Automatic Train Control Market by Automation (GoA 1, GoA 2, GoA 3, GoA 4), Service (Consulting, Integration & Deployment), Train Type (Urban (Metro & High-Speed Trains), Mainline (Passenger & Freight Trains)), and Region - Global Forecast to 2023

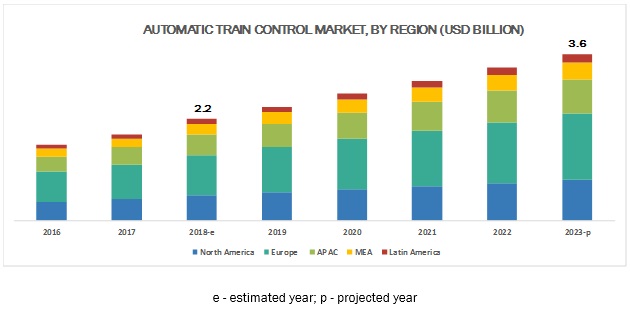

[112 Pages Report] The global Automatic Train Control market size is expected to grow from USD 2.2 billion in 2018 to USD 3.6 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 10.3% during the forecast period. High demographic growth, hyper-urbanization, technological advancements for increasing passenger convenience, and emerging trend of smart cities are expected to drive the global market.

By train type, the mainline segment to be a significant contributor to the Automatic Train Control market growth during the forecast period

Mainline train includes passenger trains and freight trains. Mainline train mainly includes long routes that cover almost every junction of the country. These trains are purposely developed for long routes only. With time, mainline trains are also designed with advanced technologies. Most of the railway operators are using ATC for mainline trains, as it helps avoid collision and maintain train routes. For instance, in 2018, Govia Thameslink Railway along with Network Rail and Siemens have deployed ATO solutions in European Train Control System (ETCS), which is deployed on the mainline railway for passenger services. This helped Govia Thameslink Railway manage passenger rail efficiently.

Support and maintenance segment to grow at a higher CAGR during the forecast period

Organizational environments are very complex, with multiple IT systems connected to perform the day-to-day operations. Therefore, the latest ATC solutions need to be upgraded in organizations for better rail operations. The support and maintenance services help the installed ATC system within the enterprises infrastructure. The support and maintenance services include 24/7 troubleshooting assistance, upgradation of the existing ATC solution, problem-solving, repairing, replacing old components, proactive services, technical support by technicians, and test scenario management. The support and maintenance segment also includes facility inspection and training, and round-the-clock support for ATC solutions. The support and maintenance services are widely adopted by organizations to avoid business threats and safeguard devices.

North America to hold the largest market size during the forecast period

North America constitutes developed economies, the United States (US) and Canada, which contribute majorly to the regional market. One of the key reasons for its major market share is the early adoption of technologies and the globalization of shared services in this region. The strong financial position of this region enables its countries to invest heavily in leading ATC solutions and technologies. The major growth drivers for this region are the increasing number of projects focused on upgrading and constructing freight infrastructures, and high-speed railway lines. Additionally, with the Rail Safety Improvement Act of 2008 and the corresponding regulations issued by the Federal Railroad Administration (FRA), passenger and major freight railroads were required to implement Positive Train Control (PTC) on most major track lines by December 31, 2018. The Rail Safety Improvement Act of 2008 has increased the deployment of ATC solutions and associated technologies in the US, as ATC solutions are at the core of PTC.

Key Market Players

Major vendors in the Automatic Train Control market include General Electric Company (GE), Toshiba Corporation (Toshiba), Alstom SA (Alstom), Tech Mahindra, WSP, Cisco Systems (Cisco), Hitachi, Bombardier, Siemens, Thales, Kyosan Electric Manufacturing Ltd (Kyosan), Mermec, Advantech, Mipro, and ADLINK Technology.

Scope of the report:

|

Report Metrics |

Details |

|

Market size available for years |

20162023 |

|

Base year considered |

2017 |

|

Forecast period |

20182023 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Automation (GoA 1, GoA 2, GoA 3, GoA 4), Service (Consulting, Integration and Deployment, Support and Maintenance) Train (Urban, Mainline), and Region |

|

Geographies covered |

North America, APAC, Europe, Middle East and Africa, and Latin America |

|

Companies covered |

Alstom (France) Bombardier (Canada) (US), Thales (France), Hitachi (Japan), Cisco (US), and Siemens (Germany). A total of 15 players covered. |

This research report categorizes the Automatic Train Control market based on automation (GoA 1, GoA 2, GoA 3, GoA 4), service (consulting, integration & deployment, support & maintenance), train (urban and mainline), and region.

By Automation Type:

- GoA 1

- GoA 2

- GoA 3

- GoA 4

By Service:

- Consulting

- Integration and Deployment

- Support and maintenance Enterprises

By Train:

- Urban

- Mainline

By Region:

- North America

- Europe

- APAC

- MEA

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the North American market into the US and Canada

- Further breakup of the European market into the UK, Germany, France, and Rest of Europe

- Further breakup of the APAC market into the China, India, Australia, and Rest of APAC

- Further breakup of the MEA market into the Qatar, UAE, and Rest of MEA

- Further breakup of the Latin American market into the Brazil, Mexico, and Rest of Latin America

Company Information

- Detailed analysis and profiling of additional market players

Key questions addressed by the report:

- Where would all these developments take the industry in the mid to long term?

- What are the upcoming industry solutions for the automatic train control market?

- Which are the major factors expected to drive the market?

- Which region would offer high growth for vendors in the market?

- Which solution would gain the largest market share in the market?

Frequently Asked Questions (FAQ):

What is Automatic Train Control?

What are the types of automation required for Automatic Train Control?

Which are the top industry players in Automatic Train Control market?

What are the top trends in Automatic Train Control market?

Trends that are impacting Automatic Train Control market includes:

- High Demographic Growth and Hyper-Urbanization

- Technological Advancement Targeted Toward Passenger Convenience

- Emerging Trend of Smart Cities

Opportunities for the Automatic Train Control market:

- Development of Semi-Autonomous and Autonomous Trains

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Segmentation

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Forecast

2.5 Assumptions for the Study

2.6 Limitations of the Study

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Automatic Train Control Market

4.2 Market, By Train Type and Region

4.3 Market, By Region

4.4 Market: Investment Scenario

5 Market Overview and Industry Trends (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Demographic Growth and Hyper-Urbanization

5.2.1.2 Technological Advancement Targeted Toward Passenger Convenience

5.2.1.3 Emerging Trend of Smart Cities

5.2.2 Restraints

5.2.2.1 Inefficiency of Train Operations

5.2.2.2 High Deployment Cost of ATC Solutions

5.2.3 Opportunities

5.2.3.1 Development of Semi-Autonomous and Autonomous Trains

5.2.4 Challenges

5.2.4.1 Complexities in Integrating ATC Solutions With Legacy Systems

5.3 Use Cases

6 Automatic Train Control Market, By Automation (Page No. - 37)

6.1 Introduction

6.2 Goa 1

6.2.1 Need for Automation to Fuel the Growth of the Market

6.3 Goa 2

6.3.1 Rising Adoption of Atp and Ato in Trains to Drive the Growth of Goa 2-Based Systems

6.4 Goa 3

6.4.1 High Adoption of Goa 3 to Fuel the Growth of the Automatic Train Control Market

6.5 Goa 4

6.5.1 Growing Need for Faster Services, Energy Efficiency, and Safety to Fuel the Growth of Goa 4

7 Market, By Service (Page No. - 43)

7.1 Introduction

7.2 Consulting

7.2.1 With the ATC Technology at A Mature Stage, the Consulting Services are Expected to Be in Demand

7.3 Integration and Deployment

7.3.1 Integration and Deployment Services to Help Deploy the Best-In-Class Solutions

7.4 Support and Maintenance

7.4.1 Wide Adoption of Support and Maintenance Services By Organizations to Avoid Business Threats and Safeguard Devices

8 Automatic Train Control Market, By Train Type (Page No. - 48)

8.1 Introduction

8.2 Urban

8.2.1 Metro Train

8.2.1.1 Rapid Urbanization and Increasing Metro Lines to Drive the Growth of ATC in Urban Railways

8.2.2 High-Speed Train

8.2.2.1 Increasing Number of High-Speed Trains Worldwide to Fuel the Growth of the Market

8.3 Mainline

8.3.1 Passenger Train

8.3.1.1 Increasing Traveling Population to Enforce Railway Operators to Adopt ATC in Passenger Trains

8.3.2 Freight Train

8.3.2.1 Need for Efficient Freight Trains to Fuel the Growth of the Automatic Train Control Market

9 Automatic Train Control Market, By Region (Page No. - 56)

9.1 Introduction

9.2 North America

9.2.1 United States

9.2.1.1 With the Implementation of Ptc Solutions, the US to See A Steady Rise in the Deployment of ATC Solutions and Services

9.2.2 Canada

9.2.2.1 Commitment to Infrastructure and Railway Spending to Drive the Market in Canada

9.3 Europe

9.3.1 Germany

9.3.1.1 Adoption of 2030 Ftip to Drive the Automatic Train Control Market in Germany

9.3.2 France

9.3.2.1 Focus on Rail Infrastructure and Spend Toward the Maintenance and Improvement of Existing Lines to Fuel the Market Growth in France

9.3.3 United Kingdom

9.3.3.1 UK to Emerge as A Lucrative Market Due to Government Regulations and Mandates on Rail Infrastructures

9.3.4 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.1.1 Strategic Rail Projects for Improving Rail Infrastructure to Increase the Deployment of ATC Solutions in China

9.4.2 Australia

9.4.2.1 Deployment of ATC Solutions in Metros to Drive the Market in Australia

9.4.3 India

9.4.3.1 Heavy Investments in Metros to Fuel the Growth of the Automatic Train Control Market in India

9.4.4 Rest of Asia Pacific

9.5 Middle East and Africa

9.5.1 United Arab Emirates

9.5.1.1 Technological Advancements and the Growing Economy to Result in ATC Solution Adoption in UAE

9.5.2 Qatar

9.5.2.1 Increase in Demand for Logistics Management to Act as A Major Driver for the Adoption of ATC Solutions

9.5.3 Rest of Middle East and Africa

9.6 Latin America

9.6.1 Brazil

9.6.1.1 Major Investments in Metros to Drive the Market Growth in Brazil

9.6.2 Mexico

9.6.2.1 Geographic and Strategic Location of Mexico Plays an Important Role in the Growth of the Automatic Train Control Market

9.6.3 Rest of Latin America

10 Competitive Landscape (Page No. - 75)

10.1 Overview

10.2 Market Ranking

10.3 Competitive Scenario

10.3.1 New Product Launches and Product Enhancements

10.3.2 Partnerships, Collaborations, and Agreements

10.4 Competitive Leadership Mapping

10.4.1 Visionary Leaders

10.4.2 Dynamic Differentiators

10.4.3 Innovators

10.4.4 Emerging Companies

11 Company Profiles (Page No. - 80)

(Business Overview, Solutions & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

11.1 Siemens

11.2 Thales

11.3 Bombardier

11.4 Cisco

11.5 Hitachi

11.6 GE

11.7 Toshiba

11.8 Alstom

11.9 Tech Mahindra

11.10 WSP

11.11 Kyosan

11.12 Mermec

11.13 Advantech

11.14 Mipro

11.15 Adlink Technology

*Details on Business Overview, Solutions & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 107)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (59 Tables)

Table 1 Factor Analysis

Table 2 Automatic Train Control Market Size and Growth Rate, 20162023 (USD Million, Y-O-Y %)

Table 3 Use Case 1: Nuremberg Rubin

Table 4 Use Case 2: Istanbul Metropolitan Municipality (Ibb)

Table 5 Use Case 3: Delhi Metro Rail Corporation

Table 6 Use Case 4: Hong Kong West Rail/Kowloon Southern Link

Table 7 Market Size, By Automation, 20162023 (USD Million)

Table 8 Goa 1: Automatic Train Control Market Size, By Region, 20162023 (USD Million)

Table 9 Goa 2: Market Size, By Region, 20162023 (USD Million)

Table 10 Goa 3: Market Size, By Region, 20162023 (USD Million)

Table 11 Goa 4: Market Size, By Region, 20162023 (USD Million)

Table 12 Market Size, By Service, 20162023 (USD Million)

Table 13 Consulting: Market Size, By Region, 20162023 (USD Million)

Table 14 Integration and Deployment: Market Size, By Region, 20162023 (USD Million)

Table 15 Support and Maintenance: Market Size, By Region, 20162023 (USD Million)

Table 16 Automatic Train Control Market Size, By Train Type, 20162023 (USD Million)

Table 17 Urban: Market Size, By Region, 20162023 (USD Million)

Table 18 Urban: Market Size: By Train Type, 20162023 (USD Million)

Table 19 Metro Train Market Size, By Region, 20162023 (USD Million)

Table 20 High-Speed Train: Market Size, By Region, 20162023 (USD Million)

Table 21 Mainline: Market Size, By Region, 20162023 (USD Million)

Table 22 Mainline: Market Size: By Train Type, 20162023 (USD Million)

Table 23 Passenger Train Market Size, By Region, 20162023 (USD Million)

Table 24 Freight Train Market Size, By Region, 20162023 (USD Million)

Table 25 Market Size, By Region, 20162023 (USD Million)

Table 26 North America: Automatic Train Control Market Size, By Automation, 20162023 (USD Million)

Table 27 North America: Market Size, By Service, 20162023 (USD Million)

Table 28 North America: Market Size, By Train Type, 20162023 (USD Million)

Table 29 North America: Market Size, By Urban Train Type, 20162023 (USD Million)

Table 30 North America: Market Size, By Mainline Train Type, 20162023 (USD Million)

Table 31 North America: Market Size, By Country, 20162023 (USD Million)

Table 32 Europe: Market Size, By Automation, 20162023 (USD Million)

Table 33 Europe: Market Size, By Service, 20162023 (USD Million)

Table 34 Europe: Market Size, By Train Type, 20162023 (USD Million)

Table 35 Europe: Market Size, By Urban Train Type, 20162023 (USD Million)

Table 36 Europe: Market Size, By Mainline Train Type, 20162023 (USD Million)

Table 37 Europe: Market Size, By Country, 20162023 (USD Million)

Table 38 Asia Pacific: Automatic Train Control Market Size, By Automation, 20162023 (USD Million)

Table 39 Asia Pacific: Market Size, By Service, 20162023 (USD Million)

Table 40 Asia Pacific: Market Size, By Train Type, 20162023 (USD Million)

Table 41 Asia Pacific: Market Size, By Urban Train Type, 20162023 (USD Million)

Table 42 Asia Pacific: Market Size, By Mainline Train Type, 20162023 (USD Million)

Table 43 Asia Pacific: Market Size, By Country, 20162023 (USD Million)

Table 44 Middle East and Africa: Automatic Train Control Market Size, By Automation, 20162023 (USD Million)

Table 45 Middle East and Africa: Market Size, By Service, 20162023 (USD Million)

Table 46 Middle East and Africa: Market Size, By Train Type, 20162023 (USD Million)

Table 47 Middle East and Africa: Market Size, By Urban Train Type, 20162023 (USD Million)

Table 48 Middle East and Africa: Market Size, By Mainline Train Type, 20162023 (USD Million)

Table 49 Middle East and Africa: Market Size, By Country, 20162023 (USD Million)

Table 50 Latin America: Market Size, By Automation, 20162023 (USD Million)

Table 51 Latin America: Market Size, By Service, 20162023 (USD Million)

Table 52 Latin America: Market Size, By Train Type, 20162023 (USD Million)

Table 53 Latin America: Market Size, By Urban Train Type, 20162023 (USD Million)

Table 54 Latin America: Market Size, By Mainline Train Type, 20162023 (USD Million)

Table 55 Latin America: Market Size, By Country, 20162023 (USD Million)

Table 56 Market Ranking for the Automatic Train Control Market, 2018

Table 57 New Product Launches and Product Enhancements, 20172018

Table 58 Partnerships, Collaborations, and Agreements, 20172018

Table 59 Evaluation Criteria

List of Figures (32 Figures)

Figure 1 Automatic Train Control Market: Research Design

Figure 2 Market: Top-Down and Bottom-Up Approaches

Figure 3 Market, Top 3 Segments, 2018

Figure 4 Market, By Train Type, 2018

Figure 5 Increasing Population and Rapid Urbanization to Drive the Growth of the Market

Figure 6 Mainline Train Type and Europe to Hold the Highest Market Shares in 2018

Figure 7 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 8 Asia Pacific to Emerge as the Best Market for Investments During the Next 5 Years

Figure 9 Drivers, Restraints, Opportunities, and Challenges: Automatic Train Control Market

Figure 10 Goa 4 to Grow at the Highest CAGR During the Forecast Period

Figure 11 Support and Maintenance Segment to Grow at the Highest CAGR During the Forecast Period

Figure 12 Mainline Train Type to Hold A Larger Market Size During the Forecast Period

Figure 13 Europe to Hold the Largest Market Size During the Forecast Period

Figure 14 Europe: Market Snapshot

Figure 15 Asia Pacific: Market Snapshot

Figure 16 Key Developments By the Leading Players in the Automatic Train Control Market During 20152018

Figure 17 Market (Global) Competitive Leadership Mapping, 2018

Figure 18 Siemens: Company Snapshot

Figure 19 SWOT Analysis: Siemens

Figure 20 Thales: Company Snapshot

Figure 21 SWOT Analysis: Thales

Figure 22 Bombardier: Company Snapshot

Figure 23 SWOT Analysis: Bombardier

Figure 24 Cisco: Company Snapshot

Figure 25 SWOT Analysis: Cisco

Figure 26 Hitachi: Company Snapshot

Figure 27 SWOT Analysis: Hitachi

Figure 28 GE: Company Snapshot

Figure 29 Toshiba: Company Snapshot

Figure 30 Alstom: Company Snapshot

Figure 31 Tech Mahindra: Company Snapshot

Figure 32 WSP: Company Snapshot

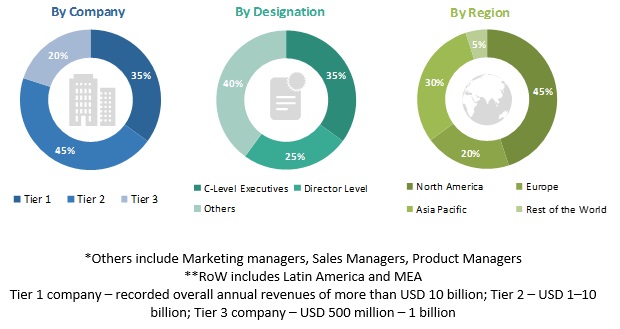

The study involved 4 major steps to estimate the current market size for the Automatic Train Control market. The exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub segments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Factiva, have been referred to, for identifying and collecting information for this study. These secondary sources included annual reports, press releases and investor presentations of companies; white papers, technology journals and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

The Automatic Train Control market comprises several stakeholders, such as solution and service providers, support and maintenance service providers, manufacturing enterprises, technology consultants, system design and development vendors, and logistics and supply chain management providers. The extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types; industry trends; key players; the competitive landscape of different market players; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies. Following is the breakdown of primary respondents:

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the overall size of the Automatic Train Control market. These methods were also used extensively to estimate the size of various sub segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through the extensive secondary research.

- The market expenditures across regions, along with the geographic split in various segments have been considered to arrive at the overall market size.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the ATC industry.

Report Objectives:

- To define, describe, and forecast the Automatic Train Control market by automation type, train, services, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of the segments with respect to 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

- To profile the key players and comprehensively analyze their market rankings and core competencies*

- To analyze competitive developments, such as new partnerships, new contracts, and new product developments, in the Automated Train Control market

*Core competencies of the companies have been captured in terms of their key developments and key strategies adopted by them to sustain their positions in the market.

Growth opportunities and latent adjacency in Automatic Train Control Market

Interested in freight traffic for railway automation.