Power Monitoring Market by Component (Hardware, Software, Services), End-User (Manufacturing & Process Industry, Datacentres, Utilities & Renewables, Public Infrastructure, Electric Vehicle Charging Stations), and Region - Global Forecast to 2024

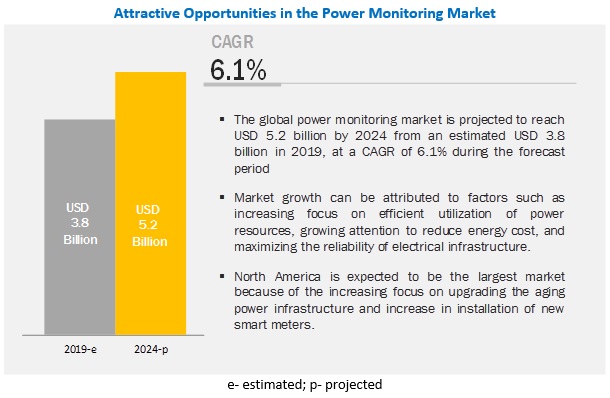

[141 Pages Report] The global power monitoring market is projected to reach USD 5.2 billion by 2024 from an estimated USD 3.8 billion in 2019, at a CAGR of 6.1% during the forecast period. The growth is attributed to the increasing focus on efficient utilization of power resources, growing attention to reducing costs, and maximizing the reliability of electrical infrastructure. Increasing the adoption of smart grid technologies and a growing focus on industrial developments has led to a rise in the implementation of power monitoring systems.

The hardware segment is expected to be the largest contributor to the power monitoring market, by component, during the forecast period

The power monitoring market is segmented, by component, into hardware, software, and services. The hardware segment is projected to hold the largest market share by 2024. This is because of its increasing number of smart grid deployment projects, increasing smart grid investments globally, and government regulations to install smart meters to reduce carbon emissions.

The datacenter's segment is expected to be the fastest-growing market during the forecast period

The power monitoring market, by end-user, is segmented into the manufacturing & process industry, data centers, public infrastructure, utilities and renewables, and electric vehicle charging stations. Datacenters is the fastest growing market because of the increasing investments in the IT hubs as well as an increase in the need for monitoring of the electrical power distribution infrastructure of the data center facility.

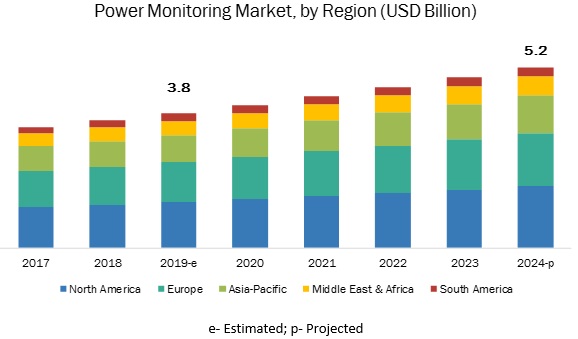

North America is expected to be the largest market during the forecast period

In this report, the power monitoring market has been analyzed for three regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is estimated to be the largest market from 2019 to 2024. This is because a power monitoring system is expected to play a significant role in upgrading the aging power infrastructure in the region. The US has seen a rising demand for power monitoring systems due to an increase in investments in smart meters to enhance the intelligent infrastructure across the country.

Key Market Players

The major players in the power monitoring market are Schneider Electric (France), ABB(Switzerland), Eaton(Ireland), Siemens(Germany), General Electric(US), Emerson(US), Rockwell Automation (US), Mitsubishi Electric (Japan), Omron(Japan), Yokogawa(Japan)

Schneider Electric (France) is a key player in this segment. The company actively focuses on organic strategies such as new product development to increase its global market share. For instance, in November 2018, Schneider Electric developed its EcoStruxure Power digital energy management system architecture, which helps in the management of low and medium voltage power distribution and energy simpler for building, grid, industry, and data center customers.

Another major player in the market is the Siemens(Germany). The company opts for new product developments as its organic business strategy for increasing its clientele base globally. For instance, in July 2019, Siemens launched SIRIUS 3UG546 DC load monitoring relay on the market. It is the first and only DC load monitoring relay to combine current and voltage measurement, power monitoring, communication, and various other useful functions in one single, compact device.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Component, End-User, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa and South America |

|

Companies covered |

Schneider Electric (France), ABB(Switzerland), Eaton(Ireland), Siemens(Germany), General Electric(US), Emerson(US), Rockwell Automation (US), Mitsubishi Electric (Japan), Omron(Japan), Yokogawa(Japan) |

This research report categorizes the power monitoring market by technology, capacity, end-user, and region.

The power monitoring market, by Component, has been segmented as follows:

- Hardware

- Metering & Communication Devices

- Measurement Devices

- Software

- Services

The power monitoring market, by End-user, has been segmented as follows:

- Manufacturing & Process Industry

- Datacenters

- Public Infrastructure

- Utilities & Renewables

- Electric Vehicle Charging Station

The power monitoring market, by Region, has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Key Questions Addressed by the Report

- What are the revolutionary technology trends that will be seen over the next five years?

- Which of the power monitoring market components will lead by 2024?

- Which of the end-user segment will have the maximum opportunity to grow during the forecast period?

- Which will be the leading region with the highest market share by 2024?

- How are companies implementing organic and strategies to gain increased market share?

Frequently Asked Questions (FAQ):

Which of the power monitoring market components will lead by 2024?

The electrolysis technology is expected to witness a rapid growth rate with a growing demand for hydrogen and massive development in renewable electricity generation. The technology has more than 50% share in the European region, and the number of new pow

Which of the end-user segment will have the maximum opportunity to grow during the forecast period?

Manufacturing & Process Industry held the largest market share in 2018. The growth of the manufacturing & process industry segment is driven by the demand for energy efficiency, power surges, and uninterrupted power supply. However, the data center segment is expected to grow at the highest CAGR from 2019 to 2024 owing to increasing investments in IT hubs in North America, Asia Pacific, and Europe.

Which will be the leading region with the highest market share by 2024?

The North American power monitoring market accounted for the highest share of the global power monitoring market. The growth of this market is driven by increasing investments in upgrading and replacing their aging infrastructure, improving grid reliability, and enabling smarter power networks.

How are companies implementing organic and strategies to gain increased market share?

New product development was the major business strategy adopted by the leading companies to maintain a competitive scenario in the market. Some of the players who adopted this strategy include ABB, Siemens, and Veris Industries, among others. For instance, in September 2019, ABB launched its first Bluetooth-equipped network analyzers, which guarantee accurate electrical measuring and power monitoring of all energy assets.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Definition

1.2.1 Power Monitoring Market, By Component: Inclusions & Exclusions

1.2.2 Power Monitoring Market, By End-User: Inclusions & Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regional Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakup of Primaries

2.2 Scope

2.3 Market Size Estimation

2.3.1 Demand-Side Analysis

2.3.1.1 Key Assumptions

2.3.1.2 Calculation

2.3.2 Forecast

2.3.3 Supply-Side Analysis

2.3.3.1 Assumptions and Calculations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the Power Monitoring Market

4.2 Power Monitoring Market, By Region

4.3 Power Monitoring Market, By Component & Country

4.4 Power Monitoring Market, By Component

4.5 Power Monitoring Market, By End-User

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Focus on Effective Utilization of Power Resources

5.2.1.2 Growing Attention to Reducing Energy Cost

5.2.1.3 Maximizing the Reliability of Electrical Infrastructure

5.2.2 Restraints

5.2.2.1 Higher Costs of High-End Monitoring Devices

5.2.3 Opportunities

5.2.3.1 Increasing Adoption of Smart Grid Technologies

5.2.3.2 Growing Focus on Industrial Developments

5.2.4 Challenges

5.2.4.1 Availability of Alternatives Such as Energy Management System

6 Power Monitoring Market, By Component (Page No. - 37)

6.1 Introduction

6.2 Hardware

6.2.1 Increasing Investments in Smart Technology are Expected to Drive the Hardware Segment

6.2.2 Metering & Communication Devices

6.2.3 Measurement Devices

6.3 Software

6.3.1 Organizing Data to Provide Meaningful Information Via Web Interface is Expected to Drive the Software Segment

6.4 Services

6.4.1 Installation of New Components and Upgrading the Existing Ones is Expected to Drive the Services Segment

7 Power Monitoring Market, By End-User (Page No. - 46)

7.1 Introduction

7.2 Manufacturing & Process Industry

7.2.1 Increasing Focus on Energy Efficiency is Expected to Drive the Manufacturing & Process Industry Segment

7.3 Data Center

7.3.1 Need for Reliable Power Supply is Driving the Data Center Power Monitoring Market

7.4 Utilities & Renewables

7.4.1 Increasing Attention to Reducing Energy Cost & Growing Investments in Smart Grid Technology are Expected to Drive the Market

7.5 Public Infrastructure

7.5.1 Increase in Urbanization Coupled With the Need for Real-Time Monitoring of Power Usage is Expected to Drive This Segment

7.6 Electric Vehicle Charging Station

7.6.1 Rise in Global Electric Car Fleet is Expected to Drive This Segment

8 Power Monitoring Market, By Region (Page No. - 53)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 Increasing Focus on Upgrading the Aging Power Equipment is Expected to Boost the Demand for the US Power Monitoring Market

8.2.2 Canada

8.2.2.1 High Maintenance Costs Due to the Aging Electricity Infrastructure in Canada are Likely to Drive the Canadian Power Monitoring Market

8.2.3 Mexico

8.2.3.1 Focus on New Electrical Infrastructure is Expected to Drive the Demand for the Mexican Power Monitoring Market

8.3 Europe

8.3.1 Germany

8.3.1.1 Increase in Renewable Power Generation is Driving the Power Monitoring Market

8.3.2 UK

8.3.2.1 Need to Manage and Monitor Complex Grid is Driving the Power Monitoring Market

8.3.3 France

8.3.3.1 Focus on Strengthening the Energy Supply Chain is Driving the Power Monitoring Market

8.3.4 Italy

8.3.4.1 Need for Reliable Power Supply and Achieving Energy Efficiency are Driving the Power Monitoring Market

8.3.5 Spain

8.3.5.1 Focus on Decreasing Energy Costs is Driving the Power Monitoring Market

8.3.6 Rest of Europe

8.4 Asia Pacific

8.4.1 China

8.4.1.1 Focus on Integrating Renewable Energy Generation and Smart Grid Technologies is Driving the Market

8.4.2 Japan

8.4.2.1 Need for Real-Time Communication of the Power Generated is Driving the Power Monitoring Market

8.4.3 South Korea

8.4.3.1 Increasing Focus on Greater Efficiency in Power Distribution is Driving the Power Monitoring Market

8.4.4 India

8.4.4.1 Focus on Reducing Costs and Monitoring the Entire Electrical Infrastructure is Driving the Power Monitoring Market

8.4.5 Rest of Asia Pacific

8.5 Middle East & Africa

8.5.1 Saudi Arabia

8.5.1.1 Focus on Reducing Energy Costs is Expected to Increase the Demand for Power Monitoring Market

8.5.2 UAE

8.5.2.1 Higher Standards for Energy Efficiency and Smart Grid Initiatives are Expected to Boost the UAE Power Monitoring Market

8.5.3 South Africa

8.5.3.1 Focus on Improving Energy Efficiency and Fulfilling Future Energy Requirements are Expected to Boost the South African Power Monitoring Market

8.5.4 Algeria

8.5.4.1 Increasing Focus on Distributed Energy Solutions is Expected to Boost the Algerian Power Monitoring Market

8.5.5 Qatar

8.5.5.1 Increasing Investments in Infrastructure are Expected to Boost the Qatari Power Monitoring Market

8.5.6 Rest of Middle East & Africa

8.6 South America

8.6.1 By Country

8.6.2 Brazil

8.6.2.1 Investments in Smart Meter and Pilot Smart Grid Projects are Expected to Boost the Power Monitoring Market in Brazil

8.6.3 Argentina

8.6.3.1 Economic and Regulatory Changes in the Energy Sector are Expected to Boost the Argentinian Power Monitoring Market

8.6.4 Rest of South America

9 Competitive Landscape (Page No. - 90)

9.1 Introduction

9.2 Market Share Analysis

9.3 Competitive Scenario

9.3.1 Contracts & Agreements

9.3.2 Mergers & Acquisitions

9.3.3 New Product Developments

9.3.4 Others

9.4 Competitive Leadership Mapping

9.4.1 Visionary Leaders

9.4.2 Innovators

9.4.3 Dynamic

9.4.4 Emerging

10 Company Profile (Page No. - 97)

(Overview, Product Offerings, Recent Developments, and SWOT Analysis)*

10.1 Schneider Electric

10.2 ABB

10.3 Eaton

10.4 Siemens

10.5 General Electric

10.6 Emerson

10.7 Rockwell Automation

10.8 Mitsubishi Electric

10.9 Omron

10.10 Yokogawa

10.11 Littelfuse

10.12 Fuji Electric Fa Components & Systems

10.13 Fluke Corporation

10.14 Samsara

10.15 Accuenergy

10.16 Veris Industries

10.17 Albireo Energy

10.18 Vacom Technologies

10.19 Etap- Operation Technology

10.20 Greystone Energy Systems

*Details on Overview, Product Offerings, Recent Developments, and SWOT Analysis Might Not be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 134)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (69 Tables)

Table 1 Power Monitoring Market: Snapshot

Table 2 Power Monitoring Market Size, By Component, 2017–2024 (USD Million)

Table 3 Hardware: Market, Subcomponent, 2017–2024 (Units)

Table 4 Hardware: Market, Subcomponent, 2017–2024 (USD Million)

Table 5 Hardware: Market, By Region, 2017–2024 (Units)

Table 6 Hardware: Market Size, By Region, 2017–2024 (USD Million)

Table 7 Metering & Communication Devices: Market Size, By Region, 2017–2024 (Units)

Table 8 Metering & Communication Devices: Market Size, By Region, 2017–2024 (USD Million)

Table 9 Measurement Devices: Market, By Region, 2017–2024 (Units)

Table 10 Measurement Devices: Market Size, By Region, 2017–2024 (USD Million)

Table 11 Software: Market Size, By Region, 2017–2024 (USD Million)

Table 12 Services: Market Size, By Region, 2017–2024 (USD Million)

Table 13 Power Monitoring Market Size, By End–User, 2017–2024 (USD Million)

Table 14 Manufacturing & Process Industry: Market Size, By Region, 2017–2024 (USD Million)

Table 15 Data Center: Market Size, By Region, 2017–2024 (USD Million)

Table 16 Utilities & Renewables: Market Size, By Region, 2017–2024 (USD Million)

Table 17 Public Infrastructure: Market Size, By Region, 2017–2024 (USD Million)

Table 18 Electric Vehicle Charging Station: Market Size, By Region, 2017–2024 (USD Million)

Table 19 Global Market Size, By Region (Units), 2017–2024

Table 20 Global Market Size, By Region, 2017–2024 (USD Million)

Table 21 North America: Market Size, By Component, 2017–2024 (USD Million)

Table 22 Hardware: North America Market, Subcomponent, 2017–2024 (Units)

Table 23 Hardware: North American Market, Subcomponent, 2017–2024 (USD Million)

Table 24 North America: Market Size, By End-User, 2017–2024 (USD Million)

Table 25 North America: Market Size, By Country, 2017–2024 (USD Million)

Table 26 US: Power Monitoring Market Size, By Component, 2017–2024 (USD Million)

Table 27 Canada: Market Size, By Component, 2017–2024 (USD Million)

Table 28 Mexico: Market Size, By Component, 2017–2024 (USD Million)

Table 29 Europe: Market Size, By Component, 2017–2024 (USD Million)

Table 30 Hardware: European Market, Subcomponent, 2017–2024 (Units)

Table 31 Hardware: European Market, Subcomponent, 2017–2024 (USD Million)

Table 32 Europe: Market Size, By End-User, 2017–2024 (USD Million)

Table 33 Europe: Market Size, By Country, 2017–2024 (USD Million)

Table 34 Germany: Market Size, By Component, 2017–2024 (USD Million)

Table 35 UK: Market Size, By Component, 2017–2024 (USD Million)

Table 36 France: Market Size, By Component, 2017–2024 (USD Million)

Table 37 Italy: Market Size, By Component, 2017–2024 (USD Million)

Table 38 Spain: Market Size, By Component, 2017–2024 (USD Million)

Table 39 Rest of Europe: Market Size, By Component, 2017–2024 (USD Million)

Table 40 Asia Pacific: Market Size, By Component, 2017–2024 (USD Million)

Table 41 Hardware: Asia Pacific Market, Subcomponent, 2017–2024 (Units)

Table 42 Hardware: Asia Pacific Market, Subcomponent, 2017–2024 (USD Million)

Table 43 Asia Pacific: Market Size, By End-User, 2017–2024 (USD Million)

Table 44 Asia Pacific: Market Size, By Country, 2017–2024 (USD Million)

Table 45 China: Market Size, By Component, 2017– 2024 (USD Million)

Table 46 Japan: Market Size, By Component, 2017–2024 (USD Million)

Table 47 South Korea: Market Size, By Component, 2017–2024 (USD Million)

Table 48 India: Market Size, By Component, 2017–2024 (USD Million)

Table 49 Rest of Asia Pacific: Market Size, By Component, 2017–2024 (USD Million)

Table 50 Middle East & Africa: Market Size, By Component, 2017–2024 (USD Million)

Table 51 Hardware: Middle East & African Market, Subcomponent, 2017–2024 (Units)

Table 52 Hardware: Middle East & African Market, Subcomponent, 2017–2024 (USD Million)

Table 53 Middle East & Africa: Market Size, By End-User, 2017–2024 (USD Million)

Table 54 Middle East & Africa: Market Size, By Country, 2017–2024 (USD Million)

Table 55 Saudi Arabia: Market Size, By Component, 2017–2024 (USD Million)

Table 56 UAE: Market Size, By Component, 2017–2024 (USD Million)

Table 57 South Africa: Market Size, By Component, 2017–2024 (USD Million)

Table 58 Algeria: Market Size, By Component, 2017–2024 (USD Million)

Table 59 Qatar: Market Size, By Component, 2017–2024 (USD Million)

Table 60 Rest of Middle East & Africa: Market Size, By Component, 2017–2024 (USD Million)

Table 61 South America: Market Size, By Component, 2017–2024 (USD Million)

Table 62 Hardware: South American Market, Subcomponent, 2017–2024 (Units)

Table 63 Hardware: South American Market Size, Subcomponent, 2017–2024 (USD Million)

Table 64 South America: Market Size, By End-User, 2017–2024 (USD Million)

Table 65 South America: Market Size, By Country, 2017–2024 (USD Million)

Table 66 Brazil: Market Size, By Component, 2017–2024 (USD Million)

Table 67 Argentina: Market size, By Component, 2017–2024 (USD Million)

Table 68 Rest of South America: Market Size, By Component, 2017–2024 (USD Million)

Table 69 Developments By Key Players in the Market, January 2017–September 2019

List of Figures (33 Figures)

Figure 1 Power Monitoring Market: Research Design

Figure 2 Main Metrics Considered While Constructing and Assessing the Demand for the Power Monitoring Market

Figure 3 Y-O-Y Investment By End-User Industry in Power Monitoring is the Determining Factor for the Global Power Monitoring Market

Figure 4 Efficient Power Utilization is the Determining Factor for the Global Power Monitoring Market

Figure 5 North America Dominated the Power Monitoring Market in 2018

Figure 6 Hardware Segment is Expected to Hold the Largest Share of the Power Monitoring Market, By Component, During the Forecast Period

Figure 7 Manufacturing & Process Industry Segment is Expected to Lead the Power Monitoring Market, By End-User, During the Forecast Period

Figure 8 Rise in Investments in Smart Grid Technologies is Expected to Drive the Power Monitoring Market, 2019–2024

Figure 9 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period (By Volume)

Figure 10 Hardware Segment and China Dominated the Asia Pacific Power Monitoring Market in 2018

Figure 11 Hardware Segment is Expected to Dominate the Power Monitoring Market, By Component, By 2024

Figure 12 Manufacturing & Process Industry Segment is Expected to Dominate the Power Monitoring Market, By End-User, By 2024

Figure 13 Drivers, Restraints, Opportunities, and Challenges

Figure 14 Hardware Segment of the Power Monitoring Market is Expected to Grow at the Fastest Rate During the Forecast Period

Figure 15 Manufacturing & Process Industry Segment is Expected to be the Largest Power Monitoring Market During the Forecast Period

Figure 16 Asia Pacific is the Fastest Growing Region in the Power Monitoring Market

Figure 17 Power Monitoring Market Share (Value), By Region, 2018

Figure 18 North America: Regional Snapshot

Figure 19 Europe: Market Snapshot

Figure 20 Key Developments in the Power Monitoring Market During January 2017–September 2019

Figure 21 Market Share Analysis, 2018

Figure 22 Power Monitoring Market (Global) Competitive Leadership Mapping, 2018

Figure 23 Schneider Electric: Company Snapshot

Figure 24 ABB: Company Snapshot

Figure 25 Eaton: Company Snapshot

Figure 26 Siemens: Company Snapshot

Figure 27 General Electric: Company Snapshot

Figure 28 Emerson: Company Snapshot

Figure 29 Rockwell Automation: Company Snapshot

Figure 30 Mitsubishi Electric: Company Snapshot

Figure 31 Omron: Company Snapshot

Figure 32 Yokogawa: Company Snapshot

Figure 33 Littelfuse: Company Snapshot

This study involved four major activities in estimating the current size of the power monitoring market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. The market breakdown and data triangulation techniques were employed to estimate the market size of the segments and the corresponding subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases such as industry publications, several newspaper articles, Statista Industry Journal, Factiva, and power monitoring journal to identify and collect information useful for a technical, market-oriented, and commercial study of the power monitoring market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The power monitoring market comprises several stakeholders such as companies related to the industry, consulting companies in the energy and power sector, power generation companies, government & research organizations, organizations, forums, alliances & associations, power monitoring system providers, state & national utility authorities, dealers & suppliers, and vendors. The demand side of the market is characterized by the investments for power monitoring systems across the countries and regions considered under the scope. Also, the estimation of the number of power monitoring units installed across countries and regions were considered. Moreover, the demand is also driven by increasing focus on efficient utilization of power resources and growing attention to reduce cost across the globe. The supply side is characterized by the increasing demand for new product developments and contracts & agreements among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global power monitoring market and its dependent submarkets. These methods were also extensively used to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and demand have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares split, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the power monitoring sector.

Report Objectives

- To define, describe, segment, and forecast the power monitoring market based on component, end-user, and region

- To provide detailed information on the significant factors influencing the growth of the power monitoring market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the power monitoring market concerning individual growth trends, prospects, and contributions of each segment to the market

- To analyze market opportunities for stakeholders and to provide a detailed competitive landscape for market leaders

- To forecast the revenue of the market segments for five main regions (along with countries), namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To track and analyze competitive developments such as new product developments, contracts & agreements, investments & expansions, and mergers & acquisitions in the power monitoring market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Power Monitoring Market