Dietary Supplements Market Trends, Growth Drivers, and Industry Report [Latest]

Dietary Supplements Market by Type (Botanicals, Vitamins, Minerals, Amino Acids, Enzymes, Probiotics), Mode of Application (Tablets, Capsules, Liquid, Powder, Gummies/Chewables), Target Consumer, Function, Region - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global dietary supplements market is projected to reach USD 278.41 billion by 2030 from USD 192.60 billion in 2025, at a CAGR of 7.6% from 2025 to 2030. The growth of this market is driven by a shift in consumer preferences for health supplement products due to rising preventive health & wellness adoption, rising healthcare burden due to chronic ailments, and increasing consumer awareness about micronutrient deficiencies.

KEY TAKEAWAYS

-

BY REGIONNorth America is estimated to account for a 33.3% share of the market in 2025.

-

BY TYPEBy type, the botanical segment is expected to register a significant CAGR of 8.1%.

-

BY TARGET CONSUMERBy target consumer, the adult segment is projected to dominate the market during the forecasted period.

-

BY FUNCTIONBy function, the sports nutrition segment is projected to grow at the highest CAGR during the forecasted period

-

BY MODE OF APPLICATIONBy mode of application, the capsules segment is estimated to hold a significant market share.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSNestlé, Abbott, and Haleon Group of Companies, were among the companies identified as star players in the global dietary supplements market, given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPE - STARTUPSAmway Corp., American Health, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The global dietary supplements market is expected to grow at a rapid rate, driven by increasing awareness regarding nutrition and healthy lifestyles and the rise of e-commerce platforms and online retailing that has revolutionized the accessibility of dietary supplements for consumers

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on the client's business is mainly driven by the evolving consumer trends and market disruptions in the global dietary supplements market. There is an expected shift in the revenue mix from the traditional supplement products to emerging offerings such as botanicals and probiotics. As a result, changes in go-to-market and distribution strategies are expected to significantly affect the market dynamics.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Shift in consumer preferences due to increasing focus on health

-

Rising geriatric population and their growing use of dietary supplements

Level

-

High R&D investments and cost of clinical trials

-

High cost of dietary supplements

Level

-

Shift toward plant-based supplements

-

Consumer awareness about micronutrient deficiencies

Level

-

Challenging regulatory environment

-

Consumer skepticism and fake supplements associated with nutraceutical products

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Shift in consumer preferences due to increasing focus on health

‘Self-care’ has become essential to the modern consumer’s lifestyle. The growing emphasis on holistic health and immunity has resulted in significant dietary changes among consumers.

Restraint: High R&D investments and cost of clinical trials

Nutraceutical products such as dietary supplements are clinically and chemically developed and, hence, require extensive R&D investments, clinical trials, and approvals from respective authorities in different countries/regions

Opportunity: Shift toward plant-based supplements

The market for plant protein ingredients is growing rapidly; consumers are shifting away from animal to plant-based proteins. This is highly likely to shift consumers toward plant-based herbal supplements and botanicals, further creating opportunities for the growth of the herbal supplements market.

Challenge: Challenging regulatory environment

There are changing regulations and mandates regarding nutrition through dietary supplements. Changing standards of nutritional care have led to the formulation of these regulations.

DIETARY SUPPLEMENTS MARKET TRENDS, GROWTH DRIVERS, AND INDUSTRY REPORT [LATEST]: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Nestlé expanded its Materna brand portfolio with the launch of two new products, Materna Pre and Materna Nausea, designed to address critical needs in women's fertility and pregnancy. | This innovation reflects the company's strategic focus on maternal health. |

|

Introduction of new own-brand sports nutrition line, “TriActive,” with ~16 products designed for everyday use, combining protein, vitamins, minerals, joint support components, and other performance/recovery-oriented ingredients, marketed for body, mind, and muscle support | Meets rising consumer demand for holistic sports & wellness nutrition (not just basic vitamins), integrating recovery, performance, and general wellness. |

|

Nature’s Bounty (Nestle) launched a new product line covering women’s wellness, healthy longevity, and digestive health | This enables the company to strengthen its leadership by expanding into fast-growing categories like women’s wellness, longevity, and gut health, capturing rising consumer demand |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The dietary supplements ecosystem is categorized into manufacturers, regulatory bodies, and end-use companies. The global dietary supplements market is a dynamic and rapidly expanding ecosystem characterized by diverse stakeholders and innovative products. Established companies and agile startups are central to this market, and they develop dietary supplement products.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Dietary Supplements Market, By Type

The vitamins segment is estimated to account for the largest market share in 2024. Increasing consumer awareness about the importance of vitamins for overall health and wellness has led to a surge in demand for dietary supplements containing vitamins.

Dietary Supplements Market, By Target Consumer

The adult segment is estimated to account for the largest share of the dietary supplements market in 2024. This segment’s dominance is attributed to factors such as increasing health consciousness, the desire to address specific health conditions or deficiencies, the need for overall well-being, and the growing aging population seeking preventive healthcare measures.

Dietary Supplements Market, By Mode of Application

Capsules account for the largest share of the market. The consumer perception that capsules allow for better nutrient absorption than tablets has played a significant role in market growth. Capsules are designed to be easily swallowed, providing a user-friendly experience for consumers.

Dietary Supplements Market, By Distribution Channel

By distribution channel, the pharmacies segment is estimated to dominate the market by 2024. Pharmacies serve as a trusted source of information, addressing consumer concerns and providing guidance on supplement usage.

REGION

North America's dietary supplements market holds the dominant share in 2024

North America accounted for the largest share in the global dietary supplements market in 2024. The large share of North America can be attributed to the rising prevalence of chronic diseases and the increasing awareness among consumers regarding the health benefits of dietary supplements.

DIETARY SUPPLEMENTS MARKET TRENDS, GROWTH DRIVERS, AND INDUSTRY REPORT [LATEST]: COMPANY EVALUATION MATRIX

In the global dietary supplements market matrix, Nestle and Abbott (Stars) lead with a strong market share and extensive product footprint for human health, driven by their strong geographical presence, significant formulation and distribution capabilities, and strong ties with distribution channels. Nature's Sunshine Products, Inc. (Emerging Leader) is gaining visibility with its specialized dietary supplement offerings, strengthening its position through specific product offerings.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Nestlé (Switzerland)

- Abbott (US)

- Haleon Group of Companies (UK)

- Otsuka Holdings Co., Ltd. (Japan)

- Glanbia plc (Ireland)

- Bayer AG (Germany)

- H&H Group (Hong Kong)

- Amway Corp (US)

- American Health (US)

- Nature’s Sunshine Products, Inc (US)

- Herbalife International of America, Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 179.53 Billion |

| Market Forecast in 2030 (Value) | USD 192.60 Billion |

| Growth Rate | CAGR of 7.6% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion), Volume (KT) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, South America, and Rest of the World |

WHAT IS IN IT FOR YOU: DIETARY SUPPLEMENTS MARKET TRENDS, GROWTH DRIVERS, AND INDUSTRY REPORT [LATEST] REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Germany-based Dietary Supplement Manufacturers |

|

|

| Dietary Supplement, Mode of Application Segment Assessment |

|

|

RECENT DEVELOPMENTS

- August 2025 : Vitanergy Health US Inc. launched three new products: D3 multivitamin gummies, B-Complex gummies with folate, and a “Rejuvenate & Glow” 4-in-1 capsule, targeting women’s daily nutritional needs with the inclusion of clean-label and vegan-friendly formulations.

- June 2025 : Nature’s Bounty launched products that addressed women’s wellness, healthy longevity, and digestive health. The product included supplements such as Advanced Menopause Relief, Ultra Collagen Booster Capsules, Advanced Vital Heart, Superfoods Plus Energy, and Prebiotic + Postbiotic + Probiotic Gummies.

- November 2024 : Nestlé expanded its Materna brand portfolio with the launch of two new products, Materna Pre and Materna Nausea. These products are designed to address critical needs in women's fertility and pregnancy. This innovation reflects the company's strategic focus on maternal health.

Table of Contents

Methodology

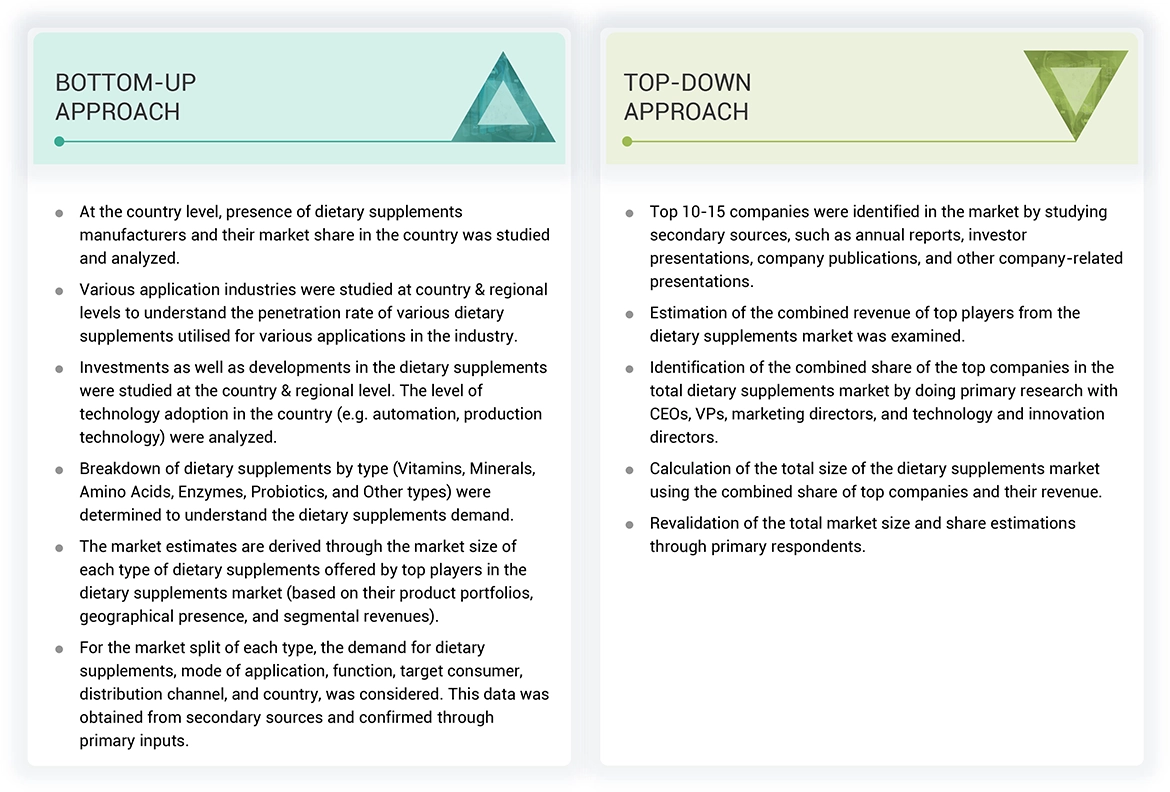

The study involved two major approaches in estimating the current size of the dietary supplements market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, directories, and databases were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

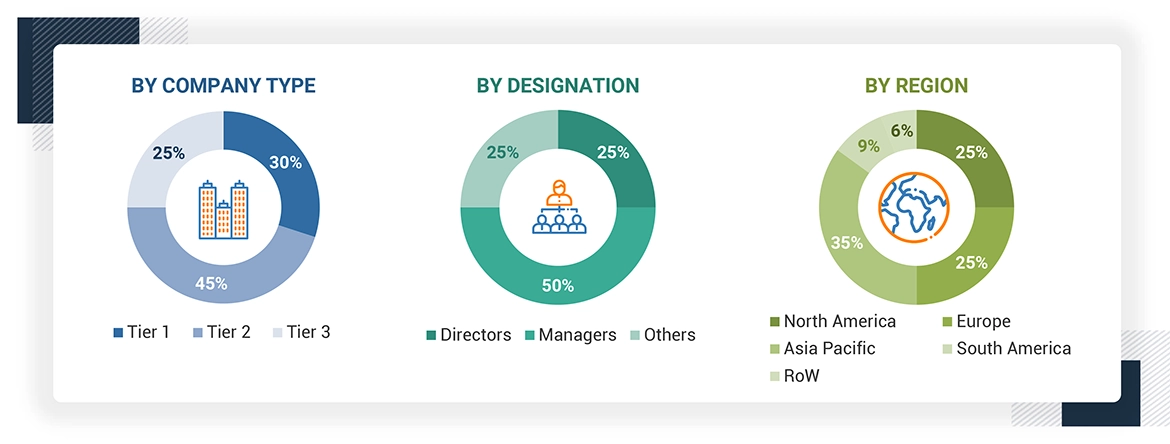

Extensive primary research was conducted after obtaining information regarding the dietary supplements market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to dietary supplements by type, mode of application, target consumer, distribution channel, function, and region. Stakeholders from the demand side, such as food and beverage companies and health and personal care companies who are using dietary supplements, were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of dietary supplements and the outlook of their business which will affect the overall market.

Note: The three tiers of the companies are defined based on their total revenues in 2022 or 2023, as per

the availability of financial data: Tier 1: Revenue > USD 1 billion; Tier 2: USD 100 million = Revenue = USD

1 billion; Tier 3: Revenue < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Nestle (Switzerland) |

General Manager |

|

Abbott (US) |

Sales Manager |

|

Otsuka Holdings Co., Ltd (Japan) |

Manager |

|

International Flavors & Fragrances Inc (US) |

Head of processing department |

|

Haleon Group of Companies (UK) |

Marketing Manager |

|

Glanbia PLC (Ireland) |

Sales Executive |

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the dietary supplements market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Dietary Supplements Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall dietary supplements market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

According to the National Institute on Aging (NIA) [a part of the National Institutes of Health (NIH)], “Dietary supplements are substances you might use to add nutrients to your diet or to lower your risk of health problems such as osteoporosis or arthritis. Dietary supplements come in the form of pills, capsules, powders, gel tabs, extracts, or liquids. They might contain vitamins, minerals, fiber, amino acids, herbs other plants, or enzymes. Sometimes, the ingredients in dietary supplements are added to foods, including drinks.”

Stakeholders

- Manufacturers of food products, beverages, and dietary supplements

- Manufacturers of nutraceutical ingredients

- Intermediary suppliers, such as traders and distributors of nutraceutical products

- Government, research organizations, and institutions

- World Health Organization (WHO)

- Codex Alimentarius Commission (CAC)

- Associations, regulatory bodies, and other industry-related bodies:

- Food and Agriculture Organization (FAO)

- United States Department of Agriculture (USDA)

- Food Safety Council (FSC)

- Food and Drug Administration (FDA)

- European Food Safety Authority (EFSA)

- Food Standards Australia New Zealand (FSANZ)

- Dietary Supplement Health and Education Act (DSHEA)

- Internal Probiotics Association

- Indian Health Foods and Dietary Supplements Association (INHADSA)

Report Objectives

- To determine and project the size of the dietary supplements market with respect to the type, mode of application, target consumer, distribution channel, function, and regions in terms of value over five years, ranging from 2024 to 2029.

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To analyze the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market.

- To identify and profile the key players in the dietary supplements market.

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe dietary supplements market into key countries.

- Further breakdown of the Rest of Asia Pacific dietary supplements market into key countries.

- Further breakdown of the Rest of South America dietary supplements market into key countries.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What are dietary supplements?

Dietary supplements are products consumed to add nutritional value to the diet. They usually contain vitamins, minerals, herbs, amino acids, enzymes, probiotics, and other bioactive compounds that support health and wellness.

What is the current size of the dietary supplements market?

The global dietary supplements market is valued at USD 179.53 billion in 2024 and is projected to reach USD 258.75 billion by 2029, growing at a CAGR of 7.6%.

What factors are driving the growth of the dietary supplements market?

Key drivers include rising consumer health awareness, growing demand for preventive healthcare, increased adoption of e-commerce channels, and a surge in demand for functional foods and nutraceuticals.

Which product categories dominate the dietary supplements market?

The market is largely dominated by vitamins, minerals, proteins & amino acids, omega-3 fatty acids, probiotics, and herbal supplements. Among these, vitamins and proteins account for the largest share.

Who are the primary consumers of dietary supplements?

The main consumer groups include adults, elderly populations, children, and athletes/fitness enthusiasts, with adults representing the largest segment due to lifestyle-driven health concerns.

Which distribution channels are most important for dietary supplements?

Supplements are distributed through pharmacies & drug stores, supermarkets & hypermarkets, specialty stores, and online platforms. E-commerce is the fastest-growing channel due to convenience and wide product access.

Which regions are leading the dietary supplements market?

North America holds the largest market share, driven by strong consumer health consciousness and established brands. Asia-Pacific is the fastest-growing region, fueled by increasing disposable income and a shift toward preventive healthcare in countries like China, India, and Japan.

What challenges does the dietary supplements market face?

Challenges include regulatory complexities, quality control issues, rising competition, counterfeit products, and varying consumer awareness levels across regions.

How is digitalization influencing the dietary supplements market?

Online platforms allow consumers to compare products, access reviews, and make informed purchases, which is significantly boosting sales, especially in regions with limited retail infrastructure.

Who are the key players in the dietary supplements market?

Major players include Nestlé (Switzerland), Abbott (US), Amway Corp (US), Otsuka Holdings Co., Ltd (Japan), Glanbia PLC (Ireland), Bayer AG (Germany), Haleon Group of Companies (UK), Herbalife International of America, Inc. (US), Nature’s Sunshine Products, Inc (US), Bionova (India), Arkopharma (France), American Health (US), H&H Group (Hong Kong), Nu Skin (US), and Vitaco (New Zealand).

What are the future trends in the dietary supplements market?

Future trends include personalized nutrition, plant-based and clean-label supplements, advanced formulations (gummies, powders, functional beverages), and AI-driven supplement recommendations.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Dietary Supplements Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Dietary Supplements Market