Diagnostic Electrocardiograph/ECG Market: Growth, Size, Share, and Trends

Diagnostic Electrocardiograph/ECG Market by Product (Resting ECG, Stress ECG, Mobile Cardiac Telemetry), Lead Type (Single-lead, 3, 5, 6 & 12-lead ECG Device), Type (Portable ECG Device, Wearable ECG Device), Connectivity - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

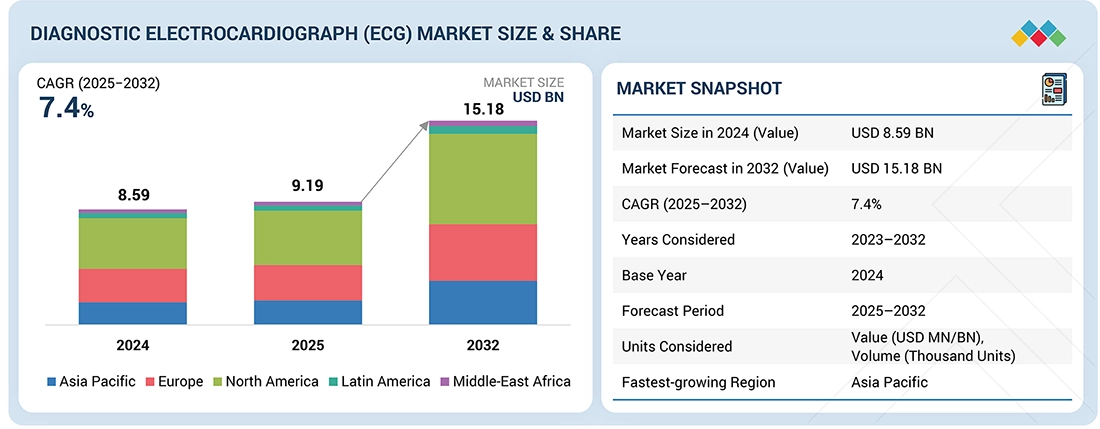

The global diagnostic electrocardiograph (ECG) market is projected to reach USD 15.18 billion by 2032 from USD 9.19 billion in 2025, at a CAGR of 7.4% during the forecast period. The rising incidence of cardiovascular diseases (CVDs), combined with an expanding elderly demographic and the pressing need for cost-effective healthcare solutions, drives the growth in the diagnostic ECG market.

KEY TAKEAWAYS

-

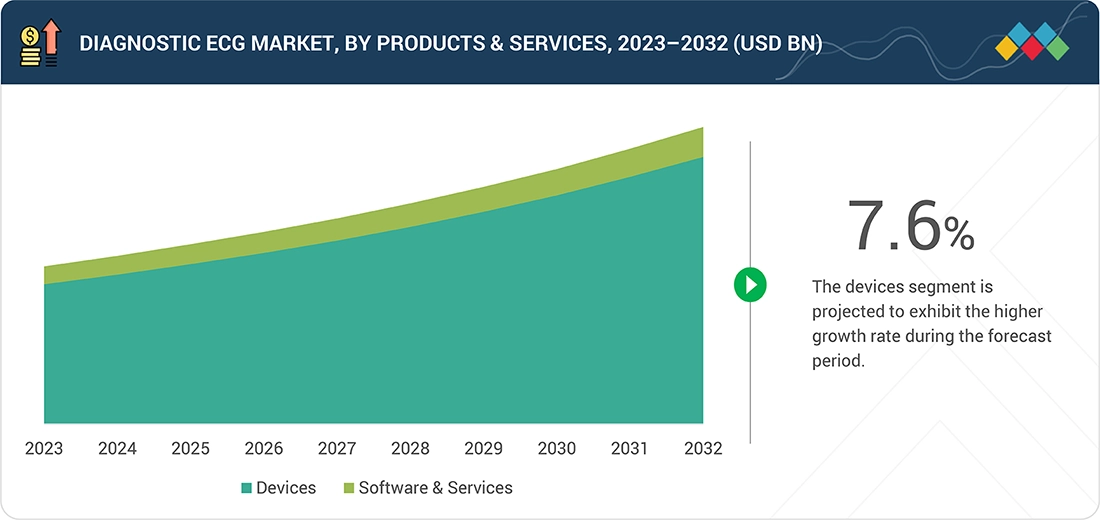

BY PRODUCTS & SERVICESBased on products and services, the market is further classified into devices and software & services. The devices segment represents the largest segment of the diagnostic ECG market owing to the increasing prevalence of cardiovascular diseases around the globe.

-

BY LEAD TYPEBased on lead type, the market is segmented into 12-lead ECG Devices, 5-lead ECG Devices, 3-lead ECG Devices, 6-lead ECG Devices, Single-lead ECG Devices, and Other ECG Lead Devices. The 5-lead ECG segment is projected to register the highest growth rate during the forecast period due to its optimal balance between diagnostic accuracy and patient comfort.

-

BY TYPEBased on type, the market is further classified into portable, wearable, and implantable ECG devices. The portable segment holds the largest share in the diagnostic ECG market, driven by its convenience, mobility, and diverse applications in clinical settings and home care.

-

BY DEPLOYMENT/CONNECTIVITYBy deployment/connectivity, the market is segmented into Standalone ECG Devices, PC-based ECG Devices, and Cloud-based ECG Devices. The standalone ECG devices segment is expected to hold the largest market share owing to their ease of use, portability, and ability to operate independently without reliance on external networks or continuous connectivity.

-

BY END USERBased on end user, the market is categorized into hospitals, primary care centers, cardiac centers, ambulatory surgery centers, home care settings, urgent care centers, and other end users. The hospitals segment represents the largest share of the diagnostic ECG Market in 2024 due to the high volume of cardiovascular patient admissions and advanced diagnostic infrastructure.

-

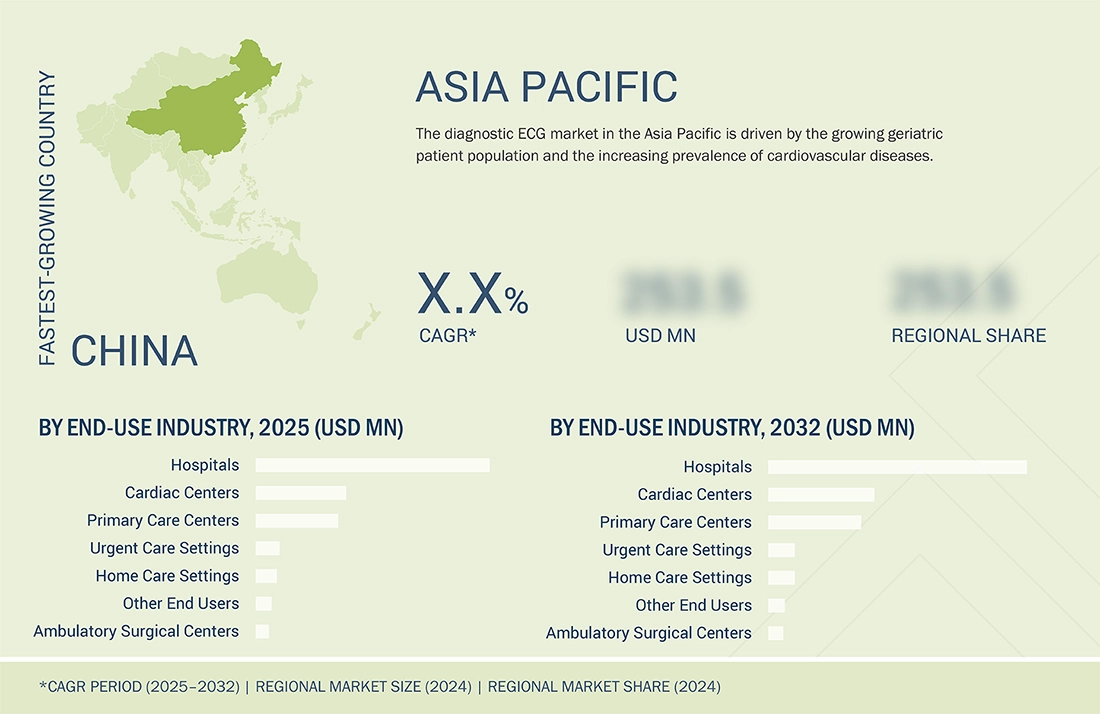

BY REGIONThe diagnostic ECG market covers Europe, North America, Asia Pacific, South America, the Middle East, and Africa. Asia Pacific is expected to grow the fastest, driven by demographic, technological, and healthcare infrastructure developments. The region's large and aging population base, particularly in countries such as China and India, is leading to a significant rise in the prevalence of cardiovascular diseases (CVDs).

-

COMPETITIVE LANDSCAPEThe major market players have adopted organic and inorganic strategies, including partnerships and collaborations. For instance, Koninklijke Philips N.V. and NYU Langone Health entered an 8-year partnership to enhance patient care through innovative technologies.

The diagnostic electrocardiograph/ECG Market is projected to grow rapidly over the next decade, supported by a significant shift towards home healthcare solutions, propelled by advancements in wearable technology and the broader digital transformation within the healthcare sector. Moreover, technological innovations, specifically the advent of portable ECG devices and AI-enhanced ECG interpretation, are anticipated to bolster market growth.

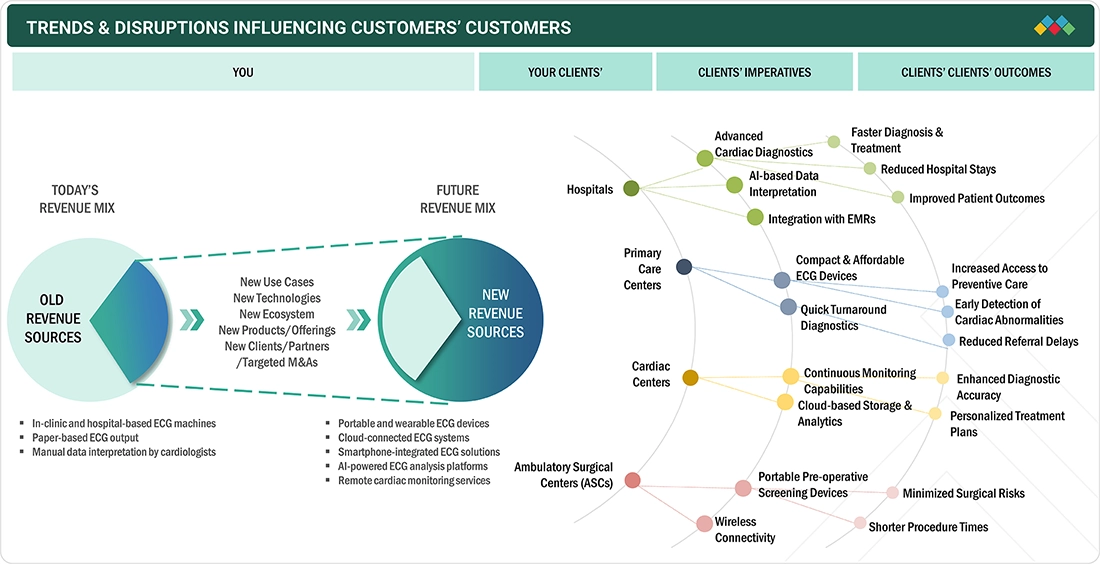

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The diagnostic ECG market is transforming, driven by advancements in digital health, remote patient monitoring, and integration with AI-powered analytics. Traditional hospital-based ECG diagnostics give way to portable, wearable, and home-based solutions, creating new revenue sources and end-user segments. These trends are reshaping clinical workflows and enabling proactive, decentralized cardiac care.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing incidence of lifestyle and cardiovascular diseases

-

Rapidly expanding global geriatric population and subsequent surge in heart conditions

Level

-

Stringent regulatory requirements delaying approval of cardiac devices

-

Technological limitations of diagnostic ECG devices and software

Level

-

Emerging markets to offer high growth opportunities

-

Expanding access to advanced cardiac diagnostics with AI and CMS support

Level

-

Challenges in integrating ECG systems with Electronic Health Records (EHRs)

-

Accuracy challenges in next-generation ECG monitoring

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Diagnostic Electrocardiograph Market, Diagnostic ECG Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

AI-powered portable ECG devices for personalized cardiac care | AliveCor has developed KardiaMobile, an FDA-cleared portable ECG device that uses AI to detect atrial fibrillation, bradycardia, and tachycardia. The device works with smartphones to record medical-grade ECGs, providing instant analysis and alerts. |

|

Wearable ECG monitors integrated with deep learning analytics | iRhythm’s Zio patch continuously records cardiac activity for up to 14 days. Data is analyzed using AI-driven algorithms to accurately detect arrhythmias and other anomalies. This solution reduces diagnostic delays and hospital visits while supporting physicians with comprehensive cardiac insights in a streamlined digital report. |

|

Portable and wearable ECG devices; AI-powered interpretation | These devices enable remote monitoring, faster diagnosis, better patient convenience, and support scaling in ambulatory and home settings. |

|

12-lead resting ECG systems; advanced digital ECG | These systems offer high diagnostic accuracy, broad clinical acceptance, and support for large hospital workflows. They are essential for detecting myocardial infarction and arrhythmias. |

|

Wearables with on-demand ECG heart screening | Whoop 5.0 and Whoop MG wearables featuring on-demand ECG heart screening and blood pressure insights, aiming to extend users' health span. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The diagnostic ECG market ecosystem consists of diverse stakeholders, including manufacturers, suppliers, healthcare providers, regulatory bodies, and end users, all playing critical roles in designing, producing, and deploying ECG systems and related components. Manufacturers rely on suppliers for key materials such as sensors, electrodes, cables, display screens, batteries, medical-grade plastics, conductive gels, adhesives, and other electronic components while managing integration, calibration, and testing. Healthcare providers, including hospitals, diagnostic labs, clinics, and ambulatory care centers, are major users demanding accurate, real-time cardiac data to diagnose and monitor heart conditions. Regulatory agencies like the FDA (US), EMA (Europe), and PMDA (Japan) enforce strict guidelines on safety, efficacy, interoperability, and patient data protection, influencing product approval timelines, labeling, and post-market surveillance. End users such as cardiologists, physicians, technicians, and home-based patients significantly shape market trends, with growing demand for compact, portable, user-friendly ECG devices featuring wireless connectivity, remote monitoring, and integration with electronic health records (EHRs).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Diagnostic Electrocardiograph/ECG Market, By Products & Services

The devices segment represents the largest segment of the diagnostic ECG market. This segment includes resting ECG devices, stress ECG systems, Holter monitors, smart ECG devices, mobile cardiac telemetry (MCT) devices, and implantable loop recorders (ILRs). As cardiovascular diseases continue to represent a significant public health challenge impacting populations around the globe, these diagnostic devices play essential roles. They provide timely and accurate diagnostic information, facilitating early intervention and effective risk assessment, and significantly improving patient monitoring processes. The ongoing refinement and adoption of these technologies are crucial in managing cardiac health and improving patient outcomes.

Diagnostic Electrocardiograph/ECG Market, By Lead type

The 5-lead ECG segment, by lead type, is projected to register the highest growth rate during the forecast period due to its optimal balance between diagnostic accuracy and patient comfort. Unlike traditional 12-lead systems, which are typically confined to clinical and hospital settings, 5-lead ECG systems offer greater mobility, lower complexity, and cost-effectiveness while enabling reliable cardiac monitoring for arrhythmias, ischemia detection, and continuous patient surveillance. Their increasing adoption in ambulatory care, home healthcare, and remote patient monitoring programs, coupled with rising CVD prevalence and technological advancements, drives this segment’s rapid expansion across both developed and emerging markets.

Diagnostic Electrocardiograph/ECG Market, By Type

The portable segment holds the largest share in the diagnostic ECG market by type, driven by their convenience, mobility, and diverse applications in both clinical settings and home care. Unlike traditional ECG machines, which are typically bulkier and stationary, portable devices enable on-demand or continuous cardiac monitoring from virtually any location. A significant advantage of these devices is their ability to wirelessly record and transmit ECG data to healthcare providers, facilitating remote patient monitoring. This capability not only allows for timely interventions but also minimizes the need for frequent hospital visits. As a result, the emphasis on remote patient care and the demand for personalized healthcare solutions are the primary factors propelling the growth of portable ECG devices.

Diagnostic Electrocardiograph/ECG Market, By End User

The hospitals segment represents the largest share of the diagnostic ECG Market in 2024 due to the high volume of cardiovascular patient admissions and advanced diagnostic infrastructure. The integration of ECG systems with other cardiac diagnostic modalities enhances their utility in inpatient and outpatient settings, especially in emergencies and ICUs. Moreover, the increasing rates of hospital admissions for cardiac conditions, combined with the emphasis on early detection and timely intervention, position hospitals as the predominant end users of ECG technologies; this trend is a key driver of overall market expansion in the diagnostic ECG market.

REGION

Asia Pacific to be fastest-growing region in global Diagnostic Electrocardiograph/ECG Market during forecast period

Asia Pacific is expected to grow at the highest CAGR globally during the forecast period, driven by demographic changes, technological advancements, and healthcare infrastructure developments. The region's large and aging population base, particularly in countries such as China, India, Japan, and South Korea, is leading to a significant rise in the prevalence of cardiovascular diseases (CVDs), including arrhythmias, myocardial infarctions, and hypertension, all of which are key conditions diagnosed using ECG devices. For instance, the International Heart Federation reports that CVDs account for over 50% of deaths in several Asian countries, underscoring a pressing need for widespread cardiac monitoring and screening solutions. Additionally, government-led health initiatives and increased public healthcare investments across Asia Pacific are further catalyzing the adoption of diagnostic ECG systems in urban and rural settings. Programs such as India’s Ayushman Bharat or China’s Healthy China 2030 enhance access to affordable diagnostic services, including ECG testing. Furthermore, the region has seen rising demand for cost-effective and portable ECG technologies, with innovations in cloud-based and smartphone-connected ECG devices becoming increasingly popular due to their convenience, lower cost, and remote monitoring capabilities. This is particularly relevant in countries with underserved rural populations, where healthcare access remains challenging.

Diagnostic Electrocardiograph Market, Diagnostic ECG Market: COMPANY EVALUATION MATRIX

In the diagnostic electrocardiograph/ECG market matrix, GE Healthcare (Star) leads with scale, extensive distribution, and a broad solutions portfolio. NIHON KOHDEN CORPORATION (Emerging Leader) is gaining momentum with innovative diagnostic ECG devices and software. While GE Healthcare dominates through reach, Nihon’s innovation positions it for rapid growth toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 8.59 Billion |

| Market Forecast in 2032 (Value) | USD 15.18 Billion |

| CAGR (2025–2032) | 7.4% |

| Years Considered | 2023–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD million/billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Europe, North America, Asia Pacific, South America, the Middle East, and Africa |

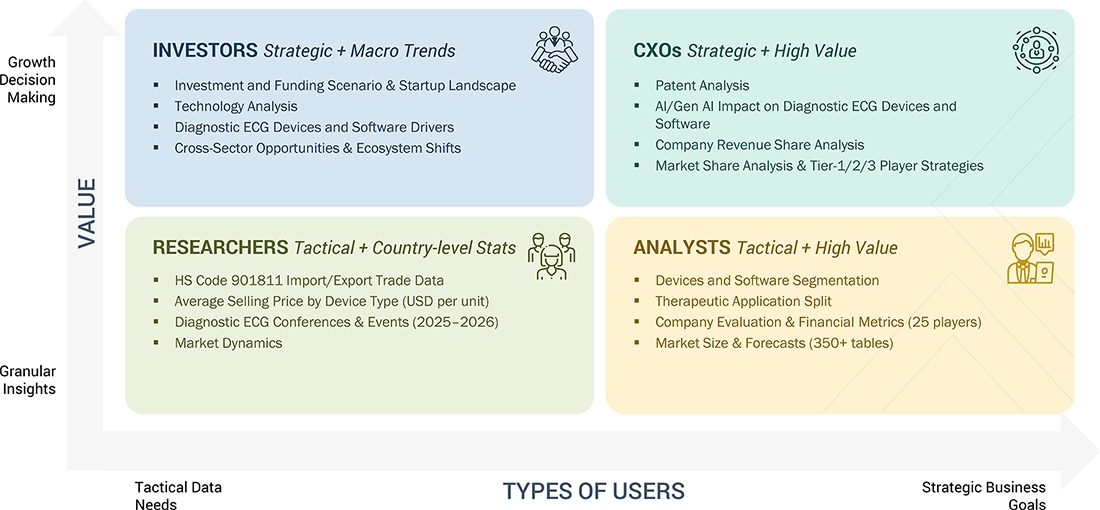

WHAT IS IN IT FOR YOU: Diagnostic Electrocardiograph Market, Diagnostic ECG Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Market Size Estimation on Diagnostic ECG Software | The custom included market size, key trends, growth opportunities, and a detailed competitive landscape highlighting leading providers, their product differentiators, and strategic positioning |

| Company Information | Key players: Top 3–5 players market share analysis in Asia Pacific and Europe at country level. | Insights on revenue shifts towards emerging device and software innovations. |

| Geographic Analysis | Detailed analysis on Rest of Asia Pacific was provided to one of the top players. Client focused on ASEAN Market country level analysis for device market. | Country-level demand mapping for new product launches and localization strategy planning. |

RECENT DEVELOPMENTS

- April 2025 : OSI Systems, Inc. announced that its Healthcare division, Spacelabs Healthcare, is expanding its footprint with an existing US-based customer. Under a new agreement, the company will provide approximately USD 4 million in patient monitoring solutions, supplies, and accessories. This deal signifies Spacelabs’ continued expansion strategy through strengthened partnerships and infrastructure modernization.

- March 2024 : Wipro GE Healthcare announced an investment of over USD 964 million over the next five years to boost local manufacturing and R&D in India. This move aims to position India as a key global MedTech innovation and manufacturing hub.

- June 2024 : Koninklijke Philips N.V. (Netherlands) launched the Cardiac Workstation in EMEA to transform diagnostic cardiology by using advanced algorithms that streamline ECG data collection and analysis. The platform helps clinicians prioritize at-risk patients and reduces administrative burdens, enabling faster, more efficient care.

Table of Contents

Methodology

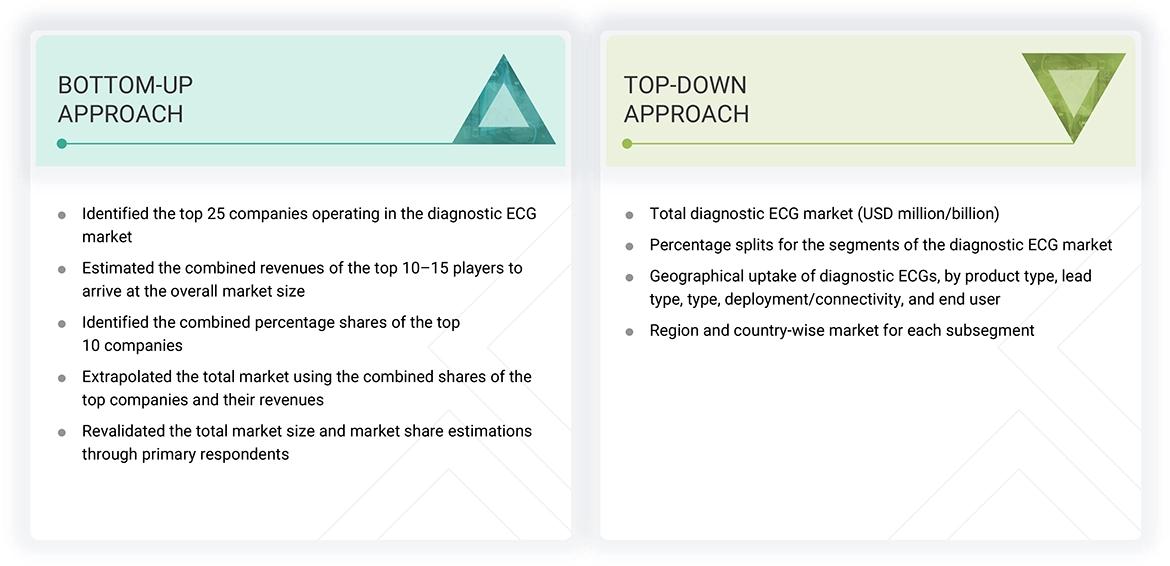

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, SEC filings of companies and publications from government sources[such as National Institutes of Health (NIH), US FDA, US Census Bureau, World Health Organization (WHO), Centers for Disease Control and Prevention (CDC), European Federation of Pharmaceutical Industries and Associations (EFPIA), American Journal of Drug Delivery and Therapeutics, International Diabetes Federation (IDF), American Association of Diabetes Educators (AADE, Asian Association for the Study of Diabetes (AASD) and Parenteral Drug Association (PDA) were referred to identify and collect information for the global diagnostic electrocardiograph/ECG market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends, to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various companies and organizations in the diagnostic ECG market. The primary sources from the demand side include hospitals & clinics and home care settings. Primary research was conducted to validate the market segmentation, identify key players, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

Note 1: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 2: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = < USD 1.00 billion.

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For the global market value, annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs active in the global diagnostic ECG market. All the major product manufacturers were identified at the global and/or country/regional level. Revenue mapping for the respective business segments/sub-segments was made for the major players (who contribute at least 70–75% of the market share at the global level). Also, the diagnostic ECG market was split into various segments and sub-segments based on:

- List of major players operating in the diagnostic ECG market at the regional and/or country level

- Product mapping of various diagnostic ECG manufacturers at the regional and/or country level

- Mapping of annual revenue generated by listed major players from diagnostic ECG products (or the nearest reported business unit/product category)

- Revenue mapping of major players to cover at least 70–75% of the global market share as of 2024

- Extrapolation of the revenue mapping of the listed major players to derive the global diagnostic ECG market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the global diagnostic ECG market

Market Size Estimation (Bottom-up and Top-down Approach)

Data Triangulation

After arriving at the overall size of the global diagnostic ECG market through the methodology mentioned above, this market was split into several segments and subsegments. Where applicable, the data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both demand- and supply-side participants.

Market Definition

Diagnostic ECG devices detect electrical signals associated with cardiac activities to produce a graphic record of the time versus voltage. These ECG devices are equipped with software that analyses the ECG graph to determine the heart rhythm. Various types of ECG devices—holter monitors, resting ECG devices, stress ECG devices, implantable loop recorders (ILRs), event monitors, mobile cardiac telemetry (MCT) devices, and smart ECG monitors—are used by healthcare professionals to monitor and diagnose cardiac conditions.

Stakeholders

- Manufacturers of diagnostic ECG devices

- Distributors of diagnostic ECG devices

- Hospitals, clinics, and cardiac centers

- Ambulatory surgery centers

- Non-government organizations

- Government regulatory authorities

- Contract manufacturers & third-party suppliers

- Research laboratories & academic institutes

- Clinical research organizations (CROs)

- Government & non-governmental regulatory authorities

- Market research & consulting firms

Report Objectives

- To define, measure, and describe the global diagnostic ECG market by product, lead type, type, deployment/ connectivity, end user, and region

- To provide detailed information about the significant factors influencing the diagnostic ECG market growth (drivers, restraints, challenges, and opportunities)

- To strategically analyze the regulatory, pricing, value chain, supply chain, ecosystem, technology, Porter’s Five Forces, and patent analysis

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of market segments in North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To strategically analyze the market structure, profile the key players in the global diagnostic ECG market, and comprehensively analyze their core competencies

- To track and analyze company developments such as acquisitions, partnerships, expansions, and product launches & approvals in the diagnostic ECG market

- To track and analyze competitive developments such as mergers & acquisitions, product developments, partnerships, agreements, collaborations, and expansions in the global diagnostic ECG market

Key Questions Addressed by the Report

What are the drivers for the diagnostic ECG market?

The increasing incidence of cardiovascular diseases (CVDs), a growing geriatric population, and the development of wireless ECG monitoring solutions are key drivers of market growth.

Which device subsegment of the diagnostic ECG devices market witnesses the highest market share?

The resting ECG devices segment holds the highest market share, supported by widespread use in hospitals and diagnostic centers, and innovations such as digital interfaces and automated interpretation.

Which end user segment is expected to show strong growth?

The hospitals segment is expected to grow significantly, driven by the rising burden of cardiovascular diseases and increased adoption of integrated ECG systems with electronic medical records.

What are the main companies present in this market?

Key companies include GE HealthCare (US), Koninklijke Philips N.V. (Netherlands), Baxter (US), FUKUDA DENSHI (Japan), Mindray (China), NIHON KOHDEN CORPORATION (Japan), OSI Systems (US), Bittium (Finland), iRhythm Technologies (US), and Lepu Medical Technology (China).

Which region is expected to witness significant demand for the diagnostic ECG market in the coming years?

The Asia Pacific region is the fastest-growing market, especially in China and India, due to increasing chronic disease prevalence, improved healthcare infrastructure, and greater awareness of cardiac health.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Diagnostic Electrocardiograph/ECG Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Diagnostic Electrocardiograph/ECG Market