Solid-State Transformer Market by Voltage Level (HV/MV, MV/LV), Application (Renewable Power Generation, Automotive, Power Grids, Traction Locomotives, and Others), and Region (North America, APAC, Europe, and RoW) - Global Forecast to 2030

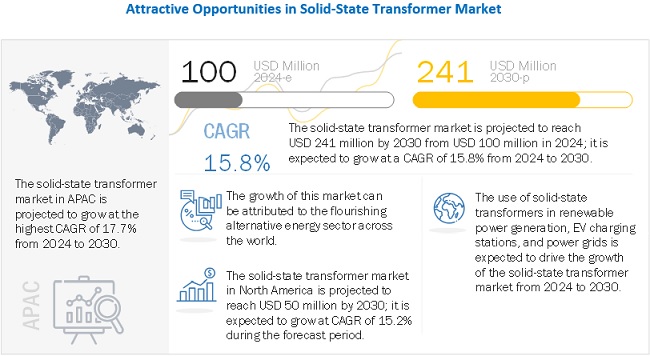

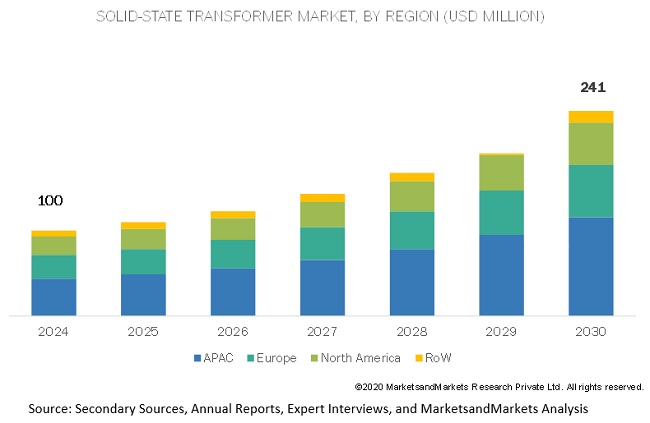

According to Industry Research Firm MarketsandMarkets™, The Solid-State Transformer Market Size is poised to expand substantially, projecting a surge from USD 100 million in 2024 to USD 241 million by 2030, registering a CAGR of 15.8% from 2024 to 2030.

One of the primary growth drivers of this market is the escalating adoption of alternative energy, coupled with rising investments in smart grids and energy systems.

To know about the assumptions considered for the study, Request for Free Sample Report

“Solid-state transformer market for MV/LV to grow at a higher CAGR during forecast period”

The market for MV/LV is expected to grow at a higher CAGR during the forecast period. This growth can be attributed to the increasing number of EVs being launched in the market,governments of different countries worldwide are jointly investing in the development of EV charginginfrastructures to tackle global warming, resulting from the combustion of fuels in vehicles. Automotive companies worldwide are investing in research, development, and launch of EVs. These vehicles have started to acquire a considerable share in the global market and are expected to replace combustion engine vehicles in coming years. Thus, the increased demand for EVs is expected to contribute to the rise in EV charging infrastructures. China has the largest number of EV stations in the world. According to the Electric Vehicle Charging Infrastructure Promotion Alliance, the country had 1.2 million stations in 2019 and is planning to increase this count by 600,000 by the end of 2020. The country plans to invest USD 1.5 billion for developing EV infrastructures by the end of 2020. Similar investments are being carried out globally, especially in APAC, thus creating promising opportunities for the growth of the MV/LV solid-state transformer market during the forecast period.

“Solid-state transformer market for renewable power generation application is expected to grow at highest CAGR during forecast period”

The market for renewable power generation application is expected to capture the highest CAGR during the forecast period. The high growth rate can be attributed to the expected early adoption of these transformers for power generation from wind, solar, and tidal energy. Wind, sun, and tides are alternative sources of energy for power generation; they have the potential to cater to the ever-increasing global requirement of energy, along with reducing the carbon footprint. Wind energy is a key contributor to the power generated from the alternative sources of energy, while APAC is a leader in this field. A typical wind energy farm has an induction generator coupled with a wind turbine to convert mechanical energy to electrical energy. The energy generated is further transferred by a step-up transformer to STATCOMs. It is then fed to a grid. The step-up transformer increases the voltage level, while the STATCOM improves the power factor of the electricity generated. Though conventional systems (step-up transformers and STATCOMs) are cost-effective solutions, solid-state transformers can be instrumental in playing the role of both step-up transformers and STATCOMs with improved reactive power compensation. This, in turn, is expected to lead to increased use of solid-state transformers for wind energy production.

To know about the assumptions considered for the study, download the pdf brochure

Solid State Transformer Market Report Scope:

|

Report Metric |

Details |

| Estimated Market Size | 100 Million |

| Projected Market Size | 241 Million |

| Growth Rate | CAGR of 15.8% |

|

Market size available for years |

2024–2030 |

|

On Demand Data Available |

2030 |

|

Report Coverage |

|

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

|

| Key Market Driver | Growing Alternative Energy Sector |

| Largest Growing Region | Asia Pacific (APAC) |

| Largest Market Share Segment | HV/MV Segment |

| Highest CAGR Segment | EV Segment |

This research report segments the solid-state transformer market based on voltage level, application, and geography.

By Voltage Level:

- HV/MV

- MV/LV

By Application

-

Renewable Power Generation

- Wind Power

- Solar Power

- Tidal Power

- Automotive

- Power Grids

- Traction Locomotives

- Others

By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific (APAC)

- China

- Japan

- India

- Rest of APAC

-

Rest of the World (RoW)

- Middle East and Africa

- South America

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for solid-state transformer market during 2024-2030?

The solid-state transformer market is expected to record the CAGR of 15.8% during 2024-2030.

Which are the drivers and opportunities influencing the growth of the solid-state transformer market?

Growing alternative energy sector are the drivers influencing the growth of solid-state transformer market.

Solid-state transformer market of which voltage level would account for the larger share of market in 2024?

HV/MV is expected to account for the majority of the solid-state transformer market share in 2024.

Who are the significant players expected to operate in solid-state transformer market?

Hitachi, Schneider Electric, Siemens, Mitsubishi Electric, General Electric are some of the major companies expected to operate in the solid-state transformer market.

How is the solid-state transformer market segment?

The solid-state transformer market has been segmented on the basis of voltage level, applications , and region.s .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

1.4.2 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 27)

2.1 RESEARCH DATA

FIGURE 1 SOLID-STATE TRANSFORMER MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of key secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key data from primary sources

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size using bottom-up analysis

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size using bottom-up analysis

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 4 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 5 ASSUMPTION FOR RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 36)

FIGURE 6 HV/MV SEGMENT TO ACCOUNT FOR LARGE SHARE OF SOLID-STATE TRANSFORMER MARKET IN 2024

FIGURE 7 RENEWABLE POWER GENERATION SEGMENT OF MARKET TO GROW AT HIGHEST CAGR FROM 2024 TO 2030

FIGURE 8 MARKET IN APAC TO GROW AT HIGHEST CAGR FROM 2024 TO 2030

4 PREMIUM INSIGHTS (Page No. - 39)

4.1 ATTRACTIVE OPPORTUNITIES IN SOLID-STATE TRANSFORMER MARKET

FIGURE 9 GROWTH OF ALTERNATIVE ENERGY SECTOR TO FUEL GLOBAL DEMAND FOR SOLID-STATE TRANSFORMERS

4.2 MARKET, BY VOLTAGE LEVEL

FIGURE 10 HV/MV SEGMENT TO ACCOUNT FOR LARGE SIZE OF MARKET FROM 2024 TO 2030

4.3 MARKET, BY INDUSTRY AND REGION

FIGURE 11 RENEWABLE POWER GENERATION SEGMENT AND APAC TO ACCOUNT FOR LARGEST SHARES OF MARKET IN 2024

4.4 MARKET, BY GEOGRAPHY

FIGURE 12 CHINA ESTIMATED TO HOLD LARGEST SHARE OF MARKET IN 2024

5 MARKET OVERVIEW (Page No. - 42)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 13 SOLID-STATE TRANSFORMER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing alternative energy sector

FIGURE 14 GLOBAL ALTERNATIVE ENERGY PRODUCTION OUTLOOK (TERAWATT-HOURS)

TABLE 1 GLOBAL INSTALLED WIND ENERGY CAPACITY (GIGAWATT)

5.2.1.2 Increasing investments in smart grids and energy systems

TABLE 2 KEY SMART GRID INVESTMENT INITIATIVES

FIGURE 15 DRIVERS OF SOLID-STATE TRANSFORMER MARKET AND THEIR IMPACTS

5.2.2 RESTRAINTS

5.2.2.1 High initial costs of solid-state transformers

5.2.2.2 Reluctance of power companies to replace aging energy infrastructures

5.2.2.3 Global industrial slowdown due to COVID-19

FIGURE 16 RESTRAINTS OF MARKET AND THEIR IMPACTS

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing adoption of electric vehicles and traction locomotives

5.2.3.2 Upcoming smart city projects in developing regions

FIGURE 17 OPPORTUNITIES OF MARKET AND THEIR IMPACTS

5.2.4 CHALLENGES

5.2.4.1 Trade-off between efficiency, reliability, and ultra-high voltage application of solid-state transformers

FIGURE 18 CHALLENGES OF MARKET AND THEIR IMPACTS

5.3 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDITION DURING MANUFACTURING/ASSEMBLY STAGES

5.4 ECOSYSTEM

FIGURE 20 SOLID-STATE TRANSFORMER MARKET: ECOSYSTEM

5.5 PORTER’S FIVE FORCES ANALYSIS

TABLE 3 IMPACT OF EACH FORCE ON MARKET

5.6 CASE STUDY

5.6.1 USE CASE 1: FUTURE RENEWABLE ELECTRIC ENERGY DELIVERY AND MANAGEMENT SYSTEM—FREEDM SYSTEM

5.6.2 USE CASE 2: HIGHLY EFFICIENT AND RELIABLE SMART TRANSFORMER-HEART PROJECT

5.7 TECHNOLOGY ANALYSIS

5.7.1 SMART GRID

5.7.2 ARTIFICIAL INTELLIGENCE IN WIND POWER GENERATION

5.8 PRICING ANALYSIS

5.9 TRADE ANALYSIS

TABLE 4 IMPORT DATA, 2015–2019 (USD MILLION)

TABLE 5 EXPORT DATA, 2015–2019 (USD MILLION)

5.10 PATENT ANALYSIS

5.11 REGULATORY LANDSCAPE

TABLE 6 AMENDED ENERGY CONSERVATION STANDARDS FOR LOW-VOLTAGE DRY-TYPE DISTRIBUTION TRANSFORMERS

6 COMPONENTS USED IN SOLID-STATE TRANSFORMERS (Page No. - 57)

6.1 INTRODUCTION

6.2 CONVERTERS

6.2.1 AC TO DC CONVERTERS

FIGURE 21 AC TO DC CONVERTER CIRCUIT DIAGRAM

6.2.2 DC TO AC CONVERTERS

6.2.3 DC TO DC CONVERTERS

6.3 SWITCHES

6.3.1 SIC POWER MOSFETS

6.3.2 POWER DIODES

6.3.3 INSULATED-GATE BIPOLAR TRANSISTORS

6.4 HIGH-FREQUENCY TRANSFORMERS

6.5 OTHERS

6.5.1 HIGH-VOLTAGE INDUCTORS

6.5.2 HIGH-VOLTAGE CAPACITORS

6.5.3 HIGH-VOLTAGE RESISTORS

6.6 SOLID-STATE TRANSFORMER ARCHITECTURE

6.6.1 SSTI-BLOCK

6.6.2 SSTBLOCK

7 CLASSIFICATION OF SOLID-STATE TRANSFORMERS (Page No. - 61)

7.1 INTRODUCTION

7.2 POWER STAGES

7.2.1 ONE STAGE

7.2.2 TWO STAGE

7.2.3 THREE STAGE

7.3 ISOLATION STAGE CONTROLS

7.3.1 DECOUPLED ISOLATION STAGE CONTROLS

7.3.2 COUPLED ISOLATION STAGE CONTROLS

8 SOLID-STATE TRANSFORMER MARKET, BY VOLTAGE LEVEL (Page No. - 63)

8.1 INTRODUCTION

FIGURE 22 HV/MV SEGMENT TO ACCOUNT FOR LARGE SIZE OF MARKET FROM 2024 TO 2030

TABLE 7 MARKET, BY VOLTAGE LEVEL, 2024–2030 (USD MILLION)

8.2 HV/MV

8.2.1 RENEWABLE POWER GENERATION SEGMENT OF HV/MV MARKET TO GROW AT HIGHEST CAGR FROM 2024 TO 2030

TABLE 8 HV/MV MARKET, BY APPLICATION, 2024–2030 (USD MILLION)

TABLE 9 HV/MV MARKET, BY REGION, 2024–2030 (USD MILLION)

8.3 MV/LV

8.3.1 AUTOMOTIVE SEGMENT OF MV/LV MARKET TO GROW AT HIGHEST CAGR FROM 2024 TO 2030

FIGURE 23 AUTOMOTIVE SEGMENT TO HOLD LARGEST SIZE OF MV/LV MARKET FROM 2024 TO 2030

TABLE 10 MV/LV MARKET, BY APPLICATION, 2024–2030 (USD MILLION)

TABLE 11 MV/LV MARKET, BY REGION, 2024–2030 (USD MILLION)

9 MODULAR STRUCTURE OF SOLID-STATE TRANSFORMERS (Page No. - 68)

9.1 INTRODUCTION

9.2 POWER INTERCONNECTION

9.3 VOLTAGE INTERCONNECTION

9.4 PHASE INTERCONNECTION

10 SOLID-STATE TRANSFORMER MARKET, BY APPLICATION (Page No. - 69)

10.1 INTRODUCTION

FIGURE 24 RENEWABLE POWER GENERATION SEGMENT TO HOLD LARGEST SIZE OF MARKET FROM 2024 TO 2030

TABLE 12 MARKET, BY APPLICATION, 2024–2030 (USD MILLION)

10.2 RENEWABLE POWER GENERATION

10.2.1 RENEWABLE POWER GENERATION SEGMENT TO HOLD LARGEST SIZE OF MARKET FROM 2024 TO 2030

FIGURE 25 WIND POWER SEGMENT TO HOLD LARGEST SIZE OF MARKET FOR RENEWABLE POWER GENERATION FROM 2024 TO 2030

TABLE 13 MARKET FOR RENEWABLE POWER GENERATION, BY TYPE, 2024–2030 (USD MILLION)

TABLE 14 MARKET FOR RENEWABLE POWER GENERATION, BY REGION, 2024–2030 (USD MILLION)

TABLE 15 MARKET IN NORTH AMERICA FOR RENEWABLE POWER GENERATION, BY COUNTRY, 2024–2030 (USD MILLION)

TABLE 16 MARKET IN EUROPE FOR RENEWABLE POWER GENERATION, BY COUNTRY, 2024–2030 (USD MILLION)

TABLE 17 MARKET IN APAC FOR RENEWABLE POWER GENERATION, BY COUNTRY, 2024–2030 (USD THOUSAND)

TABLE 18 MARKET IN ROW FOR RENEWABLE POWER GENERATION, BY REGION, 2024–2030 (USD THOUSAND)

TABLE 19 MARKET FOR RENEWABLE POWER GENERATION, BY VOLTAGE LEVEL, 2024–2030 (USD MILLION)

10.2.2 WIND POWER

10.2.2.1 Wind power segment to account for largest size of market for renewable power generation from 2024 to 2030

FIGURE 26 MARKET IN APAC FOR RENEWABLE WIND POWER GENERATION TO GROW AT HIGHEST RATE FROM 2024 TO 2030

TABLE 20 MARKET FOR RENEWABLE WIND POWER GENERATION, BY REGION, 2024–2030 (USD MILLION)

10.2.3 SOLAR POWER

10.2.3.1 Popularity of solar power in APAC to drive growth of market for renewable solar power generation from 2024 to 2030

TABLE 21 CUMULATIVE INSTALLED SOLAR PV CAPACITY IN KEY COUNTRIES, 2019 (GIGA WATT)

TABLE 22 MARKET FOR RENEWABLE SOLAR POWER GENERATION, BY REGION, 2024–2030 (USD MILLION)

10.2.4 TIDAL POWER

10.2.4.1 Tidal power segment of market for renewable power generation to grow at slow rate owing to limited investments by governments due to COVID-19

TABLE 23 MARKET FOR RENEWABLE TIDAL POWER GENERATION, BY REGION, 2024–2030 (USD THOUSAND)

10.3 AUTOMOTIVE

10.3.1 GROWTH OF EV CHARGING INFRASTRUCTURES IN APAC TO FUEL DEMAND FOR SOLID-STATE TRANSFORMERS FROM 2024 TO 2030

TABLE 24 SOLID-STATE TRANSFORMER MARKET FOR AUTOMOTIVE, BY REGION, 2024–2030 (USD MILLION)

TABLE 25 MARKET IN NORTH AMERICA FOR AUTOMOTIVE, BY COUNTRY, 2024–2030 (USD THOUSAND)

TABLE 26 MARKET IN EUROPE FOR AUTOMOTIVE, BY COUNTRY, 2024–2030 (USD MILLION)

TABLE 27 MARKET IN APAC FOR AUTOMOTIVE, BY COUNTRY, 2024–2030 (USD MILLION)

TABLE 28 MARKET IN ROW FOR AUTOMOTIVE, BY REGION, 2024–2030 (USD MILLION)

TABLE 29 MARKET FOR AUTOMOTIVE, BY VOLTAGE LEVEL, 2024–2030 (USD MILLION)

10.4 POWER GRIDS

10.4.1 MV/LV SEGMENT TO HOLD LARGE SIZE OF SOLID-STATE TRANSFORMER MARKET FOR POWER GRIDS IN 2030

TABLE 30 MARKET FOR POWER GRIDS, BY REGION, 2024–2030 (USD MILLION)

TABLE 31 MARKET IN NORTH AMERICA FOR POWER GRIDS, BY COUNTRY, 2024–2030 (USD THOUSAND)

TABLE 32 MARKET IN EUROPE FOR POWER GRIDS, BY COUNTRY, 2024–2030 (USD THOUSAND)

TABLE 33 MARKET IN APAC FOR POWER GRIDS, BY COUNTRY, 2024–2030 (USD THOUSAND)

TABLE 34 MARKET IN ROW FOR POWER GRIDS, BY REGION, 2024–2030 (USD THOUSAND)

FIGURE 27 MV/LV SEGMENT TO HOLD LARGE SIZE OF MARKET FOR POWER GRIDS IN 2030

TABLE 35 MARKET FOR POWER GRIDS, BY VOLTAGE LEVEL, 2024–2030 (USD MILLION)

10.5 TRACTION LOCOMOTIVES

10.5.1 ELECTRIFICATION OF RAILWAYS TO DRIVE DEMAND FOR SOLID-STATE TRANSFORMERS USED IN TRACTION LOCOMOTIVES

TABLE 36 SOLID-STATE TRANSFORMER MARKET FOR TRACTION LOCOMOTIVES, BY REGION, 2024–2030 (USD MILLION)

TABLE 37 MARKET IN NORTH AMERICA FOR TRACTION LOCOMOTIVES, BY COUNTRY, 2024–2030 (USD THOUSAND)

FIGURE 28 UK TO HOLD LARGEST SIZE OF MARKET IN EUROPE FOR TRACTION LOCOMOTIVES FROM 2024 TO 2030

TABLE 38 MARKET IN EUROPE FOR TRACTION LOCOMOTIVES, BY COUNTRY, 2024–2030 (USD MILLION)

TABLE 39 MARKET IN APAC FOR TRACTION LOCOMOTIVES, BY COUNTRY, 2024–2030 (USD THOUSAND)

TABLE 40 MARKET IN ROW FOR TRACTION LOCOMOTIVES, BY REGION, 2024–2030 (USD THOUSAND)

TABLE 41 MARKET FOR TRACTION LOCOMOTIVES, BY VOLTAGE LEVEL, 2024–2030 (USD MILLION)

10.6 OTHERS

FIGURE 29 SOLID-STATE TRANSFORMER MARKET IN APAC FOR OTHER APPLICATIONS TO GROW AT HIGHEST CAGR FROM 2024 TO 2030

TABLE 42 MARKET FOR OTHER APPLICATIONS, BY REGION, 2024–2030 (USD THOUSAND)

TABLE 43 MARKET IN NORTH AMERICA FOR OTHER APPLICATIONS, BY COUNTRY, 2024–2030 (USD THOUSAND)

TABLE 44 MARKET IN EUROPE FOR OTHER APPLICATIONS, BY COUNTRY, 2024–2030 (USD THOUSAND)

TABLE 45 MARKET IN APAC FOR OTHER APPLICATIONS, BY COUNTRY, 2024–2030 (USD THOUSAND)

TABLE 46 MARKET IN ROW FOR OTHER APPLICATIONS, BY REGION, 2024–2030 (USD THOUSAND)

TABLE 47 MARKET FOR OTHER APPLICATIONS, BY VOLTAGE LEVEL, 2024–2030 (USD MILLION)

11 GEOGRAPHIC ANALYSIS (Page No. - 91)

11.1 INTRODUCTION

FIGURE 30 SOLID-STATE TRANSFORMER MARKET IN CHINA PROJECTED TO GROW AT HIGHEST CAGR FROM 2024 TO 2030

TABLE 48 SOLID-STATE TRANSFORMER MARKET, BY REGION, 2024–2030 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 31 NORTH AMERICA: SOLID-STATE TRANSFORMER MARKET SNAPSHOT

11.2.1 US

11.2.1.1 US to hold largest share of market in North America

11.2.2 CANADA

11.2.2.1 Solid-state transformers to be implemented mainly in renewable power generation sector in Canada

11.2.3 MEXICO

11.2.3.1 Mexico-based companies and associations constantly striving to develop solid-state transformers used in renewable energy generation sector

TABLE 49 SOLID-STATE TRANSFORMER MARKET IN NORTH AMERICA, BY COUNTRY, 2024–2030 (USD MILLION)

TABLE 50 MARKET IN US, BY APPLICATION, 2024–2030 (USD MILLION)

TABLE 51 MARKET IN CANADA, BY APPLICATION, 2024–2030 (USD THOUSAND)

TABLE 52 MARKET IN MEXICO, BY APPLICATION, 2024–2030 (USD THOUSAND)

TABLE 53 MARKET IN NORTH AMERICA, BY APPLICATION, 2024–2030 (USD THOUSAND)

TABLE 54 MARKET IN NORTH AMERICA FOR RENEWABLE POWER GENERATION, BY TYPE, 2024–2030 (USD THOUSAND)

TABLE 55 MARKET IN NORTH AMERICA, BY VOLTAGE LEVEL, 2024–2030 (USD MILLION)

11.3 EUROPE

FIGURE 32 EUROPE: SOLID-STATE TRANSFORMER MARKET SNAPSHOT

11.3.1 GERMANY

11.3.1.1 Germany projected to account for largest share of market in Europe from 2024 to 2030

11.3.2 UK

11.3.2.1 UK among key markets for tidal energy in Europe

11.3.3 FRANCE

11.3.3.1 Growth of electric vehicle market in France to contribute to demand for solid-state transformers

11.3.4 REST OF EUROPE

TABLE 56 SOLID-STATE TRANSFORMER MARKET IN EUROPE, BY COUNTRY, 2024–2030 (USD MILLION)

TABLE 57 MARKET IN GERMANY, BY APPLICATION, 2024–2030 (USD THOUSAND)

TABLE 58 MARKET IN UK, BY APPLICATION, 2024–2030 (USD MILLION)

TABLE 59 MARKET IN FRANCE, BY APPLICATION, 2024–2030 (USD MILLION)

TABLE 60 MARKET IN REST OF EUROPE, BY APPLICATION, 2024–2030 (USD MILLION)

TABLE 61 MARKET IN EUROPE, BY APPLICATION, 2024–2030 (USD MILLION)

TABLE 62 MARKET IN EUROPE FOR RENEWABLE POWER GENERATION, BY TYPE, 2024–2030 (USD THOUSAND)

TABLE 63 MARKET IN EUROPE, BY VOLTAGE LEVEL, 2024–2030 (USD MILLION)

11.4 APAC

FIGURE 33 APAC: SOLID-STATE TRANSFORMER MARKET SNAPSHOT

11.4.1 CHINA

11.4.1.1 China to hold largest share of market in APAC from 2024 to 2030

11.4.2 JAPAN

11.4.2.1 Risen government investments for renewable power generation in Japan to fuel market growth

11.4.3 INDIA

11.4.3.1 Investments in renewable energy projects in India to drive growth of market for solid-state transformers

11.4.4 REST OF APAC

TABLE 64 SOLID-STATE TRANSFORMER MARKET IN APAC, BY COUNTRY, 2024–2030 (USD MILLION)

TABLE 65 MARKET IN CHINA, BY APPLICATION, 2024–2030 (USD MILLION)

TABLE 66 MARKET IN JAPAN, BY APPLICATION, 2024–2030 (USD THOUSAND)

TABLE 67 MARKET IN INDIA, BY APPLICATION, 2024–2030 (USD MILLION)

TABLE 68 MARKET IN REST OF APAC, BY APPLICATION, 2024–2030 (USD THOUSAND)

TABLE 69 MARKET IN APAC, BY APPLICATION, 2024–2030 (USD MILLION)

TABLE 70 MARKET IN APAC FOR RENEWABLE POWER GENERATION, BY TYPE, 2024–2030 (USD THOUSAND)

TABLE 71 MARKET IN APAC, BY VOLTAGE LEVEL, 2024–2030 (USD MILLION)

11.5 REST OF THE WORLD

FIGURE 34 ROW: SOLID-STATE TRANSFORMER MARKET SNAPSHOT

11.5.1 MIDDLE EAST AND AFRICA

11.5.1.1 Investments in EV charging infrastructures expected to fuel market growth

11.5.2 SOUTH AMERICA

11.5.2.1 Solid-state transformer market in South America to grow at slower pace than other regions in RoW

TABLE 72 MARKET IN ROW, BY REGION, 2024–2030 (USD MILLION)

TABLE 73 MARKET IN MIDDLE EAST AND AFRICA, BY APPLICATION, 2024–2030 (USD THOUSAND)

TABLE 74 MARKET IN SOUTH AMERICA, BY APPLICATION, 2024–2030 (USD THOUSAND)

TABLE 75 MARKET IN ROW, BY APPLICATION, 2024–2030 (USD THOUSAND)

TABLE 76 MARKET IN ROW FOR RENEWABLE POWER GENERATION, BY TYPE, 2024–2030 (USD THOUSAND)

TABLE 77 MARKET IN ROW, BY VOLTAGE LEVEL, 2024–2030 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 112)

12.1 OVERVIEW

12.2 MARKET SHARE ANALYSIS: SOLID-STATE TRANSFORMER MARKET

FIGURE 35 OVERALL MARKET SHARE ANALYSIS OF MARKET FOR 2024

12.3 COMPETITIVE EVALUATION QUADRANT

12.3.1 STAR

12.3.2 EMERGING LEADER

12.3.3 PERVASIVE

12.3.4 PARTICIPANT

FIGURE 36 COMPETITIVE EVALUATION QUADRANT

TABLE 78 COMPANY APPLICATION FOOTPRINT

TABLE 79 COMPANY REGION FOOTPRINT

13 COMPANY PROFILES (Page No. - 117)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 KEY PLAYERS

13.1.1 HITACHI

FIGURE 37 HITACHI: COMPANY SNAPSHOT

13.1.2 SCHNEIDER ELECTRIC

FIGURE 38 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

13.1.3 SIEMENS

FIGURE 39 SIEMENS: COMPANY SNAPSHOT

13.1.4 MITSUBISHI ELECTRIC

FIGURE 40 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

13.1.5 GENERAL ELECTRIC

FIGURE 41 GENERAL ELECTRIC: COMPANY SNAPSHOT

13.1.6 EATON

FIGURE 42 EATON: COMPANY SNAPSHOT

13.1.7 VARENTEC

13.1.8 AMANTYS

13.1.9 ERMCO

13.1.10 SPX TRANSFORMER SOLUTIONS

FIGURE 43 SPX TRANSFORMER SOLUTIONS: COMPANY SNAPSHOT

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED REPORTS (Page No. - 132)

14.1 INTRODUCTION

14.2 LIMITATIONS

14.3 POWER ELECTRONICS MARKET, BY VERTICAL

14.3.1 INTRODUCTION

FIGURE 44 POWER ELECTRONICS MARKET FOR AUTOMOTIVE & TRANSPORTATION TO GROW AT HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 80 POWER ELECTRONICS MARKET BY VERTICAL, 2017–2025 (USD BILLION)

14.3.2 ICT

14.3.2.1 Increasing demand for advanced power devices to drive growth of ICT segment

TABLE 81 POWER ELECTRONICS MARKET FOR ICT, BY DEVICE TYPE, 2017–2025 (USD MILLION)

TABLE 82 POWER ELECTRONICS MARKET FOR ICT, BY REGION, 2017–2025 (USD MILLION)

TABLE 83 POWER ELECTRONICS MARKET IN NORTH AMERICA FOR ICT, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 84 POWER ELECTRONICS MARKET IN EUROPE FOR ICT, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 85 POWER ELECTRONICS MARKET IN APAC FOR ICT, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 86 POWER ELECTRONICS MARKET IN ROW FOR ICT, BY REGION, 2017–2025 (USD MILLION)

14.3.3 CONSUMER ELECTRONICS

14.3.3.1 Growing adoption of consumer electronics to drive market for power management IC

TABLE 87 POWER ELECTRONICS MARKET FOR CONSUMER ELECTRONICS, BY DEVICE TYPE, 2017–2025 (USD MILLION)

FIGURE 45 APAC TO DOMINATE POWER ELECTRONICS MARKET FOR CONSUMER ELECTRONICS FROM 2020 TO 2025

TABLE 88 POWER ELECTRONICS MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2017–2025 (USD MILLION)

TABLE 89 POWER ELECTRONICS MARKET IN NORTH AMERICA FOR CONSUMER ELECTRONICS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 90 POWER ELECTRONICS MARKET IN EUROPE FOR CONSUMER ELECTRONICS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 91 POWER ELECTRONICS MARKET IN APAC FOR CONSUMER ELECTRONICS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 92 POWER ELECTRONICS MARKET IN ROW FOR CONSUMER ELECTRONICS, BY COUNTRY, 2017–2025 (USD MILLION)

14.3.4 INDUSTRIAL

14.3.4.1 surging Industrial automation to drive market growth

TABLE 93 POWER ELECTRONICS MARKET FOR INDUSTRIAL, BY DEVICE TYPE, 2017–2025 (USD MILLION)

FIGURE 46 POWER ELECTRONICS MARKET IN APAC FOR INDUSTRIAL VERTICAL TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

TABLE 94 POWER ELECTRONICS MARKET FOR INDUSTRIAL, BY REGION, 2017–2025 (USD MILLION)

TABLE 95 POWER ELECTRONICS MARKET IN NORTH AMERICA FOR INDUSTRIAL, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 96 POWER ELECTRONICS MARKET IN EUROPE FOR INDUSTRIAL, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 97 POWER ELECTRONICS MARKET IN APAC FOR INDUSTRIAL, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 98 POWER ELECTRONICS MARKET IN ROW FOR INDUSTRIAL, BY REGION, 2017–2025 (USD MILLION)

14.3.5 ENERGY & POWER

14.3.5.1 Photovoltaics

14.3.5.1.1 Increasing initiatives by governments for production of clean energy to drive growth of PV and power electronics market

14.3.5.2 Wind turbine

14.3.5.2.1 Rising use of wind turbines for electricity generation to fuel demand for power electronic devices

14.3.6 AUTOMOTIVE & TRANSPORTATION

14.3.6.1 Increasing importance of advanced power semiconductor devices in automotive application to drive sic and gan power electronics market

FIGURE 47 POWER MODULE SEGMENT OF POWER ELECTRONICS MARKET FOR AUTOMOTIVE & TRANSPORTATION TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

TABLE 99 POWER ELECTRONICS MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY DEVICE TYPE, 2017–2025 (USD MILLION)

FIGURE 48 APAC TO LEAD POWER ELECTRONICS MARKET FOR AUTOMOTIVE & TRANSPORTATION FROM 2020 TO 2025

TABLE 100 POWER ELECTRONICS MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2017–2025 (USD MILLION)

TABLE 101 POWER ELECTRONICS MARKET IN NORTH AMERICA FOR AUTOMOTIVE & TRANSPORTATION, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 102 POWER ELECTRONICS MARKET IN EUROPE FOR AUTOMOTIVE & TRANSPORTATION, BY COUNTRY, 2017–2025 (USD MILLION)

FIGURE 49 POWER ELECTRONICS MARKET IN CHINA FOR AUTOMOTIVE & TRANSPORTATION TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

TABLE 103 POWER ELECTRONICS MARKET IN APAC FOR AUTOMOTIVE & TRANSPORTATION, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 104 POWER ELECTRONICS MARKET IN ROW FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2017–2025 (USD MILLION)

14.3.6.2 Powertrain

14.3.6.3 Body & convenience

14.3.6.4 Chassis & safety and ADAS

14.3.6.5 Infotainment

14.3.7 AEROSPACE & DEFENSE

14.3.7.1 Growing adoption of GAN in aerospace & defense vertical owing to its high power capability

TABLE 105 POWER ELECTRONICS MARKET FOR AEROSPACE & DEFENSE, BY DEVICE TYPE, 2017–2025 (USD MILLION)

TABLE 106 POWER ELECTRONICS MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2017–2025 (USD MILLION)

TABLE 107 POWER ELECTRONICS MARKET IN NORTH AMERICA FOR AEROSPACE & DEFENSE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 108 POWER ELECTRONICS MARKET IN EUROPE FOR AEROSPACE & DEFENSE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 109 POWER ELECTRONICS MARKET IN APAC FOR AEROSPACE & DEFENSE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 110 POWER ELECTRONICS MARKET IN ROW FOR AEROSPACE & DEFENSE, BY REGION, 2017–2025 (USD MILLION)

14.3.8 OTHERS

TABLE 111 POWER ELECTRONICS MARKET FOR OTHER VERTICALS, BY DEVICE TYPE, 2017–2025 (USD MILLION)

TABLE 112 POWER ELECTRONICS MARKET FOR OTHER VERTICALS, BY REGION, 2017–2025 (USD MILLION)

TABLE 113 POWER ELECTRONICS MARKET IN NORTH AMERICA FOR OTHER VERTICALS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 114 POWER ELECTRONICS MARKET IN EUROPE FOR OTHER VERTICALS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 115 POWER ELECTRONICS MARKET IN APAC FOR OTHER VERTICALS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 116 POWER ELECTRONICS MARKET IN ROW FOR OTHER VERTICALS, BY REGION, 2017–2025 (USD MILLION)

15 APPENDIX (Page No. - 153)

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

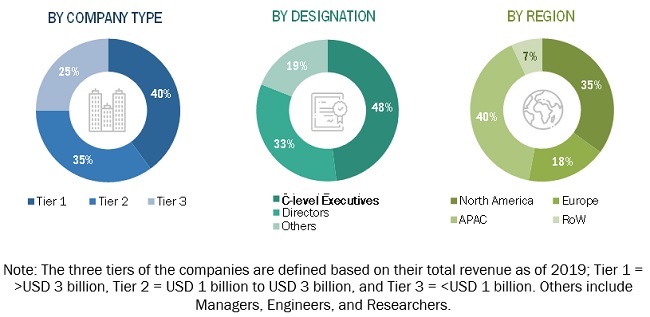

This study involved four major activities in estimating the size of the soldi-state transformer market. Exhaustive secondary research has been conducted to collect information on the solid-state transformer market. In the next step, these findings, assumptions, and sizing have been validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches have been employed to estimate the complete market size. Following that, the market breakdown and data triangulation methods have been used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for the solid-state transformer market study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, transformer associations (such as Indian Transformer Manufacturers Association (ITMA), Transformer Association (TTA), European Power Supplies Manufacturers’ Association (EPSMA)) International, and certified publications; articles from recognized authors; directories; and databases.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts, such as CEOs, VPs, marketing directors, technology and innovation directors, and related key executives from major companies and organizations expected to operate in the solid-state transformer market. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the size of the overall solid-state transformer market and the market based on segments. The research methodology used to estimate the market size has been given below:

- Key players expected to operate in the solid-state transformer market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined by using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall expected solid-state transformer market size—using the estimation processes explained above—the market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends in both the demand and supply sides of the solid-state transformer market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the solid-state transformer market report.

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Solid-State Transformer Market