Magnetic Refrigeration Market by Product ((Refrigeration Systems (Beverage Cooler, Cabinet Display, Refrigerator), Air Conditioning Systems)), Application (Domestic, Commercial, Transportation, and Industrial), and Geography - Global Forecast to 2027

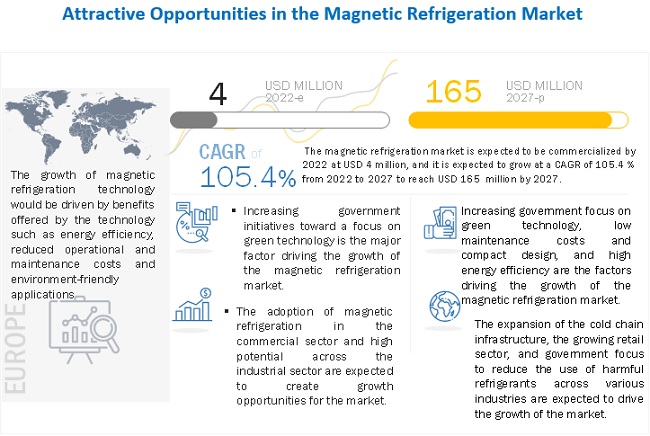

The magnetic refrigeration market is expected to be commercialized by 2022 at USD 4 million, and it is expected to grow at a CAGR of 105.4 % from 2022 to 2027 to reach USD 165 million by 2027.

The magnetic refrigeration market is experiencing significant growth driven by rising demand for energy-efficient cooling solutions. Key trends include advancements in magnetic materials and technology, making magnetic refrigeration more viable for commercial and residential applications. The increasing focus on reducing greenhouse gas emissions and improving energy efficiency in HVAC systems is propelling market expansion. Additionally, growing awareness of sustainable alternatives to traditional refrigeration methods is enhancing the adoption of magnetic refrigeration systems, positioning the market for substantial growth in the coming years.

Impact of AI in Magnetic Refrigeration Market

The integration of artificial intelligence (AI) in the magnetic refrigeration market is enhancing system efficiency, control precision, and operational reliability by enabling advanced data analysis, predictive maintenance, and adaptive system optimization. AI algorithms can monitor real-time performance metrics to fine-tune the magnetic refrigeration cycle, optimize energy consumption, and detect anomalies before they lead to system failures. This results in more sustainable and cost-effective cooling solutions, particularly important in applications requiring environmentally friendly alternatives to conventional refrigeration. As a result, AI is accelerating innovation and adoption in the magnetic refrigeration market, supporting the development of next-generation cooling technologies with minimal environmental impact.

The magnetic refrigeration market is gaining traction as an innovative and energy-efficient alternative to traditional refrigeration technologies. Leveraging the magnetocaloric effect, magnetic refrigeration systems provide cooling without harmful refrigerants, aligning with global sustainability goals. These systems are highly efficient, environmentally friendly, and offer quieter operation compared to conventional methods. With rising concerns over greenhouse gas emissions and the push for eco-friendly solutions in residential, commercial, and industrial applications, magnetic refrigeration is emerging as a transformative technology.

The magnetic refrigeration market is driven by advancements in magnetocaloric materials, increasing demand for energy-efficient cooling solutions, and supportive environmental regulations. Industries such as food and beverage, healthcare, and automotive are adopting magnetic refrigeration to reduce carbon footprints and enhance operational efficiency. As research and development activities continue to improve system performance and cost-effectiveness, the magnetic refrigeration market is poised for significant growth in the coming years.

Some of the key driving factors of the magnetic refrigeration market are increasing government initiatives on green technology, low maintenance costs, compact design, and high energy efficiency offered by magnetic refrigeration technology.

To know about the assumptions considered for the study, Request for Free Sample Report

Magnetic refrigeration market

The magnetic refrigeration market includes major Tier I and II players like Ubiblue, Camfridge Ltd, Astronautics Corporation of America, Haier Smart Home Co., Ltd, VACUUMSCHMELZE GmbH & Co. KG, and others. These players have taken various initiatives & R&D efforts to develop magnetic refrigeration technology. For instance, GE Appliances, a Haier company, and the Office of Energy & Renewable Energy (US) collaborated on a project to successfully harness the Magneto Caloric Effect (MCE) at the Oak Ridge National Laboratory (US). The project was initiated in June 2017 and planned to finish by June 2020, with the outcome of achieving cooling through MCE.

Magnetic refrigeration market Dynamics

Driver: Increasing government initiatives on green technology

The impact of global warming is one of the major challenges faced by the refrigeration and air conditioning (RAC) industry as the existing technology is not environmentally friendly. Increasing global concerns to reduce polluting emissions, especially gases that are harmful to the Earth’s environment, has created the need for some alternative source for cooling purposes. Magnetic refrigeration offers a green cooling technology that would enable manufacturers to reduce their carbon footprint.

Magnetic refrigeration-based products do not use refrigerants such as chlorofluorocarbons (CFCs), hydrochlorofluorocarbons (HCFCs), and other gases such as ammonia and chlorine, thereby reducing their direct gas emissions. Currently, the majority of refrigerants available in the magnetic refrigeration market have a high global warming potential (GWP), and especially those releasing chlorine largely lead to the depletion of the ozone layer. Refrigerants with low GWP, such as ammonia and CO2, have been introduced but have safety-related issues such as flammability, toxicity, pressure, and temperature limitations.

Restraint: High initial investment

Magnets and magnetocaloric materials contribute greatly to the cost of magnetic refrigeration equipment. A device with a high coefficient of performance (COP) would use more magnet and magnetocaloric materials. The development of a device with high efficiency requires more materials, thereby leading to an increase in the cost of the device. The magnetocaloric material that is considered most suitable for the magnetic refrigeration system, as of now, is gadolinium, which is a rare earth metal and too expensive for mass production. Although companies are experimenting on other substitute alloys that can replace gadolinium, the cost of these is also expected to be comparatively higher than that of traditional refrigerants used in compressor systems.

Opportunity: Adoption of magnetic refrigeration in the commercial sector

The commercial application includes places that are used for business, such as offices, malls, and shops. This sector is poised to grow significantly in the coming years with the commercialization of magnetic refrigeration technology. From a technological point of view, magnetic refrigeration is a clean technology that has revolutionized cooling systems, and it needs to be available in the magnetic refrigeration market.

There are various potential applications of magnetic refrigeration systems. Initial developments have been orientated toward the commercial and domestic refrigeration markets, and include display cases, beverage coolers, and commercial or domestic fridges.

Challenge: Need for suitable magnetocaloric materials

Magnetocaloric material is the most important component of a magnetic refrigeration system. The most suitable material must be applied for application areas to deliver high efficiency. One of the main issues is the supply of magneto caloric materials, which are available in limited quantities. Identifying new materials or reducing the content of MCE would increase the viability of this technology.

Refrigeration system to hold the largest market size of magnetic refrigeration market during the forecast period

Magnetic refrigeration has a huge potential for the refrigeration market as it does not use refrigerants and consumes less energy. Moreover, magnetic refrigeration systems do not require a lot of maintenance and are also quieter than traditional units and create fewer vibrations. The different types of refrigeration systems include beverage coolers, cabinet displays, ice cream cabinets, freezers, and refrigerators. Of them, beverage coolers are expected to lead in the segment. These products can be used in domestic, commercial, transportation, and industrial applications. The demand is also likely to be driven by players focusing on entering the market with refrigeration systems.

Commercial application to hold the largest market size of magnetic refrigeration market during the forecast period

Magnetic refrigeration for commercial applications is projected to be commercialized by 2022/2023 with products such as cabinet displays and beverage coolers. Many players are targeting this application to commercialize their products. Companies such as Ubiblue are already testing these products with retail partners and are expected to generate recognizable revenue by 2022.

Increasing efforts of players to develop and offer various products based on the magnetic refrigeration technology for the commercial application is a major driving factor of the magnetic refrigeration market. Government support to develop magnetic refrigeration technology and strict regulations to reduce the use of refrigerants harmful to the environment are some important factors expected to drive market growth.

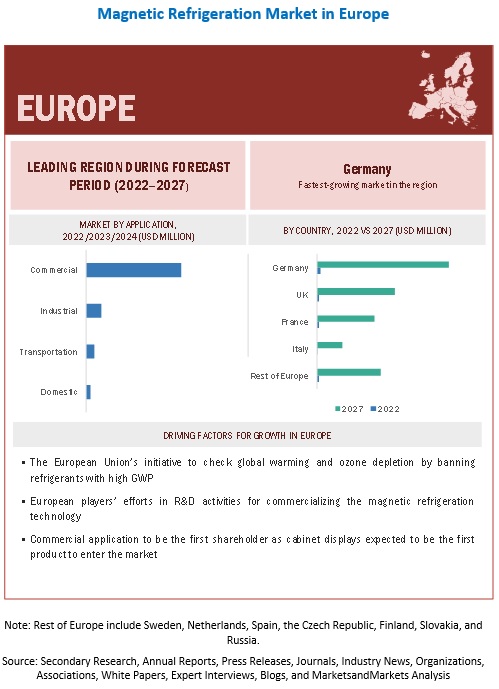

Europe to lead magnetic refrigeration market during the forecast period

The imposition of bans on the use of conventional refrigerants is expected to contribute to the growing market for magnetic refrigeration as it gradually replaces the existing technology used for cooling. The European Union’s initiative to check global warming and ozone depletion by banning high GWP refrigerants will be one of the major drivers for the growth of magnetic refrigeration in Europe. Moreover, the growing demand for frozen food and the increasing usage of refrigeration in logistics-related applications are expected to create opportunities. Being leading players based in Europe, the R&D efforts of European companies for the development of magnetic refrigeration technology and government support to develop green technology are expected to be primary driving factors making Europe a leader in this market.

To know about the assumptions considered for the study, download the pdf brochure

The magnetic refrigeration market is dominated by players such as Ubiblue (France), Haier Smart Home Co., Ltd (China), Camfridge Ltd (UK), Astronautics Corporation of America (US) and VACUUMSCHMELZE GmbH & Co. KG (Germany).

Magnetic Refrigeration Market Report Scope

|

Report Metric |

Details |

| Market size value in 2022 | USD 4 Million |

| Market size value in 2027 | USD 165 Million |

| Growth Rate | CAGR of 105.4% |

|

Market size available for years |

2022-2027 |

|

Base year considered |

2022 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Product, By Application |

|

Geographies covered |

North America, Europe, APAC, Rest of the World |

|

Companies covered |

The major market players include Ubiblue (France), Haier Smart Home Co., Ltd (China), Camfridge Ltd (UK), Astronautics Corporation of America (US), VACUUMSCHMELZE GmbH & Co. KG (Germany), BASF SE (Germany), ERAMET (France), Samsung Electronics Co., Ltd (South Korea), Toshiba Corporation (Japan), Whirlpool Corporation (US) (Total 19 players are profiled) |

The study categorizes the magnetic refrigeration market based on product and application at the regional and global level.

Magnetic Refrigeration market, By Product

-

Refrigeration Systems

- Beverage Coolers

- Cabinet Displays

- Ice Cream Cabinets

- Freezers

- Refrigerators

-

Air Conditioning Systems

- Stationary Air Conditioners

- Mobile Air Conditioners

- Chillers

Magnetic Refrigeration Market, By Application

- Commercial

- Domestic

-

Transportation

- Logistics

- Automotive

- Aerospace

- Marine

-

Industrial

- Food & Beverages

- Healthcare

Magnetic Refrigeration Market, By Region

- North America

- Europe

- APAC

- Rest of the World

Recent Developments in Magnetic Refrigeration Industry

- In January 2020, France Brevets, a French company serving the valuation and protection of high-potential technological innovations and the promotion of patents in Europe, launched its license program Kione for a series of patents specialized in magnetic refrigeration technology. The first company licensed as part of this new program was Ubiblue.

- GE Appliances, a Haier company, and the Office of Energy & Renewable Energy (US) collaborated on a project to successfully harness the Magneto Caloric Effect (MCE) at the Oak Ridge National Laboratory (US). The project was initiated in June 2017 and planned to finish by June 2020, with the outcome of achieving cooling through MCE. MCE has the potential to reduce energy consumption by 20–30% beyond vapor compression while also eliminating any risk of direct refrigerant emissions to the atmosphere.

- In October 2019, Camfridge Ltd participated in a roadshow at the Zhejiang Province (China) to demonstrate its magnetic cooling technology. The event was attended by a highly qualified public composed of Chinese officials, investors, companies, entrepreneurs, and experts.

- The refrigeration and air conditioning industry suffers from the gradual phasing out of the use of HFCs. Magnetocaloric cooling offers an energy-efficient, future-proof alternative without any greenhouse gases. To that end, VACUUMSCHMELZE launched the magnetocaloric material CALORIVAC for series production in April 2019.

- In June 2016, Haier Smart Home completed the acquisition of General Electric’s (US) GE Appliances unit. This would help the company to further strengthen its technical capabilities and increase its customer base.

Frequently Asked Questions (FAQ):

What is the market size for the magnetic refrigeration market?

The magnetic refrigeration market is expected to be commercialized by 2022 at USD 4.5 million, and it is expected to grow at a CAGR of 105.4 % from 2022 to 2027 to reach USD 165.8 million by 2027.

What are the major driving factors and opportunities in the magnetic refrigeration market amidst the COVID-19 pandemic?

Increasing government initiatives toward a focus on green technology, low maintenance costs and compact design, and high energy efficiency are the factors driving the growth of the magnetic refrigeration market. The adoption of magnetic refrigeration in the commercial sector and high potential across the industrial sector provide opportunities to the magnetic refrigeration market players during the forecast period.

Who are the leading players in the global automated passenger counting system market?

Companies such as Ubiblue (France), Haier Smart Home Co., Ltd (China), Camfridge Ltd (UK), Astronautics Corporation of America (US), and VACUUMSCHMELZE GmbH & Co. KG (Germany), are the leading players in the market. Moreover, these companies rely on strategies such as which includes new product developments, partnership, and acquisitions. Such advantages give these companies an edge over other companies in the market.

What is the commercialization timeline for magnetic refrigeration market?

Based on primary responses, the magnetic refrigeration market for refrigeration system is assumed to be commercialized by 2022 and for air conditioning system, the market is assumed to be commercialized by 2023.

What are some of the technological advancements in the magnetic refrigeration market?

Refrigeration based on the magneto-caloric effect is a modern way to be more energy efficient and has potential across air conditioning systems as well. This method is environmentally friendly because, unlike the traditional vapor compression technology, which consists of expansion and compression of gasses, it does not employ chlorofluorocarbon gasses, which contribute to the greenhouse effect. Moreover, magnetic refrigerators are characterized by a higher efficiency compared to commonly used cooling appliances. Therefore, it is expected that the future of magnetic refrigeration is bright and promising. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 STUDY OBJECTIVES

1.2 DEFINITION AND SCOPE

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 GEOGRAPHIC SCOPE

1.4 INCLUSIONS AND EXCLUSIONS

1.5 YEARS CONSIDERED

1.6 CURRENCY

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 27)

2.1 RESEARCH DATA

FIGURE 1 MAGNETIC REFRIGERATION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Breakdown of primaries

2.1.2.3 Key data from primary sources

2.2 MAGNETIC REFRIGERATION MARKET SIZE ESTIMATION

FIGURE 2 RESEARCH FLOW OF MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing market size by bottom-up analysis (demand side)

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by top-down analysis (supply side)

FIGURE 3 SUPPLY SIZE ESTIMATION TO ARRIVE AT MARKET SIZE

2.3 MAGNETIC REFRIGERATION MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 4 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 5 ASSUMPTIONS FOR RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 36)

FIGURE 6 REFRIGERATION SYSTEMS TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

FIGURE 7 COMMERCIAL APPLICATION TO HOLD LARGEST MARKET SIZE FOR MAGNETIC REFRIGERATION DURING FORECAST PERIOD

FIGURE 8 MARKET IN APAC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 ATTRACTIVE OPPORTUNITIES IN MAGNETIC REFRIGERATION MARKET

FIGURE 9 GOVERNMENT REGULATIONS IN VARIOUS COUNTRIES TO ADOPT GREEN TECHNOLOGY TO DRIVE MARKET GROWTH

4.2 MAGNETIC REFRIGERATION MARKET IN EUROPE, BY PRODUCT AND APPLICATION

FIGURE 10 REFRIGERATION SYSTEM AND COMMERCIAL APPLICATION SEGMENTS TO HOLD LARGEST SHARES OF MARKET IN EUROPE BY 2027

4.3 MAGNETIC REFRIGERATION MARKET, BY TYPE

FIGURE 11 BEVERAGE COOLERS TO HOLD LARGEST MARKET SIZE OF MAGNETIC REFRIGERATION SYSTEM

4.4 MAGNETIC REFRIGERATION MARKET, BY COUNTRY

FIGURE 12 MAGNETIC REFRIGERATION MARKET IN CHINA TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 44)

5.1 MARKET DYNAMICS

FIGURE 13 GROWING ADOPTION OF MAGNETIC REFRIGERATION TECHNOLOGY DUE TO RISING FOCUS ON ENERGY EFFICIENT AND ENVIRONMENTALLY FRIENDLY PRODUCTS

FIGURE 14 MAGNETIC REFRIGERATION MARKET DRIVERS AND THEIR IMPACT

FIGURE 15 MAGNETIC REFRIGERATION MARKET RESTRAINTS AND THEIR IMPACT

FIGURE 16 MAGNETIC REFRIGERATION MARKET OPPORTUNITIES AND THEIR IMPACT

FIGURE 17 MAGNETIC REFRIGERATION MARKET CHALLENGES AND THEIR IMPACT

5.1.1 DRIVERS

5.1.1.1 Increasing government initiatives on green technology

5.1.1.2 Low maintenance costs

5.1.1.3 Compact design and high energy efficiency

FIGURE 18 DISTRIBUTION OF GLOBAL REFRIGERATION SECTOR’S ELECTRICITY CONSUMPTION

5.1.2 RESTRAINTS

5.1.2.1 High initial investment

5.1.2.2 Limited field strength of permanent magnets

5.1.3 OPPORTUNITIES

5.1.3.1 Adoption of magnetic refrigeration in commercial sector

5.1.3.2 High potential in industrial sector

5.1.4 CHALLENGES

5.1.4.1 Need for suitable magnetocaloric materials

5.1.4.2 Lack of awareness of benefits of magnetic refrigeration

5.2 VALUE CHAIN ANALYSIS

5.3 GOVERNMENT REGULATIONS RELATED TO REFRIGERATION & AIR-CONDITIONING

5.4 TECHNOLOGY ANALYSIS

5.5 PATENT ANALYSIS

5.6 USE CASES FOR MAGNETIC REFRIGERATION

5.7 ASP ANALYSIS OF MAGNETIC REFRIGERATION SYSTEM

FIGURE 19 ASP ANALYSIS OF MAGNETIC REFRIGERATION SYSTEM

5.8 ECOSYSTEM FOR REFRIGERATION INDUSTRY

FIGURE 20 ECOSYSTEM FOR REFRIGERATION INDUSTRY

6 MAGNETIC REFRIGERATION MARKET, BY PRODUCT (Page No. - 58)

6.1 INTRODUCTION

FIGURE 21 REFRIGERATION SYSTEM TO HOLD LARGEST MARKET SIZE OF MARKET DURING FORECAST PERIOD

TABLE 1 MAGNETIC REFRIGERATION MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 2 MAGNETIC REFRIGERATION MARKET IN TERMS OF VOLUME, 2022–2027 (THOUSAND UNITS)

6.2 REFRIGERATION SYSTEM

FIGURE 22 BEVERAGE COOLERS TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 3 MAGNETIC REFRIGERATION MARKET FOR REFRIGERATION SYSTEM, BY TYPE, 2022–2027 (USD MILLION))

FIGURE 23 COMMERCIAL APPLICATION TO HOLD LARGEST MARKET SIZE FOR MAGNETIC REFRIGERATION SYSTEMS DURING FORECAST PERIOD

TABLE 4 MARKET FOR REFRIGERATION SYSTEM, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 5 MAGNETIC REFRIGERATION MARKET FOR REFRIGERATION SYSTEM FOR TRANSPORTATION, BY APPLICATION, 2024–2027 (USD MILLION)

TABLE 6 MAGNETIC REFRIGERATION MARKET FOR REFRIGERATION SYSTEM FOR INDUSTRIAL, BY APPLICATION, 2023–2027 (USD MILLION)

FIGURE 24 EUROPE TO HOLD LARGEST MARKET SIZE FOR MAGNETIC REFRIGERATION SYSTEMS DURING FORECAST PERIOD

TABLE 7 MARKET FOR REFRIGERATION SYSTEM, BY REGION, 2022–2027 (USD MILLION)

6.2.1 BEVERAGE COOLERS

6.2.1.1 Compactness and energy efficiency to drive market growth

FIGURE 25 APAC TO GROW AT HIGHEST RATE FOR BEVERAGE COOLERS IN MARKET

TABLE 8 MAGNETIC REFRIGERATION MARKET FOR BEVERAGE COOLERS, BY REGION, 2022–2027 (USD MILLION)

6.2.2 CABINET DISPLAYS

6.2.2.1 Higher efficiency and greater reliability to propel market growth

TABLE 9 MAGNETIC REFRIGERATION MARKET FOR CABINET DISPLAYS, BY REGION, 2022–2027 (USD MILLION)

6.2.3 ICE CREAM CABINETS

6.2.3.1 Ice cream cabinets induced with magnetic cooling technology to have lower maintenance costs, leading to better ROI

TABLE 10 MAGNETIC REFRIGERATION MARKET FOR ICE CREAM CABINETS, BY REGION, 2022–2027 (USD MILLION)

6.2.4 FREEZERS

6.2.4.1 Rising government initiatives to phase out harmful refrigerants to drive market growth

TABLE 11 MAGNETIC REFRIGERATION MARKET FOR FREEZERS, BY REGION, 2023–2027 (USD MILLION)

6.2.5 REFRIGERATORS

6.2.5.1 Refrigerators to grow at highest CAGR

TABLE 12 MAGNETIC REFRIGERATION MARKET FOR REFRIGERATORS, BY REGION, 2023–2027 (USD MILLION)

6.3 AIR CONDITIONING SYSTEMS

FIGURE 26 STATIONARY AIR CONDITIONERS TO HOLD LARGEST SIZE OF MARKET FOR AIR CONDITIONING SYSTEMS

TABLE 13 MARKET FOR AIR CONDITIONING SYSTEM, BY TYPE, 2023–2027 (USD MILLION)

FIGURE 27 COMMERCIAL APPLICATION TO HOLD LARGEST SIZE OF MARKET FOR AIR CONDITIONING SYSTEMS

TABLE 14 MAGNETIC REFRIGERATION MARKET FOR AIR CONDITIONING SYSTEMS, BY APPLICATION, 2023–2027 (USD THOUSAND)

TABLE 15 MAGNETIC REFRIGERATION FOR AIR CONDITIONING SYSTEM MARKET FOR TRANSPORTATION, BY APPLICATION, 2024–2027 (USD THOUSAND)

TABLE 16 MAGNETIC REFRIGERATION MARKET FOR AIR CONDITIONING SYSTEM FOR INDUSTRIAL, BY APPLICATION, 2023–2027 (USD MILLION)

FIGURE 28 EUROPE TO HOLD LARGEST MARKET SIZE OF AIR CONDITIONING SYSTEMS DURING FORECAST PERIOD

TABLE 17 MARKET FOR AIR-CONDITIONING SYSTEMS, BY REGION, 2022–2027 (USD MILLION)

6.3.1 STATIONARY AIR CONDITIONERS

6.3.1.1 Stationary air conditioners to hold largest market size for air conditioning systems

TABLE 18 MAGNETIC REFRIGERATION MARKET FOR STATIONARY AIR CONDITIONING, BY REGION, 2023–2027 (USD MILLION)

6.3.2 MOBILE AIR CONDITIONERS

6.3.2.1 Mobile air conditioners’ compact design to drive market growth

FIGURE 29 EUROPE TO HOLD LARGEST MARKET SIZE OF MOBILE AIR CONDITIONING SYSTEMS DURING FORECAST PERIOD

TABLE 19 MARKET FOR MOBILE AIR CONDITIONING, BY REGION, 2024–2027 (USD THOUSAND)

6.3.3 CHILLERS

6.3.3.1 Chillers possess huge scope for industrial applications

TABLE 20 MARKET FOR CHILLERS, BY REGION, 2024–2027 (USD MILLION)

6.4 IMPACT OF COVID-19 ON REFRIGERATION INDUSTRY

7 MAGNETIC REFRIGERATION MARKET, BY APPLICATION (Page No. - 75)

7.1 INTRODUCTION

FIGURE 30 COMMERCIAL APPLICATION TO HOLD LARGEST MARKET SIZE FOR MAGNETIC REFRIGERATION DURING FORECAST PERIOD

TABLE 21 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7.2 COMMERCIAL

7.2.1 COMMERCIAL APPLICATION TO HOLD HIGHEST MARKET SHARE

TABLE 22 COMMERCIAL APPLICATION: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

FIGURE 31 APAC TO GROW AT HIGHEST CAGR FOR COMMERCIAL APPLICATIONS OF MARKET

TABLE 23 COMMERCIAL APPLICATION: MAGNETIC REFRIGERATION MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 24 COMMERCIAL APPLICATION: MARKET FOR REFRIGERATION SYSTEM, BY REGION, 2022–2027 (USD MILLION)

TABLE 25 COMMERCIAL APPLICATION: MARKET FOR AIR CONDITIONING, BY REGION, 2023–2027 (USD MILLION)

7.3 INDUSTRIAL

FIGURE 32 FOOD & BEVERAGE FOR INDUSTRIAL APPLICATION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 26 INDUSTRIAL APPLICATION: MARKET, BY APPLICATION, 2023–2027 (USD MILLION)

TABLE 27 INDUSTRIAL APPLICATION: MARKET, BY PRODUCT, 2023–2027 (USD MILLION)

FIGURE 33 EUROPE HOLDS HIGHEST MARKET SHARE FOR INDUSTRIAL APPLICATIONS OF MAGNETIC REFRIGERATION

TABLE 28 INDUSTRIAL APPLICATION: MAGNETIC REFRIGERATION MARKET, BY REGION, 2023–2027 (USD MILLION)

TABLE 29 INDUSTRIAL APPLICATION: MARKET FOR REFRIGERATION SYSTEM, BY REGION, 2023–2027 (USD MILLION)

TABLE 30 INDUSTRIAL APPLICATION: MARKET FOR AIR CONDITIONING, BY REGION, 2023–2027 (USD THOUSAND)

7.3.1 FOOD & BEVERAGE

7.3.1.1 Growing global market for processed food and increasing concerns to maintain their quality to drive market

TABLE 31 FOOD & BEVERAGE APPLICATION: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

FIGURE 34 APAC TO GROW AT HIGHEST CAGR FOR MARKET FOR FOOD & BEVERAGE DURING FORECAST PERIOD

TABLE 32 FOOD & BEVERAGE APPLICATION: MARKET, BY REGION, 2023–2027 (USD MILLION)

TABLE 33 FOOD & BEVERAGE APPLICATION: MARKET FOR REFRIGERATION SYSTEM, BY REGION, 2023–2027 (USD MILLION)

TABLE 34 FOOD & BEVERAGE APPLICATION: MAGNETIC REFRIGERATION MARKET FOR AIR CONDITIONING, BY REGION, 2023–2027 (USD THOUSAND)

7.3.2 HEALTHCARE

7.3.2.1 Need to monitor and store critical pharmaceuticals to create need for advanced cooling solutions globally

TABLE 35 HEALTHCARE APPLICATION: MAGNETIC REFRIGERATION MARKET, BY PRODUCT, 2023–2027 (USD THOUSAND)

TABLE 36 HEALTHCARE APPLICATION: MARKET, BY REGION, 2023–2027 (USD THOUSAND)

TABLE 37 HEALTHCARE APPLICATION: MARKET FOR REFRIGERATION SYSTEM, BY REGION, 2023–2027 (USD THOUSAND)

TABLE 38 HEALTHCARE APPLICATION: MARKET FOR AIR CONDITIONING, BY REGION, 2023–2027 (USD THOUSAND)

7.4 TRANSPORTATION

FIGURE 35 LOGISTICS HOLDS HIGHEST MARKET SHARE FOR TRANSPORTATION APPLICATION OF MARKET DURING FORECAST PERIOD

TABLE 39 TRANSPORTATION APPLICATION: MARKET, BY TYPE, 2024–2027 (USD THOUSAND)

TABLE 40 TRANSPORTATION APPLICATION: MARKET, BY PRODUCT, 2024–2027 (USD MILLION)

FIGURE 36 APAC TO GROW AT HIGHEST CAGR FOR TRANSPORTATION APPLICATION OF MARKET

TABLE 41 TRANSPORTATION APPLICATION: MAGNETIC REFRIGERATION MARKET FOR TRANSPORTATION BY REGION, 2024–2027 (USD MILLION)

TABLE 42 TRANSPORTATION APPLICATION: MARKET FOR REFRIGERATION, BY REGION, 2024–2027 (USD MILLION)

TABLE 43 TRANSPORTATION APPLICATION: MARKET FOR AIR CONDITIONING, BY REGION, 2024–2027 (USD MILLION)

7.4.1 LOGISTICS

7.4.1.1 Need for maintaining quality of commodity throughout value chain drives market growth

TABLE 44 LOGISTICS APPLICATION: MARKET, BY PRODUCT, 2024–2027 (USD MILLION)

FIGURE 37 EUROPE TO HOLD LARGEST MARKET SIZE FOR LOGISTICS IN LOGISTICS APPLICATION DURING FORECAST PERIOD

TABLE 45 LOGISTICS APPLICATION: MARKET, BY REGION, 2024–2027 (USD MILLION)

TABLE 46 LOGISTICS APPLICATION: MARKET FOR REFRIGERATION SYSTEM, BY REGION, 2024–2027 (USD MILLION)

TABLE 47 LOGISTICS APPLICATION: MARKET FOR AIR CONDITIONING, BY REGION, 2024–2027 (USD THOUSAND)

7.4.2 AUTOMOTIVE

7.4.2.1 Reduced energy consumption trait of magnetic refrigeration technology to provide opportunity

TABLE 48 AUTOMOTIVE APPLICATION: MAGNETIC REFRIGERATION MARKET, BY PRODUCT, 2024–2027 (USD MILLION)

TABLE 49 AUTOMOTIVE APPLICATION: MARKET, BY REGION, 2024–2027 (USD MILLION)

TABLE 50 AUTOMOTIVE APPLICATION: MARKET, FOR REFRIGERATION SYSTEM, BY REGION, 2024–2027 (USD THOUSAND)

TABLE 51 AUTOMOTIVE APPLICATION: MAGNETIC REFRIGERATION MARKET FOR AIR CONDITIONING, BY REGION, 2024–2027 (USD THOUSAND)

7.4.3 AEROSPACE

7.4.3.1 Lower consumption of energy by magnetic refrigeration systems helps lower overall operational & maintenance costs

TABLE 52 AEROSPACE APPLICATION: MARKET, BY PRODUCT, 2025–2027 (USD THOUSAND)

TABLE 53 AEROSPACE APPLICATION: MARKET, BY REGION, 2025–2027 (USD THOUSAND)

TABLE 54 AEROSPACE APPLICATION: MARKET FOR REFRIGERATION SYSTEM, BY REGION, 2025–2027 (USD THOUSAND)

TABLE 55 AEROSPACE APPLICATION: MARKET FOR AIR CONDITIONING, BY REGION, 2025–2027 (USD THOUSAND)

7.4.4 MARINE

7.4.4.1 Marine application to be commercialized later than other applications

TABLE 56 MARINE APPLICATION: MARKET, BY PRODUCT, 2025–2027 (USD THOUSAND)

TABLE 57 MARINE APPLICATION: MARKET, BY REGION, 2025–2027 (USD THOUSAND)

TABLE 58 MARINE APPLICATION: MARKET FOR REFRIGERATION SYSTEM, BY REGION, 2025–2027 (USD THOUSAND)

TABLE 59 MARINE APPLICATION: MARKET FOR AIR CONDITIONING, BY REGION, 2025–2027 (USD THOUSAND)

7.5 DOMESTIC

7.5.1 DEMAND FOR LOW POWER CONSUMPTION IN HOUSEHOLD APPLIANCES TO DRIVE MARKET

TABLE 60 DOMESTIC APPLICATION: MARKET, BY PRODUCT, 2023–2027 (USD MILLION)

TABLE 61 DOMESTIC APPLICATION: MAGNETIC REFRIGERATION MARKET, BY REGION, 2023–2027 (USD THOUSAND)

TABLE 62 DOMESTIC APPLICATION: MARKET FOR REFRIGERATION SYSTEM, BY REGION, 2023–2027 (USD THOUSAND)

TABLE 63 DOMESTIC APPLICATION: MARKET FOR AIR CONDITIONING, BY REGION, 2023–2027 (USD THOUSAND)

7.6 IMPACT OF COVID-19 ON REFRIGERATION APPLICATIONS

8 MATERIALS USED FOR MAGNETIC REFRIGERATION (Page No. - 99)

8.1 INTRODUCTION

8.2 GADOLINIUM

8.3 DYSPROSIUM ALLOYS

8.4 ERBIUM

8.5 OTHERS

9 MAGNETIC REFRIGERATION SYSTEM, BY TYPE (Page No. - 101)

9.1 INTRODUCTION

9.2 RECIPROCATING TYPE

9.3 ROTARY TYPE

10 GEOGRAPHIC ANALYSIS (Page No. - 102)

10.1 INTRODUCTION

FIGURE 38 EUROPE TO LEAD MARKET DURING FORECAST PERIOD

TABLE 64 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 39 NORTH AMERICA: MAGNETIC REFRIGERATION MARKET SNAPSHOT

FIGURE 40 US TO GROW AT HIGHEST CAGR FOR NORTH AMERICAN MAGNETIC REFRIGERATION DURING FORECAST PERIOD

TABLE 65 MAGNETIC REFRIGERATION MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 66 MARKET IN NORTH AMERICA, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 67 MARKET IN NORTH AMERICA, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 68 MARKET IN NORTH AMERICA FOR COMMERCIAL, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 69 MARKET IN NORTH AMERICA FOR DOMESTIC, BY COUNTRY, 2023–2027 (USD THOUSAND)

TABLE 70 MARKET IN NORTH AMERICA FOR INDUSTRIAL, BY COUNTRY, 2023–2027 (USD MILLION)

TABLE 71 MARKET IN NORTH AMERICA FOR TRANSPORTATION, BY COUNTRY, 2024–2027 (USD THOUSAND)

TABLE 72 MARKET IN NORTH AMERICA FOR INDUSTRIAL, BY APPLICATION, 2023–2027 (USD MILLION)

TABLE 73 MARKET IN NORTH AMERICA FOR TRANSPORTATION, BY APPLICATION, 2024–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Increasing demand for eradicating harmful refrigerants to drive market

10.2.2 CANADA

10.2.2.1 Ongoing developments for commercial refrigeration industry to augment market growth

10.2.3 MEXICO

10.2.3.1 Rising demand for commercial and domestic refrigeration applications to propel demand for magnetic refrigeration

10.3 EUROPE

FIGURE 41 EUROPE: MAGNETIC REFRIGERATION MARKET SNAPSHOT

TABLE 74 MAGNETIC REFRIGERATION MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 75 MARKET IN EUROPE, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 76 MARKET IN EUROPE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 77 MARKET IN EUROPE FOR COMMERCIAL, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 78 MAGNETIC REFRIGERATION MARKET IN EUROPE FOR DOMESTIC, BY COUNTRY, 2023–2027 (USD THOUSAND)

TABLE 79 MARKET IN EUROPE FOR INDUSTRIAL, BY COUNTRY, 2023–2027 (USD THOUSAND)

TABLE 80 MAGNETIC REFRIGERATION MARKET IN EUROPE FOR TRANSPORTATION, BY COUNTRY, 2024–2027 (USD THOUSAND)

TABLE 81 MARKET IN EUROPE FOR INDUSTRIAL, BY APPLICATION, 2023–2027 (USD MILLION)

TABLE 82 MAGNETIC REFRIGERATION MARKET IN EUROPE FOR TRANSPORTATION, BY APPLICATION, 2024–2027 (USD MILLION)

10.3.1 UK

10.3.1.1 Growing government initiatives to curb usage of harmful refrigerants to drive market

10.3.2 GERMANY

10.3.2.1 Germany to hold highest market share for magnetic refrigeration in Europe during forecast period

10.3.3 FRANCE

10.3.3.1 Increasing adoption of F-gas regulations to drive market growth

10.3.4 ITALY

10.3.4.1 Growing adoption of commercial refrigeration systems to provide opportunity

10.3.5 REST OF EUROPE

10.4 APAC

FIGURE 42 APAC: MAGNETIC REFRIGERATION MARKET SNAPSHOT

FIGURE 43 CHINA TO HOLD LARGEST MARKET SHARE FOR MAGNETIC REFRIGERATION DURING FORECAST PERIOD

TABLE 83 MARKET IN APAC, BY COUNTRY, 2022–2027 (USD THOUSAND)

TABLE 84 MAGNETIC REFRIGERATION MARKET IN APAC, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 85 MARKET IN APAC FOR COMMERCIAL, BY COUNTRY, 2022–2027 (USD THOUSAND)

TABLE 86 MAGNETIC REFRIGERATION MARKET IN APAC FOR DOMESTIC, BY COUNTRY, 2023–2027 (USD THOUSAND)

TABLE 87 MARKET IN APAC FOR INDUSTRIAL, BY COUNTRY, 2023–2027 (USD THOUSAND)

TABLE 88 MAGNETIC REFRIGERATION MARKET IN APAC FOR TRANSPORTATION, BY COUNTRY, 2024–2027 (USD THOUSAND)

TABLE 89 MARKET IN APAC FOR INDUSTRIAL, BY APPLICATION, 2023–2027 (USD MILLION)

TABLE 90 MAGNETIC REFRIGERATION MARKET IN APAC FOR TRANSPORTATION, BY APPLICATION, 2024–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 China to hold highest market share for magnetic refrigeration in APAC

10.4.2 JAPAN

10.4.2.1 Active participation of government to reduce HCFC emission to drive market growth

10.4.3 SOUTH KOREA

10.4.3.1 Increasing per capita income to drive market growth across commercial refrigeration, eventually propelling market growth across magnetic refrigeration applications

10.4.4 REST OF APAC

10.5 ROW

TABLE 91 MAGNETIC REFRIGERATION MARKET IN ROW, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 92 MARKET IN ROW, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 93 MAGNETIC REFRIGERATION MARKET IN ROW, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 94 MARKET IN ROW FOR COMMERCIAL, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 95 MAGNETIC REFRIGERATION MARKET IN ROW FOR DOMESTIC, BY REGION, 2023–2027 (USD THOUSAND)

TABLE 96 MARKET IN ROW FOR INDUSTRIAL, BY REGION, 2023–2027 (USD THOUSAND)

TABLE 97 MAGNETIC REFRIGERATION MARKET IN ROW FOR TRANSPORTATION, BY REGION, 2024–2027 (USD THOUSAND)

TABLE 98 MARKET IN ROW FOR INDUSTRIAL, BY APPLICATION, 2023–2027 (USD THOUSAND)

TABLE 99 MAGNETIC REFRIGERATION MARKET IN ROW FOR TRANSPORTATION, BY APPLICATION, 2024–2027 (USD THOUSAND)

10.5.1 SOUTH AMERICA

10.5.1.1 Brazil to provide significant opportunities

10.5.2 MIDDLE EAST & AFRICA

10.5.2.1 Rising demand for energy-efficient solutions to drive growth of magnetic refrigeration

10.5.3 IMPACT OF COVID-19

11 COMPETITIVE LANDSCAPE (Page No. - 128)

11.1 OVERVIEW

11.2 MARKET RANKING ANALYSIS, 2022

FIGURE 44 GLOBAL MAGNETIC REFRIGERATION MARKET RANKING ANALYSIS, 2022

11.3 COMPANY EVALUATION MATRIX

11.3.1 STAR

11.3.2 EMERGING LEADER

11.3.3 PERVASIVE

11.3.4 PARTICIPANT

FIGURE 45 MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2022

11.4 PRODUCT & BUSINESS FOOTPRINT ANALYSIS OF TOP PLAYERS

FIGURE 46 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MAGNETIC REFRIGERATION MARKET

11.5 KEY MARKET DEVELOPMENTS

11.5.1 PRODUCT PROTOTYPE LAUNCHES & DEVELOPMENTS

TABLE 100 PRODUCT LAUNCHES & DEVELOPMENTS, 2016–2020

11.5.2 PARTNERSHIPS & COLLABORATIONS

TABLE 101 PARTNERSHIPS & COLLABORATIONS, 2016–2020

11.5.3 ACQUISITIONS

TABLE 102 ACQUISITIONS, 2016

12 COMPANY PROFILES (Page No. - 134)

12.1 INTRODUCTION

12.2 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.2.1 UBIBLUE

12.2.2 HAIER SMART HOME CO., LTD

FIGURE 47 HAIER SMART HOME CO., LTD: COMPANY SNAPSHOT

12.2.3 CAMFRIDGE LTD

12.2.4 ASTRONAUTICS CORPORATION OF AMERICA

12.2.5 VACUUMSCHMELZE GMBH & CO. KG

12.2.6 BASF SE

FIGURE 48 BASF SE: COMPANY SNAPSHOT

12.2.7 ERAMET

FIGURE 49 ERAMET S.A.: COMPANY SNAPSHOT

12.2.8 SAMSUNG ELECTRONICS CO., LTD

FIGURE 50 SAMSUNG ELECTRONICS CO., LTD: COMPANY SNAPSHOT

12.2.9 TOSHIBA CORPORATION

FIGURE 51 TOSHIBA CORPORATION: COMPANY SNAPSHOT

12.2.10 WHIRLPOOL CORPORATION

FIGURE 52 WHIRLPOOL CORPORATION: COMPANY SNAPSHOT

*Business Overview, Products/Solutions/Services Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

12.3 RIGHT TO WIN

12.4 OTHER KEY PLAYERS

12.4.1 CCS SA

12.4.2 CEMAFROID

12.4.3 GENERAL ENGINEERING & RESEARCH

12.4.4 KIRSCH

12.4.5 KIUTRA

12.4.6 MAGNOTHERM SOLUTIONS

12.4.7 MILLIPORE SIGMA

12.4.8 TCS MICROPUMPS LTD

12.4.9 VCU INNOVATION GATEWAY

13 APPENDIX (Page No. - 174)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

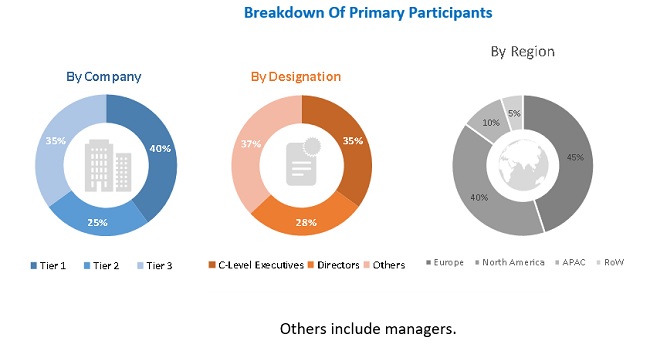

The study involved four major activities in estimating the magnetic refrigeration market. Secondary and primary sources have been used to identify and collect information for an extensive technical and commercial study of the magnetic refrigeration market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. This research includes the study of annual reports of the market players to identify the top players, along with interviews of the key opinion leaders such as chief executive officers (CEOs), directors, and marketing personnel.

Secondary Research

The secondary sources used for this research study include government sources, corporate filings (such as annual reports, investor presentations, and financial statements) and trade articles, white papers, industry news, business, and professional associations. The secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research. A few important secondary sources referred for this research study are the Environmental Protection Agency (EPA), Japan Refrigeration and Air Conditioning Industry Association (JRAIA), Heating Refrigeration and Air Conditioning Institute of Canada (HRAI), and European Environment Agency (EEA).

Primary Research

Extensive primary research has been conducted after understanding and analyzing the magnetic refrigeration market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across 4 major regions—North America, Europe, APAC, and RoW. Approximately 30% of the primary interviews has been conducted with the demand side and 70% with the supply side. This primary data has been collected mainly through telephonic interviews, which consist of 80% of the overall primary interviews; also, questionnaires and emails have been used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the overall size of the magnetic refrigeration market. These methods have also been used extensively to estimate the size of various market subsegments.

The research methodology used to estimate the market size by the top-down approach includes the following:

- Focusing initially on top-line investments and expenditures being made in the ecosystems of the magnetic refrigeration market

- Estimating the market size based on the parent market size and developments.

- Conducting multiple on-field discussions with key opinion leaders across major companies involved in the development of magnetic refrigeration to understand the market trends

- Estimating the geographic split using secondary sources based on various factors, such as the number of OEMs in a specific country and region, the role of major players in the market for the development of innovative products, the adoption and penetration rates in a particular country for various end-user applications, and the impact of government regulations to phase out harmful refrigerants

The research methodology used to estimate the market size by the bottom-up approach includes the following:

- Identifying entities in the magnetic refrigeration market that influence the entire market, along with the related component players

- Analyzing major manufacturers of magnetic refrigeration systems, studying their portfolios, and understanding different components and products

- Analyzing their patents, past & upcoming projects, developments, and efforts to develop and commercialize the technology

- Several parameters studied, including the impact of regulations regarding the usage of HFCs and HCFC-based refrigerants

- Analyzing trends pertaining to the use of magnetic refrigeration devices for different kinds of applications

- Tracking the ongoing and upcoming developments in the market, such as investments made, R&D activities, product launches, collaborations, and partnerships, and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to understand the different types of magnetic cooling systems, including magnetic refrigeration systems and air-conditioning systems, and applications and recent trends in the market, thereby analyzing the breakup of the scope of work carried out by major companies

- Arriving at the market estimates by analyzing the parent market size and penetration of magnetic refrigeration technology, along with developments of companies

- Segmenting the overall market into various other market segments

- Verifying and cross-checking the estimate at every level from discussions with key opinion leaders, such as CXOs, directors, and operations managers, and with the domain experts in MarketsandMarkets

- Studying various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases

Data Triangulation

After arriving at the overall market size through the process explained above, the overall market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, the market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the magnetic refrigeration market, in terms of value, based on product, application, and region

- To describe and forecast the regional magnetic refrigeration market, in terms of value, for North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide qualitative insights on different components, types, and materials of magnetic refrigeration systems

- To provide detailed information regarding the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the value chain pertaining to the ecosystems of magnetic refrigeration along with the average selling price trends for the market

- To strategically analyze the ecosystem and patent landscape pertaining to the magnetic refrigeration market

- To strategically analyze micro markets with regard to individual growth trends, prospects, and contributions to the overall magnetic refrigeration market

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies, along with a detailed competitive landscape, for market leaders

- To analyze strategic approaches such as new product developments, acquisitions, agreements, and partnerships in the magnetic refrigeration market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Profiling of additional market players

Growth opportunities and latent adjacency in Magnetic Refrigeration Market