ECG Cable & Lead Wire Market Size, Growth, Share & Trends Analysis

ECG Cable & Lead Wire Market by Type (ECG Cable, ECG Lead Wire (12-lead, 5-lead, 3-lead, 6-lead, Single Lead)), Material (Thermoplastic Elastomer, Thermoplastic Polyurethane), Usability (Reusable, Disposable), End User, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

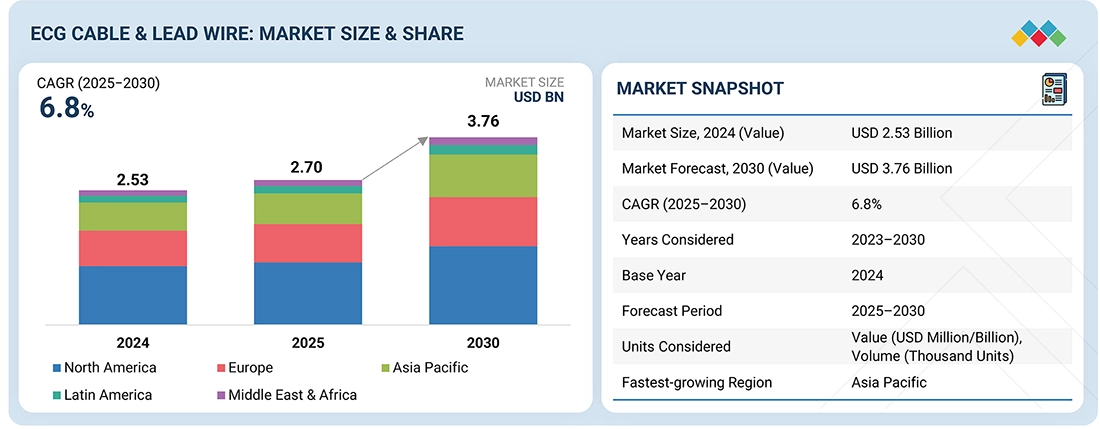

The global ECG cable & lead wire market is projected to reach USD 3.76 billion by 2030 from USD 2.70 billion in 2025, growing at a CAGR of 6.8% during the forecast period. This steady growth is driven by the expanding elderly population and the rising prevalence of cardiovascular diseases worldwide. As older adults are more prone to cardiac disorders, the need for accurate and continuous ECG monitoring is increasing rapidly. Moreover, technological advancements such as improved signal accuracy, greater product durability, and the introduction of disposable lead systems are further accelerating market adoption and supporting market growth.

KEY TAKEAWAYS

-

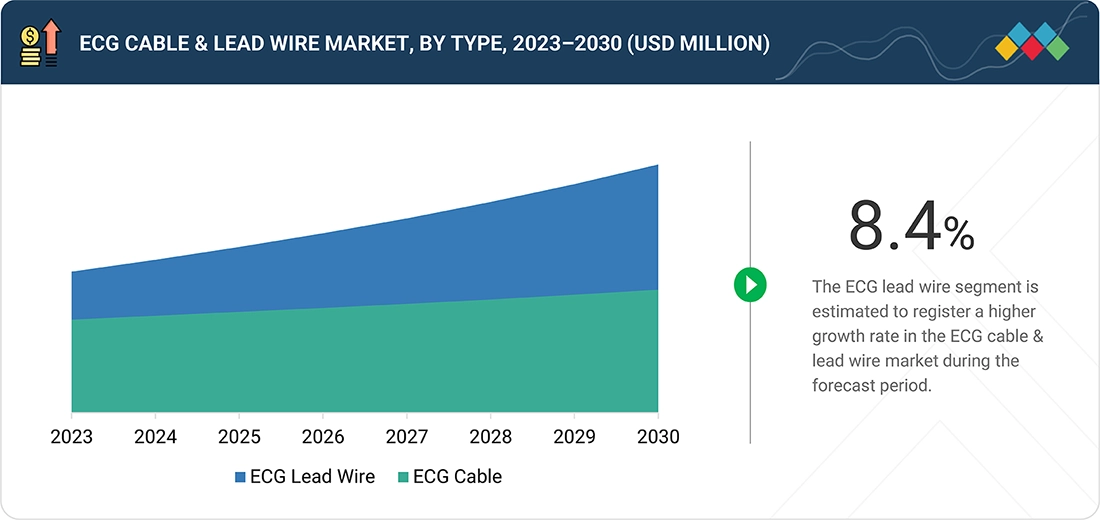

BY TYPEThe market is segmented by type into ECG lead wire and ECG cable. The ECG lead wire segment is set to account for the highest share due to the rising geriatric population, an increasing prevalence of cardiovascular diseases (CVD), technological advancements, and the implementation of improved cardiac care in developed countries, which are the major factors driving the market’s growth.

-

BY MATERIALBased on material, the market is segmented into thermoplastic elastomer, thermoplastic polyurethane, and other materials. Thermoplastic polyurethane is estimated to account for a large share in the ECG cable & lead wire market due to its excellent flexibility, durability, and resistance to wear and tear. Its lightweight and biocompatible properties make it ideal for patient safety and comfort, while its ability to withstand repeated use and cleaning ensures long-lasting performance, driving its preference over other materials.

-

BY USABILITYThe ECG cable & lead wire market is segmented by usability into reusable cable & lead wire and disposable cable & lead wire. The disposable ECG cable & lead wire segment is projected to register a high growth rate due to increasing concerns over hygiene and infection control in healthcare settings. Disposable cables reduce the risk of cross-contamination between patients, making them ideal for hospitals, clinics, and diagnostic centers.

-

BY APPLICATIONBy application, the market has been segmented into infectious disease prevention, dermatology, oncology, pain management, diagnostic testing, and other applications. The dermatology segment is set to account for the largest share of the veterinary biologics market, driven by the rising prevalence of skin infections and allergies, among companion animals. Increasing awareness about pet health, coupled with the growing demand for advanced biologic therapies for conditions such as dermatitis, is further fueling this segment's growth.

-

BY END USERBased on end user, the market is segmented into hospitals, primary care centers, cardiac centers, ambulatory surgical centers, home care settings, and other end users. In 2024, hospitals held a considerable share in the ECG cable & lead wire market by end user because they conduct the largest volume of cardiac diagnostics and continuous patient monitoring. Their need for reliable, durable, and high-quality ECG equipment to manage patients, especially those with cardiovascular conditions, drives strong demand for ECG cables and lead wires in this segment.

-

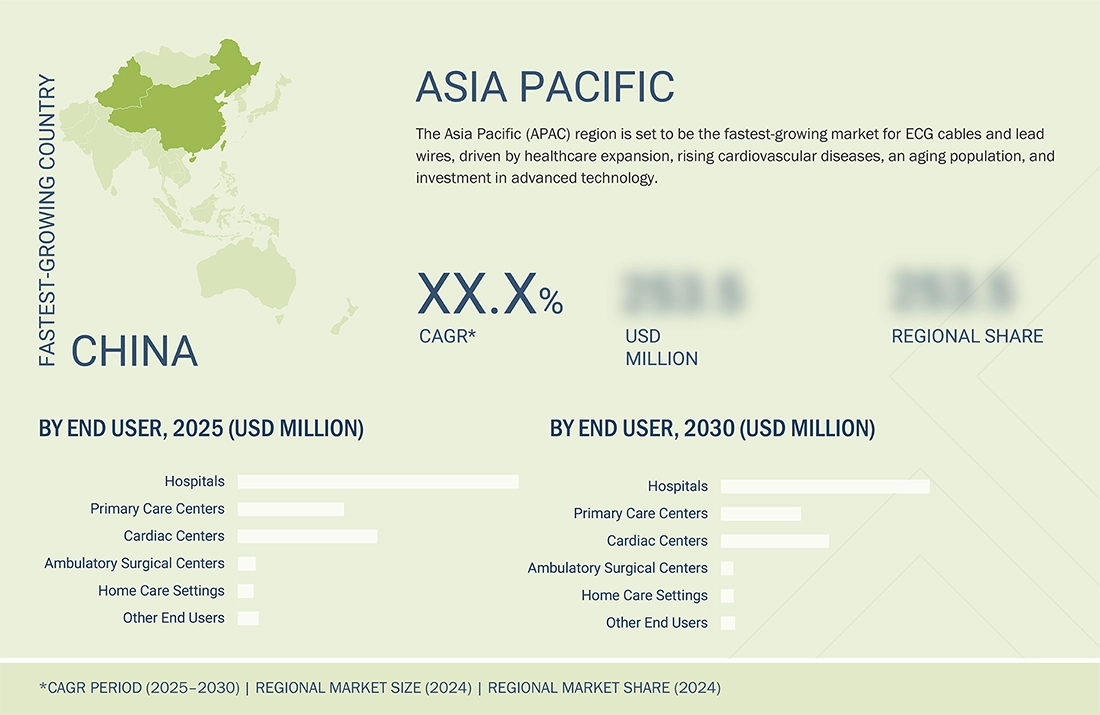

BY REGIONThe Asia Pacific region is estimated to witness the highest growth rate in the ECG cable & lead wire market. This rapid growth is driven by the expanding healthcare infrastructure, increasing awareness of cardiovascular health, rising prevalence of heart diseases, and a growing geriatric population. Additionally, improving access to advanced medical technologies and rising investments in healthcare by both governments and private players are further fueling market expansion in the region.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including partnerships and collaborations. In January 2025, Koninklijke Philips N.V. (Netherlands) received FDA 510(k) Clearance for 19 new reusable ECG lead sets and trunk cables for OR and ICU use, designed for durability, multi-patient use, and compliance with AAMI and IEC standards.

The global ECG cable & lead wire market is witnessing steady growth, driven by the rising prevalence of cardiovascular diseases and an aging population that requires continuous and reliable cardiac monitoring. Increasing demand for accurate diagnostics, coupled with technological advancements such as enhanced signal quality, improved durability, and the introduction of disposable lead systems, is further propelling market adoption. The expansion of healthcare infrastructure worldwide is supporting sustained growth in this sector.

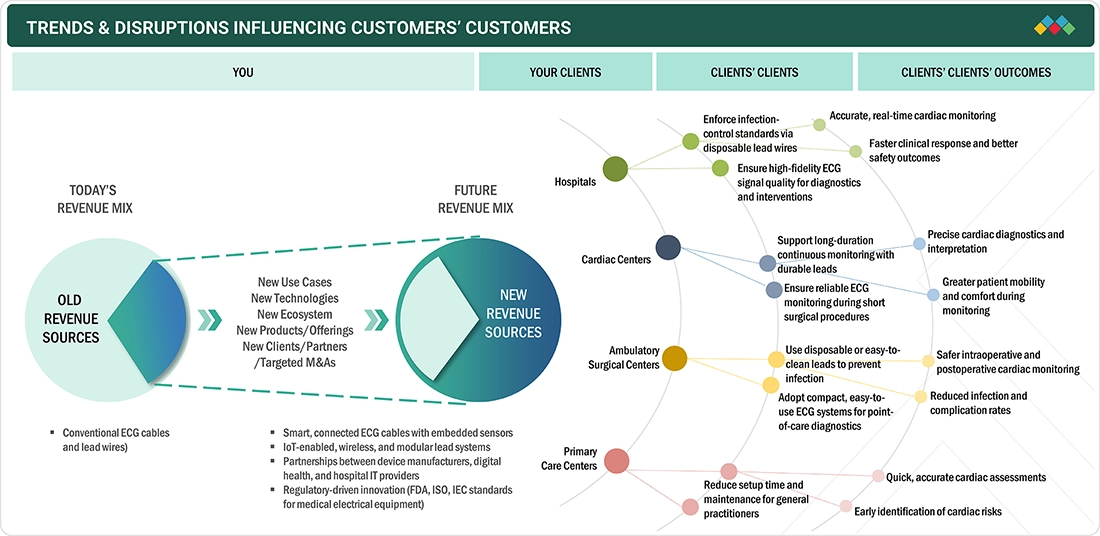

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The ECG cable & lead wire market is undergoing a significant transformation driven by technological advancements, evolving customer needs, and regulatory changes. The revenue largely comes from conventional products and one-time sales, but the future is shifting toward smart, connected solutions, subscription models, and outcome-based offerings. Clients, such as hospitals, clinics, manufacturers, and distributors, are focused on ensuring compliance, improving efficiency, and integrating real-time data to enhance patient care. These imperatives translate into better end-user outcomes, including higher treatment accuracy, reduced interventions, personalized care, and improved overall experience. At the same time, emerging trends such as new technologies, innovative use cases, ecosystem partnerships, and strategic collaborations are opening opportunities for growth, differentiation, and long-term value creation across the entire value chain.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising burden of the ageing population

-

Increasing prevalence of cardiovascular diseases

Level

-

High cost of disposable ECG lead wire

Level

-

Untapped growth potential in emerging economies

-

Advanced and high-performance features in ECG cables and lead wires

Level

-

Compatibility issues in ECG cables and lead wires

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing prevalence of cardiovascular diseases

The rising prevalence of cardiovascular diseases (CVDs) is a key driver of the ECG cables & lead wires market. According to the World Health Organization (WHO), CVDs were the leading cause of death globally in 2022, responsible for approximately 19.8 million deaths, accounting for 32% of all deaths worldwide. The European Journal of Preventive Cardiology projects that by 2050, over 1.14 billion people could be living with cardiovascular disease globally. With aging populations and increasing lifestyle-related risk factors such as obesity, diabetes, and hypertension, the demand for continuous cardiac monitoring and diagnostic testing is growing rapidly. This trend is fueling sustained demand for ECG systems and their accessories, particularly high-quality cables and lead wires, which are critical for accurate signal transmission and long-term patient monitoring in both hospital and home-care settings.

Restraint: High cost of disposable ECG lead wires

The high cost of disposable ECG lead wires acts as a key restraining factor for the market. While disposable lead wires offer advantages such as improved hygiene and reduced risk of cross-contamination, their higher price compared to reusable alternatives can limit adoption, particularly in cost-sensitive healthcare settings and emerging markets. This price barrier may slow the overall growth of the disposable segment despite increasing demand for infection control and patient safety.

Opportunity: Untapped growth potential in emerging economies

The ECG cables & lead wires market holds significant untapped growth potential in emerging markets. Rapidly expanding healthcare infrastructure, increasing awareness of cardiovascular health, and rising prevalence of heart diseases present substantial opportunities. In many developing countries, the adoption of advanced cardiac monitoring technologies is still limited, creating room for growth in both hospital and home-care settings. Additionally, government initiatives to improve healthcare access, coupled with increasing investments from private players, are expected to drive demand for high-quality ECG systems and accessories, including cables and lead wires, in these regions.

Challenge: Compatibility issues in the ECG cable and lead wire

A major challenge in the ECG cables & lead wires market is compatibility fragmentation, driven by the coexistence of multiple connector standards such as AAMI, IEC, and numerous proprietary trunk designs used by different OEMs. This lack of standardization complicates interoperability between monitors and accessories, forcing healthcare facilities to maintain large inventories of device-specific cables and replacement parts. For instance, hospitals that use a mix of GE Healthcare, Philips monitors often require distinct lead sets and trunk cables for each brand, significantly increasing procurement and maintenance complexity.

ECG Cable Market / Lead Wires Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides single-patient-use ECG cables and lead wires to reduce cross-contamination and improve patient safety | Enhanced infection control, reduced false alarms, and streamlined patient flow |

|

Develops lightweight, disposable ECG cables compatible with home care settings for remote monitoring | Improved patient comfort, ease of use, and support for telemedicine applications |

|

Offers durable, reusable ECG cables with advanced materials for hospital and ICU environments | High reliability, cost-effectiveness, and integration with hospital information systems |

|

Supplies multi-lead ECG cables designed for comprehensive cardiac diagnostics in clinical settings | Accurate diagnostics, compatibility with various ECG machines, and a user-friendly design |

|

Provides ECG cables and lead wires with ergonomic designs, optimized for intensive care and bedside monitoring | Enhanced patient comfort, reliable signal quality, and ease of integration with Mindray monitoring systems |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ECG cable & lead wire market operates within a complex ecosystem comprising manufacturers, end users, and regulatory authorities. Leading manufacturers, such as Philips, GE Healthcare, and Cardinal Health, design and produce high-quality cables and lead wires that ensure accurate cardiac monitoring. The primary end users include hospitals, clinics, diagnostic centers, and ambulatory care providers who rely on these products for patient monitoring and diagnostic purposes. Regulatory bodies, such as the US FDA, European Medicines Agency (EMA), and national health authorities, oversee the safety, quality, and compliance of ECG cables and lead wires, enforcing standards like ISO and IEC. This interconnected ecosystem drives innovation, ensures patient safety, and supports the growing demand for reliable cardiac diagnostic solutions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

ECG Cable & Lead Wire Market, by Type

Based on type, the market is divided into ECG lead wire and ECG cable. The ECG lead wire segment is estimated to lead the market due to the rising geriatric population and the increasing prevalence of cardiovascular diseases (CVD), which necessitate effective monitoring solutions. This trend is further fueled by technological advancements, such as wireless monitoring systems and smart lead wires, that enhance patient care and data collection. Additionally, developed countries are adopting improved cardiac care practices that prioritize regular monitoring and proactive treatment, driving demand for reliable ECG cables and lead wires. Collectively, these factors contribute to the growth of the ECG cable and lead wire market, highlighting its critical role in modern healthcare.

ECG Cable & Lead Wire Market, by Material

Based on material, the market is categorized into thermoplastic elastomer (TPE), thermoplastic polyurethane (TPU), and other materials. Thermoplastic polyurethane (TPU) is becoming a dominant material in medical applications due to its exceptional flexibility, durability, and biocompatibility. Its adaptability allows for a comfortable fit in devices like prosthetics and orthotics, enhancing patient compliance. TPU's resistance to wear and tear ensures long-lasting performance, while its ability to withstand repeated cleaning and sterilization makes it ideal for hygienic environments. This combination of properties not only prioritizes patient safety but also drives its increasing adoption over traditional materials in the healthcare sector.

ECG Cable & Lead Wire Market, by Usability

The ECG cable & lead wire market is segmented by usability into reusable cable and lead wire and disposable cable and lead wire. The disposable ECG cable and lead wire segment is expected to register a high growth rate due to increasing concerns over hygiene and infection control in healthcare settings. Disposable cables reduce the risk of cross-contamination between patients, making them ideal for hospitals, clinics, and diagnostic centers. Additionally, their convenience, ease of use, and compatibility with modern ECG systems are driving rapid adoption, particularly in regions with stringent healthcare standards and rising patient volumes.

ECG Cable & Lead Wire Market, by End User

Based on end users, the market is segmented into hospitals, primary care centers, cardiac centers, ambulatory surgical centers, home care settings, and other end users. The hospitals segment is estimated to account for the largest share in the ECG cable and lead wire market, as they perform the highest volume of cardiac diagnostics and continuous patient monitoring. The demand for reliable, durable, and high-quality ECG equipment, particularly for managing patients with cardiovascular conditions, drives strong adoption of ECG cables and lead wires in this segment.

REGION

Asia Pacific is expected to be the fastest-growing region in the global ECG cable & lead wire market during the forecast period.

The Asia Pacific (APAC) region is projected to be the fastest-growing market for ECG cable & lead wire. Rapidly expanding healthcare infrastructure, increasing prevalence of cardiovascular diseases, rising geriatric population, and growing awareness of advanced cardiac care are key growth drivers. Additionally, ongoing investments in hospitals, cardiac centers, and diagnostic facilities, along with the adoption of technologically advanced ECG equipment, are accelerating market expansion in countries such as China, India, Japan, and Southeast Asian nations.

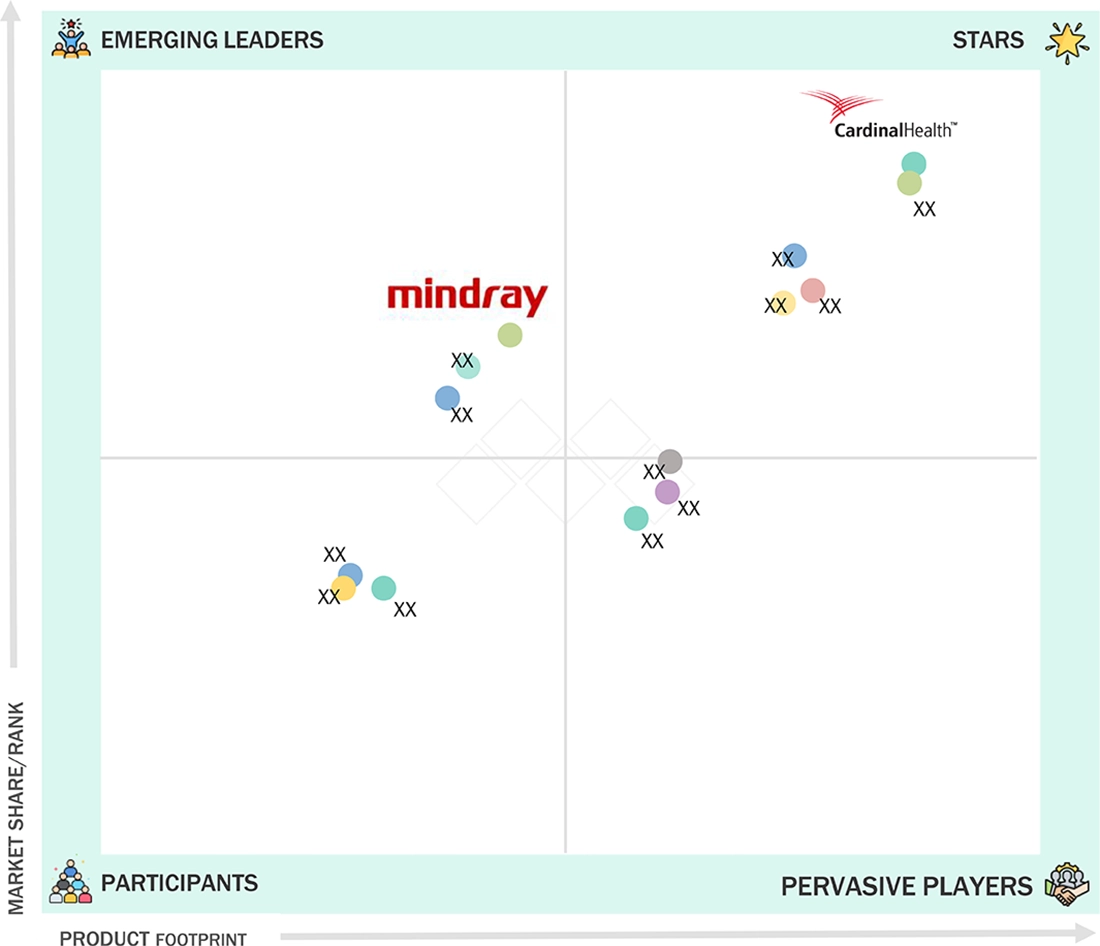

ECG Cable Market / Lead Wires Market: COMPANY EVALUATION MATRIX

In the ECG cable & lead wire market matrix, Cardinal Health (Star) leads with its extensive distribution network, strong brand presence, and comprehensive product portfolio catering to hospitals and diagnostic centers worldwide. Meanwhile, Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (Emerging Leader) is rapidly gaining traction through advanced, cost-effective technologies and expanding global reach. While Cardinal Health maintains dominance through scale and reliability, Mindray’s innovation-driven approach positions it for accelerated growth toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 2.53 Billion |

| Market Forecast, 2030 (Value) | USD 3.76 Billion |

| Growth Rate | CAGR of 6.8% from 2025 to 2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

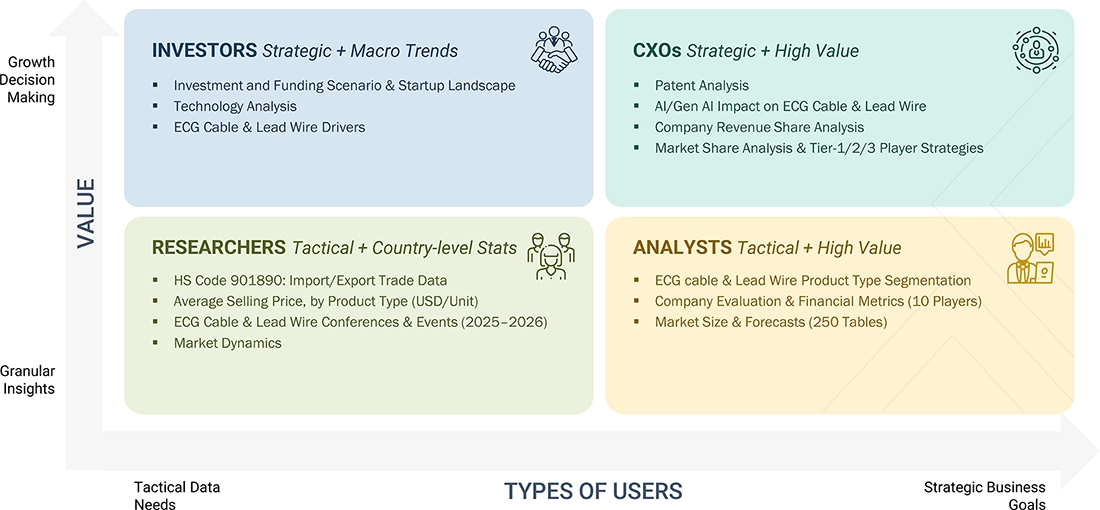

WHAT IS IN IT FOR YOU: ECG Cable Market / Lead Wires Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Detailed assessment of ECG cables and lead wires, by type, usability, and material | Analysis of emerging trends such as wireless ECG leads, smart cables with AI-enabled diagnostics, antimicrobial coatings, and improved durability & signal quality |

| Company Information | Comprehensive profiles of major players such as Cardinal Health, Philips Healthcare, GE Healthcare, Solventum | Identification of strategic partnerships, collaborations, licensing agreements, and mergers & acquisitions in the ECG cable & lead wire market |

| Geographic Analysis | Country- and region-level demand mapping with focus on North America, Europe, Asia Pacific (China, India, Japan), and emerging markets | Regional market outlook with detailed growth opportunities, regulatory updates, and adoption trends across key countries |

RECENT DEVELOPMENTS

- June 2025 : Cardinal Health launched the Kendall DL Multi System in the US, a single-patient use monitoring cable and lead wire system that tracks cardiac activity, blood oxygen levels, and temperature through one connection. Designed to stay with the patient from admission to discharge, it streamlined clinician workflows, ensured continuous and reliable monitoring, and enhanced hospital efficiency and value.

- June 2025 : Philips strengthened its long-term partnership with Medtronic through a new multi-year agreement to expand access to advanced patient monitoring technologies. The agreement integrated Medtronic’s leading technologies into Philips’ patient monitoring systems. It also bundled essential consumables, including ECG, NIBP, and batteries, to simplify procurement and provide a validated, streamlined solution for healthcare providers.

- January 2025 : Philips received FDA 510(k) Clearance for 19 new reusable ECG lead sets and trunk cables for OR and ICU use, designed for durability, multi-patient use, and compliance with AAMI and IEC standards.

- October 2024 : Cardinal Health announced the opening of a new 317,000-square-foot distribution center in Boylston, Massachusetts, supporting its US Medical Products and Distribution business.

Table of Contents

Methodology

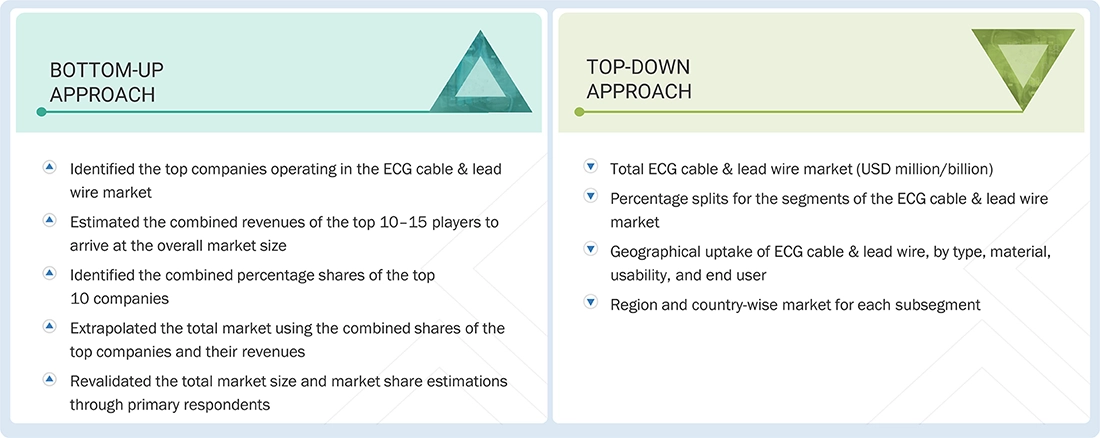

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the ECG cable & lead wire market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends, to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply & demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the ECG cable & lead wire market. The primary sources from the demand side include medical OEMs, medical device ISOs, and service providers, among others. Primary research was conducted to validate the market segmentation, identify key players, and gather insights into key industry trends & key market dynamics.

Breakdown of Primary Interviews:

A breakdown of the primary respondents for the ECG cable & lead wire market (supply side) is provided below:

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Others include sales, marketing, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = Greater than USD 2 billion, Tier 2 = Between USD 50 million and USD 2 billion, and Tier 3 = Less than USD 50 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this report, the global ECG cable & lead wire market size was determined using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the ECG cable & lead wire business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key marketing executives.

To calculate the global market value, segmental revenues were calculated based on the revenue mapping of major solution/service providers. This process involved the following steps:

- Generating a list of major global players operating in the ECG cable & lead wire market

- Mapping annual revenues generated by major global players from the ECG cable & lead wire segment (or nearest reported business unit/service category)

- Revenue mapping of key players to cover a major share of the global market as of 2024

- Extrapolating the global value of the ECG cable & lead wire industry

Global ECG Cable & Lead Wire Market Size: Top-down & Bottom-up Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global ECG cable & lead wire market was split into segments and subsegments. Data triangulation procedure was employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the ECG cable & lead wire market was validated using both top-down and bottom-up approaches.

Market Definition

An ECG cable and lead wire are medical accessories used to connect a patient to an electrocardiograph (ECG) machine. It transmits the electrical signals the heart generates to the ECG device, enabling accurate recording and monitoring of the heart’s electrical activity. The lead wires attach to electrodes placed on the patient’s body, while the cable consolidates these leads into a connection compatible with the ECG machine. These components are essential for precise cardiac monitoring, diagnosis, and patient safety.

Stakeholders

- Manufacturers of ECG cable & lead wire

- Distributors of ECG cable & lead wire

- Hospitals, clinics, and cardiac centers

- Ambulatory surgery centers

- Non-government organizations

- Government regulatory authorities

- Contract manufacturers & third-party suppliers

- Research laboratories & academic institutes

- Clinical research organizations (CROs)

- Government & non-governmental regulatory authorities

- Market research & consulting firms

Report Objectives

- To define, describe, and forecast the ECG cable & lead wire market based on type, material, usability, end user, and region

- To provide detailed information regarding the major factors influencing the growth potential of the global ECG cable & lead wire market (drivers, restraints, opportunities, challenges, and trends)

- To analyze the micro markets with respect to individual growth trends, prospects, and contributions to the global ECG cable & lead wire market

- To analyze key growth opportunities in the global ECG cable & lead wire market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the global ECG cable & lead wire market in North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the global ECG cable & lead wire market and comprehensively analyze their market shares and core competencies

- To track and analyze the competitive developments undertaken in the global ECG cable & lead wire market, such as agreements, collaborations, partnerships, expansions, and acquisitions

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the ECG Cable & Lead Wire Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in ECG Cable & Lead Wire Market