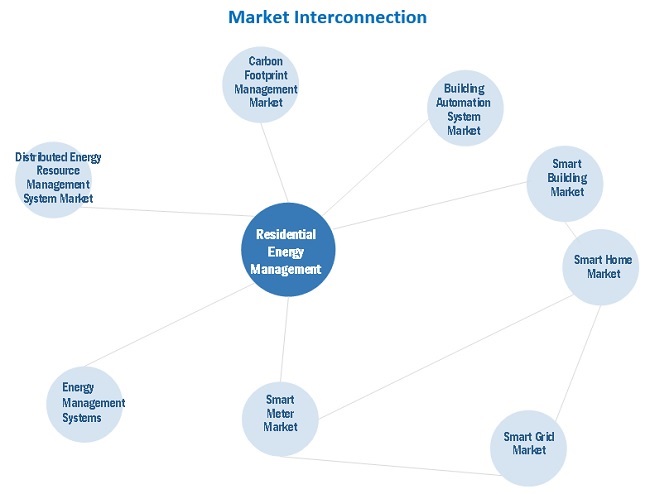

Residential Energy Management Market by Component (Hardware (RTU, Relays, LCS, DR devices, Control Devices, In-house Displays), Software(EMP, Energy Analytics, CEP); Communication Technology (Wired, Wireless); Application; Region - Global forecast to 2025

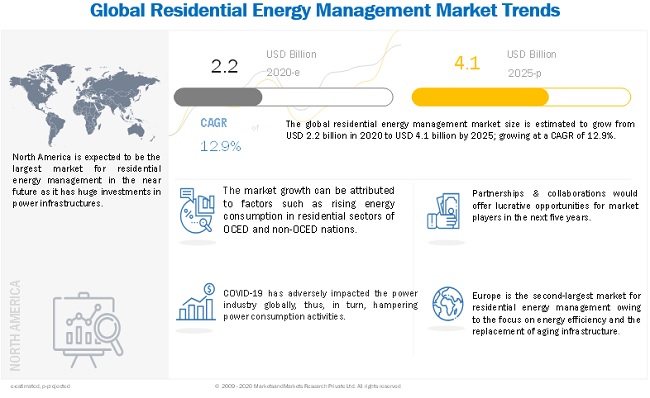

[184 Pages Report] The global residential energy management market is projected to reach USD 4.1 billion by 2025 from an estimated USD 2.2 billion in 2020, at a CAGR of 12.9% during the forecast period. Increasing government initiative for residential buildings and increasing power consumption is driving the residential energy management market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Residential energy management Market

The ongoing COVID-19 pandemic has impacted the power industry globally. Due to the current scenario ,various device manufacture companies across regions has to shut down their manufacturing facilities and services as countries practiced partial or full lockdown strategy to deal with the pandemic. The electricity demand has been reduced significantly due to the COVID-19 pandemic, though electricity use in residential buildings has increased. However, governments across the world were compelled to reduce the business activities in response to minimize the threat of coronavirus. Owing to the decline in the business activities has further negatively impacted residential energy management solutions in the short term.

Residential energy management Market Dynamics

Driver: Rising energy consumption in residential sectors of OCED and non OCED nations

Energy consumption in the residential sector includes all energy consumed by households, excluding the energy used for transportation. It includes energy used for heating, cooling, lighting, water heating, and consumer products. In the International Energy Outlook 2016, the residential sector accounted for about 13% of the total world delivered energy consumption in 2040. Delivered energy consumption in the residential sector grows by an average of 1.4%/year from 2012 to 2040, increasing by a total of 48% over the entire period. This will likely drive the demand of residential energy management market.

Restraints: High initial costs related to deploying residential energy management systems

The initial phase of residential energy management system deployment is capital intensive. The role of local and national governments is vital in transforming infrastructures. The technology requires huge investments initially to set up the transmission network between the customers and the smart grid. Furthermore, an effective deployment requires strong coordination across customary organizational boundaries, significant process change, and rigorous governance. High operational and maintenance costs post-deployment are also a huge concern for the utility providers. Thus, reducing the demand for enhanced oil recovery.

Opportunities: Increasing investments for modernizing aging grid infrastructures

Increased investments in the digitalization of the grid by implementing advanced communication technologies will fuel the market growth. Over the next decade, China plans to invest USD 6 trillion in infrastructure as part of its urbanization development plan. The private and public investments for the urbanization of the infrastructure in the UK are expected to be worth about USD 375 billion. Thus, these investments creates opportunities for the residential energy management market.

Challenges: Interoperability of residential energy management systems

The interoperability problem is compounded by the need to interconnect both legacy equipment in buildings (such as roof-top chillers, electric meters, and lighting control panels) with next-generation over the top (OTT) devices such as sensors and switches in the electric power system, to enhance the coordination of energy flow with the real-time flow of information and analysis. Lack of communication standards, incapability of different IT protocols, and incompatible components of REM systems are also a few of the major barriers to the deployment and interoperability of residential energy management systems.

To know about the assumptions considered for the study, download the pdf brochure

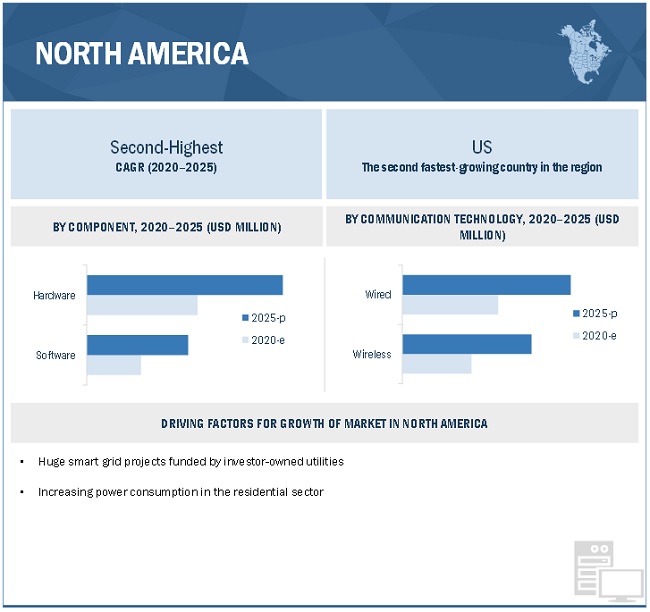

Software is expected to grow at the fastest rate for residential energy management market, by component, during the forecast period

Based on component, the market has been segmented into hardware, and software. The software segment accounted for the fastest growing market for the market in 2019.The growth of the market for software component is attributed to its ease in accessibility and the ability to manage a huge amount of data from multiple devices, which transmit data simultaneously.

The wireless segment is projected to register a higher CAGR than the wired segment during the forecast period

Based on communication technology, the market has been segmented into wired and wireless. The wireless segment is projected to witness a higher growth rate than the wired segment from 2020 to 2025. Wireless communication technology reduces maintenance costs and has easy accessibility of data from remote locations, which are expected to help drive its demand. The wireless segment includes radio frequency mesh, cellular, and WiMAX, among which the radio frequency mesh holds the largest market share owing to its high bandwidth, minimal latency, and end-to-end security features

By application, power monitoring & control is expected to be the most significant contributor to the residential energy management market during the forecast period

The power monitoring & control segment is expected to grow at the fastest rate during the forecast period. The power monitoring & control application segment is projected to hold the largest market size during the forecast period. The growth of this segment is driven by the rising demand for power in the residential sector and the need for effectively utilizing the power. Thus, increasing demand in the residnetial are driving the residential energy management market.

North America is expected to be the largest market during the forecast period.

North America, Europe, South America, Asia Pacific, Middle East, and Africa are the major regions considered for the study of the residential energy management market. North America is estimated to be the largest market from 2020 to 2025, driven by the huge increase in demand for electricity in North America, and its power sector is facing challenges in terms of reaching energy efficiency targets, compliance with federal carbon policy, and integrating various distributed energy generation sources. Hence, there is an increase in investments for residential energy management to overcome such challenges.

Key Market Players

The major players in the global residential energy management market are include ABB (Switzerland), Eaton (Ireland), Schneider Electric (France), Honeywell International (US), and Siemens (Germany).

Scope of the Report

|

Report Metric |

Details |

|

Market Size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Component, Communication technology, Application, and region |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

ABB (Switzerland), Eaton (Ireland), Schneider Electric (France), Honeywell International (US), and Siemens (Germany),General Electric (US), Engie (France), E.On (Germany), Bosch (Germany), Landis+Gyr (Switzerland) , Itron (US), Emerson (US), Trane Technologies (Ireland), Tantalus system Corp, (US), Provident Energy Management Inc. (Canada), Sunverge Energy Inc.(US) , Koben System Inc. (Canada), NeoSilica (India), Lockheed Martin Corporation (US), Uplight (US), Span.IO (US), Lumin (US), RacePoint Energy(US), and Appartme (Poland), Wattics Ltd (UK) |

This research report categorizes the residential energy management market-based technology, application, and region

Based on component, the market has been segmented as follows:

-

Hardware

- Remote Terminal Units

- Relays

- Load Control Switches

- Demand Response Devices

- Control Devices

- In- house Displays

-

Software

- Energy Management Platform

- Energy Analytics

- Customer Engagement Platform

Based on communication technology, the market has been segmented as follows:

-

Wired

- Fiber Optic

- Ethernet

- Powerline Carrier

- IP

-

Wireless

- Radio Frequency Mesh

- Cellular Network

- WiMAX

Based on application, the market has been segmented as follows:

- Power Monitoring & Control

- Load Shedding & Management

- Flexible Load Management

Based on the region, the market has been segmented as follows:

- North America

- Asia Pacific

- South America

- Europe

- Middle East & Africa

Recent Developments

- In June 2020, Eaton entered into a collaboration with Sunverge for providing intelligent and dynamic energy management of in-home appliances. Integrating Eaton’s energy management residential energy management with the Sunverge platform delivered utilities an all-in-one solution for smart home energy management, DER control, and dynamic, flexible load management.

- In May 2018, Schneider Electric entered into a partnership with SolarEdge Technologies Inc. It enhanced the residential solar market and provided homeowners with seamless energy management for smart homes.

- In May 2018, Honeywell launched IQ Vision, a building energy management system (BEMS) from Trend Control Systems.

- IQ Vision is designed to help building owners and managers optimize energy use in their properties.

- In March 2018, ABB launched the energy and asset management portfolio. The portfolio includes two energy monitoring solutions, the CMS-700 circuit-monitoring system, and the EQmatic energy analyzer. The portfolio simplifies energy management for buildings, enabling savings of up to 30 percent.

Frequently Asked Questions (FAQ):

What is the current size of the residential energy management market?

The current market size of global residential energy management market is 2.2 billion in 2020.

What is the major drivers for residential energy management market?

Rising energy consumption in residential sectors of OCED and NON OCED nations and government initiatives and policies toward energy efficiency in residential buildings are some of the major drivers driving the market of residential energy management.

Which is the fastest growing region during the forecasted period in residential energy management market?

Asia Pacific is the fastest growing region during the forecasted period owing to increasing power consumption in residential sector, and upcoming smart city projects.

Which is the fastest growing segment, by communication technology during the forecasted period in residential energy management market?

The wireless segment , by technology is the fastest growing segment during the forecasted period due to need to reduce maintenance costs and increase easy of accessibility of data from remote locations. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 RESIDENTIAL ENERGY MANAGEMENT MARKET, BY COMPONENT: INCLUSIONS VS. EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.4 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

FIGURE 1 MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

TABLE 1 RESIDENTIAL ENERGY MANAGEMENT: PLAYERS/COMPANIES CONNECTED

2.3 SCOPE

2.4 IMPACT OF COVID-19 ON POWER INDUSTRY

2.5 MARKET SIZE ESTIMATION

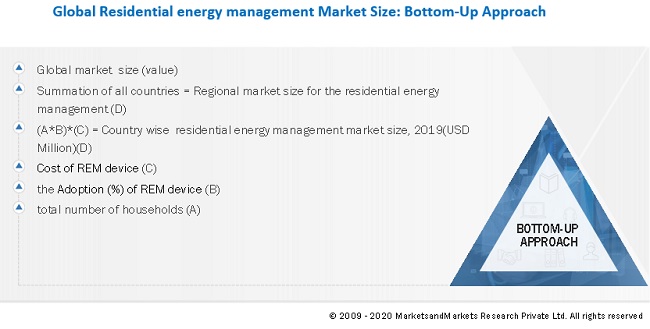

2.5.1 BOTTOM-UP APPROACH

FIGURE 3 RESIDENTIAL ENERGY MANAGEMENT MARKET: BOTTOM-UP APPROACH

2.5.2 TOP-DOWN APPROACH

FIGURE 4 MARKET: TOP-DOWN APPROACH

2.5.3 IDEAL DEMAND-SIDE ANALYSIS

FIGURE 5 MARKET: DEMAND-SIDE ANALYSIS

2.5.3.1 Assumptions for demand-side

2.5.3.2 Calculations

2.5.4 SUPPLY-SIDE ANALYSIS

FIGURE 6 MARKET: SUPPLY-SIDE ANALYSIS

2.5.4.1 Supply-side calculations

FIGURE 7 MARKET RANKING & INDUSTRY CONCENTRATION, 2019

2.5.5 FORECASTS

3 EXECUTIVE SUMMARY (Page No. - 36)

3.1 SCENARIO ANALYSIS

FIGURE 8 SCENARIO ANALYSIS: MARKET, 2017–2025

3.1.1 OPTIMISTIC SCENARIO

3.1.2 REALISTIC SCENARIO

3.1.3 PESSIMISTIC SCENARIO

TABLE 2 RESIDENTIAL ENERGY MANAGEMENT MARKET SNAPSHOT

FIGURE 9 NORTH AMERICA DOMINATED MARKET IN 2019, IN TERMS OF SHARE

FIGURE 10 HARDWARE SEGMENT TO CONTINUE TO HOLD LARGER SHARE OF MARKET, BY COMPONENT, DURING FORECAST PERIOD

FIGURE 11 WIRED COMMUNICATION TECHNOLOGY SEGMENT TO CONTINUE TO HOLD LARGER SHARE OF MARKET, BY COMMUNICATION TECHNOLOGY, DURING FORECAST PERIOD

FIGURE 12 POWER MONITORING & CONTROL SEGMENT TO CONTINUE TO HOLD LARGEST SHARE OF MARKET, BY APPLICATION, DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 ATTRACTIVE OPPORTUNITIES IN RESIDENTIAL ENERGY MANAGEMENT MARKET

FIGURE 13 INCREASING CONSUMPTION OF POWER IN RESIDENTIAL SECTOR IS DRIVING MARKET DURING 2020–2025

4.2 MARKET, BY REGION

FIGURE 14 RESIDENTIAL ENERGY MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET IN ASIA PACIFIC, BY APPLICATION & COUNTRY

FIGURE 15 POWER MONITORING & CONTROL AND CHINA DOMINATED RESIDENTIAL ENERGY MARKET IN ASIA PACIFIC, BY APPLICATION AND COUNTRY, RESPECTIVELY, IN 2019

4.4 MARKET, BY COMPONENT

FIGURE 16 HARDWARE DOMINATED RESIDENTIAL ENERGY MARKET, BY COMPONENT, IN 2019

4.5 MARKET, BY COMMUNICATION TECHNOLOGY

FIGURE 17 WIRED COMMUNICATION TECHNOLOGY SEGMENT HELD LARGER SHARE OF MARKET, BY COMMUNICATION TECHNOLOGY, IN 2019

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 18 COVID-19 GLOBAL PROPAGATION

FIGURE 19 COVID-19 PROPAGATION IN SELECTED COUNTRIES

5.3 ROAD TO RECOVERY

FIGURE 20 RECOVERY ROAD FOR 2020 & 2021

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 21 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 22 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Rising energy consumption in residential sectors of OCED and non-OCED nations

FIGURE 23 WORLD ELECTRICITY FINAL CONSUMPTION, BY SECTOR, 1974–2018 (TWH)

5.5.1.2 Government initiatives and policies toward energy efficiency in residential buildings

5.5.2 RESTRAINTS

5.5.2.1 High initial costs related to deploying residential energy management systems

5.5.2.2 Need for ensuring privacy and security of residential consumer data

5.5.3 OPPORTUNITIES

5.5.3.1 Increasing investments for modernizing aging grid infrastructures

FIGURE 24 INVESTMENTS IN SMART GRIDS, BY TECHNOLOGY AREA, 2014–2019 (USD BILLION)

5.5.3.2 Upcoming smart city projects in developing economies enhance growth in residential sector

5.5.4 CHALLENGES

5.5.4.1 Interoperability of residential energy management systems

5.5.4.2 Impact of COVID-19 on manufacture of residential energy management systems

5.6 YC-YCC SHIFT

5.6.1 REVENUE SHIFT FOR RESIDENTIAL ENERGY MANAGEMENT

FIGURE 25 REVENUE SHIFT FOR RESIDENTIAL ENERGY MANAGEMENT

5.7 MARKET MAP

FIGURE 26 MARKET MAP FOR RESIDENTIAL ENERGY MANAGEMENT

5.8 SUPPLY CHAIN ANALYSIS

FIGURE 27 RESIDENTIAL ENERGY MANAGEMENT: SUPPLY CHAIN ANALYSIS

5.8.1 ORIGINAL DEVICE MANUFACTURERS

5.8.2 ENERGY PLATFORM VENDORS

5.8.3 SYSTEM INTEGRATORS

5.9 PORTER’S FIVE FORCES ANALYSIS

FIGURE 28 REM MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 INTENSITY OF RIVALRY

5.10 TECHNOLOGY ANALYSIS

5.11 RESIDENTIAL ENERGY MANAGEMENT: PATENT ANALYSIS

5.11.1 INNOVATIONS & PATENT REGISTRATIONS

TABLE 3 IMPORTANT INNOVATIONS & PATENT REGISTRATIONS, 2016

5.12 TARIFF AND REGULATORY LANDSCAPE

TABLE 4 RESIDENTIAL ELECTRICITY PRICES IN SELECTED ECONOMIES, 2018

TABLE 5 REGULATORY PROGRAMS FOR ENERGY MANAGEMENT

5.13 CASE STUDY ANALYSIS

5.13.1 RESIDENTIAL ENERGY MANAGEMENT FOR ENERGY MARKET

5.13.1.1 ABB upgrades landmark buildings in Zaragoza’s smart city project with energy monitoring systems

5.13.1.1.1 Problem statement: February 2019

5.13.1.1.2 Solution statement

6 IMPACT OF COVID-19 ON RESIDENTIAL ENERGY MANAGEMENT MARKET, SCENARIO ANALYSIS, BY REGION (Page No. - 64)

6.1 INTRODUCTION

6.1.1 IMPACT OF COVID-19 ON GDP

TABLE 6 GDP ANALYSIS (IN PERCENTAGE)

6.1.2 OPTIMISTIC SCENARIO

TABLE 7 OPTIMISTIC SCENARIO: MARKET, BY REGION, 2018–2025 (USD MILLION)

6.1.3 REALISTIC SCENARIO

TABLE 8 REALISTIC SCENARIO: MARKET, BY REGION, 2018–2025 (USD MILLION)

6.1.4 PESSIMISTIC SCENARIO

TABLE 9 PESSIMISTIC SCENARIO: MARKET, BY REGION, 2018–2025 (USD MILLION)

7 RESIDENTIAL ENERGY MANAGEMENT MARKET, BY COMPONENT (Page No. - 68)

7.1 INTRODUCTION

FIGURE 29 HARDWARE COMPONENT SEGMENT EXPECTED TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

TABLE 10 RESIDENTIAL ENERGY MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

7.2 HARDWARE

TABLE 11 HARDWARE: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

7.2.1 REMOTE TERMINAL UNITS

7.2.1.1 Need for voltage regulation, advanced fault detection, and automating power restoration is expected to drive market

TABLE 12 REMOTE TERMINAL UNITS: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.2.2 RELAYS

7.2.2.1 Rising awareness regarding potential power wastes and optimization of energy consumption is estimated to boost market growth

TABLE 13 RELAYS: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.2.3 LOAD CONTROL SWITCHES

7.2.3.1 Need for managing energy usage at times of peak demand is likely to drive market for LCS

TABLE 14 LOAD CONTROL SWITCHES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.2.4 DEMAND RESPONSE DEVICES

7.2.4.1 Demand for controlling high-energy appliances is expected to propel market growth

TABLE 15 DEMAND RESPONSE DEVICES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.2.5 CONTROL DEVICES

7.2.5.1 Reduced long-term energy costs offered by control devices are projected to accelerate market growth

TABLE 16 CONTROL DEVICES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.2.6 IN-HOUSE DISPLAYS

7.2.6.1 Ease of connectivity offered by smart devices is expected to fuel market growth

TABLE 17 IN-HOUSE DISPLAYS: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.3 SOFTWARE

TABLE 18 SOFTWARE: MARKET SIZE, BY SOFTWARE TYPE, 2018–2025 (USD MILLION)

7.3.1 ENERGY MANAGEMENT PLATFORM

7.3.1.1 EMP handles large quantities of energy data and analyzes it on real-time basis

TABLE 19 ENERGY MANAGEMENT PLATFORM: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.3.2 ENERGY ANALYTICS

7.3.2.1 Energy analytics have potential to improve grid reliability by monitoring frequency and duration of power outages

TABLE 20 ENERGY ANALYTICS: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.3.3 CUSTOMER ENGAGEMENT PLATFORM

7.3.3.1 Customer engagement platform offers increased customer satisfaction and loyalty while increasing customer participation in home energy efficiency programs

TABLE 21 CUSTOMER ENGAGEMENT PLATFORM: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8 RESIDENTIAL ENERGY MANAGEMENT MARKET, BY COMMUNICATION TECHNOLOGY (Page No. - 79)

8.1 INTRODUCTION

FIGURE 30 WIRED COMMUNICATION TECHNOLOGY SEGMENT EXPECTED TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

TABLE 22 RESIDENTIAL ENERGY MANAGEMENT MARKET SIZE, BY COMMUNICATION TECHNOLOGY, 2018–2025 (USD MILLION)

8.2 WIRED COMMUNICATION TECHNOLOGY

TABLE 23 WIRED COMMUNICATION TECHNOLOGY: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

8.2.1 FIBER OPTICS

8.2.1.1 Increasing investments for data transfer in utilities drive growth of this segment

TABLE 24 FIBER OPTICS: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.2.2 ETHERNET

8.2.2.1 High level of security and reliability offered by Ethernet are driving market for this segment

TABLE 25 ETHERNET: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.2.3 POWERLINE CARRIERS

8.2.3.1 Increased insulation level of high-voltage power lines for transmission of data boosts adoption of powerline carrier

TABLE 26 POWERLINE CARRIER: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.2.4 IP

8.2.4.1 Cost-effectiveness and security for data transfer in utilities propel market growth

TABLE 27 IP: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.3 WIRELESS COMMUNICATION TECHNOLOGY

TABLE 28 WIRELESS COMMUNICATION TECHNOLOGY: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

8.3.1 RADIOFREQUENCY MESH

8.3.1.1 Ability to manage huge amounts of traffic from multiple devices

TABLE 29 RADIOFREQUENCY MESH: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.3.2 CELLULAR NETWORK

8.3.2.1 Increasing investments in introduction of 5G technology

TABLE 30 CELLULAR NETWORK: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.3.3 WIMAX

8.3.3.1 Ability to support high-speed data transfer over long distances

TABLE 31 WIMAX: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9 RESIDENTIAL ENERGY MANAGEMENT MARKET, BY APPLICATION (Page No. - 87)

9.1 INTRODUCTION

FIGURE 31 POWER MONITORING & CONTROL APPLICATION SEGMENT EXPECTED TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 32 RESIDENTIAL ENERGY MANAGEMENT MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

9.2 POWER MONITORING & CONTROL

9.2.1 RISING NEED FOR EFFECTIVE UTILIZATION OF POWER RESOURCES IS EXPECTED TO DRIVE MARKET

TABLE 33 POWER MONITORING & CONTROL: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.3 LOAD SHEDDING & MANAGEMENT

9.3.1 INCREASING GRID RELIABILITY BY AVOIDING SYSTEM OUTAGES IS EXPECTED TO BOOST MARKET GROWTH

TABLE 34 LOAD SHEDDING & MANAGEMENT: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.4 FLEXIBLE LOAD MANAGEMENT

9.4.1 GROWING NEED OF CONSUMERS TO SHIFT ENERGY USAGE TO OFF-PEAK TIMES IS EXPECTED TO DRIVE MARKET

TABLE 35 FLEXIBLE LOAD MANAGEMENT: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10 GEOGRAPHIC ANALYSIS (Page No. - 92)

10.1 INTRODUCTION

FIGURE 32 REGIONAL SNAPSHOT: ASIA PACIFIC TO REGISTER HIGHEST CAGR OF MARKET DURING FORECAST PERIOD

FIGURE 33 MARKET SHARE, BY REGION, 2019

TABLE 36 RESIDENTIAL ENERGY MANAGEMENT MARKET SIZE, BY SCENARIO ANALYSIS, 2018–2025 (USD MILLION)

TABLE 37 RESIDENTIAL ENERGY MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: COVID-19 IMPACT

FIGURE 34 NORTH AMERICA: REGIONAL SNAPSHOT, 2019

10.2.2 BY COMPONENT

TABLE 38 NORTH AMERICA: RESIDENTIAL ENERGY MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

10.2.2.1 By Hardware

TABLE 39 NORTH AMERICA: MARKET SIZE, BY HARDWARE TYPE, 2018–2025 (USD MILLION)

10.2.2.2 By Software

TABLE 40 NORTH AMERICA: MARKET SIZE, BY SOFTWARE TYPE, 2018–2025 (USD MILLION)

10.2.3 BY COMMUNICATION TECHNOLOGY

TABLE 41 NORTH AMERICA: MARKET SIZE, BY COMMUNICATION TECHNOLOGY, 2018–2025 (USD MILLION)

10.2.3.1 By Wired Technology

TABLE 42 NORTH AMERICA: MARKET SIZE, BY WIRED COMMUNICATION TECHNOLOGY, 2018–2025 (USD MILLION)

10.2.3.2 By Wireless Technology

TABLE 43 NORTH AMERICA: MARKET SIZE, BY WIRELESS COMMUNICATION TECHNOLOGY, 2018–2025 (USD MILLION)

10.2.4 BY APPLICATION

TABLE 44 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.2.5 BY COUNTRY

TABLE 45 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10.2.5.1 US

10.2.5.1.1 Increasing focus on upgrading aging grid infrastructure with digitalization of grids is expected to drive market

TABLE 46 US: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.2.5.2 Canada

10.2.5.2.1 Growing domestic power consumption is boosting market growth

TABLE 47 CANADA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.2.5.3 Mexico

10.2.5.3.1 Rising government initiatives to enhance energy efficiency are boosting market growth

TABLE 48 MEXICO: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: COVID-19 IMPACT

FIGURE 35 EUROPE: REGIONAL SNAPSHOT, 2019

10.3.2 BY COMPONENT

TABLE 49 EUROPE: RESIDENTIAL ENERGY MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

10.3.2.1 By Hardware

TABLE 50 EUROPE: MARKET SIZE, BY HARDWARE TYPE, 2018–2025 (USD MILLION)

10.3.2.2 By Software

TABLE 51 EUROPE: MARKET SIZE, BY SOFTWARE TYPE, 2018–2025 (USD MILLION)

10.3.3 BY COMMUNICATION TECHNOLOGY

TABLE 52 EUROPE: MARKET SIZE, BY COMMUNICATION TECHNOLOGY, 2018–2025 (USD MILLION)

10.3.3.1 By Wired Technology

TABLE 53 EUROPE: MARKET SIZE, BY WIRED COMMUNICATION TECHNOLOGY, 2018–2025 (USD MILLION)

10.3.3.2 By Wireless Technology

TABLE 54 EUROPE: MARKET SIZE, BY WIRELESS COMMUNICATION TECHNOLOGY, 2018–2025 (USD MILLION)

10.3.4 BY APPLICATION

TABLE 55 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.3.5 BY COUNTRY

TABLE 56 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10.3.5.1 Germany

10.3.5.1.1 Heightened focus on smart grid deployment is propelling market growth

TABLE 57 GERMANY: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.3.5.2 UK

10.3.5.2.1 Need to monitor energy consumption in residential buildings is driving market growth

TABLE 58 UK: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.3.5.3 France

10.3.5.3.1 Ambitious medium- and long-term energy and climate targets are fueling market growth

TABLE 59 FRANCE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.3.5.4 Italy

10.3.5.4.1 Need for reducing power factor penalties is favoring market growth

TABLE 60 ITALY: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.3.5.5 Spain

10.3.5.5.1 Focus on decreasing energy costs is supporting market growth

TABLE 61 SPAIN: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.3.5.6 Russia

10.3.5.6.1 Energy Strategy 2035 to foster market growth in Russia

TABLE 62 RUSSIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.3.5.7 Rest of Europe

TABLE 63 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: COVID-19 IMPACT

10.4.2 BY COMPONENT

TABLE 64 ASIA PACIFIC: RESIDENTIAL ENERGY MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

10.4.2.1 By Hardware

TABLE 65 ASIA PACIFIC: MARKET SIZE, BY HARDWARE TYPE, 2018–2025 (USD MILLION)

10.4.2.2 By Software

TABLE 66 ASIA PACIFIC: MARKET SIZE, BY SOFTWARE TYPE, 2018–2025 (USD MILLION)

10.4.3 BY COMMUNICATION TECHNOLOGY

TABLE 67 ASIA PACIFIC: MARKET SIZE, BY COMMUNICATION TECHNOLOGY, 2018–2025 (USD MILLION)

10.4.3.1 By Wired Technology

TABLE 68 ASIA PACIFIC: MARKET SIZE, BY WIRED COMMUNICATION TECHNOLOGY, 2018–2025 (USD MILLION)

10.4.3.2 By Wireless Technology

TABLE 69 ASIA PACIFIC: MARKET SIZE, BY WIRELESS COMMUNICATION TECHNOLOGY, 2018–2025 (USD MILLION)

10.4.4 BY APPLICATION

TABLE 70 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.4.5 BY COUNTRY

TABLE 71 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10.4.5.1 China

10.4.5.1.1 Increasing investments in residential energy efficiency are likely to drive market

TABLE 72 CHINA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.4.5.2 India

10.4.5.2.1 Rising investments in smart city projects are expected to boost market growth

TABLE 73 INDIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.4.5.3 Japan

10.4.5.3.1 Growing government initiatives toward energy-efficient technologies in buildings are expected to propel market growth

TABLE 74 JAPAN: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.4.5.4 Australia

10.4.5.4.1 Replacement of aging grid infrastructure to increase efficiency is expected to drive market

TABLE 75 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.4.5.5 Rest of Asia Pacific

TABLE 76 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.5 SOUTH AMERICA

10.5.1 BY COMPONENT

TABLE 77 SOUTH AMERICA: RESIDENTIAL ENERGY MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

10.5.1.1 By Hardware

TABLE 78 SOUTH AMERICA: MARKET SIZE, BY HARDWARE TYPE, 2018–2025 (USD MILLION)

10.5.1.2 By Software

TABLE 79 SOUTH AMERICA: MARKET SIZE, BY SOFTWARE TYPE, 2018–2025 (USD MILLION)

10.5.2 BY COMMUNICATION TECHNOLOGY

TABLE 80 SOUTH AMERICA: MARKET SIZE, BY COMMUNICATION TECHNOLOGY, 2018–2025 (USD MILLION)

10.5.2.1 By Wired Technology

TABLE 81 SOUTH AMERICA: MARKET SIZE, BY WIRED COMMUNICATION TECHNOLOGY, 2018–2025 (USD MILLION)

10.5.2.2 By Wireless Technology

TABLE 82 SOUTH AMERICA: MARKET SIZE, BY WIRELESS COMMUNICATION TECHNOLOGY, 2018–2025 (USD MILLION)

10.5.3 BY APPLICATION

TABLE 83 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.5.4 BY COUNTRY

TABLE 84 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10.5.4.1 Brazil

10.5.4.1.1 Modernization of existing power infrastructures and high electricity demand to drive market growth

TABLE 85 BRAZIL: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.5.4.2 Argentina

10.5.4.2.1 Economic and regulatory changes in Argentinian energy sector are expected to boost market growth

TABLE 86 ARGENTINA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.5.4.3 Rest of South America

TABLE 87 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

10.6.2 BY COMPONENT

TABLE 88 MIDDLE EAST & AFRICA: RESIDENTIAL ENERGY MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

10.6.2.1 By Hardware

TABLE 89 MIDDLE EAST & AFRICA: MARKET SIZE, BY HARDWARE TYPE, 2018–2025 (USD MILLION)

10.6.2.2 By Software

TABLE 90 MIDDLE EAST & AFRICA: MARKET SIZE, BY SOFTWARE TYPE, 2018–2025 (USD MILLION)

10.6.3 COMMUNICATION TECHNOLOGY

TABLE 91 MIDDLE EAST & AFRICA: MARKET SIZE, BY COMMUNICATION TECHNOLOGY, 2018–2025 (USD MILLION)

10.6.3.1 By Wired Technology

TABLE 92 MIDDLE EAST & AFRICA: MARKET SIZE, BY WIRED COMMUNICATION TECHNOLOGY, 2018–2025 (USD MILLION)

10.6.3.2 By Wireless Technology

TABLE 93 MIDDLE EAST & AFRICA: MARKET SIZE, BY WIRELESS COMMUNICATION TECHNOLOGY, 2018–2025 (USD MILLION)

10.6.4 BY APPLICATION

TABLE 94 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.6.5 BY COUNTRY

TABLE 95 MIDDLE EAST & AFRICA: MARKET SIZE, BY GEOGRAPHY, 2018–2025 (USD MILLION)

10.6.5.1 Saudi Arabia

10.6.5.1.1 Increasing investments in power projects are expected to fuel market growth

TABLE 96 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.6.5.2 UAE

10.6.5.2.1 Several upcoming transmission and distribution network projects are expected to propel market growth

TABLE 97 UAE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.6.5.3 South Africa

10.6.5.3.1 Need to modernize aging grid infrastructure is expected to augment market growth

TABLE 98 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.6.5.4 Rest of Middle East & Africa

TABLE 99 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 132)

11.1 OVERVIEW

FIGURE 36 KEY DEVELOPMENTS IN GLOBAL RESIDENTIAL ENERGY MANAGEMENT MARKET, 2017–2020

11.2 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

FIGURE 37 TOP 5 PLAYERS DOMINATED MARKET IN LAST 5 YEARS

11.3 MARKET SHARE ANALYSIS, 2019

FIGURE 38 MARKET SHARE ANALYSIS, 2019

11.4 COMPETITIVE SCENARIO

TABLE 100 DEVELOPMENTS OF KEY PLAYERS IN MARKET, 2017–2020

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STAR

11.5.2 EMERGING LEADER

11.5.3 PERVASIVE

11.5.4 PARTICIPANT

11.6 COMPANY EVALUATION MATRIX, 2019

FIGURE 39 MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING (2019)

11.7 COMPETITIVE LEADERSHIP MAPPING OF START-UPS

11.7.1 PROGRESSIVE COMPANIES

11.7.2 RESPONSIVE COMPANIES

11.7.3 STARTING BLOCKS

11.7.4 DYNAMIC COMPANIES

FIGURE 40 COMPETITIVE LEADERSHIP MAPPING OF START-UPS, 2019

11.8 KEY MARKET DEVELOPMENTS

11.8.1 PRODUCT LAUNCHES

11.8.2 INVESTMENTS & EXPANSIONS

11.8.3 MERGERS & ACQUISITIONS

11.8.4 PARTNERSHIPS, COLLABORATIONS, ALLIANCES, AND JOINT VENTURES

12 COMPANY PROFILES (Page No. - 143)

(Business Overview, Products offered, Recent Developments, MnM View)*

12.1 ABB

FIGURE 41 ABB: COMPANY SNAPSHOT

12.2 EATON

FIGURE 42 EATON: COMPANY SNAPSHOT

12.3 SCHNEIDER ELECTRIC

FIGURE 43 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

12.4 HONEYWELL INTERNATIONAL

FIGURE 44 HONEYWELL INTERNATIONAL: COMPANY SNAPSHOT

12.5 LANDIS+GYR

FIGURE 45 LANDIS+GYR: COMPANY SNAPSHOT

12.6 GENERAL ELECTRIC

FIGURE 46 GENERAL ELECTRIC: COMPANY SNAPSHOT

12.7 SIEMENS

FIGURE 47 SIEMENS: COMPANY SNAPSHOT

12.8 ITRON

FIGURE 48 ITRON: COMPANY SNAPSHOT

12.9 EMERSON

FIGURE 49 EMERSON: COMPANY SNAPSHOT

12.10 BOSCH

FIGURE 50 BOSCH: COMPANY SNAPSHOT

12.11 SPAN.IO

12.12 LUMIN

12.13 RACEPOINT ENERGY

12.14 APPARTME

12.15 UPLIGHT

12.16 WATTICS LTD

12.17 TANTALUS SYSTEMS CORP.

12.18 SUNVERGE ENERGY, INC

12.19 KOBEN SYSTEMS INC.

12.20 NEOSILICA

12.21 TANTALUS SYSTEMS CORP.

*Details on Business Overview, Products, Recent Developments,, MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 177)

13.1 INSIGHTS OF INDUSTRY EXPERTS SS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

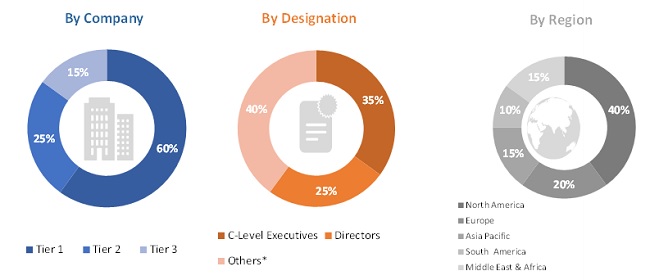

This study involved four major activities in estimating the current size of the residential energy management market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The market comprises several stakeholders, such as end-product manufacturers, service providers, and end-users in the supply chain. The demand-side of this market is characterized by its end-users, such as upstream/oilfield operators, and others. The supply-side is characterized by residential energy management service providers, tool providers, integrators, and others. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global residential energy management market and its dependent submarkets. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the oil & gas upstream sector.

Report Objectives

- To define, describe, segment, and forecast the residential energy management market by communication technology, component, and application

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, future expansions, and contribution of each segment to the market

- To provide a detailed analysis of the impact of the COVID-19 pandemic on the market and an estimation of the market size

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To forecast the growth of the market with respect to the main regions (Asia Pacific, Europe, North America, South America, and the Middle East & Africa)

- To profile key players and comprehensively analyze their market share

- To analyze competitive developments such as contracts & agreements, expansions & investments, new product launches, mergers & acquisitions, joint ventures, and partnerships & collaborations in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Residential Energy Management Market