Digital Railway Market

Digital Railway Market by Offering (Solutions (Remote Monitoring, Network Management, Security, Analytics) and Services), Application (Rail Operations Management, Passenger Information System, and Asset Management) and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

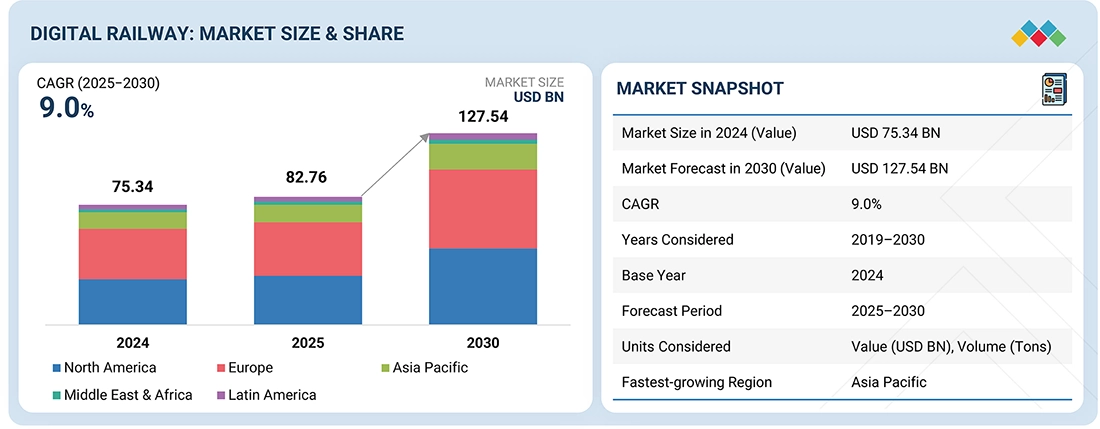

The digital railway market is projected to reach USD 82.76 billion in 2025 and is expected to grow to USD 127.54 billion by 2030, with a CAGR of 9.0% during the forecast period. The rising number of passengers is a key driver of global demand for digital railway solutions. As urban populations grow and awareness of carbon footprints increases, rail transport is seen as an efficient and sustainable option. Railway operators will need to expand capacity to accommodate this increasing demand while also enhancing safety and user experience. This surge in demand has accelerated the adoption of digital services such as signaling solutions, AI-driven passenger information via mobile apps, automated ticketing, and smart scheduling platforms. These digital services aim to manage the growing number of passengers more effectively by reducing delays and improving reliability. They also provide better experiences through real-time updates, ensuring greater convenience and higher customer satisfaction.

KEY TAKEAWAYS

- The Europe digital railway market accounted for a 32.9% revenue share in 2025.

- By solution, the predictive maintenance segment is expected to register the highest CAGR of 12.3%.

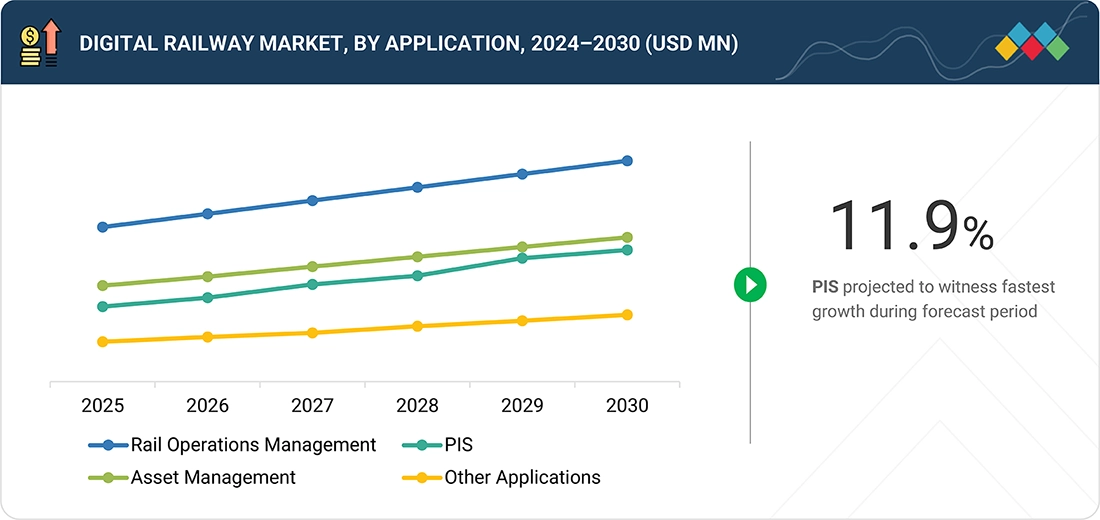

- By application, the passenger information system segment is projected to grow at the fastest rate from 2025 to 2030.

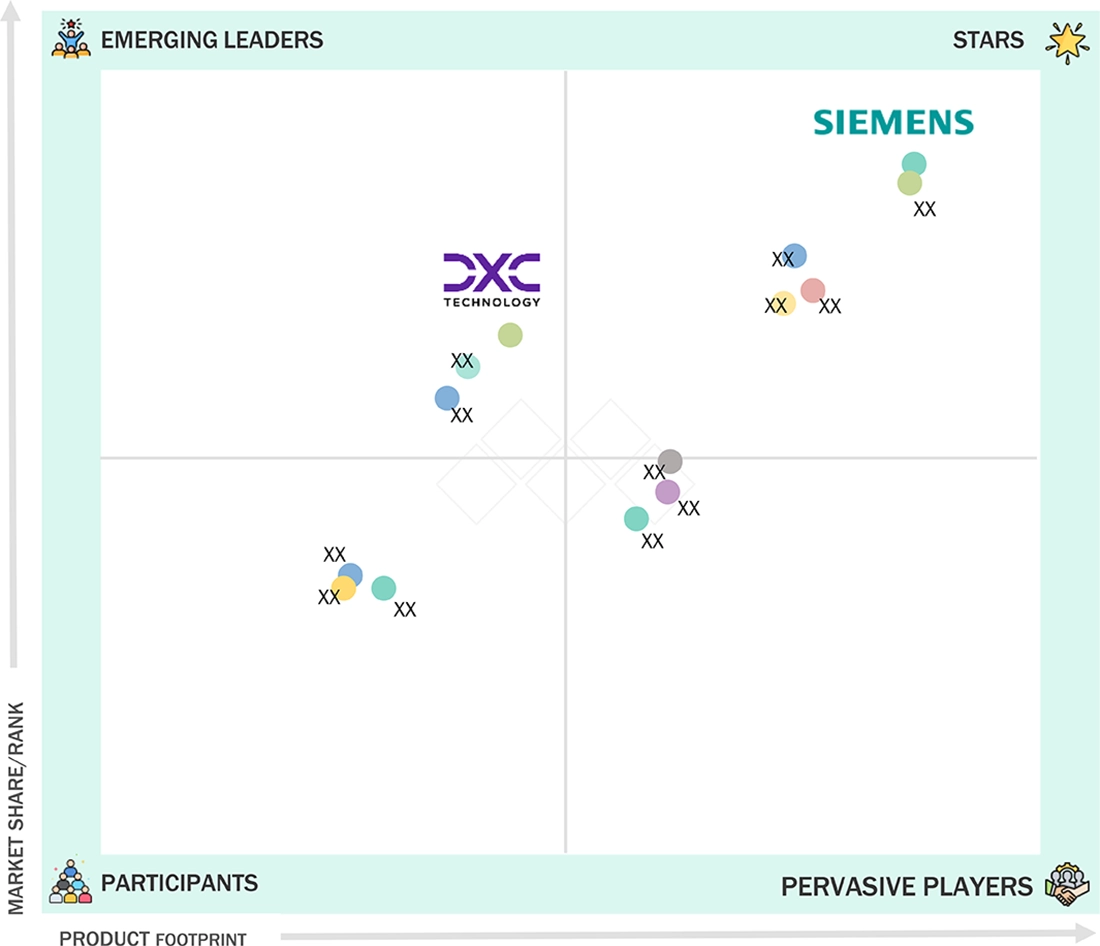

- Company Siemens, Cisco, and Alstom were identified as some of the star players in the digital railway market (global), given their strong market share and product footprint.

- Companies RailTel, r2p, and Uptake among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The demand for advanced transportation systems, commuters' mobility, and general transportation services, such as urban freight and personal mobility, continues to grow due to various geopolitical, economic, and environmental factors. Urbanization, global population increases, climate change, efforts to reduce environmental impacts from personal vehicle use, and the need for mobility exert significant pressure on modern cities and economies. With increasing concerns about sustainability and urban growth, along with heightened scrutiny on transportation emissions, digital railways are emerging as a vital component of future-ready mobility ecosystems with strong policy support. Digital railways can foster energy-efficient travel by integrating systems and technologies such as automated train operation, eco-driving technologies, and other energy-saving measures to reduce fuel emissions.

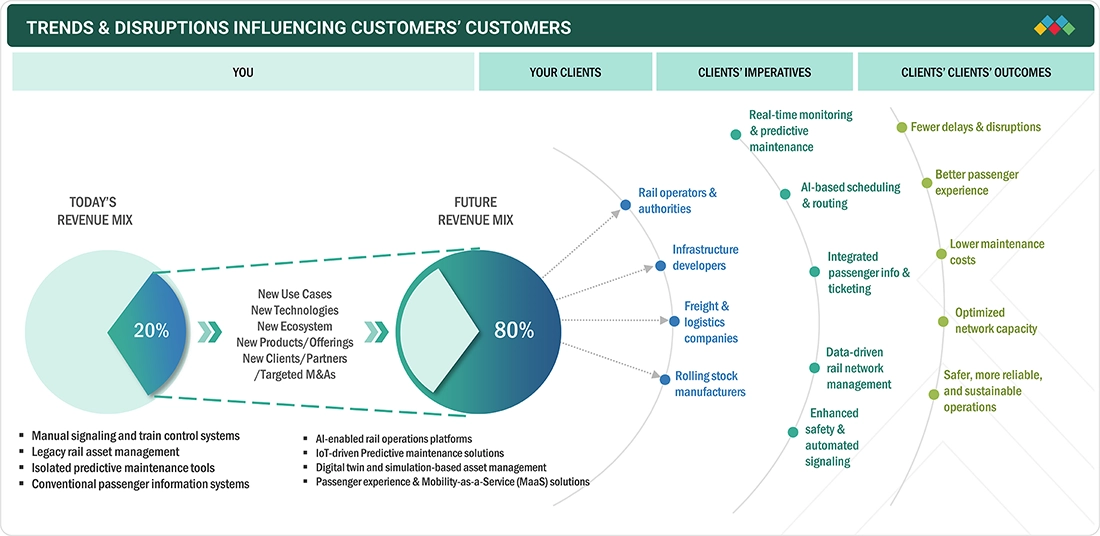

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The digital railway industry is moving away from traditional revenue sources like ticket sales and maintenance toward new opportunities such as AI-powered insights, IoT-based predictive maintenance, smart signaling, and digital twins. This transition helps operators and authorities meet goals related to efficiency, safety, and sustainability, leading to better passenger experiences, less downtime, improved logistics, and more environmentally friendly rail operations.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Advancements in communication technology

-

Surge in passenger numbers over the past few years

Level

-

High initial cost of deployment

-

Lack of strong railway infrastructure in underdeveloped countries

Level

-

Autonomous trains to offer significant opportunity for digital railway solution providers

-

Rising need for advanced transportation infrastructure

Level

-

Increased threat of cyberattacks as railway systems become digital

-

Lack of IT infrastructure and skilled personnel

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Advancements in communication technology

Advancements in communication technology greatly enhance the growth of the digital railway market. The successful implementation of railway projects depends on various technological aspects, including data communications, tracking, mobility, and sensors. Recent rapid developments in these areas have improved object connectivity, leading to the creation of smarter ecosystems. New communication technologies facilitate faster, safer, and more reliable information exchanges between trains, signaling systems, control centers, and passengers' devices using systems like 5G, LTE, and dedicated railway communication networks. Increased communication technology supports smart services such as automated ticketing, passenger information systems, remote monitoring, and rail control, resulting in a more intuitive and responsive railway experience. As the communication infrastructure continues to expand, more opportunities arise for digital railway solutions to develop further.

Restraint: High initial cost of deployment

The high initial cost of deploying smart railway technologies restricts market growth. Funding these projects can be a major obstacle for governments and private companies facing existing budget limitations in railway infrastructure. The upfront cost of installing railway management systems is significant. Expenses related to financing a railway management system project may greatly hinder market expansion. Large capital expenditure (CAPEX), combined with rising upfront installation costs, is a clear barrier to adopting railway management system technologies across various regions. The limited budgets available for railways act as a constraint on the deployment of advanced railway technologies and solutions by both governments and private sector players.

Opportunity: Autonomous trains to offer significant opportunity for digital railway solution providers

Semi-autonomous and autonomous train technologies are experiencing rapid development with significant technological progress. Autonomous trains operate with little to no human intervention. The trend toward developing driverless vehicles is evident across the transportation industry. Although large-scale adoption of autonomous trains will take time, many railway operators are expected to implement semi-autonomous trains soon. Currently, some companies offer semi-autonomous vehicle technology in cars as part of mobility-on-demand services. The deployment of autonomous vehicles is essential for the growth of the smart transportation industry, since these vehicles don’t need drivers and can reduce costs for mobility service providers.

Challenge: Increased threat of cyberattacks as railway systems become digital

A considerable amount of train and passenger data is transmitted to the operating center as train operations become more digital. Data stored on servers or in transit can become targets for cyber attackers seeking access. In March 2025, the Ukrainian state railway company, Ukrzaliznytsia, faced a major cyberattack that disrupted its digital ticketing services, taking the ticketing app offline. Consequently, large crowds gathered at Kyiv's central railway station, with many passengers lining up to buy tickets in person instead of using the digital system. Despite disruptions to digital services, train operations and schedules continued smoothly thanks to reliable backup systems. Ukrainian authorities blamed the attack on Russian cyber actors, describing it as a complex, multi-layered cyberattack. Damages from cyberattacks can be especially high in highly digitalized railway systems compared to those with fewer digital components. While the risk of cyberattacks remains significant in the railway industry, it can be mitigated through security solutions provided by various IT companies. With digital security measures in place, railway operators are expected to overcome these challenges in the coming years.

Digital Railway Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

GTR signed a contract with Siemens to acquire 150 carriages as part of a plan to replace its aging fleet of electric trains. Siemens also provides maintenance services to GTR. Siemens uses the Railigent solution to provide services for the GTR project. | The Train State Live app helps GTR in reducing train delays and shutdowns. |

|

Sydney Trains needed an advanced decision analytics solution to optimize its asset management outcomes in terms of cost, risk, and performance. The company wanted a multivariant, model-based analysis to identify the best asset management outcome. Assetic delivered the project using the established methodology of ‘Diagnose—Construct and Calibrate—Outputs’ along with its asset management solution. | The agile implementation of applications and quick feedback from customers enhance customer experience. Smart prediction doors optimize maintenance schedules. |

|

A contractual agreement was executed with Thales for the purpose of modernizing the Brescia Metro by implementing train-to-ground broadband data communication solutions. Thales will deploy an integrated CCTV encoder for the digitization of analog video signals, establish a Wi-Fi link to connect the train with the ground via onboard equipment and trackside access points, and develop a dedicated data network linking the Wi-Fi access point to the Operations Control Center. Furthermore, Thales will supply the software platform within the control center designated for video surveillance and diagnostic functions. | Assetic enabled the rail company to achieve some important high-level business objectives. Assetic’s asset management solution helped the company reach the right balance between cost, risk, and performance across its network. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

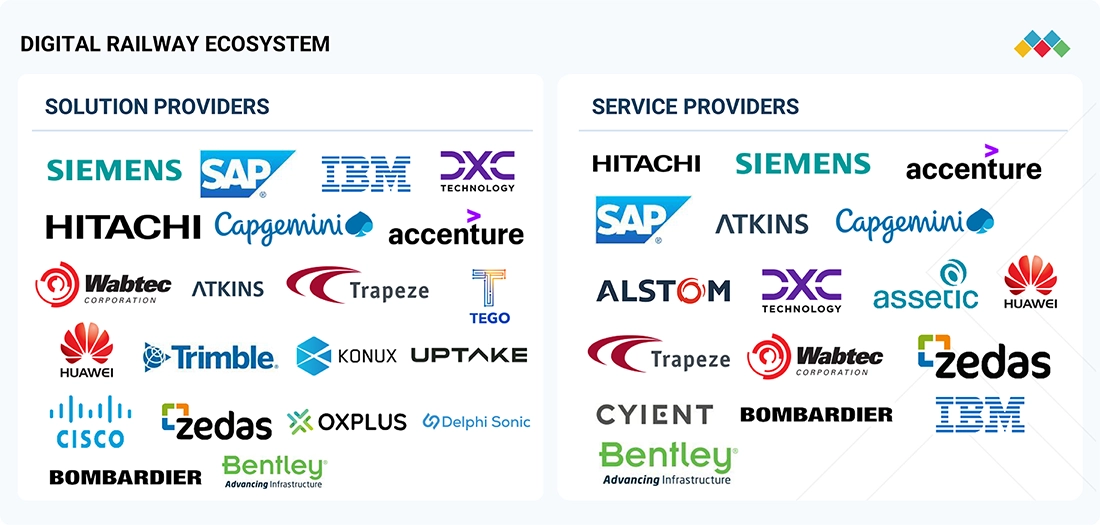

MARKET ECOSYSTEM

The digital railway market ecosystem comprises cloud service providers (e.g., Siemens, Hitachi, IBM), connectivity authorities (e.g., Nokia, Huawei), IoT technological pioneers (e.g., Bentley, Alstom), and system integrators (e.g., Atkins, Capgemini) to promote advancements in rail technology. Technology vendors such as Cisco, Honeywell, and Konux, in addition to telecommunications leaders like Vodafone and Verizon, contribute to the enhancement of infrastructure and data solutions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Digital Railway Market, By Application

Passenger information systems are expected to experience the fastest growth during the forecast period. Passenger Information Systems (PIS) play a vital role in improving the travel experience by providing timely and accurate real-time journey information. This enables passengers to stay informed and respond effectively to any disruptions. A key benefit of PIS is its future-proof design. The system offers innovative software and support services that are intended to adapt and operate reliably throughout the projected lifespan of the train. PIS delivers real-time information promptly, boosting passenger satisfaction and increasing access to public transportation. Moreover, by making public transit more accessible, PIS encourages the use of environmentally friendly mobility options, supporting the goals of smart and efficient transportation.

Digital Railways Market, By Solution

Predictive maintenance solutions are expected to witness the fastest growth during the forecast period. These techniques are designed to assess the condition of in-service equipment and estimate when maintenance should be performed. This approach offers cost savings over routine or time-based preventive maintenance because tasks are performed only when warranted. Hence, it is regarded as condition-based maintenance carried out based on estimations of the degradation state of an item. Predictive maintenance solutions are increasingly being deployed in the railway industry to enhance asset life and improve rail operations and safety. These solutions are adept at accessing multiple data sources in real-time and aid in predicting asset failure and quality issues, thereby reducing unplanned downtime and maintenance costs. By performing predictive analytics on the collected machine-specific data, predictions can be made regarding when a machine's performance may fail or fall below the desired threshold.

Digital Railways Market, By Service

The professional services segment is expected to hold the largest market size during the forecast period. Professional services involve specialized, knowledge-based offerings delivered by individuals or firms with expertise that exceeds the client’s in specific domains. Typical professional services include highly trained professionals providing expert guidance or technical capabilities in business, law, finance, engineering, IT, consulting, and more. Professional services in digital railway solutions include system integration and deployment, consulting, and support & maintenance. Deployment and integration services ensure that digital railway solutions are effectively integrated with other components of the IT system. Support and maintenance services provide ongoing customer service, technical assistance, and upgrades to optimize solution performance. Consulting services help clients identify their needs and determine the most appropriate solutions to meet their objectives.

REGION

North America is estimated to account for the largest market share during the forecast period

Asia Pacific is projected to be the fastest-growing market for digital railways due to the increasing adoption of new technologies, higher investments in digital transformation, and rising GDPs in the region. The key economies include Australia, Singapore, China, South Korea, Hong Kong, and India, all of which are rapidly investing in technological advancements. With untapped market potential, high penetration of advanced technologies, growing freight activity across various industries, ongoing economic development, and supportive government policies, the digital railway market is expected to see significant growth in the Asia Pacific during the forecast period. The United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP) is actively promoting the development and digital transformation of the Trans-Asian Railway (TAR) network. The TAR plays a crucial role in facilitating both intra- and inter-regional trade and transportation, spanning approximately 128,000 kilometers across 28 countries. In September 2023, the TAR Working Group adopted the "Strategy 2030 on Accelerating Rail Digital Transformation in Asia-Pacific” to enhance the competitiveness of rail transport.

Digital Railway Market: COMPANY EVALUATION MATRIX

In the digital railway market matrix, Siemens (Star) leads with a strong market presence providing cutting-edge automation, IoT, and analytics solutions that enhance rail efficiency, safety, and sustainability through integrated digital platforms and intelligent rail infrastructure. DXC (Emerging Leader) delivering IT modernization, data integration, and digital transformation services to help rail operators optimize operations and improve passenger experiences. While Siemens dominates with scale and ecosystem integration, DXC shows strong growth potential to advance toward the leaders’ quadrant with its expanding enterprise security portfolio.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 75.34 Billion |

| Market Forecast in 2030 (Value) | USD 127.54 Billion |

| Growth Rate | CAGR of 9.0% from 2025-2030 |

| Years Considered | 2019–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Tons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

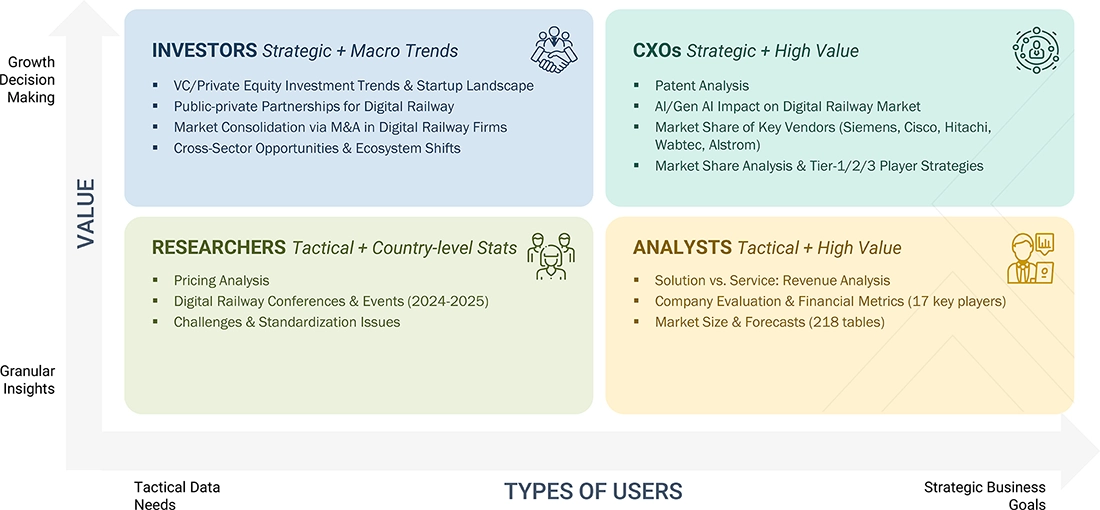

WHAT IS IN IT FOR YOU: Digital Railway Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Service Provider (US) |

|

|

| Company Information | Detailed analysis and profiling of additional market players (up to 5) |

|

RECENT DEVELOPMENTS

- May 2025 : Alstom signed a five-year service-level agreement with Storstockholms Lokaltrafik (SL) to support and enhance the digital systems in the Movia C20 and C30 fleets within the Stockholm metro network. The agreement includes 24/7 technical support, ongoing software updates, and cybersecurity improvements, along with providing predictable maintenance through Alstom's Health Hub for increased reliability and operational efficiency. The agreement also reaffirms Alstom's ongoing commitment to delivering dependable digital solutions and solidifies its dominant position in the Swedish rail market.

- March 2025 : ABB entered into a partnership with Stadler to provide traction converters and Pro Series Traction Batteries for new trainsets in the US, including full battery-powered train sets for Metra in Illinois and hydrogen-powered trainsets for Caltrans in California, with the intention to promote sustainable railways.

- March 2025 : Wabtec acquired Dellner Couplers, an established global leader in train connection systems for passenger rail. This acquisition aims to improve Wabtec's Transit business and serves as a complementary offering in the company's portfolio. The acquisition is expected to boost Wabtec's financial performance and innovation in passenger rail.

- January 2025 : Hitachi Rail agreed to acquire Omnicom from Balfour Beatty to enhance its new HMAX digital asset management platform. Omnicom’s AI-powered rail monitoring technology will support real-time infrastructure insights, boosting predictive maintenance and operational efficiency across global rail networks.

- September 2024 : At InnoTrans 2024, Siemens Mobility unveiled Signaling X, a cloud-based platform integrating mainline and mass transit signaling systems to boost operational efficiency and flexibility. It also introduced new Railigent X features, including fully automated and mobile inspections, aimed at enhancing rail service, optimizing infrastructure use, and supporting digitalization for sustainable transport.

Table of Contents

Methodology

This research study involved the extensive use of secondary sources, directories, and databases, such as Dun & Bradstreet (D&B) Hoovers and Bloomberg BusinessWeek, to identify and collect information useful for a technical, market-oriented, and commercial study of the digital railway market. The primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information.

Secondary Research

The market size of companies offering digital railways worldwide was arrived at based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolio of major companies and rating them based on their performance and quality.

In the secondary research process, various secondary sources were referred to to identify and collect information for the study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from the OECD, International Railway Journal, Railway Gazette International, and the US DoT. The spending by various countries in the railway sector was extracted from their respective transportation associations, such as Société Nationale Des Chemins De Fer Français (SNCF), Taiwan Railways Administration (TRA), Passenger Rail Agency of South Africa (PRASA), European Rail Freight Association, and the European Union (EU) Agency for Railways.

Secondary research was mainly used to obtain key information about the industry’s value chain and supply chain and to identify key players through various solutions and services, market classification and segmentation according to the offerings of major players, industry trends related to technologies, applications, and regions, and key developments from both market-oriented and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from digital railway solution vendors, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using digital railway solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of digital railway solutions, which would impact the overall digital railway market.

Note: Tier 1 companies’ revenue is more than USD 1 billion; Tier 2 companies’ revenue ranges between USD 500 million and 1 billion; and Tier 3 companies’ revenue ranges between USD 100 million and 500 million. Other designations include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the digital railway market. The first approach involved estimating market size by summing up the revenue generated by companies through the sale of digital railway offerings.

Top-down and bottom-up approaches were used to estimate and validate the total size of the digital railway market. These methods were also extensively used to estimate the size of various market segments. The research methodology used to evaluate the market size is listed below.

- Key players in the market were identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size were determined through primary and secondary research processes.

- All percentage shares, splits, and breakups were determined using secondary sources and verified through primary sources.

Digital Railway Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size, the digital railway market was divided into several segments and subsegments. A data triangulation procedure was used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

Digital railways deploy and integrate technologies such as the Internet of Things (IoT), artificial intelligence (AI), analytics, cloud, and cybersecurity to enhance railway infrastructure and improve safety and performance. These technologies are used to improve rail operations, ticketing, passenger experience, workforce management, and asset management.

Stakeholders

- Digital Railway Vendors

- Network and System Integrators (SIs)

- Cloud Service Providers

- Digital Railway Infrastructure Providers

- Digital Railway Support Service Providers

- Digital Railway Companies

- National Railway Governing Authorities/Regulators/Bodies

- Independent Software Vendors (ISVs)

- Value-added Resellers (VARs) and Distributors

- Consultancy Firms and Advisory Firms

- Regulatory Agencies

- Governments

Report Objectives

- To determine and forecast the digital railway market by offering (solutions and services), application, and region

- To forecast the size of the market segments for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market’s growth

- To analyze each submarket concerning individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments of the market

- To profile the key market players, provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials, and illustrate the market’s competitive landscape

- To track and analyze competitive developments in the market, such as mergers and acquisitions, product developments, partnerships, collaborations, and research and development (R&D) activities

Customization Options

With the given market data, MarketsandMarkets offers customizations to meet the company’s specific needs. The following customization options are available for the report:

Country-wise information

- Analysis for additional countries (up to five)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

What is the definition of the digital railway market?

Digital railways involve the deployment and integration of technologies, such as the Internet of Things (IoT), artificial intelligence (AI), analytics, cloud, and cybersecurity, to enhance railway infrastructure and improve safety and performance. These technologies improve rail operations, ticketing, passenger experience, workforce management, and asset management.

What is the market size of the digital railway market?

The digital railway market is estimated to be USD 82.76 billion in 2025 and is projected to reach USD 127.54 billion by 2030, registering a CAGR of 9.0% from 2025 to 2030.

What are the major drivers of the digital railway market?

The major drivers of the digital railway market include the surge in passenger numbers over the past few years, the rising adoption of IoT in railways, and advancements in communication technology.

Who are the key players operating in the digital railway market?

The key players profiled in the digital railway market include Alstom (France), Cisco (US), Wabtec (US), ABB (Switzerland), IBM (US), Hitachi (Japan), Huawei (China), Indra Sistemas (Spain), Siemens (Germany), Honeywell (US), Fujitsu (Japan), Toshiba (Japan), DXC (US), Nokia (Finland), Advantech (Taiwan), Televic (Belgium), Uptake (US), Tego (US), KONUX (Germany), Aitek S.p.A. (Italy), Assetic (Australia), Machines With Vision (UK), Delphisonic (US), Passio Technologies (US), Atkins (UK), CloudMoyo (US), RailTel (India), ZEDAS (Germany), Simpleway (US), EKE Electronics (Finland), and r2p (Germany).

What are the key technological trends prevailing in the digital railway market?

The digital railway market is witnessing key trends like IoT for real-time data, AI for automation and optimization, and 5G for enhanced connectivity, all of which aim to improve efficiency, safety, and passenger experience.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Digital Railway Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Digital Railway Market