Automotive Sensors Market by Sales Channel (OEM, Aftermarket), Type (Temperature, Pressure, Oxygen, Position, Speed, Inertial, Image, Level, Chemical Sensors), Vehicle Type (Passenger Car, LCV, HCV), Application, Region - Global Forecast to 2028

Updated on : October 22, 2024

Automotive Sensors Market Size & Growth

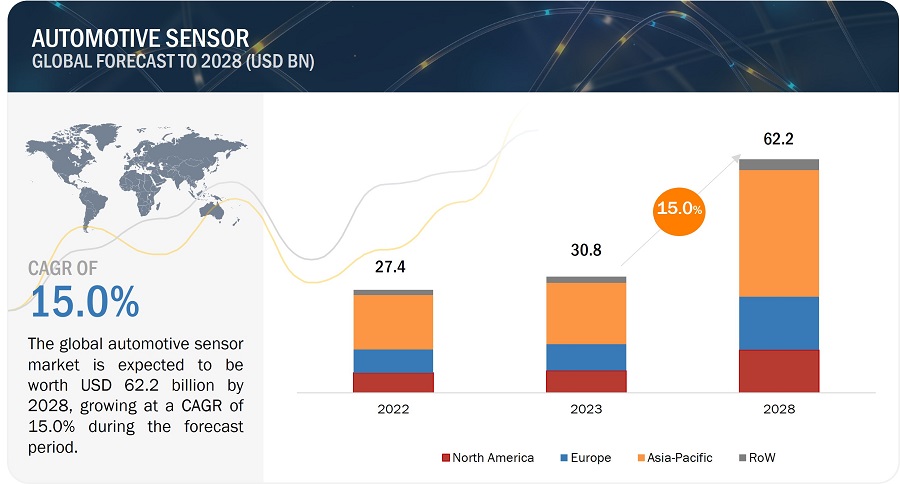

The global automotive sensors market size is projected to grow from USD 30.8 billion in 2023 and is anticipated to be USD 62.2 billion by 2028, growing at a CAGR of 15.0% from 2023 to 2028.

Growing focus on implementing vehicle authentication to ensure driver safety and comfort, Minimizing driver stress through adoption of advanced driver-assistance systems drives market growth during the forecast period. Factors such as growing adoption of EVs and HVs to reduce CO2 emissions, increasing investments by automobile manufacturers in LiDAR technology provide market growth opportunities for the automotive sensors industry.

Automotive Sensors Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Automotive Sensors Market Analysis

The automotive sensors market is projected to grow significantly, driven by the increasing demand for advanced driver-assistance systems (ADAS) and the rising production of electric vehicles. The market's expansion is also fueled by stringent government regulations aimed at improving vehicle safety and emissions.

Automotive Sensors Market Trends

Current trends in the automotive sensor market include the adoption of more sophisticated sensors for autonomous vehicles and advancements in sensor technologies such as LiDAR and radar. Additionally, the integration of IoT and AI in automotive applications is enhancing sensor functionalities and capabilities.

Automotive Sensors Market Dynamics

Driver: Advancements in sensor technologies to meet customer requirements

Sensors have become more compact, energy-efficient, and cost-effective, enabling seamless integration into various applications. Innovations, such as solid-state LiDAR, CMOS image sensors with enhanced resolution and low-light capabilities, and susceptible microelectromechanical systems (MEMS) accelerometers, have redefined the data collection and analysis landscape. These advancements have empowered businesses to gather real-time insights with unprecedented accuracy, driving efficiency gains, process optimization, and developing cutting-edge products and services that cater to evolving customer demands. The rise of electric and hybrid vehicles requires sensors to monitor battery health, temperature, charging status, and other critical parameters for optimal performance and safety. The demand for in-car infotainment, navigation, and connectivity features necessitates sensors, such as GPS and accelerometers, to provide accurate navigation data and enhance user experience.

Restraint: High cost of LiDAR automotive sensors

Automotive sensors come with a relatively high price tag, which can limit their widespread use. The cost is driven up due to the expensive raw materials, complex manufacturing processes, and increased demand for these sensors. This makes developing and implementing advanced sensor technologies difficult, especially in price-sensitive markets where the high cost can negatively impact adoption rates. Sensors are essential in vehicles for various functions, including safety, engine management, and comfort features. This diversity drives up costs due to the need to manufacture and integrate multiple sensor types within a single vehicle. Developing advanced sensor technologies demands substantial research, testing, and prototyping investment. Costs are incurred in exploring innovative sensor designs, materials, and functionalities to meet the evolving demands of the automotive industry. Rapid technological advancements lead to frequent updates and iterations of sensor designs. This ongoing innovation can inflate costs as manufacturers strive to stay at the forefront of sensor capabilities.

LiDAR sensors have become indispensable for advanced driver assistance systems (ADAS) and autonomous vehicles due to their accurate 3D mapping and object detection capabilities. However, their integration into the automotive industry has been limited due to the high cost of production. The automotive industry relies on mass production, whereas LiDAR sensors are typically manufactured at lower volumes, resulting in higher unit costs. Extensive investment in research and development, customization for automotive use, compliance with regulatory requirements, and adherence to performance standards all contribute to elevated expenses. Despite these barriers, industry efforts and innovations, such as solid-state LiDAR technology and increasing competition, are gradually driving cost reductions, promising more accessible LiDAR solutions for a broader spectrum of vehicles and applications in the future.

Opportunity: Rising demand for automotive aftermarket services

Aftermarket opportunities in the automotive sensors market referred to the potential for selling and installing sensor-based products and solutions in vehicles not equipped initially with those sensors by the manufacturer. This growth is driven by increased demand for safety features, the rising popularity of aftermarket car modifications, and the growing popularity of electric vehicles. Some specific aftermarket opportunities in the automotive sensors market are Blind spot monitoring systems, Lane departure warning systems, Parking sensors, Battery monitoring systems, and Solar charging systems. Older vehicles lack the advanced safety features that are now becoming standard in newer models. Aftermarket sensors can be installed to add features, such as lane departure warning, blind-spot detection, and collision avoidance systems. Retrofitting telematics devices can add connectivity features to older vehicles, enabling features, such as remote diagnostics, vehicle tracking, and mobile app integration. As Technology advances and consumer demand increases, the aftermarket automotive sensor market continues to grow as a viable business opportunity

Challenge: Need for high-performance sensors

The increasing automation of vehicles has led to a significant rise in the need for high-performance sensors. These sensors must possess a high level of sophistication to gather and analyze data rapidly and precisely. However, this demand has put a considerable burden on sensor manufacturers who are grappling to meet the requirements. The development of high-performance sensors is a challenge for sensor manufacturers. These sensors must be able to collect and process data quickly and accurately while being reliable and durable. In addition, it must operate in various conditions, including extreme temperatures, vibrations, and dust. They must be able to withstand the harsh environment of the automotive industry. Sensor manufacturers are working to develop new technologies that can meet these challenges. Sensor manufacturers are investing in research and development to meet this demand.

Automotive Sensors Market Ecosystem

The automotive sensors market is competitive. It is marked by the presence of a few tier-1 companies, such as Robert Bosch GmbH (Germany), ON Semiconductor (US), OMNIVISION (US), TE Connectivity (Germany), and Continental AG (Germany),. These companies have created a competitive ecosystem by investing in research and development activities to launch highly efficient and reliable automotive sensors.

Automotive Sensors Market Segmentation

Original equipment manufacturer (OEM) segment to witness the highest growth during the forecast period

The original equipment manufacturer (OEM) refers to the manufacturers of original parts assembled and installed during the construction of a new vehicle. OEMs adopt the latest, mature products to meet the new AI and IoT technology-based sensor requirements. The automotive sensor manufacturers are highly focused on providing advanced sensors for vehicle safety and control applications. Automotive manufacturers are obliged to install automotive sensors during the manufacturing process due to government mandates regarding vehicle and road safety, fuel efficiency, and emission control worldwide. As a result, the market for technologically advanced automotive sensors is expected to proliferate, particularly in the context of autonomous vehicles.

Position sensors segment to hold the largest share of automotive sensors market between 2023 and 2028.

The growth of the position sensors segment can be attributed to the rising demand for autonomous cars and autopilot applications. Advanced technologies are increasingly being adopted in passenger and commercial cars because of the improving standard of living and rising consumer preference for better safety standards and comfort. Position sensors have become integral to vehicles, from vehicle seats and pedals to gear shifters. They ensure the safety and proper functioning of all vehicle components. Thus, innovation in automotive technology has increased the use of position sensors in vehicles.

Light commercial vehicle (LCV) segment to grow at second fastest CAGR during the forecast period

The rising focus of automobile manufacturers on adding safety features, such as ABS and EBD, along with infotainment systems, in LCVs helps the automotive sensors market flourish in this vehicle segment. The cyclic growth in the sales of LCVs due to the surging demand for goods and carriage vehicles is further driving the sales of LCVs. This increase in the sales of LCVs is expected to impact the automotive sensor market positively.

Powertrain systems segment held the largest share of the automotive sensors market during the forecast period

The powertrain system of any vehicle defines its performance, comfort, and safety. Powertrain systems/components manufacturers have been adopting hybrid powertrain systems to reduce fuel consumption. The need for sensors in powertrain systems is driven by governments and automobile manufacturers worldwide' strong focus on lowering emissions, improving fuel economy, meeting onboard diagnostic requirements, and offering best-in-class drivability.

Regional Analysis - Automotive Sensors Market

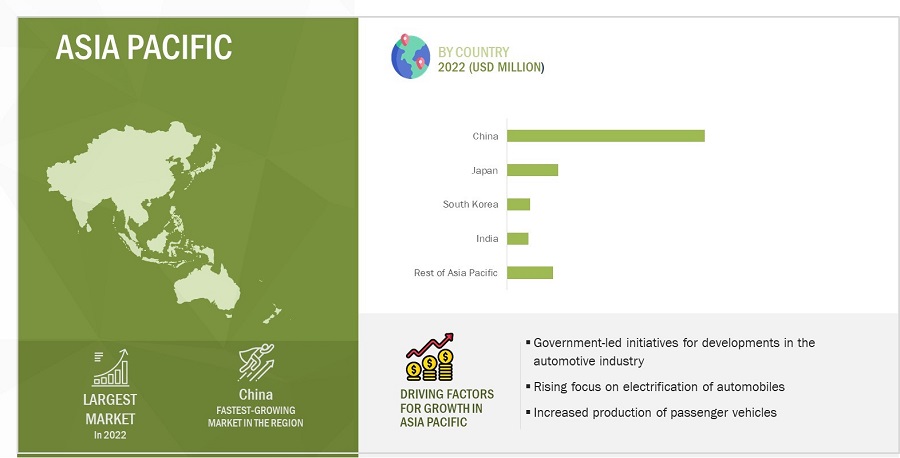

Asia Pacific to grow at the fastest CAGR during the forecast period.

Government initiatives are pivotal in fostering sensor adoption and innovation. In Japan, the government actively promotes autonomous driving technology, stimulating the demand for sensors related to advanced driver assistance systems (ADAS) and autonomous vehicles. The strong push toward electric vehicles, backed by substantial government incentives, propels the demand for sensors related to EV batteries and charging infrastructure in China. Additionally, South Korea's focus on fifth-generation (5G) and sixth-generation (6G) network technologies catalyzes the development of connected vehicles, further boosting the automotive sensors market.

The region's growing middle-class population and youthful demographics contribute significantly to the surge in automobile demand, spurring innovation and adoption of sensor technologies across countries like India and China. As Asia Pacific continues to lead the global automotive industry in adopting advanced technologies and fostering a conducive regulatory environment, it is poised to be the largest automotive sensor market size in the coming years.

Automotive Sensors Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

Automotive Sensors Market Key Players

The automotive sensor companies is dominated by globally established players such as

- Robert Bosch GmbH (Germany),

- ON Semiconductor (US),

- OMNIVISION (US),

- TE Connectivity (Germany),

- Continental AG (Germany),

- Infineon Technologies AG (Germany),

- NXP Semiconductors (Netherlands),

- Denso Corporation (Japan),

- Panasonic (Japan),

- Allegro MicroSystems, Inc. (US),

- Sensata Technologies,Inc (US),

- BorgWarner, Inc. (US),

- Analog Devices, Inc. (US),

- ELMOS Semiconductor SE (Germany),

- Aptiv. (Ireland),

- CTS Corporation (US),

- Autoliv, Inc. (Sweden),

- STMicroelectronics (Switzerland),

- ZF Friedrichshafen AG (Germany),

- Quanergy Solutions, Inc. (US),

- Innoviz Technologies Ltd (Israel),

- Valeo S.A. (France),

- Magna International Inc. (Canada),

- Melexis (Belgium),

- Amphenol Advanced Sensors (US).

These players have adopted product launches/developments, contracts, collaborations, agreements, and acquisitions for growth in the automotive sensors market.

Automotive Sensors Industry Overview

The automotive sensors industry is experiencing robust growth, supported by technological advancements and increased R&D investments by key players. The competitive landscape is characterized by strategic collaborations, mergers, and acquisitions to enhance product offerings and expand market presence. The automotive sensors industry is undergoing rapid growth due to the increasing adoption of advanced technologies in vehicles. This sector is characterized by significant investments in research and development, aiming to enhance sensor accuracy, reliability, and integration capabilities.

Automotive Sensors Market Report Scope

|

Report Metric |

Details |

|

Estimated Value |

USD 30.8 billion in 2023 |

|

Expected Value |

USD 62.2 billion by 2028 |

|

Growth Rate |

CAGR of 15.0% |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) and Volume (Million) |

|

Segments Covered |

By Sales Channel, By Sensor Types, By Vehicle Types, By Application, and By Region |

|

Region covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Companies covered |

The key players in the automotive sensors market are Robert Bosch GmbH (Germany), ON Semiconductor (US), OMNIVISION (US), TE Connectivity (Germany), Continental AG (Germany), Infineon Technologies AG (Germany), NXP Semiconductors (Netherlands), Denso Corporation (Japan), Panasonic (Japan), Allegro MicroSystems, Inc. (US), Sensata Technologies,Inc (US), BorgWarner, Inc. (US), Analog Devices, Inc. (US), ELMOS Semiconductor SE (Germany), Aptiv. (Ireland), CTS Corporation (US), Autoliv, Inc. (Sweden), STMicroelectronics (Switzerland), ZF Friedrichshafen AG (Germany), Quanergy Solutions, Inc. (US), Innoviz Technologies Ltd (Israel), Valeo S.A. (France), Magna International Inc. (Canada), Melexis (Belgium), and Amphenol Advanced Sensors (US). |

Automotive Sensors Market Highlights

The study categorizes the automotive sensors market based sales channel, sensor types, vehicle types, application, and region.

|

Segment |

Subsegment |

|

By Sales Channel |

|

|

By Sensor Types |

|

|

By Vehicle Types |

|

|

By Application |

|

|

By Region |

|

Recent Developments in Automotive Sensors Industry

- In May 2023, ON Semiconductor (US) launched its Hyperlux automotive image sensor family, featuring industry-leading 150dB ultra-high dynamic range (HDR) and LED flicker mitigation (LFM).

- In June 2022, Allegro MicroSystems, Inc. (US) launched magnetic position sensors, A33110 and A33115, designed for advanced driver assistance systems (ADAS) applications..

- In May 2022, Infineon Technologies AG (Germany) launched the XENSIV 60 GHz radar sensor for automotive applications.

Frequently Asked Questions (FAQs):

Which are the major companies in the automotive sensors market? What are their major strategies to strengthen their market presence?

Robert Bosch GmbH (Germany), ON Semiconductor (US), OMNIVISION (US), TE Connectivity (Germany), and Continental AG (Germany) are some of the major companies operating in the automotive sensors market. Partnerships were the key strategies these companies adopted to strengthen their automotive sensors market presence.

What are the drivers for the automotive sensors market share?

Drivers for the automotive sensor market are:

- Growing inclination of consumers toward alternative fuel vehicles to reduce GHG emissions

- Growing focus on vehicle authentication to ensure driver safety and comfort

- Minimizing driver stress through adoption of advanced driver-assistance systems

- Government incentives and grants to support R&D in automotive sensor technology

- Advancements in sensor technologies to meet customer requirements

What are the challenges in the automotive sensors market share?

Safety and security threats in autonomous vehicles, need for high-performance sensors, and reliance on associated technologies are among the challenges faced by the automotive sensors market.

What are the technological trends in the automotive sensors market?

Magnetic sensors, time-of-flight (ToF) sensor, and advanced driver assistance systems (ADAS) are a few of the key technology trends in the automotive sensors market.

What is the total CAGR expected to be recorded for the automotive sensors market from 2023 to 2028?

The CAGR is expected to record a CAGR of 15.0% from 2023-2028.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing inclination of consumers toward alternative fuel vehicles to reduce GHG emissions- Increasing focus on vehicle authentication to ensure driver safety and comfort- Minimizing driver stress through adoption of advanced driver-assistance systems- Government incentives and grants to support R&D in automotive sensor technology- Advancements in sensor technologies to meet customer requirementsRESTRAINTS- Shortage of aftermarket service professionals in emerging economies- High cost of LiDAR automotive sensorsOPPORTUNITIES- Increasing investments by automobile manufacturers in LiDAR technology- Growing adoption of EVs and HEVs to reduce CO2 emissions- Increasingly stringent emission regulations- Rising demand for automotive aftermarket servicesCHALLENGES- Safety and security threats in autonomous vehicles- Need for high-performance sensors- Reliance on associated technologies to ensure functional accuracy

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.5 ECOSYSTEM MAPPING

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.7 CASE STUDY ANALYSISDEVELOPMENT OF AUTOMOTIVE SENSOR CHIP FOR ELECTRIC VEHICLES TO RELAY INFORMATIONINTEGRATION OF SENSORS IN PRINTED CIRCUIT BOARDS TO WITHSTAND EXTREME TEMPERATURES AND SENSE ROAD CONDITIONSINTRODUCTION OF PRESSURE SENSOR FOR HIGH-PERFORMANCE APPLICATIONSIMPLEMENTATION OF RAIN SENSORS TO ADJUST WIPER SPEED BASED ON RAINFALL INTENSITYADOPTION OF IMAGE SENSORS TO ENHANCE STORAGE EFFICIENCY AND TRACEABILITY

-

5.8 TECHNOLOGY ANALYSISTIME-OF-FLIGHT (TOF) SENSORSMAGNETIC SENSORSADVANCED DRIVER-ASSISTANCE SYSTEMS (ADAS)ELECTRONIC STABILITY CONTROL (ESC) SYSTEMSAUTONOMOUS VEHICLESAIRBAG SYSTEMS

-

5.9 PRICING ANALYSISAVERAGE SELLING PRICE TREND, BY REGIONAVERAGE SELLING PRICE TREND OF SENSOR TYPES PROVIDED BY KEY PLAYERS

-

5.10 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.11 PATENT ANALYSIS, 2019–2023

-

5.12 TARIFFS AND REGULATORY LANDSCAPETARIFFSREGULATORY COMPLIANCE- Regulations- Standards- Regulatory bodies, government agencies, and other organizations

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 OEMGOVERNMENT MANDATES REGARDING VEHICLE AND ROAD SAFETY TO LEAD TO HIGH ADOPTION OF ADVANCED SENSOR TECHNOLOGIES BY OEMS

-

6.3 AFTERMARKETRISING USE OF AUTOMOTIVE SENSORS BY DIY ENTHUSIASTS TO DRIVE SEGMENTAL GROWTH

- 7.1 INTRODUCTION

-

7.2 TEMPERATURE SENSORSGROWING USE IN ENGINE/POWERTRAIN MANAGEMENT AND HVAC SYSTEMS OF AUTOMOBILES TO DRIVE MARKET

-

7.3 PRESSURE SENSORSRISING UTILIZATION IN AUTOMOTIVE SYSTEMS SUCH AS HVAC, SAFETY AND CONTROL, AND TIRE PRESSURE MONITORING SYSTEMS TO FUEL MARKET GROWTH

-

7.4 OXYGEN SENSORSINCREASING IMPLEMENTATION OF O2 SENSORS TO MEASURE PROPORTION OF OXYGEN IN AIR-FUEL MIXTURES TO CONTRIBUTE TO MARKET GROWTH

-

7.5 NITROGEN OXIDE (NOX) SENSORSGROWING DEPLOYMENT OF NOX SENSORS TO DETECT NITROGEN OXIDE LEVELS IN AUTOMOBILE EMISSIONS TO SUPPORT MARKET GROWTH

-

7.6 POSITION SENSORSINCREASING FOCUS OF AUTOMAKERS ON DEVELOPING VEHICLES WITH ENHANCED COMFORT AND IMPROVED FUEL EFFICIENCY TO DRIVE MARKET

-

7.7 SPEED SENSORSELEVATING ADOPTION OF SPEED SENSORS TO MEASURE ENGINE CAMSHAFT AND VEHICLE SPEED TO DRIVE MARKET

-

7.8 INERTIAL SENSORSINTEGRATION OF INERTIAL SENSORS IN ACCELEROMETERS AND GYROSCOPES TO SUPPORT MARKET GROWTH- Accelerometers- Gyroscopes

-

7.9 IMAGE SENSORSEXTENSIVE USE OF IMAGE SENSORS IN ADVANCED DRIVER-ASSISTANCE SYSTEMS TO BOOST DEMAND- Complementary metal-oxide-semiconductor (CMOS)- Charge-coupled device (CCD)

-

7.10 LEVEL SENSORSRISING DEPLOYMENT OF LEVEL SENSORS TO MONITOR AND MANAGE FUEL, ENGINE OIL, AND COOLANT LEVELS TO SUPPORT MARKET GROWTH

-

7.11 CHEMICAL SENSORSINCREASING ADOPTION OF CHEMICAL SENSORS TO ADHERE TO STRINGENT EMISSION STANDARDS TO SUPPORT SEGMENTAL GROWTH

-

7.12 RADAR SENSORSINSTALLATION OF RADAR SENSORS IN AUTONOMOUS VEHICLES TO RECOGNIZE SURROUNDINGS TO CONTRIBUTE TO MARKET GROWTH

-

7.13 ULTRASONIC SENSORSINCREASING IMPORTANCE OF PARKING ASSISTANCE, BLIND-SPOT DETECTION, AND COLLISION AVOIDANCE SYSTEMS TO BOOST DEMAND FOR ULTRASONIC SENSORS

-

7.14 LIDAR SENSORSRISING UTILIZATION OF LIDAR SENSORS TO DETECT OBSTACLES TO ENSURE SMOOTH AND SAFE RIDE TO DRIVE MARKET

-

7.15 CURRENT SENSORSINTEGRATION OF CURRENT SENSORS INTO BATTERY MANAGEMENT SYSTEMS TO FUEL MARKET GROWTH

-

7.16 OTHER SENSOR TYPESRAIN SENSORSRELATIVE HUMIDITY SENSORSPROXIMITY SENSORSPARTICULATE MATTER SENSORS

- 8.1 INTRODUCTION

-

8.2 PASSENGER CARINSTALLATION OF GPS, CAMERAS, AND INFOTAINMENT SYSTEMS IN PASSENGER CARS TO DRIVE SEGMENTAL GROWTH

-

8.3 LCVSURGING DEMAND FOR LIGHT COMMERCIAL VEHICLES TO DRIVE MARKET GROWTH

-

8.4 HCVRISING DEMAND FOR FUEL-EFFICIENT VEHICLES TO DRIVE SEGMENTAL GROWTH

- 9.1 INTRODUCTION

-

9.2 POWERTRAIN SYSTEMSNEED TO IMPROVE FUEL EFFICIENCY TO DRIVE INNOVATIONS IN POWERTRAIN SYSTEMS

-

9.3 CHASSISDEPLOYMENT OF AUTOMOTIVE SENSORS IN CHASSIS TO IMPROVE VEHICLE SAFETY AND STABILITY

-

9.4 EXHAUST SYSTEMSSTRINGENT EMISSION STANDARDS TO DRIVE DEMAND FOR EXHAUST SYSTEMS

-

9.5 SAFETY & CONTROL SYSTEMSINCREASED FOCUS ON VEHICLE AND PASSENGER SAFETY TO DRIVE MARKET

-

9.6 VEHICLE BODY ELECTRONICSINTEGRATION OF ADVANCED ELECTRONIC COMPONENTS IN VEHICLES TO SUPPORT SEGMENTAL GROWTH

-

9.7 TELEMATICS SYSTEMSSTRINGENT GOVERNMENT NORMS REGARDING PASSENGER SAFETY AND SECURITY TO PROMOTE ADOPTION OF TELEMATICS SYSTEMS

-

9.8 DRIVER ASSISTANCE & AUTOMATIONINCREASED ADOPTION OF ADVANCED TECHNOLOGIES TO IMPROVE PASSENGER AND ROAD SAFETY TO SUPPORT MARKET GROWTH

- 9.9 OTHER APPLICATIONS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Increased demand for autonomous and electric vehicles to drive marketCANADA- Government-led initiatives to reduce vehicular emissions to boost demand for automotive sensorsMEXICO- Rising number of free-trade agreements with other countries to create opportunities for market players

-

10.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Large presence of major automobile OEMs to drive marketUK- Rising implementation of automotive sensors in luxury cars to fuel market growthFRANCE- Promotion of electric and hybrid vehicles to boost demand for automotive sensorsSPAIN- Presence of stringent vehicular emission norms to boost demand for advanced automotive sensorsITALY- High demand for small city cars, sports cars, and supercars to contribute to market growthREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Growing use of LiDAR sensors in modern-day vehicles to drive marketJAPAN- Rising focus on manufacturing technologically advanced vehicles to boost demand for automotive sensorsSOUTH KOREA- Increasing demand for vehicle safety and comfort to fuel market growthINDIA- Growing interest of foreign direct investors in automotive sector to create lucrative opportunitiesREST OF ASIA PACIFIC

-

10.5 ROWROW: RECESSION IMPACTMIDDLE EAST & AFRICA- Rising demand for safe and fuel-efficient cars to foster market growthSOUTH AMERICA- Expansion of automobile OEMs into new untapped markets to boost demand

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

-

11.5 COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

11.6 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

11.7 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

-

12.1 KEY PLAYERSROBERT BOSCH GMBH- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewON SEMICONDUCTOR- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewOMNIVISION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTE CONNECTIVITY- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewCONTINENTAL AG- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewDENSO CORPORATION- Business overview- Products/Services/Solutions offered- Recent developmentsINFINEON TECHNOLOGIES AG- Business overview- Products/Services/Solutions offered- Recent developmentsNXP SEMICONDUCTORS- Business overview- Products/Services/Solutions offered- Recent developmentsPANASONIC- Business overview- Products/Services/Solutions offeredALLEGRO MICROSYSTEMS, INC.- Business overview- Products/Services/Solutions offered- Recent developments

-

12.2 OTHER KEY PLAYERSSENSATA TECHNOLOGIES, INC.BORGWARNER INC.ANALOG DEVICES, INC.ELMOS SEMICONDUCTOR SEAPTIV.CTS CORPORATIONAUTOLIV, INC.STMICROELECTRONICSZF FRIEDRICHSHAFEN AGQUANERGY SOLUTIONS, INC.INNOVIZ TECHNOLOGIES LTD.VALEO S.A.MAGNA INTERNATIONAL INC.MELEXISAMPHENOL ADVANCED SENSORS

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 CURRENCY CONVERSION RATES

- TABLE 2 LIST OF AUTOMOTIVE SENSOR MANUFACTURERS AND SUPPLIERS

- TABLE 3 AUTOMOTIVE SENSORS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE SENSORS, BY SENSOR TYPE

- TABLE 5 TOP 20 PATENT OWNERS FROM 2013 TO 2023

- TABLE 6 MFN TARIFFS FOR PRODUCTS COVERED UNDER HS CODE 903290 EXPORTED BY US

- TABLE 7 MFN TARIFFS FOR PRODUCTS COVERED UNDER HS CODE 903290 EXPORTED BY CHINA

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 AUTOMOTIVE SENSOR MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- TABLE 14 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 15 MARKET, BY SALES CHANNEL, 2019–2022 (USD MILLION)

- TABLE 16 MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 17 MARKET, BY SALES CHANNEL, 2019–2022 (MILLION UNITS)

- TABLE 18 AUTOMOTIVE SENSORS MARKET, BY SALES CHANNEL, 2023–2028 (MILLION UNITS)

- TABLE 19 OEM: MARKET, BY SENSOR TYPE, 2019–2022 (USD MILLION)

- TABLE 20 OEM: MARKET, BY SENSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 21 OEM: MARKET, BY SENSOR TYPE, 2019–2022 (MILLION UNITS)

- TABLE 22 OEM: MARKET, BY SENSOR TYPE, 2023–2028 (MILLION UNITS)

- TABLE 23 AFTERMARKET: MARKET, BY SENSOR TYPE, 2019–2022 (USD MILLION)

- TABLE 24 AFTERMARKET: MARKET, BY SENSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 25 AFTERMARKET: MARKET, BY SENSOR TYPE, 2019–2022 (MILLION UNITS)

- TABLE 26 AFTERMARKET: MARKET, BY SENSOR TYPE, 2023–2028 (MILLION UNITS)

- TABLE 27 MARKET, BY SENSOR TYPE, 2019–2022 (USD MILLION)

- TABLE 28 MARKET, BY SENSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 29 MARKET, BY SENSOR TYPE, 2019–2022 (MILLION UNITS)

- TABLE 30 MARKET, BY SENSOR TYPE, 2023–2028 (MILLION UNITS)

- TABLE 31 TEMPERATURE SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 32 TEMPERATURE SENSORS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 TEMPERATURE SENSORS: MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 34 TEMPERATURE SENSORS: MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 35 TEMPERATURE SENSORS: MARKET, BY SALES CHANNEL, 2019–2022 (USD MILLION)

- TABLE 36 TEMPERATURE SENSORS: MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 37 TEMPERATURE SENSORS: MARKET, BY SALES CHANNEL, 2019–2022 (MILLION UNITS)

- TABLE 38 TEMPERATURE SENSORS: MARKET, BY SALES CHANNEL, 2023–2028 (MILLION UNITS)

- TABLE 39 PRESSURE SENSORS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 40 PRESSURE SENSORS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 PRESSURE SENSORS: MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 42 PRESSURE SENSORS: MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 43 PRESSURE SENSORS: MARKET, BY SALES CHANNEL, 2019–2022 (USD MILLION)

- TABLE 44 PRESSURE SENSORS: MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 45 PRESSURE SENSORS: MARKET, BY SALES CHANNEL, 2019–2022 (MILLION UNITS)

- TABLE 46 PRESSURE SENSORS: MARKET, BY SALES CHANNEL, 2023–2028 (MILLION UNITS)

- TABLE 47 OXYGEN SENSORS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 OXYGEN SENSORS: AUTOMOTIVE SENSORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 OXYGEN SENSORS: MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 50 OXYGEN SENSORS: MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 51 OXYGEN SENSORS: MARKET, BY SALES CHANNEL, 2019–2022 (USD MILLION)

- TABLE 52 OXYGEN SENSORS: MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 53 OXYGEN SENSORS: MARKET, BY SALES CHANNEL, 2019–2022 (MILLION UNITS)

- TABLE 54 OXYGEN SENSORS: MARKET, BY SALES CHANNEL, 2023–2028 (MILLION UNITS)

- TABLE 55 NOX SENSORS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 56 NOX SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 NOX SENSORS: MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 58 NOX SENSORS: MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 59 NOX SENSORS: MARKET, BY SALES CHANNEL, 2019–2022 (USD MILLION)

- TABLE 60 NOX SENSORS: MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 61 NOX SENSORS: MARKET, BY SALES CHANNEL, 2019–2022 (MILLION UNITS)

- TABLE 62 NOX SENSORS: MARKET, BY SALES CHANNEL, 2023–2028 (MILLION UNITS)

- TABLE 63 POSITION SENSORS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 64 POSITION SENSORS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 POSITION SENSORS: MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 66 POSITION SENSORS: MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 67 POSITION SENSORS: MARKET, BY SALES CHANNEL, 2019–2022 (USD MILLION)

- TABLE 68 POSITION SENSORS: MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 69 POSITION SENSORS: MARKET, BY SALES CHANNEL, 2019–2022 (MILLION UNITS)

- TABLE 70 POSITION SENSORS: MARKET, BY SALES CHANNEL, 2023–2028 (MILLION UNITS)

- TABLE 71 SPEED SENSORS: AUTOMOTIVE SENSORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 72 SPEED SENSORS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 SPEED SENSORS: MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 74 SPEED SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 75 SPEED SENSORS: MARKET, BY SALES CHANNEL, 2019–2022 (USD MILLION)

- TABLE 76 SPEED SENSORS: MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 77 SPEED SENSORS: MARKET, BY SALES CHANNEL, 2019–2022 (MILLION UNITS)

- TABLE 78 SPEED SENSORS: MARKET, BY SALES CHANNEL, 2023–2028 (MILLION UNITS)

- TABLE 79 INERTIAL SENSORS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 80 INERTIAL SENSORS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 INERTIAL SENSORS: MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 82 INERTIAL SENSORS: MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 83 INERTIAL SENSORS: MARKET, BY SALES CHANNEL, 2019–2022 (USD MILLION)

- TABLE 84 INERTIAL SENSORS: MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 85 INERTIAL SENSORS: MARKET, BY SALES CHANNEL, 2019–2022 (MILLION UNITS)

- TABLE 86 INERTIAL SENSORS: MARKET, BY SALES CHANNEL, 2023–2028 (MILLION UNITS)

- TABLE 87 IMAGE SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 88 IMAGE SENSORS: AUTOMOTIVE SENSORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 89 IMAGE SENSORS: MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 90 IMAGE SENSORS: MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 91 IMAGE SENSORS: MARKET, BY SALES CHANNEL, 2019–2022 (USD MILLION)

- TABLE 92 IMAGE SENSORS: MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 93 IMAGE SENSORS: MARKET, BY SALES CHANNEL, 2019–2022 (MILLION UNITS)

- TABLE 94 IMAGE SENSORS: MARKET, BY SALES CHANNEL, 2023–2028 (MILLION UNITS)

- TABLE 95 LEVEL SENSORS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 96 LEVEL SENSORS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 97 LEVEL SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 98 LEVEL SENSORS: MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 99 LEVEL SENSORS: MARKET, BY SALES CHANNEL, 2019–2022 (USD MILLION)

- TABLE 100 LEVEL SENSORS: MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 101 LEVEL SENSORS: MARKET, BY SALES CHANNEL, 2019–2022 (MILLION UNITS)

- TABLE 102 LEVEL SENSORS: MARKET, BY SALES CHANNEL, 2023–2028 (MILLION UNITS)

- TABLE 103 CHEMICAL SENSORS: AUTOMOTIVE SENSORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 104 CHEMICAL SENSORS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 105 CHEMICAL SENSORS: MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 106 CHEMICAL SENSORS: MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 107 CHEMICAL SENSORS: MARKET, BY SALES CHANNEL, 2019–2022 (USD MILLION)

- TABLE 108 CHEMICAL SENSORS: MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 109 CHEMICAL SENSORS: MARKET, BY SALES CHANNEL, 2019–2022 (MILLION UNITS)

- TABLE 110 CHEMICAL SENSORS: MARKET, BY SALES CHANNEL, 2023–2028 (MILLION UNITS)

- TABLE 111 RADAR SENSORS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 112 RADAR SENSORS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 113 RADAR SENSORS: MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 114 RADAR SENSORS: MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 115 RADAR SENSORS: MARKET, BY SALES CHANNEL, 2019–2022 (USD MILLION)

- TABLE 116 RADAR SENSORS: AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 117 RADAR SENSORS: MARKET, BY SALES CHANNEL, 2019–2022 (MILLION UNITS)

- TABLE 118 RADAR SENSORS: MARKET, BY SALES CHANNEL, 2023–2028 (MILLION UNITS)

- TABLE 119 ULTRASONIC SENSORS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 120 ULTRASONIC SENSORS: AUTOMOTIVE SENSORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 121 ULTRASONIC SENSORS: MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 122 ULTRASONIC SENSORS: MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 123 ULTRASONIC SENSORS: MARKET, BY SALES CHANNEL, 2019–2022 (USD MILLION)

- TABLE 124 ULTRASONIC SENSORS: MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 125 ULTRASONIC SENSORS: MARKET, BY SALES CHANNEL, 2019–2022 (MILLION UNITS)

- TABLE 126 ULTRASONIC SENSORS: MARKET, BY SALES CHANNEL, 2023–2028 (MILLION UNITS)

- TABLE 127 LIDAR SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 128 LIDAR SENSORS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 129 LIDAR SENSORS: MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 130 LIDAR SENSORS: MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 131 LIDAR SENSORS: MARKET, BY SALES CHANNEL, 2019–2022 (USD MILLION)

- TABLE 132 LIDAR SENSORS: MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 133 LIDAR SENSORS: MARKET, BY SALES CHANNEL, 2019–2022 (MILLION UNITS)

- TABLE 134 LIDAR SENSORS: MARKET, BY SALES CHANNEL, 2023–2028 (MILLION UNITS)

- TABLE 135 CURRENT SENSORS: AUTOMOTIVE SENSORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 136 CURRENT SENSORS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 137 CURRENT SENSORS: MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 138 CURRENT SENSORS: AUTOMOTIVE SENSOR MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 139 CURRENT SENSORS: MARKET, BY SALES CHANNEL, 2019–2022 (USD MILLION)

- TABLE 140 CURRENT SENSORS: MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 141 CURRENT SENSORS: MARKET, BY SALES CHANNEL, 2019–2022 (MILLION UNITS)

- TABLE 142 CURRENT SENSORS: MARKET, BY SALES CHANNEL, 2023–2028 (MILLION UNITS)

- TABLE 143 OTHER SENSOR TYPES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 144 OTHER SENSOR TYPES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 145 OTHER SENSOR TYPES: MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 146 OTHER SENSOR TYPES: MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 147 OTHER SENSOR TYPES: MARKET, BY SALES CHANNEL, 2019–2022 (USD MILLION)

- TABLE 148 OTHER SENSOR TYPES: MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 149 OTHER SENSOR TYPES: MARKET, BY SALES CHANNEL, 2019–2022 (MILLION UNITS)

- TABLE 150 OTHER SENSOR TYPES: MARKET, BY SALES CHANNEL, 2023–2028 (MILLION UNITS)

- TABLE 151 AUTOMOTIVE SENSORS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 152 AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 153 MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 154 MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 155 PASSENGER CAR: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 156 PASSENGER CAR: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 157 PASSENGER CAR: MARKET, BY APPLICATION, 2019–2022 (MILLION UNITS)

- TABLE 158 PASSENGER CAR: MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 159 PASSENGER CAR: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 160 PASSENGER CAR: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 161 PASSENGER CAR: MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 162 PASSENGER CAR: MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 163 LCV: AUTOMOTIVE SENSOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 164 LCV: AUTOMOTIVE SENSORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 165 LCV: MARKET, BY APPLICATION, 2019–2022 (MILLION UNITS)

- TABLE 166 LCV: MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 167 LCV: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 168 LCV: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 169 LCV: MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 170 LCV: MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 171 HCV: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 172 HCV: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 173 HCV: MARKET, BY APPLICATION, 2019–2022 (MILLION UNITS)

- TABLE 174 HCV: MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 175 HCV: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 176 HCV: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 177 HCV: MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 178 HCV: MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 179 AUTOMOTIVE SENSOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 180 AUTOMOTIVE SENSORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 181 MARKET, BY APPLICATION, 2019–2022 (MILLION UNITS)

- TABLE 182 MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 183 POWERTRAIN SYSTEMS: MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 184 POWERTRAIN SYSTEMS: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 185 POWERTRAIN SYSTEMS: MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 186 POWERTRAIN SYSTEMS: MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 187 CHASSIS: MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 188 CHASSIS: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 189 CHASSIS: MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 190 CHASSIS: MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 191 EXHAUST SYSTEMS: MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 192 EXHAUST SYSTEMS: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 193 EXHAUST SYSTEMS: MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 194 EXHAUST SYSTEMS: MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 195 SAFETY & CONTROL SYSTEMS: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 196 SAFETY & CONTROL SYSTEMS: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 197 SAFETY & CONTROL SYSTEMS: MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 198 SAFETY & CONTROL SYSTEMS: MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 199 VEHICLE BODY ELECTRONICS: MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 200 VEHICLE BODY ELECTRONICS: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 201 VEHICLE BODY ELECTRONICS: MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 202 VEHICLE BODY ELECTRONICS: MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 203 TELEMATICS SYSTEMS: MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 204 TELEMATICS SYSTEMS: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 205 TELEMATICS SYSTEMS: AUTOMOTIVE SENSORS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 206 TELEMATICS SYSTEMS: MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 207 DRIVER ASSISTANCE & AUTOMATION: MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 208 DRIVER ASSISTANCE & AUTOMATION: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 209 DRIVER ASSISTANCE & AUTOMATION: MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 210 DRIVER ASSISTANCE & AUTOMATION: MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 211 OTHER APPLICATIONS: MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 212 OTHER APPLICATIONS: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 213 OTHER APPLICATIONS: MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 214 OTHER APPLICATIONS: MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 215 AUTOMOTIVE SENSOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 216 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 217 MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 218 AUTOMOTIVE SENSORS MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 219 NORTH AMERICA: MARKET, BY SENSOR TYPE, 2019–2022 (USD MILLION)

- TABLE 220 NORTH AMERICA: MARKET, BY SENSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 221 NORTH AMERICA: MARKET, BY SENSOR TYPE, 2019–2022 (MILLION UNITS)

- TABLE 222 NORTH AMERICA: MARKET, BY SENSOR TYPE, 2023–2028 (MILLION UNITS)

- TABLE 223 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 224 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 225 NORTH AMERICA: AUTOMOTIVE SENSOR MARKET, BY COUNTRY, 2019–2022 (MILLION UNITS)

- TABLE 226 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (MILLION UNITS)

- TABLE 227 NORTH AMERICA: MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 228 NORTH AMERICA: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 229 NORTH AMERICA: MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 230 NORTH AMERICA: MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 231 EUROPE: AUTOMOTIVE SENSORS MARKET, BY SENSOR TYPE, 2019–2022 (USD MILLION)

- TABLE 232 EUROPE: MARKET, BY SENSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 233 EUROPE: MARKET, BY SENSOR TYPE, 2019–2022 (MILLION UNITS)

- TABLE 234 EUROPE: MARKET, BY SENSOR TYPE, 2023–2028 (MILLION UNITS)

- TABLE 235 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 236 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 237 EUROPE: MARKET, BY COUNTRY, 2019–2022 (MILLION UNITS)

- TABLE 238 EUROPE: MARKET, BY COUNTRY, 2023–2028 (MILLION UNITS)

- TABLE 239 EUROPE: MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 240 EUROPE: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 241 EUROPE: MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 242 EUROPE: AUTOMOTIVE SENSOR MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 243 ASIA PACIFIC: AUTOMOTIVE SENSORS MARKET, BY SENSOR TYPE, 2019–2022 (USD MILLION)

- TABLE 244 ASIA PACIFIC: MARKET, BY SENSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 245 ASIA PACIFIC: MARKET, BY SENSOR TYPE, 2019–2022 (MILLION UNITS)

- TABLE 246 ASIA PACIFIC: MARKET, BY SENSOR TYPE, 2023–2028 (MILLION UNITS)

- TABLE 247 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 248 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 249 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (MILLION UNITS)

- TABLE 250 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (MILLION UNITS)

- TABLE 251 ASIA PACIFIC: MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 252 ASIA PACIFIC: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 253 ASIA PACIFIC: MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 254 ASIA PACIFIC: MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 255 ROW: AUTOMOTIVE SENSOR MARKET, BY SENSOR TYPE, 2019–2022 (USD MILLION)

- TABLE 256 ROW: MARKET, BY SENSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 257 ROW: MARKET, BY SENSOR TYPE, 2019–2022 (MILLION UNITS)

- TABLE 258 ROW: MARKET, BY SENSOR TYPE, 2023–2028 (MILLION UNITS)

- TABLE 259 ROW: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 260 ROW: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 261 ROW: MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 262 ROW: AUTOMOTIVE SENSORS MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 263 ROW: MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 264 ROW: MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 265 ROW: MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 266 ROW: MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 267 OVERVIEW OF STRATEGIES DEPLOYED BY KEY AUTOMOTIVE SENSOR PROVIDERS

- TABLE 268 AUTOMOTIVE SENSOR MARKET: MARKET SHARE ANALYSIS, 2022

- TABLE 269 COMPANY FOOTPRINT: APPLICATION

- TABLE 270 COMPANY FOOTPRINT: REGION

- TABLE 271 OVERALL COMPANY FOOTPRINT

- TABLE 272 MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 273 AUTOMOTIVE SENSORS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 274 PRODUCT LAUNCHES, JANUARY 2019–JUNE 2023

- TABLE 275 DEALS, JANUARY 2019–AUGUST 2023

- TABLE 276 EXPANSIONS AND INVESTMENTS, JULY 2019–AUGUST 2023

- TABLE 277 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 278 ON SEMICONDUCTOR: COMPANY OVERVIEW

- TABLE 279 OMNIVISION: COMPANY OVERVIEW

- TABLE 280 TE CONNECTIVITY: COMPANY OVERVIEW

- TABLE 281 CONTINENTAL AG: COMPANY OVERVIEW

- TABLE 282 DENSO CORPORATION: COMPANY OVERVIEW

- TABLE 283 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 284 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- TABLE 285 PANASONIC: COMPANY OVERVIEW

- TABLE 286 ALLEGRO MICROSYSTEMS, INC.: COMPANY OVERVIEW

- FIGURE 1 AUTOMOTIVE SENSOR MARKET SEGMENTATION

- FIGURE 2 MARKET: RESEARCH DESIGN

- FIGURE 3 AUTOMOTIVE SENSORS MARKET: RESEARCH FLOW

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUES GENERATED BY COMPANIES FROM SALES OF AUTOMOTIVE SENSORS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP (DEMAND SIDE): DEMAND FOR AUTOMOTIVE SENSORS IN DIFFERENT APPLICATIONS

- FIGURE 6 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 8 MARKET: DATA TRIANGULATION

- FIGURE 9 AUTOMOTIVE SENSORS MARKET: RESEARCH ASSUMPTIONS

- FIGURE 10 AUTOMOTIVE SENSOR MARKET: RESEARCH LIMITATIONS

- FIGURE 11 OEM SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 POSITION SENSORS TO HOLD LARGEST SHARE OF MARKET IN 2023

- FIGURE 13 PASSENGER CAR SEGMENT TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 14 SAFETY & CONTROL SYSTEMS TO EXHIBIT HIGHEST CAGR IN MARKET, BY APPLICATION, FROM 2023 TO 2028

- FIGURE 15 ASIA PACIFIC TO RECORD HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 16 GROWING USE OF AUTOMOTIVE SENSORS IN POWERTRAIN SYSTEMS TO DRIVE MARKET

- FIGURE 17 LIDAR SENSORS TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 CHINA AND PASSENGER CAR SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 19 ORIGINAL EQUIPMENT MANUFACTURER (OEM) TO HOLD LARGER SHARE OF MARKET IN 2023 AND 2028

- FIGURE 20 SPAIN TO RECORD HIGHEST CAGR IN GLOBAL AUTOMOTIVE SENSORS MARKET DURING FORECAST PERIOD

- FIGURE 21 AUTOMOTIVE SENSOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 MARKET: IMPACT OF DRIVERS

- FIGURE 23 MARKET: IMPACT OF RESTRAINTS

- FIGURE 24 MARKET: IMPACT OF OPPORTUNITIES

- FIGURE 25 MARKET: IMPACT OF CHALLENGES

- FIGURE 26 MARKET: VALUE CHAIN ANALYSIS

- FIGURE 27 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN AUTOMOTIVE SENSORS MARKET

- FIGURE 28 AUTOMOTIVE SENSOR ECOSYSTEM MAPPING

- FIGURE 29 KEY PLAYERS IN AUTOMOTIVE SENSOR ECOSYSTEM

- FIGURE 30 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 31 AVERAGE SELLING PRICE TREND OF SPEED SENSORS, BY REGION

- FIGURE 32 AVERAGE SELLING PRICE TREND OF TEMPERATURE SENSORS, BY REGION

- FIGURE 33 AVERAGE SELLING PRICE TREND OF PRESSURE SENSORS, BY REGION

- FIGURE 34 AVERAGE SELLING PRICE TREND OF DIFFERENT SENSORS OFFERED BY KEY PLAYERS

- FIGURE 35 IMPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 36 EXPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 37 PATENTS GRANTED WORLDWIDE FROM 2013 TO 2023

- FIGURE 38 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS FROM 2013 TO 2023

- FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 40 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 41 AUTOMOTIVE SENSOR MARKET, BY SALES CHANNEL

- FIGURE 42 OEM SEGMENT TO DOMINATE AUTOMOTIVE SENSOR MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 43 MARKET, BY SENSOR TYPE

- FIGURE 44 LIDAR SENSORS TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 45 ASIA PACIFIC TO LEAD MARKET FOR POSITION SENSORS DURING FORECAST PERIOD

- FIGURE 46 AUTOMOTIVE SENSORS MARKET, BY VEHICLE TYPE

- FIGURE 47 PASSENGER CAR SEGMENT TO RECORD HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 48 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN MARKET FOR PASSENGER CARS DURING FORECAST PERIOD

- FIGURE 49 AUTOMOTIVE SENSOR MARKET, BY APPLICATION

- FIGURE 50 SAFETY & CONTROL SYSTEMS TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 51 PASSENGER CAR SEGMENT TO LEAD MARKET FOR POWERTRAIN SYSTEMS DURING FORECAST PERIOD

- FIGURE 52 PASSENGER CAR SEGMENT TO DOMINATE MARKET FOR SAFETY & CONTROL SYSTEMS DURING FORECAST PERIOD

- FIGURE 53 MARKET, BY REGION

- FIGURE 54 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 55 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 56 US TO LEAD NORTH AMERICAN MARKET DURING FORECAST PERIOD

- FIGURE 57 EUROPE: MARKET SNAPSHOT

- FIGURE 58 GERMANY TO COMMAND EUROPEAN MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 59 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 60 CHINA TO LEAD ASIA PACIFIC AUTOMOTIVE SENSOR MARKET DURING FORECAST PERIOD

- FIGURE 61 SOUTH AMERICA TO DOMINATE MARKET IN ROW DURING FORECAST PERIOD

- FIGURE 62 FIVE-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS IN MARKET, 2018–2022

- FIGURE 63 AUTOMOTIVE SENSOR MARKET SHARE ANALYSIS, 2022

- FIGURE 64 AUTOMOTIVE SENSORS MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 65 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022

- FIGURE 66 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 67 ON SEMICONDUCTOR: COMPANY SNAPSHOT

- FIGURE 68 TE CONNECTIVITY: COMPANY SNAPSHOT

- FIGURE 69 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 70 DENSO CORPORATION: COMPANY SNAPSHOT

- FIGURE 71 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- FIGURE 72 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- FIGURE 73 PANASONIC: COMPANY SNAPSHOT

- FIGURE 74 ALLEGRO MICROSYSTEMS, INC.: COMPANY SNAPSHOT

The study involved four major activities in estimating the size of the automotive sensor market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. After that, market breakdown and data triangulation have been used to estimate the market sizes of segments and subsegments.

Secondary Research

Revenues of companies offering automotive sensors worldwide have been obtained based on the secondary data accessed through paid and unpaid sources. They have also been derived by analyzing the product portfolios of key companies, rated according to the performance and quality of their products.

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the automotive sensor market. Secondary sources considered for this research study include government sources; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations. Secondary data has been collected and analyzed to determine the overall market size, further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of automotive sensors to identify the key players based on their products and the prevailing industry trends in the automotive sensor market according to sensor type, sales channel, vehicle type, application, and region. It also includes information about the key developments undertaken from market- and technology-oriented perspectives.

Primary Research

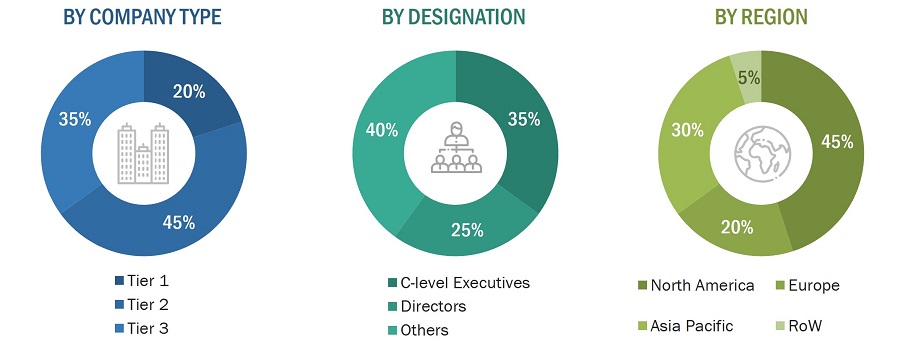

Extensive primary research has been conducted after understanding and analyzing the current scenario of the automotive sensor market through secondary research. Several primary interviews have been conducted with key opinion leaders from the demand and supply sides across four regions—North America, Europe, Asia Pacific, and RoW. Approximately 25% of primary interviews were conducted with demand and ~75% with supply side. Data was collected through questionnaires, emails, and phone interviews..

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

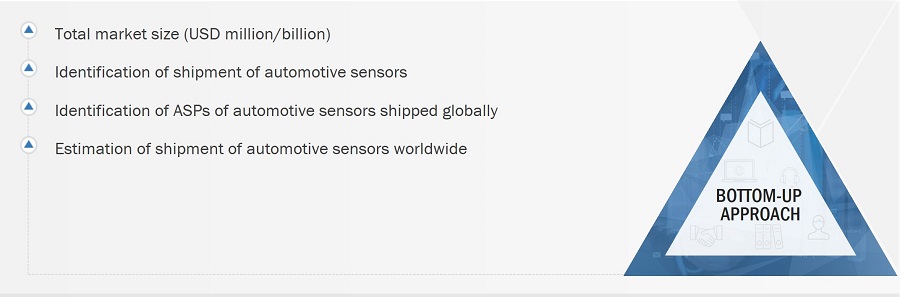

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the automotive sensor market. These methods have also been extensively used to estimate the sizes of various market subsegments. The research methodology used to estimate the market sizes includes the following:

- Identifying the number of automotive sensors shipped at the global level.

- Determining average selling prices of automotive sensors shipped globally.

- Conducting multiple discussion sessions with key opinion leaders to understand different automotive sensors and their deployment in various products and applications; analyzing the break-up of the work carried out by each key company.

- Verifying and crosschecking estimates at every level with key opinion leaders, including chief executive officers (CEO), directors, and operation managers, and finally, with the domain experts of MarketsandMarkets.

- Analyzing various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases of the company- and region-specific developments undertaken in the automotive sensor market.

Market Size Estimation Methodology-Bottom-up Approach

Market Size Estimation Methodology-Top-Down Approach

Data Triangulation

After arriving at the overall size of the automotive sensor market through the process explained above, the total market has been split into several segments and subsegments. Where applicable, market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from the demand and supply sides. The market has also been validated using top-down and bottom-up approaches.

The main objectives of this study are as follows:

- To segment and forecast the global automotive sensor market, by sales channel, sensor type, vehicle type, and application in terms of value and volume

- To describe and forecast the market size of various segments across major regions, namely, North America, Europe, Asia Pacific, and Rest of World (RoW), in terms of value and volume

- To provide industry-specific information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the automotive sensor market

- To provide an overview of the supply chain of the automotive sensor ecosystem, along with the average selling prices of automotive sensors

- To strategically analyze the ecosystem, tariffs and regulations, patent landscape, Porter’s five forces, technology trends, regulations, import and export scenarios, trade landscape, and case studies pertaining to the market under study

- To strategically analyze micromarkets1 concerning individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments

- To provide details of the competitive landscape for market leaders

- To analyze competitive developments such as product launches, collaborations, expansions, partnerships, agreements, acquisitions, joint ventures, and contracts in the automotive sensors market

- To profile key players in the automotive sensor market and comprehensively analyze their market ranking based on their revenue, market share, and core competencies.

Market Definition

Automotive sensors transform (or transduce) physical variables, such as pressure or acceleration, into electrical output signals that serve as inputs for control systems. Sensors are essential components of automotive electronic control systems. Various sensors monitor and control several parameters in an automobile, such as speed, position, level, pressure, inertia, temperature, oxygen level, nitrogen oxide (NOx) level, and position. The data collected by these sensors is provided to the electronic control unit (ECU) for control actions. This data helps improve vehicle performance, passenger and road safety, comfort, and travelers' convenience.

The car dictionary defines automotive sensors as sensors that are the sensory organs of a vehicle. They are a fundamental component of electronic control systems and must record physical or chemical variables and convert them into electrical signals.

Automotive sensors are intelligent systems that control different aspects, such as temperature, coolant levels, oil pressure, and vehicle emission levels. Over the past 30 years, electronic systems for vehicles have changed significantly. With advancements in automotive technology, more automobile manufacturers are integrating automotive sensors to offer higher vehicle control and safety levels.

Stakeholders

- Raw material suppliers

- Original equipment manufacturers (OEMs)

- Technology solution providers

- Research institutes

- Market research and consulting firms

- Governments and financial institutions

- Analysts and strategic business planners

Research Objectives

- To define, describe, and forecast the automotive sensor market size, sales channel, sensor types, vehicle types, application, and region in terms of value and volume

- To forecast the market size, in terms of value, for various segments with respect to four main regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To strategically analyze the micro markets with respect to individual growth trends, prospects, and contributions to the overall market

- To identify the drivers, restraints, opportunities, and challenges impacting the growth of the market and submarkets

- To analyze the automotive sensor supply chain and identify opportunities for the supply chain participants

- To provide key technology trends and patent analysis related to the automotive sensor market

- To provide information regarding trade data related to the automotive sensor market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the automotive sensor ecosystem

- To strategically profile the key players in the automotive sensor market and comprehensively analyze their market shares and core competencies in each segment

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of market ranking/share and product portfolio

- To analyze competitive developments such as product launches, alliances and partnerships, joint ventures, and mergers and acquisitions in the automotive sensor market

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Further breakdown of the market in different regions at the country-level

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Sensors Market

I'd be grateful if I have sample pages on (2.1.1. Automotive Sensor Market Value, By Application) and (2.1.2 Automotive Sensor Market Value, By Product Type)

Dear Sir/Madam...I am a journalist in the process of finalizing an article for the October issue of Electronic Products Magazine (US) on automotive sensors. I would appreciate receiving your forecast for automotive sensors from 2012 to 2020 with the CAGR noted.

Interested in temperature, climate, oxygen, air quality, humidity sensor cluster trends and future technology roadmap.

Hello! I would like to have a sample of this market research report. My company is looking for a high quality market report on automotive sensors.

I know this market well, I want to see if this would be helpful to me. For instance I would be interested in the view of wheel speed sensors or steering angle sensors.

Need information on sensors for auto market, with focus on emissions and fuel econ. Has this report been updated to capture the regulation changes / delays by North America and Europe that occurred late 2018?

We are reviewing where to take our auto sensors business. In particular, we're interested in purchasing a company that can manufacture a full array of automotive sensors. Should we purchase someone with these capabilities or partner with them on the development and marketing of these sensors? Need as much data (up to date). As this is a document using 2016 data, an updated one would be appreciated.

Interested in ME sheet of the report only.

Hi! I'm working on my thesis for my MBA and since it's about the business plan for a company in the US which produces electronic sensors for cars, having access to your report would be very useful. Could you please, share the report with me?

I am looking at: automotive sensor market continuous technological advancements, supportive government and environment regulations, increasing vehicle production, and customer preferences. I am trying to understand end market trends, opportunities for TAM expansion, etc.

Need information on market share analysis of major players.

Hello, I am trying to estimate the effect of electrical autonomous cars would have on the sensor market. To do that I am trying to estimate the cost of different sensors used in cars today.

We are working as automotive interiors. To give new user experience we are adding new features related smart surface. As a part of study and market trend we are analyzing automotive sensors.

I work in a company that produces polyamide compounds for automotive industry. I was interested on this report to check opportunities for polyamide in this market. I wonder if the report contains technical requirements (corrosion resistance, strength, etc.) or what are the CTQ's for this market.

Interested in knowing the recent market trend and upcoming technologies.

Special interested in commercial vehicles (trucks and heavy duty), development trends, sensors price erosion and sensors supply chain analysis.