Nutraceutical Products Market Size, Share & Trends Analysis Report by Type (Food, Beverages, Dietary Supplements), Source (Probiotics, Prebiotics, Vitamins, Minerals), Distribution Channel (Conventional Stores, Specialty Stores, Drugstores & Pharmacies), Region - Global Forecast to 2025

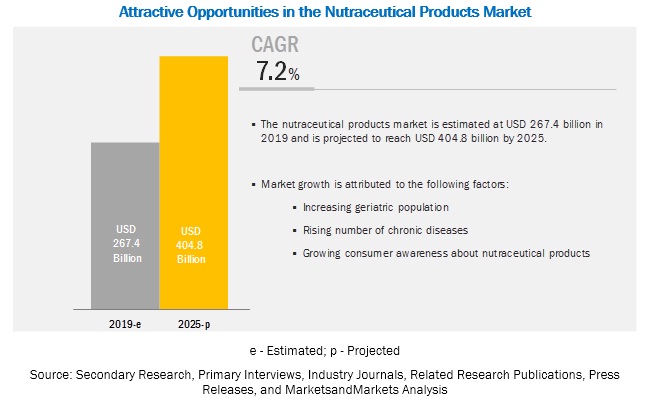

The global nutraceutical products market size was valued at USD 267.4 billion in 2019 and is expected to grow at a CAGR of 7.2% from 2019 to 2025 to reach USD 404.8 billion by 2025. This is due to the increasing geriatric population, a rising number of chronic diseases, and growing consumer awareness about nutraceutical products.

Nutraceuticals Products Market Insights:

The food segment is projected to account for the largest market share during the forecast period.

The food segment dominated the nutraceutical products market in 2019. The increasing trend of on-the-go snacking and the rising demand for nutritional food products are factors projected to drive the demand for snacks products containing functional ingredients. Nutraceutical snacks products mainly include protein-rich snacks, dry nuts, grains, and bars. Other nutraceutical products under the snacks segment include granola bars and other nutritional bars. In addition, the growing trend of opting for protein-rich food products is projected to drive the market growth.

Improved quality, texture, nutritive value, and shelf-life of snack products due to the increasing usage of sources such as vitamins, minerals, proteins, dietary fibers, and fatty acids are projected to drive the growth of the snacks segment in the nutraceuticals product market during the forecast period.

By distribution channel, the conventional stores segment is projected to account for the largest market share during the forecast period.

The conventional stores segment is projected to dominate the market as conventional stores include grocery stores, mass merchandisers, warehouse clubs, and online retailers. Conventional stores are easily accessible to consumers and offer products at economical prices. As a result, these stores are becoming a popular choice for consumers that prefer nutraceutical products.

The specialty stores segment in the nutraceuticals products market is projected to be the fastest-growing segment during the forecast period.

The specialty stores segment is projected to be the fastest-growing segment in the market during the forecast period. Specialty stores that sell nutraceutical products mainly include bakery stores, confectionery stores, and gourmet stores. The presence of bakery stores selling nutraceutical products remains high in Europe. These stores sell nutraceutical bakery products such as bread, rolls, buns, cakes, cookies, and biscuits. As bakery products are considered staple food, particularly bread, in Europe, the popularity of nutraceutical products is projected to remain high in the Western regions, such as North America and particularly Europe. These regions account for nearly 70% share in the overall bakery industry. High demand for bakery products has translated to the increasing presence of bakery stores and leading players in these regions. Some of the bakery stores offering gluten-free bakery products include Hummingbird Bakery, Dawn House, and Primrose Bakery in the UK; Dojo Bakery in Australia; and Pristine Organics in the US.

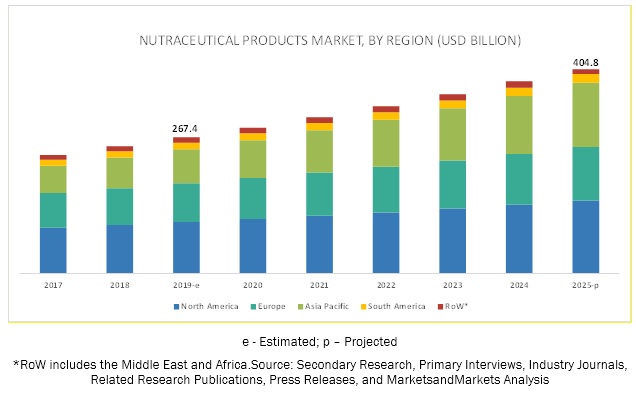

Asia Pacific is projected to record the fastest growth in the nutraceutical products market during the forecast period.

The Asia Pacific market is projected to record the fastest growth in the market. Factors such as busy lifestyles have led to an increase in the consumption of convenience food products. In addition, the rapid economic growth in countries of various regions has led to a surge in demand for fortified nutritional food & beverage products in the region. The food & beverage market in this region is currently undergoing a transformation due to rapid urbanization, diet diversification, and liberalization of foreign direct investment in the food sector. In addition, rising income, increasing purchasing power, and a surge in consumer demand for nutritional & healthy products are factors projected to widen the growth prospects for manufacturers in the nutraceutical products market in the region.

Key Market Players

Key vendors in the global market include Kraft Heinz Company (US), The Hain Celestial Group (US), Conagra (US), General Mills (US), Kellogg's (US), Nestlé (Switzerland), Nature’s Bounty (US), Amway (US), Hero Group (US), Barilla Group (Italy), Raisio Group (Finland), Pfizer Inc.(US), and Freedom Food Group Limited (Australia). These players have broad industry coverage and strong operational and financial strength; they have grown organically and inorganically in the recent past.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2017–2025 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2025 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Type, Distribution Channel, Source, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies covered |

Kraft Heinz Company (US), The Hain Celestial Group (US), Conagra (US), General Mills (US), Kellogg's (US), Nestlé (Switzerland), Nature’s Bounty (US), Amway (US), Hero Group (US), Barilla Group (Italy), Raisio Group (Finland), Pfizer Inc. (US), and Freedom Food Group Limited (Australia). |

This research report categorizes the global market based on type, distribution channel, source, and region.

On the basis of type, the nutraceutical products market has been segmented as follows:

-

Food

- Snacks

- Confectionery products

- Bakery products

- Dairy products

- Infant products

-

Beverages

- Health drinks

- Energy drinks

- Juices

-

Dietary Supplements

- Tablets

- Liquid

- Powder

- Others (Softgels, gummies, and chewable products)

On the basis of distribution channel, the market has been segmented as follows:

-

Conventional stores

- Grocery stores

- Mass merchandisers

- Warehouse clubs

- Online retailers

-

Specialty stores

- Bakery stores

- Confectionery stores

- Gourmet stores

- Health centers

- Cosmetics stores

On the basis of source, the market has been segmented as follows:

- Probiotics

- Proteins & amino acids

- Phytochemicals & plant extracts

- Fibers & Specialty carbohydrates

- Omega-3 fatty acids

- Vitamins

- Prebiotics

- Carotenoids

- Minerals

- Others (Glucosamine, chondroitin, and polyols)

On the basis of region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- RoW (Africa and the Middle East)

Recent Developments:

- In June 2019, Kraft Heinz launched a new brand—Fruitlove, to enter the yogurt market. The company launched its products in different flavors, such as strawberry banana twirl and harvest berry blend.

- Conagra launched a new line of Modern Nutrition Bowls under its brand, EVOL in November 2018. This product line offers breakfast enriched with vitamins and nutrients.

- Kraft Heinz announced the acquisition of Primal Nutrition, LLC (US) in January 2019. The company offers products, such as sauces, condiments, and dressings, with a diverse product portfolio for healthy snacks.

- In April 2019, the Nestlé Health Science entered into a strategic partnership with Amazentis (Switzerland); this would create growth opportunities for Nestlé in the consumer healthcare and medical nutrition segments.

Key Questions Addressed by the Report:

- Who are the major market players in the global market?

- What are the regional growth trends and the major revenue-generating regions for the nutraceutical products market?

- What are the key regions and industries that are projected to witness significant growth in the nutraceutical products market?

- What are the major types of nutraceutical products that are projected to account for major market revenue share during the forecast period?

- What are the major applications of nutraceutical products, and which application is projected to account for the majority of the revenue generated over the forecast period?

Frequently Asked Questions (FAQ):

How big is the nutraceutical industry market?

The nutraceutical products market is projected to grow from USD 267.4 billion in 2019 to USD 404.8 billion by 2025, recording a CAGR of 7.2% during the forecast period.

What are the trending products for nutraceutical?

Which are the largest manufacturers of nutraceuticals?

Key vendors in the global market include Kraft Heinz Company (US), The Hain Celestial Group (US), Conagra (US), General Mills (US), Kellogg's (US), Nestlé (Switzerland), Nature’s Bounty (US), Amway (US), Hero Group (US), Barilla Group (Italy), Raisio Group (Finland), Pfizer Inc.(US), and Freedom Food Group Limited (Australia).

What is the future scope of nutraceuticals?

The nutraceuticals market is estimated to grow at a CAGR of 7.2% between 2019 and 2025. The Asia Pacific market is projected to record the fastest growth in the market. The rapid economic growth in countries of various regions has led to a surge in demand for fortified nutritional food & beverage products in the region.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 21)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Segmentation

1.4 Regions Covered

1.5 Periodization Considered

1.6 Currency Considered

1.7 Stakeholders

2 Research Methodology (Page No. - 25)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions for the Study

2.5 Limitations of the Study

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 36)

4.1 Attractive Opportunities in the Market

4.2 Nutraceutical Products Market: Major Regional Submarkets

4.3 Asia Pacific: Market, By Type & Country

4.4 Market, By Type & Region

4.5 Market, By Distribution Channel, 2019 vs. 2025 (USD Billion)

4.6 Market, By Source & Region, 2018

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Aging Population and Focus on Preventive Healthcare

5.2.1.2 Partnerships Between Companies That Result in Co-Branding and Co-Marketing Between Ingredient Suppliers and Manufacturers of Finished Products

5.2.1.3 Rapid Retail Growth

5.2.1.4 Mandates on Food Fortification By Government Organizations

5.2.1.5 Increased Cost of Healthcare

5.2.2 Restraints

5.2.2.1 Higher Cost for Fortified Food Products Due to the Inclusion of Healthier Or Naturally Sourced Ingredients

5.2.3 Opportunities

5.2.3.1 Product-Based and Technological Innovations in the Nutraceutical Products Industry

5.2.3.2 Manufacturers With Integrated Functional and Medical Food Products

5.2.4 Challenges

5.2.4.1 Consumer Skepticism Associated With Nutraceutical Products

5.3 Value Chain

5.4 Regulations

5.4.1 Organizations/Regulations Governing the Nutraceutical Ingredients Market

5.4.1.1 North America

5.4.1.1.1 Canada

5.4.1.1.2 US

5.4.1.1.3 Mexico

5.4.1.2 European Union (EU)

5.4.1.3 Asia Pacific

5.4.1.3.1 Japan

5.4.1.3.2 China

5.4.1.3.3 India

5.4.1.3.4 Australia & New Zealand

5.4.1.4 Rest of the World (RoW)

5.4.1.4.1 Israel

5.4.1.4.2 Brazil

5.4.2 Organizations/Regulations Governing the Global Market

5.4.2.1 Probiotics

5.4.2.2 National/International Bodies for Safety Standards and Regulations

5.4.2.3 Codex Alimentarius Commission (CAC)

5.4.2.4 North America

5.4.2.5 US

5.4.2.6 Canada

5.4.2.7 Europe: Regulatory Environment Analysis

5.4.2.8 Asia Pacific: Regulatory Environment Analysis

5.4.2.9 Japan

5.4.2.10 India

5.4.2.11 South America

5.4.2.12 Brazil

5.4.3 Prebiotics

5.4.3.1 Introduction

5.4.3.2 Japan

5.4.3.3 Canada

5.4.3.4 US

5.4.3.5 European Union

5.4.3.6 Australia & New Zealand

5.4.3.7 South Korea

5.4.3.8 India

6 Nutraceutical Products Market, By Type (Page No. - 60)

6.1 Introduction

6.2 Food

6.2.1 Snacks

6.2.1.1 Rising Demand for Protein-Rich and Gluten-Free Snacks is Driving the Growth of the Market

6.2.2 Confectionery Products

6.2.2.1 Rising Demand for Protein-Fortified Confectionery Products is Expected to Support the Segmental Growth

6.2.3 Bakery Products

6.2.3.1 Dietary Fiber in Bakery Products Fuels the Market Growth of Nutraceutical Products

6.2.4 Dairy Products

6.2.4.1 High Consumption of Yogurt Fortified With Functional Ingredients is Expected to Propel the Demand for Nutraceutical Dairy Products

6.2.5 Infant Nutrition Products

6.2.5.1 Increasing Demand for Omega-3 Among Infants is Driving the Demand for Nutraceutical Infant Nutrition Products

6.3 Beverages

6.3.1 Health Drinks

6.3.1.1 High Demand for Fortified Beverages to Drive the Health Drinks Segment

6.3.2 Energy Drinks

6.3.2.1 Boosting Immunity Makes these Drinks Popular Among Consumers

6.3.3 Juices

6.3.3.1 Increasing Demand for Organic Drinks is Driving the Market Growth of Juices

6.4 Dietary Supplements

6.4.1 Tablets

6.4.1.1 Long Shelf Life is the Key for Growth of the Tablet Form of Dietary Supplements

6.4.2 Liquid

6.4.2.1 High Absorption of Liquids Upon Consumption is Expected to Propel the Market Growth for Liquid Supplements

6.4.3 Powder

6.4.3.1 Easy Release of Nutraceutical Active Ingredients is Increasing Its Usage Among Consumers

6.4.4 Others

6.4.4.1 Relatively Low Cost of these Types of Supplements Drives Its Demand, Globally

7 Nutraceutical Products Market, By Distribution Channel (Page No. - 69)

7.1 Introduction

7.2 Conventional Stores

7.2.1 Grocery Stores

7.2.1.1 Wide Presence of Grocery Stores Drives the Market for Nutraceutical Products

7.2.2 Mass Merchandisers

7.2.2.1 A Larger Shelf-Space for Nutraceutical Products Promote Nutraceutical Product Sales

7.2.3 Warehouse Clubs

7.2.3.1 Bulk Prices Propel Sales of Nutraceutical Products Via Warehouse Clubs

7.2.4 Online Retailers

7.2.4.1 Easy Accessibility to A Wide Range of Nutraceutical Products Aids Sales of Nutraceutical Products

7.3 Specialty Stores

7.3.1 Bakery Stores

7.3.1.1 High Consumption of Bakery Products in Europe and North America Create Opportunities for Nutraceutical Product Manufacturers in This Segment

7.3.2 Confectionery Stores

7.3.2.1 Increasing Consumption of Soft Jellies and Chocolates Creates Opportunities for Nutraceutical-Induced Confectioneries, And, in Turn, for Confectionery Stores

7.3.3 Gourmet Stores

7.3.3.1 Higher Demand for Imported Or Premium Products Drives the Market for Gourmet Stores

7.3.4 Health Centers

7.3.4.1 Patient-Directed Approach Drives the Market for Health Centers, Globally

7.3.5 Cosmetic Stores

7.3.5.1 Catering to Health and Fitness Requirements is Fueling the Growth of Cosmetic Stores

7.4 Drugstores & Pharmacies

8 Nutraceutical Products Market, By Source (Page No. - 76)

8.1 Introduction

8.2 Proteins & Amino Acids

8.2.1 The Status of Being Essential Nutritional Ingredients for Consumers Helps Drive the Market

8.3 Probiotics

8.3.1 A Wide Range of Applications in Nutraceutical Products to Drive Market Growth

8.4 Phytochemicals & Plant Extracts

8.4.1 High Preference for Natural Ingredients has Been Driving the Market for Phytochemicals & Plant Extracts

8.5 Fibers & Specialty Carbohydrates

8.5.1 Their Usage to Promote Nutritional Health Drives the Growth of the Segment

8.6 Omega-3 Fatty Acids

8.6.1 High Effectiveness of Omega-3 Fatty Acids Against Nutritional Deficiencies Promotes Market Growth for the Ingredient

8.7 Vitamins

8.7.1 Food Fortification Via Vitamins has Been Driving the Segmental Growth

8.8 Prebiotics

8.8.1 Being Efficient Low-Calorie Fat Replacers, Prebiotics Find Wide Usage in Dietary Supplements and Other Types of Nutraceutical Products

8.9 Carotenoids

8.9.1 The Ingredient’s High Antioxidant Content and High Vitamin Properties Aid the Market Growth

8.1 Minerals

8.10.1 Lower Availability of Minerals has Led to the Development of Various Mineral-Fortified Foods

8.11 Others

9 Nutraceutical Products Market, By Region (Page No. - 88)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 Increase in Consumer Demand for Fortified Food & Beverage Products and Dietary Supplements Drives the US Market for Nutraceutical Products

9.2.2 Canada

9.2.2.1 Strong Support for R&D in the Nutraceutical Space By the Government Fuels the Market for Nutraceuticals in Canada

9.2.3 Mexico

9.2.3.1 Increasing Health Food Market is Expected to Drive the Growth of this Market in Mexico

9.3 Europe

9.3.1 Germany

9.3.1.1 Growth in Consumer Awareness Toward Health has Been Driving Market Growth

9.3.2 France

9.3.2.1 The Rise in Adoption of “Alicaments” in the Country is Driving the Market for Nutraceutical Products

9.3.3 UK

9.3.3.1 Increase in Focus on ‘Better-For-You’ Products to Drive Market Growth

9.3.4 Italy

9.3.4.1 Greater Focus on Vitamin-Based Foods and Nutraceutical Foods Drives the Adoption of Such Products

9.3.5 Spain

9.3.5.1 Government Initiatives Have Been Favoring the Development of Better Nutraceutical Products

9.3.6 Russia

9.3.6.1 Complex Government Regulations Pertaining to Registration Processes Hinder the Market Growth

9.3.7 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.1.1 Increasing Preference for Probiotics in Various Food Products is Projected to Drive the Growth of the Market in the Country

9.4.2 Japan

9.4.2.1 Higher Life Expectancy is Projected to Increase the Demand for Dietary Supplements in the Country

9.4.3 India

9.4.3.1 Rising Healthcare Costs and Adoption of Preventive Measures for Diseases to Drive the Market

9.4.4 Australia & New Zealand

9.4.4.1 High Spending Capacity and Increasing Disposable Income are Key Factors Projected to Drive the Global Market in the Country

9.4.5 South Korea

9.4.5.1 Inclination Toward Fortified Products is A Major Factor Driving the Market in the Country

9.4.6 Thailand

9.4.6.1 Increasing Prevalence of Cardiovascular Diseases and Hypertension is Driving the Demand for Dietary Supplements

9.4.7 Rest of Asia Pacific

9.5 South America

9.5.1 Brazil

9.5.1.1 The Growing Young Population and the Increasing Number of Well-Informed Consumers Drive the Growth of this Market in the Country

9.5.2 Argentina

9.5.2.1 Rise in Healthcare Spending is A Major Factor Influencing the Market for Nutraceutical Products in the Country

9.5.3 Rest of South America

9.6 Rest of the World (RoW)

9.6.1 Middle East

9.6.1.1 The Growing Availability of Scientific Evidence Linking Diet and Health is the Major Driving Factor for Nutraceutical Products in the Region

9.6.2 Africa

9.6.2.1 High Economic Development is Estimated to Drive the Growth of the Market in the Region

10 Competitive Landscape (Page No. - 129)

10.1 Introduction

10.2 Competitive Leadership Mapping

10.2.1 Visionary Leaders

10.2.2 Dynamic Differentiators

10.2.3 Innovators

10.2.4 Emerging Companies

10.3 Start-Up Microquadrant

10.3.1 Progressive Companies

10.3.2 Starting Blocks

10.3.3 Responsive Companies

10.3.4 Dynamic Companies

10.4 Market Share Analysis

10.5 Competitive Scenario

10.5.1 New Product Launches

10.5.2 Mergers & Acquisitions

10.5.3 Agreements, Collaborations, Joint Ventures, and Partnerships

10.5.4 Expansions & Investments

11 Company Profiles (Page No. - 137)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View)*

11.1 Kraft Heinz Company

11.2 The Hain Celestial Group

11.3 Conagra

11.4 General Mills

11.5 Kellogg's

11.6 Nestlé

11.7 Nature’s Bounty

11.8 Amway

11.9 Hero Group

11.10 Barilla

11.11 Raisio Group

11.12 Pfizer Inc.

11.13 Freedom Foods Group Limited

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 170)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (102 Tables)

Table 1 US Dollar Exchange Rates Considered, 2015–2018

Table 2 Market Snapshot, 2019 vs. 2025

Table 3 Prevalence of the Three Major Micronutrient Deficiencies, By Who Region

Table 4 Definitions & Regulations for Nutraceutical Ingredients Around the World

Table 5 Definitions & Regulations for Nutraceuticals Around the World

Table 6 List of Accepted Dietary Fibers By Canadian Regulatory Authorities & their Sources

Table 7 Market Size For Nutraceutical Products, By Type, 2017–2025 (USD Billion)

Table 8 Nutraceutical Food Products Market Size, By Type, 2017–2025 (USD Billion)

Table 9 Nutraceutical Food Products Market Size, By Region, 2017–2025 (USD Billion)

Table 10 Nutraceutical Beverages Market Size, By Type, 2017–2025 (USD Billion)

Table 11 Nutraceutical Beverages Market Size, By Region, 2017–2025 (USD Billion)

Table 12 Nutraceutical Dietary Supplements Market Size, By Type, 2017–2025 (USD Billion)

Table 13 Nutraceutical Dietary Supplements Market Size, By Region, 2017–2025 (USD Billion)

Table 14 Market Size For Nutraceutical Products, By Distribution Channel, 2017–2025 (USD Billion)

Table 15 Conventional Stores Market Size, By Region, 2017–2025 (USD Billion)

Table 16 Conventional Stores Market Size, By Type, 2017–2025 (USD Billion)

Table 17 Specialty Stores Market Size, By Region, 2017–2025 (USD Billion)

Table 18 Specialty Stores Market Size, By Type, 2017–2025 (USD Billion)

Table 19 Drugstores & Pharmacies Market Size, By Region, 2017–2025 (USD Billion)

Table 20 Market Size For Nutraceutical Products, By Source, 2017–2025 (USD Billion)

Table 21 Proteins & Amino Acids: Nutraceutical Products Market Size, By Region, 2017–2025 (USD Billion)

Table 22 Probiotics: Market Size, By Region, 2017–2025 (USD Billion)

Table 23 Phytochemicals & Plant Extracts: Market Size, By Region, 2017–2025 (USD Million)

Table 24 Fibers & Specialty Carbohydrates: Market Size, By Region, 2017–2025 (USD Million)

Table 25 Omega-3 Fatty Acids: Nutraceutical Products Market Size, By Region, 2017–2025 (USD Million)

Table 26 Vitamins: Nutraceutical Products Market Size, By Region, 2017–2025 (USD Million)

Table 27 Prebiotics: Market Size, By Region, 2017–2025 (USD Million)

Table 28 Carotenoids: Market Size, By Region, 2017–2025 (USD Million)

Table 29 Minerals: Market Size, By Region, 2017–2025 (USD Million)

Table 30 Others: Nutraceutical Products Market Size, By Region, 2017–2025 (USD Million)

Table 31 Market Size, By Region, 2017–2025 (USD Billion)

Table 32 North America: Nutraceutical Products Market Size, By Country, 2017-2025 (USD Billion)

Table 33 North America: Market Size, By Type, 2017-2025 (USD Billion)

Table 34 North America: Nutraceutical Food Market Size, By Product Type, 2017-2025 (USD Billion)

Table 35 North America: Nutraceutical Beverages Market Size, By Product Type, 2017-2025 (USD Billion)

Table 36 North America: Nutraceutical Dietary Supplements Market Size, By Product Type, 2017-2025 (USD Billion)

Table 37 North America: Nutraceutical Products Market Size, By Distribution Channel, 2017-2025 (USD Billion)

Table 38 North America: Nutraceutical Products Market Size, By Conventional Store Type, 2017-2025 (USD Billion)

Table 39 North America: Nutraceutical Products Market Size, By Specialty Store Type, 2017-2025 (USD Million)

Table 40 North America: Market Size, By Source, 2017-2025 (USD Billion)

Table 41 US: Nutraceutical Products Market Size, By Type, 2017-2025 (USD Billion)

Table 42 Canada:Market Size, By Type, 2017-2025 (USD Billion)

Table 43 Mexico: Nutraceutical Products Market Size, By Type, 2017-2025 (USD Billion)

Table 44 Europe: Nutraceutical Products Market Size, By Country, 2017–2025 (USD Billion)

Table 45 Europe: Nutraceutical Products Market Size, By Type, 2017–2025 (USD Billion)

Table 46 Europe: Nutraceutical Food Market Size, By Product Type, 2017–2025 (USD Billion)

Table 47 Europe: Nutraceutical Beverages Market Size, By Product Type, 2017–2025 (USD Billion)

Table 48 Europe: Nutraceutical Dietary Supplements Market Size, By Product Type, 2017–2025 (USD Billion)

Table 49 Europe: Nutraceutical Products Market Size, By Distribution Channel, 2017–2025 (USD Billion)

Table 50 Europe: Market Size, By Conventional Store Type, 2017–2025 (USD Billion)

Table 51 Europe: Market Size, By Specialty Store Type, 2017–2025 (USD Billion)

Table 52 Europe: Market Size, By Source, 2017–2025 (USD Billion)

Table 53 Germany: Nutraceutical Products Market Size, By Type, 2017–2025 (USD Billion)

Table 54 France: Market Size, By Type, 2017–2025 (USD Billion)

Table 55 UK: Market Size, By Type, 2017–2025 (USD Million)

Table 56 Italy: Market Size, By Type, 2017–2025 (USD Million)

Table 57 Spain: Nutraceutical Products Market Size, By Type, 2017–2025 (USD Billion)

Table 58 Russia: Market Size, By Type, 2017–2025 (USD Million)

Table 59 Rest of Europe: Nutraceutical Products Market Size, By Type, 2017–2025 (USD Million)

Table 60 Asia Pacific: Market Size, By Region, 2017–2025 (USD Billion)

Table 61 Asia Pacific: Market Size, By Type, 2017–2025 (USD Billion)

Table 62 Asia Pacific: Nutraceutical Food Market Size, By Product Type, 2017–2025 (USD Million)

Table 63 Asia Pacific: Nutraceutical Beverages Market Size, By Product Type, 2017–2025 (USD Billion)

Table 64 Asia Pacific: Nutraceutical Dietary Supplements Market Size, By Product Type, 2017–2025 (USD Million)

Table 65 Asia Pacific: Nutraceutical Products Market Size, By Distribution Channel, 2017–2025 (USD Billion)

Table 66 Asia Pacific: Nutraceutical Products Market Size, By Conventional Store Type, 2017–2025 (USD Billion)

Table 67 Asia Pacific: Nutraceutical Products Market Size, By Specialty Store Type, 2017–2025 (USD Billion)

Table 68 Asia Pacific: Nutraceutical Products Market Size, By Source, 2017–2025 (USD Million)

Table 69 China: Nutraceutical Products Market Size, By Type, 2017–2025 (USD Billion)

Table 70 Japan: Market Size, By Type, 2017–2025 (USD Million)

Table 71 India: Market Size, By Type, 2017–2025 (USD Billion)

Table 72 Australia & New Zealand: Market Size, By Type, 2017–2025 (USD Billion)

Table 73 South Korea: Nutraceutical Products Market Size, By Type, 2017–2025 (USD Million)

Table 74 Thailand: Nutraceutical Products Market Size, By Type, 2017–2025 (USD Billion)

Table 75 Rest of Asia Pacific: Nutraceutical Products Market Size, By Type, 2017–2025 (USD Billion)

Table 76 South America: Nutraceutical Products Market Size, By Country, 2017-2025 (USD Billion)

Table 77 South America: Market Size, By Type, 2017-2025 (USD Billion)

Table 78 South America: Nutraceutical Food Market Size, By Product Type, 2017-2025 (USD Million)

Table 79 South America: Nutraceutical Beverages Market Size, By Product Type, 2017-2025 (USD Million)

Table 80 South America: Nutraceutical Dietary Supplements Market Size, By Product Type, 2017-2025 (USD Million)

Table 81 South America: Market Size, By Distribution Channel, 2017-2025 (USD Billion)

Table 82 South America: Market Size, By Conventional Store Type, 2017-2025 (USD Million)

Table 83 South America:Market Size, By Specialty Store Type, 2017-2025 (USD Million)

Table 84 South America: Market Size, By Source, 2017-2025 (USD Million)

Table 85 Brazil: Market Size, By Type, 2017-2025 (USD Million)

Table 86 Argentina: Market Size, By Type, 2017-2025 (USD Million)

Table 87 Rest of South America: Market Size, By Type, 2017-2025 (USD Billion)

Table 88 RoW: Nutraceutical Products Market Size, By Region, 2017-2025 (USD Billion)

Table 89 RoW: Market Size, By Type, 2017-2025 (USD Billion)

Table 90 RoW: Nutraceutical Food Market Size, By Product Type, 2017-2025 (USD Million)

Table 91 RoW: Nutraceutical Beverages Market Size, By Product Type, 2017-2025 (USD Million)

Table 92 RoW: Nutraceutical Dietary Supplements Market Size, By Product Type, 2017-2025 (USD Million)

Table 93 RoW: Nutraceutical Products Market Size, By Distribution Channel, 2017-2025 (USD Million)

Table 94 RoW: Market Size, By Conventional Store Type, 2017-2025 (USD Million)

Table 95 RoW: Market Size, By Specialty Store Type, 2017-2025 (USD Million)

Table 96 RoW: Market Size, By Source, 2017-2025 (USD Million)

Table 97 Middle East: Nutraceutical Products Market Size, By Type, 2017-2025 (USD Million)

Table 98 Africa: Market Size, By Type, 2017-2025 (USD Million)

Table 99 New Product Launches, 2016–2019

Table 100 Mergers & Acquisitions, 2015–2019

Table 101 Agreements, Collaborations, Joint Ventures, and Partnerships, 2016–2019

Table 102 Expansions & Investments, 2015–2018

List of Figures (46 Figures)

Figure 1 Research Design

Figure 2 Nutraceutical Products Market: Bottom-Up Approach

Figure 3 Nutraceutical Products Market: Top-Down Approach

Figure 4 Data Triangulation Methodology

Figure 5 Market Size, By Type, 2019 vs. 2025 (USD Billion)

Figure 6 Market Size, By Distribution Channel, 2019 vs. 2025 (USD Billion)

Figure 7 Market Size, By Source, 2019 vs. 2025 (USD Billion)

Figure 8 Market Growth and Share (Value), By Region

Figure 9 Increase in the Elderly Population Along With Rising Incidences of Chronic Diseases Projected to Boost the Global Market

Figure 10 India is Projected to Grow at the Highest GAGR During the Forecast Period

Figure 11 Japanese Market and Food Segment Accounting for the Largest Share, By Country and Type, Respectively, in the Asia Pacific Region, in 2018

Figure 12 North America Dominates the Market for Nutraceutical Products Across All Type Segments

Figure 13 The Market for Nutraceutical Products in Conventional Stores is Projected to Dominate Throughout 2025

Figure 14 Probiotics, the Major Source of Nutraceutical Ingredients, Globally, Dominated the Market in 2018

Figure 15 Market Dynamics

Figure 16 Leading Causes of Death, 2016

Figure 17 Increase in Online Sales as A Proportion of All Types of Retailing, 2012–2018

Figure 18 Health Spending, By Type of Service, and Major Sources of Funds

Figure 19 Nutraceutical Products Market: Value Chain

Figure 20 Market Share (Value), By Type, 2019 vs. 2025

Figure 21 Market Share (Value), By Distribution Channel, 2019 vs. 2025

Figure 22 Market Share (Value), By Source, 2019 vs. 2025

Figure 23 Market, By Key Country, 2019-2025

Figure 24 Market, By Region, 2019 vs. 2025 (USD Billion)

Figure 25 North America: Regional Snapshot

Figure 26 Asia Pacific: Regional Snapshot

Figure 27 Nutraceutical Products Market (Global): Competitive Leadership Mapping, 2018

Figure 28 Nutraceutical Products Start-Up Market: Competitive Leadership Mapping, 2018

Figure 29 Market Share of Key Players in the Nutraceutical Products Market, 2017

Figure 30 Kraft Heinz Company: Company Snapshot

Figure 31 Kraft Heinz Company: SWOT Analysis

Figure 32 The Hain Celestial Group: Company Snapshot

Figure 33 The Hain Celestial Group: SWOT Analysis

Figure 34 Conagra: Company Snapshot

Figure 35 Conagra: SWOT Analysis

Figure 36 General Mills: Company Snapshot

Figure 37 General Mills: SWOT Analysis

Figure 38 Kellogg’s: Company Snapshot

Figure 39 Kellogg’s: SWOT Analysis

Figure 40 Nestlé: Company Snapshot

Figure 41 Amway: Company Snapshot

Figure 42 Hero AG: Company Snapshot

Figure 43 Barilla Group: Company Snapshot

Figure 44 Raisio: Company Snapshot

Figure 45 Pfizer Inc.: Company Snapshot

Figure 46 Freedom Foods Group Limited: Company Snapshot

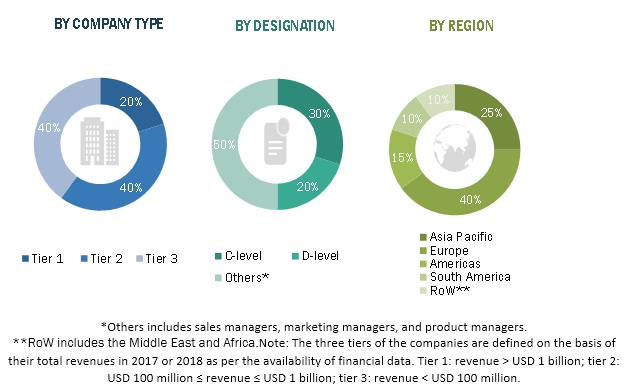

The study involved four major activities in estimating the current market size for the nutraceutical products market. Exhaustive secondary research was done to collect information on the market as well as the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to, so as to identify and collect information for this study. These secondary sources included reports from the Food and Agriculture Organization (FAO), United States Department of Agriculture (USDA), Food Safety Council (FSC), Food and Drug Administration (FDA), European Food Safety Authority (EFSA), Food Standards Australia New Zealand (FSANZ), Dietary Supplement Health and Education Act (DSHEA), European Nutraceutical Association (ENA), American Nutraceutical Association (ANA), Global Prebiotic Association (GPA), Indian Drug Manufacturers' Association, International Probiotics Association, and Indian Health Foods and Dietary Supplements Association (INHADSA). The secondary sources also included annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and databases.

Secondary research was mainly conducted to obtain key information about the industry’s supply chain, the total pool of key players, market classification & segmentation according to industry trends to the bottom-most level, and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The overall market comprises several stakeholders in the supply chain, which include raw material suppliers and manufacturers. Various primary sources from both the supply- and demand-sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the supply-side include manufacturers of food product, beverage products, dietary supplements, pharmaceutical products, and researchers. The primary sources from the demand-side include distributors, importers, and exporters of nutraceutical products.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players were identified through extensive secondary research.

- The market size, in terms of value, were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. In order to estimate the overall market and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. In addition, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- Determining and projecting the size of the market, with respect to type, distribution, source, and regional markets, over a six-year period ranging from 2019 to 2025

- Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micromarkets, with respect to individual growth trends, future prospects, and their contribution to the total market

- Identifying and profiling key market players in the nutraceutical products market

-

Providing a comparative analysis of the market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the value chain, products, and regulatory frameworks across key regions and their impact on the prominent market players

- Providing insights on key product innovations and investments in the nutraceutical product market

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific nutraceutical products market, by key country

- Further breakdown of the Rest of Europe nutraceutical products market, by key country

- Further breakdown of the nutraceutical products market, by key country, in terms of source

Company Information

-

- Analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Nutraceutical Products Market

We need to know if there is an opportunity for growth, in beverages containing nutraceutical products.