AI Infrastructure Market Size, Share and Trends

AI Infrastructure Market by Offerings (Compute (GPU, CPU, FPGA), Memory (DDR, HBM), Network (NIC/Network Adapters, Interconnect), Storage, Software), Function (Training, Inference), Deployment (On-premises, Cloud, Hybrid) – Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

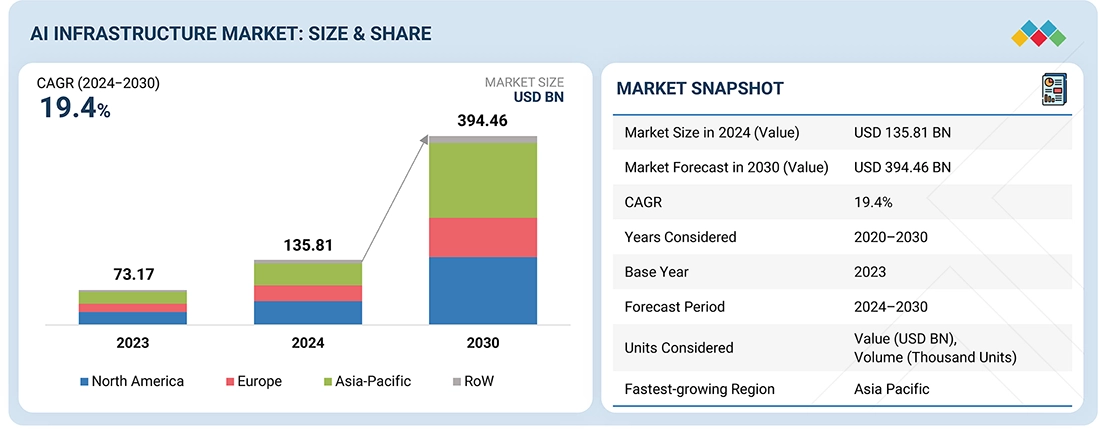

The AI infrastructure market is projected to reach USD 394.46 billion by 2030 from USD 135.81 billion in 2024, at a CAGR of 19.4% from 2024 to 2030. The growth of the AI infrastructure market is driven by the increase in data traffic and need for high computing power.

KEY TAKEAWAYS

-

By RegionThe North America AI infrastructure market accounted for a 36.2% revenue share in 2024.

-

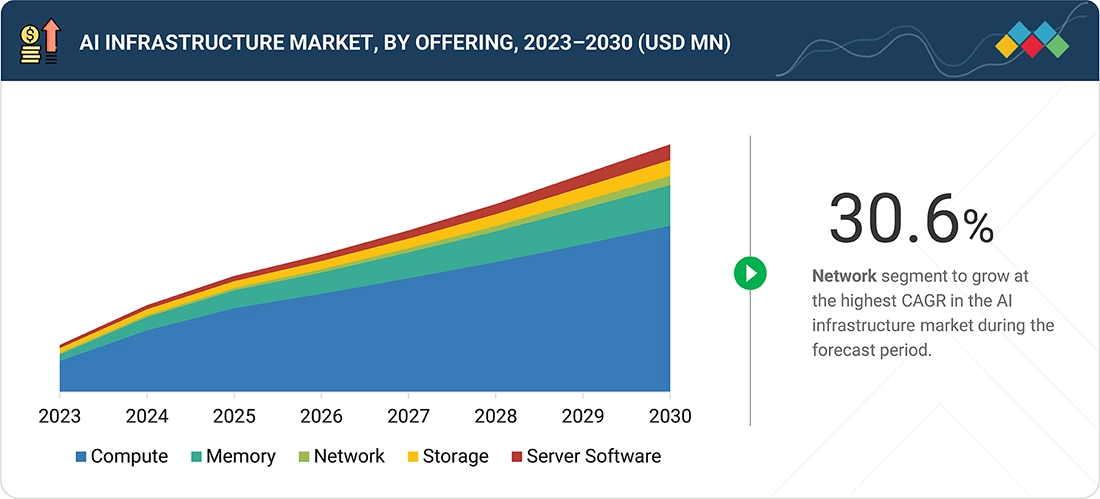

By OfferingBy offering, the network segment is expected to register the highest CAGR of 30.6%.

-

By FunctionBy function, the inference segment is projected to grow at the fastest rate from 2024 to 2030.

-

By DeploymentBy deployment, the cloud segment is expected to dominate the market.

-

By End UserBy end user, the enterprises segment will grow the fastest during the forecast period.

-

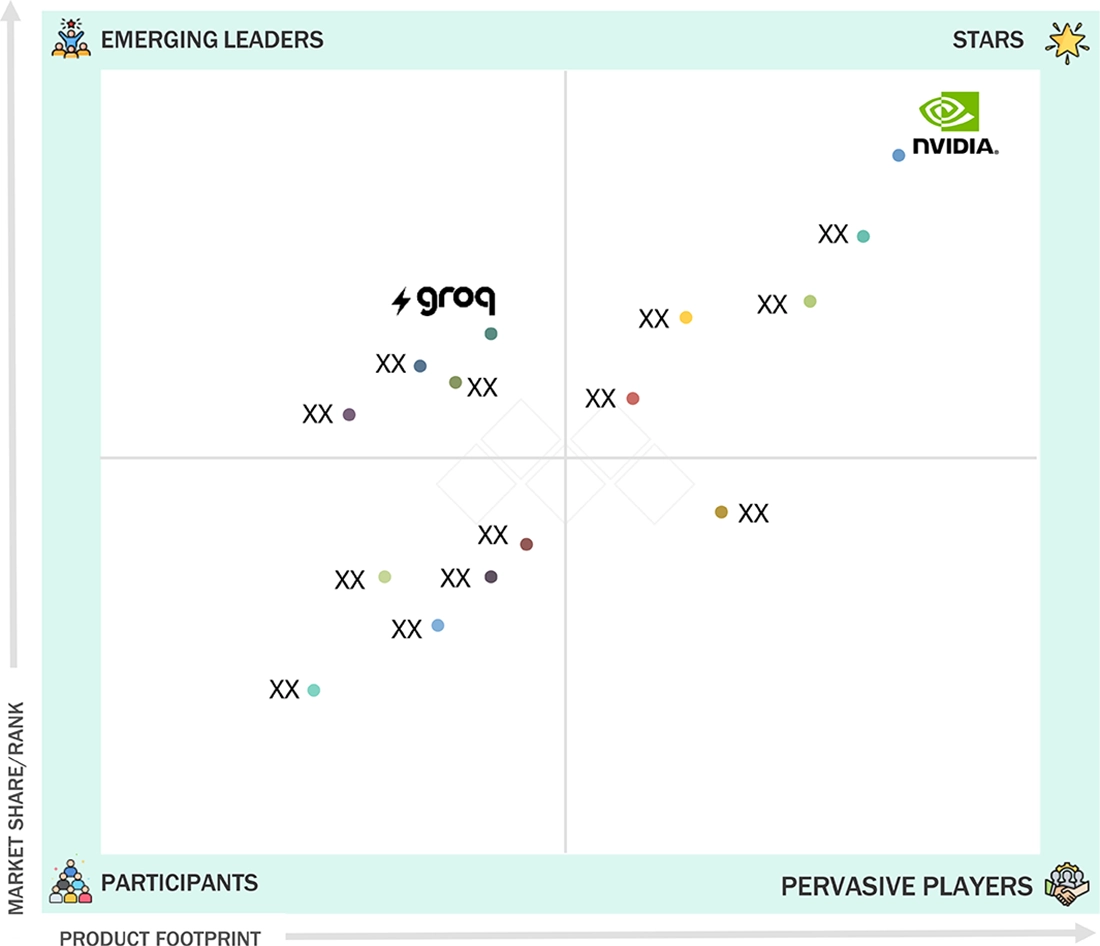

Competitive LandscapeNVIDIA, AMD, SK Hynix, SAMSUNG, and Micron were identified as some of the star players in the AI infrastructure market (global), given their strong market share and product footprint.

-

Competitive LandscapeSambaNova, HAILO, Tenstorrent, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The AI infrastructure market is witnessing strong momentum, driven by accelerating adoption of data-intensive AI, deep learning, and generative AI workloads across enterprises and cloud environments. Investments in high-performance compute systems, advanced networking, and scalable storage architectures are rapidly increasing to support growing model complexity. As organizations modernize their technology stacks, they are prioritizing integrated, flexible, and high-bandwidth AI infrastructure solutions to ensure seamless training, deployment, and inference at scale.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

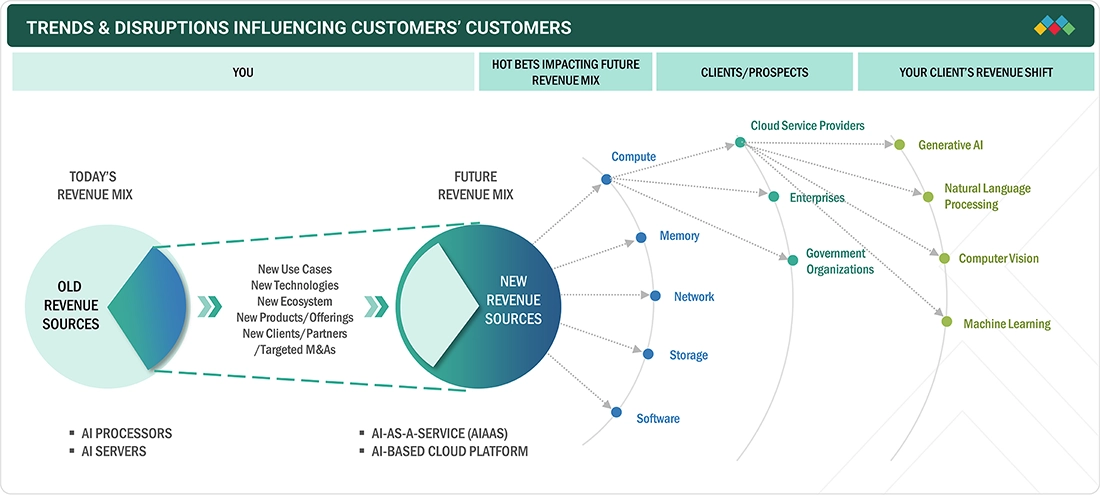

The AI infrastructure market is shifting from hardware-centric systems to flexible, service-oriented models driven by AI-as-a-Service and cloud AI platforms. Growing adoption of generative AI, NLP, and computer vision is accelerating demand for scalable compute, memory, and networking. Cloud providers now offer specialized AI services, while enterprises increasingly adopt hybrid architectures. Hardware vendors are integrating cloud-native capabilities, and seamless interoperability across infrastructure layers has become essential to support diverse AI workloads.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for high-performance computing in AI workloads

-

Government-led fundings to boost AI R&D

Level

-

Compatibility issues with legacy systems

-

Consumption of large amounts of energy

Level

-

Rise of AI-as-a-Service platforms

-

Rising demand for cloud-based AI infrastructure

Level

-

High initial investments

-

Maintaining data security and integrity in distributed AI systems

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for high-performance computing in AI workloads

AI technologies, such as machine learning and deep learning, require vast computational power for processing large datasets and complex algorithms, which traditional systems cannot handle. HPC systems enable organizations to process data faster, accelerating AI model training and deployment, leading to quicker decision-making and operational efficiency.

Restraint: Compatibility issues with legacy systems

Compatibility issues with legacy systems significantly hinder the growth of the AI infrastructure market. Many enterprises in traditional sectors like manufacturing, finance, and government rely on outdated IT systems that lack the processing power and flexibility needed to support modern AI workloads.

Opportunity: Rise of AI-as-a-Service platforms

The rise of AI-as-a-Service (AIaaS) platforms offers a significant growth opportunity for the AI infrastructure market by making advanced AI technologies more accessible to smaller enterprises. AIaaS allows businesses to access AI tools and infrastructure on a subscription or pay-as-you-go basis, eliminating the need for large upfront investments in expensive hardware and expertise.

Challenge: High initial investments

The AI infrastructure market faces a major challenge due to high initial investment costs. Building AI infrastructure requires significant financial commitments for specialized hardware like GPUs, TPUs, and FPGAs, as well as scalable storage, networking, and data centers. In addition to hardware, businesses must also invest in AI-specific software and skilled labor, further raising costs.

AI INFRASTRUCTURE MARKET SIZE, SHARE AND TRENDS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

DGX H100 AI servers deployed by Meta for Llama training clusters. | DGX H100 AI servers deployed by Meta for Llama training clusters. |

|

Liquid-cooled GPU servers used by Oracle Cloud for cloud-scale AI training. | Liquid-cooled GPU servers used by Oracle Cloud for cloud-scale AI training. |

|

XE9680 AI servers used in healthcare for imaging diagnostics and radiology AI. | XE9680 AI servers used in healthcare for imaging diagnostics and radiology AI. |

|

Cray AI servers deployed at NASA for climate simulation and deep learning workloads. | Cray AI servers deployed at NASA for climate simulation and deep learning workloads. |

|

AI servers running edge inference models for smart manufacturing plants (Foxconn case). | Real-time defect detection, higher productivity, reduced downtime. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The AI infrastructure ecosystem comprises a tightly integrated value chain spanning AI chip and memory suppliers, component vendors, server manufacturers, and global end users. Leading chipmakers such as NVIDIA, AMD, and Intel provide the compute backbone, while Samsung, SK Hynix, and Micron supply high-performance memory. PSU, PMIC, cooling, and chassis vendors enable efficient system design, supporting manufacturers like Dell, HPE, IBM, Supermicro, Huawei, and Cisco. These AI infrastructure ultimately power workloads for enterprises, CSPs, and hyperscalers including AWS, Microsoft, Google, Meta, Tencent, and Alibaba Cloud.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

AI Infrastructure Market, By Offering

The compute segment leads the AI infrastructure market, driven by surging demand for high-performance processing to support generative AI, LLMs, and advanced analytics. Organizations are rapidly adopting GPU, TPU, and accelerated compute architectures to handle intensive training and inference workloads. With enterprises scaling AI adoption, investment in compute-optimized systems continues to rise, solidifying compute as the backbone of AI infrastructure.

AI Infrastructure Market, By Function

Training remains the largest and fastest-growing AI infrastructure function, fueled by expanding generative AI, multimodal models, and enterprise AI initiatives. Training workloads require massive compute, advanced accelerators, and scalable memory and networking. Enterprises and hyperscalers increasingly deploy dedicated training clusters to reduce development cycles and improve efficiency. As models grow in size and complexity, training infrastructure continues to command the highest investment priority.

AI Infrastructure Market, By End User

Cloud service providers dominate AI infrastructure spending as enterprises shift toward scalable, on-demand AI platforms. CSPs are expanding GPU instances, AI-optimized clusters, and specialized model-training services to meet rising demand for generative AI and hybrid cloud deployments. Their ability to deliver elastic compute, integrated software stacks, and global-scale infrastructure positions CSPs as the primary enablers of next-generation AI workloads and enterprise adoption.

REGION

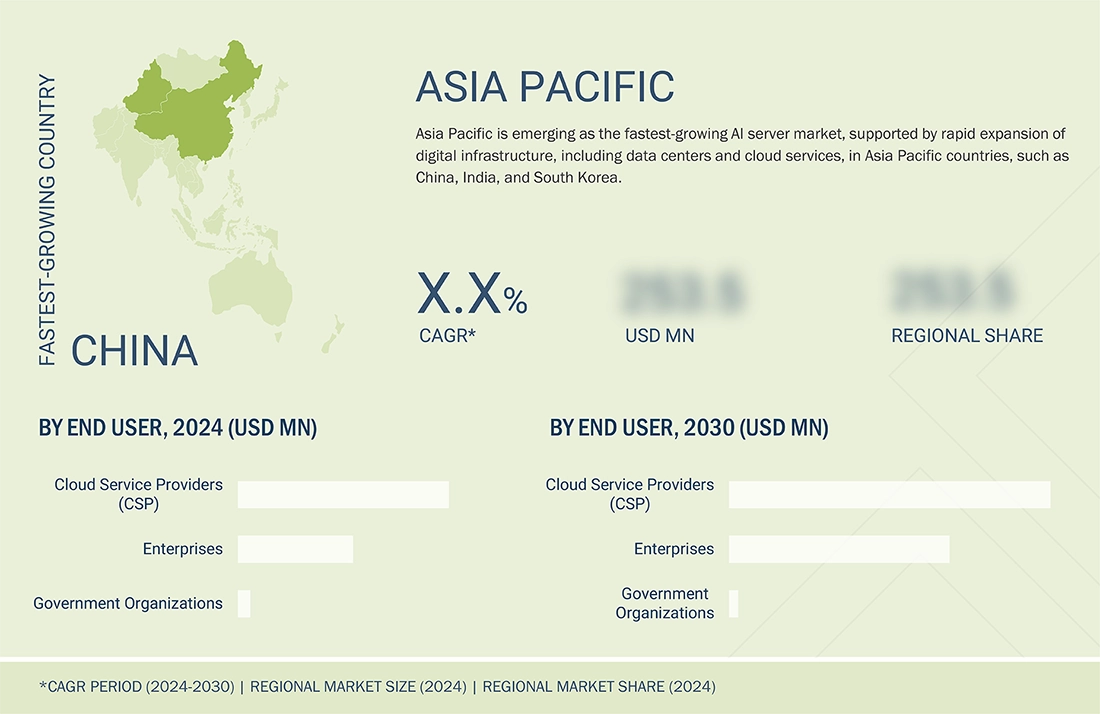

Asia Pacific to be fastest-growing region in global AI infrastructure market during forecast period

Asia Pacific is emerging as the fastest-growing region in the AI infrastructure market, driven by rapid digital transformation, strong government AI initiatives, and expanding cloud adoption across China, Japan, South Korea, and India. Massive investments in data centers, accelerated computing, and hyperscale cloud platforms are fueling demand for advanced AI hardware and software. Growing enterprise adoption of generative AI, automation, and edge AI further strengthens the region’s momentum, positioning Asia Pacific as a key engine of global AI infrastructure growth.

AI INFRASTRUCTURE MARKET SIZE, SHARE AND TRENDS: COMPANY EVALUATION MATRIX

In the AI infrastructure market matrix, NVIDIA (Star) leads with a strong market share and extensive product footprint, driven by its advanced composites and high-performance GPUs widely adopted by CSPs. Groq (Emerging Leader) is gaining visibility with its ability to delivering high-performance AI infrastructure optimized for advanced compute workloads, accelerating enterprise AI training and inference applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- NVIDIA

- AMD

- Intel Corporation

- SK Hynix Inc.

- SAMSUNG

- Micron

- AWS

- Tesla

- Microsoft

- Meta

- Graphcore

- Cerebras

- Groq

- Blaize

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 135.81 Billion |

| Market Forecast in 2030 (Value) | USD 394.46 Billion |

| Growth Rate | CAGR of 19.4% from 2024-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, RoW |

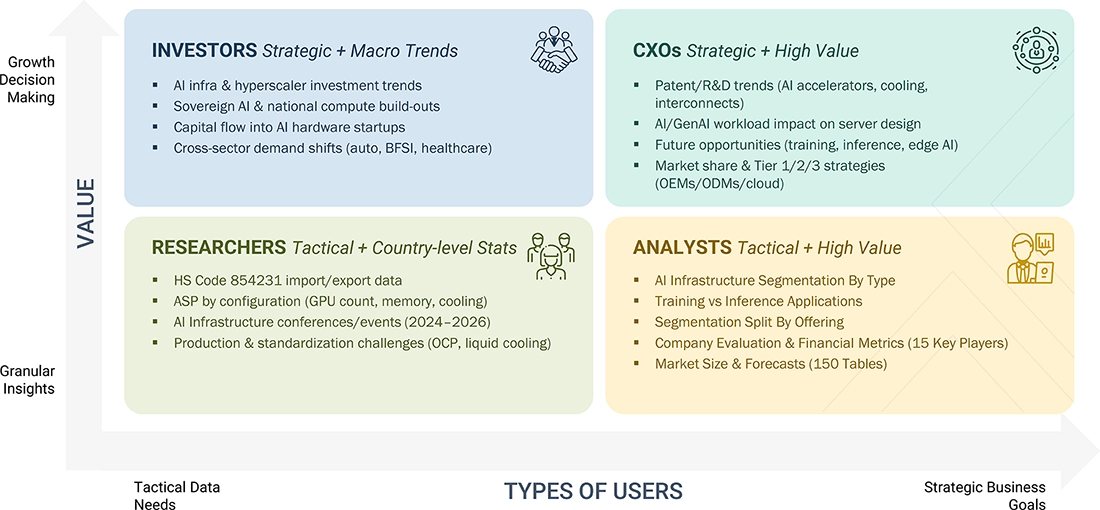

WHAT IS IN IT FOR YOU: AI INFRASTRUCTURE MARKET SIZE, SHARE AND TRENDS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Cloud Service Provider (CSP) |

|

|

| Enterprise (Healthcare, BFSI, Retail, Automotive) |

|

|

| Government Organizations |

|

|

| AI Server Manufacturers (Dell, HPE, Supermicro, Lenovo) |

|

|

| Component Suppliers (Cooling, PSU, PMIC, Chassis) |

|

|

RECENT DEVELOPMENTS

- October 2024 : Super Micro launched its H14 server series, featuring AMD EPYC 9005 CPUs and AMD Instinct MI325X GPUs, tailored for AI, cloud, and edge workloads. The new systems, including Hyper and FlexTwin, enhance performance with up to 192 cores per CPU, AVX-512 support, and efficient cooling options, achieving 2.44X faster processing than prior models, enabling AI-ready, power-efficient, and compact data center upgrades.

- Sep-24 : The HPE ProLiant DL145 Gen11 server, part of the Gen11 edge server portfolio, delivers high performance for diverse edge workloads. It supports applications such as inventory management, point of sale, and AI/ML workloads. The server is optimized for edge-specific solutions, with a growing ecosystem of ISV partners offering tailored solutions for retail, manufacturing, and others.

- August 2024 : Lenovo introduced three new high-performance AI servers: ThinkSystem SR680a V3, SR685a V3, and SR780a V3. These systems support eight GPUs, offering massive computational power for AI and high-performance computing (HPC) workloads. The servers feature Intel and AMD processors, air or hybrid cooling, and support for NVIDIA and AMD GPUs, enhancing performance for demanding AI, graphical, and simulation tasks.

- COLUMN 'A' SHOULD BE IN TEXT FORMAT AND NOT DATE FORMAT :

Table of Contents

Methodology

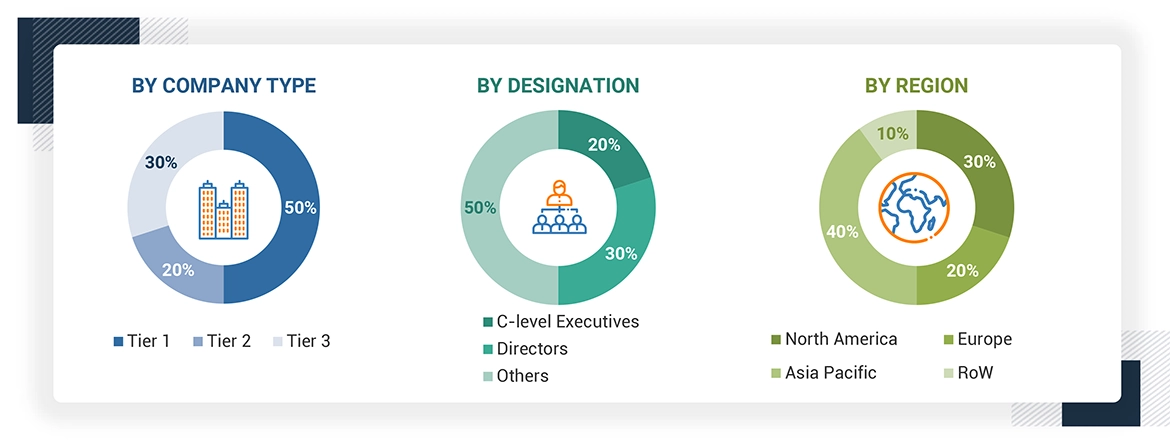

The research process for this technical, market-oriented, and commercial study of the AI infrastructure market included the systematic gathering, recording, and analysis of data about companies operating in the market. It involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) to identify and collect relevant information. In-depth interviews were conducted with various primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess the growth prospects of the market. Key players in the AI infrastructure market were identified through secondary research, and their market rankings were determined through primary and secondary research. This included studying annual reports of top players and interviewing key industry experts, such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information for this study. These include annual reports, press releases, and investor presentations of companies, whitepapers, certified publications, and articles from recognized associations and government publishing sources. Research reports from a few consortiums and councils were also consulted to structure qualitative content. Secondary sources included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; Journals and certified publications; articles by recognized authors; gold-standard and silver-standard websites; directories; and databases. Data was also collected from secondary sources, such as the International Trade Centre (ITC) (Switzerland), and the International Monetary Fund (IMF).

List of key secondary sources

|

Source |

Web Link |

|

Generative AI Association (GENAIA) |

https://www.generativeaiassociation.org/ |

|

Association for Machine Learning and Application (AMLA) |

https://www.icmla-conference.org/ |

|

Association for the Advancement of Artificial Intelligence |

https://aaai.org/ |

|

European Association for Artificial Intelligence |

https://eurai.org/ |

|

International Monetary Fund |

https://www.umaconferences.com/ |

|

Institute of Electrical and Electronics Engineers (IEEE) |

https://ieeexplore.ieee.org/ |

Primary Research

Extensive primary research was accomplished after understanding and analyzing the AI infrastructure market scenario through secondary research. Several primary interviews were conducted with key opinion leaders from both demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 30% of the primary interviews were conducted with the demand side, and 70% with the supply side. Primary data was collected through questionnaires, emails, and telephonic interviews. Various departments within organizations, such as sales, operations, and administration, were contacted to provide a holistic viewpoint in the report.

Note: Other designations include technology heads, media analysts, sales managers, marketing managers, and product managers.

The three tiers of the companies are based on their total revenues as of 2023 ? Tier 1: >USD 1 billion, Tier 2: USD 500 million–1 billion, and Tier 3: USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

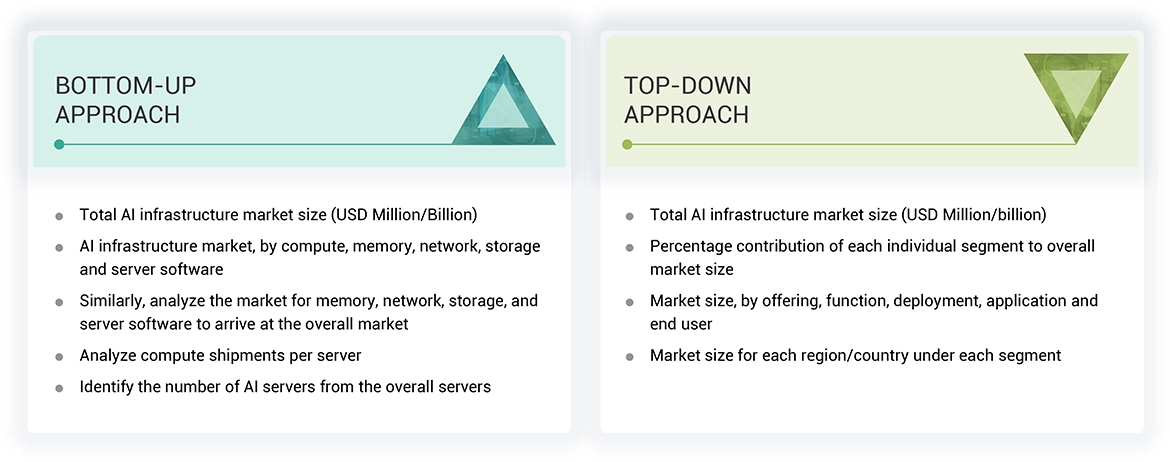

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods have been used to perform the market size estimation and forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analyses have been performed on the complete market engineering process to list the key information/insights throughout the report. The following table explains the process flow of the market size estimation.

The key players in the market were identified through secondary research, and their rankings in the respective regions determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, and interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for quantitative and qualitative key insights. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

AI Infrastructure Market : Top-Down and Bottom-Up Approach

Bottom-Up Approach

- Initially, the companies offering AI infrastructure were identified. Their products were mapped based on offering, function, deployment, application, and end user.

- After understanding the different types of AI infrastructure offering by various manufacturers, the market was categorized into segments based on the data gathered through primary and secondary sources.

- To derive the global AI infrastructure market, global server shipments of top players for AI servers considered in the report's scope were tracked

- A suitable penetration rate was assigned for computing, memory, network, storage, and server software offerings to derive the shipments of AI infrastructure.

- We derived the AI infrastructure market based on different offerings using the average selling price (ASP) at which a particular company offers its devices. The ASP of each offering was identified based on secondary sources and validated from primaries.

- For the CAGR, the market trend analysis was carried out by understanding the industry penetration rate and the demand and supply of AI infrastructure offerings for different end users.

- The AI infrastructure market is also tracked through the data sanity method. The revenues of key providers were analyzed through annual reports and press releases and summed to derive the overall market.

- For each company, a percentage is assigned to its overall revenue or, in a few cases, segmental revenue to derive its revenue for the AI Infrastructure. This percentage for each company is assigned based on its product portfolio and range of AI infrastructure offerings.

- The estimates at every level, by discussing them with key opinion leaders, including CXOs, directors, and operation managers, have been verified and cross-checked, and finally, with the domain experts at MarketsandMarkets.

- Various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases, have been studied.

Top-Down Approach

- The global market size of AI infrastructure was estimated through the data sanity of major companies.

- The growth of the AI infrastructure market witnessed an upward trend during the studied period, as it is currently in the initial stage of the product cycle, with major players beginning to expand their business into various application areas of the market.

- Types of AI infrastructure offerings, their features and properties, geographical presence, and key applications served by all players in the AI infrastructure market were studied to estimate and arrive at the percentage split of the segments.

- Different types of AI infrastructure offerings, such as compute, memory, and network, storage and server software and their penetration for end users were also studied.

- The market split for AI infrastructure by offering, function, deployment, application, and end user was estimated based on secondary research.

- The demand generated by companies operating in different end-use application segments was analyzed.

- Multiple discussions with key opinion leaders across major companies involved in developing the AI Infrastructure offerings and related components were conducted to validate the offering, function, deployment, application, and end user market split.

- The regional splits were estimated using secondary sources based on factors such as the number of players in a specific country and region and the adoption and use cases of each implementation type with respect to applications in the region.

Data Triangulation

After arriving at the overall size of the AI infrastructure market through the process explained above, the overall market has been split into several segments. Data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

AI infrastructure refers to the foundational technological ecosystem required to develop, deploy, and scale artificial intelligence applications. It encompasses a combination of high-performance computing resources (e.g., GPUs, CPUs, FPGAs, etc.), memory solutions (e.g., DDR, HBM), networking components (e.g., network adapters, interconnects), software, and storage systems optimized for handling AI workloads. AI infrastructure supports both training and inference functions across diverse deployment models, including on-premises, cloud, and hybrid environments. It is utilized in generative AI, machine learning, natural language processing (NLP), and computer vision applications.

Key Stakeholders

- Government and financial institutions and investment communities

- Analysts and strategic business planners

- Semiconductor product designers and fabricators

- Application providers

- AI solution providers

- AI platform providers

- AI system providers

- Manufacturers and AI technology users

- Business providers

- Component and device suppliers and distributors

- Professional service/solution providers

- Research organizations

- Technology standard organizations, forums, alliances, and associations

- Technology investors

- Investors (private equity firms, venture capitalists, and others)

Report Objectives

- To define, describe, segment, and forecast the size of the AI infrastructure market, in terms of value, based on offering, function, deployment, application, end user, and region

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific, and RoW

- To define, describe, segment, and forecast the size of the AI infrastructure market, in terms of volume, based on offering.

- To give detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide an value chain analysis, ecosystem analysis, case study analysis, patent analysis, Trade analysis, technology analysis, pricing analysis, key conferences and events, key stakeholders and buying criteria, Porter's five forces analysis, investment and funding scenario, and regulations pertaining to the market

- To provide a detailed overview of the value chain analysis of the AI infrastructure ecosystem

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities for stakeholders by identifying high-growth segments of the market

- To strategically profile the key players, comprehensively analyze their market positions in terms of ranking and core competencies2, and provide a competitive market landscape.

- To analyze strategic approaches such as product launches, acquisitions, agreements, and partnerships in the AI infrastructure market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 7)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the AI Infrastructure Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in AI Infrastructure Market