Planar Solid Oxide Fuel Cell Market by Cost Breakdown (Planar Cells, Separator Plates, Manifolds, Seals, and Others), Application (Stationary, Transportation, and Portable) & by Region (Asia-Pacific, North America, Europe, and Rest of the world) - Global Trends & Forecast to 2020

[147 Pages Report] The planar solid oxide fuel cell (SOFC) is a high-temperature electrochemical device that converts chemical energy to electrical energy. Unlike other fuel cells, the electrolyte used in SOFC is solid in form, which enables design and fabrication in various forms and shapes. Planar SOFC is a subtype of SOFC wherein the cell is a sandwich structure arranged in stacks, as opposed to the tubular SOFC, which is tubular in shape.

This technology is witnessing rapid commercialization owing to its advantages over other fuel cells. These advantages include low power losses and high transformation efficiency compared to conventional power generation. Major application areas of planar SOFC are stationary power generation, transportation, portable device, military applications such as unmanned aircraft and underwater vehicles, and auxiliary power units for armored and transport vehicles.

The planar SOFC market which has been projected to reach a value of $ 639.2 Million in 2020 is segmented on the basis of application, cost breakdown, and region. On the basis of application, the market has been segmented into stationary, portable, and transportation.

Planar SOFC is suitable for a wide variety of applications, which ensures sizable growth opportunities in almost all major countries in the world. The current commercial market is limited to a few major regions, with the technology still in the research phase in most regions. Large multinational companies and reputed research organizations all over the world, especially in North America, Europe, and Asia-Pacific, are currently conducting R&D on planar SOFC.

Various factors such as availability of many varieties of fuels; high conversion efficiency compared to other fuel types such as biogas, tubular SOFC; and advantages which includes small stationary, large stationary, transportation, and portable & military applications driving the planar SOFC market globally. However, the market has been restrained by high capital investment and longer start up time.

The report profiles leading players in the planar SOFC market, along with their recent developments and other strategic industry activities. These players include Aisin Seiki Corporation Limited (Japan), Delphi (U.S.), Ultra Electronics AMI (U.K.), Fuel Cell Energy (Houston, U.S.), and Ceramic Fuel Cells Limited (Australia). Ceres Power Holdings (U.K.) is currently the market leader.

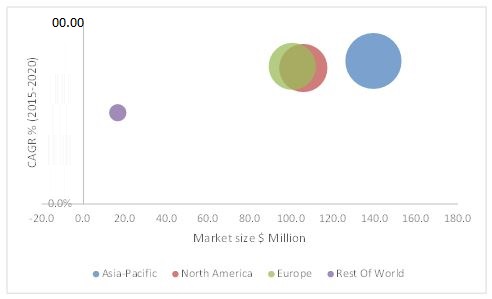

Asia-Pacific is expected to be a lucrative market with an estimated market size, by value, of $139.4 Million in 2015 and a projected value of $ 251.7Million in 2020.

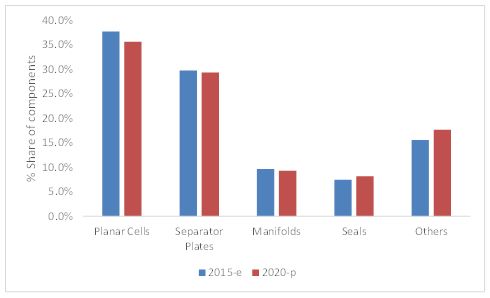

Planar SOFC Market Size, by Cost Breakdown, 2015 & 2020 ($Million)

Source: Press Releases and MarketsandMarkets Analysis

The planar SOFC market has also been analyzed with respect to Porter's Five Forces model. The value chain analysis of the planar SOFC market consists of an analysis of the process through which the material and associated components form the final product that reaches the end-user.

The report also describes the competitive landscape of major market players, including new product developments, mergers & acquisitions, facility expansion, agreements & collaborations, and contracts. Key developments have been identified for major market players to determine the growth strategies implemented by them. The report also classifies and defines the market size, by value, of planar SOFC and its parent market. Additionally, the study provides a comprehensive review of the major market drivers, restraints, opportunities, winning imperatives, and key burning issues in the planar SOFC market.

Scope of the Report:

The global planar SOFC market size, in terms of value ($million), has been analyzed as follows:

By Cost Breakdown

- Planar SOFC

- Separator Plates

- Manifolds

- Seals

- Others

By Application

- Portable

- Stationary

- Transportation

By Region

- Asia-Pacific

- North America

- Europe

- Rest of the World

The global planar solid oxide fuel cell (SOFC) market is expected to grow at a CAGR of 12.0% from 2015 to 2020. Increasing R&D expenditure for commercializing planar SOFC technology and growing support for alternative power generation technologies from governments across the world are some of the key drivers of the global planar SOFC market.

The demand for electricity is increasing in developed nations in North America and Europe as well as in fast-growing economies in Asia-Pacific. This has resulted in significant investments being made in developing alternative power generating technologies to improve the electrical power distribution infrastructure. Transmission and distribution losses in existing networks, constantly varying load patterns, and the growing inclination towards distributed generation are boosting the demand for planar SOFC. Planar SOFC has emerged as a viable option to help solve the above-mentioned issues.

The global planar SOFC market is segmented based on cost breakdown into planar cells, separator plates, manifolds, seals, and other components. The market has been segmented on the basis of application into stationary, transportation, and portable. Regions considered are Asia-Pacific, North America, Europe, and Rest of World (RoW), and information regarding key countries in each region, such as Japan, South Korea, the U.S., the U.K., and Germany has been provided.

This report offers a detailed analysis of key companies and a competitive analysis of developments recorded in the industry in the past three years. Market drivers, restraints, opportunities, burning issues, and industry trends have been discussed in detail. Leading players in the market, such as Bloom Energy (U.S.), Aisin Seiki (Japan), Fuel Cell Energy Inc. (U.S.), and Ceramic Fuel Cell Ltd. (Australia) have been profiled.

Planar SOFC Market Size, by Region 2015-2020 ($Million)

Source: Company Annual Reports, Press Releases, Secondary Research, and MarketsandMarkets Analysis,

E-Estimated, Bubble Size=Projected Market Size in 2020

Asia-Pacific is estimated to be the largest market for planar SOFC in the world in 2015, and is expected to retain its dominance till 2020. Key players are entering into various contracts and agreements (including joint ventures, collaborations, and partnerships) to increase their presence in the market. Leading companies are expanding in rapidly growing markets such as Asia-Pacific, North America, and Europe through new sales and service facilities and expansion of manufacturing capacity.

Asia-Pacific is also projected to emerge as the fastest-growing market during the forecast period, registering a CAGR of 12.5%. It is followed by North America, which is set to grow at a CAGR of 11.9%. Europe and the RoW are expected to register CAGRs of 12.1% and 8.0% respectively during the forecast period.

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Markets Scope

1.3.1 Year Considered for the Study

1.3.2 Currency

1.4 Limitation

1.5 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Secondary Data

2.1.1 Key Data From Secondary Sources

2.2 Primary Data

2.2.1 Key Data From Primary Sources

2.2.2 Breakdown of Primary Interviews

2.2.3 Key Industry Insights

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Planar SOFC Market Overview

4.2 Asia-Pacific: The Fastest Growing Market in the Coming Years for Planar SOFC

4.3 Stationary Application Dominate the Planar SOFC Market By Applications

4.4 Top Regions in the Planar SOFC Market

4.5 Japan to Dominate the Planar SOFC Market

4.6 Planar Cells is Expected to Lead the Planar SOFC Market By Component During the Forecast Period

4.7 Life Cycle Analysis

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Evolution

5.3 Market Segmentation

5.3.1 By Component

5.3.2 By Application

5.3.3 By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Wide Variety of Fuel Compatibility Makes Them More Versatile Systems for Power Generation

5.4.1.2 Highest Conversion Efficiency Enables Faster Return on Investments

5.4.1.3 Suitable for Wide Variety of Applications

5.4.1.4 Biomass Utilization Makes Them Highly Lucrative Technology

5.4.2 Restraints

5.4.2.1 High Capital Investment is the Key Issue

5.4.2.2 Longer Start-Up Time Limits Full Scale Adoption

5.4.3 Opportunities

5.4.3.1 Combined Heat & Power(CHP)Applications has Highest Conversion Efficiency

5.4.3.2 SOFC Based Auxiliary Power Units in Transportation Applications

5.4.3.3 Application of Planar SOFC for Cathodic Protection in Oil & Gas Pipelines

5.4.3.4 Growing Concerns Over Emissions From Conventional Power Generation Methods

5.4.4 Challenges

5.4.4.1 Low Cost Commercial Manufacturing

5.4.4.2 Operating Stability at High Temperaturesh

6 Industry Trends (Page No. - 46)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.3.1 Key Influencers

6.4 Industry Trends

6.5 Porter’s Five Forces Analysis

6.5.1 Threat of New Entrants

6.5.2 Threat of Substitutes

6.5.3 Bargaining Power of Suppliers

6.5.4 Bargaining Power of Buyers

6.5.5 Intensity of Competitive Rivalry

7 Planar SOFC Market, By Component (Page No. - 53)

7.1 Introduction

7.2 Planar Cell

7.3 Separator Plate

7.4 Manifold

7.5 Seal

7.6 Other Components

8 Planar SOFC Market, By Application (Page No. - 58)

8.1 Introduction

8.2 Stationary

8.3 Transportation

8.4 Portable

9 Planar SOFC Market, By Region (Page No. - 63)

9.1 Introduction

9.2 Planar SOFC Key Markets

9.3 Asia-Pacific

9.4 Asia-Pacific Market By Application

9.5 Asia-Pacific Market By Component

9.5.1 Asia-Pacific: Planar SOFC Market Size, By Planar Cell

9.5.2 Asia-Pacific: Planar SOFC Market Size, By Separator Plate

9.5.3 Asia-Pacific: Planar SOFC Market Size, By Manifold

9.5.4 Asia-Pacific: Planar SOFC Market Size, By Seal

9.5.5 Asia-Pacific: Planar SOFC Market Size, By Other Components

9.6 Asia-Pacific Planar SOFC Component Market, By Country

9.6.1 Japan

9.6.2 South Korea

9.6.3 China

9.6.4 India

9.6.5 Australia

9.6.6 Rest of Asia-Pacific

9.7 North America

9.8 North America Market By Application

9.9 North America Market By Component

9.9.1 North America: Planar SOFC Market Size, By Planar Cell

9.9.2 North America: Planar SOFC Market Size, By Separator Plate

9.9.3 North America: Planar SOFC Market Size, By Manifold

9.9.4 North America: Planar SOFC Market Size, By Seal

9.9.5 North America: Planar SOFC Market Size, By Other Components

9.10 North America Planar SOFC Component Market, By Country

9.10.1 U.S.

9.10.2 Canada

9.10.3 Mexico

9.11 Europe

9.12 Europe Market By Application

9.13 Europe Market By Component

9.13.1 Europe: Planar SOFC Market Size, By Planar Cell

9.13.2 Europe: Planar SOFC Market Size, By Separator Plate

9.13.3 Europe: Planar SOFC Market Size, By Manifold

9.13.4 Europe: Planar SOFC Market Size, By Seal

9.13.5 Europe: Planar SOFC Market Size, By Other Components

9.14 Europe Planar SOFC Component Market, By Country

9.14.1 U.K.

9.14.2 Germany

9.14.3 Rest of Europe

9.15 Rest of the World

9.16 Rest of the World Market By Application

9.17 Rest of World Market By Component

9.17.1 Rest of the World: Planar SOFC Market Size, By Planar Cell

9.17.2 Rest of the World: Planar SOFC Market Size, By Separator Plate

9.17.3 Rest of the World: Planar SOFC Market Size, By Manifold

9.17.4 Rest of the World: Planar SOFC Market Size, By Seal

9.17.5 Rest of the World: Planar SOFC Market Size, By Other Components

9.18 Rest of the World Planar SOFC Component Market, By Country

9.18.1 Brazil

9.18.2 South Africa

9.18.3 Turkey

9.18.4 Other Countries in RoW

10 Competitive Landscape (Page No. - 98)

10.1 Overview

10.2 Market Share Analysis

10.3 Competitive Situation & Trends

10.4 Market Evolution Framework

10.5 Partnerships/Agreement/Collaborations

10.6 New Product Development

10.7 Mergers & Acquisitions

10.8 Expansion

10.9 Other Developments

11 Company Profiles (Page No. - 107)

11.1 Introduction

11.2 Aisin Seiki Corporation Limited

11.3 Delphi

11.4 Fuel Cell Energy

11.5 Ceramic Fuel Cells Limited

11.6 Ultra Electronics

11.7 Ceres Power Holdings PLC.

11.8 Accumentrics Corporation

11.9 Bloom Energy Corporation

11.10 Convion Fuel Cells Ltd.

11.11 Hexis AG

11.12 SOFC Power S.P.A.

11.13 Staxera Sunfire Gmbh

11.14 Topsoe Fuel Cell

11.15 Protonex Technology Corporation

11.16 Watt Fuel Cell Corporation

12 Appendix (Page No. - 140)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Introducing RT: Real Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

List of Tables (70 Tables)

Table 1 Wide Variety of Fuel Compatibility, High Electrical Efficiency, Versatility in Applications and Biomass Utilization are Propelling the Growth of the Planar SOFC Market

Table 2 High Initial Investment and Longer Startup Time Restrain Market Growth

Table 3 Stationary Power Generation and Comined Heat & Power Applications are the Most Lucrative Opportunities for Planar SOFC Market

Table 4 Low Cost Manufacturing is the Biggest Challenge

Table 5 Planar SOFC Market Size, By Component, 2013-2020 ($Million)

Table 6 Planar Cell: Global Planar SOFC Market Size, By Region, 2013-2020 ($Million)

Table 7 Separator Plate: Global Planar SOFC Market Size, By Region, 2013-2020 ($Million)

Table 8 Manifold: Global Planar SOFC Market Size, By Region, 2013-2020 ($Million)

Table 9 Seal: Global Planar SOFC Market Size, By Region, 2013-2020 ($Million)

Table 10 Other Components: Global Planar SOFC Market Size, By Region, 2013-2020 ($Million)

Table 11 SOFC Applications, By Rated Power

Table 12 Planar SOFC Market Size, By Application, 2013–2020 ($Million)

Table 13 Stationary Application: Planar SOFC Market Size, By Region, 2013–2020 ($Million)

Table 14 Transportation Application: Planar SOFC Market Size, By Region, 2013-2020 ($Million)

Table 15 Portable Application: Planar SOFC Market Size, By Region, 2013-2020 ($Million)

Table 16 Planar SOFC Market Size, By Region, 2013-2020 ($Million)

Table 17 Japan, U.S. and Germany to Lead the Planar SOFC Market During 2015 -2020

Table 18 Asia-Pacific: Planar SOFC Market Size, By Country, 2013-2020 ($Million)

Table 19 Asia-Pacific: Planar SOFC Market Size, By Application, 2013–2020 ($Million)

Table 20 Asia-Pacific: Planar SOFC Market Size, By Component, 2013-2020 ($Million)

Table 21 Planar Cell: Asia-Pacific Planar SOFC Market Size, By Country, 2013-2020 ($Million)

Table 22 Separator Plate: Asia-Pacific Planar SOFC Market Size, By Country, 2013-2020 ($Million)

Table 23 Manifold: Asia-Pacific Planar SOFC Market Size, By Country, 2013-2020 ($Million)

Table 24 Seal: Asia-Pacific Planar SOFC Market Size, By Country, 2013-2020 ($Million)

Table 25 Other Components: Asia-Pacific Planar SOFC Market Size, By Country, 2013-2020 ($Million)

Table 26 Japan: Planar SOFC Market Size, By Component, 2013-2020 ($Million)

Table 27 South Korea: Planar SOFC Market Size, By Component, 2013-2020 ($Million)

Table 28 China: Planar SOFC Market Size, By Component, 2013-2020 ($Million)

Table 29 India: Planar SOFC Market Size, By Component, 2013-2020 ($Million)

Table 30 Australia: Planar SOFC Market Size, By Component, 2013-2020 ($Million)

Table 31 Rest of Asia-Pacific: Planar SOFC Market Size, By Component, 2013-2020 ($Million)

Table 32 North America: Planar SOFC Market Size, By Country, 2013-2020 ($Million)

Table 33 North America: Planar SOFC Market Size, By Application, 2013–2020 ($Million)

Table 34 North America: Planar SOFC Market Size, By Component, 2013-2020 ($Million)

Table 35 Planar Cell: North America Planar SOFC Market Size, By Country, 2013-2020 ($Million)

Table 36 Separator Plate: North America Planar SOFC Market Size, By Country, 2013-2020 ($Million)

Table 37 Manifold: North America Planar SOFC Market Size, By Country, 2013-2020 ($Million)

Table 38 Seal: North America Planar SOFC Market Size, By Country, 2013-2020 ($Million)

Table 39 Other Components: North America Planar SOFC Market Size, By Country, 2013-2020 ($Million)

Table 40 U.S.: Planar SOFC Market Size, By Component, 2013-2020 ($Million)

Table 41 Canada: Planar SOFC Market Size, By Component, 2013-2020 ($Million)

Table 42 Mexico: Planar SOFC Market Size, By Component, 2013-2020 ($Million)

Table 43 Europe: Planar SOFC Market Size, By Country, 2013-2020 ($Million)

Table 44 Europe: Planar SOFC Market Size, By Application, 2013–2020 ($Million)

Table 45 Europe: Planar SOFC Market Size, By Component, 2013-2020 ($Million)

Table 46 Planar Cell: Europe Planar SOFC Market Size, By Country, 2013-2020 ($Million)

Table 47 Separator Plate: Europe Planar SOFC Market Size, By Country, 2013-2020 ($Million)

Table 48 Manifold: Europe Planar SOFC Market Size, By Country, 2013-2020 ($Million)

Table 49 Seal: Europe Planar SOFC Market Size, By Country, 2013-2020 ($Million)

Table 50 Other Components: Europe Planar SOFC Market Size, By, 2013-2020 ($Million)

Table 51 U.K.: Planar SOFC Market Size, By Component, 2013-2020 ($Million)

Table 52 Germany: Planar SOFC Market Size, By Component, 2013-2020 ($Million)

Table 53 Rest of Europe: Planar SOFC Market Size, By Component, 2013-2020 ($Million)

Table 54 Rest of the World: Planar SOFC Market Size, By Country, 2013-2020 ($Million)

Table 55 Rest of World: Planar SOFC Market Size, By Application, 2013–2020 ($Million)

Table 56 Rest of the World: Planar SOFC Market Size, By Component, 2013-2020 ($Million)

Table 57 Planar Cell: Rest of the World Planar SOFC Market Size, By Country, 2013-2020 ($Million)

Table 58 Separator Plate: Rest of the World Planar SOFC Market Size, By Country, 2013-2020 ($Million)

Table 59 Manifold: Rest of the World Planar SOFC Market Size, By Country, 2013-2020 ($Million)

Table 60 Seal: Rest of the World Planar SOFC Market Size, By Country, 2013-2020 ($Million)

Table 61 Other Components: Rest of the World Planar SOFC Market Size, By, 2013-2020 ($Million)

Table 62 Brazil: Planar SOFC Market Size, By Component, 2013-2020 ($Million)

Table 63 South Africa: Planar SOFC Market Size, By Component, 2013-2020 ($Million)

Table 64 Turkey: Planar SOFC Market Size, By Component, 2013-2020 ($Million)

Table 65 Other Countries in RoW: Planar SOFC Market Size, By Component, 2013-2020 ($Million)

Table 66 Partnerships/Agreement/Collaborations, 2011-2015

Table 67 New Product Development, 2011-2015

Table 68 Mergers & Acquisitions, 2013-2015

Table 69 Expansions, 2014-2015

Table 70 Other Developments, 2011-2013

List of Figures (46 Figures)

Figure 1 Markets Covered: Planar SOFC Market

Figure 2 Planar SOFC Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, & Region

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Estimation Approach & Data Triangulation Methodology

Figure 7 Planar SOFC Market Snapshot (2015 vs 2020): Asia-Pacific to Lead the Market During the Next Five Years

Figure 8 Global Planar SOFC Market By Component , 2015–2020

Figure 9 Global Planar SOFC Market By Applications, 2015-2020

Figure 10 Global Planar SOFC Market, By Region, 2014

Figure 11 Fuel Flexibility, High Conversion Efficiency to Drive the Planar SOFC Market During the Forecast Period

Figure 12 Asia-Pacific is the Fastest Growing Region for Planar SOFC Systems From 2015 to 2020

Figure 13 Stationary Applications to Lead the Planar SOFC Market During 2015-2020

Figure 14 Japan and U.S. are the Top Two Regions in the Planar SOFC Market During 2015-2020

Figure 15 Japan’s Dominance in Asia-Pacific During 2015

Figure 16 Planar Cells Segment to Lead the Market By Component

Figure 17 Asia Pacific,North America and Europe to Enter Growth Phase During Forecast Period

Figure 18 Metallic Interconnects for Stable Low Temperature Operation is Increasingly Becoming A Part of Planar SOFC

Figure 19 Market Segmentation of Planar SOFC

Figure 20 Segmentation of the Planar SOFC Market, By Component

Figure 21 Segmentation of the Planar SOFC Market, By Application

Figure 22 Segmentation of the Planar SOFC Market, By Region

Figure 23 Market Dynamics of Planar SOFC

Figure 24 Value Chain: Major Value Addition Occurs During Manufacturing & Assembling Phase

Figure 25 Supply Chain Analysis of Planar SOFC

Figure 26 High-Efficiency & Low-Emissions to Drive the Global Planar SOFC Market

Figure 27 Porter’s Five Forces Analysis:

Figure 28 Snapshot 2014: Planar Cells Accounted for the Largest Market Share

Figure 29 Global Snapshot: Stationary Applications Segment Dominates in the Planar SOFC Market

Figure 30 Regional Snapshot: Developed Regions are Growth Markets for Planar SOFC

Figure 31 Japan– An Attractive Destination for Planar SOFC

Figure 32 Companies Adopted Partnerships/Agreements/Collaborations as the Key Growth Strategy in the Past Three Years

Figure 33 Global Planar SOFC Market Share (Value), By Key Player, 2014

Figure 34 Partnership/Agreements/Collaborations, New Product Developments, and Mergers & Acquisitions Have Fuelled the Growth of Companies From 2011 T0 2015

Figure 35 Geographic Revenue Mix of the Top 5 Market Players

Figure 36 Aisin Seiki Corporation Limited: Company Snapshot

Figure 37 SWOT Analysis: Aisin Seiki Corporation Ltd.

Figure 38 Delphi: Company Snapshot

Figure 39 SWOT Analysis: Delphi

Figure 40 Fuel Cell Energy: Compnay Snapshot

Figure 41 SWOT Analysis: Fuel Cell Energy

Figure 42 Ceramic Fuel Cells Limited: Company Snapshot

Figure 43 SWOT Analysis: Ceramic Fuel Cells Limited

Figure 44 Ultra Electronics: Company Snapshot

Figure 45 Ceres Power Holdings PLC: Company Snapshot

Figure 46 SWOT Analysis: Bloom Energy Corporation

Growth opportunities and latent adjacency in Planar Solid Oxide Fuel Cell Market