Bone & Joint Health Supplements Market by Type (Vitamin D, Vitamin K, Calcium, Collagen, Omega 3-Fatty Acid, Glucosamine-Chondroitin), Distribution Channels, Form (Tablets, Capsules, Liquid, Powder), Target Consumers and Region - Global Forecast to 2027

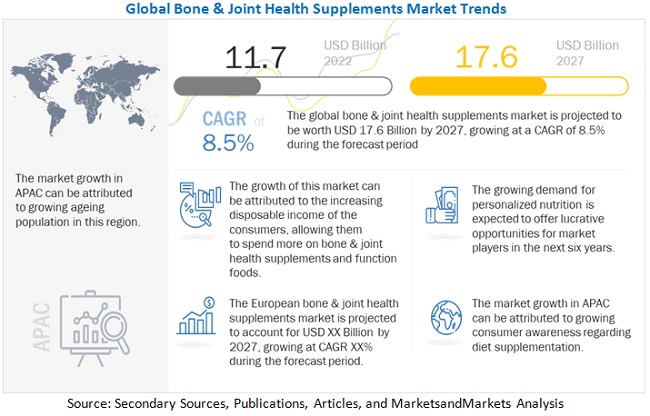

The global Bone and joint health supplements market is estimated to be valued at USD 11.7 billion in 2022. It is projected to reach USD 17.6 billion by 2027, recording a CAGR of 8.5% during the forecast period. The global market for bone & joint health supplements is predicted to grow due to rising demand for nutritional supplements like calcium and vitamin D. Advancements in the field and the discovery of the multi-functional properties of these products have led to increased innovation, further fueling demand. Technological progress has also expanded the usage of these supplements in various industries.

To know about the assumptions considered for the study, Request for Free Sample Report

Bone and Joint Health Supplements Market Dynamics

Drivers: Aging population to drive the market growth

The elderly population is focusing on adapting to nutritional supplements specifically tailored to their needs to maintain their good health and quality of life. The process of aging results in various changes in individuals, including psychological, physiological, and social, which affect their dietary and food choices. The aging population increasingly relies on habitual food choices and tailored dietary consumption patterns. Consumers have become more aware of healthy aging and disease prevention with increasing bone health and mobility concerns. Thus, there is an increased demand for supplemental nutrition solutions that align with the nutritional needs of aging consumer.

"The growing elderly population has driven demand for age-friendly food alternatives with better nutrition, leading to increased demand for bone and joint health supplements and driving market growth."

Restraints: High R & D investments and high cost of clinical trials

Nutraceutical products such as bone & joint health supplements are clinically and chemically developed and hence, require extensive R&D investments, clinical trials, and approvals from respective authorities in different countries/regions. Besides, developing such products is not a short-term activity, as it includes the formulation, trial & testing, and commercialization of it into the market. However, high R&D investments do not give equal returns in terms of productivity, as even after successful molecule discovery, the cost of bringing a new supplement into the market is significantly high. The cost of proving the effectiveness of a bone & joint health supplement through clinical trials is also relatively expensive. It can be a major hindrance to developing novel supplements in the market.

Opportunities: Consumer awareness about micronutrient deficiencies

Consumers are becoming increasingly aware of the risks and prevalence of nutritional deficiencies. Also, their knowledge about how nutritional deficiencies can be optimized through supplementation will drive increased intake of supplements further driving the bone & joint health supplements market growth. The link between diet and health is significant, and people are opting for healthier supplement alternatives. The rising middle-class income in parts of Asia, Latin America, and Africa has enabled consumers to spend more on nutritional, dietary, and food supplements. The growth in the world’s older population in parts of Europe and other regions is likely to be more aware of nutritional deficiencies, thereby driving the demand for dietary supplements. In 2013, according to the Business Development Bank of Canada, “health concerns are rising, and health awareness is growing among Canadian consumers and will continue to accelerate as the population ages, with 25% of the population over the age of 65 by 2031.

Challenges: Regulatory influence

The overall shift in consumer trends is causing several changes in the market. There are changing regulations and mandates regarding nutrition through dietary supplements. Changing standards of nutritional care have led to the formulation of these regulations. Some of these regulations are introduced by the FDA and FSSAI. These regulations cover health supplements, food for special dietary use, and probiotic and prebiotic foods. There are recommended dietary allowances and safe upper limits recognized by the Food and Nutrition Board of the National Academy of Medicine. There are regulatory challenges related to the safety, quality, and effectiveness of bone & joint health supplements. Regulations regarding vitamins-based and omega fatty acids-based supplements offered in South Africa ensure that all the products are registered and evaluated under SAHPRA. These new regulations can pose significant challenges for the overall market.

The tablet segment is estimated to grow at the highest CAGR during the forecast period

The tablet form of bone & joint health supplements is widely consumed on account of the easy availability of various dosage patterns, easy packaging techniques, storage, and cost-effectiveness. Bone and joint health supplements in the tablet form are consumed for various nutrients such as vitamins and omega-3 fatty acids enclosed in it. Tablets are also preferred in comparison to other types of nutritional supplements due to the high shelf life associated with them. Compressed tablets have the advantage of being generally stable and available in a variety of sizes and shapes. As a result, a wide range of nutritional supplements can be easily incorporated into tablet form. For this reason, compressed tablets are popular.

The supermarket/hypermarket segment is estimated to account for the largest share in the market in 2022

Supermarkets expanded the scope of traditional smaller grocers and general stores to cover products such as health supplements decades ago, and so also represent a small but firmly established sales channel for health food market. Interestingly, unlike Pharmacies, products bought at supermarkets are mostly intended for use by someone other than the consumer, but as gifts, or bought for a family member. Developed countries from North America and Europe are expecting a major growth compared to developing countries because of there is more awareness of health supplements buying criteria though in developing countries people are used by a health supplement from pharmacies only.

North America dominated the bone and joint health supplements market, with a value of USD 3,736.6 million in 2021; it is projected to reach USD 5,873.9 million by 2027, at a CAGR of 7.9% during the forecast period.

North America is one of the major consumers of bone & joint health supplements globally, owing to the high demand from elderly people population. Due to this, a few leading manufacturers are established across this region, such as Procter & Gamble (US), Amway (US), Archer Daniels Midland (US), Reckitt Benckiser (UK), Pfizer (US), Arazo Nutrition (US), Nature’s Sunshine Products, Inc (US). Increasing aging population in the Asia Pacific region in countries such as Japan, China and India which are witnessing the higher growth in future for bone & joint health supplements. Hence, in terms of growth, it is expected that the Asia Pacific region would be growing at the highest rate, driven by the increasing awareness of bone & joint health with increasing aging population.

To know about the assumptions considered for the study, download the pdf brochure

Top Comapnies in the Bone and Joint Health Supplements Market

The key players in this market include Bayer AG(Germany), Procter & Gamble (US), Amway (US), Basf SE (Germany) and Archer Daniels Midland (US).

Scope of the Report

|

Report Metric |

Details |

|

Market size value in 2022 |

USD 11.7 billion |

|

Market size value in 2027 |

USD 17.6 billion |

|

Growth Rate |

CAGR of 8.5% |

|

Market size estimation |

2022–2027 |

|

Market size estimation |

2022–2027 |

|

Base year considered |

2021 |

|

Forecast period considered |

2022–2027 |

|

Units considered |

Value (USD) |

|

Segments covered |

By type, distribution channel, form, target consumer and region |

|

Regions covered |

North America, Asia Pacific, Europe, South America and RoW |

|

Companies studied |

|

Bone and Joint Health Supplements Market Report Segmentation:

This research report categorizes the Bone and Joint Health Supplements Market, based on type, distribution channel, form, target consumer and region

By Type

- Vitamin D

- Vitamin K

- Calcium

- Collagen

- Omega-3 Fatty acids

- Glucosamine-Chondroitin

- Others

By Distribution channels

- Supermarkets/hypermarkets

- Pharmacies & drug stores

- Health & beauty stores

- Others

By Form:

- Tablets

- Capsules

- Liquid

- Powder

- Others

By Target consumers:

- Infants

- Children

- Adults

- Pregnant woman

- Elderly people

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Target Audience:

- Manufacturers of food products, beverages, and bone & joint health supplements

- Manufacturers of nutraceutical ingredients

- Intermediary suppliers, such as traders and distributors of nutraceutical products

- Government and research organizations

- Associations, regulatory bodies, and other industry-related bodies:

- Food and Agriculture Organization (FAO)

- United States Department of Agriculture (USDA)

- Food Safety Council (FSC)

- Food and Drug Administration (FDA)

- European Food Safety Authority (EFSA)

- Food Standards Australia New Zealand (FSANZ)

- Dietary Supplement Health and Education Act (DSHEA)

- International Probiotics Association

- Indian Health Foods and Dietary Supplements Association (INHADSA)

Recent Developments

- In February 2022, Amway has launched jelly strips under its flagship brand Nutrilite.

- In December 2021, ADM acquired Flavor Infusion International(FISA), a full range provider of flavor and specialty ingredients across Latin America and the Caribbean.

- In November 2021, Nature’s Bounty has launched jelly beans vitamins that cater to a variety of wellness needs.

- In November 2020, Bayer acquired a majority stake in Care/of which manufactures high quality vitamins, supplements and powders.

- In August 2019, Herbs Nutriproducts Pvt. Ltd. has opened Pure Nutrition brand store at Delhi airport. The store has a wide range of products including bone and joint health supplements.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the bone and joint health supplements market?

North America dominated the bone and joint health supplements market, with a value of USD 3.7 Billion in 2021; it is projected to reach USD 5.8 Billion by 2027, at a CAGR of 7.9% during the forecast period.

How big is the bone and joint health supplements market?

The global bone and joint health supplements market is estimated to be valued at USD 10.8 billion in 2022. It is projected to reach USD 17.6 billion by 2027, recording a CAGR of 8.5% during the forecast period.

Which are the key players in the bone and joint health supplements market, and how intense is the competition?

Key players in this market include Bayer AG(Germany), Procter & Gamble (US), Amway (US), BASF SE (Germany), Archer Daniels Midland (US), Reckitt Benckiser (UK), Pfizer (US), Vita Life Sciences Ltd (Australia), Arazo Nutrition (US), Nature’s Sunshine Products, Inc (US), (France), and Glanbia Plc (Ireland). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 35)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.4 REGIONS COVERED

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2021

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 2 BONE & JOINT HEALTH SUPPLEMENTS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

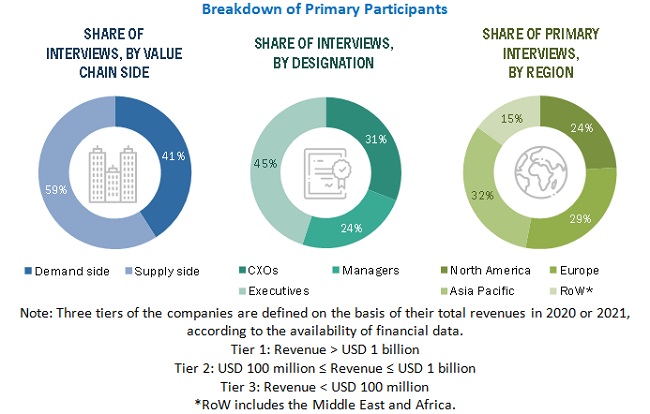

2.1.2.3 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION, BY TYPE (SUPPLY-SIDE)

FIGURE 5 MARKET SIZE ESTIMATION (DEMAND-SIDE)

2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 6 BONE AND JOINT HEALTH SUPPLEMENTS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 ASSUMPTIONS FOR THE STUDY

2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 51)

TABLE 2 BONE AND JOINT HEALTH SUPPLEMENTS MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 9 MARKET SIZE, BY TYPE, 2022 VS. 2027 (USD BILLION)

FIGURE 10 MARKET SIZE, BY FORM, 2022 VS. 2027 (USD BILLION)

FIGURE 11 MARKET SIZE, BY DISTRIBUTION CHANNEL, 2022 VS. 2027 (USD BILLION)

FIGURE 12 MARKET SIZE, BY TARGET CONSUMER, 2022 VS. 2027 (USD BILLION)

FIGURE 13 MARKET SHARE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN THE BONE & JOINT HEALTH SUPPLEMENTS MARKET

FIGURE 14 EMERGING ECONOMIES OFFER OPPORTUNITIES FOR MARKET GROWTH

4.2 NORTH AMERICA: BONE & JOINT HEALTH SUPPLEMENT MARKET, BY TYPE & COUNTRY

FIGURE 15 VITAMIN D FORMED THE DOMINANT SEGMENT IN TERMS OF TYPE, IN THE NORTH AMERICAN BONE AND JOINT HEALTH SUPPLEMENTS MARKET

4.3 MARKET, BY TARGET CONSUMERS

FIGURE 16 ELDERLY SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.4 BONE & JOINT HEALTH SUPPLEMENT MARKET, BY FORM AND BY REGION

FIGURE 17 NORTH AMERICA LED THE MARKET IN 2021

4.5 BONE & JOINT HEALTH SUPPLEMENTS MARKET, BY REGION

FIGURE 18 THE US ACCOUNTED FOR THE LARGEST SHARE OF THE GLOBAL MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 AGING POPULATION

FIGURE 19 POPULATION AGED 65 & ABOVE (% OF TOTAL POPULATION) (2016–2020)

5.2.2 GLOBAL POPULATION IS WITNESSING A HIGH PROPORTION OF OBESITY

5.2.3 KEY FACTS

5.3 MARKET DYNAMICS

FIGURE 20 DIETARY SUPPLEMENTS MARKET: MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Increase in the prevalence of vitamin D deficiencies across the globe is expected to boost demand

5.3.1.2 Shift in consumer preferences due to the rising health awareness

5.3.1.3 Aging population to drive the market growth

FIGURE 21 AGING POPULATION IN JAPAN, 2014 - 2021

FIGURE 22 AGING POPULATION IN CHINA, 2014 - 2021

FIGURE 23 AGING POPULATION IN UK, 2014 - 2021

FIGURE 24 AGING POPULATION IN GERMANY, 2014 - 2021

FIGURE 25 PERCENTAGE OF US ADULTS BY AGE TAKING DIETARY SUPPLEMENTS, 2021

5.3.1.4 Growing retail sale of nutritional & fortified products

FIGURE 26 RETAIL SALE OF NUTRITIONAL AND FORTIFIED PRODUCTS IN AUSTRALIA (USD MILLION), 2018-2022

5.3.2 RESTRAINTS

5.3.2.1 High R&D investments and high cost of clinical trials

5.3.3 OPPORTUNITIES

5.3.3.1 Rise in the number of osteoporosis patients is anticipated to propel the market demand

5.3.3.2 Food fortification to satisfy consumer awareness about micronutrient deficiencies

5.3.4 CHALLENGES

5.3.4.1 Consumer skepticism associated with nutraceutical products

5.3.4.2 Regulatory influence

6 INDUSTRY TRENDS (Page No. - 68)

6.1 OVERVIEW

6.2 REGULATORY FRAMEWORK

6.2.1 NORTH AMERICA

6.2.1.1 Canada

6.2.1.2 US

6.2.1.3 Mexico

6.2.2 EUROPEAN UNION

6.2.3 ASIA PACIFIC

6.2.3.1 Japan

6.2.3.2 China

6.2.3.3 India

6.2.3.4 Australia & New Zealand

6.2.4 SOUTH AMERICA

6.2.4.1 Brazil

6.2.4.2 Argentina

6.2.5 MIDDLE EAST

6.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 3 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 4 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 5 ASIA-PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 6 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.4 TRADE ANALYSIS

TABLE 8 KEY EXPORTING COUNTRIES WITH EXPORT VALUE OF VITAMINS & VITAMIN SUPPLEMENTS, 2021 (USD MILLION)

FIGURE 27 IMPORT TARIFF OF KEY COUNTRIES ON VITAMINS & VITAMIN SUPPLEMENTS, 2020 (%)

6.5 PATENT ANALYSIS

FIGURE 28 NO OF PATENTS GRANTED FOR BONE AND JOINT HEALTH SUPPLEMENTS MARKET, 2011-2021

FIGURE 29 REGIONAL ANALYSIS OF PATENT GRANTED FOR THE MARKET, 2011-2021

TABLE 9 KEY PATENTS PERTAINING TO BONE & JOINT HEALTH SUPPLEMENTS, 2021

6.6 VALUE CHAIN ANALYSIS

FIGURE 30 BONE & HEALTH SUPPLEMENTS: VALUE CHAIN ANALYSIS

6.6.1 RESEARCH & DEVELOPMENT

6.6.2 MANUFACTURING

6.6.3 PACKAGING AND STORAGE

6.6.4 DISTRIBUTION

6.6.5 END USER

6.7 TRENDS/DISRUPTIONS IMPACTING THE CUSTOMER’S BUSINESS

FIGURE 31 YC-YCC SHIFT FOR THE BONE AND JOINT HEALTH SUPPLEMENTS MARKET

6.8 ECOSYSTEM/MARKET MAP

TABLE 10 DIETARY SUPPLEMENTRS MARKET: ECOSYSTEM

6.8.1 MARKET MAP

FIGURE 32 MARKET: MARKET MAP

6.9 TECHNOLOGY ANALYSIS

6.9.1 FOOD MICROENCAPSULATION

6.9.1.1 Encapsulation of Omega-3 to mask the odor

6.9.2 BIOTECHNOLOGY

6.9.3 INNOVATIVE AND DISRUPTIVE TECH

6.9.3.1 Robotics as a key technological trend leading to innovations in the market

6.9.3.2 3D printing to uplift the future of the dietary supplements market with high end products

6.9.3.3 Hologram Sciences: Consumer-facing digital platforms for personalized nutrition and advice

6.10 PORTER’S FIVE FORCES ANALYSIS

TABLE 11 BONE & JOINT HEALTH SUPPLEMENTS MARKET: PORTER’S FIVE FORCES ANALYSIS

6.10.1 DEGREE OF COMPETITION

6.10.2 BARGAINING POWER OF SUPPLIERS

6.10.3 BARGAINING POWER OF BUYERS

6.10.4 THREAT OF SUBSTITUTES

6.10.5 THREAT OF NEW ENTRANTS

6.11 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 12 BONE AND JOINT HEALTH SUPPLEMENTS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6.12 KEY STAKEHOLDERS & BUYING CRITERIA

6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 33 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE FORMS

TABLE 13 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE FORMS (%)

6.12.2 BUYING CRITERIA

FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE FORMS

TABLE 14 KEY BUYING CRITERIA FOR TOP THREE FORMS

6.13 CASE STUDY ANALYSIS

6.13.1 SAFETY ASSESSMENT AND CERTIFICATION DEMAND BY INDUSTRY PLAYERS TO ENSURE TRANSPARENCY

6.13.1.1 Problem statement

6.13.1.2 Solution offered

6.13.1.3 Outcome

6.13.2 FRUNUTTA STARTED OFFERING EASY-TO-USE AND EFFICIENT-TO-TAKE VITAMIN AND MINERAL PILLS THAT DISSOLVE INSTANTLY

6.13.2.1 Problem statement

6.13.2.2 Solution offered

6.13.2.3 Outcome

6.13.3 NOW FOODS AVAILS FLAVOURED DIETARY SUPPLEMENT PRODUCTS

6.13.3.1 Problem statement

6.13.3.2 Solution offered

6.13.3.3 Outcome

6.13.4 BAYER AG: HOW CAN WE MAKE OUR EXTENDED LIFESPAN A HEALTHY ONE?

6.13.4.1 Problem statement

6.13.4.2 Solution offered

6.13.4.3 Outcome

6.14 AVERAGE SELLING PRICES

FIGURE 35 PRICING ANALYSIS: BONE AND JOINT HEALTH SUPPLEMENTS MARKET, BY TYPE

FIGURE 36 PRICING ANALYSIS OF KEY PLAYERS: MARKET, BY REGION

FIGURE 37 PRICING ANALYSIS: MARKET, BY FORM (2017–2021), USD/KG

FIGURE 38 PRICING ANALYSIS: MARKET, BY REGION (2017–2021), USD/KG

7 BONE & JOINT HEALTH SUPPLEMENTS MARKET, BY TYPE (Page No. - 101)

7.1 INTRODUCTION

FIGURE 39 BONE & JOINT HEALTH SUPPLEMENTS MARKET, BY TYPE, 2022 VS 2027 (USD MILLION)

TABLE 15 MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 16 MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

7.2 VITAMIN D

7.2.1 DEFICIENCY OF VITAMIN D IS THE KEY FACTOR DRIVING THEIR USAGE

TABLE 17 VITAMIN D: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 18 VITAMIN D: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.3 VITAMIN K

7.3.1 VITAMIN K PLAYS A VITAL ROLE IN BONE HEALTH

TABLE 19 VITAMIN K: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 20 VITAMIN K: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.4 CALCIUM

7.4.1 LACTOSE INTOLERANCE PEOPLE DRIVING THE GROWTH OF CALCIUM SUPPLEMENTS

TABLE 21 CALCIUM: BONE AND JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 22 CALCIUM: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.5 COLLAGEN

7.5.1 RISE IN THE AGING POPLUATION IN DEVELOPED COUNTRIES CONTRIBUTES TO HIGHER GROWTH OF THE COLLAGEN MARKET IN FUTURE

TABLE 23 COLLAGEN: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 24 COLLAGEN: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.6 OMEGA 3 FATTY ACID

7.6.1 OMEGA 3 FATTY ACIDS HAVE ANTI-INFLAMMATORY EFFECTS

TABLE 25 OMEGA 3 FATTY ACID: BONE AND JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 26 OMEGA 3 FATTY ACID: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.7 GLUCOSAMINE AND CHONDROITIN

7.7.1 HEALTH-CONSCIOUS PEOPLE ARE TAKING GLUCOSAMINE AND CHONDROITIN AS A PREVENTIVE MEASURE AGAINST ARTHRITIS

TABLE 27 GLUCOSAMINE AND CHONDROITIN: BONE & JOINT HEALTH SUPPLEMENT MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 28 GLUCOSAMINE AND CHONDRAITIN: BONE & JOINT HEALTH SUPPLEMENT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.8 OTHER TYPES

7.8.1 VEGAN AND VEGETARIAN PEOPLE ARE DRIVING THE DEMAND FOR PLANT BASED SUPPLEMENTS

TABLE 29 OTHER TYPES: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 30 OTHER TYPES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8 BONE AND JOINT HEALTH SUPPLEMENTS MARKET, BY FORM (Page No. - 112)

8.1 INTRODUCTION

FIGURE 40 MARKET SHARE, BY FORM, 2022 VS. 2027 (USD MILLION)

TABLE 31 MARKET SIZE, BY FORM, 2017–2021 (USD MILLION)

TABLE 32 MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

TABLE 33 MARKET SIZE, BY FORM, 2017–2021 (KILOTONS)

TABLE 34 MARKET SIZE, BY FORM, 2022–2027 (KILOTONS)

8.2 TABLETS

8.2.1 LONG LIFE IS THE KEY TO THE GROWTH OF THE TABLET FORM OF BONE & JOINT HEALTH SUPPLEMENTS

TABLE 35 TABLETS: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 36 TABLETS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 37 TABLETS: MARKET SIZE, BY REGION, 2017–2021 (KILOTONS)

TABLE 38 TABLETS: MARKET SIZE, BY REGION, 2022–2027 (KILOTONS)

8.3 CAPSULES

8.3.1 FASTER ABSORPTION OF NUTRIENTS THROUGH CAPSULES

TABLE 39 CAPSULES: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 40 CAPSULES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 41 CAPSULES: MARKET SIZE, BY REGION, 2017–2021 (KILOTONS)

TABLE 42 CAPSULES: MARKET SIZE, BY REGION, 2022–2027 (KILOTONS)

8.4 LIQUID

8.4.1 HIGH ABSORPTION OF LIQUIDS UPON CONSUMPTION IS EXPECTED TO PROPEL THE MARKET GROWTH OF LIQUID SUPPLEMENTS

TABLE 43 LIQUID: BONE AND JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 44 LIQUID: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 45 LIQUID: MARKET SIZE, BY REGION, 2017–2021 (KILOTONS)

TABLE 46 LIQUID: MARKET SIZE, BY REGION, 2022–2027 (KILOTONS)

8.5 POWDER

8.5.1 EASY RELEASE OF ACTIVE INGREDIENTS DRIVING THE USAGE OF THE POWDER FORM

TABLE 47 POWDER: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 48 POWDER: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 49 POWDER: MARKET SIZE, BY REGION, 2017–2021 (KILOTONS)

TABLE 50 POWDER: MARKET SIZE, BY REGION, 2022–2027 (KILOTONS)

8.6 OTHER FORMS

8.6.1 RELATIVELY LOW-COST DRIVING DEMAND OF OTHER SEGMENT

TABLE 51 OTHER FORMS: BONE AND JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 52 OTHER FORMS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 53 OTHER FORMS: MARKET SIZE, BY REGION, 2017–2021 (KILOTONS)

TABLE 54 OTHER FORMS: MARKET SIZE, BY REGION, 2022–2027 (KILOTONS)

9 BONE AND JOINT HEALTH SUPPLEMENTS MARKET, BY TARGET CONSUMER (Page No. - 125)

9.1 INTRODUCTION

FIGURE 41 MARKET, BY TARGET CONSUMER, 2022 VS. 2027 (USD MILLION)

TABLE 55 MARKET SIZE, BY TARGET CONSUMER, 2017–2021 (USD MILLION)

TABLE 56 MARKET SIZE, BY TARGET CONSUMER, 2022–2027 (USD MILLION)

9.2 INFANTS

9.2.1 ESSENTIAL NUTRIENTS REQUIRED FOR INFANT NUTRITION TRIGGER THE DEMAND FOR BONE & JOINT HEALTH SUPPLEMENTS

TABLE 57 INFANTS: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 58 INFANTS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.3 CHILDREN

9.3.1 RISE IN CONSUMPTION OF NUTRIENTS AMONG CHILDREN PROPELLING THE DEMAND FOR BONE & JOINT HEALTH SUPPLEMENTS

TABLE 59 CHILDREN: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 60 CHILDREN: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.4 ADULTS

9.4.1 DEFICIENCY OF SEVERAL MINERALS AND VITAMINS IN ADULTS

TABLE 61 ADULTS: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 62 ADULTS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.5 PREGNANT WOMEN

9.5.1 REQUIREMENT FOR OPTIMAL NUTRITION DURING PREGNANCY DRIVING THE DEMAND FOR BONE & JOINT HEALTH SUPPLEMENTS

TABLE 63 PREGNANT WOMEN: BONE AND JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 64 PREGNANT WOMEN: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.6 ELDERLY

9.6.1 NEED FOR CONSUMPTION OF BONE & JOINT HEALTH SUPPLEMENTS BY THE AGING POPULATION

TABLE 65 ELDERLY: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 66 ELDERLY: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10 BONE & JOINT HEALTH SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL (Page No. - 134)

10.1 INTRODUCTION

FIGURE 42 MARKET, BY DISTRIBUTION CHANNEL, 2022 VS. 2027 (USD MILLION)

TABLE 67 MARKET SIZE, BY DISTRIBUTION CHANNEL, 2017–2021 (USD MILLION)

TABLE 68 MARKET SIZE, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

10.2 SUPERMARKETS/HYPERMARKETS

10.2.1 SUPERMARKETS OF DEVELOPED COUNTRIES CONTRIBUTE A MAJOR SHARE OF BONE & JOINT HEALTH SUPPLEMENTS

TABLE 69 SUPERMARKETS/HYPERMARKETS: BONE AND JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 70 SUPERMARKETS/HYPERMARKETS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.3 PHARMACIES & DRUG STORES

10.3.1 ELDERLY PEOPLE PREFER PHARMACIES OVER CONVENTIONAL STORE

TABLE 71 PHARMACIES & DRUG STORES: BONE & JOINT HEALTH MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 72 PHARMACIES & DRUG STORES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.4 HEALTH AND BEAUTY STORES

10.4.1 PATIENT-DIRECTED APPROACH DRIVES THE MARKET FOR HEALTH CENTERS, GLOBALLY

TABLE 73 HEALTH & BEAUTY STORES: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 74 HEALTH & BEAUTY STORES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.5 OTHER DISTRIBUTION CHANNELS

10.5.1 EASY ACCESSIBILITY TO A WIDE RANGE OF HEALTH PRODUCTS AIDS SALES OF BONE & JOINT HEALTH SUPPLEMENTS

TABLE 75 OTHER DISTRIBUTION CHANNELS: BONE AND JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 76 OTHER DISTRIBUTION CHANNELS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

11 BONE & JOINT HEALTH SUPPLEMENTS MARKET, BY REGION (Page No. - 141)

11.1 INTRODUCTION

FIGURE 43 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

FIGURE 44 INDIA IS EXPECTED TO REGISTER THE HIGHEST CAGR IN THE GLOBAL MARKET FROM 2022 TO 2027

TABLE 77 GLOBAL MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 78 GLOBAL MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 79 GLOBAL MARKET SIZE, BY REGION, 2017–2021 (KILOTONS)

TABLE 80 GLOBAL BONE AND JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2022–2027 (KILOTONS)

11.2 NORTH AMERICA

FIGURE 45 NORTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SNAPSHOT

TABLE 81 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY FORM, 2017–2021 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY FORM, 2017–2021 (KILOTONS)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY FORM, 2022–2027 (KILOTONS)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY TARGET CONSUMER, 2017–2021 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY TARGET CONSUMER, 2022–2027 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2017–2021 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

11.2.1 US

11.2.1.1 Vitamin D deficiency fueling the growth of the bone and joint health supplements market

TABLE 93 US: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 94 US: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Markets for Omega-3 fatty acids, vitamin d, and calcium as bone & joint health supplements gaining an opportunity

FIGURE 46 DEATHS BY DISEASES OF THE MUSCULOSKELETAL SYSTEM AND CONNECTIVE TISSUE IN CANADA

TABLE 95 CANADA: MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 96 CANADA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

11.2.3 MEXICO

11.2.3.1 Malnutrition and obesity triggering the demand for bone & joint health supplements

TABLE 97 MEXICO: MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 98 MEXICO: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

11.3 EUROPE

TABLE 99 EUROPE: BONE and JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 100 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 101 EUROPE: MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 102 EUROPE: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 103 EUROPE: MARKET SIZE, BY FORM, 2017–2021 (USD MILLION)

TABLE 104 EUROPE: MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

TABLE 105 EUROPE: MARKET SIZE, BY FORM, 2017–2021 (KILOTONS)

TABLE 106 EUROPE: MARKET SIZE, BY FORM, 2022–2027 (KILOTONS)

TABLE 107 EUROPE: MARKET SIZE, BY TARGET CONSUMER, 2017–2021 (USD MILLION)

TABLE 108 EUROPE: MARKET SIZE, BY TARGET CONSUMER, 2022–2027 (USD MILLION)

TABLE 109 EUROPE: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2017–2021 (USD MILLION)

TABLE 110 EUROPE: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Surge in demand for plant-based food products provides an avenue for herbal supplements

TABLE 111 GERMANY: BONE AND JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 112 GERMANY: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

11.3.2 UK

11.3.2.1 Increasing risk of arthritis gaining popularity for bone & joint health supplements

TABLE 113 UK: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 114 UK: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

11.3.3 FRANCE

11.3.3.1 Government support for promoting the consumption of nutritional supplements

TABLE 115 FRANCE: MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 116 FRANCE: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

11.3.4 ITALY

11.3.4.1 Higher prevalence of vitamin d deficiency driving the demand for bone & joint health supplements

TABLE 117 ITALY: MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 118 ITALY: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

11.3.5 SPAIN

11.3.5.1 Consumer preference for clean-label ingredients paving the way for bone & joint health supplement products

TABLE 119 SPAIN: BONE AND JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 120 SPAIN: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

11.3.6 REST OF EUROPE

11.3.6.1 Rising aging population and growing awareness about the importance of consuming healthy foods

TABLE 121 REST OF EUROPE: MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 122 REST OF EUROPE: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 47 ASIA PACIFIC: BONE & JOINT HEALTH SUPPLEMENTS MARKET SNAPSHOT

TABLE 123 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET SIZE, BY FORM, 2017–2021 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET SIZE, BY FORM, 2017–2021 (KILOTONS)

TABLE 130 ASIA PACIFIC: MARKET SIZE, BY FORM, 2022–2027 (KILOTONS)

TABLE 131 ASIA PACIFIC: MARKET SIZE, BY TARGET CONSUMER, 2017–2021 (USD MILLION)

TABLE 132 ASIA PACIFIC: MARKET SIZE, BY TARGET CONSUMER, 2022–2027 (USD MILLION)

TABLE 133 ASIA PACIFIC: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2017–2021 (USD MILLION)

TABLE 134 ASIA PACIFIC: BONE AND JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Elderly and the millennial population are the forefront users of nutritional supplements for bone & joint health

TABLE 135 CHINA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 136 CHINA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

11.4.2 INDIA

11.4.2.1 The millennial population play a key role in driving the demand for bone & joint health supplements

TABLE 137 INDIA: MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 138 INDIA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

11.4.3 JAPAN

11.4.3.1 Rise in the aging population is driving the growth of the market

FIGURE 48 JAPAN: COUNTRIES WITH THE LARGEST SHARE OF POPULATION AGED 65 OR OVER, 2019

TABLE 139 JAPAN: MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 140 JAPAN: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

11.4.4 REST OF ASIA PACIFIC

11.4.4.1 Surge in the consumption rate of several types of healthy food products helping the growth of nutritional supplements of bone & joint supplements

TABLE 141 REST OF ASIA PACIFIC: BONE AND JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 142 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

11.5 SOUTH AMERICA

TABLE 143 SOUTH AMERICA: BONE AND JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 144 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 145 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 146 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 147 SOUTH AMERICA: MARKET SIZE, BY FORM, 2017–2021 (USD MILLION)

TABLE 148 SOUTH AMERICA: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

TABLE 149 SOUTH AMERICA: MARKET SIZE, BY FORM, 2017–2021 (KILOTONS)

TABLE 150 SOUTH AMERICA: MARKET SIZE, BY FORM, 2022–2027 (KILOTONS)

TABLE 151 SOUTH AMERICA: MARKET SIZE, BY TARGET CONSUMER, 2017–2021 (USD MILLION)

TABLE 152 SOUTH AMERICA: MARKET SIZE, BY TARGET CONSUMER, 2022–2027 (USD MILLION)

TABLE 153 SOUTH AMERICA: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2017–2021 (USD MILLION)

TABLE 154 SOUTH AMERICA: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

11.5.1 BRAZIL

11.5.1.1 Increasing obesity is driving the consumers toward bone & joint health supplements

TABLE 155 BRAZIL: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 156 BRAZIL: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

11.5.2 ARGENTINA

11.5.2.1 Increase in the osteoporosis concern influencing the growth of bone & joint health supplements

TABLE 157 ARGENTINA: BONE AND JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 158 ARGENTINA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

11.5.3 REST OF SOUTH AMERICA

11.5.3.1 Influence of health and wellness trends contributing to the market growth

TABLE 159 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 160 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

11.6 REST OF THE WORLD

TABLE 161 REST OF THE WORLD: BONE AND JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 162 REST OF THE WORLD: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 163 REST OF THE WORLD: MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 164 REST OF THE WORLD: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 165 REST OF THE WORLD: MARKET SIZE, BY FORM, 2017–2021 (USD MILLION)

TABLE 166 REST OF THE WORLD: MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

TABLE 167 REST OF THE WORLD: MARKET SIZE, BY FORM, 2017–2021 (KILOTONS)

TABLE 168 REST OF THE WORLD: MARKET SIZE, BY FORM, 2022–2027 (KILOTONS)

TABLE 169 REST OF THE WORLD: MARKET SIZE, BY TARGET CONSUMER, 2017–2021 (USD MILLION)

TABLE 170 REST OF THE WORLD: MARKET SIZE, BY TARGET CONSUMER, 2022–2027 (USD MILLION)

TABLE 171 REST OF THE WORLD: BONE & JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2017–2021 (USD MILLION)

TABLE 172 REST OF THE WORLD: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

11.6.1 AFRICA

11.6.1.1 Prevalence of vitamin deficiency among women and children results in concerning authorities providing food products, including bone & joint health supplements

TABLE 173 AFRICA: MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 174 AFRICA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

11.6.2 MIDDLE EAST

11.6.2.1 Use of bone & joint health supplements for the pharmaceuticals and sports nutrition segments

TABLE 175 MIDDLE EAST: BONE AND JOINT HEALTH SUPPLEMENTS MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 176 MIDDLE EAST: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 197)

12.1 OVERVIEW

12.2 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 49 THREE-YEAR TOTAL REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2019–2021 (USD BILLION)

12.3 MARKET SHARE ANALYSIS, 2021

TABLE 177 BONE & JOINT HEALTH SUPPLEMENTS MARKET: DEGREE OF COMPETITION

12.4 KEY PLAYER STRATEGIES

12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

12.5.1 STARS

12.5.2 PERVASIVE PLAYERS

12.5.3 EMERGING LEADERS

12.5.4 PARTICIPANTS

FIGURE 50 BONE AND JOINT HEALTH SUPPLEMENTS MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

12.6 PRODUCT FOOTPRINT

TABLE 178 COMPANY, BY TYPE FOOTPRINT

TABLE 179 COMPANY, BY APPLICATION FOOTPRINT

TABLE 180 COMPANY, BY REGIONAL FOOTPRINT

TABLE 181 COMPANY, BY OVERALL FOOTPRINT

12.7 START-UP/SME EVALUATION QUADRANT (OTHER PLAYERS)

12.7.1 PROGRESSIVE COMPANIES

12.7.2 STARTING BLOCKS

12.7.3 RESPONSIVE COMPANIES

12.7.4 DYNAMIC COMPANIES

FIGURE 51 BONE & JOINT HEALTH SUPPLEMENTS MARKET: COMPANY EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

TABLE 182 DETAILED LIST OF KEY STARTUP/SMES

TABLE 183 BONE & JOINT HEALTH MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

12.7.5 NEW PRODUCT LAUNCHES

TABLE 184 BONE AND JOINT HEALTH SUPPLEMENTS MARKET: NEW PRODUCT LAUNCHES, 2018–2021

12.7.6 DEALS

TABLE 185 BONE & JOINT HEALTH SUPPLEMENTS MARKET: DEALS, 2018–2021

13 COMPANY PROFILES (Page No. - 209)

(Business overview, Products offered, Recent Developments, MNM view)*

13.1 KEY PLAYERS

13.1.1 BAYER AG

TABLE 186 BAYER AG: BUSINESS OVERVIEW

FIGURE 52 BAYER: COMPANY SNAPSHOT

TABLE 187 BAYER AG: PRODUCTS OFFERED

13.1.2 PROCTER & GAMBLE

TABLE 188 PROCTER & GAMBLE: BUSINESS OVERVIEW

FIGURE 53 PROCTER & GAMBLE: COMPANY SNAPSHOT

TABLE 189 PROCTER & GAMBLE: PRODUCTS OFFERED

13.1.3 AMWAY

FIGURE 54 AMWAY: COMPANY SNAPSHOT

TABLE 190 AMWAY: PRODUCTS OFFERED

13.1.4 BASF SE

TABLE 191 BASF SE: BONE AND JOINT HEALTH SUPPLEMENTS MARKET BUSINESS OVERVIEW

FIGURE 55 BASF SE: COMPANY SNAPSHOT

TABLE 192 BASF SE: PRODUCTS OFFERED

13.1.5 ADM

TABLE 193 ADM: BUSINESS OVERVIEW

FIGURE 56 ADM: COMPANY SNAPSHOT

TABLE 194 ADM: PRODUCTS OFFERED

13.1.6 RECKITT BENCKISER GROUP PLC

TABLE 195 RECKITT BENCKISER GROUP PLC: BUSINESS OVERVIEW

FIGURE 57 RECKITT BENCKISER: COMPANY SNAPSHOT

TABLE 196 RECKITT BENCKISER: PRODUCTS OFFERED

13.1.7 PFIZER

TABLE 197 PFIZER: BUSINESS OVERVIEW

FIGURE 58 PFIZER: COMPANY SNAPSHOT

TABLE 198 PFIZER: PRODUCTS OFFERED

13.1.8 VITA LIFE SCIENCES

TABLE 199 VITA LIFE SCIENCES: BUSINESS OVERVIEW

FIGURE 59 VITA LIFE SCIENCES: COMPANY SNAPSHOT

TABLE 200 VITA LIFE SCIENCES: PRODUCTS OFFERED

13.1.9 NATURE'S SUNSHINE PRODUCTS, INC.

TABLE 201 NATURE'S SUNSHINE PRODUCTS, INC.: BUSINESS OVERVIEW

FIGURE 60 NATURE'S SUNSHINE PRODUCTS, INC.: COMPANY SNAPSHOT

TABLE 202 NATURE'S SUNSHINE PRODUCTS, INC.: PRODUCTS OFFERED

13.1.10 GLANBIA PLC

TABLE 203 GLANBIA PLC: BUSINESS OVERVIEW

FIGURE 61 GLANBIA PLC: COMPANY SNAPSHOT

TABLE 204 GLANBIA PLC: PRODUCTS OFFERED

13.1.11 ARAZO NUTRITION

TABLE 205 ARAZO NUTRITION: BUSINESS OVERVIEW

TABLE 206 ARAZO NUTRITION: PRODUCTS OFFERED

13.1.12 NATURE’S BOUNTY

TABLE 207 NATURE’S BOUNTY: BONE AND JOINT HEALTH SUPPLEMENTS MARKET BUSINESS OVERVIEW

TABLE 208 NATURE’S BOUNTY: PRODUCTS OFFERED

13.1.13 BUTTERFLY AYURVEDA PVT. LTD.

TABLE 209 BUTTERFLY AYURVEDA PVT. LTD.: BUSINESS OVERVIEW

TABLE 210 BUTTERFLY AYURVEDA PVT. LTD.: PRODUCTS OFFERED

13.1.14 HERBS NUTRIPRODUCTS PVT. LTD.

TABLE 211 HERBS NUTRIPRODUCTS PVT. LTD.: BUSINESS OVERVIEW

TABLE 212 HERBS NUTRIPRODUCTS PVT. LTD: PRODUCTS OFFERED

TABLE 213 HERBS NUTRIPRODUCTS PVT. LTD.: OTHERS

13.1.15 MILLENNIUM HERBAL CARE

TABLE 214 MILLENNIUM HERBAL CARE: BUSINESS OVERVIEW

TABLE 215 MILLENNIUM HERBAL CARE: PRODUCTS OFFERED

13.2 OTHER PLAYERS

13.2.1 VITAWIN

13.2.2 NUTRAMAX LABORATORIES CONSUMER CARE, INC.

13.2.3 SIMPLY SUPPLEMENTS

13.2.4 LOVE LIFE SUPPLEMENTS LTD., 245

13.2.5 NOW FOODS

13.2.6 BELLAVITA HEALTHCARE PRIVATE LIMITED

13.2.7 VITACO

13.2.8 NUTRAVITA

13.2.9 LIFE EXTENSION

13.2.10 PURE ENCAPSULATIONS, LLC.

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS (Page No. - 252)

14.1 INTRODUCTION

TABLE 216 ADJACENT MARKETS TO THE FOOD PROCESSING & HANDLING EQUIPMENT MARKET

14.2 LIMITATIONS

14.3 DIETARY SUPPLEMENTS MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

TABLE 217 DIETARY SUPPLEMENTS MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 218 DIETARY SUPPLEMENTS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.4 NUTRACEUTICAL PRODUCTS MARKET

14.4.1 MARKET DEFINITION

14.4.2 MARKET OVERVIEW

TABLE 219 NUTRACEUTICAL PRODUCTS MARKET SIZE, BY TYPE, 2017–2025 (USD BILLION)

14.5 VITAMIN D MARKET

14.5.1 MARKET DEFINITION

14.5.2 MARKET OVERVIEW

TABLE 220 VITAMIN D MARKET SIZE, BY ANALOG, 2016–2019 (USD MILLION)

TABLE 221 VITAMIN D MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

14.6 COLLAGEN MARKET

14.6.1 MARKET DEFINITION

14.6.2 MARKET OVERVIEW

TABLE 222 COLLAGEN MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

15 APPENDIX (Page No. - 257)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the bone and joint health supplements market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects. The following figure depicts the research design applied in drafting this report on the market.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology oriented perspectives

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the bone & joint health supplement market.

To know about the assumptions considered for the study, download the pdf brochure

Bone and Joint Health Supplements Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the starter cultures market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- The revenues of major starter cultures manufacturers were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

- All macroeconomic and microeconomic factors affecting the growth of the market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Bone and Joint Health Supplements Market Report Objectives

- To define, segment, and project the global market for bone & joint health supplements on the basis of type, distribution channel, form, target consumer and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value and volume, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the bone & joint health supplement market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe market for bone & joint health supplements into the The Netherlands, Sweden, Poland, Belgium, Switzerland, and other EU & non-EU countries

- Further breakdown of the Rest of Asia Pacific market for bone & joint health supplements into Thailand, Indonesia, South Korea, Malaysia, Singapore, Australia, New Zealand, and other ASEAN countries

- Further breakdown of the Rest of South America market for bone & joint health supplements into Columbia, Peru, Chile, Uruguay, and Venezuela

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Bone & Joint Health Supplements Market