Anti-Counterfeit Packaging Market

Anti-Counterfeit Packaging Market by Technology (Mass Encoding, RFID, Hologram, Tamper Evidence, Forensic Markers), End-use Industry (Food & Beverage, Pharmaceutical, Personal Care, Apparel & Footwear, Luxury Goods), & Region - Global Forecast to 2030

Updated on : January 27, 2026

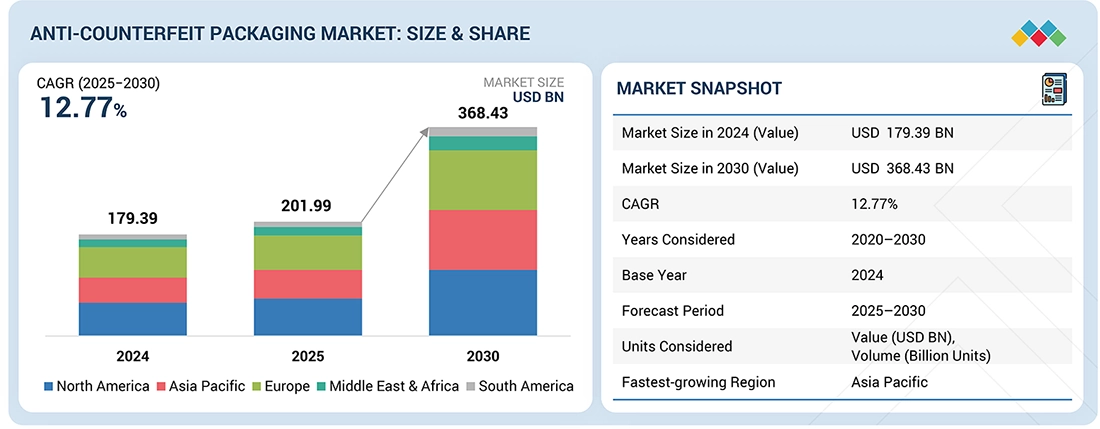

ANTI-COUNTERFEIT PACKAGING MARKET SIZE & SHARE

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Anti-counterfeit packaging market was valued at USD 201.99 billion in 2025 and is projected to reach USD 368.43 billion by 2030, growing at 12.77% cagr from 2025 to 2030. Increasing cases of counterfeiting, the imposition of stricter regulatory norms, and the rapid growth of e-commerce are fueling the growth of the anti-counterfeiting packaging market globally. The use of RFID/NFC, holographic labels, QR code technology, tamper-proof packaging, and mass-encoded packaging is being driven by regulations such as the Pharmaceutical Serialization Act, food and beverage traceability, and other consumer protection obligations. The use of digital verification technology and real-time tracking systems increases the level of product verification and makes the chances of reaching the end consumer with counterfeit products almost negligible. Rising consumer and industry awareness, along with the growth of international trade, is also fueling the demand for the product rapidly. Technological advancements such as networked authentication systems, cloud-based tracking systems, and AI-based monitoring platforms, along with regulatory support, are major drivers pushing the use of anti-counterfeiting packaging solutions worldwide.

KEY TAKEAWAYS

-

By RegionNorth America's anti-counterfeit packaging market dominated, with a share of 32.75% in 2024.

-

By TechnologyBy technology, the RFID segment is expected to register the highest CAGR of 17.78% from 2025 to 2030, in terms of value.

-

By End-use IndustryBy end-use industry, the pharmaceutical segment is expected to dominate the market, growing at the highest CAGR of 16.15%.

-

Competitive Landscape - Key PlayersAvery Dennison Corporation, 3M, Zebra Technologies Corporation, and CCL Industries Inc. were identified as Star players in the Anti-counterfeit packaging market, as they have focused on innovation and have broad industry coverage, and strong operational & financial strength.

-

Competitive Landscape- StartupsEDGYN, Impinj Inc., 3D AG, Prooftag, among others, have distinguished themselves among startups and SMEs due to their strong product portfolio and business strategy.

The anti-counterfeit packaging market is experiencing significant growth as global supply chains become more complex and counterfeit activities escalate across industries such as pharmaceuticals, luxury goods, electronics, and consumer products. The issue of counterfeit items is among the most paramount concerns for all organizations, which results in financial loss, reputation, as well as other dangers connected to the security of the consumer. The impact of the global economy connected with the issue of counterfeit items proves the need for technology in the field of anti-counterfeit packaging. The rising requirement for the latest technology in securing items, as well as the need for the capabilities of traceability, has led to the rise in the use of the following tech items in packaging: QR code packaging, bar code packaging, tamper-proof packaging, hologram sticker packaging, as well as RFID packaging. The rising awareness among the population has led to the formulation of strict guidelines to tackle the risk of counterfeit items.

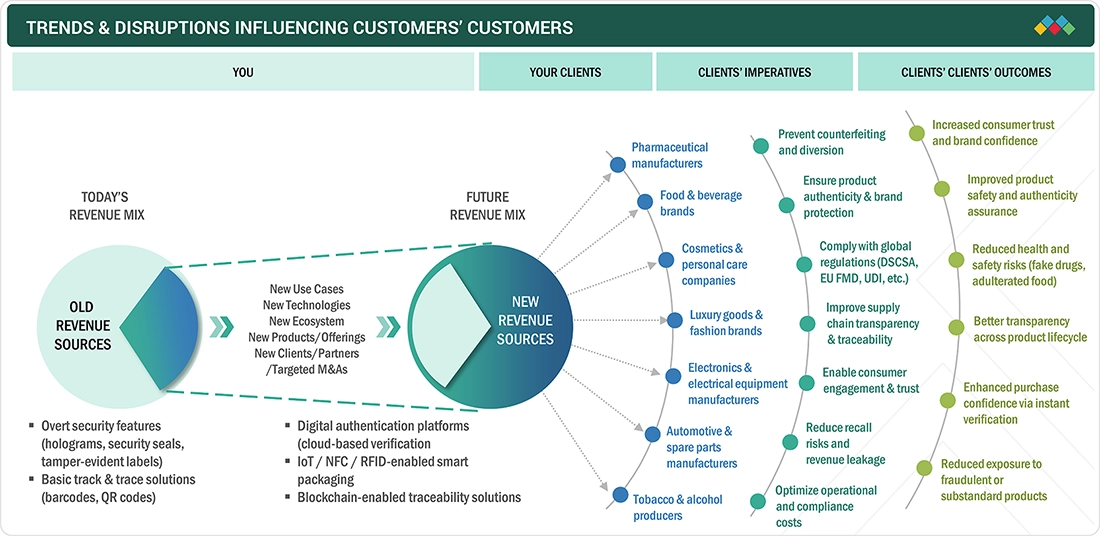

ANTI-COUNTERFEIT PACKAGING MARKET TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on the end-use industry in the anti-counterfeit packaging market is fueled by the increasing requirement for secure, traceable, and authentic items. The major industries, namely pharmaceuticals, consumer goods, electronics, automotive, luxury goods, and food & beverages, are inclining towards the usage of anti-counterfeit packaging due to the increasing threats associated with counterfeiting items, governmental regulations, and the increasing penetration rate of e-commerce. The governmental regulations associated with serialization, traceability, and tamper evidence in high-risk sectors like the pharmaceutical industry and the food industry are the primary drivers for the adoption of advanced anti-counterfeit packaging technologies. The increasing concern for efficiency in operations by companies is leading to the growth in the adoption of anti-counterfeit packaging in various industries, and this is ultimately fueling the growth in the anti-counterfeit packaging market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rise in pharmaceutical crime incidents

-

Implementation of stringent regulations

Level

-

Growing complexity of counterfeit operations

-

Significant initial investment requirements

Level

-

Ongoing developments in technologies

-

Customized solutions across various industries

Level

-

Barriers to consumer understanding

-

High R&D investment requirements

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rise in pharmaceutical crime incidents

As reported by the Pharmaceutical Security Institute, there were approximately 6,897 cases of pharmaceutical crime reported for 2023, indicating the rising levels of counterfeited and substandard drugs. With the rise in pharmaceutical crime cases, the demand for cutting-edge anti-counterfeit packaging technology has become a necessity. This technology plays a pivotal role for both consumer and pharmaceutical companies in ensuring health and financial safety. As reported, online pharmacies and e-commerce platforms have become alarmingly popular. This situation has increased concerns regarding counterfeited goods reaching ultimate consumers. Hence, authentication at both points, during the purchase and shipping process, has become even more critical. Also known as authentication packaging, anti-counterfeit packaging technology relies upon concepts such as digital authenticity verification, S/N numbers, and RFID/NFC tags. Meanwhile, tamper-proof packaging and holographic stamps enable authenticity verification at any time from the government and public levels. Advanced anti-counterfeit packaging technology has become a significant area for pharmaceutical companies, with growing levels of sophistication displayed by counterfeits. This rise in consumer concern for health and financial security has increased spending on packaging technology development. As such, innovation and demand for anti-counterfeit packaging have become increasingly relevant.

Restraint: Significant initial investment requirements

The high barrier to entry for new competitors comes from the large capital expenditure required for anti-counterfeit technologies. This is primarily due to the high cost of the cutting-edge technologies needed to ensure product authenticity. These technologies' initial and ongoing costs are high, making them more financially demanding. Startups will have to spend money on effective technology and, in some cases, purchase a fleet of vehicles to guarantee safe delivery, which is a high barrier, particularly in a critical area like pharmaceuticals. A lot of time and investment is needed to develop a robust distribution network. Startups will have difficulties competing against companies without a distribution network or connections. There are strict legal and regulatory frameworks to which new companies are required to adhere. Startups will have to make a lot of investment to gain a trustworthy brand.

Opportunity: Customized Solutions Across Various Industries

The anti-counterfeit packaging market holds great promise in terms of its ability to offer customized solutions for various industries. This flexibility makes it possible for the market to choose the technology or approach as per the requirements of the products in the respective industry. In the luxury products market, organizations use advanced authentication technologies such as hologram stickers, serial number coding, and tamper-evident banding to safeguard their product image from counterfeiters. In the electronics and automotive markets, the use of industry-specific labeling, RFID/NFC coding, and track-and-trace technology ensures product authenticity and tracks the product through the supply chain. Ultimately, this technology prevents the use of counterfeit parts that could affect the performance of the product. Similarly, in the pharmaceuticals and food and beverage markets, the demand for anti-counterfeit packaging remains high as organizations use the technology to safeguard products. In addition to the previous advantages of the technology in these industries, it also meets the regulatory requirements of tracing the end product. This adaptability of the technology makes it an in-demand product in the market.

Challenge: High R&D investment requirements

Innovation within the anti-counterfeit packaging market is an expensive process, and players have to spend quite an amount on R&D to outsmart and outdate counterfeiters and develop new ways for authenticating products. Even for new players within the industry, it becomes a challenge to find resources and expertise to invest in R&D, as they cannot afford to compete with established giants within the market, and as a result, they cannot account for high-quality security packaging solutions to offer to the public, but as the need for authentic products across the globe increases, these brands are willing to spend and develop ways to minimize risks associated with counterfeit goods. Those players within the market who invest effectively in R&D are able to create differentiated offerings and develop scalable solutions to enter new sectors and eventually improve their place within the market as well as their profitability.

ANTI-COUNTERFEIT PACKAGING MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Implemented ScanTrust Secure QR codes on wine packaging for anti-counterfeiting and authentication via a mobile phone application. | Protected premium wines, enhanced authentication, reinforced brand integrity, and supported real-time counterfeit notifications. |

|

Deployed Avery Dennison's EPC/RFID Item Level Tagging solution to label items uniquely. Enhancing inventory management, as well as encouraging retail and wholesale business. | Enhanced order accuracy to 99.54%, decreased chargebacks by 98.8%, increased efficiency of operations, as well as facilitated scalable business expansion among 350 retail customers. |

|

Incorporated RFID technology into medication packaging (for example, for high-risk medications) to ensure the ability to scan packages for authenticity. This would prevent the issue of counterfeit drugs. | Minimized distribution of counterfeit drugs, increased patient safety, and improved the drug distribution chain. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The anti-counterfeit packaging ecosystem consists of an interconnected value chain that provides secure, traceable products. These include suppliers of packaging materials, RFID/NFC tags, holograms, tamper-evident labels, and digital verification solutions. This is followed by suppliers of solutions for serializing, coding, and authentication software. Brands, companies, and retail stores adopt these solutions. These include pharmaceuticals, consumer products, electronics, luxury goods, and other products. The respective authorities provide quality, safety, and traceability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

ANTI-COUNTERFEIT PACKAGING MARKET OUTLOOK & FORECAST (MARKET SEGMENTS)

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Anti-counterfeit Packaging Market, By Technology

By technology, mass encoding was the largest segment in the global anti-counterfeit packaging market during 2024 due to its scalability, cost-effectiveness, and applicability across industries. In mass encoding, a unique identifier such as a barcode, QR code, serial number, and digital watermark is given to each unit of the product, which not only makes it very difficult to counterfeit countless packaging but also allows for authenticity verification across the value chain. Its applicability across the existing infrastructure related to manufacturing and scanning processes makes it possible for companies to easily adopt it without having to make significant changes to manufacturing and scanning processes, which applies to industries such as the pharmaceutical, consumer, and electronics sectors, which have an extra reason to be cautious about the authenticity of products and overall product traceability.

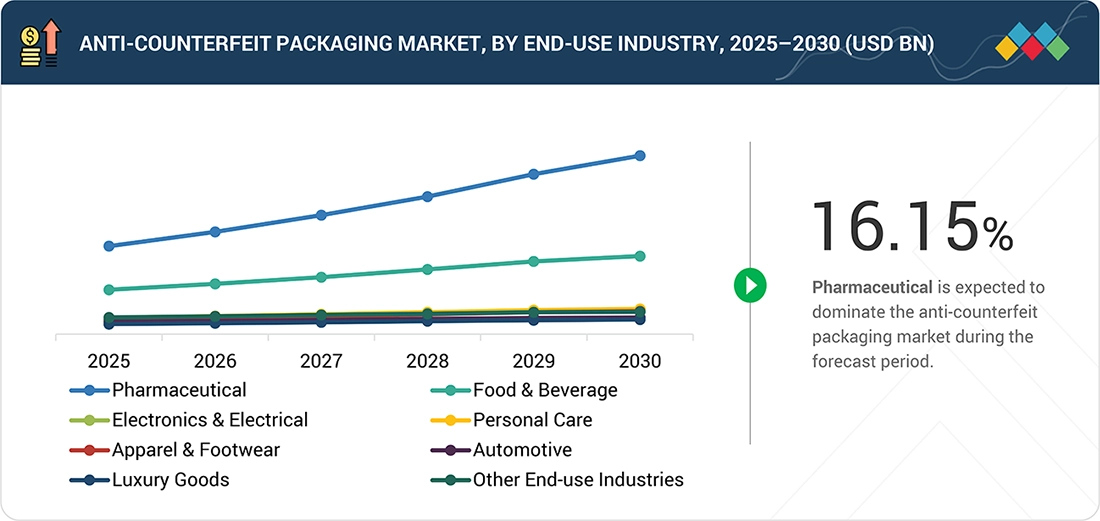

Anti-counterfeit Packaging Market, By End-use Industry

In the global anti-counterfeit packaging market, the pharmaceuticals sector dominates by capturing the largest market share in 2024. The rising instances of counterfeit or substandard drugs have forced the governments and trade associations of different regions, such as the Asia Pacific, Europe, and North America, to implement the use of serialization, tamper-evident packaging, and track-and-trace technologies. The players operating in the pharmaceuticals industry have embraced the adoption of advanced technologies such as mass encoding, RFID & NFC packaging, holographic packaging, and QR code packaging to protect their products from counterfeiting at different points of the packaging distribution chain. The sector's emphasis on patient wellness and regulatory requirements has spurred the growth of the global anti-counterfeit packaging market. In the global market, the key drugs such as biologics, vaccines, and prescription medicines have driven the critical end-user segment.

REGION

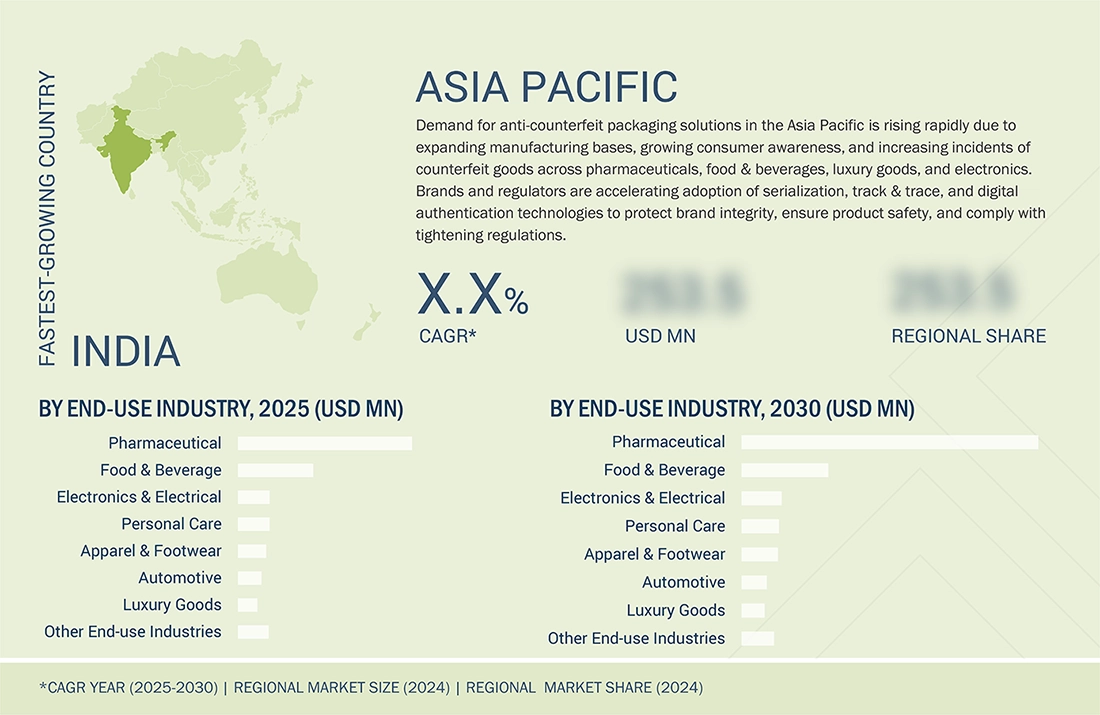

Asia Pacific to be the fastest-growing region in the anti-counterfeit packaging market during the forecast period

The Asia-Pacific market is rapidly shaping up to be the fastest-growing market for anti-counterfeit packaging technology, driven by various economic, legislative, and technological reasons. Increasing fast pace of industrialization and the advent of large-scale productions of pharmaceutical, electrical, consumer, as well as luxury items, have resulted in the development of lengthy supply chains where the danger of counterfeiting is substantial. Governments across the region, primarily China, India, and Southeast Asian countries, are enforcing tough regulations regarding serialization, traceability, and tamper evidence, which are compelling enterprises to switch to sophisticated methods of authentication involving the use of RFID/NFC, secure holographic foils, and QR code verification. Growth in the e-commerce industry has also amplified the demand for product verification at the time of the end-use transaction. Technological advancements involving the Internet of Things technology and real-time verification platforms also allow enterprises to track their items across the supply chain.

ANTI-COUNTERFEIT PACKAGING MARKET: COMPANY EVALUATION MATRIX

Avery Dennison Corporation (Star) is a world leader in anti-counterfeit packaging solutions. They are known for their RFID tags, secure holographic labels, and tamper-evident solutions. Along with aggressive investment in Research & Development and a robust global reach, Avery helps their customers increase the security of their pharmaceuticals, consumer goods, luxury goods, and other items through dependable anti-counterfeit packaging solutions. SATO Holdings Corporation (Emerging Leader) provides anti-counterfeit solutions for its customers through its array of solutions, such as barcode solutions, RFID/NFC solutions, and auto-ID solutions. Their solutions are used for the authentication of different products.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Avery Dennison Corporation

- CCL Industries Inc.

- 3M

- SATO Holdings Corporation

- Zebra Technologies Corporation

- Intelligent Label Solutions

- SML Group

- SICPA Holding SA

- Systech International

- Applied DNA Sciences Inc.

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 179.39 BN |

| Market Size in 2030 (Value) | USD 368.43 BN |

| CAGR | 12.77% |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD BN), Volume (Billion Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

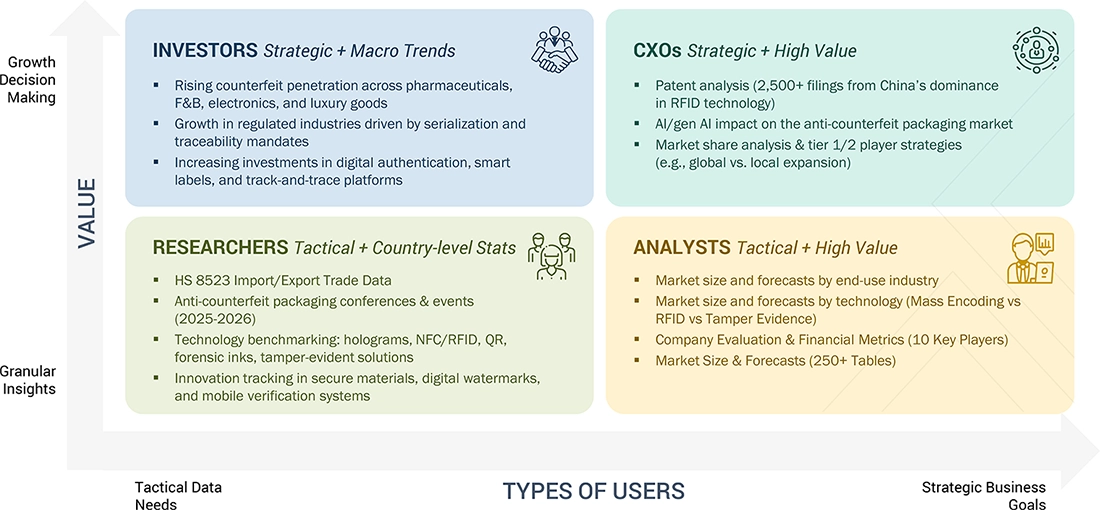

WHAT IS IN IT FOR YOU: ANTI-COUNTERFEIT PACKAGING MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based Anti-counterfeit Packaging Manufacturers |

|

|

| RFID-based Anti-counterfeit Packaging Manufacturers |

|

|

| Hologram-based Anti-counterfeit Packaging Manufacturers |

|

|

RECENT DEVELOPMENTS

- April 2024 : Avery Dennison expanded its AD Pure range, fully plastic-free inlays and tags made with innovative paper-based antenna technology.

- January 2024 : Avery Dennison launched AD 2Metal Rock M781, an RFID tag for harsh conditions, suitable for metal, liquids, and curved or flat surfaces.

- October 2023 : Avery Dennison acquired Silver Crystal Group, specializing in sports apparel customization for in-venue, B2B, and e-commerce platforms.

- May 2023 : SATO International America acquired Stafford Press, a North American provider of inkjet on-demand horticulture tags and labels.

- April 2023 : Avery Dennison acquired Lion Brothers (LG Group, Inc.), a designer and manufacturer of apparel brand embellishments.

Table of Contents

Methodology

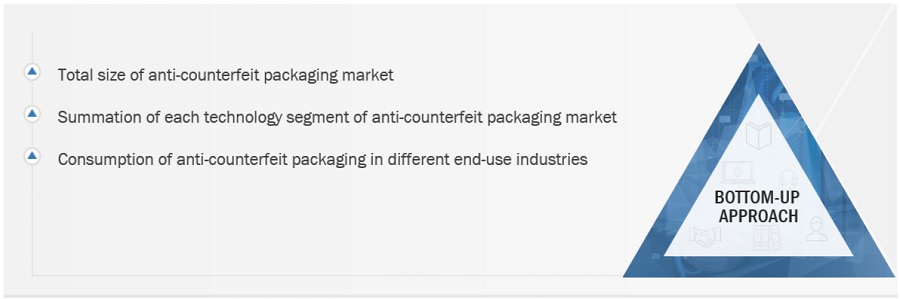

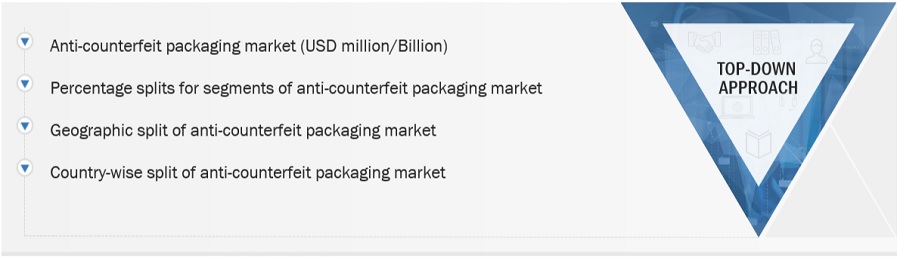

The study involved four major activities for estimating the current global size of the anti-counterfeit packaging market. Exhaustive secondary research was conducted to gather information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of anti-counterfeit packaging through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the anti-counterfeit packaging market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study on the anti-counterfeit packaging market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

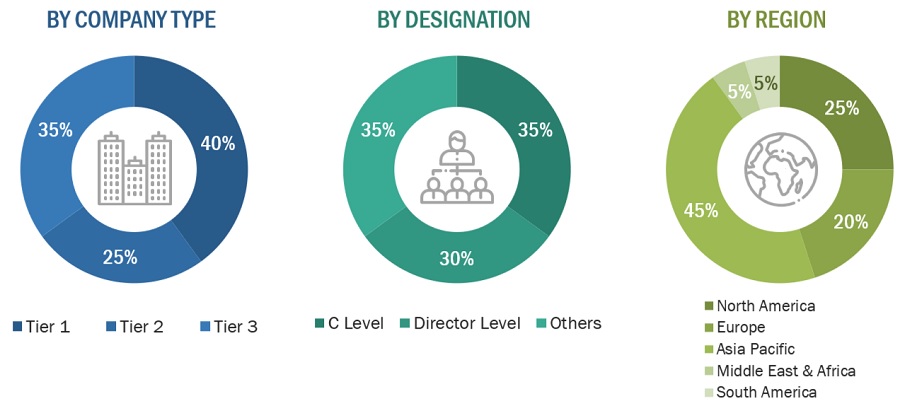

Various primary sources from both the supply and demand sides of the anti-counterfeit packaging market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the anti-counterfeit packaging industry. The breakdown of the profiles of primary respondents is as follows:

Breakdown of Primary Interviews

Notes: Companies are classified based on their revenue–Tier 1 = >USD 5 billion, Tier 2 = USD 1 billion to USD 5 billion, and Tier 3 = <USD 1 billion.

Others include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the anti-counterfeit packaging market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the anti-counterfeit packaging market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

In addition, the market size was validated by using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources—top-down approach, bottom-up approach, and expert interviews. The data were assumed to be correct when the values arrived at from the three sources matched.

Market Definition

Anti-counterfeiting involves various methods and techniques to protect products from being illegally duplicated, distributed, or sold. Anti-counterfeit packaging encompasses any packaging that integrates features or technologies designed to prevent unauthorized parties from copying, tampering with, or diverting the product. These features can be visible, hidden, or forensic, based on the required level of security and verification. The technologies used in anti-counterfeit packaging are mass encoding, RFID, holograms, forensic markers, and others. These technologies can be utilized in various types of packaging, such as bottles, cartons, and bags. They can either be integrated into the packaging materials themselves or added as separate components. The anti-counterfeit packaging solution is widely used in the end-use industries such as pharmaceutical, personal care, and food & beverage.

Key Stakeholders

- Raw material suppliers

- Packaging manufacturers & suppliers

- Logistics & shipment companies

- Technology companies

- Traders & distributors of anti-counterfeit and authentication packaging

- Commercial R&D institutions

- Industry associations and regulatory bodies

- Retailers

- End users

Research Objectives

- To estimate and forecast the anti-counterfeit packaging market, in terms of value and volume

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To define, describe, and forecast the market size, based on technology, end-use industry and region

- To forecast the market size along with segments and submarkets, in key regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and South America along with their key countries

- To strategically analyze micro markets, with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as acquisition, expansion, and new product development in the anti-counterfeit packaging market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the anti-counterfeit packaging report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the anti-counterfeit packaging market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Anti-Counterfeit Packaging Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Anti-Counterfeit Packaging Market