Refrigeration Insulation Materials Market by Material Type (Elastomeric Foam, PU & PIR), Application (Commercial, Industrial), End-Use Industry (Food & Beverage, Chemicals & Pharmaceuticals, Oil & Gas and Petrochemicals) Region - Global Forecast to 2025

Updated on : April 04, 2024

Refrigeration Insulation Materials Market

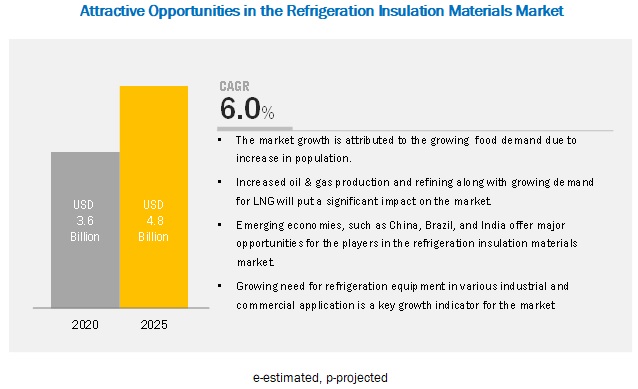

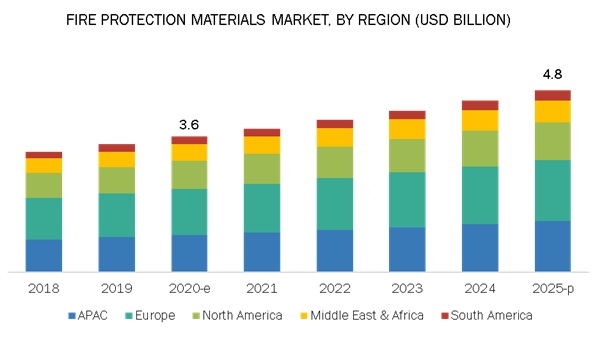

Refrigeration insulation materials market size was valued at USD 3.6 billion in 2020 and is projected to reach USD 4.8 billion by 2025, growing at 6.0% cagr from 2020 to 2025. Increasing demand for food preservation, growing LNG demand, and increased oil and gas production has positively impacted the refrigeration insulation market. Europe is the largest market for refrigeration insulation materials, followed by APAC and North America.

Refrigeration Insulation Materials Market Dynamics

PU/PIR is expected to lead the market during the forecast period.

The refrigeration insulation materials market is broadly segmented on the basis of material type as elastomeric foams, PU & PIR, polystyrene (EPS & XPS), fiber glass, phenolic foams, and others. PU & PIR accounted for the largest share of the refrigeration insulation materials market in 2019. PU & PIR is the most produced insulation type in the market. Its operational temperature range allows it to be used in a wide range of applications. It is also used in cryogenic applications. These foams are suitable for all types of equipment, such as tanks, walls & roofs, pipes, compressors, and are even preformed for joints and bents. PU & PIR are expected to remain the largest insulation material type during the forecast period.

Commercial refrigeration is projected to be the largest application of refrigeration insulation materials

The commercial refrigeration application is expected to dominate the refrigeration insulation materials market and accounted for a share of 37% in 2019. Growing demand for retail groceries, refrigerated vending machines, commercial refrigerators, and chillers had a significant impact on the commercial segment. The global demand for refrigerated warehouses has also boosted the market for refrigeration insulation materials in commercial applications.

Food & beverage industry is expected to account for the largest share of the refrigeration insulation materials

The food & beverage industry is expected to dominate the refrigeration insulation materials market and accounted for a share of 46% in 2019. The global demand for food & beverage has significantly increased due to the growing population. Due to growing environmental issues, the total irrigable land area has reduced drastically in the last decade, thereby putting more emphasis on food preservation. Food processing and preservation are likely to boost the demand for refrigeration. Thus, the refrigeration insulation materials market is expected to grow in the food & beverage industry.

Europe is expected to account for the largest share of the refrigeration insulation materials market

Europe is expected to account for the largest market share in the refrigeration insulation materials market during the forecast period. The presence of various key refrigeration insulation market players, such as Armacell (Germany), Isover (France), Kflex (Italy), and Kingspan (Ireland), along with the growing emphasis on energy conservation and use of low GWP and ODP materials, are influencing the growth of refrigeration insulation materials in the region.

Refrigeration Insulation Materials Market Players

The key players in this market are Armacell (Germany), Owens Corning (US), Kingspan Group Plc (Ireland), Morgan Advanced Materials (UK), Etex (Belgium), Isover (France), BASF SE (Germany), Kflex (Italy), and Aspen Aerogel (US).

Armacell is the largest player in the refrigeration insulation materials market. The company is developing its business via expansion in countries in APAC and the Middle East. It mainly focuses on channel selling and expansion to strengthen its position in the market. The company is also focusing on new product developments.

Kingspan is one of the major manufacturers of refrigeration insulation materials. The company is focusing on expansion as well as acquisition strategies. It has a very strong global presence through its global acquisition strategy. The company also caters to a wide range of insulation materials and also focuses on material development and innovation.

Refrigeration Insulation Materials Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2018–2025 |

|

Base Year Considered |

2019 |

|

Forecast Period |

2020–2025 |

|

Unit considered |

Value (USD Billion) |

|

Segments Covered |

Material type, application, end-use industry, and region |

|

Regions covered |

Europe, North America, APAC, Middle East & Africa, and South America |

|

Companies profiled |

Armacell (Germany), Owens Corning (US), Kingspan Group Plc (Ireland), Morgan Advanced Materials (UK), Etex (Belgium), Isover (France), BASF SE (Germany), Kflex (Italy), and Aspen Aerogel (US).Top 20 major players covered

|

This report categorizes the global refrigeration insulation materials market based on material type, application, end-use industry, and region.

On the basis of type, the refrigeration insulation materials market has been segmented as follows:

- Elastomeric foam (NBR & EPDM)

- PU & PIR

- Polystyrene Foam (XPS & EPS)

- Fiberglass

- Phenolic Foam

- Others (Aerogel, Cellular Glass, Perlite, Plastic Foams, and others)

On the basis of application, the refrigeration insulation materials market has been segmented as follows:

- Commercial

- Industrial

- Cryogenic

- Refrigerated Transportation

On the basis of end-use industry, the refrigeration insulation materials market has been segmented as follows:

- Food –& Beverage

- Chemicals & Pharmaceuticals

- Oil & Gas and Petrochemicals

- Others (Energy & Utilities, Healthcare, Semiconductor, and Textile)

On the basis of region, the refrigeration insulation materials market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments:

- In August 2018, Armacell launched aerogel blanket ArmaGel HT. It is lightweight, easy-to-handle, and suitable for a wide range of applications. This innovation helped the company provide customers with products having higher performance.

- In 2019, KFLEX opened a new production site in Vietnam to support the growing demand from the Asian market.

- In March 2018, Kingspan invested in the manufacturing facility of Kooltherm, a phenolic insulation material, in Sweden. The strategic location of the plant is beneficial for the future growth of the firm.

- In October 2018, Saint-Gobain-Isover acquired Kaimann, a European manufacturer of elastomeric products. This transaction strengthened its position in the European industrial insulation market.

- In April 2019, Aspen Aerogel extended an existing supply agreement and a joint development agreement with BASF (Germany). BASF is procuring materials for its new product called SLENTEX®. This will help the company to increase its profitability.

Key questions addressed by the report:

- What are the major changes impacting market development?

- How will all the developments shape the industry in the mid to long term?

- What are the upcoming products of the refrigeration insulation materials market?

- What are the emerging markets for refrigeration insulation materials?

- What initiatives are companies undertaking to tap into the potential of the industry?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 18)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 22)

2.1 RESEARCH DATA

2.1.1 PRIMARY AND SECONDARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Key data from secondary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.3 PRIMARY DATA

2.2.3.1 Key data from primary interviews

2.2.3.2 Breakdown of primary interviews

2.3 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTION

3 EXECUTIVE SUMMARY (Page No. - 30)

4 PREMIUM INSIGHTS (Page No. - 34)

4.1 REFRIGERATION INSULATION MATERIALS WILL HELP RESOLVE THE FOOD SECURITY ISSUE

4.2 REFRIGERATION INSULATION MATERIALS MARKET, BY REGION

4.3 REFRIGERATION INSULATION MATERIALS MARKET SHARE, BY APPLICATION

4.4 REFRIGERATION INSULATION MATERIALS MARKET, BY END-USE INDUSTRY

4.5 EUROPE: REFRIGERATION INSULATION MATERIALS MARKET, BY TYPE AND COUNTRY

4.6 REFRIGERATION INSULATION MATERIALS MARKET ATTRACTIVENESS

5 MARKET OVERVIEW (Page No. - 37)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growth in sales of refrigeration equipment

5.2.1.2 Increasing demand for cryogenic applications

5.2.1.3 Growing demand for food and increased emphasis on food security

5.2.1.4 Rise in consumption of cold beverages and beer

5.2.2 RESTRAINTS

5.2.2.1 Fluctuating availability and prices of raw materials

5.2.2.2 Government regulations on insulation materials

5.2.3 OPPORTUNITIES

5.2.3.1 Development of more effective and environmentally friendly materials

5.2.3.2 Increased infrastructure spending in emerging economies

5.2.3.3 Increase in demand from the energy industry and niche applications

5.2.4 CHALLENGES

5.2.4.1 Lack of awareness and non-compliance of regulations in emerging markets

5.2.4.2 High capital cost and lack of skilled labor for installation

5.3 SHIFT IN REVENUE STREAMS DUE TO MEGATRENDS IN END-USE INDUSTRIES

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 THREAT OF NEW ENTRANTS

5.4.2 BARGAINING POWER OF SUPPLIERS

5.4.3 THREAT OF SUBSTITUTES

5.4.4 BARGAINING POWER OF BUYERS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 MACROECONOMIC INDICATORS

5.5.1 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES

6 REFRIGERATION INSULATION MATERIALS MARKET, BY MATERIAL TYPE (Page No. - 47)

6.1 INTRODUCTION

6.2 POLYURETHANE & POLYISOCYANURATE (PU & PIR)

6.2.1 EXTENSIVE APPLICATION OF PU& PIR FOAMS IN COLD PIPING

6.3 ELASTOMERIC FOAM

6.3.1 GROWING DEMAND FOR REFRIGERATION IN COMMERCIAL APPLICATIONS TO DRIVE THE MARKET

6.4 POLYSTYRENE FOAM

6.4.1 POSITIVE IMPACT OF GROWING COLD CHAIN MARKET

6.5 FIBERGLASS

6.5.1 LOW COST OF FIBERGLASS IN REFRIGERATION INSULATION

6.6 PHENOLIC FOAM

6.6.1 HIGHER FIRE RATING IN COMPARISON TO OTHER INSULATION MATERIALS HELPING THE PHENOLIC FOAM MARKET TO GROW

6.7 OTHERS

7 REFRIGERATION INSULATION MATERIALS MARKET, BY APPLICATION (Page No. - 54)

7.1 INTRODUCTION

7.2 COMMERCIAL

7.3 INDUSTRIAL

7.4 CRYOGENIC

7.5 REFRIGERATED TRANSPORT

8 REFRIGERATION INSULATION MATERIALS MARKET, BY END-USE INDUSTRY (Page No. - 59)

8.1 INTRODUCTION

8.2 FOOD & BEVERAGE

8.2.1 FRESH FRUITS & VEGETABLES

8.2.2 MEAT, POULTRY & FISH PROCESSING

8.2.3 DAIRY & ICE CREAM PROCESSING

8.2.4 BEVERAGES

8.3 CHEMICALS & PHARMACEUTICALS

8.4 OIL & GAS AND PETROCHEMICALS

8.5 OTHERS

9 REFRIGERATION INSULATION MATERIALS MARKET, BY REGION (Page No. - 67)

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 US

9.2.2 CANADA

9.2.3 MEXICO

9.3 EUROPE

9.3.1 GERMANY

9.3.2 UK

9.3.3 FRANCE

9.3.4 ITALY

9.3.5 RUSSIA

9.3.6 SPAIN

9.4 APAC

9.4.1 CHINA

9.4.2 JAPAN

9.4.3 INDIA

9.4.4 SOUTH KOREA

9.4.5 INDONESIA

9.5 MIDDLE EAST & AFRICA

9.5.1 SAUDI ARABIA

9.5.2 IRAN

9.5.3 UAE

9.6 SOUTH AMERICA

9.6.1 BRAZIL

9.6.2 ARGENTINA

10 COMPETITIVE LANDSCAPE (Page No. - 112)

10.1 OVERVIEW

10.2 COMPETITIVE LEADERSHIP MAPPING (OVERALL MARKET)

10.2.1 DYNAMIC DIFFERENTIATORS

10.2.2 INNOVATORS

10.2.3 VISIONARY LEADERS

10.2.4 EMERGING PLAYERS

10.3 MARKET RANKING, 2019

10.3.1 NEW PRODUCT LAUNCHES

10.3.2 EXPANSIONS

10.3.3 ACQUISITIONS

10.3.4 CONTRACTS, PARTNERSHIP, JOINT VENTURES & AGREEMENTS

11 COMPANY PROFILES (Page No. - 118)

(Business overview, Products offered, Recent Developments, Winning Imperatives, Current Focus and Strategies, Threat from Competition, Right to Win)*

11.1 OWENS CORNING

11.2 KINGSPAN GROUP PLC

11.3 ARMACELL INTERNATIONAL S.A.

11.4 SAINT-GOBAIN ISOVER

11.5 L'ISOLANTE K-FLEX S.P.A.

11.6 ASPEN AEROGELS

11.7 BASF SE

11.8 MORGAN ADVANCED MATERIALS

11.9 ETEX

11.10 ZHEJIANG ZHENSHEN INSULATION TECHNOLOGY CORP. LTD.

11.11 JOHNS MANVILLE

11.12 NMC SA

11.13 ZOTEFOAMS

11.14 CABOT CORPORATION

11.15 LYDALL INC.

11.16 OTHER KEY MARKET PLAYERS

*Business overview, Products offered, Recent Developments, Winning Imperatives, Current Focus and Strategies, Threat from Competition, Right to Win might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 155)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHORS DETAILS

LIST OF TABLES (113 TABLES)

TABLE 1 INCLUSIONS AND EXCLUSIONS

TABLE 2 TRENDS AND FORECAST OF GDP, BY MAJOR ECONOMIES, 2017–2024 (USD BILLION)

TABLE 3 REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 4 PU & PIR MARKET SIZE FOR REFRIGERATION INSULATION MATERIALS, BY REGION, 2018–2025 (USD MILLION)

TABLE 5 ELASTOMERIC FOAM: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 6 POLYSTYRENE FOAM: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 7 FIBERGLASS: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 8 PHENOLIC FOAM: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 9 OTHER MATERIALS: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 10 REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 11 REFRIGERATION INSULATION MATERIALS MARKET SIZE IN COMMERCIAL REFRIGERATION APPLICATION, BY REGION, 2018–2025 (USD MILLION)

TABLE 12 REFRIGERATION INSULATION MATERIALS MARKET SIZE IN INDUSTRIAL APPLICATION, BY REGION, 2018–2025 (USD MILLION)

TABLE 13 REFRIGERATION INSULATION MATERIALS MARKET SIZE IN CRYOGENIC APPLICATION, BY REGION, 2018–2025 (USD MILLION)

TABLE 14 REFRIGERATION INSULATION MATERIALS MARKET SIZE IN REFRIGERATED TRANSPORT APPLICATION, BY REGION, 2018–2025 (USD MILLION)

TABLE 15 REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 16 REFRIGERATION INSULATION MATERIALS MARKET SIZE IN FOOD & BEVERAGE INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

TABLE 17 REFRIGERATION INSULATION MATERIALS MARKET SIZE IN FOOD & BEVERAGE INDUSTRY, BY SUB-TYPE, 2018–2025 (USD MILLION)

TABLE 18 REFRIGERATION INSULATION MATERIALS MARKET SIZE FOR FRESH FRUITS & VEGETABLES, BY REGION, 2018–2025 (USD MILLION)

TABLE 19 REFRIGERATION INSULATION MATERIALS MARKET SIZE FOR MEAT, POULTRY & FISH PROCESSING, BY REGION, 2018–2025 (USD MILLION)

TABLE 20 REFRIGERATION INSULATION MATERIALS MARKET SIZE FOR DAIRY & ICE CREAM PROCESSING, BY REGION, 2018–2025 (USD MILLION)

TABLE 21 REFRIGERATION INSULATION MATERIALS MARKET SIZE FOR BEVERAGES, BY REGION, 2018–2025 (USD MILLION)

TABLE 22 REFRIGERATION INSULATION MATERIALS MARKET SIZE IN CHEMICALS & PHARMACEUTICALS INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

TABLE 23 APPLICATIONS OF REFRIGERATION IN OIL & GAS INDUSTRY

TABLE 24 REFRIGERATION INSULATION MATERIALS MARKET SIZE IN OIL & GAS AND PETROCHEMICALS INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

TABLE 25 REFRIGERATION INSULATION MATERIALS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2025 (USD MILLION)

TABLE 26 REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 27 NORTH AMERICA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 28 NORTH AMERICA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 29 NORTH AMERICA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 30 NORTH AMERICA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 31 NORTH AMERICA: REFRIGERATION INSULATION MATERIALS MARKET SIZE IN FOOD & BEVERAGE, BY SUB-TYPE, 2018-2025 (USD MILLION)

TABLE 32 US: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2018-2025 (USD MILLION)

TABLE 33 US: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 34 US: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 35 CANADA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2018-2025 (USD MILLION)

TABLE 36 CANADA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 37 CANADA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 38 MEXICO: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2018-2025 (USD MILLION)

TABLE 39 MEXICO: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 40 MEXICO: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 41 EUROPE: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 42 EUROPE: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2018-2025 (USD MILLION)

TABLE 43 EUROPE: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 44 EUROPE: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY END-USE INDUSTRY 2018-2025 (USD MILLION)

TABLE 45 EUROPE: REFRIGERATION INSULATION MATERIALS MARKET SIZE IN FOOD & BEVERAGE INDUSTRY, BY SUB-TYPE, 2018-2025 (USD MILLION)

TABLE 46 GERMANY: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2018-2025 (USD MILLION)

TABLE 47 GERMANY: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 48 GERMANY: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 49 UK: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2018-2025 (USD MILLION)

TABLE 50 UK: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 51 UK: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 52 FRANCE: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2018-2025 (USD MILLION)

TABLE 53 FRANCE: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 54 FRANCE: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 55 ITALY: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2018-2025 (USD MILLION)

TABLE 56 ITALY: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 57 ITALY: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 58 RUSSIA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2018-2025 (USD MILLION)

TABLE 59 RUSSIA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 60 RUSSIA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 61 SPAIN: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2018-2025 (USD MILLION)

TABLE 62 SPAIN: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 63 SPAIN: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 64 APAC: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 65 APAC: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 66 APAC: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 67 APAC: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 68 APAC: REFRIGERATION INSULATION MATERIALS MARKET SIZE FOR FOOD & BEVERAGE INDUSTRY, BY SUB-TYPE, 2018–2025 (USD MILLION)

TABLE 69 CHINA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 70 CHINA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 71 CHINA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 72 JAPAN: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2018–2025(USD MILLION)

TABLE 73 JAPAN: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 74 JAPAN: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 75 INDIA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 76 INDIA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 77 INDIA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 78 SOUTH KOREA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 79 SOUTH KOREA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 80 SOUTH KOREA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 81 INDONESIA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2018–2025 (USD MILLION)

TABLE 82 INDONESIA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 83 INDONESIA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 84 MIDDLE EAST & AFRICA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 85 MIDDLE EAST & AFRICA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2018-2025 (USD MILLION)

TABLE 86 MIDDLE EAST & AFRICA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 87 MIDDLE EAST & AFRICA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 88 MIDDLE EAST & AFRICA: REFRIGERATION INSULATION MATERIALS MARKET SIZE IN FOOD & BEVERAGE INDUSTRY, BY SUB-TYPE, 2018-2025 (USD MILLION)

TABLE 89 SAUDI ARABIA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2018-2025 (USD MILLION)

TABLE 90 SAUDI ARABIA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 91 SAUDI ARABIA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 92 IRAN: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2018-2025 (USD MILLION)

TABLE 93 IRAN: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 94 IRAN: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 95 UAE: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2018-2025 (USD MILLION)

TABLE 96 UAE: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 97 UAE: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 98 SOUTH AMERICA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 99 SOUTH AMERICA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2018-2025 (USD MILLION)

TABLE 100 SOUTH AMERICA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 101 SOUTH AMERICA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 102 SOUTH AMERICA: REFRIGERATION INSULATION MATERIALS MARKET SIZE IN FOOD & BEVERAGE INDUSTRY, BY SUB-TYPE, 2018-2025 (USD MILLION)

TABLE 103 BRAZIL: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2018-2025 (USD MILLION)

TABLE 104 BRAZIL: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 105 BRAZIL: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 106 ARGENTINA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2018-2025 (USD MILLION)

TABLE 107 ARGENTINA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 108 ARGENTINA: REFRIGERATION INSULATION MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 109 MAJOR REFRIGERATION INSULATION MATERIAL PRODUCERS

TABLE 110 NEW PRODUCT LAUNCHES, 2017–2019

TABLE 111 EXPANSIONS, 2017-2019

TABLE 112 ACQUISITIONS, 2017-2019

TABLE 113 CONTRACTS, PARTNERSHIP, JOINT VENTURES & AGREEMENTS, 2017-2020

LIST OF FIGURES (52 FIGURES)

FIGURE 1 MARKET SEGMENTATION

FIGURE 2 GLOBAL MARKET CALCULATION

FIGURE 3 MARKET CALCULATION, BY MATERIAL TYPE

FIGURE 4 MARKET CALCULATION, BY APPLICATION

FIGURE 5 MARKET CALCULATION, BY END-USE INDUSTRY

FIGURE 6 MARKET CALCULATION, BY REGION

FIGURE 7 REFRIGERATION INSULATION MATERIALS MARKET: BOTTOM-UP APPROACH

FIGURE 8 REFRIGERATION INSULATION MATERIALS MARKET: TOP-DOWN APPROACH

FIGURE 9 REFRIGERATION INSULATION MATERIALS MARKET: DATA TRIANGULATION

FIGURE 10 COMMERCIAL APPLICATION LED THE REFRIGERATION INSULATION MATERIALS MARKET

FIGURE 11 PU & PIR TO BE THE LARGEST SEGMENT OF REFRIGERATION INSULATION MATERIALS MARKET

FIGURE 12 FOOD & BEVERAGE TO BE THE LARGEST END-USE INDUSTRY FOR REFRIGERATION INSULATION MATERIALS

FIGURE 13 EUROPE TO BE THE LARGEST MARKET BETWEEN 2020 AND 2025

FIGURE 14 GROWTH IN FOOD PROCESSING ACTIVITIES IS PROPELLING THE MARKET FOR REFRIGERATION INSULATION MATERIALS

FIGURE 15 EUROPE TO BE THE LARGEST REFRIGERATION INSULATION MATERIALS MARKET BETWEEN 2020 AND 2025

FIGURE 16 COMMERCIAL APPLICATION LED THE REFRIGERATION INSULATION MATERIALS MARKET

FIGURE 17 FOOD & BEVERAGE TO REMAIN THE LARGEST END-USE INDUSTRY

FIGURE 18 GERMANY ACCOUNTED FOR THE LARGEST MARKET SHARE FOR REFRIGERATION INSULATION MATERIALS

FIGURE 19 CHINA TO WITNESS HIGHEST GROWTH IN REFRIGERATION INSULATION MATERIALS MARKET

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE REFRIGERATION INSULATION MATERIALS MARKET

FIGURE 21 PORTER’S FIVE FORCES ANALYSIS: REFRIGERATION INSULATION MATERIALS MARKET

FIGURE 22 PU & PIR TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

FIGURE 23 COMMERCIAL REFRIGERATION TO BE THE LARGEST APPLICATION OF REFRIGERATION INSULATION MATERIALS

FIGURE 24 FOOD & BEVERAGE TO BE LARGEST END-USE INDUSTRY IN REFRIGERATION INSULATION MATERIALS MARKET

FIGURE 25 FRESH FRUITS & VEGETABLES TO LEAD FOOD & BEVERAGE SEGMENT

FIGURE 26 EUROPE TO BE THE LARGEST REFRIGERATION INSULATION MATERIALS MARKET

FIGURE 27 NORTH AMERICA: REFRIGERATION INSULATION MATERIALS MARKET SNAPSHOT

FIGURE 28 EUROPE: REFRIGERATION INSULATION MATERIALS MARKET SNAPSHOT

FIGURE 29 GERMANY REMAINS LARGEST MARKET FOR REFRIGERATION INSULATION MATERIALS

FIGURE 30 APAC: REFRIGERATION INSULATION MATERIALS MARKET SNAPSHOT

FIGURE 31 CHINA TO REMAIN THE LARGEST REFRIGERATION INSULATION MATERIALS MARKET IN APAC

FIGURE 32 THE UAE TO LEAD REFRIGERATION INSULATION MATERIALS MARKET

FIGURE 33 BRAZIL TO REMAIN THE LARGEST REFRIGERATION INSULATION MATERIALS MARKET IN SOUTH AMERICA

FIGURE 34 REFRIGERATION INSULATION MATERIALS MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 35 OWENS CORNING: COMPANY SNAPSHOT

FIGURE 36 OWENS CORNING: WINNING IMPERATIVES

FIGURE 37 KINGSPAN GROUP PLC: COMPANY SNAPSHOT

FIGURE 38 KINGSPAN: WINNING IMPERATIVES

FIGURE 39 ARMACELL INTERNATIONAL S.A.: COMPANY SNAPSHOT

FIGURE 40 ARMACELL: WINNING IMPERATIVES

FIGURE 41 SAINT-GOBAIN ISOVER: WINNING IMPERATIVES

FIGURE 42 ASPEN AEROGELS: COMPANY SNAPSHOT

FIGURE 43 ASPEN AEROGELS: WINNING IMPERATIVES

FIGURE 44 BASF SE: COMPANY SNAPSHOT

FIGURE 45 BASF SE: WINNING IMPERATIVES

FIGURE 46 MORGAN ADVANCED MATERIALS: COMPANY SNAPSHOT

FIGURE 47 MORGAN ADVANCED MATERIALS: WINNING IMPERATIVES

FIGURE 48 ETEX: COMPANY SNAPSHOT

FIGURE 49 ETEX: WINNING IMPERATIVES

FIGURE 50 ZOTEFOAMS: COMPANY SNAPSHOT

FIGURE 51 CABOT CORPORATION: COMPANY SNAPSHOT

FIGURE 52 LYDALL: COMPANY SNAPSHOT

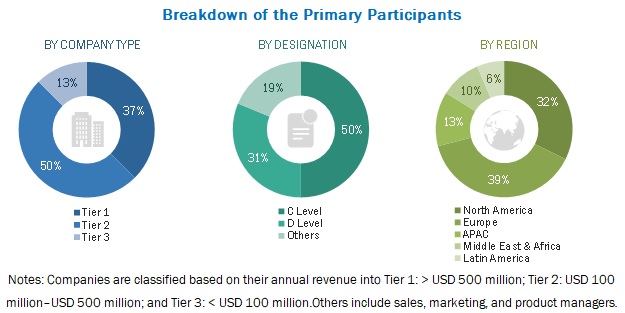

The study involved four major activities in estimating the market size for refrigeration insulation materials. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and sub-segments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites, such as Factiva, ICIS, and Bloomberg. The findings of this study were verified through primary research by conducting extensive interviews with key officials, such as CEOs, VPs, directors, and other executives.

Primary Research

The refrigeration insulation market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of applications, such as commercial, industrial, cryogenic, and refrigerated transport. The supply side is characterized by the type of products and width of product portfolio. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the refrigeration insulation materials market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To estimate and forecast the market size for refrigeration insulation materials, in terms of value

- To provide detailed information regarding the important factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To define, describe, and forecast the global refrigeration insulation materials market by material type, application, and end-use industry

- To forecast the market size based on five key regions, namely, Asia Pacific (APAC), Europe, North America, the Middle East & Africa, and South America

- To strategically analyze the market with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities for stakeholders in the market and provide a competitive landscape for the market leaders

- To strategically profile the key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or application

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Refrigeration Insulation Materials Market