AI Governance Market

AI Governance Market by Functionality (Model Lifecycle Management, Risk & Compliance, Monitoring & Auditing, Ethics & Responsible AI), Product Type (End-to-end AI Governance Platforms, MLOps & LLMOps Tools, Data Privacy Tools) - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global AI governance market is projected to grow from USD 0.89 billion in 2024 to USD 5.78 billion by 2029, expanding at a CAGR of 45.3%. This rapid growth is being driven by the convergence of regulatory mandates, ethical AI imperatives, and the increasing deployment of AI in high-stakes decision-making environments.As AI systems become embedded in critical sectors such as healthcare, insurance, finance, and defense, the risks of algorithmic bias, data privacy violations, and opaque decision-making have come under intense scrutiny. Regulatory bodies are responding with comprehensive frameworks, including The EU AI Act, OECD AI Principles, NIST AI Risk Management Framework, These regulations mandate transparency, accountability, and explainability in AI systems, compelling enterprises to adopt AI governance platforms that support Model risk management, Bias detection and mitigation, Auditability and traceability, Compliance reporting. Enterprises are under growing pressure from stakeholders, investors, and consumers to ensure that AI systems are Fair and unbiased, secure and privacy-preserving, Aligned with human values and societal norms. The increasing frequency of high-profile AI failures—such as biased lending algorithms, facial recognition inaccuracies, and unintended discrimination—has elevated the importance of governance-by-design approaches.Organizations are seeking comprehensive AI governance solutions that span the entire AI lifecycle, including Data governance and lineage tracking, Model validation and monitoring, Policy enforcement and access controls, Incident response and remediation. Vendors are responding with modular, scalable platforms that integrate with MLOps, data science, and compliance ecosystems, enabling real-time oversight and continuous assurance.

KEY TAKEAWAYS

-

BY REGIONNorth America is estimated to account for the largest share (40.1%) of the AI governance market in 2024.

-

BY PRODUCT TYPEThe MLOps tools segment is expected to lead the market growth with a CAGR of 49.0% during the forecast period.

-

BY FUNCTIONALITYThe risk management & compliance segment is expected to grow at the highest CAGR of 49.2% during the forecast period.

-

BY END USERThe BFSI segment is estimated to account for the largest market share of 18.0% in 2024.

-

COMPETITIVE LANDSCAPE- Key PlayersKey players such as IBM, Securiti, Fiddler, and 2021.AI are shaping the market through Scalable AI governance platforms, Integrated model risk management frameworks, Strategic partnerships with cloud and MLOps providers, AI observability and automated compliance reporting.

-

COMPETITIVE LANDSCAPE-StartupsMonitaur, 2021.AI, and Fairly AI have distinguished themselves among startups and SMEs through robust product portfolios and effective business strategies.

The AI Governance market is rapidly maturing as enterprises prioritize responsible AI deployment, regulatory compliance, and risk mitigation. Organizations are increasingly adopting AI observability, model risk management, and compliance automation to ensure that AI systems are transparent, accountable, and ethically aligned. Leading vendors such as IBM, Securiti, Fiddler, and 2021.AI are delivering enterprise-grade AI governance platforms that integrate MLOps, automated audit reporting, and continuous model monitoring to support scalable, compliant AI operations.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The AI governance market is reshaping enterprise operations as organizations adopt solutions for model risk management, compliance automation, AI observability, and ethical AI frameworks. Key drivers include rising regulatory requirements, demand for explainable AI, bias mitigation, and data privacy compliance. Emerging trends such as integration with MLOps platforms, automated audit-ready reporting, continuous model monitoring, and generative AI–driven explainability enhance operational transparency and accountability. Scalable AI governance tools enable enterprises to reduce regulatory risk, improve model reliability, and ensure ethical AI adoption. Vendors benefit by delivering high-demand solutions that support responsible AI, regulatory alignment, and enterprise-wide risk management, driving market growth.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Awareness of risk mitigation efforts prompting investments in AI governance tools

-

Need for compliance, credibility, safety, and decision-making fuels adoption of governance solutions.

Level

-

Lack of harmonized global standards for AI governance

Level

-

Growing demand for ethical AI creating opportunities in bias mitigation solutions

-

Rising adoption of AI by SMEs fueling demand for scalable governance solutions.

Level

-

Resistance to change in established workflows

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Awareness of risk mitigation efforts prompting investments in AI governance tools

The growing awareness of AI-related risks—including algorithmic bias, data breaches, and regulatory non-compliance—is driving significant investment in AI governance tools. Between 2019 and 2023, global investments in AI governance reached USD 13 billion, with USD 6.9 billion allocated to MLOps and model monitoring, USD 1.6 billion directed toward data privacy and compliance automation. Organizations are prioritizing AI observability and explainability, Model risk management, Enterprise-wide accountability dashboards. These investments reflect a shift toward proactive governance frameworks that ensure ethical, secure, and auditable AI operations.

Restraint: Lack of harmonized global standards for AI governance

The lack of harmonized global standards for AI governance is a major barrier to scalable adoption. Enterprises must navigate a patchwork of region-specific regulations, including The EU AI Act, China’s AI accountability guidelines, U.S. sector-specific compliance frameworks, India’s AI ethics and data privacy mandates. This regulatory fragmentation forces organizations to implement multiple governance strategies, increasing Operational complexity, Compliance costs, Deployment timelines. The absence of universal frameworks limits the scalability of AI governance solutions, despite rising demand.

Opportunity: Growing demand for ethical AI creating opportunities in bias mitigation solutions

The global push for ethical AI is creating significant opportunities in bias detection, fairness auditing, and explainable AI. Enterprises and regulators are increasingly adopting Bias mitigation tools (e.g., Microsoft Azure’s Fairlearn), Model transparency frameworks, Accountability dashboards. Key sectors such as recruitment, healthcare, and law enforcement are deploying these solutions to ensure Fair decision-making, Regulatory compliance, Public trust in AI systems. Vendors offering scalable, domain-specific bias mitigation and model monitoring tools are well-positioned to lead in the ethical AI market.

Challenge: Resistance to change in established workflows

Despite growing awareness, many organizations face internal resistance to adopting AI governance frameworks. Key challenges include Disruption to existing workflows, Integration complexity with legacy systems, Perceived cost and time burdens. This resistance slows down framework development, audit readiness, and compliance automation. To overcome this, vendors must Offer targeted training and change management support, Demonstrate ROI and regulatory benefits, Provide plug-and-play integrations with existing MLOps and data platforms.

AI GOVERNANCE MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

GF-Forsikring partnered with 2021.AI to develop an ML-based fraud detection model on the Grace AI Platform, ensuring regulatory compliance and operational efficiency. | The solution detected 76% of hidden fraudulent claims, enhanced compliance readiness, and enabled scalable, adaptable AI model development for future use. |

|

Tide leveraged Fiddler’s AI Observability platform to scale machine learning solutions, enhance model transparency, and align performance with business goals. | Tide reduced troubleshooting time, improved model interpretability, and prioritized high-impact ML projects to drive operational efficiency and growth. |

|

LinkGRC partnered with 2021.AI to implement AI-driven governance automation, enhancing compliance monitoring, regulatory intelligence, and adaptive risk management across its enterprise GRC platform. | The AI governance solution improved compliance accuracy, automated regulatory monitoring, and strengthened customers’ ability to manage evolving governance requirements proactively. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The AI governance market is a diverse ecosystem, with specialized vendors, such as BreezeML and Trustible, addressing bias and compliance. At the same time, cloud hyperscalers, such as Google and AWS, integrate governance into their platforms. Transparency players like causaLens focus on model explainability, and MLOps vendors like Arize automate governance in the AI lifecycle. Data governance firms like Collibra, alongside privacy vendors such as OneTrust, ensure compliance with data regulations, creating a comprehensive governance framework

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

AI Governance Market, By Product Type

The MLOps tools segment is the fastest-growing in the AI governance market, driven by the need for end-to-end model lifecycle management. These platforms offer Version control and model lineage tracking, Automated monitoring and deployment orchestration, Compliance tracking and audit-ready reporting. Integrated features such as explainable AI, bias detection, and governance dashboards ensure that AI models remain Transparent and accountable, Aligned with regulatory frameworks, Operationally efficient and scalable. As AI pipelines grow in complexity, MLOps platforms are becoming essential for embedding governance-by-design into enterprise AI strategies.

AI Governance Market, By Functionality

Risk management and compliance functionality is the leading segment, addressing the growing need for proactive model risk monitoring, bias and fairness auditing, data privacy enforcement, and regulatory compliance tracking. These tools support explainability, accountability, and ethical AI standards, helping organizations reduce legal and reputational risks, ensure alignment with global AI regulations, maintain trust in AI-driven decisions. As regulatory frameworks like the EU AI Act and NIST AI RMF gain traction, risk and compliance capabilities are becoming non-negotiable components of robust AI governance strategies.

AI Governance Market, By End User

The manufacturing sector is the fastest-growing end-user segment, driven by the widespread use of AI in Predictive maintenance, Process automation, Quality control and defect detection. These mission-critical applications require governance frameworks to ensure Model reliability and performance monitoring, Regulatory compliance and auditability, Fairness and explainability in AI-driven decisions. Global manufacturers are adopting AI governance platforms to manage complex AI workflows, reduce operational risks, and ensure safe, ethical, and compliant AI deployment across production environments.

REGION

Asia Pacific to be the fastest-growing region in the AI Governance Market during the forecast period

Asia Pacific is the fastest-growing region in the AI governance market, driven by rapid enterprise AI adoption, stricter regulatory compliance, and rising demand for explainable AI, algorithmic risk management, and model monitoring solutions. Countries like Japan, where NEC Corporation integrates transparency and fairness into AI offerings, and India, where Fractal Analytics emphasizes robust AI governance for compliance with new data protection laws, exemplify this trend. Vendors provide scalable solutions for regulatory compliance automation, AI accountability, and continuous model performance evaluation. Regional drivers such as digital transformation initiatives, smart cities, and large-scale AI deployments are further accelerating market growth.

AI GOVERNANCE MARKET: COMPANY EVALUATION MATRIX

In the AI Governance market matrix, IBM (Star) leads with a dominant market presence and a comprehensive portfolio of AI governance solutions, including AI model risk management, regulatory compliance automation, explainable AI, audit-ready reporting, and ethical AI frameworks. Its ecosystem enables scalable deployment of enterprise AI governance strategies, helping organizations implement responsible AI, monitor model performance, ensure data privacy compliance, and meet global AI regulations. Securiti (Emerging Leader) is rapidly advancing through its AI governance platform, offering data privacy automation, compliance monitoring, risk management, and actionable AI insights. While IBM leads with scale and regulatory expertise, Securiti demonstrates accelerating momentum through innovative governance automation and simplified adoption.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- IBM (US)

- Microsoft (US)

- Google (US)

- Salesforce (US)

- SAP (Germany)

- AWS (US)

- SAS Institute (US)

- FICO (US)

- Accenture (Ireland)

- Qlik (US)

- H2O.AI (US)

- Alteryx (US)

- DataRobot (UK)

- Dataiku (US)

- Domino Data Lab (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 0.62 BN |

| Market Forecast in 2029 | USD 5.78 Billion |

| Growth Rate | CAGR of 45.3% during 2024-2029 |

| Years Considered | 2019-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: AI GOVERNANCE MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Solution Provider (US) |

|

|

| Leading Solution Provider (Europe) |

|

|

RECENT DEVELOPMENTS

- December 2024 : DataRobot introduced significant enhancements to its AI Governance and AI Observability features, aiming to centralize oversight and unify the management of AI assets across various platforms. These updates are designed to ensure secure and dependable operations at scale. Key features include real-time monitoring and intervention for generative AI models, customizable metrics tracking, automated retraining policies, centralized model management, automated compliance documentation, and robust model risk management tools.

- November 2024 : AWS and IBM are enhanced their partnership to promote responsible generative AI by integrating governance, transparency, and trust into AI solutions. They aim to scale enterprise AI adoption through tools like IBM watsonx.governance, ensuring secure, explainable, and compliant AI workflows on AWS platforms.

- November 2024 : Microsoft and Saidot announced a collaboration on AI governance by integrating Saidot's Model Catalogue with Microsoft Azure AI. This supports responsible AI development, risk management, and compliance in multi-cloud environments.

- October 2024 : AWS and Domino Data Lab have teamed up to enhance AI governance by integrating automated compliance into AI workflows. This collaboration enables better risk management, regulatory adherence, and efficient AI model deployment using Domino’s platform on AWS.

- October 2024 : Google Cloud has expanded its strategic partnership with Quantiphi to drive enterprise-wide AI adoption, leveraging advanced AI/ML solutions. The partnership aims to integrate AI across industries, enhancing customer value through improved operational efficiency and innovation.

Table of Contents

Methodology

The research methodology for the global AI governance market report involved the use of extensive secondary sources and directories, as well as various reputed open-source databases, to identify and collect information useful for this technical and market-oriented study. In-depth interviews were conducted with various primary respondents, including key opinion leaders, subject matter experts on AI model lifecycle management, MLOps, model monitoring and data governance, high-level executives of multiple companies offering AI governance offerings, and industry consultants to obtain and verify critical qualitative and quantitative information and assess the market prospects and industry trends.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports; press releases and investor presentations of companies; white papers, certified publications such as AI and Ethics Journal, Journal of Artificial Intelligence Research, World Economic Forum’s Holistic Framework on AI Governance, AI Ethics and Governance by EU; and articles from recognized associations and government publishing sources including but not limited to AI Global, Global Initiative on Ethics of Autonomous and Intelligent Systems, Global Partnership on Artificial Intelligence, The Responsible AI Institute, European AI Alliance, AI for Good (United Nations), and World Economic Forum’s AI Governance and Policy Center.

The secondary research was used to obtain key information about the industry’s value chain, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary Research

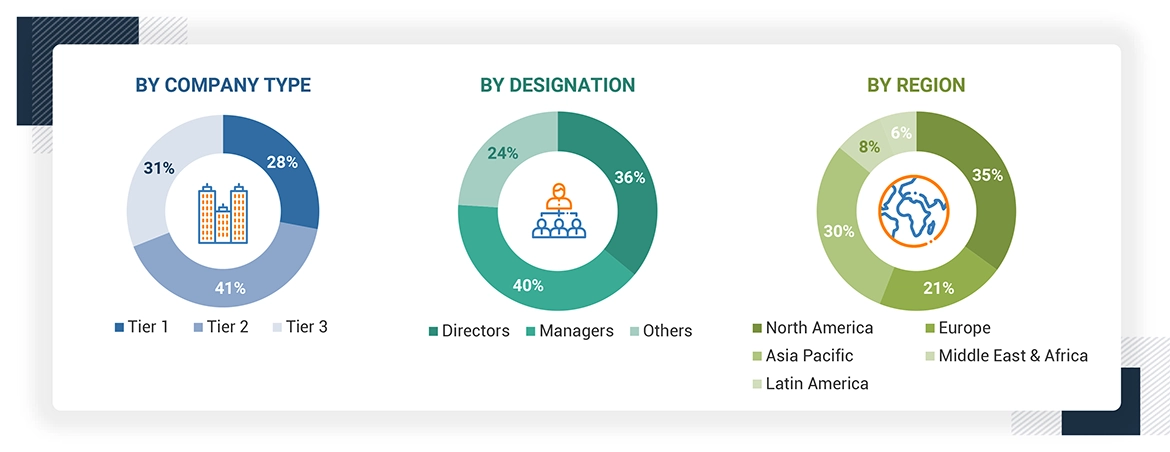

In the primary research process, a diverse range of stakeholders from both the supply and demand sides of the AI governance ecosystem were interviewed to gather qualitative and quantitative insights specific to this market. From the supply side, key industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, as well as technical leads from vendors offering AI governance were consulted. Additionally, system integrators, managed service providers (MSPs), and IT service firms that implement and support AI governance were included in the study. On the demand side, input from IT decision-makers, infrastructure managers, and cybersecurity heads was collected to understand the user perspectives and adoption challenges within targeted industries.

The primary research ensured that all crucial parameters affecting the AI governance market—from technological advancements and evolving use cases (model monitoring & auditing, risk management & compliance, transparency & explanability, data governance etc.) to regulatory and compliance needs (GDPR, EU AI Act, California Consumer Privacy Act etc.)—were considered. Each factor was thoroughly analyzed, verified through primary research, and evaluated to obtain precise quantitative and qualitative data for this market.

Once the initial phase of market engineering was completed, including detailed calculations for market statistics, segment-specific growth forecasts, and data triangulation, an additional round of primary research was undertaken. This step was crucial for refining and validating critical data points, such as AI governance product types (data privacy tools, end-to-end AI governance platforms, data governance platforms, MLOps tools, LLMOps tools, responsible AI toolkits, AI governance consulting services, and AI governance as a service), industry adoption trends, the competitive landscape, and key market dynamics like demand drivers (Increasing regulatory compliance pressures, risk mitigation efforts prompting investments in AI governance tools etc.), challenges (Lack of harmonized global standards for AI governance, high costs of implementing AI governance frameworks, etc.), and opportunities (growing demand for ethical AI, integration with MLOps platforms etc.)

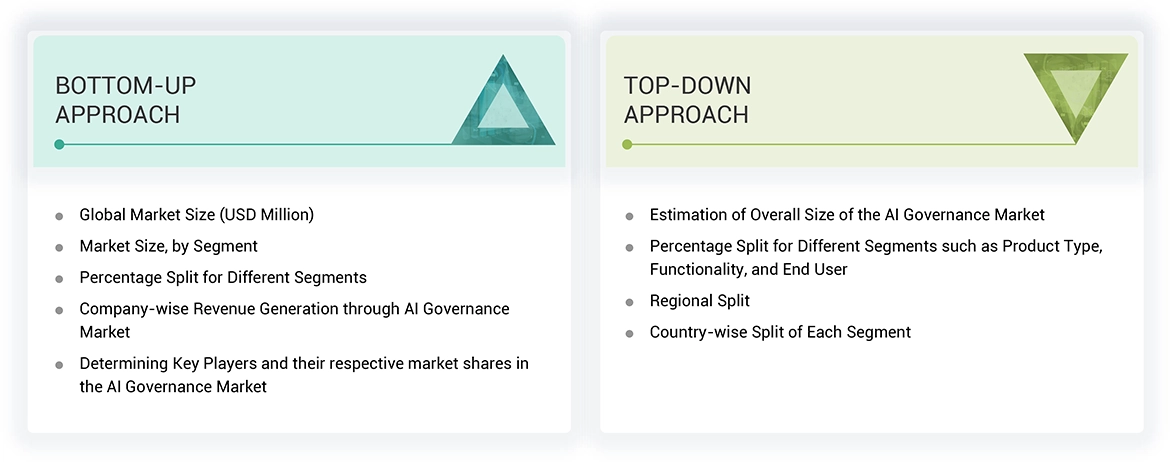

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecast for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to record the critical information/insights throughout the report.

Note: Three tiers of companies are defined based on their total revenue as of 2023; tier 1 = revenue more than USD 1 billion, tier 2 = revenue between USD 100 million and 1 billion, tier 3 = revenue less than USD 100 million

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To estimate and forecast the AI governance market and its dependent submarkets, both top-down and bottom-up approaches were employed. This multi-layered analysis was further reinforced through data triangulation, incorporating both primary and secondary research inputs. The market figures were also validated against the existing MarketsandMarkets repository for accuracy. The following research methodology has been used to estimate the market size:

AI Governance Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

AI governance is a structured framework that ensures the ethical, transparent, and accountable development, deployment, and monitoring of AI systems. It encompasses policies, processes, and tools designed to manage risks such as bias, lack of transparency, data privacy issues, and security vulnerabilities. AI governance focuses on aligning AI operations with ethical standards, regulatory compliance, and organizational values, ensuring that AI models operate safely, fairly, and responsibly throughout their lifecycle. It also addresses accountability by implementing mechanisms for auditing, monitoring, and reporting AI decisions, fostering trust and reducing the potential for unintended harm.

Stakeholders

- AI governance platform vendors

- MLOps and LLMOPs tools vendors

- Business analysts

- Cloud service providers

- AI governance consulting service providers

- Enterprise end-users

- Distributors and Value-added Resellers (VARs)

- Government agencies

- Independent Software Vendors (ISV)

- Managed service providers

- Market research and consulting firms

- Data privacy tool providers

- AI transparency & explainability tool vendors

- Software & technology providers

Report Objectives

- To define, describe, and predict the AI governance market by product type, functionality, end user, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the AI governance market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, Middle East Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies.

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the AI governance market

- To analyze the impact of recession across all the regions across the AI governance market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakup of the North American market for AI governance

- Further breakup of the European market for AI governance

- Further breakup of the Asia Pacific market for AI governance

- Further breakup of the Latin American market for AI governance

- Further breakup of the Middle East & Africa market for AI governance

Company information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the AI Governance Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in AI Governance Market