Healthcare IT Solutions Market by Product (EHR, PACS, Interoperability, Healthcare Analytics, Telemedicine, CRM), Market Size, Adoption Trends, Competitive landscape (Market Share Analysis, Product Portfolio Assessment) - Global Forecast to 2020

The global healthcare IT solutions market size is projected to grow at a CAGR of 13.4%. Factors such as rising healthcare costs, strong government support and initiatives to curtail rising healthcare costs, the growing need to integrate healthcare systems, and efforts from healthcare providers to maximize their returns on investment are fueling the growth of this market.

The report analyzes the healthcare IT solutions market by solutions, application, and region.

The interface/integration engines segment accounted for the largest share of the global healthcare IT solutions market, followed by medical device integration software

Based on products, the market is segmented into interface/integration engines, medical device integration software, media integration solutions, and other integration tools. Interface engines are key components in healthcare data integration, thus dominating this market with a majority share.

The hospital integration segment accounted for the global healthcare IT solutions market

Based on application, the market is broadly segmented into hospital integration, clinics integration, lab integration, radiology integration, medical device integration, and other applications. Other integration applications include telehealth services, ambulatory services, and billing and revenue cycle management. Hospital integration dominated this market. The large share is primarily attributed to the increasing use of IT integration within hospitals in order to maximize value-based reimbursements.

North America dominated the healthcare IT solutions market, this trend is expected to continue during the forecast period

Geographically, the market is segmented into North America, Europe, Asia Pacific and Rest of World. North America accounted for the largest share of this market. The presence of major companies and the growing need to curtail the soaring healthcare costs, enhance the quality of healthcare, improve the overall efficiency of healthcare organizations are the key factors driving the growth of the North American healthcare IT solutions market.

The prominent players in the global healthcare IT solutions market are InterSystems Corporation (U.S.), Corepoint Health (U.S.), Orion Health (New Zealand), Infor, Inc. (U.S.), iNTERFACEWARE (Canada), Quality Systems Inc. (U.S.), Cerner Corporation (U.S.), IBM (U.S.), Allscripts Healthcare Solutions, Inc. (U.S.), Oracle Corporation (U.S.), Summit Health, Inc. (U.S.), and AVI-SPL (U.S.).

Healthcare IT Solutions Market Report Scope

|

Report Metric |

Details |

|

Forecast units |

Value (USD) |

|

Segments covered |

Products, applications and regions. |

|

Geographies covered |

North America, Europe, Asia Pacific, Rest of World |

Segmentation

The research report categorizes the market into the following segments and subsegments:

By Solution

-

By Product

- Interface/Integration Engines

- Medical Device Integration Software

- Media Integration Solutions

- Other Integration Tools

-

By Service

- Implementation Services

- Support and Maintenance Services

- Training Services Systems

By Application

- Hospital Integration

- Lab Integration

- Medical Device Integration

- Clinic Integration

- Radiology Integration

- Other Applications

By Region

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Rest of Europe

- Asia Pacific

- Rest of the World

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of product portfolios of each company

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Recent Developments

- In 2016, InterSystems entered into a partnership with Pulse Infoframe (U.S.). Under this partnership, the company’s InterSystems HealthShare platform will be used by Pulse Infoframe for interoperability between clinical research systems and electronic health records (EHRs).

- In 2015, Merge Healthcare partnered with ICT Health (UAE). The partnership intended to deliver high-quality, affordable integrated clinical technology solutions to hospitals and clinics in the Middle East, North Africa, and India.

- In 2015, Infor launched CloudSuite Clinical, a new cloud-based interoperability, analytics, and patient engagement platform. The new product was designed to overcome complex interoperability challenges faced by payers, providers, and private exchanges. This helped the company provide better care and risk management solutions in the healthcare IT market.

Key Questions Addressed in the Report

- Who are the top 10 players operating in the healthcare IT solutions market?

- What are the driving factors, restraints, opportunities, and challenges in the healthcare IT integration market?

- What are the industry trends and current scenario of the healthcare IT solutions market?

- What are the growth trends in the healthcare IT integration market at segmental and overall market levels?

Frequently Asked Questions (FAQ):

What is the size of Healthcare IT Solutions Market ?

The global Healthcare IT Solutions Market size is growing at a CAGR of 13.4%

What are the major growth factors of Healthcare IT Solutions Market ?

Factors such as rising healthcare costs, strong government support and initiatives to curtail rising healthcare costs, the growing need to integrate healthcare systems, and efforts from healthcare providers to maximize their returns on investment are fueling the growth of this market.

Who all are the prominent players of Healthcare IT Solutions Market ?

The prominent players in the global healthcare IT integration market are InterSystems Corporation (U.S.), Corepoint Health (U.S.), Orion Health (New Zealand), Infor, Inc. (U.S.), iNTERFACEWARE (Canada), Quality Systems Inc. (U.S.), Cerner Corporation (U.S.), IBM (U.S.), Allscripts Healthcare Solutions, Inc. (U.S.), Oracle Corporation (U.S.), Summit Health, Inc. (U.S.), and AVI-SPL (U.S.). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.3 Healthcare IT Solutions Market Scope

1.3.1 Geographic Coverage

1.3.2 Product Markets

1.3.2 End User Markets

2 Research Methodology

2.1 Research Approach

2.2 Healthcare IT Solutions Market Size Estimation

3 Key Healthcare IT Solutions Market Dynamics

3.1 Key Factors Affecting the Market Growth and Their Impact Assessment

3.1.1 Key Healthcare IT Solutions Market Drivers

3.1.1.1 Growing Need to Manage Regulatory Compliance Through Healthcare It Solutions

3.1.1.2 RISing Need to Curtail Escalating Healthcare Costs

3.1.1.3 Government Support for Healthcare It Solutions

3.1.1.4 High Return on Investment for HCIT Solutions

3.1.1.5 Growing Focus on Improving Quality of Care and Clinical Outcomes

3.1.2 Key Healthcare IT Solutions Market Restraints

3.1.2.1 High Cost of Deployment

3.1.2.2 Reluctance Among Medical Professionals to Adopt Advanced Healthcare It Tools

3.1.2.3 Lack of Skilled It Professionals in the Healthcare Industry

3.1.3 Key Challenges

3.1.3.1 Integration of Healthcare It Solutions Within Healthcare Organizations

3.1.3.2 Data Security Concerns

4 Healthcare IT Solutions Market Assessment

Access Market Size & Growth Rates for Each of the Following HCIT Product/Solutions, at Country Level Using Interactive Product Dashboard.

4.1 Healthcare IT Solutions Market Size, By Product (2013–2020)

4.1.1 Healthcare Provider Solutions

4.1.1.1 Clinical Solutions

4.1.1.1.1 Electronic Health Records(EHR)/Electronic Medical Records(EMR)

4.1.1.1.2 Mobile Health Solutions

4.1.1.1.2.1 Connected Medical Devices

4.1.1.1.2.2 Healthcare Applications (Mhealth Apps)

4.1.1.1.3 Picture Archiving and Communication Systems (PACS) and Vendor Neutral Archives (VNA)

4.1.1.1.4 Healthcare It Integration Systems

4.1.1.1.5 Computerized Physician Order Entry (CPOE)

4.1.1.1.6 Clinical Decision Support Systems (CDSS)

4.1.1.1.7 Radiology Information Systems (RIS)

4.1.1.1.8 Radiation Dose Management

4.1.1.1.9 Specialty Management Information Systems

4.1.1.1.10 Medical Image Analysis Systems

4.1.1.1.11 Practice Management Systems

4.1.1.1.12 Laboratory Information Systems

4.1.1.1.13 Digital Pathology Solutions

4.1.1.1.14 Telehealth Solutions

4.1.1.2 Non-Clinical Healthcare It Solutions

4.1.1.2.1 Pharmacy Information Systems (PIS)

4.1.1.2.2 Medication Management Systems

4.1.1.2.2.1 Electronic Medication Administration Software

4.1.1.2.2.2 Barcode Medication Administration

4.1.1.2.2.3 Medication Inventory Management Systems

4.1.1.2.2.4 Medication Assurance Systems

4.1.1.2.3 Healthcare Asset Management

4.1.1.2.3.1 Equipment Management

4.1.1.2.3.2 Patient Tracking and Management

4.1.1.2.3.3 Temperature and Humidity Monitoring

4.1.1.2.4 Workforce Management Systems (WFM)

4.1.1.2.5 Revenue Cycle Management Solutions(RCM)

4.1.1.2.5.1 Admit Discharge Transfer Registration (ADT/Registration)

4.1.1.2.5.2 Computer-Assisted Coding Systems

4.1.1.2.5.3 Patient Scheduling Solutions

4.1.1.2.5.4 Patient Billing and Claims Management Solutions

4.1.1.2.5.5 Electronic Data Interchange

4.1.1.2.6 Medical Document Management Solutions

4.1.1.2.7 Financial Management Systems

4.1.1.2.8 Healthcare Information Exchange (HIE)

4.1.1.2.9 Population Health Management Solutions(PHM)

4.1.1.2.10 Supply Chain Management Solutions (SCM)

4.1.1.2.10.1 Procurement Management

4.1.1.2.10.2 Inventory Management

4.1.1.2.11 Healthcare Analytics

4.1.1.2.11.1 Clinical Analytics

4.1.1.2.11.2 Financial Analytics

4.1.1.2.11.3 Operational and Administrative Analytics

4.1.1.2.12 Customer Relationship Management (CRM)

4.1.2 Healthcare Payer Solutions

4.1.2.1 Pharmacy Audit and Analysis Systems

4.1.2.2 Claims Management Solutions

4.1.2.3 Fraud Management Solutions

4.1.2.4 Computer-Assisted Coding (CAC)Systems

4.1.2.5 Member Eligibility Management Solutions

4.1.2.6 Provider Network Management Solutions

4.1.2.7 Payment Management Solutions

4.1.2.7.1 Patient Billing Management Solutions

4.1.2.7.2 Provider Blling Management Solutions

4.1.2.8 Customer Relationship Management Solutions

4.1.2.9 Medical Document Management Solutions

4.1.2.10 Other Payer Solutions

4.1.3 HCIT Outsourcing Services

4.1.3.1 Provider HCIT Outsourcing Services Market

4.1.3.1.1 Electronic Medical Records and Medical Document Management Services

4.1.3.1.2 Pharmacy Information Management Services

4.1.3.1.3 Laboratory Information Management Services

4.1.3.1.4 Revenue Cycle Management Services

4.1.3.1.5 Other Provider Outsourcing Services

4.1.3.2 Payer It Outsourcing Services

4.1.3.2.1 Customer Relationship Management Services

4.1.3.2.2 Claims Processing Services

4.1.3.2.3 Billing Management Systems

4.1.3.2.4 Fraud Detection Services

4.1.3.2.5 Other Payer Outsourcing Services

4.1.3.3 Operational It Outsourcing Services

4.1.3.3.1 Business Process Management Services

4.1.3.3.2 Supply Chain Management Services

4.1.3.3.3 Other Operational It Outsourcing Services

4.1.3.4 It Infrastructure Management Services

4.2 Market Share Analysis, By Product (2015)

4.2.1 Workforce Management Solutions

4.2.2 Radiation Dose Management Solutions

4.2.3 Connected Medical Devices

4.2.4 Revenue Cycle Management Solutions

4.2.5 Practice Management Solutions

4.2.6 Electronic Health Records/ Electronic Medical Records

4.2.7 Picture Archiving and Communication Systems (PACS) and Vendor Neutral Archives (VNA)

4.2.8 Computerized Physician Order Entry (CPOE)

4.2.9 Clinical Decision Support Systems

4.2.10 Radiology Information Systems

4.2.11 Telehealth Solutions

4.2.12 Medication Management Systems

4.2.13 Medical Document Management Systems

4.2.14 Medical Image Processing & Analysis Systems

5 Healthcare IT Solutions Market Size, By Geography (2013–2020)

Access Country-Level Market Size & Growth Rates for Each of the HCIT Product/Solutions, at Country Level Using Interactive Country Dashboard. This Provides Market Size

5.1 Healthcare IT Solutions Market Size, By Product

5.1.1 North America

5.1.1.1 U.S.

5.1.1.2 Canada

5.1.2 Europe

5.1.2.1 Germany

5.1.2.2 U.K.

5.1.2.3 France

5.1.2.4 Italy

5.1.2.5 Spain

5.1.2.6 Rest of Europe (RoE)

5.1.3 Asia-Pacific (APAC)

5.1.3.1 Japan

5.1.3.2 China

5.1.3.3 India

5.1.3.4 Rest of Asia-Pacific (RoAPAC)

5.1.4 Latin America

5.1.4.1 Brazil

5.1.4.2 Mexico

5.1.4.3 Rest of Latin America

5.1.5 Middle East and Africa

5.2 Healthcare IT Solutions Market Size, By End-User

5.2.1 Healthcare Providers

5.2.1.1 Hospitals

5.2.1.2 Ambulatory Care Centers

5.2.1.3 Home Healthcare Agencies, Nursing Homes, and Assisted Living Facilities

5.2.1.4 Diagnostic and Imaging Centers

5.2.1.5 Pharmacies

5.2.2 Healthcare Payers

5.2.2.1 Private Payers

5.2.2.2 Public Payers

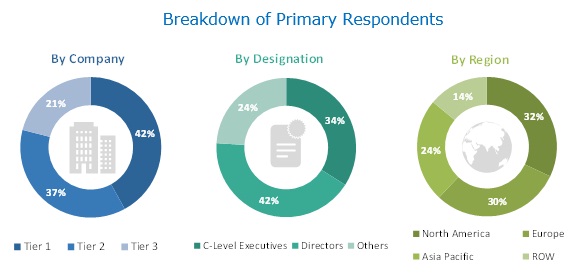

The study involved four major activities to estimate the current market size for healthcare IT solutions. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, trade directories, and databases such as D&B Hoovers and Bloomberg Businessweek were referred to identify and collect information for this study.

Primary Research

The healthcare IT solutions market comprises several stakeholders such as Healthcare IT solution providers healthcare IT vendors, healthcare IT service providers, healthcare payers, academic research institutes, government institutes, market research & consulting firms and venture capitalists & investors. Primary sources from the supply side include CEOs, vice presidents, marketing and sales directors, business development managers, and innovation directors of healthcare IT integration solutions companies. Demand-side primary sources include industry experts such as healthcare providers from hospitals and clinics and healthcare payers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to validate the size of the global healthcare IT solutions market and estimate the size of various other dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The Major players in the market were identified through secondary research and their market revenues determined through primary and secondary research.

- The market estimations in this report are based on the marketed sales price of healthcare IT integration devices and accessories, excluding any discounts provided by the manufacturer or distributor.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and sub segments. In order to complete the overall market engineering process and arrive at the exact statistics for all segments and sub segments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides.

Objectives of the Study

- To define, describe, and forecast the global healthcare IT solutions market on the basis of products, applications, and regions.

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges).

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and contributions to the overall market.

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of the healthcare IT integration market with respect to four main regions, namely, North America, Europe, Asia-Pacific, and the Rest of the World.

- To strategically profile the key players in the global healthcare IT integration market and comprehensively analyze their core competencies.

- To track and analyze competitive developments such as joint ventures and alliances, mergers and acquisitions, new product developments, and R&D activities of the leading players in the global healthcare IT solutions market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Healthcare IT Solutions Market