The study involved four major activities in estimating the current size of the drone logistics and transportation market. Exhaustive secondary research was done to collect information on the drone logistics and transportation market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analyses were carried out to estimate the overall size of the market. After that, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the drone logistics and transportation market.

Secondary Research

Several Sources of paid and unpaid secondary data were used to determine the market rankings of manufacturers of cargo, freight and passenger drones, examining their product portfolios and operations. This was followed by a ranking of their companies basis their sales performance and quality of their products. This was further validated via primary sources. Secondary data sources referred to for the study included financial statements of major companies manufacturing freight, passenger and air ambulance drones along with information from various trade, business and professional associations. The collected data was analyzed to arrive at the overall size of the drone logistics and transportation market, which was then validated via primaries.

Primary Research

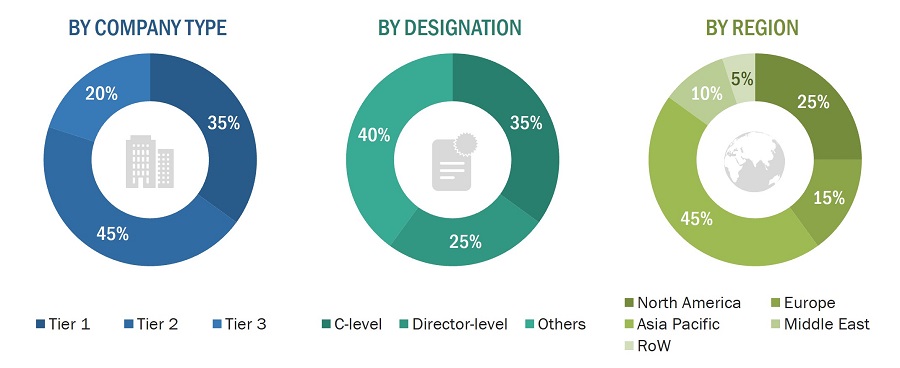

Extensive primary research was conducted after acquiring information regarding the drone logistics and transportation market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East, Latin America and Africa. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

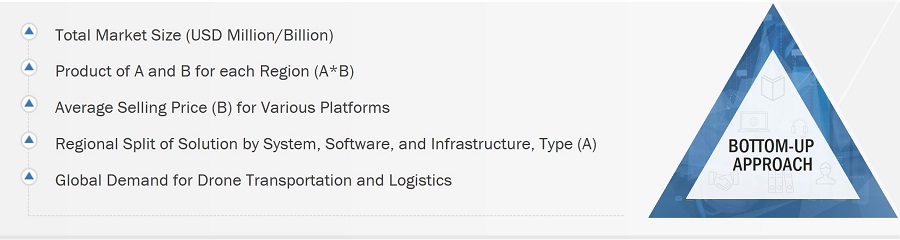

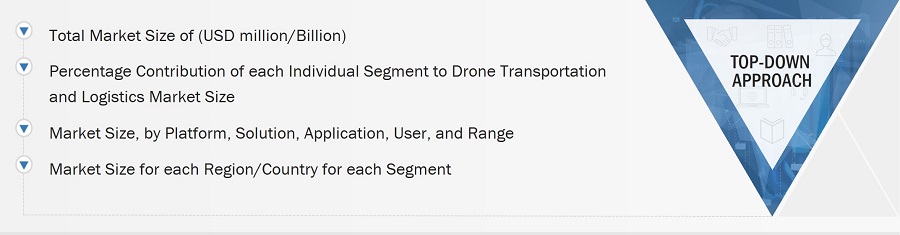

Market estimation is done using a bottom-up approach and validated by a top-down approach. Volume data gathered using prebook order volumes and completed deliveries by manufacturers was used to estimate the future deliveries for each drone segment. Such data sets provide information on each application's demand aspects of logistics and transportation drones. For each application, all possible end users in the drone logistics and transportation market were identified.

Market size estimation methodology: Bottom-up Approach

Market size estimation methodology: Top-Down Approach

Data Triangulation

After arriving at the overall size of the market, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both, the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

-

To define, describe, segment, and forecast the size of the drone transportation and logistics market based on solution, platform, architecture, deployment, and region

-

To forecast the size of different segments of the market with respect to various regions, including North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa, along with key countries in each of these regions

-

To identify and analyze key drivers, opportunities, and challenges influencing the growth of the market

-

To identify technology trends that are currently prevailing in the drone transportation and logistics market

-

To provide an overview of the tariff and regulatory landscape with respect to the drone regulations across regions

-

To analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

-

To analyze opportunities in the market for stakeholders by identifying key market trends

-

To profile key market players and comprehensively analyze their market share and core competencies2

-

To analyze the degree of competition in the market by identifying key growth strategies, such as acquisitions, new product launches, new service launches, contracts, and partnerships, adopted by leading market players

-

To identify detailed financial positions, key products, and unique selling points of leading companies in the market

-

To provide a detailed competitive landscape of the drone transportation and logistics market, along with a ranking analysis, market share analysis, and revenue analysis of key players

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

-

Further breakdown of the market segments at country-level

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Olivier

Apr, 2019

We are focusing on semi-urban airborne electric logistics at first before transporting people, and would like to see if this report crosses our own findings..

Yassine

Sep, 2022

I would like a sample of your drone delivery and/or drone industry report..