Wearable Sensors Market Size, Share, Statistics and Industry Growth Analysis Report by Type (Accelerometers, Pressure & force sensors, Gyroscopes, Medical based sensors), Application (Wristwear, Eye-wear, Footwear, Neckwear, Bodywear), Vertical and Region - Global Forecast to 2028

Updated on : August 13, 2025

Wearable Sensors Market Summary

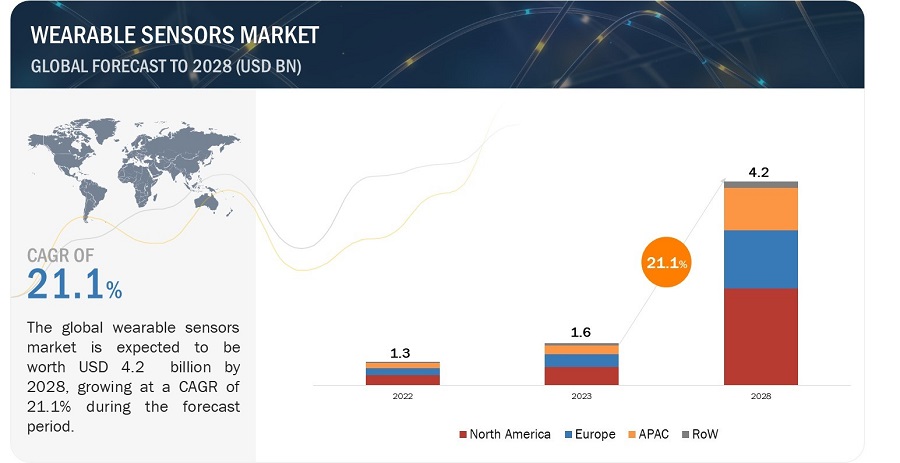

[253 Pages Report] The Wearable Sensors Market size was estimated at USD 1.3 Billion in 2022 and is predicted to increase from USD 1.6 Billion in 2023 to approximately USD 4.2 Billion by 2028, expanding at a CAGR of 21.1% from 2023 to 2028.

Wearable Sensors Market Key Takeaways

-

By embracing health-conscious lifestyles and fitness trends, the global Wearable Sensors Market was valued at USD 1.6 Billion, and is projected to reach USD 4.2 Billion by 2028, growing at a CAGR of 21.1% from 2023 to 2028.

-

By responding to the surging demand for smartwatches and fitness trackers, consumer goods continue to drive the market forward, particularly in urban regions focused on proactive health management.

-

By expanding adoption in healthcare settings, wearable sensors are playing a vital role in remote patient monitoring, chronic disease management, and elderly care, offering continuous health insights without clinical visits.

-

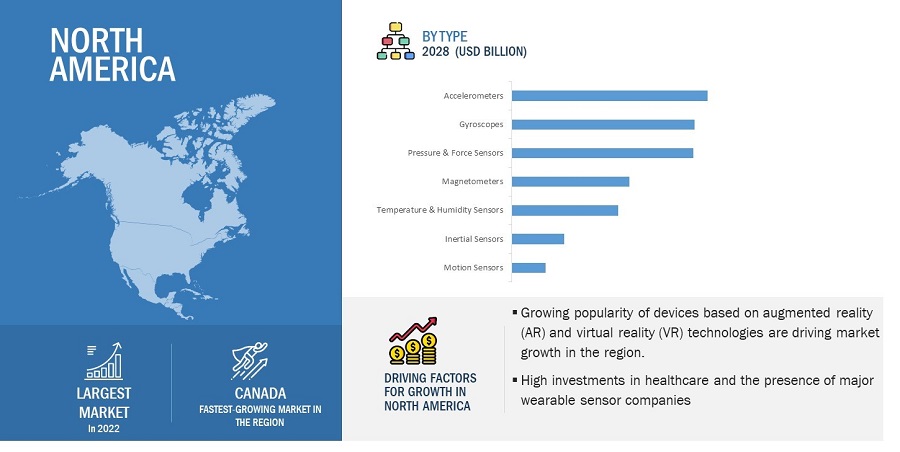

By seeing significant momentum in North America, the region leads due to a tech-savvy population, strong healthcare infrastructure, and a growing culture of digital wellness.

-

By leading with motion sensors, this sensor type dominates the market thanks to its core role in tracking physical activities, gestures, and fitness levels in a wide range of wearables.

-

By integrating with smart textiles and next-gen materials, wearable devices are becoming more comfortable, non-intrusive, and adaptable for everyday use in both sports and medical applications.

-

By driving innovation through compact and energy-efficient designs, manufacturers are enhancing battery life and accuracy, making wearables more reliable for continuous real-time data collection.

-

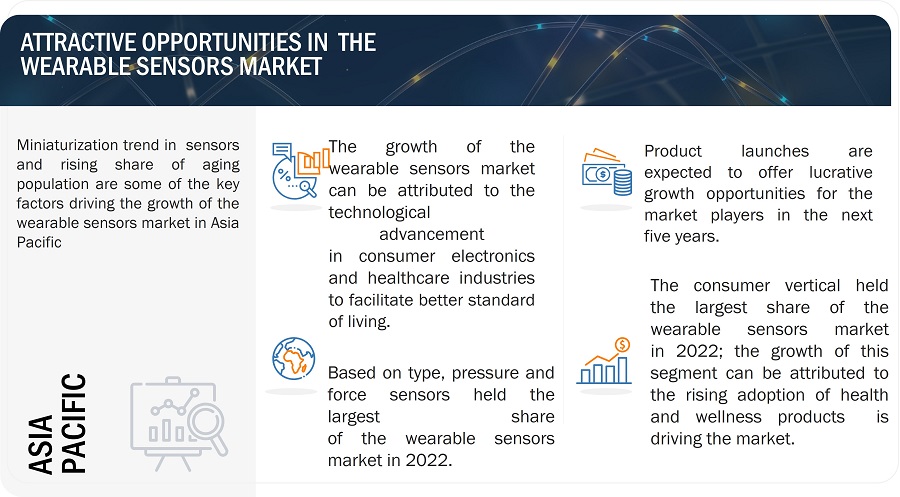

By fostering growth in the Asia Pacific region, emerging economies are fueling adoption through rising health awareness, increasing smartphone penetration, and local tech manufacturing capabilities.

Market Size & Forecast Report

-

2023 Market Size: USD 1.6 Billion

-

2028 Projected Market Size: USD 4.2 Billion

-

CAGR (2023-2028): 21.1%

-

North America : Largest market share

The increasing demand shift towards smaller, smarter, and cheaper sensors is an essential driver for the wearable sensors industry. Due to this, the sensors can be seamlessly integrated into various smart devices, smartphones, or cloud services, making the interpretation more accessible and meaningful.

Wearable Sensors Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Wearable Sensor Market Trends & Dynamics

Drivers: The increasing trend toward smaller, smarter, and cheaper sensors

Led by rising demand for smart platforms such as IoT and M2M, the demand for sensors that are small, low prices, and incorporate smart technology is increasing. With such platforms and increasing inventions in smart mobile devices such as smartphones and tablets, there has been a decline in the cost of sensors, and the introduction of new simple, easy-to-use next-generation sensors has increased. Moreover, led by significant developments in technology, since the past decade, the size of sensors such as level, pressure, and image sensors has decreased appreciably; this is one of the major factors behind the overall wearable sensors market growth.

Restraint: Lack of common standards and interoperability issues

The lack of common standards for sensor communication also creates interoperability issues. Interoperability and easy exchange of information between connected devices are vital for the further growth of the wearable ecosystem. Presently, the technical and market scenarios for wearable technology are not very satisfactory in terms of architectural solutions or a universal standard to solve the issue of interoperability. To achieve this, efforts such as understanding the role of security and its importance will be required from enterprises, organizations, and developers for a considerable amount of time. Thus, the lack of common standards and interoperability issues restricts the growth of the overall wearable sensors industry .

Opportunity: Increasing number of connected devices

In the past five years, Internet penetration worldwide has seen a remarkable change. Almost one-third of the world population is using the Internet now, at higher bandwidths. This has increased the number of Internet-enabled smart devices in developing countries. In 2014, worldwide smartphone usage grew at a rate of ~25%. Smartphones are among the widely used portable devices in the wearable ecosystem, and they are primarily used for gathering and tracking data related to health and fitness for the 0–9 and 60 and above age groups. In addition, wearable technology forms an important segment of platforms such as IoT and M2M, and these platforms are the key factors for increasing the number of connected devices worldwide.

Challenge: Device protection and thermal consideration

Wearable devices such as fitness bands and health monitors that are worn continuously are expected to function in rugged conditions involving dust and moisture. Materials used in packaging and assembly remain sensitive to external temperature and moisture. Thus, the operating temperature of the device is decided by reliability requirements in addition to a certain comfort level for the users. These thermal design challenges are significant enough since they are user-friendly and durable.

Wearable Sensors Market Ecosystem:

Wearable Sensors Market Share

The market for Bodywear segment to grow at a significant CAGR during the forecast period.

Bodywear refers to textiles embedded with sensors, which is an emerging trend in the market. It works on fibertronics, which explains the electronics and computational functionality integrated into textile fabrics. They have attracted the emerging trend of techno-fashion clothing that brings electronics and sensors closer to our skin for measuring various health and fitness parameters. Bodywear mainly includes clothing and innerwear, arm wear and legwear, smart socks, and chest straps.

Magnetometers expected to hold the second highest CAGR of the wearable sensors market during the forecast period.

Magnetometers are designed to measure the strength and direction of magnetic fields. Magnetometers are compact in size and are surrounded by small electronic chips that help detect the magnetic field and measure the relative orientation of the device. These devices have a sensor that senses the magnetic field density. These are used to detect position and location in smartphones and devices. Magnetometers are a major component of wristwear and bodywear devices. They are efficient, and maintenance is cheap.

Wearable Biosensors Market Growth

Wearable Sensors Market Regional Analysis

Wearable sensors market in North America holds the largest market share during the forecast period.

The wearable sensors market in North America has been studied in the US, Canada, and Mexico. North America is the fastest-growing wearable sensors market owing to the ongoing technological innovations and the presence of some of the leading sensor manufacturers in North America; growing demand for consumer electronics such as wearable devices and gaming consoles is also boosting the use of sensors in different end-user industries such as entertainment and healthcare.

Wearable Sensors Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Wearable Sensors Companies: Key players

Major vendors in the wearable sensor companies include

- STMicroelectronics (Switzerland);

- Infineon Technologies (Germany);

- Knowles Electronics (US);

- NXP Semiconductors (Netherlands);

- Texas Instruments (US);

- TE Connectivity (Switzerland);

- Broadcom (Switzerland);

- Analog Devices (US);

- Panasonic (Japan);

- Asahi Kasei (Japan).

Wearable Sensors Market Report Scope:

|

Report Metric |

Details |

|

Estimated Market Size in 2023 |

USD 1.6 Billion |

|

Projected Market Size in 2028 |

USD 4.2 Billion |

|

Growth Rate |

CAGR of 21.1% |

|

Market size available for years |

2019—2028 |

|

Base year |

2022 |

|

Forecast period |

2023—2028 |

|

Forecast Units |

USD Millions/USD Billions and Million Units |

|

Segments Covered |

Type, Application, Verticals, and Region |

|

Geographic regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

STMicroelectronics (Switzerland); Infineon Technologies (Germany); Knowles Electronics (US); Nxp Semiconductors (Netherlands); Texas Instruments (US); TE Connectivity (Switzerland); Broadcom (Switzerland); Analog Devices(US); Panasonic (Japan); and Asahi Kasei (Japan) among others. |

Wearable Sensors Market Size Highlights

This research report categorizes the wearable sensors market size based on type, application, vertical, and region.

|

Segment |

Subsegment |

|

Wearable Sensors Market size Based on Type: |

|

|

Wearable Sensors Market size Based on Application: |

|

|

Wearable Sensors Market size Based on Vertical: |

|

|

Wearable Sensors Market size Based on Region: |

|

Recent Developments in Wearable Sensors Industry

- In May 2023, the engineers at the University of California (San Diego) developed the first fully integrated wearable ultrasound system for deep tissue monitoring. It facilitates potentially life-saving cardiovascular monitoring and marks a major breakthrough for one of the world's leading wearable ultrasound labs.

- In May 2023, STMicroelectronics (Switzerland) launched their first MEMS pressure sensors with high accuracy and superior environmental robustness suitable for gas and water-metering equipment, weather monitoring, air conditioning, and home appliances.

- In April 2023, Knowles Electronics (US) introduced the Trio of Sisonic MEMS microphones for ear and wearable solutions. The new SiSonic microphones help raise the standard of audio for today’s on-the-go lifestyle.

Frequently Asked Questions (FAQ):

What are the key strategies adopted by key companies in the wearable sensor market?

Product launches, acquisitions, and collaborations have been and continue to be some of the major strategies adopted by the key players to grow in the wearable sensor market.

What region dominates the wearable sensor market?

The North American region will dominate the wearable sensor market.

What vertical dominates the wearable sensor market?

The consumer sector is expected to dominate the wearable sensor market.

Which type dominates the wearable sensor market?

Pressure & force sensor is expected to have the largest market size during the forecast period.

Who are the major companies in the wearable sensor market?

STMicroelectronics (Switzerland); Infineon Technologies (Germany); Knowles Electronics (US); NXP Semiconductors (Netherlands); Texas Instruments (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing trend toward smaller, smarter, and cheaper sensors- Miniaturization trend in sensors- Rising share of aging population- Benefits of wearable devices in healthcare sector- Rise of IoT, AR, and M2M- Growing interest of Tier I players- Growing trend toward smart living among end usersRESTRAINTS- Lack of common standards and interoperability issues- High cost of wearable products- Regulatory issues- Security and privacy concernsOPPORTUNITIES- Increasing number of connected devices- Potential applications of wearable technologyCHALLENGES- Technical difficulties related to hardware and software- Device protection and thermal consideration- Growing miniaturization in sensors and wearable devices

-

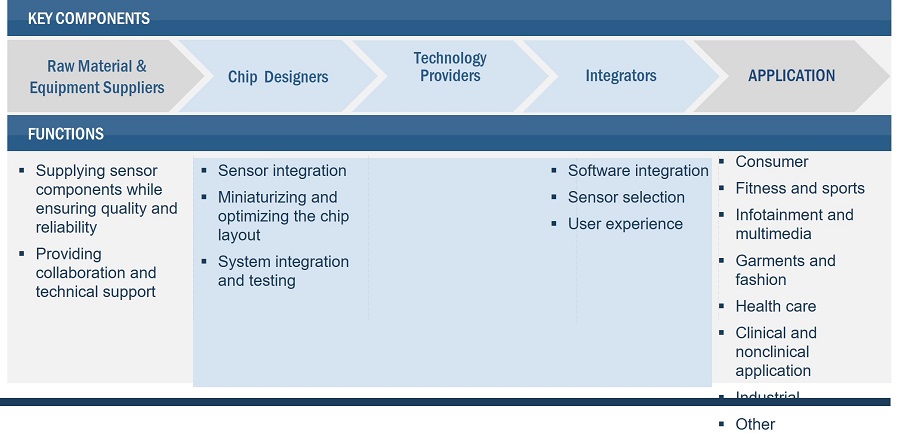

5.3 VALUE CHAIN ANALYSISRAW MATERIAL AND EQUIPMENT SUPPLIERSCHIP DESIGNERSTECHNOLOGY PROVIDERSINTEGRATORSAPPLICATIONS

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE OF WEARABLE SENSORS OFFERED BY KEY PLAYERSAVERAGE SELLING PRICE TREND

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR MARKET PLAYERS

-

5.7 TECHNOLOGY ANALYSISFULLY PRINTED AND MULTIFUNCTIONAL GRAPHENE-BASED WEARABLE E-TEXTILES FOR PERSONALIZED HEALTHCARE APPLICATIONSDESIGN OF WEARABLE SENSORS IN CLINICAL DIAGNOSTICS

-

5.8 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.9 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.10 USE CASESUSE CASE 1: WATERPROOF MEMS PRESSURE SENSORS BY STMICROELECTRONICSUSE CASE 2: USE OF HUMAN CONDITION SAFETY SENSORS TO MINIMIZE JOB SITE RISKSUSE CASE 3: FITBIT’S NEW SENSE SMARTWATCH TAKES SKIN TEMPERATURE FOR MANAGING STRESS

-

5.11 TRADE ANALYSISTARIFF ANALYSIS

-

5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.14 REGULATORY STANDARDSREGULATORY COMPLIANCE- Regulations

- 6.1 INTRODUCTION

-

6.2 ACCELEROMETERSUSE OF ACCELEROMETERS IN SMART TEXTILES AND SMART WATCHES TO DRIVE MARKET

-

6.3 MAGNETOMETERSUSE OF MAGNETOMETERS IN WRISTWEAR AND BODYWEAR DEVICES TO DRIVE MARKET

-

6.4 GYROSCOPESUSE OF GYROSCOPES IN VIRTUAL REALITY HEADSETS, SMARTWATCHES, AND FITNESS TRACKERS TO DRIVE MARKET

-

6.5 INERTIAL SENSORSUSE OF INERTIAL SENSORS IN EYEWEAR DEVICES TO DRIVE MARKET

-

6.6 MOTION SENSORSWRISTWEAR TO ACCOUNT FOR LARGEST MARKET SHARE FOR MOTION SENSORS

-

6.7 PRESSURE AND FORCE SENSORSUSE OF PRESSURE AND FORCE SENSORS IN SMARTWATCHES AND FITNESS BANDS TO DRIVE MARKET

-

6.8 TEMPERATURE AND HUMIDITY SENSORSWRISTWEAR APPLICATION TO DRIVE MARKET

-

6.9 MICROPHONES AND MICRO SPEAKERSWRISTWEAR, BODYWEAR, AND HEALTHCARE APPLICATIONS TO DRIVE MARKET

-

6.10 MEDICAL-BASED SENSORSINCREASING DEMAND FOR HEALTH TRACKING DEVICES TO DRIVE MARKETBLOOD OXYGEN SENSORSBLOOD GLUCOSE SENSORSBLOOD FLOW SENSORSECG SENSORSHEART RATE SENSORSHALL EFFECT SENSORS

-

6.11 IMAGE SENSORSINCREASED DEMAND FOR ACTIVITY MONITORING DEVICES TO DRIVE MARKET

-

6.12 TOUCH SENSORSRISING DEMAND FOR WEARABLE DEVICES TO DRIVE MARKET

-

6.13 OTHER SENSORSPOSITION SENSORSLIGHT SENSORSCHEMICAL SENSORSELECTRODE SENSORSBIOSENSORS

- 7.1 INTRODUCTION

-

7.2 MICROELECTROMECHANICAL SYSTEM (MEMS)INCREASED DEMAND IN HEALTHCARE SECTOR TO DRIVE MARKET

-

7.3 VERY-LARGE-SCALE INTEGRATION (VLSI)USE IN HEALTHCARE, SECURITY, AND NAVIGATION APPLICATIONS TO DRIVE MARKET

-

7.4 NANOELECTROMECHANICAL SYSTEM (NEMS)USE IN SMARTWATCHES, SMART GLASSES, AND SMART BANDS TO DRIVE MARKET

-

7.5 COMPLEMENTARY METAL OXIDE SEMICONDUCTOR (CMOS)INCREASING TREND OF MICROFABRICATION AND NANOFABRICATION OF ELECTRONIC STRUCTURES TO DRIVE MARKET

-

7.6 MICROSYSTEMS TECHNOLOGY (MST)INCREASING TREND OF MINIATURIZATION TO DRIVE MARKET

-

7.7 APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC)RISING DEMAND FOR ENVIRONMENTAL MONITORING TO DRIVE MARKET

-

7.8 OPTICAL TECHNOLOGYRISING ADOPTION OF HEALTH MONITORING SYSTEMS TO DRIVE MARKET

-

7.9 CHEMICAL TECHNOLOGYINCREASED FOCUS ON SENSOR FABRICATION TO DRIVE MARKET

-

7.10 ELECTRODEGROWING ADOPTION OF MEDICAL DEVICES TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 WRISTWEARINCREASING DEMAND FROM CONSUMER GOODS VERTICAL TO DRIVE MARKETWRIST-WEARABLE BANDS/WATCHESWRIST-WEARABLE BRACELETS

-

8.3 EYEWEARINCREASING DEMAND IN CONSUMER GOODS VERTICAL TO DRIVE MARKETGOOGLE GLASSESSMART CONTACT LENSES, HEAD-UP DISPLAYS, AND HEAD-MOUNTED DISPLAYSAR/VRNEUTRAL INTERFACEEYE-TRACKINGDEPTH SENSING

-

8.4 FOOTWEARINCREASING DEPLOYMENT OF WEARABLE SENSORS BY FOOTWEAR MANUFACTURERS TO DRIVE MARKETSMART SOCKSINSOLES

-

8.5 NECKWEARINCREASING DEMAND FOR SMART NECKWEAR TO DRIVE MARKETTIES AND COLLARSORNAMENTS AND JEWELRY

-

8.6 BODYWEAREMERGING TREND OF TECHNO-FASHION CLOTHING TO DRIVE MARKETCLOTHING AND INNERWEARARM AND LEGWEARSMART SOCKSCHEST STRAPS

-

8.7 OTHER APPLICATIONSRING SCANNER/WEARSMART HEADSETS/HEADBANDSEARWEARSKIN PATCHES

- 9.1 INTRODUCTION

-

9.2 CONSUMER GOODSFITNESS AND SPORTS- Increased awareness toward fitness and sports to drive marketINFOTAINMENT AND MULTIMEDIA- Use of wearable sensors in various communication technologies to drive marketPAYMENT AND ACCESS CONTROL- Use of wearable sensors in secure and convenient transactions and access management to drive marketPERSONAL SAFETY AND SECURITY- Use of wearable sensors in safety and security applications to drive marketGARMENTS AND FASHION- Integration of wearable sensors in fashion industry to drive market

-

9.3 HEALTHCAREVITAL SIGNS MONITORING- Glucose monitoring- Cardiac monitoring- Oxygen saturation level monitoring- Blood pressure monitoringSLEEP AND MENTAL HEALTH MONITORING- Utilization of sensors in sleep and mental health analysis to drive marketFALL AND MOVEMENT DETECTION- Detection of safety alerts and track movement patterns to drive marketALCOHOL CONSUMPTION MONITORING- Monitoring of real-time alcohol consumption to drive marketURINE MONITORING- Analyzing various parameters related to urine composition to drive marketLACTIC ACID MONITORING- Detection of real-time lactate levels to drive market

-

9.4 INDUSTRIALLOGISTICS, PACKAGING, AND WAREHOUSE APPLICATIONS- Increased mobility and productivity due to usage of wearable devices to drive marketOTHER INDUSTRIAL VERTICALS (CHEMICALS, PETROLEUM, OIL AND GAS, AND MINING AND CONSTRUCTION)

- 9.5 OTHER VERTICALS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICARECESSION IMPACT ANALYSISUS- Investments and innovations in healthcare and security applications to drive marketCANADA- Increased popularity of IoT platforms to drive marketMEXICO- Increased adoption of advanced technologies in various industries to drive market

-

10.3 EUROPERECESSION IMPACT ANALYSISGERMANY- Use of wearables in healthcare, sports, and fashion industries to drive marketUK- Advancements in healthcare sector to drive marketFRANCE- Adoption of advanced technology in automotive and aerospace industries to drive marketITALY- Adoption of wearables in health monitoring to drive marketREST OF EUROPE

-

10.4 ASIA PACIFICRECESSION IMPACT ANALYSISCHINA- Increased implementation of wearable sensors in various sectors to drive marketJAPAN- Increased technological innovation in consumer electronics sector to drive marketSOUTH KOREA- Presence of leading firms from consumer electronics sector to drive marketINDIA- Increased usage of smart devices to drive marketREST OF ASIA PACIFIC

-

10.5 REST OF THE WORLDRECESSION IMPACT ANALYSISSOUTH AMERICA- Availability of affordable electronic products to drive marketMIDDLE EAST & AFRICA- Stringent safety requirements in oil & gas industries to drive market

- 11.1 OVERVIEW

- 11.2 WEARABLE SENSORS MARKET SHARE ANALYSIS, 2022

- 11.3 REVENUE ANALYSIS OF TOP FIVE COMPANIES, 2020–2022

-

11.4 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.5 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

- 11.6 COMPANY FOOTPRINT

-

11.7 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

12.1 KEY PLAYERSSTMICROELECTRONICS- Business overview- Products offered- Recent developments- MnM viewINFINEON TECHNOLOGIES AG- Business overview- Products offered- Recent developments- MnM viewNXP SEMICONDUCTORS- Business overview- Products offered- Recent developments- MnM viewTEXAS INSTRUMENTS INC.- Business overview- Products offered- Recent developments- MnM viewTE CONNECTIVITY- Business overview- Products offered- MnM viewBROADCOM- Business overview- Products offered- Recent developmentsANALOG DEVICES, INC.- Business overview- Products offered- Recent developmentsPANASONIC HOLDINGS CORPORATION- Business overview- Products offeredASAHI KASEI CORPORATION- Business overview- Products offered- Recent developmentsKNOWLES ELECTRONICS, LLC.- Business overview- Products offered- Recent developments

-

12.2 OTHER KEY PLAYERSROBERT BOSCH GMBHINVENSENSE, INC.MCUBESENSIRION AGAMS-OSRAM AGARMS LIMITEDEMPATICA INCHEXOSKINNEO FECTENFLUXHOCOMAACTOFITWHOOPMOTIVOURA HEALTH OY

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 LIST OF KEY SECONDARY SOURCES

- TABLE 2 WEARABLE SENSORS MARKET ECOSYSTEM

- TABLE 3 AVERAGE SELLING PRICES OF WEARABLE SENSORS

- TABLE 4 MARKET: INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 5 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 6 MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 7 TARIFF FOR WRISTWATCHES, WHETHER OR NOT INCORPORATING STOPWATCH FACILITY, ELECTRICALLY OPERATED, EXPORTED BY CHINA, 2021

- TABLE 8 TARIFF FOR WRISTWATCHES, WHETHER OR NOT INCORPORATING STOPWATCH FACILITY, ELECTRICALLY OPERATED, EXPORTED BY GERMANY, 2021

- TABLE 9 TARIFF FOR WRISTWATCHES, WHETHER OR NOT INCORPORATING STOPWATCH FACILITY, ELECTRICALLY OPERATED EXPORTED BY US, 2021

- TABLE 10 TARIFF FOR WRISTWATCHES, WHETHER OR NOT INCORPORATING STOPWATCH FACILITY, ELECTRICALLY OPERATED, EXPORTED BY FRANCE 2021

- TABLE 11 TOP 20 PATENT OWNERS IN LAST 10 YEARS (US)

- TABLE 12 SENSORS MARKET: KEY PATENTS, 2020–2022

- TABLE 13 SENSORS MARKET: KEY CONFERENCES AND EVENTS

- TABLE 14 WEARABLE SENSORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 15 MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 16 MARKET, BY TYPE, 2019–2022 (MILLION UNITS)

- TABLE 17 MARKET, BY TYPE, 2023–2028 (MILLION UNITS)

- TABLE 18 MARKET FOR ACCELEROMETERS, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 19 MARKET FOR ACCELEROMETERS, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 20 MARKET FOR ACCELEROMETERS, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 21 MARKET FOR ACCELEROMETERS, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 22 MARKET FOR MAGNETOMETERS, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 23 MARKET FOR MAGNETOMETERS, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 24 MARKET FOR MAGNETOMETERS, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 25 MARKET FOR MAGNETOMETERS, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 26 MARKET FOR GYROSCOPES, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 27 MARKET FOR GYROSCOPES, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 28 WEARABLE SENSORS MARKET FOR GYROSCOPES, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 29 MARKET FOR GYROSCOPES, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 30 MARKET FOR INERTIAL SENSORS, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 31 MARKET FOR INERTIAL SENSORS, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 32 MARKET FOR INERTIAL SENSORS, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 33 MARKET FOR INERTIAL SENSORS, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 34 MARKET FOR MOTION SENSORS, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 35 MARKET FOR MOTION SENSORS, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 36 WEARABLE SENSORS MARKET FOR MOTION SENSORS, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 37 MARKET FOR MOTION SENSORS, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 38 MARKET FOR PRESSURE AND FORCE SENSORS, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 39 MARKET FOR PRESSURE AND FORCE SENSORS, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 40 MARKET FOR PRESSURE AND FORCE SENSORS, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 41 MARKET FOR PRESSURE AND FORCE SENSORS, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 42 MARKET FOR TEMPERATURE AND HUMIDITY SENSORS, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 43 MARKET FOR TEMPERATURE AND HUMIDITY SENSORS, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 44 MARKET FOR TEMPERATURE AND HUMIDITY SENSORS, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 45 MARKET FOR TEMPERATURE AND HUMIDITY SENSORS, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 46 MARKET FOR MICROPHONES AND MICRO SPEAKERS, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 47 WEARABLE SENSORS MARKET FOR MICROPHONES AND MICRO SPEAKERS, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 48 MARKET FOR MICROPHONES AND MICRO SPEAKERS, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 49 MARKET FOR MICROPHONES AND MICRO SPEAKERS, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 50 MARKET FOR MEDICAL-BASED SENSORS, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 51 MARKET FOR MEDICAL-BASED SENSORS, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 52 MARKET FOR MEDICAL-BASED SENSORS, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 53 MARKET FOR MEDICAL-BASED SENSORS, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 54 MARKET FOR IMAGE SENSORS, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 55 MARKET FOR IMAGE SENSORS, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 56 MARKET FOR IMAGE SENSORS, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 57 MARKET FOR IMAGE SENSORS, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 58 MARKET FOR TOUCH SENSORS, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 59 MARKET FOR TOUCH SENSORS, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 60 WEARABLE SENSORS MARKET FOR TOUCH SENSORS, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 61 MARKET FOR TOUCH SENSORS, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 62 MARKET FOR OTHER SENSORS, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 63 MARKET FOR OTHER SENSORS, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 64 WEARABLE SENSORS MARKET FOR OTHER SENSORS, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 65 MARKET FOR OTHER SENSORS, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 66 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 67 WEARABLE SENSORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 68 MARKET FOR WRISTWEAR APPLICATION, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 69 MARKET FOR WRISTWEAR APPLICATION, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 70 MARKET FOR EYEWEAR APPLICATION, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 71 MARKET FOR EYEWEAR APPLICATION, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 72 MARKET FOR FOOTWEAR APPLICATION, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 73 MARKET FOR FOOTWEAR APPLICATION, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 74 MARKET FOR NECKWEAR APPLICATION, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 75 MARKET FOR NECKWEAR APPLICATION, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 76 WEARABLE SENSORS MARKET FOR BODYWEAR APPLICATION, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 77 MARKET FOR BODYWEAR APPLICATION, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 78 MARKET FOR OTHER APPLICATIONS, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 79 MARKET FOR OTHER APPLICATIONS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 80 MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 81 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 82 MARKET FOR CONSUMER GOODS, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 83 MARKET FOR CONSUMER GOODS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 84 MARKET FOR CONSUMER GOODS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 85 MARKET FOR CONSUMER GOODS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 86 MARKET FOR HEALTHCARE, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 87 WEARABLE SENSORS MARKET FOR HEALTHCARE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 88 MARKET FOR HEALTHCARE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 89 MARKET FOR HEALTHCARE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 90 MARKET FOR INDUSTRIAL VERTICAL, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 91 WEARABLE SENSORS MARKET FOR INDUSTRIAL VERTICAL, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 92 MARKET FOR INDUSTRIAL VERTICAL, BY REGION, 2019–2022 (USD MILLION)

- TABLE 93 WEARABLE SENSORS MARKET FOR INDUSTRIAL VERTICAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 94 WEARABLE SENSORS MARKET FOR OTHER VERTICALS, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 95 MARKET FOR OTHER VERTICALS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 96 MARKET FOR OTHER VERTICALS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 97 MARKET FOR OTHER VERTICALS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 98 WEARABLE SENSORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 99 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 100 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 101 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 102 NORTH AMERICA: MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 103 NORTH AMERICA: WEARABLE SENSORS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 104 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 105 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 106 EUROPE: MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 107 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 108 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 109 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 111 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 112 REST OF THE WORLD: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 113 REST OF THE WORLD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 114 REST OF THE WORLD: MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 115 REST OF THE WORLD: WEARABLE SENSORS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 116 WEARABLE SENSORS MARKET: STRATEGIES ADOPTED BY KEY PLAYERS FROM 2019 TO 2023

- TABLE 117 MARKET: DEGREE OF COMPETITION

- TABLE 118 MARKET: RANKING ANALYSIS

- TABLE 119 START-UPS/SMES IN WEARABLE SENSORS MARKET

- TABLE 120 MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 121 MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 122 COMPANY FOOTPRINT

- TABLE 123 COMPANY WEARABLE SENSOR TYPE FOOTPRINT

- TABLE 124 COMPANY VERTICAL FOOTPRINT

- TABLE 125 COMPANY REGION FOOTPRINT

- TABLE 126 PRODUCT LAUNCHES, 2022–2023

- TABLE 127 DEALS, 2021–2023

- TABLE 128 OTHERS, 2023

- TABLE 129 STMICROELECTRONICS: COMPANY OVERVIEW

- TABLE 130 STMICROELECTRONICS: PRODUCTS OFFERED

- TABLE 131 STMICROELECTRONICS: PRODUCT LAUNCHES

- TABLE 132 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 133 INFINEON TECHNOLOGIES AG: PRODUCTS OFFERED

- TABLE 134 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES

- TABLE 135 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- TABLE 136 NXP SEMICONDUCTORS: PRODUCTS OFFERED

- TABLE 137 DEALS NXP SEMICONDUCTORS: DEALS

- TABLE 138 TEXAS INSTRUMENTS INC.: COMPANY OVERVIEW

- TABLE 139 TEXAS INSTRUMENTS INC.: PRODUCTS OFFERED

- TABLE 140 TEXAS INSTRUMENTS INC.: PRODUCT LAUNCHES

- TABLE 141 TE CONNECTIVITY: COMPANY OVERVIEW

- TABLE 142 TE CONNECTIVITY: PRODUCTS OFFERED

- TABLE 143 BROADCOM: COMPANY OVERVIEW

- TABLE 144 BROADCOM: PRODUCTS OFFERED

- TABLE 145 BROADCOM: PRODUCT LAUNCHES

- TABLE 146 ANALOG DEVICES, INC.: COMPANY OVERVIEW

- TABLE 147 ANALOG DEVICES, INC.: PRODUCTS OFFERED

- TABLE 148 ANALOG DEVICES, INC.: OTHERS

- TABLE 149 PANASONIC HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 150 PANASONIC HOLDINGS CORPORATION: PRODUCTS OFFERED

- TABLE 151 ASAHI KASEI CORPORATION: COMPANY OVERVIEW

- TABLE 152 ASAHI KASEI: PRODUCTS OFFERED

- TABLE 153 ASAHI KASEI: DEALS

- TABLE 154 KNOWLES ELECTRONICS, LLC.: COMPANY OVERVIEW

- TABLE 155 KNOWLES ELECTRONICS, LLC.: PRODUCTS OFFERED

- TABLE 156 KNOWLES ELECTRONICS, LLC.: PRODUCT LAUNCHES

- TABLE 157 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 158 INVENSENSE, INC.: COMPANY OVERVIEW

- TABLE 159 MCUBE: COMPANY OVERVIEW

- TABLE 160 SENSIRION AG: COMPANY OVERVIEW

- TABLE 161 AMS-OSRAM AG: COMPANY OVERVIEW

- TABLE 162 ARMS LIMITED: COMPANY OVERVIEW

- TABLE 163 EMPATICA INC: COMPANY OVERVIEW

- TABLE 164 HEXOSKIN: COMPANY OVERVIEW

- TABLE 165 NEO FECT: COMPANY OVERVIEW

- TABLE 166 ENFLUX: COMPANY OVERVIEW

- TABLE 167 HOCOMA: COMPANY OVERVIEW

- TABLE 168 ACTOFIT: COMPANY OVERVIEW

- TABLE 169 WHOOP: COMPANY OVERVIEW

- TABLE 170 MOTIV: COMPANY OVERVIEW

- TABLE 171 OURA HEALTH OY: COMPANY OVERVIEW

- FIGURE 1 WEARABLE SENSORS MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS: REVENUE OF PRODUCTS/SOLUTIONS/SERVICES IN WEARABLE SENSORS MARKET

- FIGURE 3 WEARABLE SENSORS MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 WEARABLE SENSORS MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 MAGNETOMETER SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 7 BODYWEAR SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 8 CONSUMER GOODS VERTICAL TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 9 WEARABLE SENSORS MARKET, BY REGION, 2023–2028

- FIGURE 10 DEMAND FOR FITNESS AND HEALTH TRACKING DEVICES TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 11 GYROSCOPE SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 12 CONSUMER GOODS AND CHINA TO HOLD LARGEST MARKET SHARES IN ASIA PACIFIC IN 2023, BY VERTICAL AND BY COUNTRY

- FIGURE 13 INDIA TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 14 WEARABLE SENSORS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 15 MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 16 MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 17 MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 18 MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 19 WEARABLE SENSORS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 MARKET: ECOSYSTEM ANALYSIS

- FIGURE 21 AVERAGE SELLING PRICE OF WEARABLE SENSORS OFFERED BY KEY PLAYERS

- FIGURE 22 AVERAGE SELLING PRICE OF ACCELEROMETERS

- FIGURE 23 REVENUE SHIFT IN MARKET

- FIGURE 24 MARKET: INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 25 MARKET: KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 26 IMPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 27 EXPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 28 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 29 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2022

- FIGURE 30 GYROSCOPE SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 31 WRISTWEAR SEGMENT TO HOLD MAJOR MARKET SHARE DURING FORECAST PERIOD

- FIGURE 32 INDUSTRIAL VERTICAL TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 33 EYEWEAR SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 34 BODYWEAR SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 35 CONSUMER GOODS TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 36 PRESSURE AND FORCE SENSORS TO LEAD MARKET FOR INDUSTRIAL VERTICAL IN 20232028

- FIGURE 37 ACCELEROMETERS AND PRESSURE AND FORCE SENSORS TO HOLD SIGNIFICANT MARKET FOR OTHER VERTICALS BETWEEN 2023 AND 2028

- FIGURE 38 MARKET: REGIONAL SNAPSHOT (2019–2022)

- FIGURE 39 NORTH AMERICA: WEARABLE SENSORS MARKET SNAPSHOT

- FIGURE 40 EUROPE: MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 42 MARKET SHARE ANALYSIS, 2022

- FIGURE 43 REVENUE ANALYSIS OF TOP FIVE PLAYERS IN MARKET, 2020–2022

- FIGURE 44 MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 45 WEARABLE SENSORS MARKET: START-UP/SME EVALUATION MATRIX, 2022

- FIGURE 46 STMICROELECTRONICS: COMPANY SNAPSHOT

- FIGURE 47 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- FIGURE 48 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- FIGURE 49 TEXAS INSTRUMENTS INC.: COMPANY SNAPSHOT

- FIGURE 50 TE CONNECTIVITY: COMPANY SNAPSHOT

- FIGURE 51 BROADCOM: COMPANY SNAPSHOT

- FIGURE 52 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

- FIGURE 53 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 KNOWLES ELECTRONICS, LLC.: COMPANY SNAPSHOT

The study involved four major activities in estimating the size of the wearable sensors market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were used to identify and collect information important for this study. These include annual reports, press releases & investor presentations of companies, white papers, technology journals, certified publications, articles by recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the supply chain of the industry, the total pool of market players, the classification of the market according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary research was also conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, and industry trends, along with key strategies adopted by players operating in the wearable sensors market. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

Primary Research

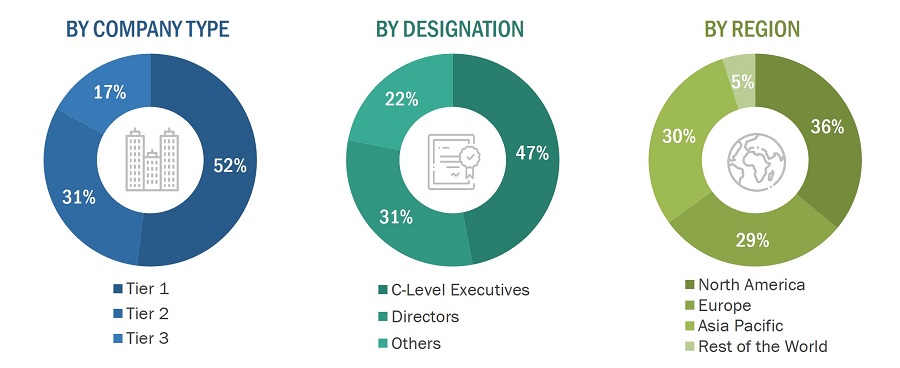

Extensive primary research has been conducted after acquiring knowledge about the wearable sensors market scenario through secondary research. Several primary interviews have been conducted with experts from both the demand (end users) and supply side (wearable sensors providers) across 4 major geographic regions: North America, Europe, Asia Pacific, and RoW. Approximately 80% and 20% of the primary interviews have been conducted from the supply and demand side, respectively. These primary data have been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

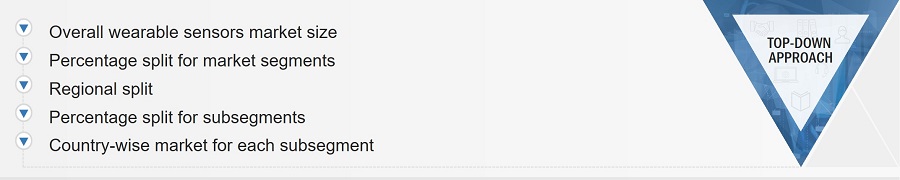

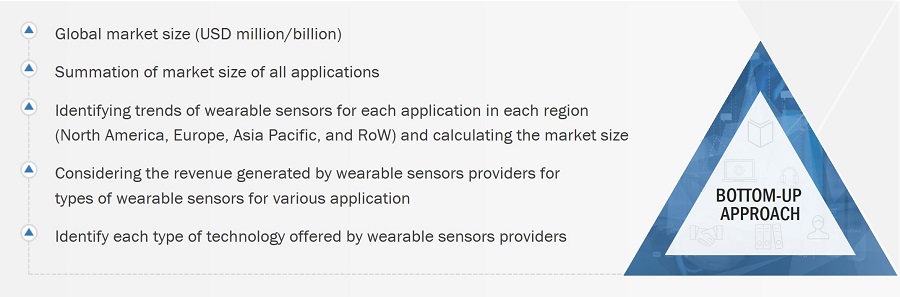

In the complete market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the wearable sensors market and various other dependent submarkets. Key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire research methodology included the study of annual and financial reports of the top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Wearable Sensors Market: Top-Down Approach

Wearable Sensors Market: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process, as explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using top-down and bottom-up approaches.

Market Definition

Wearable computing or wearable technology refers to electronic devices or equipment that can be worn on a user’s body. They include smart watches, glasses, clothing, and shoes. They operate with the help of sensors such as accelerometers, magnetometers, gyroscopes, motion sensors, temperature and humidity sensors, pressure and force sensors, image sensors, and other medical-based sensors. Sensors in wearable devices offer a wide range of functionalities, from basic features such as monitoring heart rate and calories burned to advanced smart features such as providing data about smell, taste, hearing, and sight. Individuals use these devices to track fitness and health, and in infotainment and fashion, sportspersons can monitor their performance in various sports, such as golf, football, and basketball, among others.

Key Stakeholders

- Electronic design automation (EDA) and design tool vendors

- Players are involved in machine-to-machine (M2M) and Internet of Things (IoT) platforms.

- Consumer wearable manufacturers

- Healthcare-related product manufacturers

- Textile, cloth, and yarn manufacturers and suppliers

- Luxury clothing and accessory manufacturers

- Consumer electronics manufacturers

- Integrated device manufacturers (IDMs)

- Sensor, actuator, and transducer players

- Wearable electronics intellectual property players

- Wearable electronics technology platform developers

- Original equipment manufacturers (OEMs) (wireless equipment manufacturers or electronic product manufacturers)

- Research organizations

Report Objectives

- To describe, segment, and forecast the wearable sensors market size based on type, verticals, and application in terms of value.

- To describe and forecast the wearable sensors market, by type, in terms of value and volume.

- To describe and forecast the market for four key regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value.

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the wearable sensors market

- To provide a detailed overview of the supply chain and ecosystem pertaining to wearable sensors and the average selling prices of wearable sensors.

- To strategically analyze the ecosystem, tariffs and regulations, patent landscape, trade landscape, and case studies pertaining to the market under study

- To strategically analyze micro markets with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market

- To analyze competitive developments such as product launches and developments, expansions, partnerships, collaborations, contracts, and mergers and acquisitions in the wearable sensors market.

- To strategically profile the key players in the wearable sensors market and comprehensively analyze their market ranking and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Wearable Sensors Market

Market (current and forecast) information on military wearable for vital sign monitoring during training, for various regions worldwide. Is the military application covered? If yes up to what extent?

We are a startup and have invented a new type of optical stretch sensors. Have you included this in your research? If yes in which application? Also I would like to understand the use of Smart Devices and its impact on Wearable sensor market.

What are the major applications and the future trends in the market for wearable sensors? Have you considered IoT or smart sensors in the scope of the report?

How wearable sensors can be used for medical applications? How would the use of AR, IoT and M2M impact the use of wearable sensors in medical applications?