Cyclopentane Market

Cyclopentane Market by Function (Blowing Agent & Refrigerant, Solvent & Reagent), Application (Residential Refrigerators, Commercial Refrigerators, Insulated Containers, Insulating Construction Materials, Electrical), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

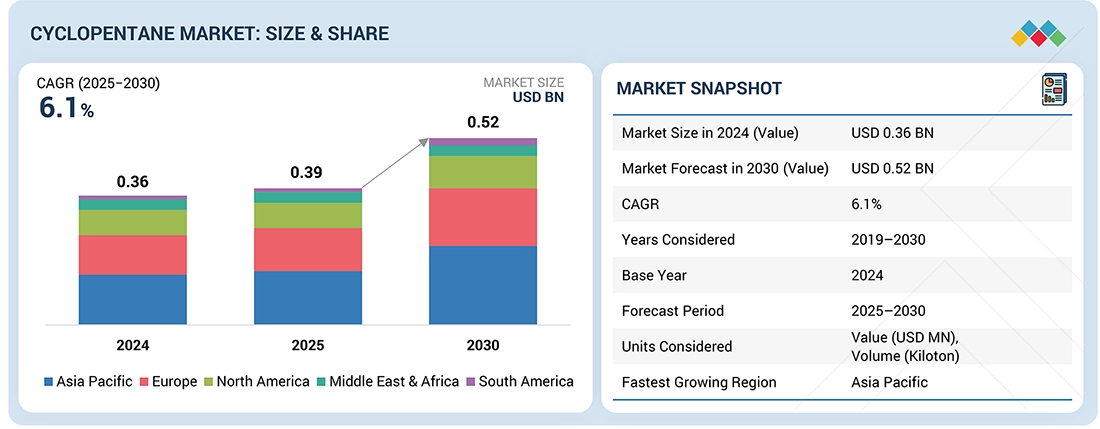

The global cyclopentane market is projected to grow from USD 0.39 billion in 2025 to reach USD 0.52 billion by 2030, at a CAGR of 6.1% during the forecast period. Cyclopentane finds various applications in refrigerators for domestic and commercial purposes, insulated containers, sippers, protective building materials, and numerous other electrical and electronic products. The growth of cyclopentane-based blowing agents segment is mainly propelled by the global shift away from HCFCs and other harmful blowing agents. Properties and demand for polyurethane foam insulation have steadily increased in conjunction with the expansion of key industries in construction, refrigeration, automotive, and appliance production which utilize cyclopentane. Being an environmentally friendly product with a very low global warming potential and zero ozone depletion capabilities, this product is also supported by increasing regulatory measures for environmentally friendly materials and foam insulation development technologies, which is leading to the growth of the market for cyclopentane across the globe.

KEY TAKEAWAYS

-

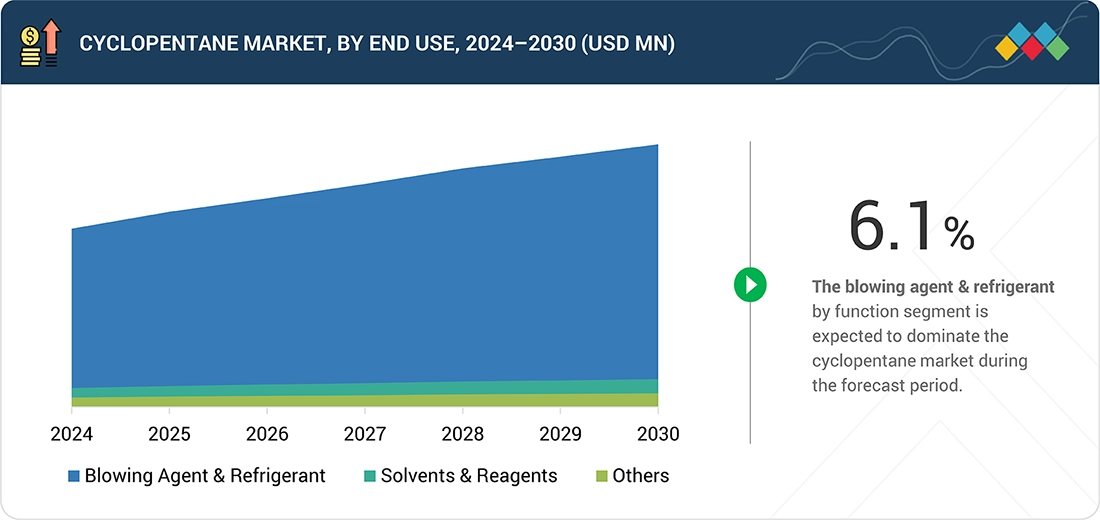

BY FUNCTIONThe Functions include blowing agent & refrigerant, solvent and reagents, and others. The blowing agent & refrigerant is expected to be the fastest and largest growing function in the market, in terms of value, during the forecast period.

-

BY APPLICATIONKey Application includes residential refrigerators, commercial refrigerators, insulated containers & sippers, insulating construction materials, electrical & electronics, personal care products, fuel & fuel additives, and others. The insulating construction materials are projected to be the fastest and largest growing application in the market, in terms of volume, during the forecast period.

-

BY REGIONThe cyclopentane market has been segmented into Asia Pacific, North America, Europe, Middle East & Africa, and South America. Asia Pacific and Europe are expected to be the leading markets for cyclopentane. The Asia Pacific is the largest market, with countries such as China, India, Japan, and South Korea witnessing an increase in demand for cyclopentanes. Europe is projected to be the second-largest market.

-

COMPETITIVE LANDSCAPEHaltermann Carless Group GmbH (Germany), Junyuan Petroleum Group (China), INEOS (UK), Zeon Corporation (Japan), and Puyang Zhongwei Fine Chemical Co., Ltd. (China) are the key players with distribution networks spread across Asia Pacific, North America, Middle East & Africa, South America, and Europe. These companies are vital in their domestic regions and explore geographic diversification alternatives to grow their businesses. They focus on increasing their market share through expansions and enhancing their product portfolios.

Cyclopentane is a crucial blowing agent used in the production of polyurethane foam, which plays a key role in thermal insulation for refrigerators, freezers, buildings, and various industrial applications. The rising focus on energy efficiency, along with stringent regulations promoting effective insulation across sectors like construction and appliances, is driving its demand. As sustainability and environmental standards tighten globally, cyclopentane-based insulation solutions are increasingly favored for their low environmental impact and superior thermal performance.

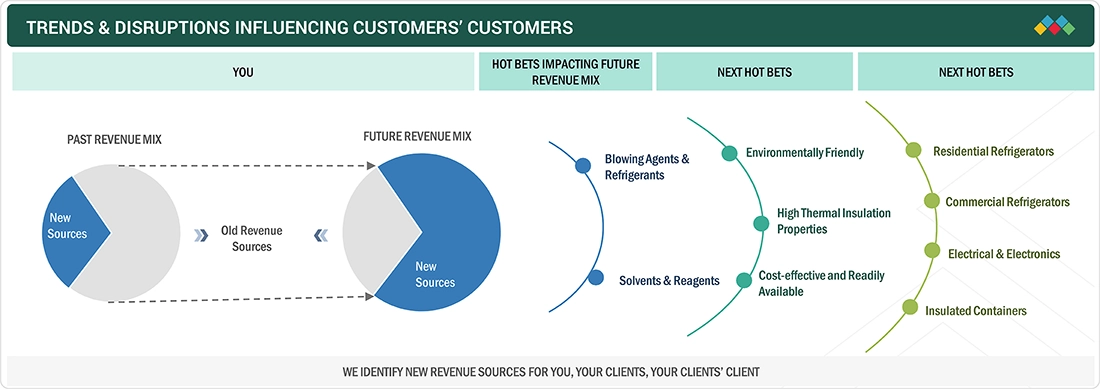

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Cyclopentane offers several advantages that make it a preferred choice in various industrial applications. It has a very low Global Warming Potential (GWP) and zero Ozone Depletion Potential (ODP), making it an environmentally friendly alternative to HCFCs and HFCs. Its use in polyurethane foam production enhances thermal insulation performance, which is essential for energy-efficient refrigeration and construction. Additionally, cyclopentane is cost-effective and readily available as a by-product of petroleum refining, making it suitable for large-scale adoption.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Global phase-out of hydrochlorofluorocarbons.

-

Wide use of cyclopentane in solvent and reagent applications

Level

-

Volatility in raw material prices

-

High capital investments.

Level

-

Increasing use of blowing agents in construction and automotive industries.

-

Pressing need for cyclopentane in thermal energy storage systems

Level

-

Flammability of cyclopentane

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Global phase-out of hydrochlorofluorocarbons to increase demand for cyclopentane

The urgent demand for cyclopentane is mainly because of the phase-out of hydrochlorofluorocarbons (HCFCs). HCFCs have been widely used to produce foam insulation as blowing agents and refrigerants. But they contain a high ozone-depletion potential (ODP) and also lead to global warming. The Montreal Protocol, a global pact to conserve the ozone layer, requires HCFCs to be phased out. Therefore, industries are switching to more environmentally friendly alternatives. In the majority of the emerging (Article 5) and a few industrialized (non-Article 5) nations, including the Russian Federation, HCFC 141 b has been the agent of choice for blowing in the past. In 2007, however, at the 19th meeting of the Montreal Protocol, countries signed up to speed the phase-out of HCFCs. The Montreal Protocol is an international accord that has successfully safeguarded the Earth's ozone layer by curtailing the production and consumption of ozone-depleting substances like CFCs and HCFCs. The protocol has successfully ensured technology transfer and financial aid to the needy. The success of the protocol has been the long-term dedication to stop manufacturing and consuming ozone-depleting substances. HCFC 141 b in foam applications has been banned in the European Union and the US for almost a decade. India has successfully eliminated HCFC 141b, an ozone-depleting and climate-warming chemical. The Environment Ministry and UNDP released the report at a side event of the annual climate talks, COP28. The report concluded that India registered a whopping 44 percent phase-out of HCFCs, well above the 35 percent target, showing the nation's determination in using innovation and collaboration to achieve climate goals. In a press release issued on the evening of World Ozone Day, the European Environment Agency (EEA) released new figures confirming the EU made significant progress in phasing out the use of ozone-depleting substances in the world during 2022. Accordingly, all these efforts toward the phase-down of HCFCs are expected to fuel the demand for cyclopentane.

Restraints: Volatility in raw material prices

The cyclopentane market is characterized by raw materials price fluctuations, posing opportunities and challenges to players in different industries. Normally, cyclopentane production from feedstocks such as cyclopentadiene and these feedstocks depend on crude oil price, supply and demand considerations, and even geopolitical events. Fluctuations in the prices of these raw materials for raw material production consequently resulted in an unstable cost of producing cyclopentane and then its market price. The energy costs for manufacturing, shipping, and storage related to cyclopentane impinge on the final price of the product. The price of cyclopentane may be further exposed to high fluctuations as these are correlated with oil and gas prices that are affected by supply-side disruptions, geopolitical tensions, and changes in the global market.

Opportunity: Increasing use of blowing agents in the construction and automotive industries

The usage of blowing agents has thus increased for construction, automotive, and appliance end-use sectors. Their properties, like insulation and physical integration, allow them to be used to formulate polyurethane foam. The foam finds extensive applications in the construction industry for purposes such as PIR/PUR boards, XPS boards, sandwich panels, pipe, and roof insulation, etc. In the automotive sector, foams find applications in seats, headrests, armrests, roof liners, dashboards, and instrument panels. Appliances find their use in refrigerator/freezer insulation, commercial refrigeration, and water heater insulation. The growth in the industries is further pushing the market for blowing agents.

Challenge: Flammability of cyclopentane

As cyclopentane is a highly flammable chemical, there are significant safety concerns when using cyclopentane as a blowing agent in the production of polyurethane foam. To alleviate potential hazards such as fire or explosion hazards, cyclopentane users must follow strict safety procedures during every stage of the process for the entire polyurethane manufacturing and synthesis process, including handling cyclopentane, storage, mixing with polyol, metering, and foaming. It is important for users to ensure that they are using safe equipment, properly welded pipe connections, and take the necessary precautions to avoid leaks. They must also ensure proper ventilation to avoid explosive mixtures of cyclopentane vapor in the air environment of the workplace and use non-sparking tools for any touches when mixing with polyol, and in case of emergency, must have the proper detection systems to examine and manage vapour concentrations. Some precautions require that foam dispensing units and the foam molds should be enclosed in ventilated booths; proper sensors and high-pressure pump systems should be used to avoid leaks or ignite any vapors; and to avoid any ignition sources to prevent fires/explosions.

Cyclopentane Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Haltermann Carless supplies cyclopentane for foam insulation, refrigeration systems, and pharmaceutical applications. | Offers high-quality and globally recognized products with strong North American and European penetration, enabling reliable insulation and cooling performance. |

|

INEOS provides cyclopentane used in refrigeration systems and polyurethane foam insulation, as well as solvents and chemical intermediates for industrial use. | Ensures strong brand reliability within Europe, supporting efficient insulation and chemical processes for manufacturers and end-users in these regions. |

|

YNCC delivers cyclopentane as a blowing agent for construction insulation, refrigeration, solvents, and chemical intermediates. | Provides cost-effective solutions and robust regional supply, enhancing insulation value, reducing costs, and broadening market access in Asia-Pacific and the Middle East. |

|

Haldia Petrochemicals manufactures cyclopentane for insulation and refrigeration, supporting construction and refrigerants industries with chemical intermediates. | Delivers competitively priced cyclopentane for diverse applications, enabling economical solutions for end-users, especially in cost-sensitive markets. |

|

Zeon produces cyclopentane utilized in refrigeration and freezer units, where it contributes to thermal insulation. | Supplies cyclopentane with strong purity and reliability, ensuring high-performance insulation. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The cyclopentane market ecosystem consists of raw material suppliers, manufacturers, and end users. Prominent companies in this market include well-established and financially stable manufacturers of cyclopentane. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in this market include Haltermann Carless Group GmbH (Germany), Junyuan Petroleum Group (China), INEOS (UK), Zeon Corporation (Japan), and among others.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Cyclopentane Market, By Function

The blowing agents & refrigerants segment is projected to grow at the highest CAGR in the cyclopentane market during the forecast period. The blowing agents & refrigerants segment is expected to control the cyclopentane market mainly because of its wide use in foam insulation and cooling-related applications. Being environmentally friendly with excellent technical properties makes cyclopentane the perfect candidate in place of traditional and ozone-depleting blowing agents. Since industries such as refrigeration, construction, and appliances are moving toward sustainability and regulatory compliance, the demand for cyclopentane in this segment has been rising with time. Its versatility and efficiency are the strongest reasons supporting its domination in this market.

Cyclopentane Market, By Application

Based on application, the insulating construction material segment is anticipated to register the highest CAGR in the cyclopentane industry during the forecast period. The insulating building materials segment is expected to lead the cyclopentane market, supported by the increasing focus on green and energy-efficient building requirements. Cyclopentane, acting as an excellent blowing agent in polyurethane foam, finds application mostly for thermal insulation in modern buildings. As green building standards become more prevalent and regulatory frameworks evolve, the use of cyclopentane for insulation materials has become a preferred choice in residential, commercial, and industrial projects. The recent trend occurs within the context of a larger trend toward promoting environmentally friendly construction solutions.

REGION

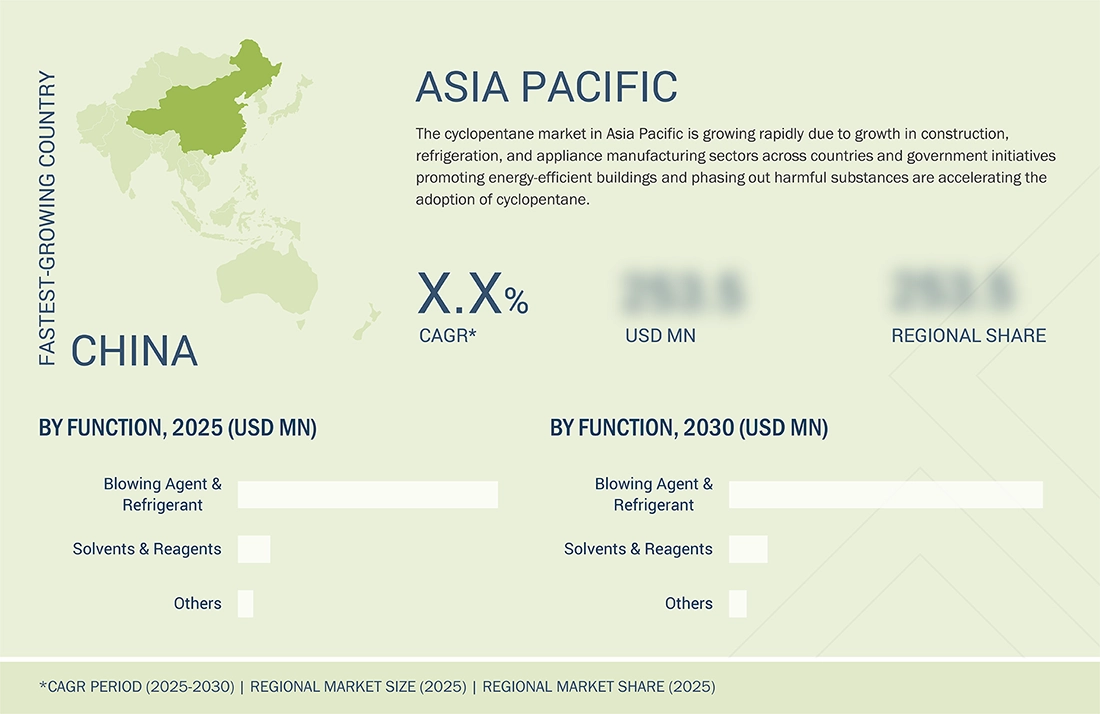

Asia Pacific is to be the fastest-growing region in global cyclopentane market during forecast period

The Asia Pacific region is expected to experience the highest CAGR in the cyclopentane market during the forecast period. Asia Pacific is anticipated to be the leading cyclopentane market, with factors such as rapid industrialization, growing construction activities, and demand for energy-efficient appliances across the region. Countries like China, India, and other countries in the region are increasingly turning toward cyclopentane in consideration of its environmental characteristics and the regional sustainability agenda. Moreover, fostering government policies, increased consciousness regarding green building techniques, and robust manufacturing capacities have made the region the leading in the global scenario.

Cyclopentane Market: COMPANY EVALUATION MATRIX

In the Cyclopentane market matrix, Haltermann Carless is recognized is a star player, one of the leading manufacturer of hydrocarbon-based solvents, including specialized pentanes, with a major global footprint and focus on sustainable, low-carbon products. In contrast, Merck KGaA is emerging as a significant player with a broad product portfolios and robust potential to build strong business strategies to expand their businesses and stay on par with the star players.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.36 BN |

| Market Forecast in 2030 (value) | USD 0.52 BN |

| Growth Rate | CAGR 6.1% from 2025-2030 |

| Years Considered | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD MN), Volume (Kiloton) |

| Report Coverage | Revenue forecast, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

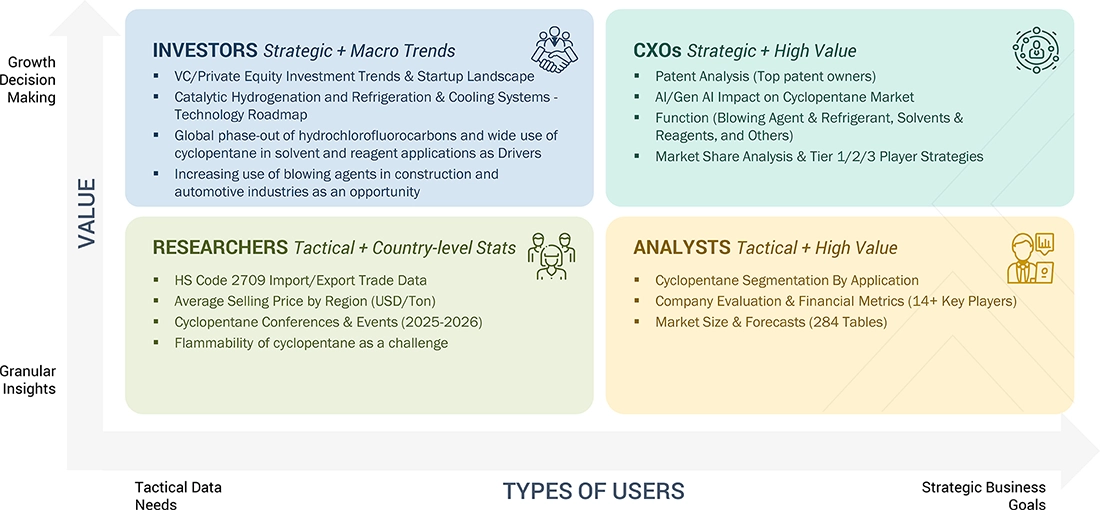

WHAT IS IN IT FOR YOU: Cyclopentane Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Appliance Manufacturers | Analysis of cyclopentane adoption in foam insulation for refrigerators and freezers across global brands. Benchmarking of insulation performance, cost-effectiveness, and regulatory compliance in end-use appliances. Sourcing strategy development for OEMs, assessment of supply stability, and technical support for manufacturing integration. | Enables data-driven decision-making for insulation material selection and regulatory compliance. Supports OEMs in improving appliance energy efficiency, cost savings, and adherence to environmental standards across global markets. |

| Refrigeration OEMs | Mapping and benchmarking cyclopentane-blown foam for thermal insulation efficiency and lifecycle performance in commercial and industrial refrigeration. Study on compatibility with evolving environmental standards and market trends. Supplier evaluation and technology roadmap for next-gen refrigerants and insulation materials. | Supports OEMs in evaluating long-term costs, environmental impact, and product competitiveness. Aids design decisions for durable, high-performance refrigeration units while mitigating compliance risks in different regions. |

| Chemical Producers | Survey and benchmarking of competing cyclopentane technologies (high-purity, specialty blends). Analysis of process innovations and cost drivers in manufacturing. Study of global and regional demand, pricing trends, and supply chain vulnerabilities. Roadmap development for capacity expansion and diversification based on market signals and regulatory changes. | Identifies innovation opportunities and emerging technology gaps. Assists in strategic investment and diversification planning. Provides clarity on global entry strategies, competitive positioning, and long-term supply/demand forecasting. |

| Material Distributors/Suppliers | Evaluation of purity, packaging specifications, and logistics challenges for cyclopentane in target markets. Assessment of distributor portfolios and regional supply chain integration opportunities. Analysis of competitive pricing and sustainability expectations driving supply decisions for key end-user sectors. | Facilitates supply chain integration and partnership opportunities. Aids in strategic product portfolio diversification and provides insights aligned with evolving standards for transportation safety, packaging, and environmental sustainability requirements. |

RECENT DEVELOPMENTS

- June 2024 : Merk KGaA expanded its facility, which will play a key role in ensuring the safety, purity, and compliance of life science products used in research and medical manufacturing. It will be GMP-compliant and built to meet German Sustainable Building Council GOLD standards, featuring low-CO2 construction, regenerative energy systems, and specialized labs with strict hygiene and biosafety protocols. This investment underscores Merck’s commitment to quality, sustainability, and innovation, strengthening its global leadership in life science tools and technologies.

- February 2023 : Haltermann Carless, part of the HCS Group and a leader in sustainable hydrocarbon solutions, launched a new range of low-carbon mass balance pentane products. This ISCC PLUS certified lineup, which includes cyclopentane, n-pentane, iso-pentane, and their blends, is designed for specialized applications in industries where reducing carbon emissions is a key priority, such as in insulation materials for the refrigeration and construction sectors.

- June 2022 : Balmoral Funds, LLC Balmoral has officially completed its earlier announced acquisition of Trecora Resources Trecora for USD 9.81 per share in cash, net to each shareholder, excluding interest and subject to applicable tax withholdings. As a result of the acquisition, Trecora's shares will no longer be traded on the New York Stock Exchange and the company will no longer be publicly listed.

- February 2022 : Zeon Corporation acquired Aurora Microplates, a Montana-based company that specializes in the sale of microplates used for biochemical analysis. This strategic move aims to enhance Zeon's expansion into the healthcare and life sciences sectors, key focus areas under its medium-term management plan for exploring new business opportunities. Additionally, the acquisition will support Zeon's entry into the European and US markets in this field.

Table of Contents

Methodology

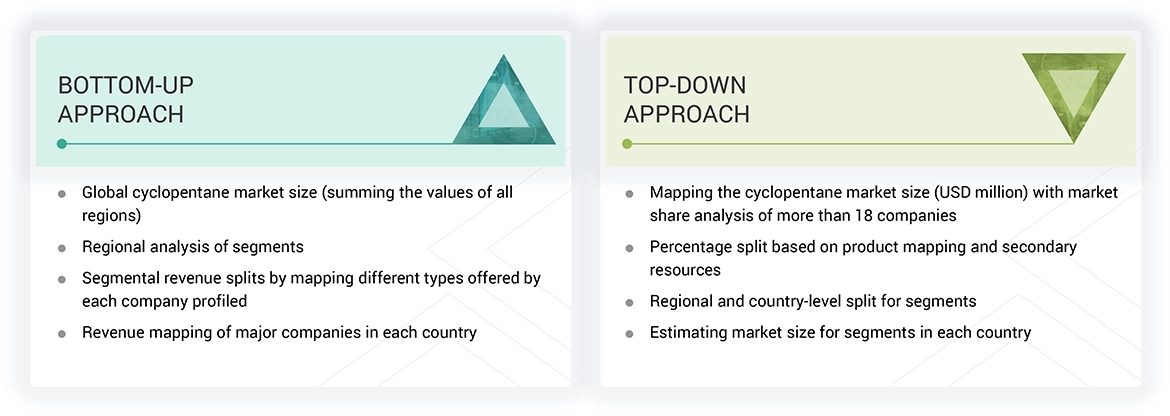

The research encompassed four primary actions in assessing the present market size of cyclopentane. Comprehensive secondary research was conducted to gather information on the market, the peer market, and the parent market. The subsequent stage involved corroborating these findings, assumptions, and dimensions with industry specialists throughout the cyclopentane value chain via primary research. The total market size is ascertained using both top-down and bottom-up methodologies. Subsequently, market segmentation analysis and data triangulation were employed to ascertain the dimensions of the market segments and subsegments.

Secondary Research

The research approach employed to assess and project the market begins with the collection of revenue data from prominent suppliers using secondary research. In the course of secondary research, many secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, the World Bank, and industry magazines, were utilized to identify and compile information for this study. The secondary sources comprised annual reports, press releases, and investor presentations from corporations, white papers, accredited periodicals, writings by esteemed authors, announcements from regulatory agencies, trade directories, and databases. Vendor offerings have been considered to ascertain market segmentation.

Primary Research

The cyclopentane market comprises several stakeholders, such as manufacturers, suppliers, traders, associations, and regulatory organizations, in the supply chain. The demand side of this market is characterized by the development of various applications, including residential refrigerators, commercial refrigerators, insulated containers & sippers, insulating construction materials, electrical & electronics, personal care products, fuel & fuel additives, and others. Advancements in technology characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

The following is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the cyclopentane market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the cyclopentane market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Cyclopentane Market Size: Bottom-up and Top-down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The market size was calculated globally by summing up the country-level and regional-level data.

Market Definition

Cyclopentane is a cyclic hydrocarbon with the chemical formula C5H10. It comprises a five-carbon atom ring, each bonded to two hydrogen atoms. Structurally, it is classified as a cycloalkane, a saturated hydrocarbon with carbon atoms arranged in a ring formation. Cyclopentane is a clear, colorless liquid at room temperature and atmospheric pressure. It has a relatively low boiling point of approximately 49°C (120°F) and is highly volatile. It is used as a blowing agent, refrigerant, reagent, and solvent in various applications.

Stakeholders

- Cyclopentane Manufacturers

- Cyclopentane Suppliers

- Cyclopentane Traders, Distributors, and Suppliers

- Investment Banks and Private Equity Firms

- Raw Material Suppliers

- Government and Research Organizations

- Consulting Companies/Consultants in the Chemicals and Materials Sectors

- Industry Associations

- Contract Manufacturing Organizations (CMOs)

- NGOs, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

Report Objectives

- To define, describe, and forecast the size of the global cyclopentane market in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the global cyclopentane market

- To analyze and forecast the size of various segments of the cyclopentane market based on five major regions—North America, Asia Pacific, Europe, and Rest of the World, along with key countries in each of these regions

- To analyze recent developments and competitive strategies, such as acquisitions, agreements, partnerships, collaborations, product launches, expansions, and others, to draw the competitive landscape of the market

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Key Questions Addressed by the Report

What is the critical driver for the cyclopentane market?

The global phase-out of hydrochlorofluorocarbons (HCFCs) and the increasing use of blowing agents in the construction, automotive, and appliance industries are key drivers of the cyclopentane market.

Which region is expected to register the highest CAGR in the cyclopentane market during the forecast period?

The Asia Pacific region is expected to register the highest CAGR during the forecast period.

Which application is projected to be the largest in the market during the forecast period?

Insulated containers & sippers are projected to be the largest application in the cyclopentane market during the forecast period.

Who are the major players in the cyclopentane market?

Major players include Haltermann Carless Group GmbH (Germany), Junyuan Petroleum Group (China), INEOS (UK), Zeon Corporation (Japan), and Puyang Zhongwei Fine Chemical Co., Ltd. (China).

What is expected to be the CAGR of the cyclopentane market from 2025 to 2030?

The market is expected to grow at a CAGR of 6.1% from 2025 to 2030.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Cyclopentane Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Cyclopentane Market