Data Integration Market

Data Integration Market by Software (Data Integration Platforms, iPaaS, Streaming Integration Tools), Data Type (Structured, Unstructured, Semi-structured), Application (Data Warehousing & BI, Data Lakes & Big Data Management) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

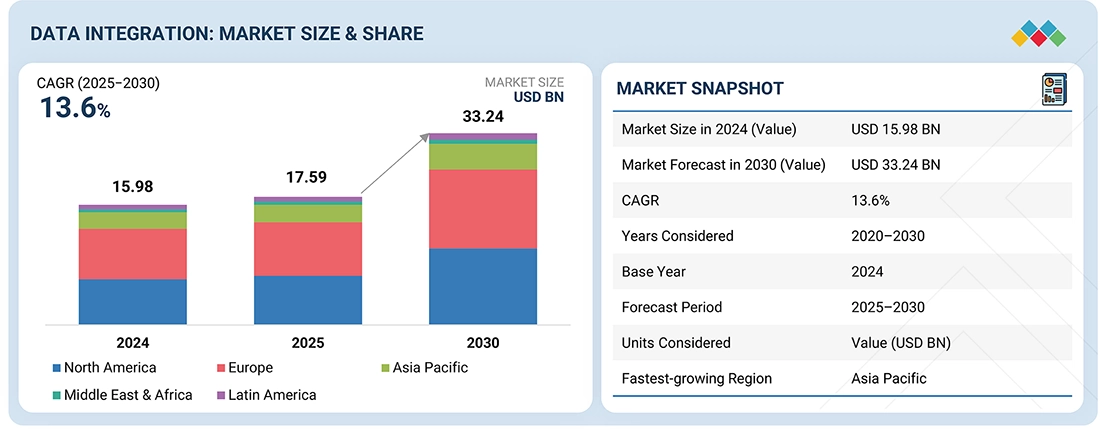

The data integration market is expected to grow from USD 17.58 billion in 2025 to USD 33.24 billion by 2030, at a CAGR of 13.6% during the forecast period. This growth is driven by the increasing complexity of enterprise data environments, characterized by the rise of multi-cloud, edge, and hybrid infrastructures that require seamless, scalable integration. Organizations are shifting from legacy ETL tools to modern cloud-native platforms that enable real-time processing, event-driven architectures, and low-code API integrations. Significant momentum is observed in data-intensive industries like banking, telecom, and retail, where unifying streaming, transactional, and third-party data is critical for AI readiness and operational agility. Government policies are further accelerating adoption, with initiatives such as the US Federal Data Strategy, India's National Data Governance Framework, and the EU’s Data Act driving improvements in data portability, interoperability, and transparency across public and private sectors. These regulations are prompting agencies and enterprises to invest in standardized, policy-compliant integration frameworks.

KEY TAKEAWAYS

- By Region, North America accounted for largest market share in Data Integration market in 2025.

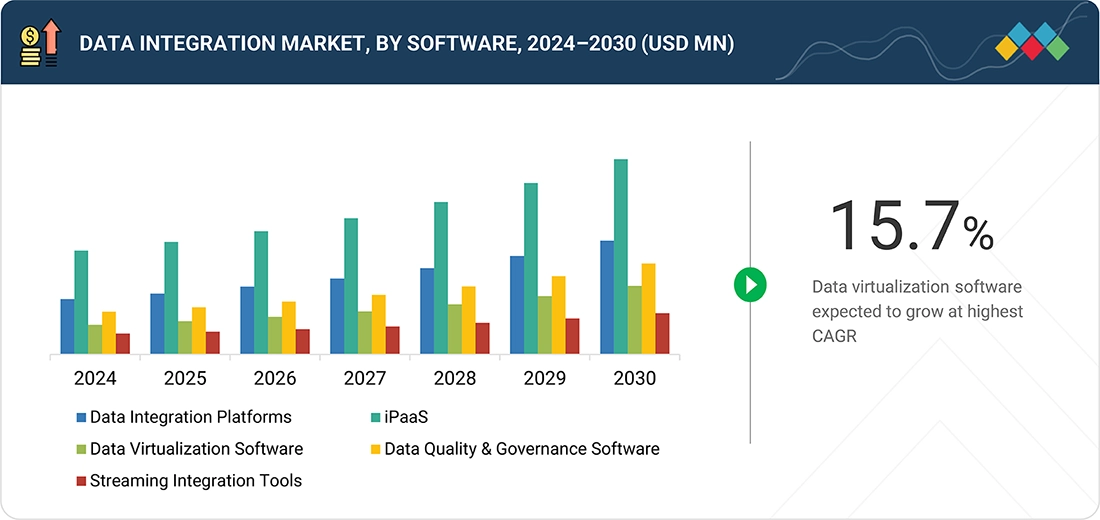

- By Software, the Data Virtualization Software is expected to grow at the highest CAGR of 10.2% during the forcast period.

- By Data Type, the structured data type segment is projected to hold largest market share during the forecast period

- By Application, the Real-time Data Integration segment is expected to grow at the highest CAGR of 15.7%.

- By Business Function, IT segment accounted for largest market share of 27.09% in 2025.

- By End User, Healthcare & Life Sciences segment is projected to grow at highest GAGR

- Market leaders like SAP, Oracel, and Informatica are merging organic innovation with strategic partnerships and acquisitions to enhance their portfolios. This dual strategy allows for quicker product development, broader ecosystem reach, and a sustained competitive edge in a quickly changing market.

- Companies like Zaiper, Celigo, and Denodo among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The data integration market is steadily growing, fueled by the increasing demand for Customer 360 initiatives and personalized experiences, which require seamless integration of customer data from sources like CRM, web, and support systems. At the same time, the rise of low-code and no-code platforms is enabling business users to build and manage integration workflows without extensive technical skills, accelerating deployment. Additionally, the shift toward event-driven architectures is boosting the need for intelligent, real-time integration to support responsive and dynamic business operations.

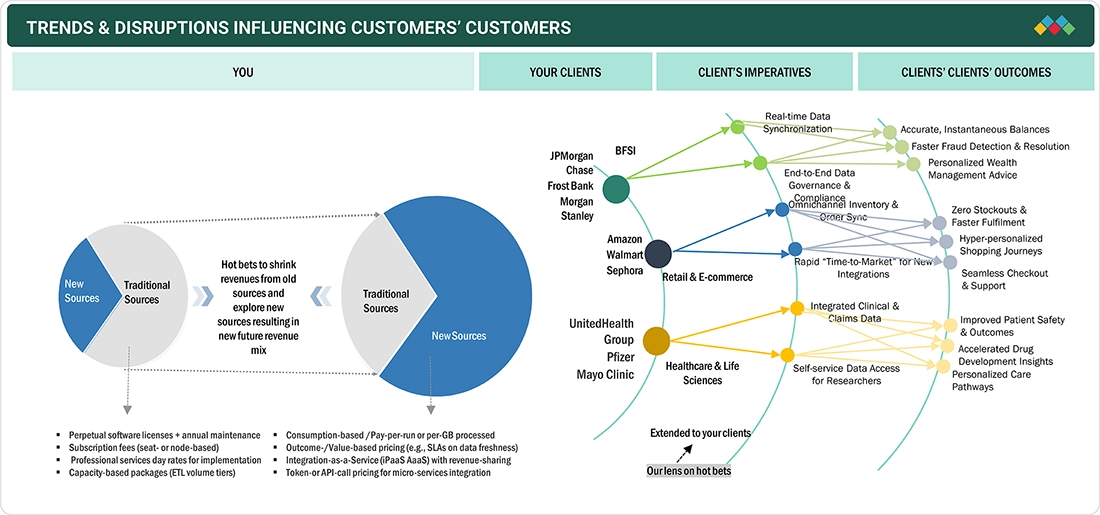

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The data integration market is experiencing rapid growth, driven by the emergence of innovative revenue streams. In today’s data-driven landscape, legacy subscription and license-based models are giving way to consumption- and outcomes-oriented pricing that aligns costs more closely with actual business value. As organizations across finance, healthcare, retail, and other sectors adopt flexible, pay-per-use, and integration-as-a-service offerings, they gain the agility to onboard new data sources quickly, scale seamlessly, and shift IT spending from fixed to variable. This transition empowers enterprises to democratize data access—enabling lines of business to self-serve analytics and integrate applications without IT bottlenecks—while also providing fresher insights and tighter governance. Ultimately, end users and their customers benefit from faster time-to-insight, more personalized experiences, and operational resilience as these new models reshape how data integration solutions are bought, deployed, and used.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Demand for unified data access

-

Rise of data products and productization of integration pipelines

Level

-

Complexity of legacy systems

-

Performance bottlenecks in iPaaS for high-frequency data loads

Level

-

Cloud and AI-powered integration

-

AI-generated pipelines and metadata-driven pipeline authoring

Level

-

Data security and compliance

-

Lack of unified data contracts across source systems

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Demand for Unified Data Access

The data integration market is driven by the increasing enterprise adoption of real-time and event-driven data architectures, as traditional batch-oriented ETL tools are proving inadequate for high volumes of transactional data. The need for continuous data processing has led to the widespread deployment of streaming technologies such as Apache Kafka and Flink. In response, data integration platforms are expanding capabilities to support Change Data Capture (CDC) and webhook-triggered pipelines, ensuring low-latency synchronization and consistent data states. This real-time integration is mission-critical in sectors like banking and e-commerce, accelerating market expansion.

Restraint: Complexity of Legacy Systems

Many organizations face difficulties in integrating modern data solutions into legacy IT systems. Complex architectures, outdated databases, and siloed applications can make integration expensive and slow. Buyers encounter challenges with data mapping, transformation, and maintaining data quality, which can hinder adoption and increase reliance on skilled IT resources, thereby limiting ROI from integration efforts.

Opportunity: Cloud and AI-Powered Integration

The rise of cloud platforms and AI-driven tools offers a major opportunity for buyers. Cloud-native integration cuts infrastructure costs, while AI/ML automates data mapping, anomaly detection, and workflow orchestration, greatly reducing manual effort. This enables enterprises to expand analytics faster, enhance data-driven insights, and speed up innovation, making integration a strategic advantage rather than just an IT task.

Challenge: Data Security and Compliance

As organizations handle more sensitive and regulated data, ensuring compliance with global standards like GDPR, CCPA, and HIPAA becomes essential. Buyers must navigate the difficulty of maintaining data privacy, securing data transfers across systems, and meeting regulatory requirements, all while avoiding operational disruptions. Failing to address these issues can result in financial penalties and damage to reputation.

Data Integration Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Domino's was overwhelmed with data stemming from siloed systems, where manual ETL processes required days to complete, thereby impeding prompt global decision-making. | The integration provided real-time data visibility and faster decision-making (days to minutes), which significantly increased digital sales to over 50% of global transactions. |

|

Facing long lead times, Schneider Electric needed to democratize application development and reduce IT dependency. It sought a low-code solution to empower global business teams, accelerate time-to-market, and maintain workflow governance. | SnapLogic enabled 140+ citizen developers and integrated over 100 applications using its platform. This successfully increased the autonomy and productivity of business teams across the enterprise. |

|

HomeServe's fragmented, monolithic legacy systems prevented consistent multi-channel service and unified reporting. The outdated structure hindered the launch of new digital self-service features and could not support the growing demand for real-time transactions. | MuleSoft's API-led approach achieved a 59% integration asset reuse rate and a 69% footprint reduction. The modernization resulted in 30% faster API response times, allowing HomeServe to provide scalable, real-time omnichannel services. |

|

MIT's finance team manually gathered billing data from 11 campuses, causing reporting delays of several days and reducing operational flexibility. Fragmented student records and departmental silos limited the institute's ability to quickly respond to enrollment and remote-learning demands. | Talend's platform cut billing processing time from days to minutes, freeing staff to focus on strategic initiatives. This scalable solution supported an agile cloud migration that facilitates remote learning and promotes ongoing digital transformation. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The data integration ecosystem consists of a layered matrix of capabilities and domains. Core software categories include full-stack integration platforms, low-code iPaaS suites, data virtualization tools, dedicated quality and governance engines, and streaming or event-driven connectors. Market segmentation is also based on applications, with solutions designed for data warehouse modernization, lake-oriented big data management, real-time synchronization, and specialized enterprise workloads. From a functional perspective, the integration stacks are developed for revenue operations in sales, omnichannel marketing analytics, finance and accounting automation, and cross-domain orchestration for emerging business use cases and strategic initiatives.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Data Integration Market, By Offering

The data virtualization software segment is expected to witness the highest CAGR in the data integration market during the forecast period, mainly due to its ability to provide real-time data access without physically moving or replicating the data. As organizations deal with increasing volumes of data spread across multiple sources, such as cloud, on-premises, data lakes, and SaaS platforms, data virtualization offers a flexible and efficient way to integrate and query data without the need for complex ETL processes.

Data Integration Market, By Application

The real-time data integration segment is expected to grow the fastest during the forecast period. This growth is fueled by enterprises' increasing need for quick decision-making, operational flexibility, and responsive customer experiences. Traditional batch data transfer methods are quickly being replaced by event-driven architectures and streaming pipelines that enable continuous data ingestion, transformation, and synchronization. Organizations in sectors such as banking, e-commerce, telecommunications, and logistics are using real-time data integration to support fraud detection, recommendation systems, dynamic pricing, and operational dashboards.

Data Integration Market, By Business Function

Marketing is expected to grow at the fastest CAGR by business function in the data integration market, as companies leverage integrated data for hyper-personalized campaigns, real-time customer insights, and ROI optimization. The rise of AI-driven targeting and omnichannel engagement further accelerates adoption, making marketing a key driver of future growth.

Data Integration Market, By End User

Healthcare and life sciences are expected to experience the highest CAGR in the data integration market, propelled by the need to unify clinical, genomic, and patient data for advanced analytics. Increasing adoption of AI in drug discovery, precision medicine, and digital health solutions further boosts demand for robust data integration.

Data Integration Market, By Region

North America is expected to hold the largest share of the data integration market in 2025, driven by early cloud adoption and high enterprise demand for cross-platform data unification. In the US, over 90% of Fortune 500 companies have adopted multi-cloud or hybrid data strategies, leading to increased investment in integration platforms that manage interoperability across AWS, Azure, and on-premise systems.

REGION

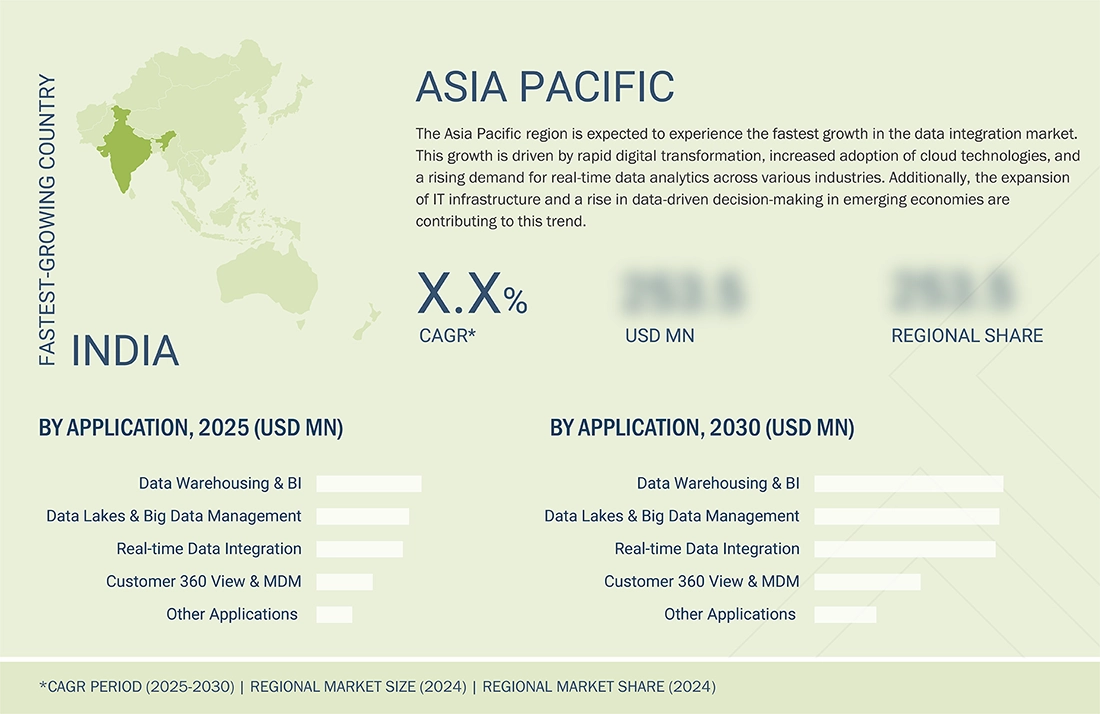

Asia Pacific to be fastest-growing region in global Data Integration Market during forecast period

Asia Pacific is projected to be the fastest-growing market in data integration, driven by rapid digital transformation across industries, large-scale cloud adoption, and government-backed data localization initiatives. Enterprises in China, India, Japan, and Southeast Asia are increasingly investing in real-time data integration to support AI, analytics, and digital platforms. The region’s expanding ecosystem of startups and collaborations with global providers further accelerates adoption, positioning Asia Pacific as the most dynamic growth hub for the data integration market.

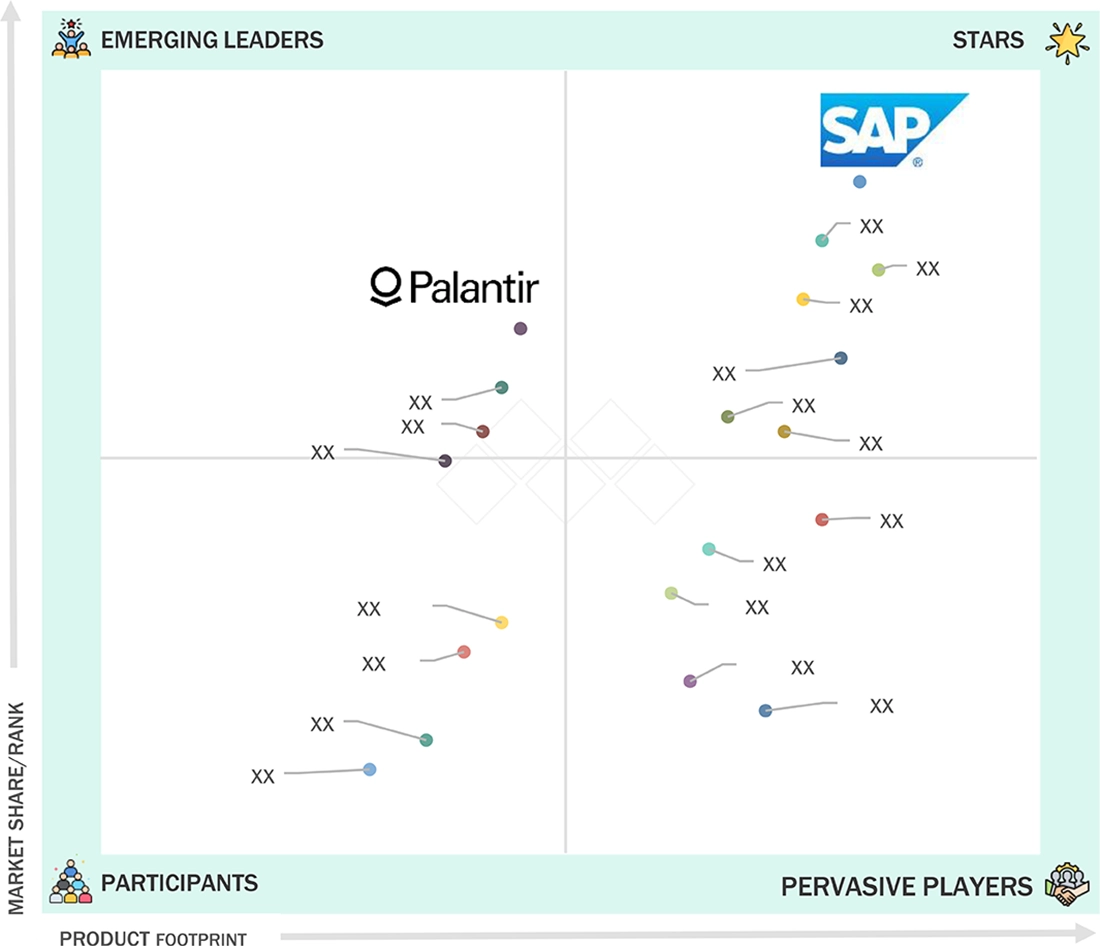

Data Integration Market: COMPANY EVALUATION MATRIX

In the data integration market matrix, SAP (Star) leads with its robust enterprise-grade platforms that unify data across complex IT environments, offering advanced tools for data orchestration, governance, and real-time integration. Its scalability and embedded AI capabilities reinforce its leadership in enabling intelligent enterprises. Palantir (Emerging Leader) is progressing with innovative platforms that focus on data unification, operational AI, and decision intelligence, helping organizations unlock actionable insights from diverse, large-scale datasets.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 15.98 BN |

| Market Forecast in 2030 (value) | USD 33.24 BN |

| Growth Rate | 13.60% |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Units Considered | USD Million/Billion |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

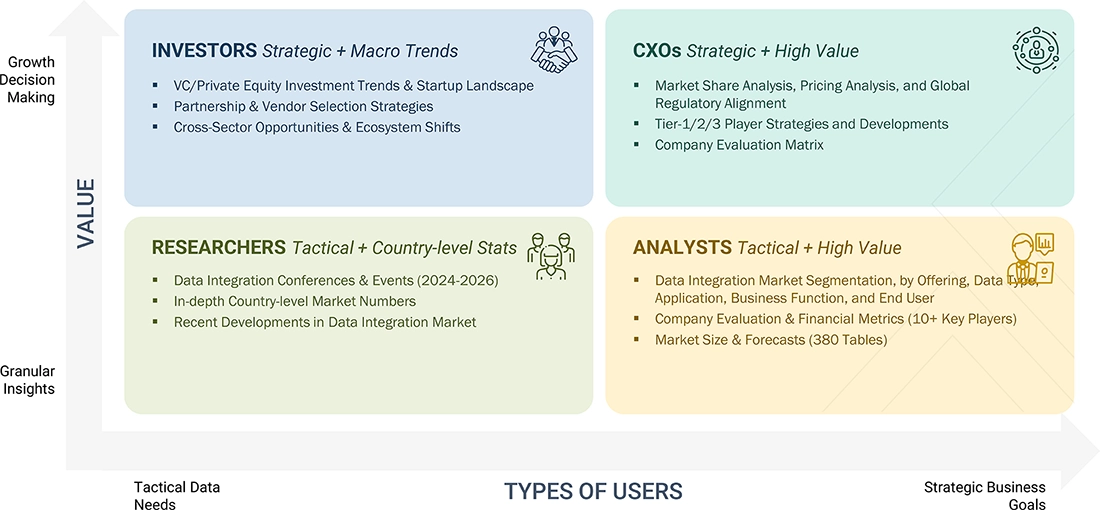

WHAT IS IN IT FOR YOU: Data Integration Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Data Integration Vendor |

|

|

| Leading Data Integration Vendor |

|

|

RECENT DEVELOPMENTS

- June 2025 : SAP added new updates to the SAP Integration Suite, strengthening its position in the data integration market with new event-driven integration capabilities, expanded adapters for third-party platforms like Snowflake and IBM MQ, and improved data space integration. These features enable organizations to unify diverse data sources, automate processes in real time, and facilitate scalable, secure, and compliant data sharing across ecosystems.

- May 2025 : AWS partnered with Dataddo, an AWS Differentiated Technology Partner, to provide advanced, end-to-end data integration for organizations using AWS storage services. Dataddo’s platform supports strong ETL, reverse ETL, and database replication across Amazon Redshift, S3, Aurora, and RDS, offering no-code and code options, built-in data quality, compliance, and privacy features, along with fully managed pipelines for smooth integration and analytics workflows.

- May 2025 : Salesforce signed a definitive agreement to acquire Informatica. This will integrate Informatica’s advanced data catalog, integration, governance, quality, metadata management, and Master Data Management (MDM) capabilities with Salesforce’s platform. The goal is to create a unified architecture for AI-driven data integration, enabling trusted, transparent, and governed data for enterprise AI, and enhancing Salesforce’s Data Cloud, Agentforce, Tableau, MuleSoft, and Customer 360.

- May 2025 : Microsoft added built-in AI and vector search features, real-time change event streaming to Azure Event Hubs, and seamless integration with Microsoft Fabric for zero-ETL analytics in the SQL Server 2025 update. Enhanced support for JSON, REST endpoints, and regular expressions further helps organizations unify, enrich, and operationalize data for modern, AI-driven applications.

- April 2025 : IBM introduced new data integration features in the IBM Watsonx.Data 2.2.0 upgrade, including updated API support for Milvus service connectivity, region-aware Hive and Iceberg catalogs for Presto (C++), and a high-performance Glue-accelerated Spark engine. These improvements enable organizations to better integrate, analyze, and manage diverse data sources, supporting scalable and agile data-driven strategies.

Table of Contents

Methodology

The research methodology for the data integration market report involved the use of extensive secondary sources and directories, as well as various reputed open-source databases, to identify and collect information useful for this technical and market-oriented study. In-depth interviews were conducted with various primary respondents, including data integration software providers, data integration service providers, iPaaS providers, data virtualization tool vendors, and enterprise end users; high-level executives of multiple companies offering data integration solutions; and industry consultants to obtain and verify critical qualitative and quantitative information and assess the market prospects and industry trends.

Secondary Research

In the secondary research process, various secondary sources were referred to to identify and collect information for the study. The secondary sources included annual reports; press releases and investor presentations of companies; white papers, certified publications such as Harvard Data Science Review, Journal of Big Data, IEEE Transactions on Big Data, ACM Transactions on Data Science, Data & Knowledge Engineering, Information Systems Journal, International Journal of Data Science and Analytics, Journal of Data and Information Quality, Big Data Research, Journal of Intelligent Information Systems, Data Mining and Knowledge Discovery, Journal of Data Science, Springer Big Data Analytics, Wiley Big Data Journal, and Expert Systems with Applications; and articles from recognized associations and government publishing sources including but not limited to Association for Computing Machinery (ACM), International Data Engineering and Science Association (IDEAS), Data Management Association (DAMA International), Big Data Value Association (BDVA), Open Data Institute (ODI), International Institute for Analytics (IIA), Global Big Data Conference, Data Science Association (DSA), Big Data Working Group (under CSA), and Linux Foundation AI & Data.

Secondary research was used to obtain key information about the industry’s value chain, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary Research

In the primary research process, a diverse range of stakeholders from both the supply and demand sides of the data integration ecosystem were interviewed to gather qualitative and quantitative insights specific to this market. From the supply side, key industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology & innovation directors, as well as technical leads from vendors offering data integration software & services, were consulted. Additionally, system integrators, service providers, and IT service firms that implement and support data integration were included in the study. On the demand side, input from IT decision-makers, infrastructure managers, and business heads of prominent enterprise end users was collected to understand the user perspectives and adoption challenges within targeted industries.

The primary research ensured that all crucial parameters affecting the data integration market—from technological advancements and evolving use cases (data warehousing & business intelligence, data lakes & Big Data management, customer 360 view and master data management etc.) to regulatory and compliance needs (GDPR, CCPA, Europe AI Act, AIDA, etc.) were considered. Each factor was thoroughly analyzed, verified through primary research, and evaluated to obtain precise quantitative and qualitative data for this market.

Once the initial phase of market engineering was completed, including detailed calculations for market statistics, segment-specific growth forecasts, and data triangulation, an additional round of primary research was undertaken. This step was crucial for refining and validating critical data points, such as data integration offerings (software & services), industry adoption trends, the competitive landscape, and key market dynamics like demand drivers (Surge in AI-centric data workloads needing high-fidelity input pipelines, rise of data products and productization of integration pipelines, enterprise adoption of data fabric and data mesh architectures, rise of contextual and event-driven integrations), challenges (fragmentation between business domains and centralized it pipelines, performance bottlenecks in iPaaS for high-frequency data loads, vendor lock-in with managed services and lack of interoperability), and opportunities (industry-specific AI-integrated iPaaS solutions, AI-generated pipelines and metadata-driven pipeline authoring, real-time CX orchestration in B2C businesses, edge orchestration via containerized ETL agents and federated scheduling).

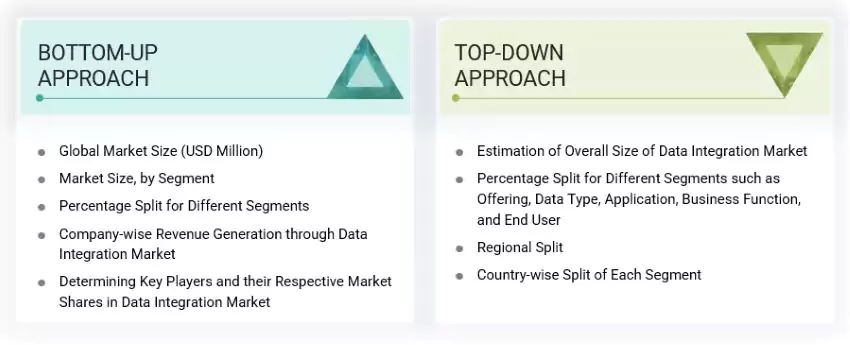

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecast for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to record the critical information/insights throughout the report.

Note: Three tiers of companies are defined based on their total revenue as of 2024;

tier 1 = revenue more than USD 500 million, tier 2 = revenue between USD 500 million and 100 million, tier 3 = revenue less than USD 100 million

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were employed to estimate and forecast the data integration market and its dependent submarkets. This multi-layered analysis was further reinforced through data triangulation, incorporating both primary and secondary research inputs. The market figures were also validated against the existing MarketsandMarkets repository for accuracy. The following research methodology was used to estimate the market size:

Data Integration Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

Data integration is the process of combining data from different sources and providing the user with a unified view of this data. It involves the movement and consolidation of data from disparate sources into meaningful and valuable information. Data integration serves as a core function of enterprise data architecture, enabling data quality, consistency, and availability across operational and analytical use cases.

Stakeholders

- Data Integration Software Developers

- Integration Platform as-a-Service (iPaaS) Vendors

- Data Integration Service Providers

- Big Data Providers

- Business Analysts

- Cloud Service Providers

- Consulting Service Providers

- Enterprise End-users

- Distributors and Value-added Resellers (VARs)

- Government Agencies

- Independent Software Vendors (ISV)

- Managed Service Providers

- Market Research and Consulting Firms

- Support & Maintenance Service Providers

- System Integrators (SIs)/Migration Service Providers

- Technology Providers

- Academia & Research Institutions

- Investors & Venture Capital Firms

Report Objectives

- To define, describe, and forecast the data integration market, by offering (software and services), data type, application, business function, and end user

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for the five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To profile the key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments, such as partnerships, product launches, and mergers & acquisitions, in the data integration market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakup of the North American market for Data integration

- Further breakup of the European market for Data integration

- Further breakup of the Asia Pacific market for Data integration

- Further breakup of the Middle Eastern & African market for Data integration

- Further breakup of the Latin American market for Data integration

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is data integration?

Data integration is the process of consolidating data from multiple, heterogeneous sources such as databases, cloud platforms, enterprise applications, and streaming systems into a unified and consistent format. It involves data ingestion, transformation, mapping, and synchronization to ensure seamless accessibility and usability across environments. Modern data integration supports real-time processing, API connectivity, and automation through AI and low-code platforms. It plays a critical role in enabling cross-system analytics, business intelligence, and decision-making across hybrid and multi-cloud infrastructures.

What is the total CAGR expected to be recorded for the data integration market during 2025–2030?

The data integration market is expected to record a CAGR of 13.6% from 2025 to 2030.

How is data integration shaping the broader big data industry?

Data integration is the backbone of the big data industry, enabling the consolidation of structured, semi-structured, and unstructured data from diverse sources into unified, analytics-ready formats. It ensures that large-scale data environments such as data lakes, warehouses, and streaming platforms operate cohesively by managing data movement, transformation, and quality control. Integration tools support scalable ingestion from APIs, databases, IoT devices, and external data feeds, which is essential for powering AI, machine learning, and advanced analytics.

Which are the key factors supporting the growth of the data integration market?

Some factors driving the growth of the data integration market include the rapid adoption of LLM orchestration frameworks accelerating autonomous agent deployment; advances in edge AI and neuromorphic chips enabling real-time autonomy in physical systems; rising industrial use of autonomous robotics boosting efficiency in logistics, agriculture, and field services; and growing demand for cost-effective, continuous operations driving autonomous system investments.

Which are the top 3 end users prevailing in the data integration market?

BFSI, technology providers, and retail and e-commerce are the top verticals in the data integration market due to their high automation potential, data-rich environments, and clear ROI pathways. BFSI uses agents for fraud detection, compliance, and client onboarding. Technology firms embed agentic capabilities into cloud platforms and developer tools. Retail and e-commerce apply agents to optimize pricing, inventory, and fulfillment. These sectors are mature, digitally advanced, and focused on efficiency and personalization, driving rapid adoption.

Which are the key vendors in the data integration market?

Some major players in the data integration market include IBM (US), NVIDIA (US), OpenAI (US), Oracle (US), Microsoft (US), Google (US), AWS (US), Salesforce (US), LivePerson (US), Waymo (US), Tempus AI (US), Mobileye (Israel), Uber (US), DJI (China), Boston Dynamics (US), Shield AI (US), Anduril Industries (US), AeroVironment (US), Tesla (US), Kore.ai (US), Amelia (US), Softbank Robotics (Canada), Aisera (US), Rasa (US), Stability AI (UK), Infinitus Systems (US), Level AI (US), Leena AI (US), Cujo AI (US), Skydio (US), Cognigy (Germany), ANYbotics (Switzerland), Badger Technologies (US), Monica.im (Singapore), Deeproute.ai (US), Adept (US), Nanonets (US), Wayve (UK), Seegrid (US), and Blue River Technologies (US).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Data Integration Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Data Integration Market