Cryogenic Equipment Market

Cryogenic Equipment Market by Equipment (Tanks, Valves, Vaporizers, Pumps), Cryogen (Nitrogen, Argon, Oxygen, LNG, Hydrogen), End-user Industry (Energy & Power, Chemical, Metallurgy, Transportation), System Type, Application, & Region - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The cryogenic equipment market is projected to reach USD 22.96 billion by 2030 from USD 13.55 billion in 2024, at a CAGR of 9.3%. The increasing use of these industrial gases in industries such as energy & power, metallurgy, electronics, chemicals, and transportation is likely to propel the demand for cryogenic equipment. Also, the increasing adoption of high-efficiency and application-specific cryogenic systems, particularly for LNG, industrial gases, healthcare, and hydrogen applications, is leading to market growth.

KEY TAKEAWAYS

-

BY REGIONThe Asia Pacific is expected to account for 38.0% of the cryogenic equipment market in 2030.

-

By System TypeStorage systems are likely to hold the largest share of 57.8% of the cryogenic equipment market in 2030.

-

By CryogenThe LNG segment is expected to hold the largest market share till 2030.

-

By EquipmentTanks will dominate the market for equipment types during the forecast period.

-

By end-user industryBy end-user industry, the electronics segment is expected to grow at the highest rate of 10.9% during the forecast period.

-

COMPETITIVE LANDSCAPECompanies such as Linde plc, Air Liquide, and PARKER HANNIFIN CORP are identified as stars in this market. They have pursued collaborations and other growth-oriented strategies.

-

COMPETITIVE LANDSCAPECRYOSTAR, HEROSE GMBH, and Five SAS have been identified as startups and SMEs, reflecting their growing market presence and expanding operational capabilities.

Cryogenic equipment solutions help industrial and energy users meet safety, efficiency, and decarbonization needs by enabling reliable ultra-low-temperature operations. Through advanced systems for LNG, hydrogen, and industrial gases, customers can modernize critical infrastructure with improved operational stability, lower risk, and long-term performance support.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The growing use of advanced technologies for cryogenic purposes is transforming industries and the energy sector by enabling ultra-low-temperature processing, reliable storage of liquefied gases, and efficiency improvements in critical applications. The increasing demand for LNG, hydrogen, and clean energy infrastructure is driving the need for high-performance cryogenic systems that support the energy transition while prioritizing safety and reliability. Simultaneously, industries are becoming more energy-efficient and reducing emissions, fostering the integration of digitally connected cryogenic equipment with monitoring and predictive maintenance features. As a result, cryogenic equipment suppliers are shifting from traditional equipment sales to offering performance solutions that include temperature control, efficient operation, and long-term service contracts.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing utilization of industrial gases in metallurgy, oil & gas, and energy & power industries

-

Growing popularity of liquefied natural gas as a source of clean and efficient energy

Level

-

Volatile raw material and metal prices and significant competition from gray market

-

High CAPEX and OPEX costs associated with cryogenic plants

Level

-

Evolving applications of cryogenic electronics

-

Launch of new space and satellite missions

Level

-

Supply chain disruptions due to Russia–Ukraine war

-

Hazards and greenhouse gas emissions resulting from leakage of cryogenic fluids

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing utilization of industrial gases in metallurgy, oil & gas, and energy & power industries

In the metallurgy industry, gases are required in their cryogenic liquid forms to provide precise temperature control and enhanced process efficiency. Different types of cryogenic equipment, such as storage tanks and distribution systems, are indispensable in handling and supplying these gases in their liquid state. The superior performance and cost-effectiveness of cryogenic systems make them the preferred choice in metallurgical applications. Further, steel is expected to witness a significant rise in demand across the world, especially in the developing economies. According to the World Steel Association (WSA), ~73% of global steel production is produced using the oxygen process (Basic Oxygen Process). In steel production and processing, oxygen gas is often used in conjunction with cryogenic equipment to enhance the efficiency and quality of operations. In the steelmaking process, oxygen is injected into the molten iron in blast furnaces to promote combustion and accelerate the removal of impurities, resulting in improved steel quality. Cryogenic equipment is employed to store and supply liquid oxygen, ensuring precise control over the injection process. The growth of industry fuels demand for industrial gases, which, in turn, drives demand for cryogenic equipment to handle, store, and transport them.

Restraint: Volatile raw material and metal prices and significant competition from gray market

Cryogenic equipment is constructed using a variety of materials, including stainless steel, bronze, carbon steel, and specialized alloys. In recent years, there has been a substantial increase in the prices of raw materials like iron ore and other ores, leading to a consistent upward trend in global prices for metals, particularly stainless steel. China, being the largest steel producer and exporter, has experienced fluctuations in processed metal prices, impacting various industries. The production of cryogenic equipment demands top-quality raw materials, and the rising cost of these materials has created intense competition among leading cryogenic equipment manufacturers. The surge in cryogenic equipment prices has also prompted a preference for smaller-scale manufacturers in the informal market, especially in countries like China and India. Consequently, the fluctuating prices of metals have become a significant obstacle for the market. In addition to major raw material suppliers, the presence of numerous local and regional providers who can offer materials meeting international standards at competitive prices provides manufacturers with procurement options. This, in turn, gives rise to the existence of unregulated gray market players, which further impedes the market's growth

Opportunity: Evolving applications of cryogenic electronics

Cryogenic gases play a pivotal role in semiconductor manufacturing and testing processes. Liquid nitrogen is a widely employed coolant for dissipating heat generated during the manufacturing phase. The use of extremely low temperatures, often approaching absolute zero, can facilitate the creation of electronics with heightened performance, reduced noise, and enhanced efficiency. Furthermore, subjecting electronics to cryogenic treatment can minimize gaps within the metallic components of their structure. This, in turn, enhances the reliability of electronics by improving both thermal and electrical conductivity and reducing operating power requirements. The applications of cryogenic electronics are on the rise. Cryogenic electronics find applications in the development of quantum computers. Quantum bits (qubits) are incredibly sensitive and require temperatures close to absolute zero to minimize environmental interference. Additionally, the expanding use of cryogenic electronics in various research endeavors, superconducting magnet systems, low-temperature detector systems, and infrared array systems is expected to create opportunities for providers of cryogenic equipment.

Challenge: Supply chain disruptions due to Russia–Ukraine war

The Russia–Ukraine war has had a significant impact on the global LNG market, leading to soaring prices and disrupting supply chains. Europe, in particular, has been hit hard, as it has traditionally relied heavily on Russian pipeline gas. In response to the war, European countries have scrambled to diversify their gas supplies, with LNG playing a key role. Prior to the war, Europe imported around 40% of its natural gas from Russia. However, in the wake of the invasion, European countries have moved to reduce their reliance on Russian gas, and LNG imports have surged. In 2022, European LNG imports increased by 60% from the previous year. The increase in European LNG demand has had a knock-on effect on global LNG prices, which have soared to record highs. In March 2022, the benchmark European LNG price reached over USD 80 per million British thermal units (MMBtu), more than four times higher than the level at the start of the year. The war also had an impact on Asian LNG demand. As European countries have competed for LNG supplies, Asian buyers have faced higher prices and reduced availability. This has led to some demand destruction in Asia, as buyers have switched to other fuels, such as coal and oil.

CRYOGENIC EQUIPMENT MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

An LNG facility implemented a Fisher Joule–Thomson (JT) control valve, provided by Emerson, in the liquefaction section to improve the main cryogenic heat exchanger (MCHE) performance and stabilize low-temperature operation under demanding cryogenic conditions. | Improved MCHE operating stability, better process efficiency and control at cryogenic temperatures, and reduced operational risk through more reliable valve performance |

|

A pharmaceutical ingredient manufacturer worked with AFcryo to deploy CryoCube, a mobile cryogenic system providing on-site production of pharmacopoeia-compliant liquid and gaseous nitrogen for vaccine and serum development. The solution was rapidly deployable and designed to meet strict pharmaceutical safety and quality standards. | Enabled independence from external liquid gas supply, ensured continuous availability of high-purity liquid and gas, reduced supply risk, and improved operational reliability through remote monitoring and proactive servicing |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The cryogenic equipment market ecosystem includes suppliers, manufacturers, and end users that collectively shape market development. The ecosystem includes raw material suppliers such as Sabre Steel, A-1 Alloys, and Aviva Metals, which provide critical metals and alloys required for cryogenic equipment manufacturing. Cryogenic equipment and industrial gas manufacturers, including Linde plc, Air Liquide, and Air Products, play a central role by designing and supplying cryogenic tanks, air separation units, and gas handling systems for industrial and energy applications. Industrial gas producers such as Praxair Technology, Airgas, and Iwatani Corporation support downstream demand by supplying cryogenic gases across multiple industries. End users, including ArcelorMittal, Enel SpA, and BASF, rely on these integrated solutions to support operations in metallurgy, energy & power, chemicals, and healthcare. This interconnected ecosystem enables reliable cryogenic supply chains, supports industrial efficiency, and drives sustained growth in the cryogenic equipment market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Cryogenic Equipment Market, By Equipment

The cryogenic equipment types studied in this report are tanks, valves, vaporizers, pumps, and other components that comprise pipes, regulators, freezers, dewars, strainers, samplers, heat exchangers, leak detection systems, dispensers, and accessories, which include manifolds, fittings, vacuum-jacketed or insulated piping, hoses, and connections. Among these, tanks are projected to exhibit the fastest growth during the forecast period due to increased global demand for LNG storage tanks and microbulk tanks. Further driving the commercial adoption of these tanks will be the increased use of LNG in energy, transportation, and industrial applications.

Cryogenic Equipment Market, By System Type

By system type, the cryogenic equipment market has been segmented into storage, handling, supply, and other systems. The storage systems segment is expected to hold the largest market share during the forecast period. The large market share and high growth rate of this segment are driven by the lucrative opportunities offered by the expanding aerospace industry and technological advancements in cryogenic energy storage (CES) systems.

Cryogenic Equipment Market, By Cryogen

Based on cryogen types, the market is segmented into nitrogen, argon, oxygen, LNG (liquefied natural gas), hydrogen, and other cryogens such as helium, nitrous oxide, ethylene, and carbon dioxide. Among these considered cryogenic gases, the LNG segment is expected to capture the highest share in the forecast period, backed by rising investments in LNG liquefaction, storage, transportation, and regasification infrastructure. The global demand for cryogenic equipment related to LNG has been persistently fueled by increasing acceptance of LNG as a cleaner fuel for power generation, industrial use, and transport, coupled with the expanding global LNG trade.

Cryogenic Equipment Market, By End-User Industry

Based on end-user industry, the cryogenic equipment market has been split into six types: metallurgy, energy & power, chemical, electronics, transportation, and other end-user industries. The metallurgy segment is expected to be the largest segment during the forecast period. In the metallurgy industry, processes such as metal forming, fabrication, welding, and combustion require industrial gases such as oxygen, nitrogen, argon, and hydrogen. The research and innovations associated with the development of high-strength and high-conductivity alloys for non-rare-earth induction motors used in EVs, metals with high rigidity and stiffness for use in industrial applications, new composites such as highly conducting carbon nanotubes to enhance the efficiency of electrical energy transport, and new corrosion protection systems for marine and offshore applications are also expected to create a high demand for cryogenic equipment in the metallurgy industry.

REGION

Asia Pacific to be the largest market for cryogenic equipment market throughout forecast period

Rapid industrialization, extensive LNG infrastructure growth, and increasing investments in hydrogen and clean energy projects are key drivers for the cryogenic equipment industry in the Asia Pacific. The swift expansion of sectors such as metallurgy, chemicals, electronics manufacturing, and energy & power in countries like China, India, Japan, and South Korea is fueling demand for advanced cryogenic systems. Government efforts to decarbonize economies, enhance LNG import capacity, and develop hydrogen supply chains will further boost market growth. With ongoing industrial demand and significant investments in energy infrastructure, the Asia Pacific is set to be the fastest-growing end-user for the cryogenic equipment market throughout the forecast period.

CRYOGENIC EQUIPMENT MARKET: COMPANY EVALUATION MATRIX

Linde plc, positioned as a “star” in the cryogenic equipment market, derives its strength from industrial gases, cryogenic air separation units, LNG, and hydrogen infrastructure. It specializes in providing large-scale, high-efficiency cryogenic systems and integrated solutions to support energy, metallurgical, chemical, and clean-fuel applications under long-term supply and service agreements. Emerson Electric Co., an emerging leader in the cryogenic equipment market, is strengthening its position through advanced automation, control valves, measurement technologies, and digital solutions that enhance the reliability, safety, and operational efficiency of cryogenic systems across industrial and energy end-use sectors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Linde plc (Ireland)

- Air Liquide (France)

- Air Products and Chemicals, Inc. (US)

- Chart Industries (US)

- PARKER HANNIFIN CORP (US)

- Flowserve Corporation (US)

- Nikkiso Co., Ltd. (Japan)

- INOX India Limited (India)

- SHI Cryogenics Group (Japan)

- Emerson Electric Co. (US)

- Sulzer Ltd (Switzerland)

- Taylor-Wharton (US)

- Wessington Cryogenics (UK)

- PHPK Technologies (US)

- Acme Cryo (US)

- Five SAS (France)

- HEROSE GMBH (Germany)

- Shell-N-Tube (India)

- CRYOFAB (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 13.55 Billion |

| Market Forecast in 2030 (Value) | USD 22.96 Billion |

| CAGR | 9.3% |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Middle East, Africa, South America |

WHAT IS IN IT FOR YOU: CRYOGENIC EQUIPMENT MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Company profiling | Competitive Landscape & Key Player Benchmarking Customization | Startup and key players mapping, strategic partnerships and alliances, technology and solution positioning, M&A and investment activity tracking, competitive differentiation, and emerging business model identification. |

RECENT DEVELOPMENTS

- July 2023 : Chart Industries opened a second facility in Alabama. This plant is expected to fabricate the largest shop-built cryogenic tanks ever manufactured globally—70% larger than the previous model—to begin in the first quarter of 2024. The tanks manufactured at this site will be used as propellant storage solutions in the aerospace industry, hydrogen and LNG storage solutions in the marine industry, and many other processes and technologies adopted in the sciences and decarbonization industries.

- June 2023 : INOX India Limited built an LNG facility in Tamil Nadu, which comprises 2 x 113 KL LNG tanks, regas system with a capacity of 5,000 SCMH @ 22 Bar pressure and associated equipment was supplied by INOXCVA on a turnkey basis in a record time.

- April 2023 : Linde signed an agreement with Evonik, a leading specialty chemicals company, to supply green hydrogen in Singapore. According to the agreement, Linde will build, own, and operate a nine-megawatt alkaline electrolyzer plant on Jurong Island, Singapore. The plant will produce green hydrogen, which Evonik will utilize to manufacture methionine, a vital component in animal feed.

- March 2023 : Air Products and Chemicals, Inc. and Shaanxi LNG Reserves & Logistics Company signed an agreement to supply its proprietary liquefied natural gas (LNG) process technology and equipment to Technip Energies for the Xi'An LNG Emergency Reserve & Peak Regulation Project with Shaanxi LNG Reserves & Logistics Company Ltd., in ShaanXi Province, China.

Table of Contents

Methodology

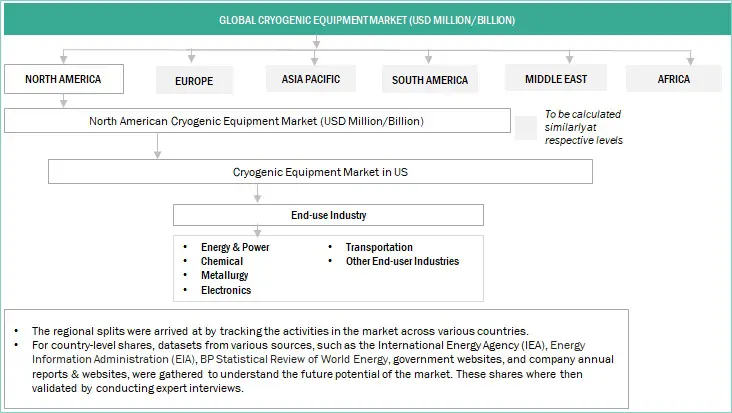

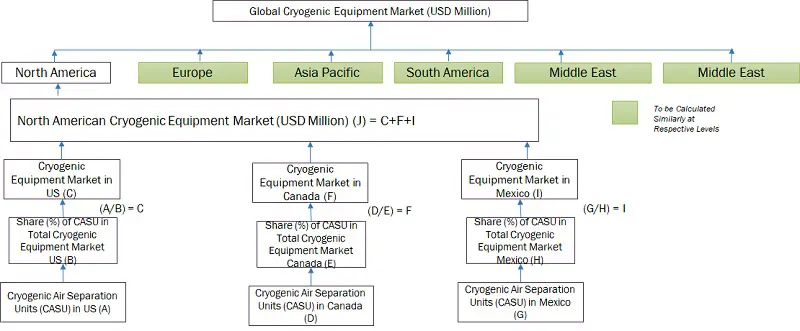

The study involved major activities in estimating the current size of the cryogenic equipment market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the cryogenic equipment market involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg, Factiva, IRENA, International Energy Agency, and Statista Industry Journal, to collect and identify information useful for a technical, market-oriented, and commercial study of the cryogenic equipment market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

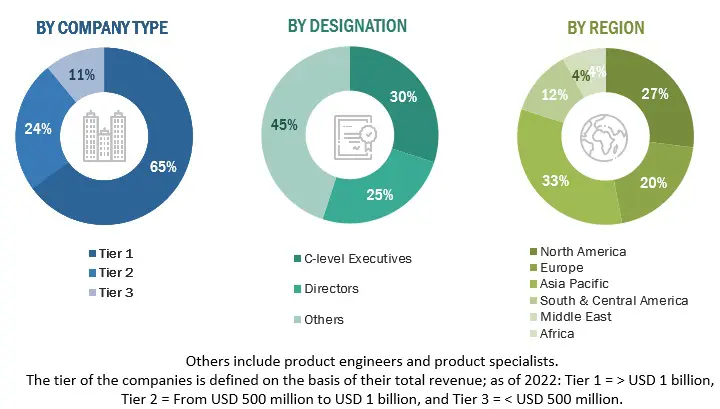

The cryogenic equipment market comprises several stakeholders, such as cryogenic equipment manufacturers, technology providers, and technical support providers in the supply chain. The demand side of this market is characterized by the rising demand for types of cryogenic equipments such as rod lift systems, electric submersible pumps, progressive cavity pumps, and gas lift systems. The supply side is characterized by rising demand for contracts from the industrial sector and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the cryogenic equipment market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share has been determined through primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through both primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Cryogenic Equipment Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Cryogenic Equipment Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the total market has been split into several segments and subsegments. Data triangulation and market breakdown processes have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

Cryogenic equipment comprises specialized machinery designed for use at extremely low temperatures, typically below -150 degrees Celsius. It enables the storage, transport, and handling of materials like gases and biological samples at these ultra-low temperatures. This technology finds application in various fields, from healthcare to aerospace, supporting scientific research and industrial processes.

The market for cryogenic equipment is the sum of revenues generated by global companies through the sales of cryogenic equipment.

Key Stakeholders

- Cryogenic equipment manufacturers and providers

- Industrial gas supplying companies

- Manufacturing industries

- R&D laboratories

- Consulting companies from energy & power sector

- Distributors of cryogenic equipment

- Government and research organizations

- State and national regulatory authorities

Objectives of the Study

- To define, describe, segment, and forecast the cryogenic equipment market by equipment, cryogen, end-user industry, system type, application, and region, in terms of value

- To describe and forecast the market for six key regions: North America, Europe, Asia Pacific, South America, the Middle East, and Africa, along with their country-level market sizes, in terms of value

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing market growth

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market size

- To provide supply chain analysis, trends/disruptions impacting customer business, ecosystem/market map, pricing analysis, Porter’s five forces analysis, case study analysis, and regulatory standards pertaining to cryogenic equipment

- To analyze opportunities for stakeholders in the cryogenic equipment and draw a competitive landscape of the market

- To strategically analyze the ecosystem, tariffs and regulations, patents, and trading scenarios pertaining to cryogenic equipment

- To compare key market players based on product specifications and applications

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as contracts and agreements, investments and expansions, mergers and acquisitions, partnerships, joint ventures and collaborations, in the cryogenic equipment.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Cryogenic Equipment Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Cryogenic Equipment Market