 NORTH AMERICA

FIGURE 49 NORTH AMERICA: MARKET SNAPSHOT

TABLE 129 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 130 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.4.1 CANADA

TABLE 131 CANADA: FUEL CELL POWERTRAIN PROJECTS

TABLE 132 CANADA: MARKET - POLICIES AND REGULATIONS

12.4.1.1 Presence of leading fuel cell suppliers

TABLE 133 CANADA: MARKET, BY VEHICLE TYPE, 2018–2021 (USD THOUSAND)

TABLE 134 CANADA: MARKET, BY VEHICLE TYPE, 2022–2027 (USD THOUSAND)

12.4.2 MEXICO

12.4.2.1 Limited hydrogen infrastructure for market growth

TABLE 135 MEXICO: MARKET, BY VEHICLE TYPE, 2022–2027 (USD THOUSAND)

12.4.3 US

TABLE 136 US: TARGETS, VISIONS, AND PROJECTIONS

TABLE 137 US: FUEL CELL POWERTRAIN PROJECTS

TABLE 138 US: MARKET - POLICIES AND REGULATIONS

12.4.3.1 Trucks segment projected to grow fastest

TABLE 139 US: MARKET, BY VEHICLE TYPE, 2018–2021 (USD THOUSAND)

TABLE 140 US: MARKET, BY VEHICLE TYPE, 2022–2027 (USD THOUSAND)

13 COMPETITIVE LANDSCAPE (Page No. - 202)

13.1 OVERVIEW

13.2 MARKET SHARE ANALYSIS, 2021

FIGURE 50 FUEL CELL POWERTRAIN MARKET SHARE ANALYSIS, 2021

13.3 REVENUE ANALYSIS OF TOP FIVE PLAYERS

FIGURE 51 TOP FIVE PLAYERS DOMINATED MARKET FROM 2017 TO 2021

13.4 COMPETITIVE SCENARIO

TABLE 141 NEW PRODUCT DEVELOPMENTS

TABLE 142 DEALS

TABLE 143 OTHERS

13.5 COMPETITIVE LEADERSHIP MAPPING

13.5.1 STARS

13.5.2 EMERGING LEADERS

13.5.3 PERVASIVE PLAYERS

13.5.4 PARTICIPANTS

FIGURE 52 FUEL CELL POWERTRAIN MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

13.6 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 53 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MARKET

13.7 BUSINESS STRATEGY EXCELLENCE

FIGURE 54 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN FUEL CELL POWERTRAIN MARKET

14 COMPANY PROFILES (Page No. - 221)

(Business Overview, Products Offered, Recent Developments, MnM view, Key strengths/right to win, Strategic choices made, Weaknesses and competitive threats)*

14.1 KEY PLAYERS

14.1.1 CUMMINS INC.

TABLE 144 CUMMINS INC.: BUSINESS OVERVIEW

FIGURE 55 CUMMINS INC.: COMPANY SNAPSHOT

TABLE 145 CUMMINS INC.: PRODUCTS OFFERED

TABLE 146 CUMMINS INC.: NEW PRODUCT DEVELOPMENTS

TABLE 147 CUMMINS INC.: DEALS

TABLE 148 CUMMINS INC.: OTHERS

14.1.2 BALLARD POWER SYSTEMS

TABLE 149 BALLARD POWER SYSTEMS: BUSINESS OVERVIEW

FIGURE 56 BALLARD POWER SYSTEMS: COMPANY SNAPSHOT

TABLE 150 BALLARD POWER SYSTEMS: PRODUCTS OFFERED

TABLE 151 BALLARD POWER SYSTEMS: NEW PRODUCT DEVELOPMENTS

TABLE 152 BALLARD POWER SYSTEMS: DEALS

14.1.3 ROBERT BOSCH GMBH

TABLE 153 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

FIGURE 57 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

TABLE 154 ROBERT BOSCH GMBH: PRODUCTS OFFERED

TABLE 155 ROBERT BOSCH GMBH: DEALS

14.1.4 DENSO CORPORATION

TABLE 156 DENSO CORPORATION: BUSINESS OVERVIEW

FIGURE 58 DENSO CORPORATION: COMPANY SNAPSHOT

TABLE 157 DENSO CORPORATION: PRODUCTS OFFERED

TABLE 158 DENSO CORPORATION: DEALS

14.1.5 FEV EUROPE GMBH

TABLE 159 FEV EUROPE GMBH: BUSINESS OVERVIEW

TABLE 160 FEV EUROPE GMBH: PRODUCTS OFFERED

TABLE 161 FEV EUROPE GMBH: OTHERS

14.1.6 FCP FUEL CELL POWERTRAIN GMBH

TABLE 162 FCP FUEL CELL POWERTRAIN GMBH: BUSINESS OVERVIEW

TABLE 163 FCP FUEL CELL POWERTRAIN GMBH: PRODUCTS OFFERED

14.1.7 ITM POWER

TABLE 164 ITM POWER: BUSINESS OVERVIEW

FIGURE 59 ITM POWER: COMPANY SNAPSHOT

TABLE 165 ITM POWER: PRODUCTS OFFERED

TABLE 166 ITM POWER: DEALS

TABLE 167 ITM POWER: OTHERS

14.1.8 CERES POWER

TABLE 168 CERES POWER: BUSINESS OVERVIEW

FIGURE 60 CERES POWER: COMPANY SNAPSHOT

TABLE 169 CERES POWER: PRODUCTS OFFERED

TABLE 170 CERES POWER: NEW PRODUCT DEVELOPMENTS

TABLE 171 CERES POWER: DEALS

14.1.9 DELPHI TECHNOLOGIES

TABLE 172 DELPHI TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 173 DELPHI TECHNOLOGIES: PRODUCTS OFFERED

14.1.10 AVL LIST GMBH (AVL)

TABLE 174 AVL LIST GMBH: BUSINESS OVERVIEW

TABLE 175 AVL LIST GMBH: PRODUCTS OFFERED

TABLE 176 AVL LIST GMBH: DEALS

14.1.11 SHANGHAI FUEL CELL VEHICLE POWERTRAIN CO., LTD.

TABLE 177 SHANGHAI FUEL CELL VEHICLE POWERTRAIN CO., LTD.: BUSINESS OVERVIEW

TABLE 178 SHANGHAI FUEL CELL VEHICLE POWERTRAIN CO., LTD.: PRODUCTS OFFERED

14.1.12 PLUG POWER

TABLE 179 PLUG POWER: BUSINESS OVERVIEW

FIGURE 61 PLUG POWER: COMPANY SNAPSHOT

TABLE 180 PLUG POWER: PRODUCTS OFFERED

TABLE 181 PLUG POWER: NEW PRODUCT DEVELOPMENTS

TABLE 182 PLUG POWER: DEALS

TABLE 183 PLUG POWER: OTHERS

14.1.13 NUVERA FUEL CELLS

TABLE 184 NUVERA FUEL CELLS: BUSINESS OVERVIEW

TABLE 185 NUVERA FUEL CELLS: PRODUCTS OFFERED

TABLE 186 NUVERA FUEL CELLS: NEW PRODUCT DEVELOPMENTS

TABLE 187 NUVERA FUEL CELLS: DEALS

14.1.14 NEDSTACK

TABLE 188 NEDSTACK: BUSINESS OVERVIEW

TABLE 189 NEDSTACK: PRODUCTS OFFERED

TABLE 190 NEDSTACK: DEALS

14.1.15 DOOSAN CORPORATION

TABLE 191 DOOSAN CORPORATION: BUSINESS OVERVIEW

FIGURE 62 DOOSAN CORPORATION: COMPANY SNAPSHOT

TABLE 192 DOOSAN CORPORATION: PRODUCTS OFFERED

TABLE 193 DOOSAN CORPORATION: DEALS

TABLE 194 DOOSAN CORPORATION: OTHERS

14.1.16 PROTON POWER SYSTEM

TABLE 195 PROTON POWER SYSTEM: BUSINESS OVERVIEW

FIGURE 63 PROTON POWER SYSTEM: COMPANY SNAPSHOT

TABLE 196 PROTON POWER SYSTEM: PRODUCTS OFFERED

TABLE 197 PROTON POWER SYSTEM: DEALS

TABLE 198 PROTON POWER SYSTEM: OTHERS

14.1.17 DANA INCORPORATED

TABLE 199 DANA INCORPORATED: BUSINESS OVERVIEW

FIGURE 64 DANA INCORPORATED: COMPANY SNAPSHOT

TABLE 200 DANA INCORPORATED: PRODUCTS OFFERED

TABLE 201 DANA INCORPORATED: DEALS

14.2 OTHER KEY PLAYERS

14.2.1 HYUNDAI KEFICO CORPORATION

TABLE 202 HYUNDAI KEFICO CORPORATION: BUSINESS OVERVIEW

14.2.2 PANASONIC

TABLE 203 PANASONIC: BUSINESS OVERVIEW

14.2.3 TORAY INDUSTRIES

TABLE 204 TORAY INDUSTRIES: BUSINESS OVERVIEW

14.2.4 SUNRISE POWER CO., LTD.

TABLE 205 SUNRISE POWER CO., LTD.: BUSINESS OVERVIEW

14.2.5 INTELLIGENT ENERGY

TABLE 206 INTELLIGENT ENERGY: BUSINESS OVERVIEW

14.2.6 POWERCELL SWEDEN AB

TABLE 207 POWERCELL SWEDEN AB: BUSINESS OVERVIEW

14.2.7 SYMBIO

TABLE 208 SYMBIO: BUSINESS OVERVIEW

14.2.8 ELRINGKLINGER AG

TABLE 209 ELRINGKLINGER AG: BUSINESS OVERVIEW

14.2.9 SWISS HYDROGEN POWER

TABLE 210 SWISS HYDROGEN POWER: BUSINESS OVERVIEW

14.2.10 DAIMLER

TABLE 211 DAIMLER: BUSINESS OVERVIEW

14.2.11 FUEL CELL SYSTEM MANUFACTURING LLC.

TABLE 212 FUEL CELL SYSTEM MANUFACTURING LLC.: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 280)

15.1 KEY INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

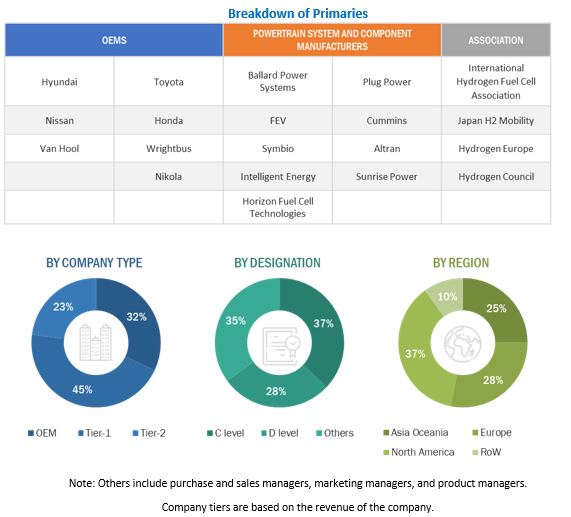

The study involved four major activities in estimating the current size of the fuel cell powertrain market. Extensive primary research was conducted after obtaining an understanding of the market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand- [(in terms of fuel cell vehaicle manufacturers) country-level government associations, and trade associations] and supply-side (fuel cell powertrain system and component providers) across major regions, namely, North America, Europe, and Asia Oceania.

Secondary Research

The secondary sources referred to for this research study include corporate filings (such as annual reports, investor presentations, and financial statements), trade, business, and professional associations, whitepapers and automotive fuel cell and fuel cell powertrain -related journals, certified publications, articles from recognized authors, directories, and databases. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research. Secondary resources considered for fuel cell includes Alternative Fuels Data Center (AFDC), Automotive Electronics Council (AEC) , California Fuel Cell Partnership (CFCP), California Hydrogen Business Council (CHBC), Canadian Hydrogen Fuel Cell Association (CHFCA), and other Country-level Automotive Associations.

Primary Research

Extensive primary research was conducted after obtaining an understanding of the fuel cell powertrain market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand- [(in terms of fuel cell vehicle manufacturers) country-level government associations, and trade associations] and supply-side (fuel cell powertrain system and component providers) across major regions, namely, North America, Europe, and Asia Oceania. Approximately 45% and 55% of primary interviews were conducted from the demand and supply side, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and marketing, to provide a holistic viewpoint in the report.

After interacting with industry experts, we also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter expert opinions, led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the size of the fuel cell powertrain market. Country-level sales of each vehicle type (passenger cars, LCV, trucks, and buses) were derived through secondary research and primary insights. The sales of FCEVs at the country level are multiplied with the respective ASP of the powertrain to derive the market size, by vehicle type, at the country level. Data from country level, regional level, and global electric vehicle and fuel cell electric vehicles is used to derive the sales of fuel cell electric vehicles at the country level. The database collected by secondary research is verified with the help of extensive primary research. The summation of the country-levelmarket is carried out to derive the regional level market. Further, the summation of the regional level market is carried out to derive the global market size.

Data Triangulation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified by primary sources. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Report Objectives

- To define, describe, and forecast the size of the fuel cell powertrain market, in terms of value (USD million and USD thousand) and volume (units)

- To define, describe, anxmod forecast the size of the market based on component, drive type, power output, vehicle type, H2 fuel station, and region

- To segment and forecast the market size, by component (fuel cell system, battery system, hydrogen storage system, drive system, and others)

- To segment and forecast the market size, by drive type [rear-wheel drive (RWD), front-wheel drive (FWD), and all-wheel drive (AWD)]

- To segment and qualitatively cover the following power outputs: <150 kW, 150-250 kW, and >250kW

- To cover the market by vehicle type (passenger cars, LCV, trucks, and buses)

-

To segment and forecast the market size, by H2 fuel station (Asia Oceania, Europe, and

North America) - To segment and forecast the market size, by region (Asia Oceania, Europe, and North America)

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the market

- To analyze the ranking of key players operating in the market

- To understand the dynamics of competitors in the market and distinguish them into visionary leaders, innovators, emerging companies, and dynamic differentiators according to their product portfolio strength and business strategies

- To track and analyze competitive developments, such as new product launches, deals and other developments by key players

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To analyze and forecast the trends and orientation for market in the global industry.

- To strategically profile key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with the company’s specific needs.

- Fuel cell powertrain Market, By components at the regional level

- Fuel cell powertrain Market, By vehicle type at country level

Company Information

- Profiling of Additional Market Players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Fuel Cell Powertrain Market