This research study extensively uses secondary sources, such as company annual reports/presentations, industry association publications, magazine articles, directories, technical handbooks, world economic outlook, trade websites, technical articles, and databases, have been used to identify and collect information for an extensive study of the automotive actuators market. Primary sources—experts from related industries and automotive actuator manufacturers and suppliers—have been interviewed to obtain and verify critical information and assess prospects and market estimations.

Secondary Research

The market for the companies offering automotive actuators is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality.

Secondary research has identified key players in the automotive actuators market. Primary research interviews have been conducted with key opinion leaders in the automotive sector, such as CEOs, directors, industry experts, and other executives, to validate revenues. The size of the automotive actuators market, in terms of value (USD Million) and volume (thousand units) for various regions, has been derived using forecasting techniques based on the demand for automotive actuators and market trends.

In the secondary research process, the secondary sources referred to for this research study include automotive sector organizations such as the Automotive Component Manufacturers Association (ACMA) and corporate filings (including annual reports, investor presentations, and financial statements). Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

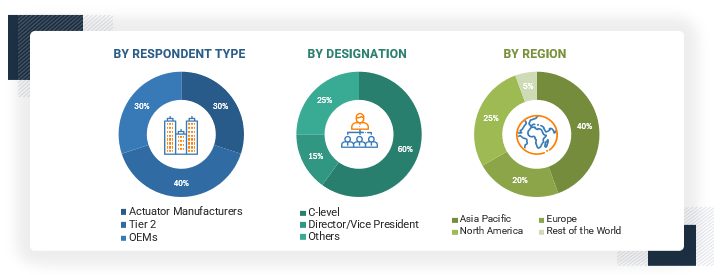

Extensive primary research has been conducted after acquiring an understanding of the automotive actuators market scenario through secondary research. Several primary interviews have been conducted with market experts from demand (OEMs) and supply sides (automotive actuator and component manufacturers) across North America, Europe, Asia Pacific, and the Rest of the World. Approximately 30%, 40%, and 30% of primary interviews were conducted with automotive actuator manufacturers, Tier 2 suppliers, and OEMs, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and marketing, were covered to provide a holistic viewpoint in the report.

After interacting with industry experts, brief sessions were conducted with experienced independent consultants to reinforce the findings from primary areas. This, along with the in-house subject matter experts’ opinions, has led to the findings described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Bottom-up approach wase used to estimate and validate the total size of the automotive actuators market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Automotive Actuators Market Size: Bottom-UP Approach

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size using the market size estimation processes explained above. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

An automotive actuator is a type of motor that operates through electric current, hydraulic fluid, or pneumatic pressure and converts that energy into motion. It is responsible for the moving and controlling mechanisms of a system.

Stakeholders

-

Authorized service centers

-

Automobile OEMs

-

Automobile organizations/associations and government bodies

-

Automotive actuator manufacturers and suppliers

-

Automotive component providers.

-

Automotive software providers

-

Automotive system manufacturers

-

Independent aftermarket service providers

-

Technology integrators

-

Traders and distributors of automotive actuators

Report Objectives

-

To define, describe, and forecast the size of the automotive actuators market in terms of value (USD million) and volume (thousand units).

-

By Product Type (Brake Actuators, Cooling Valve Actuators, EGR Actuators, Grill Shutter Actuators, Headlamp Actuators, HVAC Actuators, Power Seat Actuators, Power Window Actuators, Steering Column Adjustment Actuators, Sunroof Actuators, Tailgate Actuators, Throttle Actuators, Turbo Actuators, Telescopic Nozzle Actuators, Piezoelectric Actuators, Door Lock Actuators, and Fuel Door Actuators)

-

By Application (Engine, Body Control & Exterior, and Interior)

-

By Actuation (Hydraulic, Pneumatic, and Electric)

-

By Motion (Linear and Rotary)

-

By Vehicle Type (On-highway Vehicle and Off-Highway Vehicle)

-

By On-Highway Vehicle (Passenger Car, Light Commercial Vehicle, and Heavy Commercial Vehicle)

-

By EV Propulsion (BEV, PHEV, and FCEV)

-

By EV Application (E-powertrain, Body Control & Exterior, and Interior)

-

By Region (Asia Pacific, Europe, North America, and Rest of the World)

-

To provide qualitative insights on Artificial Muscles (Shape Memory Alloy and Smart Polymer)

-

To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

-

To strategically analyze the market and provide the average selling price (ASP) analysis and patent analysis

-

To evaluate the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

-

To evaluate the dynamics of competitors in the automotive actuators market and distinguish them into stars, emerging leaders, pervasive players, and participants

-

To understand the dynamics of start-ups/SMEs prevalent in the automotive actuators market ecosystem and distinguish them into progressive companies, responsive companies, dynamic companies, and starting blocks

-

To analyze the product launches/developments, expansions, collaborations, acquisitions, and other activities carried out by key players in the automotive actuators market

Growth opportunities and latent adjacency in Automotive Actuators Market