The study involved four major activities in estimating the current size of the district heating market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process for identifying and collecting information important for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

List of major secondary sources

|

Source

|

Web Link

|

|

International District Energy Association (IDEA)

|

https://www.districtenergy.org/home

|

|

International Energy Agency (IEA)

|

https://www.iea.org/reports/district-heating

|

|

Euroheat & Power (EHP)

|

https://www.euroheat.org/

|

Primary Research

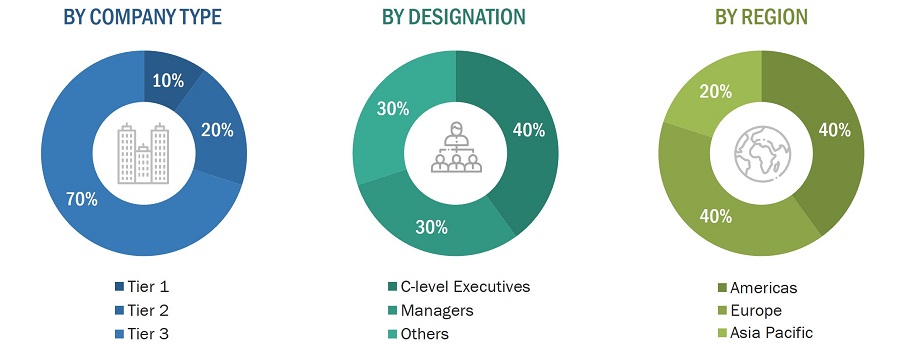

Extensive primary research was conducted after gaining knowledge about the current scenario of the district heating market through secondary research. Several primary interviews were conducted with experts from both the demand and supply sides across four major regions—Americas, Europe, and Asia Pacific. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been used, along with several data triangulation methods, to perform market estimation and forecasting for the overall market segments and subsegments listed in this report. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figure represents this study’s overall market size estimation process.

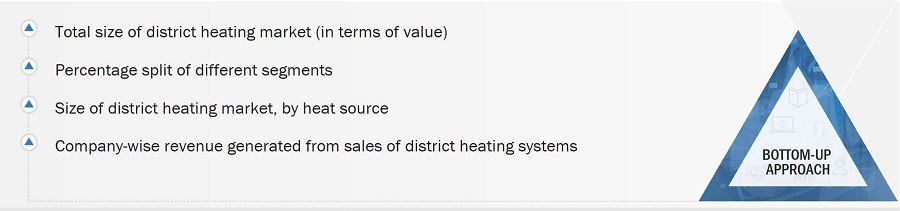

Bottom-Up Approach

The bottom-up approach was used to arrive at the overall size of the district heating market from the revenues of the key players and their shares in the market. The overall market size was calculated based on the revenues of the key players identified in the market.

-

Identifying approximate revenues of companies involved in the district heating ecosystem

-

Identifying different offerings of district heating

-

Analyzing the global penetration of each offering of district heating through secondary and primary research

-

Conducting multiple discussion sessions with key opinion leaders to understand the district heating systems and their applications; analyzing the breakup of the work carried out by each key company

-

Verifying and crosschecking estimates at every level with key opinion leaders, including chief executive officers (CEO), directors, and operation managers, and then finally, with the domain experts of MarketsandMarkets

-

Studying various paid and unpaid sources of information such as press releases, white papers, and databases of the company- and region-specific developments undertaken in the district heating market

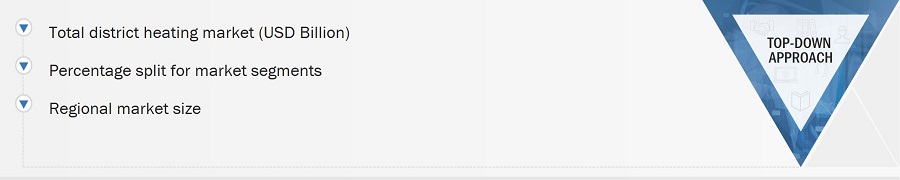

Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research.

The most appropriate immediate parent market size has been used to implement the top-down approach to calculate the market size of specific segments. The top-down approach has been implemented for the data extracted from the secondary research to validate the market size obtained.

Each company’s market share has been estimated to verify the revenue shares used earlier in the top-down approach. This study has determined and confirmed the overall parent market and individual market sizes by the data triangulation method and data validation through primaries. The data triangulation method in this study is explained in the next section.

-

Focusing initially on the top-line investments and expenditures made in the district heating ecosystem; further splitting into offering and listing key developments in key market areas

-

Identifying all major players offering a variety of district heating systems, which were verified through secondary research and a brief discussion with industry experts

-

Analyzing revenues, product mix, and geographic presence for which district heating systems are offered by all identified players to estimate and arrive at the percentage splits for all key segments

-

Discussing these splits with industry experts to validate the information and identify key growth domains across all major segments

-

Breaking down the total market based on verified splits and key growth domains across all segments

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The data triangulation procedure has been employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size has been validated using top-down and bottom-up approaches.

Market Definition

According to the International District Energy Association (IDEA), “district heating is an underground infrastructure asset, through which thermal energy can be provided to several buildings from central energy plants”. These plants produce steam or hot water that can be transmitted continuously through highly insulated underground thermal pipeline networks. District heating systems can contribute to a more integrated and efficient energy infrastructure by centralized heat production and delivery, lowering overall energy consumption and costs for end users. Therefore, district heating offers end-use customers improved energy efficiency, reduced carbon emissions, fuel flexibility, simplification of building operations and maintenance, decreased infrastructure costs, etc. Moreover, the heat required is produced by various plants, such as boilers and combined heat and power plants. The produced heat is distributed for space heating and water heating requirements of residential, industrial, and commercial consumers.

Key Stakeholders

-

Raw material suppliers

-

Original equipment manufacturers (OEMs)

-

Original design manufacturers (ODM)

-

Research institutes

-

District heating producers and component manufacturers

-

Forums, alliances, and associations

-

Governments and financial institutions

-

Analysts and strategic business planners

Report Objectives

-

To describe and forecast the size of the district heating market, in terms of value, by heat source, plant type, and application

-

To describe and forecast the market size of various segments across three key regions—the Americas, Europe, and Asia Pacific, in terms of value

-

To describe the components used for district heating.

-

To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges).

-

To provide an overview of the value chain pertaining to the district heating ecosystem, along with the average selling prices of district heating systems

-

To strategically analyze the ecosystem, tariffs and regulations, patent landscape, Porter’s five forces, regulations, import and export scenarios, trade landscape, and case studies pertaining to the market under study

-

To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the overall market

-

To analyze opportunities in the market for stakeholders by identifying high-growth segments

-

To provide details of the competitive landscape for market leaders

-

To strategically profile the key players and comprehensively analyze their market position regarding ranking and core competencies2, along with detailing the competitive landscape for market leaders.

-

To track and analyze competitive developments, such as partnerships, collaborations, agreements, joint ventures, mergers and acquisitions, expansions, product launches, and other developments in the district heating market.

-

Updated market developments of profiled players: The current report includes the market developments from May 2020 to October 2023.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

-

Detailed analysis and profiling of additional market players (up to 5)

-

Additional country-level analysis of the district heating market

Product Analysis

-

Product matrix, which provides a detailed comparison of the product portfolio of each company in the district heating market.

Growth opportunities and latent adjacency in District Heating Market