The research methodology for the global customer information system market report involved the use of extensive secondary sources and directories, as well as various reputed open-source databases, to identify and collect information useful for this technical and market-oriented study. In-depth interviews were conducted with various primary respondents, including CIS software providers, CIS service providers, public utility commissions, technology providers, utilities providers, and government agencies; high-level executives of multiple companies offering customer information system & services; and industry consultants to obtain and verify critical qualitative and quantitative information and assess the market prospects and industry trends.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports; press releases and investor presentations of companies; white papers, certified publications such as Journal of Energy Engineering, Journal of Energy Markets, International Journal of Electrical Power & Energy Systems, Journal of Cleaner Production; and articles from recognized associations and government publishing sources including but not limited to American Public Power Association (APPA), Utilities Technology Council (UTC), Electric Power Research Institute (EPRI), International Association for Energy Economics, and Smart Electric Power Alliance (SEPA).

The secondary research was used to obtain key information about the industry’s value chain, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary Research

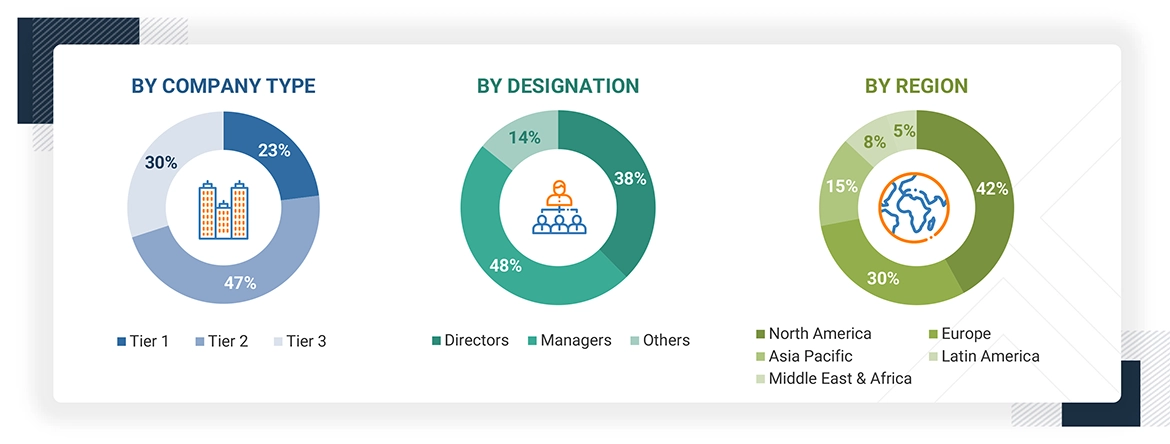

In the primary research process, a diverse range of stakeholders from both the supply and demand sides of the customer information system ecosystem were interviewed to gather qualitative and quantitative insights specific to this market. From the supply side, key industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology & innovation directors, as well as technical leads from vendors offering customer information system software & services were consulted. Additionally, system integrators, service providers, and IT service firms that implement and support customer information system were included in the study. On the demand side, input from IT decision-makers, infrastructure managers, and business heads of prominent utility providers was collected to understand the user perspectives and adoption challenges within targeted industries.

The primary research ensured that all crucial parameters affecting the customer information system market—from technological advancements and evolving use cases (customer data storage & retrieval, billing & payment automation, metering data integration, service order management, etc.) to regulatory and compliance needs (GDPR, CCPA, NIS2 Act, BDSG etc.) were considered. Each factor was thoroughly analyzed, verified through primary research, and evaluated to obtain precise quantitative and qualitative data for this market.

Once the initial phase of market engineering was completed, including detailed calculations for market statistics, segment-specific growth forecasts, and data triangulation, an additional round of primary research was undertaken. This step was crucial for refining and validating critical data points, such as CIS offerings (customer information system software & services), industry adoption trends, the competitive landscape, and key market dynamics like demand drivers (regulatory compliance & government mandates, shift to smart grids & advanced metering, digital transformation in utilities, rising utility customer expectations), challenges (interoperability between legacy & modern systems, cybersecurity & compliance pressure), and opportunities (integration with AI & data analytics, demand for personalized tariff structures, utility E-marketplaces & value-added services).

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecast for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to record the critical information/insights throughout the report.

Note: Three tiers of companies are defined based on their total revenue as of 2024; tier 1 = revenue more than USD 500 million, tier 2 = revenue between USD 100 million and 500 million, tier 3 = revenue less than USD 100 million

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To estimate and forecast the customer information system market and its dependent submarkets, both top-down and bottom-up approaches were employed. This multi-layered analysis was further reinforced through data triangulation, incorporating both primary and secondary research inputs. The market figures were also validated against the existing MarketsandMarkets repository for accuracy. The following research methodology has been used to estimate the market size:

Customer Information System (CIS) Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

Customer information system comprises of specialized software solutions designed for utilities to manage customer-centric functions, including billing, meter data management, service orders, customer communications, payment processing, and outage handling. Unlike general CRM systems, utility-specific CIS integrate closely with advanced metering infrastructure (AMI), distribution management systems (DMS), and workforce management systems, enabling utilities to streamline complex billing cycles, optimize revenue management, and provide personalized customer interactions. Utility-focused CIS becomes integral in modernizing customer relationship management, enhancing operational efficiency, and fulfilling regulatory compliance demands, which are increasingly prevalent in the utility industry.

Stakeholders

-

Vendors offering CIS software

-

CIS implementation teams

-

CIS-as-a-Service Companies

-

Technology providers

-

Business analysts

-

Distributors and Value-added Resellers (VARs)

-

Public Utility Commissions

-

Independent Software Vendors (ISV)

-

Market research and consulting firms

-

Support & maintenance service providers

-

Billing & Revenue Management Providers

-

Government agencies and regulatory bodies

-

CIS Consultants & Integration Partners

-

Academia & research institutions

-

Investors & venture capital firms

Report Objectives

-

To define, describe, and forecast the customer information system market, by offering, deployment mode, application, and end user

-

To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

-

To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

-

To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the customer information system market

-

To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

-

To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

-

To profile the key players and comprehensively analyze their market ranking and core competencies

-

To analyze competitive developments, such as partnerships, product launches, and mergers and acquisitions, in the customer information system market

-

To analyze competitive developments, such as partnerships, product launches, and mergers and acquisitions, in the customer information system market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

-

Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

-

Further breakup of the North American market for Customer information system

-

Further breakup of the European market for Customer information system

-

Further breakup of the Asia Pacific market for Customer information system

-

Further breakup of the Middle Eastern & African market for Customer information system

-

Further breakup of the Latin American market for Customer information system

Company Information

-

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Customer Information System (CIS) Market