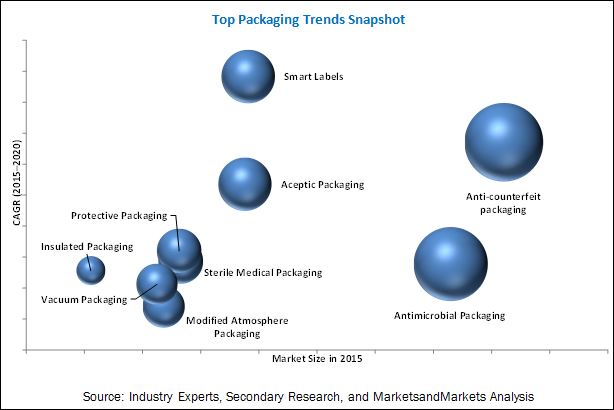

Top Packaging Trends – (Aseptic Packaging, Insulated Packaging, Antimicrobial Packaging, Modified Atmosphere Packaging, Protective Packaging, Smart Labels, Sterile Packaging, Anti-counterfeit Packaging, and Vacuum Packaging) - Forecast to 2021

[137 Pages Report] The report on top packaging trends provides a detailed information regarding the major factors influencing the growth of each trend/market (drivers, restraints, opportunities, and challenges). It also includes the key players’ profiles and analysis of their recent developments for the top packaging trends.

The objectives of the study are as follows:

- To define, describe, and forecast the packaging market segmented on the basis of type/ technology.

- To provide detailed information regarding the major factors influencing the growth of the packaging market (drivers, restraints, opportunities, and industry-specific challenges).

- To analyze the opportunities in the market for various stakeholders by identifying the high-growth segments of the top packaging trends.

- To profile the key players and comprehensively analyze their market position in terms of the ranking and core competencies, along with detailing the competitive landscape for the market leaders.

- To analyze competitive developments such as partnerships and joint ventures, mergers and acquisitions, product developments, expansions, and research and development in the packaging market

The research methodology used to estimate and forecast the packaging market begins with obtaining data on key vendor revenues through secondary research. Some of the secondary sources used in this research include information from various journals and databases such as published journals, Factiva, Hoovers, and OneSource. The vendor offerings have also been taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the overall size of the packaging market from the revenues of the key players in the market. After arriving at the overall market size, the total market has been split into several segments and subsegments which have been then verified through primary research by conducting extensive interviews with people holding key positions in the industry such as CEOs, VPs, directors, and executives. The market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

The top packaging trends ecosystem has various key players such as Amcor Limited. (Australia), E.I. du Pont de Nemours and Company (U.S.), Bemis company, Inc. (U.S.), Sonoco Products Company (U.S.), Huhtamaki OYJ (Finland), Linpac Packaging (U.K.), The Dow Chemical Company (U.S.), Avery Dennison (U.S.), Sealed Air Corporation (U.S.), and Coveris Holdings S.A. (U.S.).

Target Audience

- Raw material suppliers

- Packaging manufacturers

- Logistics & shipment companies

- Packaging industry experts

- Traders and distributors of packaging

- Commercial packaging R&D institutions

- Associations and industry bodies

- Regulatory bodies

- End-use sectors such as food & beverages, home & personal care products, and pharmaceuticals

“The study answers several questions for the target audiences, primarily which market segments to focus on in the next two to five years for prioritizing the efforts and investments.”

To know about the assumptions considered for the study, download the pdf brochure

Scope of the Report:

In this report, the top packaging trends has been segmented into the following categories:

Aseptic Packaging Market

- Executive Summary

- Drivers, Restraints, Opportunities, and Challenges

- By Type

Sterile Packaging Market

- Executive Summary

- Drivers, Restraints, Opportunities, and Challenges

- By Type

Modified Atmosphere Packaging Market

- Executive Summary

- Drivers, Restraints, Opportunities, and Challenges

- By Machinery/Technology

Antimicrobial Packaging Market

- Executive Summary

- Drivers, Restraints, Opportunities, and Challenges

- By Pack Type

Vacuum Packaging Market

- Executive Summary

- Drivers, Restraints, Opportunities, and Challenges

- By Pack Type

Anti-counterfeit Packaging Market

- Executive Summary

- Drivers, Restraints, Opportunities, and Challenges

- By Technology

Smart Labels Market

- Executive Summary

- Drivers, Restraints, Opportunities, and Challenges

- By Technology

Insulated Packaging Market

- Executive Summary

- Drivers, Restraints, Opportunities, and Challenges

- By Type

Protective Packaging Market

- Executive Summary

- Drivers, Restraints, Opportunities, and Challenges

- By Type

Available Customization

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Breakdown of the major regions and countries

Company Information

- Detailed analysis and profiling of additional market players (Up to five)

In this report on top packaging trends, the packaging market has been segmented on the basis of technology and type. In the anti-counterfeit packaging market, the pharmaceutical & healthcare segment is projected to be the fastest-growing end-use sector that requires advanced packaging technologies to prevent counterfeiting of medicines and healthcare products. On the basis of technology, the RFID segment is projected to grow at highest rate during the forecast period in the anti-counterfeit packaging market, due to its ability to read and capture information stored on the tag attached to the product.

In the modified atmosphere packaging market, deep-drawing machines dominated the market in 2015; the segment is projected to grow at a moderate CAGR during the forecast period. Deep-drawing machine is a package wrapping machine. Horizontal and vertical flow packaging machines are machines that are majorly used for sealed packaging through gas flushing and shrink packing. Hence, both these machines have unique functionalities, which are frequently used for MAP (modified atmosphere packaging). The global MAP machinery/technology market is projected to register a constant growth between 2016 and 2021, due to various innovations and technological advancements in the field of MAP machinery/technology.

The aseptic packaging market has been growing in accordance with the packaging industry. Factors such as increasing urban population, demand for pharmaceutical supplies, and the changing mindset of consumers towards the usage of food preservatives have driven the growth of the global aseptic packaging industry. With increasing demand for convenience and quality food products, people are opting for packaged food products, which is an opportunity to aseptic packaging manufacturers.

A smart label is a conventional print-coded label, with an extremely flat item identification chip inside it, which includes chips, antenna, transceivers, and bonding wires. It is usually made of paper, fiber, or plastics. Along with its ability to identify products in the supply chain, smart labels also allow companies to share the product location; this ability to share information about the location of products makes smart labels a potentially useful technology. Additionally, smart labels can also provide protection against theft, loss, and counterfeiting. Smart labels provide better tolerance in fully automated reading from a certain specified distance, which eliminates errors and improves efficiency. The technology segment of the smart labels market includes electronic article surveillance (EAS) labels, radio frequency identification (RFID) labels, sensing labels, and electronic shelf labels (ESL)/dynamic display labels. The smart labels market is in its growth phase. In 2015, RFID labels accounted for the maximum share in the overall smart labels market, whereas the ESL market, a newly introduced technology, is expected to grow at the highest rate from 2016 to 2021. The EAS labels market is in the matured phase and is expected to grow at a relatively slower rate during the forecast period.

The need for high initial capital investments has caused an unfavorable impact on the profitability of the packaging industry. The global top packaging trends is dominated by players such as Amcor Limited (Australia), E.I. du Pont de Nemours and Company (U.S.), Bemis Company Inc. (U.S.), Sonoco Products Company (U.S.), Huhtamaki OYJ (Finland), Linpac packaging (U.K.), The Dow Chemical Company (U.S.), Avery Dennison (U.S.), Sealed Air Corporation (U.S.), and Coveris Holdings S.A. (U.S.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definitions

1.2.1 Aseptic Packaging

1.2.2 Sterile Packaging

1.2.3 Modified Atmosphere Packaging

1.2.4 Antimicrobial Packaging

1.2.5 Vacuum Packaging

1.2.6 Anti-Counterfeit Packaging

1.2.7 Smart Labels

1.2.8 Insulated Packaging

1.2.9 Protective Packaging

1.3 Currency

1.4 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

3 Aseptic Packaging (Page No. - 19)

3.1 Executive Summary

3.2 Drivers, Restraints, Opportunities, and Challenges

3.2.1 Drivers

3.2.1.1 Increasing Urban Population

3.2.1.2 Growing Demand for Pharmaceutical Supplies

3.2.1.3 Changing Mindset of Consumer Towards Use of Food Preservatives

3.2.1.4 Growth of the Dairy Beverage Market

3.2.1.5 Growing Demand for Convenience and Quality Food Products

3.2.1.6 Growth of the Parent Industry

3.2.2 Restraints

3.2.2.1 High Initial Capital Investment Involved

3.2.2.2 Need for Higher Technological Understanding Than Other Packaging Forms

3.2.3 Opportunities

3.2.3.1 Emergence of New Product Developments

3.2.3.2 Improved Equipment and Technologies

3.2.3.3 Electronic Business Processing

3.2.3.4 Emerging Nutraceutical Market

3.2.3.5 Growth in the Usage of Self-Administered Drugs

3.2.4 Challenges

3.2.4.1 Varying Environmental Mandates Across Regions

3.2.4.2 Cost to Benefit Ratio A Concern to Small Manufacturers

3.2.4.3 High Research & Development Investment

3.2.4.4 Difficulty in Management of the Packaging Supply Chain

3.3 Ascepting Packaging Market, By Type

3.3.1 Cartons

3.3.2 Bottles & Cans

3.3.3 Bags & Pouches

3.3.4 Pre-Filled Syringes

3.3.5 Vials & Ampoules

3.3.6 Others

4 Sterile Packaging (Page No. - 26)

4.1 Executive Summary

4.2 Drivers, Restraints, Opportunities, and Challenges

4.2.1 Drivers

4.2.1.1 Increased Health Awareness

4.2.1.2 Growing Demand From Healthcare Industry

4.2.1.3 Aging Population

4.2.2 Restraints

4.2.2.1 Stringent Regulations

4.2.3 Opportunities

4.2.3.1 New Product Development and Continuous Innovations in Pharmaceuticals

4.2.3.2 Developing New Sustainable Packaging Options

4.2.4 Challenges

4.2.4.1 Maintaining Medical Packaging Integrity

4.3 Sterile Medical Packaging Market, By Type

4.3.1 Introduction

4.3.2 Thermoform Trays

4.3.3 Sterile Bottles & Containers

4.3.4 Vials & Ampoules

4.3.5 Pre-Fillable Inhalers

4.3.6 Sterile Closures

4.3.7 Pre-Filled Syringes

4.3.8 Blister & Clamshells

4.3.9 Bags & Pouches

4.3.10 Wraps

4.3.11 Other Sterile Medical Packaging

5 Modified Atmosphere (Page No. - 36)

5.1 Executive Summary

5.2 Drivers, Restraints, Opportunities, and Challenges

5.2.1 Drivers

5.2.1.1 Hygienic Packaging of Food: A Critical Driver in the Packaging Industry

5.2.1.2 Increasing Demand for Fresh and Quality Packaged Food

5.2.1.3 Manufacturers’ Demand for A Longer Shelf-Life

5.2.1.4 On-The-Go Lifestyle to Impel the Growth of the Food Packaging Technology & Equipment Market

5.2.1.5 Shift Towards Easy-To-Handle and Convenient Packaging

5.2.2 Restraints

5.2.2.1 High Cost of Development

5.2.2.2 Stringent Environmental Legislations

5.2.3 Opportunities

5.2.3.1 Emerging Economies: High Growth Potential Markets

5.2.3.2 Consumer Gaining Confidence on Food Safety

5.2.3.3 Packaging as A Tool for Product Differentiation

5.2.4 Challenges

5.2.4.1 Providing the Right Mix of Gases in Map Technology

5.2.4.2 High Level of Competition in the Modified Atmosphere Packaging Industry

5.3 Modified Atmosphere Packaging Machinery/Technology

5.3.1 Introduction

5.3.2 Deep-Drawing Machine

5.3.3 Horizontal & Vertical Flow Packaging Machine

5.3.4 Tray Sealing Machine

5.3.5 Vacuum Chamber Machine

5.3.6 Bag Sealing Machine

5.3.7 Others Machinery/Technology

6 Antimicrobial Packaging (Page No. - 49)

6.1 Executive Summary

6.2 Drivers, Restraints, Opportunities, and Challenges

6.2.1 Drivers

6.2.1.1 Rising Concerns About Food Wastage

6.2.1.2 Growing Consumer Awareness About Health Related Issues

6.2.2 Restraints

6.2.2.1 Fluctuations in Raw Material Prices

6.2.3 Opportunities

6.2.3.1 Rising Consumption of Products With Shorter Shelf Life

6.2.3.2 Increasing Demand From the Healthcare Sector

6.2.4 Challenges

6.2.4.1 Variations in Laboratory Viability Results and Actual/Practical Food Conditions

6.2.4.2 Compliance to Stringent Regulations

6.3 Antimicrobial Packaging Market, By Pack Type

6.3.1 Carton Packages

6.3.2 Trays

6.3.3 Bags

6.3.4 Cups & Lids

6.3.5 Others

7 Vacuum Packaging (Page No. - 56)

7.1 Executive Summary

7.2 Drivers, Restraints, Opportunities, and Challenges

7.2.1 Drivers

7.2.1.1 Hygienic Packaging of Food: A Critical Driver in the Packaging Industry

7.2.1.2 Manufacturers’ Demand for A Longer Shelf-Life

7.2.1.3 Shift Towards Easy-To-Handle and Convenient Packaging

7.2.1.4 Growth in Pharmaceutical Industry

7.2.1.5 Growth of the Parent Industry

7.2.2 Restraints

7.2.2.1 High Cost of Development

7.2.3 Opportunities

7.2.3.1 Emerging Economies: High-Growth Potential Markets

7.2.3.2 Sustainable Packaging: High Focus on Not Just Recycle But Reuse

7.2.3.3 Emergence of New Technologies

7.2.3.4 Growth of the E-Commerce Industry

7.2.4 Challenges

7.2.4.1 Variation in Environmental Mandates Across Regions

7.2.4.2 Difficulty in Managing the Vacuum Packaging Supply Chain

7.3 Vacuum Packaging Market, By Pack Type

7.3.1 Introduction

7.3.2 Flexible Packaging

7.3.3 Semi-Rigid Packaging

7.3.4 Rigid Packaging

8 Anti-Counterfeit Packaging (Page No. - 66)

8.1 Executive Summary

8.2 Drivers, Restraints, Opportunities, and Challenges

8.2.1 Drivers

8.2.1.1 Laws & Regulations Enforced By Governments

8.2.1.2 Increase in Awareness Programs Among Consumers With Regards to Secure Packaging

8.2.1.3 Increasing Focus of Manufacturers on Brand Protection

8.2.1.4 Maintaining an Efficient Supply Chain

8.2.1.5 Growth of the Parent Industry

8.2.2 Restraints

8.2.2.1 Existence of Technologies That are Deterrent to Counterfeiters

8.2.2.2 Huge Set-Up Costs

8.2.3 Opportunities

8.2.3.1 Growing Demand in Emerging Industrial Markets

8.2.3.2 Remote Authentication of Products

8.2.4 Challenges

8.2.4.1 Spreading Awareness of Anti-Counterfeit Technologies Used By the Manufacturers Among Consumers

8.2.4.2 High Research & Development Investment

8.3 Anti-Counterfeit Packaging Market, By Technology

8.3.1 Introduction

8.3.2 Coding & Printing

8.3.3 RFID (Radio-Frequency Identification)

8.3.4 Holograms

8.3.5 Security Labels

8.3.6 Packaging Designs

8.3.7 Others

9 Smart Labels Market (Page No. - 73)

9.1 Executive Summary

9.2 Drivers, Restraints, Opportunities, and Challenges

9.2.1 Drivers

9.2.1.1 Protection Against Theft, Loss, and Counterfeiting

9.2.1.2 Lack of Human Intervention

9.2.1.3 A Single Product Can Be Used Instead of Multiple Existing Technologies

9.2.1.4 Overall Reduction in Tracking Time

9.2.1.5 Reliable and Easy Real-Time Tracking

9.2.2 Restraints

9.2.2.1 Lack of Standards

9.2.2.2 Additional Cost Incurred Due to the Use of Smart Labels

9.2.3 Opportunities

9.2.3.1 Increasing Demand in Logistics

9.2.3.2 Technological Advancements in Printed Electronics

9.2.3.3 Introduction of New Technologies Such as Electronic Shelf/Dynamic Display Labels

9.2.3.4 Huge Opportunities in the Healthcare, Automotive, and Chemical Sectors

9.2.4 Challenges

9.2.4.1 Reflection and Absorption of Rf Signals By Metallic and Liquid Objects

9.2.4.2 Reducing Cost of Printed Electronics

9.3 Smart Labels, By Technology

9.3.1 Introduction

9.3.2 Electronic Article Surveillance Labels (EAS)

9.3.2.1 Acousto-Magnetic (AM) EAS

9.3.2.2 Microwave EAS

9.3.2.3 Electro-Magnetic (AM) EAS

9.3.2.4 UHF, Gen 2 RFID EAS

9.3.3 RFID Labels

9.3.3.1 Low Frequency (LF) RFID

9.3.3.2 High Frequency (HF) RFID

9.3.3.3 Ultra-High Frequency RFID

9.3.4 Sensing Labels

9.3.4.1 Position/Tilt Sensing Labels

9.3.4.2 Chemical Sensing Labels

9.3.4.3 Humidity Sensing Labels

9.3.4.4 Temperature Sensing Labels

9.3.5 Dynamic Display Labels

9.3.6 Near Field Communication Tags (NFC)

10 Insulated Packaging Market (Page No. - 87)

10.1 Executive Summary

10.2 Drivers, Restraints, Opportunities, and Challenges

10.2.1 Drivers

10.2.1.1 Increasing Production and Consumption of Temperature-Sensitive Goods: Key Driver for Insulated Packaging Market

10.2.1.2 Increasing Production and Consumption of Temperature-Sensitive Goods

10.2.1.3 Increasing Urban Population

10.2.1.4 Growing E-Commerce Industry

10.2.2 Food & Beverages Sector: Leading Market of Insulated Packaging

10.2.2.1 Development in the Food & Beverages Sector

10.2.3 Restraints

10.2.3.1 Rise in Raw Material Cost: Key Restraint for the Growth of Insulated Packaging Market

10.2.3.2 Rise in Raw Material Cost

10.2.3.3 Stringent Government Rules & Regulations

10.2.4 Opportunities

10.2.4.1 Developing Countries: Opportunity for the Packaging Industry

10.2.4.2 Developing Countries: High Potential Growth Markets for Insulated Packaging Industry

10.2.4.3 Growth in Pharmaceuticals Industry

10.2.5 Challenge

10.2.5.1 Fluctuations in Prices of Raw Materials

10.3 Insualted Packaging Market, By Type

10.3.1 Introduction

10.3.2 Boxes & Containers

10.3.3 Bags & Pouches

10.3.4 Wraps

10.3.5 Others

11 Protective Packaging (Page No. - 95)

11.1 Executive Summary

11.2 Drivers, Restraints, Opportunities, and Challenges

11.2.1 Drivers

11.2.1.1 Rising Trend of Online Shopping

11.2.1.2 Rising Disposable Income

11.2.1.3 Improving Global Manufacturing Activities

11.2.2 Restraints

11.2.2.1 Stringent Government Rules & Regulations

11.2.3 Opportunities

11.2.3.1 Emerging Economies

11.2.3.2 Investment in R&D Activities

11.2.4 Challenges

11.2.4.1 Fluctuations in Prices of Raw Materials

11.3 Protective Packaging Market, By Type

11.3.1 Introduction

11.3.2 Rigid Protective Packaging

11.3.3 Flexible Protective Packaging

11.3.4 Foam Protective Packaging

12 Company Profiles (Page No. - 101)

(Overview, Financial*, Products & Services, Strategy, and Developments)

12.1 Amcor Ltd

12.2 E.I. Du Pont De Nemours and Company

12.3 Bemis Company

12.4 Sonoco Products Company

12.5 Huhtamaki OYJ

12.6 Linpac Packaging

12.7 The DOW Chemical Company

12.8 Avery Dennison

12.9 Sealed Air Corporation

12.10 Coveris Holdings S.A.

*Details Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 133)

13.1 Knowledge Store: Marketsandmarkets Subscription Portal

13.2 Introducing RT: Real-Time Market Intelligence

13.3 Author Details

List of Tables (21 Tables)

Table 1 Sterile Medical Packaging Market Size, By Type, 2013–2020 (USD Million)

Table 2 Sterile Medical Packaging Market Size, By Type, 2013–2020 (Million Units)

Table 3 Modified Atmosphere Packaging Machinery/Technology Market Size, 2013–2020 (USD Million)

Table 4 Deep-Drawing Machines in Modified Atmosphere Packaging Market Size, By Region 2013–2020 (USD Million)

Table 5 Horizontal and Vertical Flow Packaging Machine in Modified Atmosphere Packaging Market Size, By Region 2013–2020 (USD Million)

Table 6 Tray Sealing Machine in Modified Atmosphere Packaging Market Size, By Region 2013–2020 (USD Million)

Table 7 Vacuum Chamber Machine in Modified Atmosphere Packaging Market Size, By Region 2013–2020 (USD Million)

Table 8 Bag Sealing Machine in Modified Atmosphere Packaging Market Size, By Region 2013–2020 (USD Million)

Table 9 Others in Modified Atmosphere Packaging Market Size, By Region 2013–2020 (USD Million)

Table 10 Vacuum Packaging Market Size, By Pack Type, 2013–2020 (USD Million)

Table 11 Vacuum Packaging Market Size, By Pack Type, 2013–2020 (Million Units)

Table 12 Anti-Counterfeit Packaging Market Size, By Technology, 2013–2020 (USD Billion)

Table 13 Anti-Counterfeit Packaging Market Size, By Technology, 2013–2020 (Billion Units)

Table 14 List of Various Materials & Their Effect on Rf Signals

Table 15 Smart Labels Market Size, By Technology, 2014–2021 (USD Million)

Table 16 Smart Labels Market Size, By Technology, 2014–2021 (Million Units)

Table 17 Benefits of RFID Labels

Table 18 Insulated Packaging Market Size, By Packaging Type, 2013–2020 (USD Million)

Table 19 Insulated Packaging Market Size, By Packaging Type, 2013–2020 (KT)

Table 20 Protective Packaging Market Size, By Product Type, 2013–2020 (USD Million)

Table 21 Protective Packaging Market Size, By Product Type, 2013–2020 (MT)

List of Figures (38 Figures)

Figure 1 Revenue Generated By Pharmaceuticals and Medicines in the U.S.

Figure 2 Global Aging Population, 2010–2015

Figure 3 Number of Recalls, 2010–2012

Figure 4 Sterile Medical Packaging Market Size, By Type, 2015 & 2020 (USD Million)

Figure 5 Deep-Drawing Machine is Expected to Dominate the Modified Atmosphere Packaging Machinery/Technology Market, From 2015 to 2020

Figure 6 North America is the Largest Market for Deep-Drawing Machine

Figure 7 North America is the Largest Market for Horizontal & Vertical Flow Packaging Machines Used in Modified Atmosphere Packaging

Figure 8 Asia-Pacific is the Fastest Growing Market for Tray-Sealing Machines Used in Modified Atmosphere Packaging

Figure 9 North America is the Largest Market for Vacuum Chamber Machine Used in Modified Atmosphere Packaging

Figure 10 Asia-Pacific is the Fastest-Growing Market for Bag Sealing Machines Used in Modified Atmosphere Packaging

Figure 11 Asia-Pacific is the Fastest-Growing Market for the Others Machiney/Technology Used in Modified Atmosphere Packaging

Figure 12 Price Fluctuations in Natural Gas From 2008–2011

Figure 13 Price Fluctuations in Aluminum, 2011–2015

Figure 14 Meat Production in North America, 2014

Figure 15 Revenue Generated By Pharmaceuticals and Medicines in the U.S. (2014–2015)

Figure 16 Global E-Commerce Industry Market Size, 2013–2015

Figure 17 Vacuum Packaging Market, By Pack Type, 2015 vs 2020 (USD Million)

Figure 18 Anti-Counterfeit Packaging Market, By Technology, 2015 vs 2020, (USD Billion)

Figure 19 Global Sources of Shrinkage, By Source, 2014

Figure 20 Smart Labels Market Size, By Technology, 2015 vs 2021 (USD Million)

Figure 21 High-Frequency RFID Labels Dominated the Smart Labels Market in Terms of Value in 2015

Figure 22 Global Urban Population (% of Total Population)

Figure 23 Insulated Packaging Industry Market, By Packaging Type, 2015 & 2020 (KT)

Figure 24 Protective Packaging Market Size, By Product Type, 2015 & 2020

Figure 25 Amcor Limited: Company Snapshot

Figure 26 Amcor Limited: SWOT Analysis

Figure 27 E.I. Du Pont De Nemours and Company: Company Snapshot

Figure 28 E.I. Du Pont De Nemours and Company: SWOT Analysis

Figure 29 Bemis Company, Inc.: Company Snapshot

Figure 30 Bemis Company, Inc.: SWOT Analysis

Figure 31 Sonoco Products Company: Company Snapshot

Figure 32 Sonoco Products Company: SWOT Analysis

Figure 33 Huhtamaki OYJ: Company Snapshot

Figure 34 Huhtamaki OYJ: SWOT Analysis

Figure 35 The DOW Chemical Company: Company Snapshot

Figure 36 Avery Dennison Corporation: Company Snapshot

Figure 37 Sealed Air Corporation: Company Snapshot

Figure 38 Coveris Holdings S.A.: Company Snapshot

Growth opportunities and latent adjacency in Top Packaging Trends