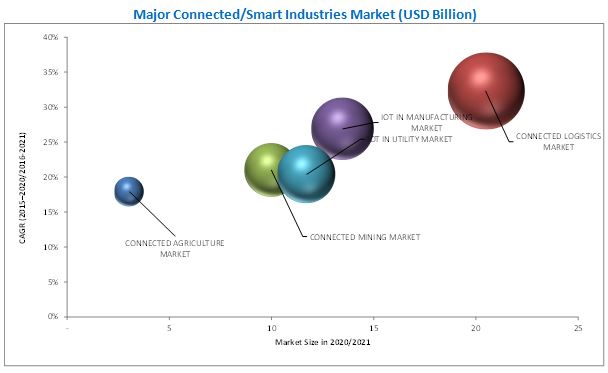

Top 10 Connected/Smart Industries (IoT in Manufacturing, IoT in Retail, IoT in Utility, Connected Mining, Connected Logistics, Connected Agriculture, Smart Education and Learning, Smart Buildings, Smart Grid Management, and Smart Transportation)

[178 Pages Report] The top 10 connected/smart industries are estimated to grow on the account of decrease in Internet of Things (IoT) hardware cost, need for operational efficiency, and wide adoption of Bring Your Own Device (BYOD) practice.

The objective of this study is to define, describe, and forecast the adoption of IoT in different industries and identify the fastest growing industries. It also provides detailed information regarding the major factors (such as drivers and restraints) influencing the growth of the IoT across different industries. Additionally, the study aims at strategically profiling key players and comprehensively analyzing their recent developments and positioning such as mergers & acquisitions, new product developments, and Research & Development (R&D) activities in the market.

This research study involved the extensive usage of secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for this technical, market-oriented, and commercial study of top 10 smart/connected industries market. Along with that, a few other market-related sources such as IEEE and white papers have also been considered while doing extensive secondary research. The primary sources are mainly several industry experts from core and related industries and preferred system developers, service providers, system integrators, resellers, partners, standards, and certification organizations from companies and organizations related to various segments of this industrys value chain. In-depth interviews were conducted from various primary respondents that include key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information as well as to assess future prospects.

The top 10 connected/smart industries ecosystem comprises solution vendors such as ABB Ltd, Cisco Systems, Inc., Intel Corporation, Siemens AG, and Schneider Electric SE; platform providers such as IBM Corporation, PTC, Inc., and Microsoft Corporation; and other solutions and services providers.

Key Target Audience

- Embedded systems companies

- Application developers and aggregators

- Networking and communication service providers

- Data management and predictive analysis companies

- Machine-To-Machine (M2M), IoT, and telecommunication companies

- System Integrators

- IT Service Providers

- Consulting Service Providers

- Managed Service Providers

- Market Research and Consulting Firms

- Educational Institutions (K-12 and higher education schools and universities)

- Government Authorities/Non-profit Organizations

- Utility Platform and Analytics Vendors

- Transportation Agencies

- Public Transportation Departments

The study answers several questions for the stakeholders, primarily which market segments to focus in next two to five years for prioritizing the efforts and investments.

To know about the assumptions considered for the study, download the pdf brochure

Scope of the Report

In this report, the top 10 connected/smart industries has been segmented into the following categories:

Connected Agriculture Market

- Executive Summary

- Drivers and Restraints

- Industry Trends

- Market by Solution

- Market by Service

- Market by Application

- Market by Region

Connected Logistics Market

- Executive Summary

- Drivers and Restraints

- Industry Trends

- Market by System and Solution

- Market by Network Technology

- Market by Device

- Market by Service

- Market by Transportation Mode

- Market by Region

Connected Mining Market

- Executive Summary

- Drivers and Restraints

- Industry Trends

- Market by System and Solution

- Market by Service

- Market by Method

- Market by Region

IoT in Manufacturing Market

- Executive Summary

- Drivers and Restraints

- Industry Trends

- Market by Software

- Market by Connectivity Technology

- Market by Platform

- Market by Service

- Market by Application

- Market by Region

IoT in Retail Market

- Executive Summary

- Drivers and Restraints

- Industry Trends

- Market by Component

- Market by Service

- Market by Technology

- Market by Functional Area

- Market by Region

IoT in Utility Market

- Executive Summary

- Drivers and Restraints

- Industry Trends

- Market by Software

- Market by Platform

- Market by Service

- Market by Application

- Market by Region

Smart Education and Learning Market

- Executive Summary

- Drivers and Restraints

- Industry Trends

- Market by Product

- Market by Learning Mode

- Market by User Type

- Market by Region

Smart Buildings Market

- Executive Summary

- Drivers and Restraints

- Industry Trends

- Market by Building Automation Software

- Market by Service

- Market by Building Type

- Market by Region

Smart Grid Management Market

- Executive Summary

- Drivers and Restraints

- Industry Trends

- Market by Solution

- Market by Service

- Market by Region

Smart Transportation Market

- Executive Summary

- Drivers and Restraints

- Industry Trends

- Market by Solution

- Market by Service

- Market by Region

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

The top 10 connected/smart industries market size is expected to grow at a significant rate during the forecast period. The major growth drivers of the top 10 connected/smart industries market include the emergence of cloud platform, need for enhanced operational efficiency, decreasing cost of industrial hardware and networking component, government regulations, and increasing infrastructural development initiatives such as intelligent transportation, smart cities, and smart highways.

The smart transportation market promises huge opportunities during the forecast period. The key trends contributing to this market growth are demographic growth and hyper-urbanization, increase in vehicles leading to road congestion, and reduction of greenhouse gas emission. Government initiatives and emerging partnership models are also fueling the market growth. For example, the U.K. governments Department of Transport is investing a sum of USD 16 Million in smart ticketing especially among the small and medium-sized bus companies. Moreover, the Governor of Ohio announced a USD 15 Million state investment to embed high-capacity fiber-optic cable and wireless sensors along the auto-industry-rich corridor to permit testing and research of smart transportation technology such as self-driving vehicles.

The Internet of Things (IoT) in manufacturing market is expected to grow at a high Compound Annual Growth Rate (CAGR). The manufacturers need for operational efficiency has increased the utilization of sensors through enhanced automation and integrated connected technology solutions across the manufacturing process which, in turn, has increased the demand for IoT solutions for various manufacturing applications. Other driving forces include decreasing hardware & connectivity costs and increasing penetration of connected devices. Moreover, the cost benefits of Software-as-a-Service (SaaS) and cloud-based deployment of IoT in manufacturing solutions are also expected to provide a wholesome growth opportunity to the market.

The North American region is expected to be the largest revenue generating region for top 10 connected/smart industries solutions and services providers owing to the early adoption of technology and large-scale investments in the region. APAC, on the other hand, is projected to grow at the highest CAGR due to increasing technological adoption and increased technological spending in China, India, Australia, and Singapore.

Factors such as centralized infrastructure and low levels of operational efficiency in developing economies are hindering the growth of the top 10 connected/smart industries market. Additionally, lack of skilled workforce also restrains the adoption of smart industries solutions.

The report also contains the profiling and competitive landscape of the major technology vendors. Some of the major technology vendors include ABB Group (Switzerland), Cisco Systems, Inc. (U.S.), General Electric (U.S.), IBM Corporation (U.S.), and Intel Corporation (U.S.). The companies are taking different measures such as mergers & acquisitions, partnerships & collaborations, and new product developments to increase their share in the market. These activities have also been tracked and mentioned in the report.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objective of the Study

1.2 Market Definition

1.3 Currency

1.4 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.2 Research Assumptions

3 Connected Agriculture Market (Page No. - 19)

3.1 Executive Summary

3.2 Drivers and Restraints

3.3 Industry Trends

3.4 Connected Agriculture Market Analysis, By Solution

3.5 Connected Agriculture Market Analysis, By Service

3.6 Connected Agriculture Market Analysis, By Application

3.7 Connected Agriculture Market Analysis, By Region

4 Connected Logistics Market (Page No. - 28)

4.1 Executive Summary

4.2 Drivers and Restraints

4.3 Industry Trends

4.4 Connected Logistics Market Analysis, By System and Solution

4.5 Connected Logistics Market Analysis, By Network Technology

4.6 Connected Logistics Market Analysis, By Device

4.7 Connected Logistics Market Analysis, By Service

4.8 Connected Logistics Market Analysis, By Transportation Mode

4.9 Connected Logistics Market Analysis, By Region

5 Connected Mining Market (Page No. - 42)

5.1 Executive Summary

5.2 Drivers and Restraints

5.3 Industry Trends

5.4 Connected Mining Market Analysis, By System and Solution

5.5 Connected Mining Market Analysis, By Service

5.6 Connected Mining Market Analysis, By Method

5.7 Connected Mining Market Analysis, By Region

6 Internet of Things in Manufacturing Market (Page No. - 53)

6.1 Executive Summary

6.2 Drivers and Restraints

6.3 Industry Trends

6.4 IoT in Manufacturing Market Analysis, By Software

6.5 IoT in Manufacturing Market Analysis, By Connectivity Technology

6.6 IoT in Manufacturing Market Analysis, By Platform

6.7 IoT in Manufacturing Market Analysis, By Service

6.8 IoT in Manufacturing Market Analysis, By Application

6.9 IoT in Manufacturing Market Analysis, By Region

7 Internet of Things in Retail Market (Page No. - 66)

7.1 Executive Summary

7.2 Drivers and Restraints

7.3 Industry Trends

7.4 IoT in Retail Market Analysis, By Component

7.5 IoT in Retail Market Analysis, By Service

7.6 IoT in Retail Market Analysis, By Technology

7.7 IoT in Retail Market Analysis, By Functional Area

7.8 IoT in Retail Market Analysis, By Region

8 Internet of Things in Utility Market (Page No. - 78)

8.1 Executive Summary

8.2 Drivers and Restraints

8.3 Industry Trends

8.4 IoT in Utility Market Analysis, By Software

8.5 IoT in Utility Market Analysis, By Platform

8.6 IoT in Utility Market Analysis, By Service

8.7 IoT in Utility Market Analysis, By Application

8.8 IoT in Utility Market Analysis, By Region

9 Smart Education and Learning Market (Page No. - 91)

9.1 Executive Summary

9.2 Drivers and Restraints

9.3 Industry Trends

9.4 Smart Education and Learning Market Analysis, By Product

9.5 Smart Education and Learning Market Analysis, By Learning Mode

9.6 Smart Education and Learning Market Analysis, By User Type

9.7 Smart Education and Learning Market Analysis, By Region

10 Smart Buildings Market (Page No. - 103)

10.1 Executive Summary

10.2 Drivers and Restraints

10.3 Industry Trends

10.4 Smart Buildings Market Analysis, By Building Automation Software

10.5 Smart Buildings Market Analysis, By Service

10.6 Smart Buildings Market Analysis, By Building Type

10.7 Smart Buildings Market Analysis, By Region

11 Smart Grid Management Market (Page No. - 118)

11.1 Executive Summary

11.2 Drivers and Restraints

11.3 Industry Trends

11.4 Smart Grid Management Market Analysis, By Solution

11.5 Smart Grid Management Market Analysis, Service

11.6 Smart Grid Management Market Analysis, By Region

12 Smart Transportation Market (Page No. - 131)

12.1 Executive Summary

12.2 Drivers and Restraints

12.3 Industry Trends

12.4 Smart Transportation Market Analysis, By Solution

12.5 Smart Transportation Market Analysis, By Service

12.6 Smart Transportation Market Analysis, By Region

13 Company Profiles (Page No. - 141)

13.1 ABB Group

13.2 Cisco Systems, Inc.

13.3 General Electric

13.4 IBM Corporation

13.5 Intel Corporation

13.6 Microsoft Corporation

13.7 Parametric Technology Corporation, Inc.

13.8 SAP SE

13.9 Schneider Electric SE

13.10 Siemens AG

14 Appendix (Page No. - 174)

14.1 Knowledge Store: Marketsandmarkets Subscription Portal

14.2 Introducing RT: Real-Time Market Intelligence

14.3 Available Customization

14.4 Author Details

List of Tables (54 Tables)

Table 1 Connected Agriculture Market Growth Rate, 20142021 (USD Billion, Y-O-Y %)

Table 2 Connected Agriculture Market Size, By Solution, 20142021 (USD Million)

Table 3 Connected Agriculture Market Size, By Service, 20142021 (USD Million)

Table 4 Connected Agriculture Market Size, By Application, 20142021 (USD Million)

Table 5 Connected Agriculture Market Size, By Region, 20142021 (USD Million)

Table 6 Connected Logistics Market Size, 20152020 (USD Billion)

Table 7 System and Solution: Connected Logistics Market Size, By Type, 20152020 (USD Million)

Table 8 Connected Logistics Market Size, By Device, 20152020 (USD Million)

Table 9 Connected Logistics Market Size, By Device, 20152020 (USD Million)

Table 10 Connected Logistics Market Size, By Service, 20152020 (USD Million)

Table 11 Connected Logistics Market Size, By Transportation Mode, 20152020 (USD Million)

Table 12 Connected Logistics Market Size, By Region, 20152020 (USD Million)

Table 13 Connected Mining Market Size and Growth Rate, 20152020 (USD Billion, Y-O-Y %)

Table 14 Connected Mining Market: Conventional Practices vs Emerging Practices

Table 15 Connected Mining Market Size, By System and Solution, 20152020 (USD Million)

Table 16 Connected Mining Market Size, By Service, 20152020 (USD Million)

Table 17 Connected Mining Market Size, By Method, 20152020 (USD Million)

Table 18 Connected Mining Market Size, By Region, 20152021 (USD Million)

Table 19 IoT in Manufacturing Market Size, By Component, 20152020 (USD Billion)

Table 20 IoT in Manufacturing Market Size, By Software, 20152020 (USD Million)

Table 21 IoT in Manufacturing Market Size, By Connectivity Technology, 20152020 (USD Million)

Table 22 IoT in Manufacturing Market Size, By Platform, 20152020 (USD Million)

Table 23 IoT in Manufacturing Market Size, By Service, 20152020 (USD Million)

Table 24 IoT in Manufacturing Market Size, By Application, 20152020 (USD Million)

Table 25 IoT in Manufacturing Market Size, By Region, 20152020 (USD Million)

Table 26 IoT in Retail Market Size, 20152020 (USD Billion)

Table 27 IoT in Retail Market Size, By Component, 20152020 (USD Million)

Table 28 IoT in Retail Market Size, By Service, 20152020 (USD Million)

Table 29 IoT in Retail Market Size, By Technology, 20152020 (USD Million)

Table 30 IoT in Retail Market Size, By Functional Area, 20152020 (USD Million)

Table 31 IoT in Retail Market Size, By Region, 20152020 (USD Million)

Table 32 IoT in Utility Market Size and Growth Rate, 20152020 (USD Billion, Y-O-Y %)

Table 33 IoT in Utility Market Size, By Software, 20152020 (USD Million)

Table 34 IoT in Utility Market Size, By Platform, 20152020 (USD Million)

Table 35 IoT in Utility Market Size, By Service, 20152020 (USD Million)

Table 36 IoT in Utility Market Size, By Region, 20152020 (USD Million)

Table 37 Global Smart Education and Learning Market Size and Growth Rate, 20142021 (USD Billion) (Y-O-Y %)

Table 38 Smart Education and Learning Market Size, By Product, 20142021 (USD Billion)

Table 39 Smart Education and Learning Market Size, By Learning Mode, 20142021 (USD Billion)

Table 40 Smart Education and Learning Market Size, By User Type, 20142021 (USD Billion)

Table 41 Smart Education and Learning Market Size, By Region, 20142021 (USD Billion)

Table 42 Smart Building Market Size and Growth Rate, 20142021 (USD Billion) (Y-O-Y %)

Table 43 Smart Building Market Size, By Building Automation Software, 20142021, (USD Million)

Table 44 Smart Building Market Size, By Service, 20142021, (USD Million)

Table 45 Smart Building Market Size, By Building Type, 20142021, (USD Million)

Table 46 Smart Building Market Size, By Region, 20142021, (USD Million)

Table 47 Smart Grid Management Market Size and Growth Rate, 20142021, (USD Billion, Y-O-Y %)

Table 48 Smart Grid Management Market Size, By Solution, 20142021, (USD Million)

Table 49 Smart Grid Management Market Size, By Service, 20142021, (USD Million)

Table 50 Smart Grid Management Market Size, By Region, 20142021 (USD Million)

Table 51 Smart Transportation Market Size and Growth Rate, 20132020 (USD Billion, Y-O-Y %)

Table 52 Smart Transportation Market Size, By Solution, 20132020 (USD Million)

Table 53 Smart Transportation Service Market Size, By Type, 20132020 (USD Million)

Table 54 Smart Transportation Market Size, By Region, 20132020 (USD Million)

List of Figures (82 Figures)

Figure 1 Connected Agriculture Market, 20142021 (USD Billion, Y-O-Y %)

Figure 2 Connected Agriculture Market: Value Chain Analysis

Figure 3 Smart Water Management Solution to Gain Traction During Forecast Period

Figure 4 Managed Services Segment Expected to Grow at Highest CAGR During Forecast Period

Figure 5 Farm Planning Management Projected to Dominate During Forecast Period

Figure 6 Asia-Pacific to Grow at Highest CAGR From 2016 to 2021

Figure 7 Connected Logistics Market, 20152020 (USD Billion, Y-O-Y %)

Figure 8 Value Chain Analysis: Connected Logistics Market

Figure 9 Logistic Management System Market to Dominate During Forecast Period

Figure 10 Cellular Technology: Most Adopted Network Technology in Connected Logistics Market

Figure 11 RFID Tags Expected to Lead Device Market During Forecast Period

Figure 12 Connected Logistics Market Size, By Service, 20152020 (USD Million)

Figure 13 Roadway Transportation to the Grow Fastest During Forecast Period

Figure 14 Asia-Pacific Estimated to Grow at Highest CAGR From 2015 to 2020

Figure 15 Connected Mining Market, 20152020, (USD Billion, Y-O-Y %)

Figure 16 Connected Mining: Value Chain Analysis

Figure 17 Connected Assets Segment to Hold Largest Market Size in 2015

Figure 18 System Integration to Hold Largest Market Size During Forecast Period

Figure 19 Surface Mining Segment to Hold Largest Market Size During Forecast Period

Figure 20 North America to Hold Largest Market Size in 2015

Figure 21 IoT in Manufacturing Market, 20152020 (USD Billion, Y-O-Y %)

Figure 22 IoT in Manufacturing: Value Chain Analysis

Figure 23 Data Management Segment to Hold Largest Market Size in 2015

Figure 24 RFID to Hold Largest Market Size During Forecast Period

Figure 25 Application Management Platform to Grow at Highest CAGR During Forecas Period

Figure 26 Managed Services to Grow at Highest CAGR During Forecast Period

Figure 27 Asset Management to Dominate Market During Forecast Period

Figure 28 North America to Hold Largest Market Size in 2015

Figure 29 IoT in Retail Market, 20152020 (USD Billion, Y-O-Y %)

Figure 30 Value Chain Analysis: IoT in Retail Market

Figure 31 Software Market to Grow the Fastest During Forecast Period

Figure 32 Managed Service to Witness High Growth During Forecast Period

Figure 33 Zigbee Technology to Witness High Growth During Forecast Period

Figure 34 Safety and Security is Key Functional Area in IoT in Retail Market

Figure 35 Asia-Pacific to Be Fastest Growing Region During Forecast Period

Figure 36 IoT in Utility Market Size and Growth Rate, 20152020 (USD Billion, Y-O-Y %)

Figure 37 IoT in Utility: Value Chain Analysis

Figure 38 Analytics to Grow at Highest CAGR During Forecast Period

Figure 39 Device Management Platform to Grow at Highest CAGR During Forecast Period

Figure 40 Deployment and System Integration Service to Dominate During Forecast Period

Figure 41 IoT in Utility Market Size, By Application, 20152020 (USD Million)

Figure 42 Electricity Grid Management Application to Dominate IoT in Utility Market During Forecast Period

Figure 43 Asia-Pacific to Grow at Highest CAGR From 2016 to 2021

Figure 44 Global Smart Education and Learning Market Size and Growth Rate, 20142021 (USD Billion) (Y-O-Y %)

Figure 45 Educational Technology Providers to Play A Crucial Role in Smart Education and Learning Market

Figure 46 Value Chain Analysis: Smart Education and Learning Market

Figure 47 Services to Grow at Highest CAGR in Smart Education and Learning Market During Forecast Period

Figure 48 Adaptive Learning to Grow at Highest CAGR in Smart EducationAnd Learning Market During Forecast Period

Figure 49 Corporate User Segment to Grow at Highest CAGR in Smart Education and Learning Market During Forecast Period

Figure 50 Asia-Pacific to Exhibit Highest Growth Rate in Smart Education and Learning Market During Forecast Period

Figure 51 Smart Building Market Size and Growth Rate, 20142021 (USD Billion) (Y-O-Y %)

Figure 52 Smart Building Market: Value Chain

Figure 53 Smart Building Market: Strategic Benchmarking

Figure 54 Vendor Portfolio Analysis

Figure 55 Intelligent Security System to Grow at Highest CAGR During Forecast Period

Figure 56 Managed Services to Grow at Highest CAGR During Forecast Period

Figure 57 Residential Buildings Segment to Grow at Highest CAGR During Forecast Period

Figure 58 Europe to Hold Largest Market Share in Global Smart Building Market During Forecast Period

Figure 59 Smart Grid Management Market Size and Growth Rate, 20142021, (USD Billion, Y-O-Y %)

Figure 60 Smart Grid Venture Investment, 20092014

Figure 61 Smart Grid Global Deals Outlook, 20092014

Figure 62 North America Accounts for Most Smart Grid Projects

Figure 63 Smart Grid Market: Strategic Benchmarking

Figure 64 Smart Grid Management Market Size, By Solution, 20142021, (USD Million)

Figure 65 Integration and Deployment Service to Gain Highest Traction By 2021

Figure 66 North America to Dominate Smart Grid Market During Forecast Period

Figure 67 Smart Transportation Market Size and Growth Rate, 20132020 (USD Billion, Y-O-Y %)

Figure 68 Industry and Technology Road Map for Smart Transportation

Figure 69 Smart Transportation: Value Chain Analysis

Figure 70 Passenger Information System to Lead Smart Transportation Solution Market in 2015

Figure 71 Cloud Services to Lead Smart Transportation Services Market During Forecast Period

Figure 72 Asia-Pacific Offers Attractive Opportunities for Smart Transportation Market During Forecast Period

Figure 73 Abb.: Company Snapshot

Figure 74 Cisco Systems, Inc.: Company Snapshot

Figure 75 General Electric: Company Snapshot

Figure 76 IBM Corporation: Company Snapshot

Figure 77 Intel Corporation: Company Snapshot

Figure 78 Microsoft Corporation: Company Snapshot

Figure 79 PTC: Company Snapshot

Figure 80 SAP SE: Company Snapshot

Figure 81 Schneider Electric: Company Snapshot

Figure 82 Siemens AG: Company Snapshot

Growth opportunities and latent adjacency in Top 10 Connected/Smart Industries