EV Charging Station Market Size, Share & Analysis

EV Charging Station Market by Application, Level of Charging, Charging Point, Charging Infrastructure, Operation, DC Fast Charging, Charge Point Operator, Connection Phase, Service, Installation, and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global EV charging station market is expected to grow from USD 28.46 billion in 2025 to USD 76.31 billion by 2032 at a CAGR of 15.1%. The EV charging station market is growing quickly with strong government support and private investments in infrastructure. Fast charging networks are expanding, and OEMs are partnering with providers to improve accessibility.

KEY TAKEAWAYS

-

BY CHARGING INFRASTRUCTURE TYPECCS and Type 2 are becoming global standards, NACS is gaining traction in North America, while CHAdeMO chargers are losing relevance.

-

BY CHARGING POINT TYPEDC fast and ultra-fast are growing faster in public and highway networks.

-

BY DC FAST CHARGING TYPEThe market is shifting toward higher-power fast and ultra-fast charging, with slow DC declining in relevance.

-

BY LEVEL OF CHARGINGLevel 2 is widely adopted, Level 3 is expanding the fastest for quick turnaround, and Level 1 is declining due to slow charging speeds for public charger use cases.

-

BY REGIONChina leads the EV charging station market with large-scale rollouts. The European market is growing strongly due to strict emission targets and cross-border fast-charging corridors.

-

COMPETITIVE LANDSCAPEABB leads the EV charging station market for CPMs, followed by ChargePoint and EVBox. Shell plc leads the market for CPOs, followed by TotalEnergies among others. Key players are expanding their product portfolios, increasing their charging station network, and collaborating with OEMs and other companies in the ecosystem to address evolving charging solution needs.

The EV charging station market is evolving with strong OEM-led investments, large-scale urban network rollouts, and integration into smart city infrastructure. Ultra-fast DC charging is scaling to match advanced EV capabilities, while fleet electrification and battery swapping in Asia are diversifying access models. These developments strengthen infrastructure readiness and support the transition to a sustainable transportation ecosystem.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The market’s revenue mix is evolving, moving from chargers, installation, and maintenance to new growth areas. Rising EV adoption and faster charging demand are driving revenue from ultrafast chargers, smart charging solutions, subscription services, and energy management offerings.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Financial incentives offered by governments to promote charging networks

-

Advancements in battery chemistry improving driving range

Level

-

High capital investment for ultrafast charging infrastructure

-

Underdeveloped power infrastructure for EV charging

Level

-

Adoption of IoT-enabled smart charging networks

-

Expansion of Charging-as-a-Service (CaaS) business model

Level

-

Cost gap between ICE vehicles and EVs

-

Low utilization rates and profitability challenges for CPOs

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Financial incentives offered by governments to promote charging networks

Rising EV demand accelerates charging infrastructure growth, supported by government subsidies, national targets, and private investments. Countries are funding large-scale rollouts, while innovations in fast, wireless, and smart charging are advancing adoption. Collaboration across policy, technology, and renewables remains key to scaling the ecosystem.

Restraint: High capital investment required for ultrafast charging infrastructure

Ultrafast EV chargers, reaching 80% in 20-30 minutes, face high costs in low-traffic or remote areas. Limited usage challenges profitability, but dynamic pricing, partnerships, and renewable energy can help. Rising EV adoption in urban and busy corridors makes these stations a strong long-term investment.

Opportunity: Adoption of IoT-enabled smart charging networks

OEMs link vehicles and EV chargers with smartphones and IoT for better operation. Smart chargers enable real-time monitoring, load management, and payments while reducing downtime and grid stress. IoT tracks usage, adjusts speeds, and controls access, boosting efficiency and reliability. This shift cuts costs and supports grid stability.

Challenge: Cost gap between ICE vehicles and Evs

High EV costs, driven by batteries, chargers, and installation, can slow adoption and limit demand for charging infrastructure, affecting operator profitability. Falling battery prices and production efficiencies, along with government incentives, are reducing these barriers and supporting wider EV uptake.

EV Charging Station Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

On-site charging at workplaces and tenant parking (Commercial Wall Connector) | Improves tenant satisfaction, supports ESG goals |

|

Charging for fleets and commercial properties, chargers at retail locations to attract EV customers | Lowers TCO, increases station utilization, increases foot traffic, adds revenue stream |

|

Fleet depot and public fast charging (e.g. modular high-power) | Scalability, reliability, and modular upgrade support |

|

Integrated charging and energy management | Enhances energy efficiency, supports smart grid integration |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The EV charging station ecosystem includes manufacturers, operators, payment processors, mapping providers, and OEMs. Key players like ABB, BYD, EVBox, ChargePoint, and Tesla hold the major market share. OEMs such as Hyundai, Renault, GM, and Toyota are focusing on fleet electrification and decarbonization.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

EV Charging Station Market, By Level of Charging

Level 3 chargers are expected to see the fastest growth due to their ability to charge EVs in under an hour, significantly reducing downtime for consumers and fleet operators. This demand is fueled by longer EV ranges, growing public charging needs, and supportive government policies. Key players like ABB are innovating with scalable Level 3 solutions, including megawatt systems for heavy-duty vehicles.

EV Charging Station Market, By Charging Infrastructure Type

Tesla Superchargers dominate North America, while Type 2 chargers lead in Europe. CCS is growing moderately as top manufacturers adopt it, with most European cars supporting CCS sockets. CHAdeMO chargers, popular with Nissan, Mitsubishi, and Kia, are slowing down in adoption across Europe and North America, and GB/T leads due to China’s high level 3 charging demand.

EV Charging Station Market, By Charging Point Type

AC chargers dominate the market due to their lower cost and widespread installation in homes and workplaces. However, DC chargers are expected to capture the majority market share over the forecast period, driven by faster charging speeds, growing demand for ultrafast charging, and increasing adoption in public and high-traffic locations. This shift is supported by expanding EV adoption and infrastructure upgrades.

EV Charging Station Market, By DC Fast Charging Type

The DC ultrafast 1 charging type is expected to hold the largest market share over the forecast period due to its established presence and compatibility with most EVs. Meanwhile, the DC ultrafast 2 type is set for the fastest growth, driven by increasing demand for rapid charging, network expansion in high-traffic corridors, and adoption by new EV models supporting higher power levels.

REGION

China to be the largest region in global EV charging station market during forecast period

China is set to remain the largest EV charging market by 2032, with strong government support and rapid EV adoption driving demand. The country predominantly uses GB/T chargers, while DC fast charging is expanding quickly. BYD’s 1,000 kW supercharging plans, Huawei’s rollout of 100,000 ultrafast stations, and the Mercedes-Benz–BMW JV targeting 7,000 stations by 2026 highlight aggressive infrastructure growth. However, utilization rates at networks like StarCharge remain low, signaling challenges in efficiency despite large-scale expansion.

EV Charging Station Market: COMPANY EVALUATION MATRIX

In the EV charging station market matrix, Tesla (Star) leads with a strong market presence and extensive charging network, driving large-scale adoption across passenger and commercial EVs. Delta Electronics Inc. (Emerging Leader) is gaining momentum with new fast and smart charging solutions and strategic partnerships. It shows strong growth potential to advance toward the stars quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 28.46 Billion |

| Market Forecast in 2032 (Value) | USD 76.31 Billion |

| Growth Rate | CAGR of 15.1% from 2025-2032 |

| Years Considered | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | China, Asia Pacific, Europe, North America, Middle East, and Rest of the World |

WHAT IS IN IT FOR YOU: EV Charging Station Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Tier 1 EV infrastructure provider planning network expansion | EV charging station market sizing, segmentation by charger type, and regional demand forecast | Identified high-potential locations and optimal charger mix for deployment, enabling efficient network planning |

| Fleet operator planning depot electrification | Fleet charging infrastructure sizing and cost-benefit modeling | Optimized energy use, reduced operational costs, streamlined logistics |

| Automotive OEM assessing fleet electrification strategy | Analysis of public vs private charging infrastructure and integration with OEM vehicles | Provided insights on charger compatibility, utilization patterns, and strategic partnerships for fleets |

| Municipal authority planning public EV infrastructure | City-level EV adoption forecast, grid capacity mapping, and fast-charging station requirements | Supported regulatory compliance, grid stability, and optimized station placement to maximize utilization |

| DC charging provider planning for MCS charger development | Technology roadmap assessment, competitor activity scan, and heavy-duty EV adoption outlook | Guided product roadmap with clear visibility on megawatt charging demand and competitive positioning |

| European EV charging operator planning for LATAM entry | Regional EV adoption trends, policy landscape, and infrastructure readiness study | Enabled market entry planning with clarity on high-growth LATAM countries and partnership opportunities |

RECENT DEVELOPMENTS

- April 2025 : ChargePoint announced new AC Level 2 charging technology. This architecture features bidirectional charging, V2X capability, ultra-fast charging speeds of 19.2 kW in North America and 22 kW in Europe, and more. This architecture will target various models in North America and Europe within commercial, residential, and fleet applications.

- March 2025 : BYD launched its Super e-Platform featuring megawatt flash charging technology, capable of 1,000 kW charging power and a 2 km/second peak charging speed. This launch includes an all-liquid-cooled Megawatt Flash Charging terminal system, and plans are to establish over 4,000 Megawatt Flash Charging stations in China.

- December 2024 : ChargePoint and General Motors announced a collaboration to install up to 500 ultra-fast EV charging ports across strategic US locations by the end of 2025. These GM Energy-branded stations will feature ChargePoint’s Express Plus platform (up to 500kW) and Omni Port technology, supporting both CCS and NACS connectors to enhance nationwide EV charging accessibility.

- February 2024 : Tesla announced that its supercharger network had been adopted as the North America Charging Standard (NACS). The company further announced that major automakers such as GM (US), Honda (Japan), and more will transition to using NACS as a charging format by 2025.

- February 2024 : Raizen Power and BYD partnered to accelerate sustainable electric mobility in Brazil. The initiative aims to significantly expand the public network of electric chargers, providing 100% clean and renewable energy and enhancing the recharging experience for users. Raízen Power, aiming for a 25% market share in Brazil's electromobility sector, will install approximately 600 new DC charge points, contributing an additional 18 MW of installed power for nationwide EV recharging.

Table of Contents

Methodology

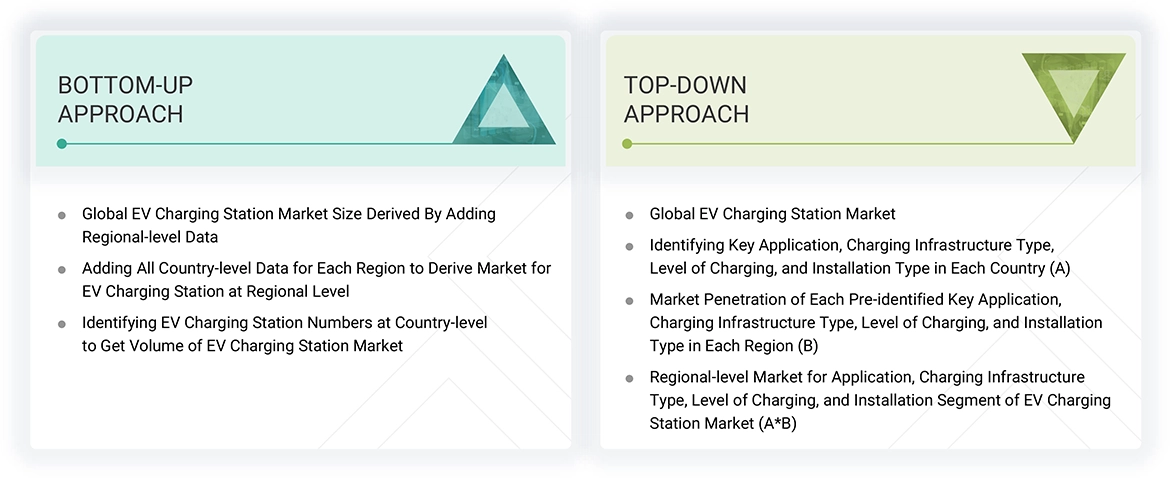

The study involved four major activities in estimating the current size of the EV charging station market. Exhaustive secondary research was done to collect information on the market, the peer market, and the child markets. The next step was to validate these findings and assumptions and size them with industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, European Alternative Fuels Observatory (EAFO), European Automobile Manufacturers' Association (ACEA), China Association of Automobile Manufacturers (CAAM), International Organization of Motor Vehicle Manufacturers (OICA), Electrical Vehicle Charging Association (EVCA), National Highway Traffic Safety Administration (NHTSA), International Energy Association (IEA)], articles, directories, technical handbooks, trade websites, technical articles, and databases (for example, Marklines, and Factiva) have been used to identify and collect information useful for an extensive commercial study of the global EV charging station market.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the EV charging station market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand (OEMs) and supply sides (EV charging station manufacturers, service providers, and component manufacturers) across major regions: North America, Europe, the Middle East, Asia Pacific, and the Rest of the World. Approximately 24% and 76% of primary interviews were conducted from the demand and supply sides, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews.

In the canvassing of primaries, various departments within organizations, such as sales, operations, and marketing, were covered to provide a holistic viewpoint in the report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from primaries. This, along with in-house subject matter experts’ opinions, led to the findings described in the remainder of this report.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

EV Charging Station Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

EV charging station is electrical equipment used to charge plug-in electric vehicles. This equipment can charge an electric vehicle in 6-20 hours for normal charging (Level 1 & Level 2 charging) and approximately 15-60 minutes for fast/supercharging (Level 3 charging). EVs have different charging requirements and can be used with the required chargers. They allow the conversion of current for the vehicle to be easily charged and set up at homes, semi-public places, public charging stations, and a portable charging system.

Stakeholders

- Associations, Forums, and Alliances related to EV Charging Stations

- Utility Companies

- Oil & Gas Companies

- Automobile Manufacturers

- Battery Distributors

- Battery Manufacturers

- Charging Infrastructure Providers

- Charging Service Providers

- Energy Storage Companies

- Environmental Groups

- EV Charging Pole Manufacturers

- EV Charging Network Operators

- EV Charging Station Service Providers

- EV Component Manufacturers

- EV Distributors and Retailers

- EV Manufacturers

- Electric Utilities and Grid Operators

- Electrical Contractors

- Government Agencies and Policymakers

- Property Owners

Report Objectives

To define, describe, and forecast the EV charging station market based on level of charging, charging service type, charge point operator, charging infrastructure type, charging point type, installation type, connection phase, application, DC fast charging type, operation, and region

- To segment and forecast the market size by volume (thousand units) and value (USD million) based on the level of charging (Level 1, Level 2, Level 3)

- To segment and forecast the market size by volume (thousand units) based on application (private, semi-public, public)

- To segment and forecast the market size by volume (thousand units) based on charging point type (AC charging, DC charging)

- To segment and forecast the market size by volume (thousand units) based on charging infrastructure type (CCS, CHAdeMO, Type 1, NACS, GB/T Fast, Type 2)

- To provide qualitative insights on electric bus charging type (off-board top-down pantographs, onboard bottom-up pantographs, charging via connectors)

- To provide qualitative insights on charging service type (EV charging services, battery swapping services)

- To segment and forecast the market size by volume (thousand units) based on charge point operator (Asia Pacific, Europe, North America)

- To segment and forecast the market size by volume (thousand units) based on installation type (portable chargers, fixed chargers)

- To segment and forecast the market size by volume (thousand units) based on DC fast charging type (slow DC, fast DC, DC ultrafast 1, DC ultrafast 2)

- To segment and forecast the market size by volume (thousand units) based on operation (Mode 1, Mode 2, Mode 3, Mode 4)

- To segment and forecast the market size by volume (thousand units) based on connection phase (single phase, three phase)

-

To forecast the market size with respect to key regions, namely, China, Asia Pacific, Europe, North America, Middle East, and Rest of the World

- To provide detailed information regarding the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze the market with respect to individual growth trends, prospects, and contributions to the total market

- To study the following with respect to the market

- Value Chain Analysis

- Ecosystem Analysis

- Technology Analysis

- Case Study Analysis

- Patent Analysis

- Tariff & Regulatory Landscape

- Average Selling Price Analysis

- Buying Criteria

- Impact of AI

- Investment and Funding Scenario

- Trends and Disruptions Impacting Customer Business

- Bill of Materials

- Evolution of EV Charging

- Opportunities in EV Charging

- Future of Charging

- Key Stakeholders and Buying Criteria

- Performance Indicators for EV Charging

-

Power Booster in Charging Systems

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as deals, product developments, and other activities carried out by key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with company-specific needs.

- Further breakdown for the EV charging station market, by charging level, at the country level (for countries covered in the report)

- Further breakdown of the EV charging station market, by DC charging type, at the country level (for countries covered in the report)

Company Information

- Profiles of additional market players (up to five)

Key Questions Addressed by the Report

What is the current size of the global EV charging station market?

The global EV charging station market is projected to grow from USD 28.47 billion in 2025 to USD 76.31 billion by 2032 at a CAGR of 15.1%.

Who are the winners in the global EV charging station market?

The EV charging station market is dominated by major CPOs, including ABB (Switzerland), EVBox (Netherlands), BYD Company Ltd. (China), ChargePoint, Inc. (US), Tesla (US), and Charge Point Operators, including bp (UK), Shell (UK), ENGIE (France), and Total Energies (France).

Which would be the largest market for EV charging stations?

China is projected to be the largest market for EV charging stations due to strong government mandates, including NEV quotas and national targets, coupled with rapid urban electrification and rising EV penetration.

Which country is expected to have a significant demand for EV charging stations in Europe?

Germany is projected to be a significant market for EV charging stations due to the developments in charging technologies and various favorable policies. The country has high R&D capability and can stay ahead of most countries in terms of EV charging station technology. Also, the deployment of chargers with 400 kW capacity has drastically reduced wait times, which addresses one of the key friction points in EV adoption.

What are the key market trends impacting the growth of the EV charging station market?

Megawatt charging system (MCS), integration of renewable energy with energy storage systems, induction charging, Vehicle-to-Grid (V2G), and wireless charging are the key market trends or technologies that will have a major impact on the EV charging station market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the EV Charging Station Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in EV Charging Station Market

James

Jun, 2022

I would like to know more about the investments and policies expected to help boost the growth of the electric vehicle charging station market.

Jason

Dec, 2022

The global electric vehicle charging station market size is projected to grow from 2,354 thousand units in 2022 to 14,623 thousand units by 2027, at a CAGR of 44.1. Factors such as rising sales of EVs around the world, along with the growing demand for zero-emission transport will boost the demand for the electric vehicle charging station market. Developments in technologies like portable charging stations, bi-directional charging, smart charging with load management, usage-based analytics, and automated payment, and the development of ultra-fast charging technology will create new opportunities for this market..

Leon

Dec, 2022

This is a brand-new study published couple e of weeks ago and the report covers the industry statistics considering the actual sales volumes and revenue for the year 2021 as the base year data to estimate and forecast the market to 2027. Yes, we have covered the post-COVID19 impact analysis and Supply Chain disruption of the market and also since we track the EV market, we have drawn parallels from the EV sales growth report to estimate the growth rates for the EVSE market..