Thermal Energy Storage Market by Technology (Sensible, Latent, Thermochemical), Storage Material (Water, Molten Salts, PCM), Application (Power Generation, District Heating & Cooling, Process Heating & Cooling), End User and Region - Global Forecast to 2025

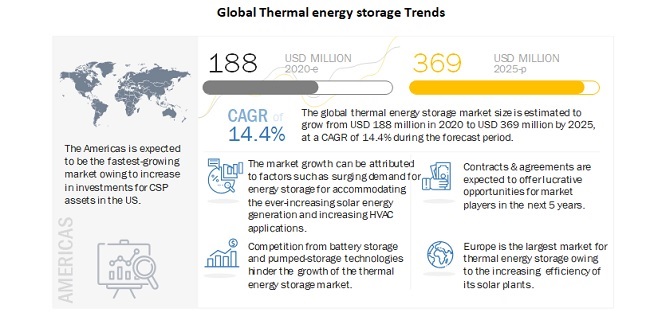

[219 Pages Report] The global thermal energy storage market in terms of revenue was estimated to be worth $188 million in 2020 and is poised to reach $369 million by 2025, growing at a CAGR of 14.4% from 2020 to 2025. The growth of the global thermal energy storage market is backed by increasing demand for electricity during peak hours, increasing commercialization of CSP plants, and demand for heating & cooling applications for smart infrastructure.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the global thermal energy storage market

At the start of 2020, the development of renewable energy technologies in several markets was already challenged by financing, policy uncertainties, and grid integration, which has been intensified further by COVID-19. According to the IEA, the COVID-19 crisis has significantly impacted the global growth in renewable power capacity addition. According to the IEA estimates, the number of new renewable power installations worldwide is set to fall in 2020 as a result of the unprecedented global COVID-19 crisis. This marks the first annual decline in 20 years since 2000 for renewable energy capacity addition. The net additions of renewable electricity capacity in 2020 are projected to decline by 13% compared with 2019.

The decline is represented by delays in construction activities due to supply chain disruptions caused mainly by China, lockdown measures across all major economies, social-distancing guidelines for workers, and the subsequent financing challenges. In 2021, renewable energy capacity addition is projected to increase with the resumption of the majority of the delayed projects. This will lead to a rebound in new installations, and as a result, the next year is forecast to reach the same level of renewable electricity capacity additions as in 2019. This will be further supplemented by supportive government policies for renewable energy technologies in multiple countries. In addition, countries are likely to make investments in renewables a key part of stimulus packages to reinvigorate their economies. Advancements and investments in renewable technologies, such as solar and wind, can also help in economic development by creating jobs, reducing emissions, and fostering innovation. For the analysis of the COVID-19 impact on the market, we have considered key parameters such as the impact of COVID-19 on electricity demand and power sector investment. The IEA forecasts that renewable electricity capacity additions will decline by 13% in 2020, while CSP installed capacity additions will decline by 38% in 2020 as compared with 2019, the first downward trend since 2000. The COVID-19 impact is further intensified by policy uncertainties associated with the newly financed renewable energy projects, just before the COVID-19 outbreak. According to the Union of the Electricity Industry (Eurelectric AISBL), new investments by utilities are likely to decrease by 10 to 15% due to the COVID-19 outbreak. All these factors have been considered for the scenario analysis of COVID-19 impact on the global thermal energy storage market.

Thermal energy storage Dynamics

Driver: Demand for energy storage for supplementing ever-increasing solar energy generation

Decarbonization of the energy sector and reduction of carbon emissions in order to cap the global climate change are some of the most hegemonic goals for governments, energy authorities, and utilities across the world. According to IRENA, accelerated deployment of renewables, along with electrification and increasing energy efficiency of electric grid, can help to achieve over 90% of the energy-related carbon dioxide (CO2) emission reductions required to meet the Paris Climate targets by 2050.

According to IRENA, global renewable energy installed capacity in 2019 was 176 GW higher than that in 2018—an increase of 7.4%. Generation growth returned to its long-term trend, due to a recovery in the hydropower sector. Solar generation continues to grow strongly; in 2018, solar overtook bioenergy to become the third largest source of renewable electricity generation. Solar and wind generation in 2018 increased by 28% and 11%, respectively. Collectively, these 2 sources of energy continue to dominate renewable energy generation, accounting for 73% of growth since 2014. Solar energy has experienced an average annual growth rate of 49% globally due to strong federal policy mechanisms to encourage the adoption of the energy, Investment Tax Credit for solar power, and increasing demand for clean energy from both public and private sectors across all major economies in North America, Europe, and Asia Pacific region. According to the Renewable Energy World, in China, power generation from renewable energy sources reached up to 1,870 TWh in 2018 (26.7% of the country’s total), which is an increase of 170 TWh. Hydro contributed 1,200 TWh (increased by 3.2%), wind contributed 366 TWh (increased by 20%), PV contributed 177.5 TWh (increased by 50%), and biomass contributed 90.6 TWh (increased by 14%) to the country’s overall energy generation from renewables. In November 2018, the National Energy Administration of China disclosed that it might increase its solar target in 2020 to at least 210 GW and has the potential to reach as high as 270 GW. This will significantly impact China’s annual capacity additions.

The Government of India has set a target of installing 175 GW of renewable energy capacity by 2022; this includes adding 60 GW from wind, 10 GW from bio power, 100 GW from solar, and 5 GW from small hydropower to its overall renewable capacity. Similarly, the Spanish government raised its renewable energy target to 74% by 2030, and also aims to add 157 GW of renewable energy capacity.

According to the IEA, CSP generation increased by an estimated 34% in 2019 and is expected to grow in coming years as well. This can be achieved through continuous policy support to CSP projects across the Middle East and Africa, Asia Pacific, and North America regions. Thermal energy storage stocks solar thermal energy by cooling or heating a storage medium, such as sand, rocks, water, and molten salt, in order to use the stored energy later for cooling and heating applications and power generation. Thermal energy storage is important for electricity storage in concentrating solar power plants in which solar heat can be stored for the production of electricity when sunlight is not available. This facilitates uninterrupted operations of CSP plants. Some of the key CSP thermal energy storage technologies include single-tank thermocline system, two-tank indirect system, and two-tank direct system. The advantages of thermal energy storage in CSP plants include better reliability, increase in overall efficiency, reductions in investment and running costs, and economical operations. It can also reduce the emission of carbon dioxide. Thus, integration of thermal energy storage in CSP plants is likely to drive the market growth.

Restraint: Competition from battery storage and pumped-storage

Being able to differentiate between the perks of battery and thermal energy storage, two of the most common solutions available, is vital for utilities and power plant operators considering deployment in the near future. Choosing the appropriate technology ensures that the installation helps a commercial facility to consume electricity in as cost-effective manner as possible. Batteries are great for providing backup power for lighting, elevators, and computers whereas thermal energy storage is a building's easiest way of reducing peak electric demand. Air conditioning makes up a third of energy costs in summer months and it would be highly inefficient and costly to store energy in a battery only to have it transformed yet again to create instantaneous cooling. In contrast, the entire building load cannot be backed up with just thermal storage.

In the US, pumped-storage hydropower (PSH) is by far the most popular form of energy storage which accounts for 95% of utility-scale energy storage. According to the US Department of Energy (DOE), 2019, pumped-storage hydropower has increased by 2 GW in the past 10 years.

Most of the battery storage projects that system operators (ISOs/RTOs) develop are for short-term energy storage and are not built to replace the traditional grid. Most of these facilities use lithium-ion batteries, which provide enough energy to shore up the local grid for approximately 4 hours or less. These facilities are used for grid reliability, to integrate renewables into the grid, and to provide relief to the energy grid during peak hours.

Although, Thermal energy storage demands for lower project costs but it is less preferred over battery storage and pumped-hydro storage due to their lower efficiency at economies of scale. Thus, these substitutes act as barriers to the growth of the thermal energy storage market.

Opportunity: Decentralization of renewable energy sector

The deployment of decentralized renewable energy is powering a disrupting transformation of the energy sector. The speedy growth of decentralized renewable energy technologies is likely to change the structure of the energy sector towards a multi-operator set-up in which large utilities interact with captive consumers and mini-utilities. Renewable energy distributed through the grid, as well as through mini-grids and off-grid installations, have provided power to 30% of the people who have gained access to electricity since 2000. To achieve 100% electrification rate by 2030, the share of decentralized renewable energy share will need to increase significantly. For over 70% of those who gain access in rural areas, decentralized systems based on renewable energy will be the most cost-effective solution.

Industrial bulk consumption, self-consumption, and the application of distributed storage can yield benefits for both end users and the power system as a whole. Therefore, thermal energy storage technology is expected to gain opportunities in the coming years. However, costs related with storage projects need to be reduced and become cost-efficient at scale to observe increased deployment.

Challenge: High initial set-up costs varying with technology

The cost of thermal energy storage technologies depends on application, size, and thermal insulation technology. Costs of phase change material- and thermo-chemical storage-based thermal storage systems are usually higher in comparison to the cost of storage capacity they provide. The cost of storage systems constitutes nearly 30% to 40% of the total system cost. Continued research into energy storage technologies to drive down the upfront capital requirement is anticipated to make thermal energy storage technologies more competitive in the near future.

Sensible heat storage offers a storage capacity ranging from 10 kWh/t–50 kWh/t and storage efficiencies between 50%–90%, depending on the specific heat of the storage medium and thermal insulation technologies. PCMs can offer higher storage capacity and storage efficiencies in the range of 75%–90%. In most cases, storage is based on a solid or liquid phase change with energy densities on the order of 100 kWh/ m3 (e.g. ice). TCS systems can reach storage capacities of up to 250 kWh/t with operation temperatures of more than 300°C and efficiencies from 75% to nearly 100%. The cost of a complete system for sensible heat storage ranges between Euros 0.1/kWh–10/kWh (USD 0.11/kWh–10.7/kWh), depending on the size, application, and thermal insulation technology. The costs for PCM and TCS systems are higher in general. In these systems, major costs are associated with the heat (and mass) transfer technology, which has to be installed to achieve a sufficient charging or discharging power. Costs of latent heat storage systems based on PCMs range between Euros 10/kWh–50/kWh (USD 10.7/kWh–53.5/kWh) while TCS costs are estimated to range from Euros 8/kWh–100/kWh (USD 8.56/kWh–107/kWh). The economic viability of a TES depends heavily on application and operation needs, including the number and frequency of storage cycles.

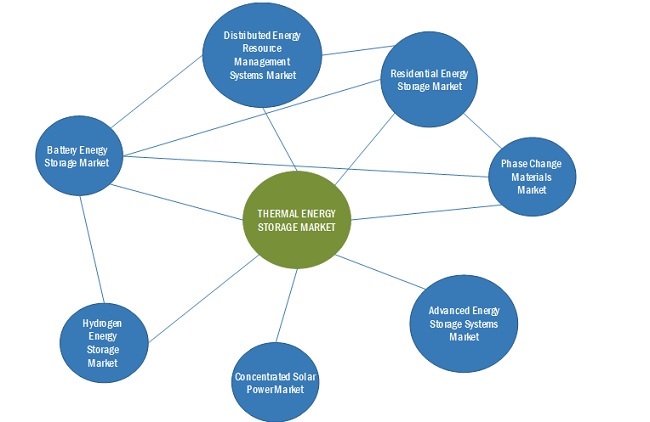

Market Interconnection

To know about the assumptions considered for the study, download the pdf brochure

By technology, sensible heat storage segment is the largest contributor in the thermal energy storage during the forecast period.

Thermal energy storage, in the form of sensible heat, is based on the specific heat of a storage medium, which is kept in storage tanks with high thermal insulation. The most widely used and commercial heat storage medium is molten salt, which has a number of commercial and industrial applications. Moten salts exhibit excellent thermal properties and have been used in more than 50% of the operational thermal energy projects to date. Also, sensible heat storage technology is the most cost-efficient when it comes to economies of scale.

By storage material, the molten salt segment is expected to grow at the fastest rate during the forecast period.

Molten salts are the most commonly used storage media for thermal energy storage as these have higher boiling points and high volumetric heat capacities. When energy is needed, the salt is pumped into a steam generator that boils water, spins a turbine, and generates electricity.

By application, the power generation segment is expected to be the largest contributor during the forecast period.

Thermal energy storage in concentrating solar power (CSP) plants can help in overcoming the intermittency of the solar resource and also reduce the levelized cost of energy (LCOE) by utilizing power for extended periods of time. TES systems can collect energy during sunshine hours and store it in order to shift its delivery to a later time or to facilitate plant output during cloudy weather conditions. Hence, the operation of a solar thermal power plant can be extended beyond periods of no solar radiation without the need to burn fossil fuels. Energy storage not only reduces the mismatch between supply and demand but also improves the performance and reliability of energy systems and plays an important role in conserving energy.

By end user, the utilities segment is expected to be the largest contributor during the forecast period.

Thermal energy storage systems are incorporated in electric utility plants as a viable demand-side management option. These systems use ice or chilled water technologies for storing thermal energy in tanks during utility off-peak hours. This helps to meet the peak demand with fewer power plants by shifting customer’s power demand to off-peak hours. Many utilities currently offer time-of-day pricing to their customers and sell power at a lower price during off-peak hours.

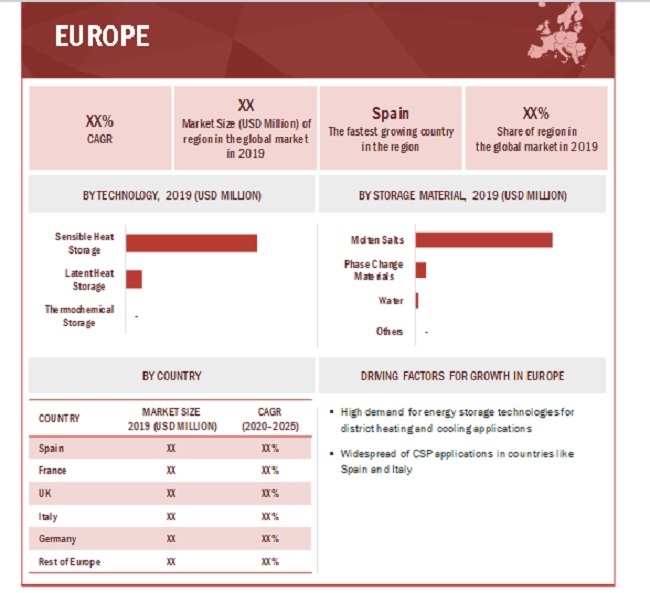

Europe held the largest share of the market in 2019.

According to the IRENA, Europe’s installed CSP capacity is predicted to rise from 2.3 GW in 2017 to 4 GW by 2030, based on the market framework and current costs. Attempts of European nations to meet carbon reduction targets, shift from coal-fired power generation, and simultaneous hike in renewable energy generation will also support the case for dispatchable CSP plants with storage.

Key Market Players

Abengoa Solar, Burns & McDonnell, SolarReserve, BrightSource Energy, Calmac, MAN Energy Solutions, and Baltimore Air Coil Technology are the leading players in the market. Cristopia Energy, Cryogel, Caldwell Energy, Dunham Bush, Goss Engineering, Steffes Corporation, DN Tanks, Turbine Air Systems (TAS), Evapco Inc., Fafco, Sunwell Tehnologies, DC Pro Engineering, CB&I (McDermott), and LIME are other players operating in the market are the leading players in the global thermal energy storage market.

Scope of the Report

|

Report Coverage |

Details |

|

Market size: |

USD 188 million in 2020 to USD 369 million by 2025 |

|

Growth Rate: |

14.4% |

|

Largest Market: |

Europe |

|

Market Dynamics: |

Drivers, Restraints, Opportunities & Challenges |

|

Forecast Period: |

2020-2025 |

|

Forecast Units: |

Value (USD Billion) |

|

Report Coverage: |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered: |

Technology, Storage Material, Application, End User, and Region |

|

Geographies Covered: |

North America, Europe, Asia Pacific, Latin America, and Middle East and Africa |

|

Report Highlights:

|

Updated financial information / product portfolio of players |

|

Key Market Opportunities: |

Decentralization of renewable energy sector |

|

Key Market Drivers: |

Demand for energy storage for supplementing ever-increasing solar energy generation |

This research report categorizes the thermal energy storage based on technology, storage material, application, end user, and region.

Based on the technology:

- Sensible Heat Storage

- Latent Heat Storage

- Thermochemical Storage

Based on the storage material:

- Water

- Molten Salts

- Phase Change Materials

- Others

Based on the application:

- Power generation

- District Heating & Cooling

- Process Heating & Cooling

Based on the end user:

- Utilities

- Commercial

- Industrial

Based on the region:

- Asia Pacific

- Americas

- Europe

- Middle East & Africa

Recent Developments

- In August 2018, SolarReserve signed an agreement with the South Australian Government (Australia) to build a 150 MW solar thermal power station. It will use molten salt for its storage and uses parabolic tower systems.

- In May 2018, SolarReserve expanded by adding 70 MW solar farm to Port Augusta concentrating solar power tower in South Australia. It also provided molten salt storage facility and delivered electricity at USD 78/MWh.

Frequently Asked Questions (FAQ):

What is the current market size of the thermal energy storage market?

The size of the global thermal energy storage is USD 237 million in 2019.

What are the major drivers for the thermal energy storage market?

The thermal energy storage is driven by major factors such as increasing demand for electricity and the rising consumption of solar CSP.

Which region dominates during the forecasted period in the thermal energy storage market?

Americas is the fastest-growing market for thermal energy storages during the forecast period.

Which is the fastest-growing technology segment during the forecasted period in the thermal energy storage market?

The latent heat storage segment is the fastest-growing during the forecasted period.

Who are the leading players in the global thermal energy storage market?

Leading players in the global thermal energy storage market are Abengoa Solar, Burns & McDonnell, SolarReserve, BrightSource Energy, Calmac, MAN Energy Solutions, and Baltimore Air Coil Technology, with high-end technological innovation. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 THERMAL ENERGY STORAGE MARKET: INCLUSIONS AND EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKET SEGMENTATION

1.4.2 REGIONS COVERED

1.4.3 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 1 THERMAL ENERGY STORAGE MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

TABLE 1 THERMAL ENERGY STORAGE MARKET: PLAYERS/COMPANIES CONNECTED

2.3 SCOPE

FIGURE 3 MAIN METRICS CONSIDERED IN ASSESSING DEMAND FOR MARKET

2.4 MARKET SIZE ESTIMATION

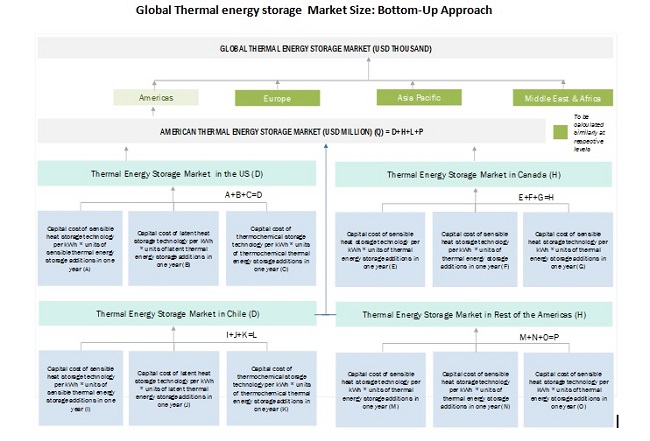

2.4.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4.3 IDEAL DEMAND-SIDE ANALYSIS

2.4.3.1 Assumptions

2.4.3.2 Limitations

2.4.3.3 Calculation

2.4.4 FORECAST

2.4.5 SUPPLY-SIDE ANALYSIS

FIGURE 6 MAIN METRICS CONSIDERED IN ASSESSING SUPPLY FOR THERMAL ENERGY STORAGE MARKET

2.4.5.1 Calculation

2.4.5.2 Assumptions

FIGURE 7 INDUSTRY CONCENTRATION, 2019

2.5 PRIMARY INSIGHTS

3 EXECUTIVE SUMMARY (Page No. - 48)

3.1 SCENARIO ANALYSIS

FIGURE 8 SCENARIO ANALYSIS: THERMAL ENERGY STORAGE, 2018–2025

3.1.1 OPTIMISTIC SCENARIO

3.1.2 REALISTIC SCENARIO

3.1.3 PESSIMISTIC SCENARIO

TABLE 2 THERMAL ENERGY STORAGE MARKET SNAPSHOT

FIGURE 9 AMERICAS TO GROW AT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

FIGURE 10 LATENT HEAT STORAGE SEGMENT TO GROW AT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

FIGURE 11 MOLTEN SALTS SEGMENT TO CONTINUE TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

FIGURE 12 POWER GENERATION SEGMENT TO WITNESS FASTEST GROWTH IN MARKET DURING FORECAST PERIOD

FIGURE 13 UTILITIES SEGMENT TO WITNESS FASTEST GROWTH IN MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 55)

4.1 ATTRACTIVE OPPORTUNITIES IN THERMAL ENERGY STORAGE MARKET

FIGURE 14 DECENTRALIZATION OF RENEWABLE ENERGY SECTOR TO DRIVE MARKET DURING FORECAST PERIOD

4.2 MARKET, BY TECHNOLOGY

FIGURE 15 SENSIBLE HEAT STORAGE SEGMENT TO DOMINATE MARKET, BY TECHNOLOGY, DURING FORECAST PERIOD

4.3 MARKET, BY STORAGE MATERIAL

FIGURE 16 MOLTEN SALTS SEGMENT CAPTURED LARGEST SHARE OF MARKET IN 2019

4.4 MARKET, BY APPLICATION

FIGURE 17 DISTRICT HEATING & COOLING SEGMENT CAPTURED LARGEST SHARE OF MARKET IN 2019

4.5 MARKET, BY END USER

FIGURE 18 UTILITIES SEGMENT COMMANDED LARGEST SHARE OF MARKET IN 2019

4.6 MARKET, BY REGION

FIGURE 19 MARKET IN AMERICAS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.7 MARKET IN AMERICAS, BY END USER & COUNTRY

FIGURE 20 UTILITIES SEGMENT AND US DOMINATED MARKET IN AMERICAS IN 2019

5 MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

5.2 YC SHIFT

5.3 COVID-19 HEALTH ASSESSMENT

FIGURE 21 COVID-19: GLOBAL PROPAGATION

FIGURE 22 COVID-19 PROPAGATION IN SELECT COUNTRIES

5.4 ROAD TO RECOVERY

FIGURE 23 RECOVERY ROAD FOR 2020

5.5 COVID-19 ECONOMIC ASSESSMENT

FIGURE 24 REVISED GDP FORECAST FOR SELECT G20 COUNTRIES IN 2020

5.6 MARKET DYNAMICS

FIGURE 25 THERMAL ENERGY STORAGE MARKET: MARKET DYNAMICS

5.6.1 DRIVERS

5.6.1.1 Demand for energy storage for supplementing ever-increasing solar energy generation

FIGURE 26 CHANGE IN RENEWABLE ENERGY GENERATION, BY SOURCE, 2017 VS 2018

TABLE 3 CSP TOWER PROJECTS WITH STORAGE IN 2017

5.6.1.2 Increasing HVAC applications fueling demand for thermal energy storage

5.6.1.3 Promotion of TES by governments and other regulatory authorities

5.6.2 RESTRAINTS

5.6.2.1 High grid connection barriers related to thermal energy storage

5.6.2.2 Competition from battery storage and pumped-storage technologies

TABLE 4 COST COMPARISON OF VARIOUS STORAGE TECHNOLOGIES

5.6.3 OPPORTUNITIES

5.6.3.1 Decentralization of renewable energy sector

5.6.3.2 Increasing use of molten salts for CSP plants

5.6.4 CHALLENGES

5.6.4.1 High initial costs, along with changing costs by technology

5.7 VALUE CHAIN ANALYSIS

FIGURE 27 THERMAL ENERGY STORAGE: VALUE CHAIN

5.7.1 PROJECT DEVELOPMENT

5.7.2 PROCUREMENT OF MATERIALS

5.7.3 PROCUREMENT OF COMPONENTS

5.7.4 PLANT ENGINEERING & CONSTRUCTION

5.7.5 OPERATION

5.7.6 DISTRIBUTION

5.8 AVERAGE SELLING PRICE

TABLE 5 THERMAL ENERGY STORAGE UNIT CAPITAL COST, BY TECHNOLOGY (USD/KWH)

5.9 MARKET INTERCONNECTION

5.10 CASE STUDY ANALYSIS

5.10.1 CRESCENT DUNES USES MOLTEN SALT STORAGE FOR SOLAR POWER TOWER CSP 74

TABLE 6 CRESCENT DUNES PROJECT STATISTICS

5.10.2 SUPCON DELINGHA 50MW MOLTEN SALT TOWER CSP USES SOLAR POWER TOWER CSP FOR UTILITIES

TABLE 7 SUPCON DELINGHA PROJECT STATISTICS

6 IMPACT OF COVID-19 ON THERMAL ENERGY STORAGE MARKET, SCENARIO ANALYSIS, BY REGION (Page No. - 76)

6.1 INTRODUCTION

6.1.1 IMPACT OF COVID-19 ON GDP

TABLE 8 GDP ANALYSIS (%)

6.1.2 SCENARIO ANALYSIS OF GLOBAL POWER SECTOR

FIGURE 28 ANNUAL AVERAGE GROWTH RATE OF ELECTRICITY DEMAND, 2017–2020

6.1.3 OPTIMISTIC SCENARIO

TABLE 9 OPTIMISTIC SCENARIO: MARKET, BY REGION, 2018–2025 (USD THOUSAND)

6.1.4 REALISTIC SCENARIO

TABLE 10 REALISTIC SCENARIO: MARKET, BY REGION, 2018–2025 (USD THOUSAND)

6.1.5 PESSIMISTIC SCENARIO

TABLE 11 PESSIMISTIC SCENARIO: MARKET, BY REGION, 2018–2025 (USD THOUSAND)

7 THERMAL ENERGY STORAGE MARKET, BY TECHNOLOGY (Page No. - 80)

7.1 INTRODUCTION

TABLE 12 TECHNOLOGY COMPARISON

FIGURE 29 SENSIBLE HEAT SEGMENT IS EXPECTED TO CONTINUE TO ACCOUNT FOR LARGEST SIZE OF MARKET DURING FORECAST PERIOD

TABLE 13 MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD THOUSAND)

7.2 SENSIBLE HEAT STORAGE TECHNOLOGY

7.2.1 HIGH DEMAND FOR MOLTEN SALTS FOR THERMAL ENERGY STORAGE IS DRIVING SENSIBLE HEAT STORAGE TECHNOLOGY DEMAND

TABLE 14 LIST OF STORAGE MATERIALS FOR SENSIBLE HEAT STORAGE

TABLE 15 SENSIBLE HEAT STORAGE: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

7.3 LATENT HEAT STORAGE TECHNOLOGY

7.3.1 DEVELOPMENT OF PHASE CHANGE MATERIALS IS LIKELY TO DRIVE MARKET

TABLE 16 LIST OF STORAGE MATERIALS FOR LATENT HEAT STORAGE

TABLE 17 LATENT HEAT STORAGE: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

7.4 THERMOCHEMICAL STORAGE TECHNOLOGY

7.4.1 US OFFERS HIGH POTENTIAL FOR GROWTH OF THERMOCHEMICAL STORAGE TECHNOLOGY

TABLE 18 THERMOCHEMICAL STORAGE: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

8 THERMAL ENERGY STORAGE MARKET, BY STORAGE MATERIAL (Page No. - 87)

8.1 INTRODUCTION

FIGURE 30 MOLTEN SALTS SEGMENT IS EXPECTED TO CONTINUE TO ACCOUNT FOR LARGEST SIZE OF MARKET DURING 2020–2025

TABLE 19 MARKET SIZE, BY STORAGE MATERIAL, 2018–2025 (USD THOUSAND)

8.2 WATER

8.2.1 WATER-BASED THERMAL ENERGY STORAGE SYSTEMS REQUIRE LOW INVESTMENT

TABLE 20 WATER: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

8.3 MOLTEN SALT

8.3.1 LITHIUM SALTS

8.3.1.1 Good thermophysical properties and low costs of lithium salts make them more demandable for CSP thermal plants

8.3.2 POTASSIUM SALTS

8.3.2.1 Binary and ternary salts, including potassium nitrate, make good storage materials for thermal energy storage

TABLE 21 MOLTEN SALT: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

8.4 PHASE CHANGE MATERIALS (PCM)

8.4.1 PCMS ENABLE TARGET-ORIENTED DISCHARGING TEMPERATURES

TABLE 22 PHASE CHANGE MATERIALS: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

8.5 OTHERS

TABLE 23 OTHERS: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

9 THERMAL ENERGY STORAGE MARKET, BY APPLICATION (Page No. - 93)

9.1 INTRODUCTION

FIGURE 31 DISTRICT HEATING & COOLING SEGMENT IS EXPECTED TO CONTINUE TO ACCOUNT FOR LARGEST SIZE OF MARKET DURING 2020–2025

TABLE 24 MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

9.2 POWER GENERATION

9.2.1 UPCOMING CSP PROJECTS TO DRIVE POWER GENERATION APPLICATION OF THERMAL ENERGY STORAGE

TABLE 25 POWER GENERATION: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

9.3 DISTRICT HEATING & COOLING

9.3.1 EVOLVING SMART CITY CONCEPT AND HVAC APPLICATIONS IN MIDDLE EAST AND EUROPEAN COUNTRIES IS DRIVING MARKET GROWTH

TABLE 26 DISTRICT HEATING & COOLING: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

9.4 PROCESS HEATING & COOLING

9.4.1 INCREASING DEMAND FOR THERMAL ENERGY STORAGE TO PROVIDE HEATING AND COOLING SOLUTIONS FOR ENERGY-INTENSIVE INDUSTRIES IS FUELING MARKET GROWTH

TABLE 27 PROCESS HEATING & COOLING: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

10 THERMAL ENERGY STORAGE MARKET, BY END USER (Page No. - 98)

10.1 INTRODUCTION

FIGURE 32 UTILITIES SEGMENT IS EXPECTED TO CONTINUE TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 28 MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

10.2 UTILITIES

10.2.1 INCREASING FOCUS ON POWER LOAD MANAGEMENT DURING PEAK HOURS IS DRIVING DEMAND FROM UTILITIES

TABLE 29 UTILITIES: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

10.3 COMMERCIAL

10.3.1 THERMAL ENERGY STORAGE SYSTEMS ARE USED FOR HVAC APPLICATIONS IN COMMERCIAL SECTOR

TABLE 30 COMMERCIAL: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

10.4 INDUSTRIAL

10.4.1 HIGH VOLUMES OF WASTE HEAT GENERATED IN INDUSTRIES IS ENCOURAGING USE OF TES SYSTEMS FOR PROCESS HEATING & COOLING APPLICATIONS

TABLE 31 INDUSTRIAL: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

11 THERMAL ENERGY STORAGE MARKET, BY REGION (Page No. - 103)

11.1 INTRODUCTION

FIGURE 33 REGIONAL SNAPSHOT: MARKET IN AMERICAS IS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 34 MARKET SHARE (VALUE), BY REGION, 2020 & 2025

TABLE 32 MARKET, CAPACITY, BY REGION, 2018–2025 (MWH)

TABLE 33 MARKET, BY REGION, 2018–2025 (USD THOUSAND)

11.2 EUROPE

11.2.1 IMPACT OF COVID-19 ON MARKET IN EUROPE

FIGURE 35 REGIONAL SNAPSHOT: EUROPE

11.2.2 EUROPE: MARKET, SCENARIO ANALYSIS, 2018–2025

TABLE 34 EUROPE: MARKET, SCENARIO ANALYSIS, 2018–2025 (USD THOUSAND)

11.2.3 BY TECHNOLOGY

TABLE 35 EUROPE: MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD THOUSAND)

11.2.3.1 Sensible heat storage technology, by country

TABLE 36 SENSIBLE HEAT STORAGE: EUROPE MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

11.2.3.2 Latent heat storage technology, by country

TABLE 37 LATENT HEAT STORAGE: EUROPE MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

11.2.3.3 Thermochemical storage, by country

TABLE 38 THERMOCHEMICAL STORAGE: EUROPE MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

11.2.4 BY STORAGE MATERIAL

TABLE 39 EUROPE: MARKET SIZE, BY STORAGE MATERIAL, 2018–2025 (USD THOUSAND)

11.2.5 BY APPLICATION

TABLE 40 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

11.2.6 BY END USER

TABLE 41 EUROPE: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

11.2.6.1 Utilities, by country

TABLE 42 UTILITIES: EUROPE MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

11.2.6.2 Commercial, by country

TABLE 43 COMMERCIAL: EUROPE MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

11.2.6.3 Industrial, by country

TABLE 44 INDUSTRIAL: EUROPE MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

11.2.7 BY COUNTRY

TABLE 45 EUROPE MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

11.2.7.1 Spain

11.2.7.1.1 High demand from utilities for low-cost CSP plus storage solutions is driving market

TABLE 46 SPAIN MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD THOUSAND)

TABLE 47 SPAIN MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

11.2.7.2 France

11.2.7.2.1 High demand for thermal energy storage for heating & cooling applications drives market in France

TABLE 48 FRANCE MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD THOUSAND)

TABLE 49 FRANCE MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

11.2.7.3 Germany

11.2.7.3.1 Government initiatives to increase share of renewables in power generation mix will drive market in Germany

TABLE 50 GERMANY MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD THOUSAND)

TABLE 51 GERMANY MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

11.2.7.4 UK

11.2.7.4.1 High focus on decarbonization of heat is driving market growth in UK

TABLE 52 UK MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD THOUSAND)

TABLE 53 UK MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

11.2.7.5 Italy

11.2.7.5.1 Increased demand for molten salts and demand for energy storage in Italy is fueling market growth

TABLE 54 ITALY MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD THOUSAND)

TABLE 55 ITALY MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

11.2.7.6 Rest of Europe

TABLE 56 REST OF EUROPE MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD THOUSAND)

TABLE 57 REST OF EUROPE MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

11.3 AMERICAS

FIGURE 36 REGIONAL SNAPSHOT: AMERICAS

11.3.1 IMPACT OF COVID-19 ON THERMAL ENERGY STORAGE MARKET IN AMERICAS

11.3.2 AMERICAS: MARKET, SCENARIO ANALYSIS, 2018–2025

TABLE 58 AMERICAS: MARKET, SCENARIO ANALYSIS, 2018–2025 (USD THOUSAND)

11.3.3 BY TECHNOLOGY

TABLE 59 AMERICAS: MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD THOUSAND)

11.3.3.1 Sensible heat storage technology, by country

TABLE 60 SENSIBLE HEAT STORAGE: AMERICAS MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

11.3.3.2 Latent heat storage technology, by country

TABLE 61 LATENT HEAT STORAGE: AMERICAS MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

11.3.3.3 Thermochemical storage, by country

TABLE 62 THERMOCHEMICAL STORAGE: AMERICAS MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

11.3.4 BY STORAGE MATERIAL

TABLE 63 AMERICAS: MARKET SIZE, BY STORAGE MATERIAL, 2018–2025 (USD THOUSAND)

11.3.5 BY APPLICATION

TABLE 64 AMERICAS: MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

11.3.6 BY END USER

TABLE 65 AMERICAS: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

11.3.6.1 Utilities, by country

TABLE 66 UTILITIES: AMERICAS MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

11.3.6.2 Commercial, by country

TABLE 67 COMMERCIAL: AMERICAS MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

11.3.6.3 Industrial, by country

TABLE 68 INDUSTRIAL: AMERICAS MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

11.3.7 BY COUNTRY

TABLE 69 AMERICAS: MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

11.3.7.1 US

11.3.7.1.1 High investments in solar thermal storage and planned CSP power generation is likely to drive market in the US

TABLE 70 US MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD THOUSAND)

TABLE 71 US MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

11.3.7.2 Canada

11.3.7.2.1 Steadily integration of solar power in overall generation mix is likely to bring opportunities for thermal energy storage market in Canada

TABLE 72 CANADA MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD THOUSAND)

TABLE 73 CANADA MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

11.3.7.3 Chile

11.3.7.3.1 Potential to supply molten salts fostering thermal energy storage market growth in Chile

TABLE 74 CHILE MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD THOUSAND)

TABLE 75 CHILE MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

11.3.7.4 Rest of Americas

TABLE 76 REST OF AMERICAS MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD THOUSAND)

TABLE 77 REST OF AMERICAS MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

11.4 MIDDLE EAST & AFRICA

11.4.1 IMPACT OF COVID-19 ON MIDDLE EAST & AFRICA MARKET

11.4.2 MIDDLE EAST & AFRICA: MARKET, SCENARIO ANALYSIS, 2018–2025

TABLE 78 MIDDLE EAST & AFRICA: MARKET, SCENARIO ANALYSIS, 2018–2025 (USD THOUSAND)

11.4.3 BY TECHNOLOGY

TABLE 79 MIDDLE EAST & AFRICA: THERMAL ENERGY STORAGE MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD THOUSAND)

11.4.3.1 Sensible heat storage technology, by country

TABLE 80 SENSIBLE HEAT STORAGE: MIDDLE EAST & AFRICA MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

11.4.3.2 Latent heat storage technology, by country

TABLE 81 LATENT HEAT STORAGE: MIDDLE EAST & AFRICA MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

11.4.3.3 Thermochemical storage, by country

TABLE 82 THERMOCHEMICAL STORAGE: MIDDLE EAST & AFRICA MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

11.4.4 BY STORAGE MATERIAL

TABLE 83 MIDDLE EAST & AFRICA: MARKET SIZE, BY STORAGE MATERIAL, 2018–2025 (USD THOUSAND)

11.4.5 BY APPLICATION

TABLE 84 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

11.4.6 BY END USER

TABLE 85 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

11.4.6.1 Utilities, by country

TABLE 86 UTILITIES: MIDDLE EAST & AFRICA MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

11.4.6.2 Commercial, by country

TABLE 87 COMMERCIAL: MIDDLE EAST & AFRICA MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

11.4.6.3 Industrial, by country

TABLE 88 INDUSTRIAL: MIDDLE EAST & AFRICA MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

11.4.7 BY COUNTRY

TABLE 89 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

11.4.7.1 South Africa

11.4.7.1.1 Escalating power demand from mining sector to drive thermal energy storage market growth

TABLE 90 SOUTH AFRICA MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD THOUSAND)

TABLE 91 SOUTH AFRICA MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

11.4.7.2 UAE

11.4.7.2.1 Availability of inexpensive thermal storage materials, such as sand, to favor thermal energy storage capacity additions

TABLE 92 UAE MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD THOUSAND)

TABLE 93 UAE MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

11.4.7.3 Morocco

11.4.7.3.1 Growing number of CSP projects and supportive legislation to drive market in Morocco

TABLE 94 MOROCCO MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD THOUSAND)

TABLE 95 MOROCCO MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

11.4.7.4 Rest of Middle East & Africa

TABLE 96 REST OF MIDDLE EAST & AFRICA MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD THOUSAND)

TABLE 97 REST OF MIDDLE EAST & AFRICA MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

11.5 ASIA PACIFIC

11.5.1 IMPACT OF COVID-19 ON MARKET IN ASIA PACIFIC 138

11.5.2 ASIA PACIFIC: MARKET, SCENARIO ANALYSIS, 2018–2025

TABLE 98 ASIA PACIFIC: MARKET, SCENARIO ANALYSIS, 2018–2025 (USD THOUSAND)

11.5.3 BY TECHNOLOGY

TABLE 99 ASIA PACIFIC: MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD THOUSAND)

11.5.3.1 Sensible heat storage technology, by country

TABLE 100 SENSIBLE HEAT STORAGE: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

11.5.3.2 Latent heat storage technology, by country

TABLE 101 LATENT HEAT STORAGE: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

11.5.3.3 Thermochemical storage, by country

TABLE 102 THERMOCHEMICAL STORAGE: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

11.5.4 BY STORAGE MATERIAL

TABLE 103 ASIA PACIFIC: MARKET SIZE, BY STORAGE MATERIAL, 2018–2025 (USD THOUSAND)

11.5.5 BY APPLICATION

TABLE 104 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

11.5.6 BY END USER

TABLE 105 ASIA PACIFIC: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

11.5.6.1 Utilities, by country

TABLE 106 UTILITIES: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

11.5.6.2 Commercial, by country

TABLE 107 COMMERCIAL: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

11.5.6.3 Industrial, by country

TABLE 108 INDUSTRIAL: ASIA THERMAL PACIFIC ENERGY STORAGE MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

11.5.7 BY COUNTRY

TABLE 109 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

11.5.7.1 China

11.5.7.1.1 Increasing focus on CSP for hedging carbon emissions and meeting peak hours demand is driving thermal energy storage market in China

TABLE 110 CHINA MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD THOUSAND)

TABLE 111 CHINA MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

11.5.7.2 India

11.5.7.2.1 Focus on renewable energy generation capacity additions will support thermal energy storage technologies in India

TABLE 112 INDIA MARKET, BY TECHNOLOGY, 2018–2025 (USD THOUSAND)

TABLE 113 INDIA THERMAL ENERGY STORAGE MARKET, BY END USER, 2018–2025 (USD THOUSAND)

11.5.7.3 Australia

11.5.7.3.1 Initiation of ARENA-funded thermal energy storage projects is fostering market growth in Australia

TABLE 114 AUSTRALIA MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD THOUSAND)

TABLE 115 AUSTRALIA MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

11.5.7.4 Rest of Asia Pacific

TABLE 116 REST OF ASIA PACIFIC MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD THOUSAND)

TABLE 117 REST OF ASIA PACIFIC MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

12 COMPETITIVE LANDSCAPE (Page No. - 148)

12.1 OVERVIEW

FIGURE 37 KEY DEVELOPMENTS IN GLOBAL THERMAL ENERGY STORAGE MARKET, 2017–AUGUST 2020

12.2 MARKET EVALUATION FRAMEWORK

FIGURE 38 MARKET EVALUATION FRAMEWORK: CONTRACTS & AGREEMENTS HAVE FUELED GROWTH OF COMPANIES FROM 2017 TO 2020

12.3 INDUSTRY CONCENTRATION, 2019

FIGURE 39 INDUSTRY CONCENTRATION, 2019

12.3.1 CONTRACTS & AGREEMENTS

12.3.2 INVESTMENTS & EXPANSION

12.4 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

12.4.1 STARS

12.4.2 EMERGING LEADERS

12.4.3 PERVASIVE

12.4.4 EMERGING COMPANIES

12.5 COMPANY EVALUATION MATRIX, 2019

FIGURE 40 THERMAL ENERGY STORAGE MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

12.6 WINNERS VS. TAIL-ENDERS

12.6.1 WINNERS

12.6.2 TAIL ENDERS

13 COMPANY PROFILE (Page No. - 153)

(Business overview, Products/solutions/services offered, Recent Developments,SWOT Analysis, MNM view)*

13.1 ABENGOA

FIGURE 41 ABENGOA: COMPANY SNAPSHOT

13.2 MAN ENERGY SOLUTIONS

13.3 BRIGHTSOURCE ENERGY

13.4 BALTIMORE AIRCOIL COMPANY

13.5 SOLARRESERVE

13.6 CALDWELL ENERGY

13.7 BURNS & MCDONNELL

13.8 CRISTOPIA ENERGY

13.9 CRYOGEL THERMAL ENERGY STORAGE

13.10 DUNHAM BUSH

13.11 STEFFES CORPORATION

13.12 TURBINE AIR SYSTEMS (TAS)

13.13 EVAPCO

13.14 CALMAC

13.15 CB&I (MCDERMOTT)

13.16 LIME

13.17 VOGTICE

13.18 SUNWELL TECHNOLOGIES

13.19 DC PRO ENGINEERING

13.20 FAFCO

*Details on Business overview, Products/solutions/services offered, Recent Developments,SWOT Analysis, MNM view might not be captured in case of unlisted companies.

14 ADJACENT & RELATED MARKETS (Page No. - 175)

14.1 INTRODUCTION

14.2 LIMITATIONS

14.3 ENERGY STORAGE INTERCONNECTED MARKETS

14.4 CONCENTRATING SOLAR POWER (CSP) MARKET

14.4.1 MARKET DEFINITION

14.4.2 LIMITATIONS

14.4.3 MARKET OVERVIEW

14.4.4 CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY

TABLE 118 CONCENTRATING SOLAR POWER MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

14.4.4.1 Solar power towers

TABLE 119 SOLAR POWER TOWERS: CONCENTRATING SOLAR POWER MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

14.4.4.2 Linear concentrating systems

TABLE 120 LINEAR CONCENTRATING SYSTEMS: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2018–2025 (USD MILLION)

14.4.4.3 Stirling dish technology

TABLE 121 STIRLING DISH TECHNOLOGY: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2018–2025 (USD MILLION)

14.4.5 CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE

TABLE 122 CONCENTRATING SOLAR POWER MARKET, BY OPERATION TYPE, 2018–2025 (USD MILLION)

14.4.5.1 Stand-alone systems

TABLE 123 STAND-ALONE SYSTEMS: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2018–2025 (USD MILLION)

14.4.5.2 With storage

TABLE 124 WITH STORAGE: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2018–2025 (USD MILLION)

14.4.6 CONCENTRATING SOLAR POWER MARKET, BY CAPACITY

TABLE 125 CONCENTRATING SOLAR POWER MARKET, BY CAPACITY, 2018–2025 (USD MILLION)

14.4.6.1 Less than 50 MW

TABLE 126 LESS THAN 50 MW: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2018–2025 (USD MILLION)

14.4.6.2 50 MW to 99 MW

TABLE 127 50 MW TO 99 MW: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2018–2025 (USD MILLION)

14.4.6.3 100 MW and Above

TABLE 128 100 MW AND ABOVE: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2018–2025 (USD MILLION)

14.4.7 CONCENTRATING SOLAR POWER MARKET, BY END USER

TABLE 129 CONCENTRATING SOLAR POWER MARKET, BY END USER, 2018–2025 (USD MILLION)

14.4.7.1 Utilities

TABLE 130 UTILITIES: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2018–2025 (USD MILLION)

14.4.7.2 EOR

TABLE 131 EOR: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2018–2025 (USD MILLION)

14.4.7.3 Others

TABLE 132 OTHERS: CONCENTRATING SOLAR POWER MARKET, BY REGION, 2018–2025 (USD MILLION)

14.4.8 CONCENTRATING SOLAR POWER MARKET, BY REGION

TABLE 133 GLOBAL CONCENTRATING SOLAR POWER MARKET, CAPACITY, BY REGION, 2018–2025 (IN MW)

TABLE 134 GLOBAL CONCENTRATING SOLAR POWER MARKET, BY REGION, 2018–2025 (USD MILLION)

14.5 RESIDENTIAL ENERGY STORAGE MARKET

14.5.1 MARKET DEFINITION

14.5.2 LIMITATIONS

14.5.3 MARKET OVERVIEW

14.5.4 RESIDENTIAL ENERGY STORAGE MARKET, BY POWER RATING

TABLE 135 RESIDENTIAL ENERGY STORAGE MARKET SIZE, BY POWER RATING, 2017–2024 (USD MILLION)

14.5.4.1 3–6 kW

TABLE 136 3–6 KW: RESIDENTIAL ENERGY STORAGE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

14.5.4.2 6–10 kW

TABLE 137 6–10 KW: RESIDENTIAL ENERGY STORAGE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

14.5.5 RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY

TABLE 138 RESIDENTIAL ENERGY STORAGE MARKET SIZE, BY TECHNOLOGY, 2017–2024 (USD MILLION)

14.5.5.1 Lithium-ion

TABLE 139 LITHIUM-ION: GLOBAL RESIDENTIAL ENERGY STORAGE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

14.5.5.2 Lead–acid

TABLE 140 LEAD–ACID: RESIDENTIAL ENERGY STORAGE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

14.5.6 RESIDENTIAL ENERGY STORAGE MARKET, BY OWNERSHIP TYPE

TABLE 141 RESIDENTIAL ENERGY STORAGE MARKET SIZE, BY OWNERSHIP TYPE, 2017–2024 (USD MILLION)

14.5.6.1 Customer owned

TABLE 142 CUSTOMER OWNED: RESIDENTIAL ENERGY STORAGE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

14.5.6.2 Utility owned

TABLE 143 UTILITY OWNED: RESIDENTIAL ENRGY STORAGE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

14.5.6.3 Third-party owned

TABLE 144 THIRD-PARTY OWNED: RESIDENTIAL ENERGY STORAGE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

14.5.7 RESIDENTIAL ENERGY STORAGE MARKET, BY OPERATION TYPE

TABLE 145 RESIDENTIAL ENERGY STORAGE MARKET SIZE, BY OPERATION TYPE, 2017–2024 (USD MILLION)

14.5.7.1 Standalone systems

TABLE 146 STANDALONE SYSTEMS: GLOBAL RESIDENTIAL ENERGY STORAGE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

14.5.7.2 Solar and storage

TABLE 147 SOLAR AND STORAGE: RESIDENTIAL ENERGY STORAGE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

14.5.8 RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY TYPE

TABLE 148 RESIDENTIAL ENERGY STORAGE MARKET SIZE, BY CONNECTIVITY TYPE, 2017–2024 (USD MILLION)

14.5.8.1 On-grid

TABLE 149 ON-GRID: GLOBAL RESIDENTIAL ENERGY STORAGE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

14.5.8.2 Off-grid

TABLE 150 OFF-GRID: RESIDENTIAL ENERGY STORAGE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

14.5.9 RESIDENTIAL ENERGY STORAGE MARKET, BY REGION

TABLE 151 RESIDENTIAL ENERGY STORAGE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

14.6 DISTRIBUTED ENERGY RESOURCE MANAGEMENT SYSTEM (DERMS) MARKET

14.6.1 MARKET DEFINITION

14.6.2 LIMITATIONS

14.6.3 MARKET OVERVIEW

14.6.4 DISTRIBUTED ENERGY RESOURCE MANAGEMENT SYSTEM (DERMS) MARKET, BY TECHNOLOGY

TABLE 152 DISTRIBUTED ENERGY RESOURCE MANAGEMENT SYSTEM MARKET SIZE, BY TECHNOLOGY, 2015–2022 (USD MILLION)

14.6.4.1 Solar PV

TABLE 153 SOLAR PV: DISTRIBUTED ENERGY RESOURCE MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

14.6.4.2 Wind

TABLE 154 WIND: DISTRIBUTED ENERGY RESOURCE MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

14.6.4.3 Energy Storage

TABLE 155 ENERGY STORAGE: DISTRIBUTED ENERGY RESOURCE MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

14.6.4.4 Combined Heat & Power (CHP)

TABLE 156 COMBINED HEAT & POWER: DISTRIBUTED ENERGY RESOURCE MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

14.6.4.5 Others

TABLE 157 OTHERS: DISTRIBUTED ENERGY RESOURCE MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

14.6.5 DISTRIBUTED ENERGY RESOURCE MANAGEMENT SYSTEM (DERMS) MARKET, BY SOFTWARE

TABLE 158 DISTRIBUTED ENERGY RESOURCE MANAGEMENT SYSTEM MARKET SIZE, BY SOFTWARE, 2015–2022 (USD MILLION)

14.6.5.1 Analytics

TABLE 159 ANALYTICS: DISTRIBUTED ENERGY RESOURCE MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

14.6.5.2 Management & Control

TABLE 160 MANAGEMENT & CONTROL: DISTRIBUTED ENERGY RESOURCE MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

14.6.5.3 Virtual Power Plants

TABLE 161 VIRTUAL POWER PLANTS: DISTRIBUTED ENERGY RESOURCE MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

14.6.6 DISTRIBUTED ENERGY RESOURCE MANAGEMENT SYSTEM (DERMS) MARKET, BY END-USER

TABLE 162 DISTRIBUTED ENERGY RESOURCE MANAGEMENT SYSTEM MARKET SIZE, BY END-USER INDUSTRY, 2015–2022 (USD MILLION)

14.6.6.1 Industrial

TABLE 163 INDUSTRIAL: DISTRIBUTED ENERGY RESOURCE MANAGEMENT SYSTEM, MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

14.6.6.2 Government & Municipalities

TABLE 164 GOVERNMENT & MUNICIPALITIES: DISTRIBUTED ENERGY RESOURCE MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

14.6.6.3 Commercial

TABLE 165 COMMERCIAL: DISTRIBUTED ENERGY RESOURCE MANAGEMENT SYSTEM, MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

14.6.6.4 Military

TABLE 166 MILITARY: DISTRIBUTED ENERGY RESOURCE MANAGEMENT SYSTEM, MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

14.6.6.5 Residential

TABLE 167 RESIDENTIAL: DISTRIBUTED ENERGY RESOURCE MANAGEMENT SYSTEM, MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

14.6.7 DISTRIBUTED ENERGY RESOURCE MANAGEMENT SYSTEM (DERMS) MARKET, BY REGION

TABLE 168 DISTRIBUTED ENERGY RESOURCE MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

15 APPENDIX (Page No. - 211)

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

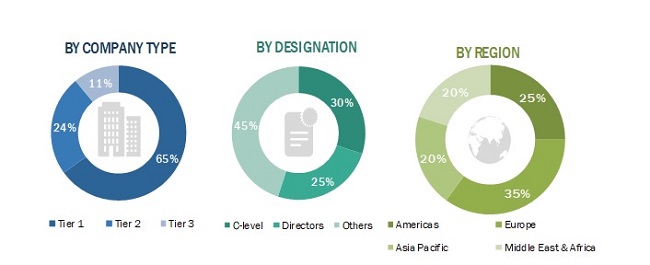

This study involved four major activities in estimating the current market size. Exhaustive secondary research was done to collect information on the market and the peer market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, World Bank, BP Statistical Review of World Energy 2020, US DOE, and IEA, to identify and collect information useful for a technical, market-oriented, and commercial study of the global thermal energy storage market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The thermal energy storage market comprises several stakeholders, such as power companies, thermal energy storage technology providers, government and research organizations, consulting companies, and power & energy associations. The demand side of this market is characterized by estimating the year-on-year installed power generation capacity and replacement of power generation capacity each year. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as following-

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global thermal energy storage market and its dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Thermal energy storage Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, segment, and forecast the global market by technology, storage material, application, end user, and region, in terms of value

- To provide critical analysis of the drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the market

- To provide a detailed overview of the thermal energy storage value chain

- To strategically analyze the global market with respect to individual growth trends, future expansions, and contribution of each segment to the market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape of the market

- To forecast the growth of the global market in key regions, namely, Americas, Europe, Asia Pacific, and Middle East & Africa

- To profile and rank key players and comprehensively analyze their market shares

- To analyze competitive developments in the market, such as product launches, investments & expansions, contracts & agreements, expansions & investments, mergers & acquisitions, joint ventures, and partnerships & collaborations

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Thermal Energy Storage Market