Blood Glucose Monitoring System Market Size, Growth, Share & Trends Analysis

Blood Glucose Monitor Market by Product Type (Self blood glucose monitoring, Professional point of care), Application (Diabetes management, Health & Wellness Monitoring), Test site (Fingertip, Upper arm), End User (Self/Homecare) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global blood glucose monitoring system market, valued at US$15.16 billion in 2024, stood at US$16.46 billion in 2025 and is projected to advance at a resilient CAGR of 9.1% from 2024 to 2030, culminating in a forecasted valuation of US$25.41 billion by the end of the period. Advances in glucose monitoring technologies, including continuous glucose monitors (CGMs) and smart self-monitoring devices, enable higher accuracy, real-time data, and improved patient convenience compared to traditional methods. These innovations support better glycemic management, reduce complications, and enhance overall diabetes care outcomes. Rising diabetes prevalence, increasing health awareness, and growing adoption of digital health solutions are driving demand for blood glucose monitoring devices worldwide.

KEY TAKEAWAYS

-

BY PRODUCT TYPEBased on product type, the global blood glucose monitor market is divided into four main segments: self-monitoring blood glucose systems, continuous glucose monitoring systems, professional point-of-care devices, and non-invasive products. The minimally self-monitoring blood glucose systems segment held the largest share in the market, supported by its low cost, ease of use, and strong penetration across both home-care and clinical settings, resulting in extensive usage among diabetes patients being monitored at home.

-

BY APPLICATIONThe global blood glucose monitor market is segmented into three categories by application: diabetes management, health & wellness monitoring, and other applications. The diabetes management segment is expected to grow at the highest CAGR during the forecast period due to the increasing incidence of type 1 and type 2 diabetes globally.

-

BY TEST SITEBased on the test site, the global blood glucose monitor market is divided into three main segments: fingertip, upper arm, and alternate sites. The fingertip segment contributed the largest share because of its convenience, fast results, and extensive usage both among patients and healthcare professionals.

-

BY END USERThe blood glucose monitor market can be divided by end user into three main categories: self/home care, hospitals & clinics, and other end users. The self/home care segment accounted for the largest share due to the increased use of convenient in-home diabetes management, heightened awareness of the benefits of frequent glucose monitoring, and a growing population dealing with diabetes at home.

-

BY REGIONThe blood glucose monitor market is segmented by region into North America, Europe, Asia Pacific, Latin America, GCC Countries, and the Middle East & Africa. The Asia Pacific is anticipated to be the fastest-growing market due to rising diabetes prevalence, increasing healthcare awareness, rapid adoption of affordable self-monitoring solutions, and the rapid development of healthcare infrastructure in countries such as China, India, and South Korea.

-

COMPETITIVE LANDSCAPEThe major market players have adopted organic and inorganic strategies, including product launches, partnerships, and acquisitions. For example, in April 2025, DexCom, Inc. (US) announced that the US FDA approved the DexCom G7 15 Day Continuous Glucose Monitoring System for use by people over the age of 18 with diabetes.

The global blood glucose monitor market is witnessing steady growth, driven by several key factors. The rising prevalence of diabetes worldwide, fueled by aging populations, urbanization, and lifestyle changes, is increasing the demand for effective self-monitoring solutions. In addition, the growing adoption of advanced continuous and non-invasive glucose monitoring technologies, along with innovations in connectivity, mobile health integration, and smart analytics, is broadening their clinical and home-based use.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The blood glucose monitor market is experiencing a shift from traditional glucose meters and strip-based testing toward advanced, technology-driven solutions. Emerging trends include the adoption of continuous glucose monitoring (CGM) systems, non-invasive and minimally invasive sensors, smart connected devices, and AI-powered analytics. These innovations are creating high-growth opportunities, driven by demand for real-time monitoring, improved accuracy, and enhanced diabetes management. End users such as hospitals, clinics, and home-care patients are increasingly adopting these disruptive technologies, reshaping the future of diabetes care.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing prevalence of diabetes

-

Growing elderly population and increasing life expectancy

Level

-

High cost and socioeconomic disparities in access to blood glucose sensors

-

Short sensor lifespan and frequent replacements

Level

-

Integration with digital health platforms and smart devices

-

Expansion of coverage and reimbursement policies for CGMs

Level

-

Regulatory compliance challenges for non-invasive glucose monitoring technologies

-

Data overload & alarm fatigue

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing prevalence of diabetes

The global burden of diabetes continues to rise at an alarming rate, significantly driving the demand for blood glucose monitoring devices. According to the World Health Organization, approximately 830 million individuals worldwide were living with diabetes in 2022. The International Diabetes Federation (IDF) 2025 report further estimates that 589 million adults (aged 20–79 years), representing about 11.1% of the global population, currently live with diabetes, which is expected to surge by 45% to reach 853 million by 2050. In 2024, over 9.5 million people were affected by type 1 diabetes, including 1.9 million children and adolescents under 20 years of age. With diabetes accounting for more than 3.4 million deaths globally, or nearly 9.3% of total mortality, the condition represents a growing public health challenge. The escalating prevalence of disease creates a sustained demand for reliable, user-friendly, and technologically advanced blood glucose monitoring solutions to enable early detection, continuous management, and improved patient outcomes.

Restraint: High cost and socioeconomic disparities in access to blood glucose sensors

The high cost of continuous and flash glucose monitoring systems poses a major restraint to market growth, especially in low- and middle-income regions. Although these technologies offer superior accuracy and convenience compared to traditional glucose meters, their high upfront and recurring costs for sensor replacements make them unaffordable for many patients. Socioeconomic disparities, limited reimbursement coverage, and inadequate insurance support further restrict access, particularly in emerging markets where out-of-pocket healthcare spending is high. Moreover, gaps in healthcare infrastructure and digital connectivity in rural areas exacerbate the inequality in adoption, preventing widespread use of advanced monitoring systems. These factors underscore the need for affordable product innovations, tiered pricing strategies, and stronger policy initiatives to ensure equitable access to modern diabetes management technologies.

Opportunity: Integration with digital health platforms and smart devices

The integration of blood glucose monitors with digital health platforms and smart devices is emerging as a transformative opportunity in diabetes management. Advancements in Bluetooth and cloud connectivity enable real-time glucose data to be synchronized with smartphones, wearables, and electronic health records, allowing for continuous monitoring and data-driven decision-making. Patients benefit from personalized alerts, automated insulin dose recommendations, and trend analytics that improve self-management and clinical outcomes. For healthcare providers, integrated platforms facilitate remote monitoring, teleconsultations, and population-level analytics, enhancing care coordination and reducing hospital visits. As governments and insurers increasingly support digital health adoption, this trend is expected to accelerate, positioning connected glucose monitoring as a cornerstone of next-generation diabetes care.

Challenge: Regulatory compliance challenges for non-invasive glucose monitoring technologies

Non-invasive glucose monitoring technologies face significant regulatory challenges as authorities such as the FDA and EMA require rigorous proof of safety, accuracy, and consistency across diverse populations and conditions. Unlike conventional blood-based systems, these devices rely on optical or electromagnetic sensing, which can be affected by skin tone, hydration, and environmental factors, complicating validation. The absence of standardized testing protocols increases uncertainty, leading to lengthy approval timelines and costly clinical studies. Consequently, despite strong innovation potential, regulatory and reimbursement barriers continue to delay the large-scale commercialization of non-invasive glucose monitoring solutions.

Blood Glucose Monitor Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

FreeStyle Libre 3 continuous glucose monitoring (CGM) system designed for real-time glucose tracking without routine fingersticks; transmits minute-by-minute readings to a connected smartphone app. | Eliminates fingerstick calibration, enhances patient comfort, enables proactive glucose management, and supports better glycemic control through trend-based insights |

|

Dexcom G7 all-in-one CGM sensor providing real-time glucose readings, customizable alerts, and integration with smartphones and insulin pumps for seamless diabetes management. | Offers superior accuracy and fast warm-up; provides predictive alerts to prevent hypo- and hyperglycemia; improves adherence through connectivity and data visualization |

|

Guardian 3 Sensor used with Medtronic insulin pumps to deliver continuous glucose data every five minutes, supporting automated insulin delivery and trend-based therapy adjustments | Enables hybrid closed-loop insulin management, improves time-in-range, reduces glycemic variability, and enhances safety for insulin-dependent users |

|

Omnitest self-monitoring blood glucose (SMBG) device designed for capillary blood testing, offering reliable and quick results for daily home or point-of-care glucose monitoring | Provides affordable, accurate, and easy-to-use glucose testing; supports frequent monitoring and improved patient engagement in self-managed care |

|

Accu-Chek range of SMBG systems designed for fast and dependable glucose measurement with connectivity to digital platforms for progress tracking and data sharing | Ensures consistent accuracy, simplifies diabetes management, enables remote data access, and strengthens patient–clinician communication for improved outcomes |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The blood glucose monitor market operates within a complex ecosystem comprising multiple stakeholders that collectively drive innovation, distribution, and adoption. Device manufacturers develop accurate and reliable blood glucose monitoring systems, while distributors ensure these products reach hospitals, clinics, pharmacies, and retail channels. Healthcare providers, including hospitals and specialized diabetes care centers, integrate these devices into patient management, supported by doctors, nurses, and other healthcare professionals who guide their use and monitor outcomes. Patients and caregivers form the end-user base, relying on these devices for daily diabetes management. Health advocacy organizations promote awareness, best practices, and policy support, while government and regulatory bodies ensure safety, efficacy, and compliance, shaping market access and product standards. Together, this interconnected network defines the operational and innovation landscape of the global blood glucose monitor market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Blood Glucose Monitor Market, By Product

Based on product, the global blood glucose monitor market is categorized into four primary segments. Based on product type, the global blood glucose monitor market is divided into four main segments: self-monitoring blood glucose systems, continuous glucose monitoring systems, Professional point-of-care devices, and non-invasive products. Among these, continuous glucose monitoring systems are expected to witness the fastest growth during the forecast period, driven by rapid technological advancements and rising demand for real-time glucose tracking. CGM devices provide continuous, automated glucose readings without the need for multiple finger-prick tests, enabling better glycemic control and early detection of fluctuations. Their integration with digital health platforms, insulin pumps, and smartphone applications further enhances patient convenience and personalization of treatment. Additionally, regulatory approvals of next-generation sensors, such as the Dexcom G7 and Abbott FreeStyle Libre 3, coupled with expanding reimbursement support and increasing adoption among type 1 and type 2 diabetic populations, are accelerating the market expansion of CGM systems worldwide.

Blood Glucose Monitor Market, By Application

The global blood glucose monitor market is primarily segmented by application into diabetes management, health and wellness monitoring, and other uses, with the diabetes management segment projected to witness the highest growth during the forecast period. The rising prevalence of type 1 and type 2 diabetes worldwide has driven demand for continuous and reliable glucose monitoring, with continuous glucose monitoring (CGM) systems providing real-time data to support optimized insulin therapy, dietary adjustments, and lifestyle modifications. Integration with digital health platforms enables seamless tracking, automated reminders, and enhanced collaboration with healthcare professionals, allowing for personalized care and tailored treatment plans. Consistent monitoring facilitates early detection of glucose fluctuations, helping patients maintain optimal glycemic control and reduce the risk of severe complications. Furthermore, supportive government initiatives, public health programs, and insurance coverage that promote early diagnosis and effective diabetes management are helping to expand access to care. Meanwhile, user-friendly home monitoring devices empower patients to self-manage their condition, improving adherence and long-term health outcomes. The convergence of technology, policy support, and patient-centric solutions is expected to further accelerate adoption in this high-growth segment.

Blood Glucose Monitor Market, By End User

Based on end users, the global blood glucose monitor market is categorized into three segments: self/home care, hospitals and clinics, and other end users. Among these, the self/home care segment holds the largest share, driven by the growing preference for convenient in-home diabetes management, rising awareness about the importance of frequent glucose monitoring, and the increasing number of individuals managing diabetes independently at home. The widespread availability of user-friendly devices, combined with ease of accessibility and affordability, has further accelerated adoption. Technological advancements such as smart meters, continuous glucose monitoring systems, and seamless smartphone integration have enhanced device usability and engagement, positioning home monitoring solutions as the primary growth engine for the market. Additionally, the shift toward proactive health management and the adoption of telemedicine have reinforced the dominance of the self-care segment, highlighting its critical role in driving market expansion.

REGION

Asia Pacific to be fastest-growing region in global blood glucose monitor market during forecast period

The blood glucose monitor market in the Asia Pacific region is expected to witness the highest CAGR during the forecast period. The rising prevalence of diabetes, increasing awareness of the importance of regular blood glucose monitoring, and growing adoption of non-invasive and connected monitoring technologies are driving market expansion. The region’s large and ageing population, coupled with rising healthcare expenditure, is fueling the demand for convenient, affordable, and patient-friendly monitoring solutions. Furthermore, improvements in healthcare infrastructure, growing disposable incomes, and the rapid integration of digital health innovations are anticipated to accelerate the growth of the Asia Pacific blood glucose monitor market.

Blood Glucose Monitor Market: COMPANY EVALUATION MATRIX

In the blood glucose monitor market matrix, Abbott Laboratories (Star) leads with a dominant global presence and a comprehensive portfolio that spans both continuous and self-monitoring glucose systems. Its leadership is anchored in strong R&D, proven accuracy, and advanced digital integration through the FreeStyle Libre series, reinforcing its position as a pioneer in real-time diabetes management. i-Sens, Inc. (Emerging Leader) is rapidly gaining ground with its highly accurate and affordable self-monitoring devices, as well as its expanding footprint in continuous glucose monitoring through its CE-approved CareSens Air system. While Abbott maintains its edge through scale, innovation, and brand trust, i-Sens shows strong potential to advance toward the leaders’ quadrant as it leverages its manufacturing expertise, broad distribution network, and focus on connected, cost-effective glucose monitoring solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Abbott Laboratories (US)

- Medtronic (Ireland),

- Dexcom (US)

- Sinocare (China)

- F. Hoffmann-La Roche Ltd (Switzerland),

- B Braun SE (Germany)

- Nipro (Japan)

- Senseonics (US)

- i-Sens, Inc (South Korea)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 (Value) | USD 15.16 BN |

| Market Forecast in 2030 (Value) | USD 25.41 BN |

| Growth Rate | CAGR of 9.1% from 2025–2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD BN), Volume (Thousands Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Product type: Self-monitoring Blood Glucose Systems, Continuous Glucose Monitoring Systems, Professional Point-of-Care Devices, Non-invasive Products. I Test Site: Fingertip, Upper Arm, Alternate Sites I By Application: Diabetes Management, Health & Wellness Monitoring, Other Applications I End User: Self/Home Care, Hospitals & Clinics, Other End Users |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, GCC Countries, and the Middle East & Africa |

WHAT IS IN IT FOR YOU: Blood Glucose Monitor Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Volume Analysis | Market assessment by volume (units) for products such as self-monitoring blood glucose monitoring systems and continuous glucose monitoring systems |

|

| Company Information | Key players: Abbott Laboratories (US), DexCom, Inc. (US), Medtronic (Ireland), F. Hoffmann-La Roche Ltd. (Switzerland), B. Braun SE (Germany), and Ascensia Diabetes Care Holdings AG (Switzerland) Top 3-5 players market share analysis at APAC and the European country level | Insights on revenue shifts toward emerging innovations |

| Disease Prevalence |

|

|

RECENT DEVELOPMENTS

- April 2025 : DexCom, Inc. (US) announced that the US FDA has approved the DexCom G7 15 Day Continuous Glucose Monitoring System for use by people over the age of 18 with diabetes.

- June 2024 : Abbott Laboratories (US) announced US FDA clearance for two new over-the-counter continuous glucose monitoring (CGM) systems: Lingo and Libre Rio, which are based on Abbott's world-leading FreeStyle Libre continuous glucose monitoring technology.

- August 2024 : Medtronic received US FDA approval for the Simplera continuous glucose monitor (CGM). This is the company’s first disposable, all-in-one CGM, half the size of previous Medtronic CGMs.

- July 2024 : Roche announced that it has received the CE Mark for its Accu-Chek SmartGuide continuous glucose monitoring (CGM) solution.

- April 2025 : F. Hoffmann-La Roche Ltd announced the establishment of a new manufacturing facility for continuous glucose monitoring (CGM) in Indiana.

Table of Contents

Methodology

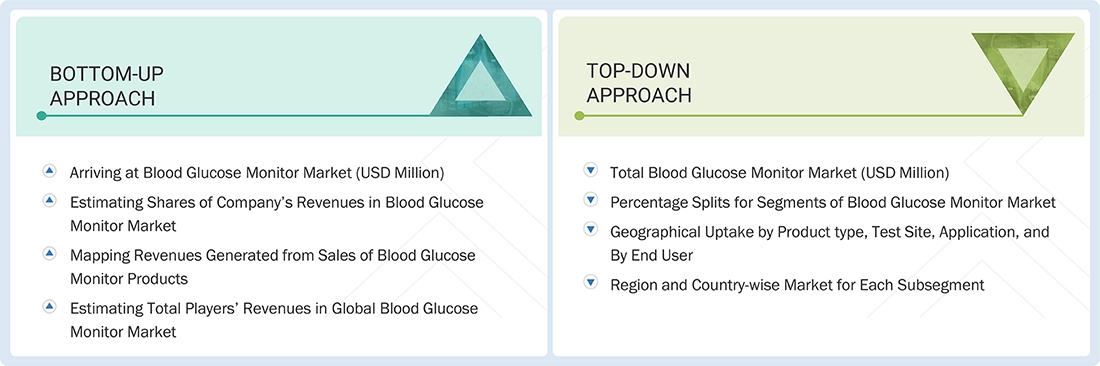

The study comprised four key activities to estimate the current size of the blood glucose monitor market. First, extensive secondary research was conducted to gather information on the market, including related and parent markets. The next step involved validating these findings, assumptions, and market size estimates through primary research with industry experts across the value chain. Top-down and bottom-up approaches were used to arrive at a comprehensive estimate of the overall market size. Finally, market breakdown and data triangulation techniques were utilized to determine the sizes of segments and subsegments within the market.

Secondary Research

The secondary research process involved extensive use of various secondary sources, including directories, databases like Bloomberg Business, Factiva, and D&B Hoovers, as well as white papers, annual reports, company house documents, investor presentations, and SEC filings. This research was conducted to gather information valuable for a comprehensive, technical, market-oriented, and commercial study of the blood glucose monitor market. It also helped obtain critical insights about key players in the industry, market classification, and segmentation based on current industry trends, down to the finest details. Additionally, a database of leading industry players was created through this secondary research.

Primary Research

In the primary research process, interviews were conducted with various sources from the supply and demand sides to gather qualitative and quantitative information for this report. On the supply side, industry experts were interviewed, including CEOs, vice presidents, marketing & sales directors, technology & innovation directors, and other key executives from prominent companies and organizations involved in the blood glucose monitor market. For the demand side, interviews were conducted with industry experts, purchase and sales managers, doctors, and personnel from research organizations. This primary research was essential to validate market segmentation, identify key players in the industry, and gather insights on important industry trends and market dynamics.

A breakdown of the primary respondents for the blood glucose monitor market is provided below:

Note 1: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 2: Other designations include sales, marketing, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024: Tier 1=>USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the blood glucose monitor market includes the following details. The market sizing was undertaken from the global side.

Country-level Analysis: The size of the blood glucose monitor market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of products in the overall blood glucose monitor market was obtained from secondary data and validated by primary participants to arrive at the total blood glucose monitor market. Primary participants further validated the numbers.

Geographic Market Assessment (By Region and Country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated by industry experts who were contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall blood glucose monitor market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

Global Blood Glucose Monitor Market Size: Bottom-up Approach and Top-down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Blood glucose monitors are medical devices used to measure and monitor blood glucose (sugar) levels in individuals, primarily for the diagnosis and management of diabetes mellitus. These monitors help patients and healthcare professionals assess glycemic control, adjust treatment plans, and prevent diabetes-related complications.

Stakeholders

- Blood Glucose Monitor Manufacturers

- Contract Manufacturers

- Suppliers and Distributors of Blood Glucose Monitors

- Senior Management

- Finance Department

- Healthcare Services Providers (Hospitals and Public & Private Clinics)

- Academic & Research Institutes

- E-commerce and Digital Platforms

- Retail Pharmacies and Supermarkets

- Trade Associations and Industry Bodies

- Regulatory Bodies and Government Agencies

- Business Research and Consulting Service Providers

- Market Research and Consulting Firms

- Venture Capitalists and Investors

Report Objectives

- To define, describe, segment, analyze, and forecast the global blood glucose monitor market by product type, application, test site, end user, and region.

- To provide detailed information about the factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets concerning individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the blood glucose monitor market in North America, Europe, the Asia Pacific, Latin America, the Middle East & Africa, and GCC countries

- To profile the key players in the blood glucose monitor market and comprehensively analyze their core competencies

- To track and analyze competitive developments such as agreements, collaborations, and partnerships; acquisitions; and product approvals & launches in the blood glucose monitor market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Blood Glucose Monitor Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Blood Glucose Monitor Market