The study involved four major activities in estimating the current size of the electric heat tracing market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of major secondary sources

|

SOURCE

|

WEB LINK

|

|

European Committee for Electrotechnical Standardization (CENELEC)

|

https://www.cencenelec.eu/

|

|

International Electrotechnical Commission (IEC)

|

https://www.iea.org/

|

|

German Institute for Standardization (DIN)

|

https://www.din.de/en

|

|

International Energy Agency(IEA)

|

https://www.iea.org/

|

Primary Research

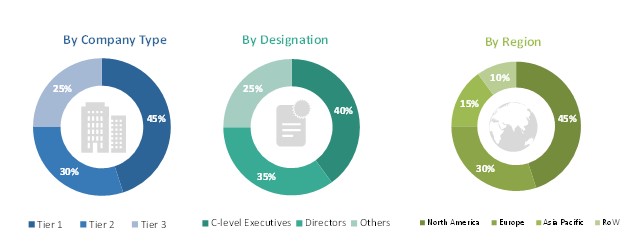

Extensive primary research was conducted after gaining knowledge about the current scenario of the electric heat tracing market through secondary research. Several primary interviews were conducted with experts from both demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the electric heat tracing market and its various dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire procedure involved the study of annual and financial reports of top players and extensive interviews with industry leaders such as chief executive officers (CEOs), vice presidents (VPs), directors, and marketing executives. All percentage shares and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

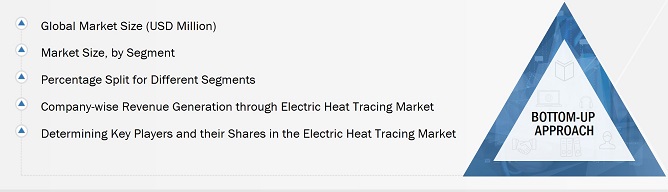

Bottom-Up Approach

The bottom-up approach was used to arrive at the overall size of the electric heat tracing market from the revenues of the key players and their shares in the market. The overall market size was calculated based on the revenues of the key players identified in the market.

-

Identifying various verticals using or expected to implement Electric heat tracing systems

-

Analyzing each verticals, along with the major related companies and Electric heat tracing system providers

-

Estimating the Electric heat tracing market for verticals

-

Understanding the demand generated by companies operating across different verticals

-

Tracking the ongoing and upcoming implementation of projects based on electric heat tracing technology by vertical and forecasting the market based on these developments and other critical parameters

-

Carrying out multiple discussions with the key opinion leaders to understand the type of Heat tracing products designed and developed vertically. This information would help analyze the breakdown of the scope of work carried out by each major company in the electric heat tracing system market

-

Arriving at the market estimates by analyzing electric heat tracing companies as per their countries and subsequently combining this information to arrive at the market estimates by region

-

Verifying and cross-checking the estimates at every level through discussions with the key opinion leaders, including CXOs, directors, and operations managers, and finally with domain experts at MarketsandMarkets

-

Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

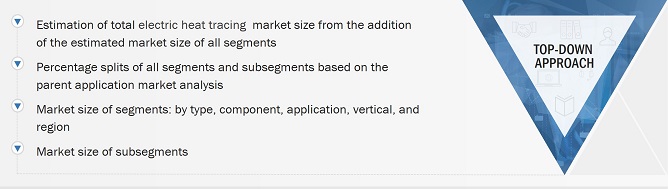

Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research.

To calculate the market size of specific segments, the most appropriate immediate parent market size has been used to implement the top-down approach. The top-down approach was implemented for the data extracted from the secondary research to validate the market size obtained.

The market share of each company was estimated to verify the revenue shares used earlier in the top-down approach. The overall parent market size and individual market sizes were determined and confirmed in this study by the data triangulation method and the validation of data through primaries. The data triangulation method used in this study is explained in the next section.

-

Focusing on top-line investments and expenditures being made in the ecosystems of various verticals.

-

Building and developing the information related to the market revenue generated by key electric heat tracing system manufacturers

-

Conducting multiple on-field discussions with the key opinion leaders involved in the development of Electric heat tracing products in various verticals

-

Estimating geographic splits using secondary sources based on various factors, such as the number of players in a specific country and region, the offering of Electric heat tracing, and the level of solutions offered in verticals

-

The impact of the recession on the steps mentioned above has also been considered.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation procedure has been employed wherever applicable. The data has been triangulated by studying various factors and trends from both demand and supply sides. Along with this, the market size has been validated using top-down and bottom-up approaches.

Market Definition

Electric heat tracing refers to a system that uses electrical cables to generate heat for the purpose of maintaining or controlling temperatures in pipelines, tanks, or other equipment. It is commonly employed in industrial, commercial, and residential settings to prevent freezing, maintain process temperatures, or control viscosity in fluids. The system typically involves self-regulating heating cables that automatically adjust their heat output based on ambient conditions, providing an efficient and reliable solution for temperature-related challenges in various applications.

Key Stakeholders

-

Component Manufacturers

-

End-User Organizations

-

System Integrators

-

Consumers

-

Regulatory Bodies and Compliance Agencies

-

Research Institutions

-

Distributors and Resellers

-

Industry Associations and Organizations

-

Investors and Financial Institutions

Report Objectives

-

To define, describe, and forecast the electric heat tracing market based on product type, application, by component, vertical, and region.

-

To forecast the shipment data of electric heat tracing cables.

-

To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

-

To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

-

To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the total market

-

To study the complete value chain and allied industry segments and perform a value chain analysis of the market

-

To strategically profile the key players and comprehensively analyze their market shares and core competencies

-

To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market

-

To analyze competitive developments such as collaborations, partnerships, product developments, and research & development (R&D) in the market

-

To analyze the impact of the recession on the Electric heat tracing market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

-

Detailed analysis and profiling of additional market players (up to 5)

-

Additional country-level analysis of the Electric heat tracing market

Product Analysis

-

Product matrix, which provides a detailed comparison of the product portfolio of each company in the Electric heat tracing market.

Rajat

Dec, 2017

I want to check weather this report includes information on Russia? If yes, then can I buy Russian part - and cost associated with it..