Biosensors Market Size, Share & Trends Report 2030

Biosensors Market by Type (Sensor Patch, Embedded Device), Product (Wearable, Non-Wearable), Wearable (Wristwear, Bodywear), Technology (Electrochemical, Optical, Piezoelectric, Thermal, Nanomechanical), Application and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global biosensor market is projected to grow from USD 34.5 billion in 2025 to USD 54.4 billion by 2030, at a CAGR of 9.5%. Home diagnostic products include blood glucose monitors, A1C test kits, and monitoring supplies (including lancets and test strips); home pregnancy and ovulation tests; blood pressure monitors; blood cholesterol level monitors; heart-rate monitors; and kits that require blood or other tissue samples to be sent out for testing, such as test kits for blood cholesterol levels, HIV, hepatitis C, and DNA tests that can be used to prove paternity. The growth in the market is attributed to the growing number of infectious diseases in developing countries, increasing demand for rapid diagnosis and efficient monitoring solutions, and rising technological advancements, such as miniaturization, nanotechnology, and microfluidics, and new product developments.

KEY TAKEAWAYS

-

BY TYPEBased on type, embedded devices hold a larger market share of the biosensors market. These devices are widely used across a range of applications such as point of care, home diagnostics, food & beverages, research lab, environmental monitoring, and biodefense.

-

BY PRODUCTBased on product, the biosensor market for non-wearable (POC) devices holds a larger market share in 2024 whereas, the market for wearable biosensors is expected to grow at a higher rate from 2025 to 2030. Wearable biosensors have attracted considerable attention because of their potential to change the classical medical diagnostics and continuous health monitoring concepts.

-

BY TECHNOLOGYThe market for optical biosensors is expected to grow at the highest CAGR during the forecast period. Optical biosensors are commonly used to analyze biomolecular interactions as they can determine the affinity and kinetics of a wide variety of molecular interactions in real time, without requiring a molecular tag or label. Optical sensors are used for several new applications, such as drug discovery, including target identification; ligand fishing; assay development; and quality control.

-

BY APPLICATIONThe market for home diagnostics applications is expected to grow at the highest rate during the forecast period. The market growth can be attributed to increasing developments in the healthcare sector, the high rate of adoption of new diagnostic methods, and convenience in terms of using home-based medical devices.

-

BY REGIONAsia Pacific is expected to experience the highest growth rate in the biosensor market, during the forecast period. The presence of a large population base and increasing incidents of different lifestyle diseases are the main factors for the growth of the market in Asia Pacific.

-

COMPETITIVE LANDSCAPEThe biosensor market's competitive landscape is shaped by technology leadership, strategic partnerships, and product innovation, with companies focusing on high-efficiency modules, turnkey solutions, and expansion into various applications.

Biosensors refer to semiconductor devices designed to sense biological responses and make use of transducers to change responses into electrical signals. It achieves this by combining a biological recognition element (bioreceptor) with a physicochemical transducer. The bioreceptor selectively interacts with a specific biological analyte. This interaction is then converted by the transducer into a measurable signal, such as an electrical current, optical change, mass change, or thermal signal, which is proportional to the concentration of the analyte. The growing demand in urban areas with easy accessibility and ease of use of diagnostic devices is boosting market growth. Moreover, biosensor devices have emerged as relevant diagnostic techniques for environmental monitoring, and in the food industry due to their specificity, ease of mass fabrication, economics, and field applicability, as well as their capability to provide quick results.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The biosensor industry is undergoing a transformative shift driven by a growing demand for advanced, multi-functional systems. Key innovation hotspots, such as industrial automation, healthcare automation, and smart wearable, are reshaping the future revenue mix. These advancements directly influence industries including consumer electronics, healthcare, and others, ultimately leading to measurable shifts in client revenues.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Significant technological advancements in last few years

-

Emergence of nanotechnology-based biosensors

Level

-

Slow rate of commercialization and reluctance in adopting new treatment practices

-

High costs involved in R&D

Level

-

Emerging market in developing countries

-

High-growth opportunities in food industry and environmental monitoring applications

Level

-

Government regulations—long certification and approval cycles

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing use of biosensors to monitor glucose levels in individuals with diabetes

Glucose biosensors are normally used to detect concentrations of glucose in individuals with diabetes. These biosensors use bioelements—such as proteins, including enzymes and nucleic acids—to analyze the concentration of glucose in individuals. The glucose biosensors market is expected to witness high growth owing to the increasing number of people suffering from diabetes. The World Health Organization (WHO) estimates diabetes as the seventh-leading cause of death by 2030. This has significantly contributed to the increasing use of glucose monitoring devices that use biosensors. Glucose monitoring devices are gaining traction due to increasing incidences and prevalence of lifestyle diseases, such as diabetes, that require regular monitoring. Moreover, the proven efficacy of such testing kits has resulted in their growing adoption by doctors. According to the International Diabetes Federation, the number of people suffering from diabetes is expected to grow by 853 million by 2040 worldwide. Glucose monitoring devices are used to detect and monitor diabetes. Presently, it is estimated that glucose-detecting biosensors account for a major share of the biosensors market.

Restraint: Reluctance in adopting new treatment practices

Biosensors technology has witnessed a slow rate of adoption in the recent years due to the high price of biosensors and the demand emanating only from the healthcare industry. Adoption of biosensors for nonmedical applications, such as military, biodefense, fermentation control, and environment monitoring is a challenge for industry players due to limited R&D and positive outcomes. However, there is also a potential market for non-biomedical applications, which need to be identified by players and promoted to end users. Another reason for slow adoption is enzyme-based transducers used in biosensors. Enzyme-based transducers are expensive as the cost of sourcing, extraction, isolation, and purification is high. Biosensors also have certain disadvantages, such as heat sterilization not being possible because of denaturalization of biological material, stability of biological material (e.g., enzyme, cell, antibody, and tissue) dependent on natural properties of the molecule that can be denaturalized under environmental conditions (pH, temperature, or ions), and cells in biosensors becoming affected by other molecules that are capable of diffusing through the membrane. These factors have led to a slow rate of adoption.

Opportunity: High-growth opportunities in wearable device market

Wearable biosensors find increasing opportunities for the continuous monitoring of vital signs of patients, premature infants, children, athletes or fitness buffs, and individuals in remote areas far from medical and health services. Wearable and connected biosensors enable remote monitoring to allow patients to avoid hospitalization or leave earlier. By enabling telemedicine (monitoring and transmitting physiological data from outside the hospital), wearable biosensors can ease the burden on healthcare personnel and free up hospital space for more responsive care. Smart textiles with sensors in the fabric can provide a simple, more convenient system to monitor vital signs. Biosensor patches or tattoos, leverage conformal, printed electronics, can better enable physicians to collect data on a patient for long periods. Such sensors dovetail with the quantified self-trend to track one’s biological data to optimize one’s health. Moreover, disposable patches can allow analyzing key biomarkers such as sodium, potassium, and glucose, in sweat or other substances.

Challenge: Government regulations—long certification and approval cycles

Despite the high demand for biosensors for medical applications, manufacturers are facing several regulatory barriers due to multilayered regulations mandated by the FDA and the laboratory regulations under the Clinical Laboratory Improvement Amendments of 1988 (CLIA) (for the premarket approval of POC testing kits). For the approval of any new POC device in the US, manufacturers are required to submit performance data to the FDA. This data should demonstrate that healthcare professionals and patients can use devices and can obtain results like clinical laboratory tests. Standards and guidelines developed for point-of-care testing (POCT) using evidence-based procedures are designed to assist with the implementation, management, operation, and on-going quality assessment of the selected technology. With adherence to appropriate standards and guidelines, POCT provides significant benefits for both patients and healthcare providers. Though it helps end users, the standards and guidelines are stringent and time-consuming for the approval of new POC devices and pose a key challenge for market players.

Biosensor Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Offer biosensors that are used for glucose monitoring, cardiac markers, and infectious diseases | Provides convenient testing by delivering quick and accurate results and helps people see the connections between their food choices and glucose data, and create healthier habits over time. |

|

Offer biosensors that are used for clinical diagnostics, oncology, and metabolic monitoring | Provides diagnostic solutions for screening, early detection, evaluation, and monitoring of diseases. |

|

Offer biosensors that are used for chronic disease monitoring, implantable biosensors | Offers continuous glucose monitoring solutions with daily glucose patterns. |

|

Offer biosensors that are used for life science research, clinical diagnostics | Provides label-free, high-throughput, real-time affinity, specificity, and kinetic data for protein interaction analysis using multiplexed surface plasmon resonance (SPR) technology. |

|

Offer biosensors that are used for food safety, environmental, and industrial monitoring | Serves a wide range of medical device applications requiring high-quality and easy-to-process medical-grade elastomers, adhesives, and parts. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The biosensor ecosystem includes research and development; raw material provider; biosensor manufacturers; system integrators; and applications. In the connected supplier ecosystem, different biosensor technologies used have been mentioned, which are electrochemical, optical, thermal, piezoelectric, nanomechanical, and others. A few of the companies involved across the biosensors ecosystem are Abbott Laboratories, F. Hoffmann-La Roche Ltd, Medtronic, Siemens, Bayer Healthcare, Bio-Rad Laboratories, DuPont, Dexcom, Inc., Lifescan IP Holdings, LLC, and others.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Biosensor Market, By Product

By product, the wearable segment accounted for a highest CAGR of the biosensor market in 2030. Wearable biosensors have attracted considerable attention because of their potential to change classical medical diagnostics and continuous health monitoring concepts. Wearable biosensor applications aim to change centralized hospital-based care systems to home-based personal medicine and reduce healthcare cost and time for diagnosis. Nowadays, we can see that wearable biosensors are bringing out a wave of innovation to society. Their comfort and better use can provide a new level of exposure to a patient’s real-time health status. This real-time data availability allows better clinical decisions and results in better health results and more efficient use of health systems. For human society, wearable biosensors may help in the early detection of health events and the avoidance of hospitalization. Such events are expected to boost the market growth of wearable biosensors. The wearable biosensor ecosystem comprises companies from different verticals, including IT, such as Google (US); consumer electronics, such as Apple (US), Samsung Electronics (South Korea), LG Electronics (South Korea), Sony Corporation (Japan) and others; and fitness and sport, such as Nike (US), Adidas (Germany), Reebok (US), and others.

Biosensor Market, By Type

Embedded devices accounted for the largest share during the forecast period. Embedded devices are widely used across a range of applications such as point of care, home diagnostics, food & beverages, research lab, environmental monitoring, and biodefense. With the proliferation of the Internet of Things (IoT) devices, there has been a huge transformation in terms of connected healthcare applications. IoT enables real-time alerting, tracking, and monitoring, which permits hands-on treatments, better accuracy, appropriate intervention by doctors and improve complete patient care. Many healthcare facilities have started adopting embedded solutions for medical devices enabled with IoT to address the lack of availability of doctors in remote areas. These IoT-enabled medical devices help identify diseases in patients and conduct different tests to provide accurate and reliable treatment to patients in remote locations. Therefore, the rising adoption of embedded devices will drive the market growth of biosensors.

Biosensor Market, By Application

POC applications capture the largest share throughout the forecast period. POC applications are included in glucose monitoring, cardiac marker, infectious disease detection, and coagulation monitoring, among others. Technological advancements in POC devices, rising incidences of infectious diseases, and an increase in investments by key players are key factors driving the growth of the point-of-care biosensor market. Opportunities for biosensors will also be driven by the further proliferation of mobile phones for the easier communication of health data. Drivers for biosensors for point-of-care diagnostics include the aging of the population, increasing need to decrease healthcare expenditures, the rise of cardiovascular diseases and cancer globally, and unhealthy lifestyles (e.g., lack of physical activity and obesity). Another driver is the rising demand for improved healthcare in emerging countries such as China and India. The high prevalence of infectious and lifestyle diseases worldwide is boosting the demand for POC testing devices. In addition, increasing inclination toward rapid diagnostic testing and rising private investments and venture funding to support new product developments, along with growing government support, have increased the adoption of POC devices.

REGION

Asia Pacific to be fastest-growing region in global biosensor market during forecast period

Asia Pacific is expected to be among the key markets for biosensor applications in the future due to its high population density. Other major factors contributing to the growth of the biosensor market in Asia Pacific include the development of healthcare systems and the increasing number of lifestyle diseases in the region. The biosensor market in Asia Pacific is the amalgamation of a few leading markets, such as China, Japan, and India. Moreover, the adoption of PoC devices in a view to address lifestyle diseases and enhance the general health of people has led to the increased use of biosensor. The growth of the biosensor market in Asia Pacific for PoC applications can be attributed to the huge population base, increasing investments in the healthcare sector, growing focus of key industry players on technological advancements, and significant R&D pertaining to biosensor.

Biosensor Market: COMPANY EVALUATION MATRIX

In the biosensor market, Abbott Laboratories is positioned as a star player due to its strong product portfolio and backed by strong global presence and technological innovation.In contrast, LifeScan IP Holdings, LLC is classified as an emerging player as it continues to expand its capabilities in biosensor companies and strengthen its market reach through partnerships and product diversification

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 31.80 Billion |

| Market Forecast in 2030 (Value) | USD 54.37 Billion |

| Growth Rate | CAGR of 9.5% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Milion Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Type: Sensor patches and Embedded Devices; By product: Wearable and Non-wearable; By Technology: Electrochemical, Optical, Piezoelectric, Thermal, and Nanomechanical; By Application: POC, Home Diagnostics, Research Labs, Food & Beverages, Environmental Monitoring, and Biodefense |

| Regional Scope | North America, Asia Pacific, Europe, and RoW |

WHAT IS IN IT FOR YOU: Biosensor Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| North America-based Biosensor Adoption | Regional segmentation of biosensor demand (wearable vs non-wearable, healthcare, food safety, environmental monitoring) | Identify high-potential application areas, guide new product launches, enhance forecast accuracy |

RECENT DEVELOPMENTS

- May 2025 : Cytiva announced that it was collaborating with Nuclera, a biotechnology company that is helping accelerate protein expression and optimization via its benchtop eProtein Discovery™ System. This collaboration aims to accelerate the production, purification and characterization of proteins needed for drug research and development by leveraging Nuclera's eProtein Discovery System together with Cytiva's Biacore™ surface plasmon resonance (SPR) technology.

- April 2025 : Medtronic has announced FDA approval in the United States for the use of the Simplera Sync™ sensor with the MiniMed™ 780G system. The Simplera Sync™ is an all-in-one disposable sensor that needs no fingersticks* with SmartGuard or overtape and a two-step simple insertion.

- November 2024 : F. Hoffmann-La Roche Ltdhas entered into a definitive merger agreement to acquire Poseida Therapeutics, Inc, a public clinical-stage biopharmaceutical company pioneering donor-derived car-t cell therapies. Poseida’s R&D portfolio includes pre-clinical and clinical-stage off-the-shelf (also referred to as allogeneic) CAR-T therapies across several therapeutic areas including haematological malignancies, solid tumours, and autoimmune disease, as well as manufacturing capabilities and technology platforms.

- August 2024 : Abbott announced that it has partnered with Medtronic to collaborate on an integrated Continuous Glucose Monitoring (CGM) system using Abbott's own FreeStyle Libre technology that will link with Medtronic's automated insulin delivery (AID) and smart insulin pen systems. The combination of Abbott's CGM sensor paired with Medtronic's AID algorithms will allow for automatic insulin adjusting to assist in keeping glucose within range.

- December : DuPont™ Liveo™ Healthcare Solutions is collaborating with STMicroelectronics, a global leader in semiconductor technology serving customers across the spectrum of electronics applications, to develop a new smart wearable device concept for remote biosignal-monitoring.

Table of Contents

Methodology

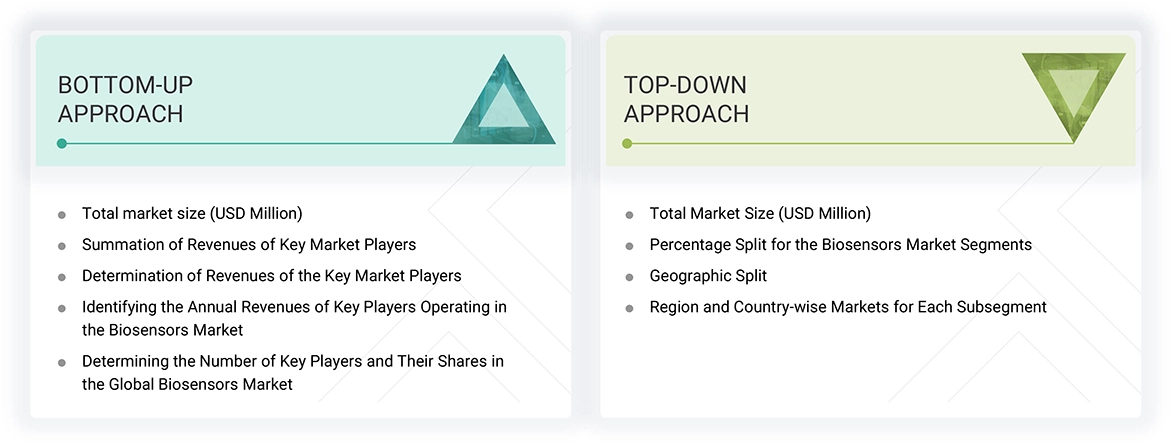

The study involved major activities in estimating the current size of the biosensors market. Exhaustive secondary research was done to collect information on biosensors. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the biosensor.

Secondary Research

Various secondary sources were referred to in the secondary research process to identify and collect information relevant to this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research was mainly carried out to obtain critical information about the industry’s supply chain, value chain, the pool of key players, and market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives. Secondary sources included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; IoT technologies journals and certified publications; articles by recognized authors; gold- and silver-standard websites; directories; and databases. Data was also collected from secondary sources, such as the Semiconductor Industry Association, Global Semiconductor Alliance, and Taiwan Semiconductor Industry Association.

Secondary research was mainly used to obtain critical information about the industry's supply chain and value chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments from both the market and technology-oriented perspectives. Secondary data has been gathered and analyzed to determine the overall market size, which has also been validated by primary research.

Primary Research

Extensive primary research was conducted after understanding and analyzing the current scenario of the biosensors market through secondary research. Primary interviews were held with key opinion leaders from the demand and supply sides in four key regions: North America, Europe, Asia Pacific, and the rest of the world. Nearly 25% of the primary interviews were held with the demand side and 75% with the supply side. The primary data was gathered primarily through telephonic interviews, which were 80% of the total primary interviews. Surveys and e-mails were also utilized to gather data.

Note: Three tiers of companies are defined based on their total revenue as of 2024; tier 1: revenue more than or equal to USD 500 million, tier 2: revenue between USD 100 million and USD 500 million, and tier 3: revenue less than or equal to USD 100 million. Other designations include sales and marketing executives, researchers, and members of various biosensor organizations.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this report, both the top-down and bottom-up approaches were implemented to estimate and validate the size of the biosensors market and various other dependent submarkets. Secondary research identified key players in this market, and their market shares in the respective regions were determined through primary and secondary research.

This entire research methodology included the study of annual and financial reports of top companies, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative). All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the market covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The figures below show the overall market size estimation process employed for this study.

Bottom-Up Approach

- Key players in the biosensors market were identified through secondary research, and their global market share was determined through primary and secondary research.

- The research methodology included a study of annual and quarterly financial reports, regulatory filings of major market players (public), and interviews with industry experts for detailed market insights.

- All biosensor penetration rates, percentage shares, splits, and breakdowns for the biosensors market were determined using secondary sources and verified through primary sources.

- All key macroindicators influencing the revenue growth of market segments and subsegments were considered, examined in detail, validated through primary research, and analyzed to produce accurate quantitative and qualitative data.

- The market data gathered was consolidated, enhanced with detailed inputs, analyzed, and presented in this report.

Top-Down Approach

- Focusing initially on the top-line investments and expenditures made in the biosensor ecosystem, splitting the key market areas into component, type, product, technology, and region, and listing key developments

- Identifying all leading players and end users in the biosensors market based on product, type, technology, and application through secondary research and fully verifying them through a brief discussion with industry experts

- Analyzing revenues, product mix, geographic presence, and key applications served by all identified players to estimate and arrive at percentage splits for all key segments

- Discussing splits with industry experts to validate the information and identify key growth pockets across all key segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

Biosensors Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the biosensors market from the estimation process explained above, the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed (wherever applicable) to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The biosensors market size was validated using both top-down and bottom-up approaches.

Market Definition

Biosensors are semiconductor devices designed to detect biological responses using transducers that convert these responses into electrical signals. They achieve this by combining a biological recognition element (bioreceptor) with a physicochemical transducer. The bioreceptor specifically interacts with a particular biological analyte. The transducer then converts this interaction into a measurable signal, such as an electrical current, optical change, mass change, or thermal signal, which relates to the analyte’s concentration. Common bioreceptors include enzymes, antibodies, nucleic acids, cells, or microorganisms. They are used as analytical tools to deliver qualitative or quantitative results in detecting protein or nucleic acid targets.

Key Stakeholders

- Semiconductor Industry Association

- Global Semiconductor Alliance

- European Semiconductor Industry Association

- Taiwan Semiconductor Industry Association

- International Diabetes Federation (IDF)

- American Diabetes Association (ADA)

- National Biodefense Analysis and Countermeasures Center (NBACC).

- IEEE

- Educational Institutions Research/White Papers (Published by Communication Organizations)

- Investor Presentations and Annual Reports of Key Market Players

Report Objectives

- To define, describe, and forecast the biosensors market, by type, product, technology, application, and region, in terms of value

- To define, describe, and forecast the global biosensors market by product, in terms of volume

- To forecast the sizes of various segments with respect to the four major regions: North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To provide a detailed analysis of the biosensors supply chain

- To strategically analyze the micromarkets with respect to individual growth trends and prospects, and their contributions to the total market

- To analyze competitive developments, such as expansions, agreements, partnerships, acquisitions, product developments, and research & development (R&D), in the biosensors market

- To analyze the opportunities for market players and provide details of the market's competitive landscape

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of business strategy excellence and strength of product portfolios

- To strategically profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies, along with a detailed competitive landscape of the market

- To analyze the supply chain, ecosystem, trend/disruptions impacting customer business, technologies, trade & patent scenario, key conferences & events, regulations, and conduct Porter’s five force analysis

Available customizations:

With the market data given, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Key Questions Addressed by the Report

What are the major driving factors and opportunities for the players in the biosensors market?

The major factors driving the biosensors market include the emergence of nanotechnology-based biosensors and the increasing use of biosensors to monitor glucose levels in individuals with diabetes. Key opportunities lie in the food, environmental monitoring, and wearable device markets.

Which region is expected to hold the largest share of the biosensors market in 2025?

North America is projected to capture the largest market share in 2025 due to the huge demand from early adoption of new technological advancements such as nanotechnology and presence of key market players to have a positive impact on the market in this region.

Who are the leading players in the global biosensors market?

Leading players operating in the global biosensors market include Abbott Laboratories (US), F. Hoffmann-La Roche Ltd (Switzerland), Medtronic (Ireland), Bio-Rad Laboratories, Inc. (US), and DuPont (US).

Which product is expected to drive the biosensors market?

Wearable biosensors are expected to drive the market.

What will be the size of the global biosensors market in 2025 and 2030?

The global biosensors market is projected to grow from USD 34.51 billion in 2025 to USD 54.37 billion by 2030, at a CAGR of 9.5%.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Biosensors Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Biosensors Market

Angel

Sep, 2022

Looking to add this information as part of a research publication..

Roberto

Sep, 2022

I teach a course on biosensors and microsystems to bioengineering students and I would like to show updated figures and trends regarding the biosensor market and application fields .

Linda

Sep, 2022

We are trying to build a market penetration strategy for our biotech start up..

Nitish

Sep, 2022

We are looking for information on electrochemistry detection method. .