Agricultural Micronutrients Market

Agricultural Micronutrients Market by Type (Zinc, Boron, Iron, Manganese, Molybdenum, Copper), Mode of Application (Soil, Foliar and Fertigation), Form (Chelated and Non-Chelated Micronutrients), Crop Type and Region - Global Forecast to 2028

OVERVIEW

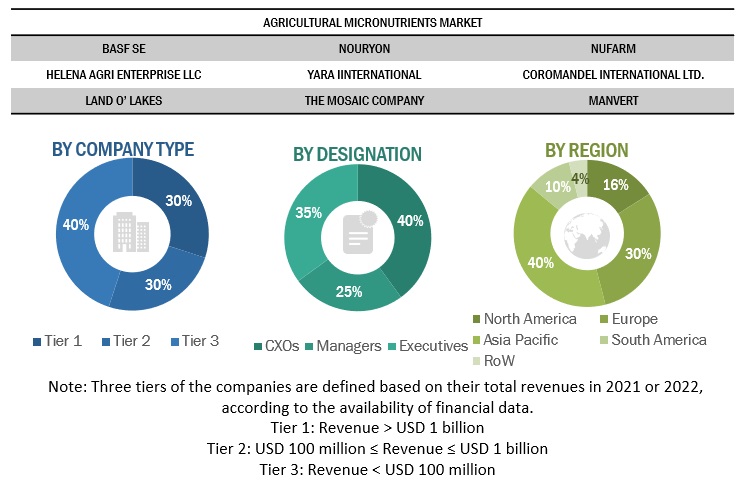

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global agricultural micronutrients market will be projected to grow from USD 5.39 billion in the year 2025 to USD 8.19 billion by 2030, registering a CAGR of 8.6%, owing to the rising focus on providing a well-rounded diet to the crops and adopting science-backed agronomic practices. The rising demand for micronutrients that improve crop yield, quality, efficiency of nutrient uptake, and resilience to various stresses like insects, diseases, and climatic extremes for various crop types such as Cereals & Grains, F&V, Oils & Pulses, and others will boost the growth of the agricultural micronutrients market.

KEY TAKEAWAYS

-

BY REGIONThe Asia Pacific agricultural micronutrients market accounted for a significant share of 43% in 2025.

-

BY TYPEBy type, the molybdeum segment is expected to dominate with a market share of 34.9% in the agricultural micronutrients market in 2025.

-

BY CROP TYPEBy crop type, the fruits & vegetables segment is projected to register notable growth during the forecast period.

-

BY FORMBy form, the non-chelated micronutrients segment is estimated to hold a significant market share by 69.1% in 2025.

-

BY MODE OF APPLICATIONBy mode of application, the foliar application segment is expected to lead by 36.9% in the agricultural micronutrients market in 2025.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSBASF SE, Nouryon, Nufarm, Yara International ASA, Syngenta AG, The Mosaic Company, and Coromandel International Limited were identified as some of the key players in the agricultural micronutrients market.

-

COMPETITIVE LANDSCAPE - STARTUPSManvert, Zuari Agrochemicals, Haifa Negev Technologies, Stoller Enterprises, and ATP Nutrition, among others, have established a presence as emerging players in the agricultural micronutrients market.

The market for agricultural micronutrients is currently growing steadily with an increase in the interest of growers in ensuring that their crops receive well-balanced nutrients. Additionally, the rising awareness of micronutrient deficiencies in the soil and the adoption of modern farming technologies have increased the application of micronutrients in major crops.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Shifts in customer preferences patterns of customers as well as agricultural trends have a direct impact on the market performance of end-users in the agricultural micronutrients market. The rising areas of interest in the market include specialty nutrition management in agriculture, changes in agricultural patterns, and methods of application. These trends are growing at a pace or shifting in a certain direction with an impact on the buying patterns of the end-user in the market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Expansion of commercial and intensive farming systems

-

Rising focus on improving crop yield, quality, and nutrient use efficiency

Level

-

Volatility in raw material and fertilizer input prices

-

Limited awareness and adoption among smallholder farmers

Level

-

Growing demand for chelated and specialty micronutrient formulations

-

Adoption of precision agriculture and targeted nutrient application

Level

-

Price competition from conventional fertilizer products

-

Regulatory compliance and formulation standardization

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Expansion of commercial and intensive farming systems

The growing need for integrated agricultural methodologies and commercial farming is triggering a demand for well-balanced micronutrient application for overcoming soil deficiencies and enhancing produce quality and efficiency.

Restraint: Volatility in raw material and fertilizer input prices

The fluctuations with respect to fertilizer prices and raw materials increase the cost inputs, making it difficult for micronutrient products to be adopted.

Opportunity:Growing demand for chelated and specialty micronutrient formulations

Increasing use of chelated and special micronutrients, thanks to practices like "precision agriculture," is offering various opportunities in targeted and value-added crop nutrient management.

Challenge: Price competition from conventional fertilizer products

Price competition offered by traditional fertilizers, as well as the requirement to adhere to different regulations in different regions, remain obstacles in the adoption of advanced micronutrient compounds.

AGRICULTURAL MICRONUTRIENTS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Application of chelated micronutrients in cereals, fruits, and vegetables to address soil nutrient deficiencies | Improves nutrient availability, enhances crop yield and quality, and supports sustainable soil management |

|

Integration of micronutrient-enriched fertilizers through soil and fertigation systems | Enables balanced crop nutrition, improves nutrient use efficiency, and supports precision agriculture practices |

|

Use of specialty chelating agents in micronutrient formulations for broad-acre and horticultural crops | Enhances micronutrient stability, improves uptake under challenging soil conditions, and reduces nutrient losses |

|

Deployment of crop-specific micronutrient solutions combined with crop protection programs | Strengthens plant health, improves stress tolerance, and supports integrated crop management strategies |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The agricultural micronutrients market is a part of a comprehensive global agricultural micronutrients ecosystem, which includes entities such as agricultural micronutrient producers, producers of fertilizers, specialty, and agricultural inputs, agricultural micronutrient distributors, agricultural micronutrient regulatory agencies, agricultural research agencies, and agricultural communities. The agricultural micronutrients market is a continuously growing, agronomy-based sector that is shaped by advancements in soil health, balanced plant nutrition, and sustainable yield growth. Multinational companies as well as local companies come together as part of this sector, resulting in the growth of innovative agricultural micronutrients.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

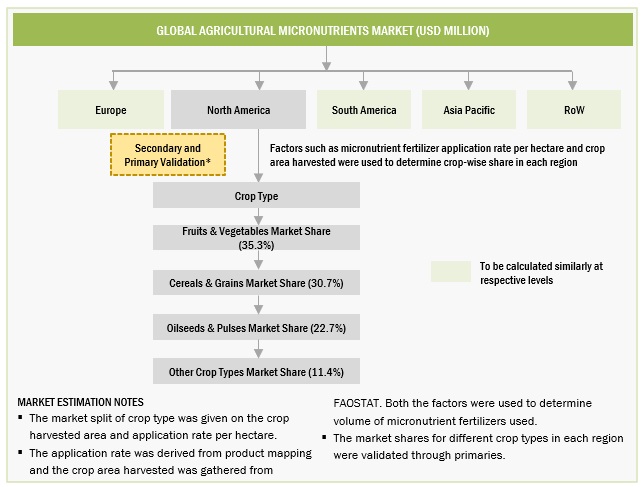

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

agricultural micronutrients market, By type

The market is also anticipated to be dominated by the molybdenum market due to the importance of the element in the fixation of nitrogen and enzyme functions, especially in legume and cereal crops, and also due to the increasing use of the element to counter nutrient deficiencies in the soil.

agricultural micronutrients market, By crop type

The fruits & vegetables category is projected to register robust growth, as horticultural crops are very responsive to the treatment of micronutrients and need accurate nutrient management in order to enhance the quality, storage life, and appearance of produce.

agricultural micronutrients market, By form

The market share is expected to be significant, as micronutrients non-chelated are cost-effective, readily available, and are used widely by many farmers as a mode of conventional or large-scale agriculture.

agricultural micronutrients market, By mode of application

The foliar application segment segment of the industry is poised to lead due to its quick uptake of nutrients, targeted delivery, and efficiency in rapidly addressing micronutrient deficiencies in a broad spectrum of agricultural products.

REGION

Asia-Pacific is expected to dominate the agricultural micronutrients market

Asia-Pacific is poised to lead the market for agricultural micronutrients, owing to its vast agricultural base, extremely high cropping intensity, and rising awareness regarding soil micronutrient deficiencies. The increasing acceptance of advanced agriculture practices and measures by governments to enhance crop productivity and soil health will also boost the demand for micronutrient-based crop nutritional solutions in the Asia-Pacific region.

AGRICULTURAL MICRONUTRIENTS MARKET: COMPANY EVALUATION MATRIX

In the agricultural micronutrients market landscape, leading players such as BASF SE and Yara International ASA (Star) hold strong market positions, supported by their large-scale production capabilities, comprehensive micronutrient portfolios, and well-established global distribution networks. Their integration with fertilizer and crop nutrition programs and emphasis on consistent, science-backed micronutrient solutions reinforce their dominance. Meanwhile, Manvert (Emerging Leader) is strengthening its presence through specialized micronutrient blends and customized crop nutrition solutions, addressing region-specific soil deficiencies and evolving crop productivity and quality requirements.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 5.39 Billion |

| Market Forecast in 2030 (Value) | USD 8.19 Billion |

| Growth Rate | CAGR of 8.6% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion), Volume (KT) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Type: Zinc, Boron, Iron, Manganese, Molybdenum, Copper, and Other Types By Form: Chelated Micronutrients (EDTA, EDDHA, DTPA, IDHA, and Other Chelates) and Non-Chelated Micronutrients By Crop Type: Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Other Crop Types By Mode of Application: Foliar, Fertigation, Soil, and Other Modes of Application |

| Regions Covered | North America, Europe, Asia Pacific, South America and ROW |

WHAT IS IN IT FOR YOU: AGRICULTURAL MICRONUTRIENTS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based agricultural micronutrient manufacturers | Detailed analysis of the agricultural micronutrients market by micronutrient type (zinc, boron, iron, manganese, molybdenum, copper, and others), form (chelated and non-chelated), mode of application (soil, foliar, fertigation), and crop type (cereals & grains, fruits & vegetables, oilseeds & pulses, and others). Comprehensive competitive landscape assessment covering key micronutrient manufacturers, fertilizer companies, and specialty input suppliers, including evaluation of production capabilities, product portfolios, and distribution presence. Customer landscape evaluation across growers, agri-input distributors, and cooperatives, along with market benchmarking, pricing dynamics, and regulatory review for agricultural micronutrients in the US. | Identified and profiled 20+ agricultural micronutrient manufacturers and suppliers operating in North America, including global leaders, regional players, and specialty micronutrient providers. Tracked adoption trends for micronutrient application across major crop segments, highlighting demand driven by yield optimization, soil health improvement, and sustainable farming practices. Mapped regulatory and compliance requirements for micronutrient usage in agriculture, supporting client decision-making on product positioning, formulation strategy, and market entry. |

| Agricultural micronutrients – Type, Form & Application Segment Assessment | Segmentation of agricultural micronutrient demand by micronutrient type, crop type, form, and mode of application. Benchmarked adoption and usage patterns of micronutrients across cereals, horticultural crops, and oilseeds, with emphasis on nutrient deficiency correction, yield response, and crop quality improvement. Assessed switching barriers for farmers and distributors, including cost sensitivity, formulation effectiveness, compatibility with existing fertilization practices, and regulatory compliance. | Delivered revenue share and growth outlook for key micronutrient segments across crop categories. Identified substitution risks and opportunities between conventional micronutrient products and chelated or specialty formulations in cost-sensitive markets. Mapped regulatory frameworks and approval pathways relevant to agricultural micronutrients, enabling clearer go-to-market and product differentiation strategies. |

RECENT DEVELOPMENTS

- October 2021 : Grupa Azoty announced its 2021–2030 strategy, positioning Green Azoty as a flagship initiative focused on decarbonization and carbon-emission reduction. The strategy includes R&D projects aligned with the European Green Deal and the development of new environmentally friendly solutions, including micronutrient-enriched formulations derived from utilized waste streams.

- April 2021 : Compass Minerals entered into a definitive agreement with Koch Agronomic Service (LLP), a subsidiary of Koch Industries, to sell its North American micronutrient assets for approximately USD 60.25 million, strengthening Koch’s position in agricultural micronutrients.

- March 2021 : The Mosaic Company and Sound Agriculture announced a strategic partnership to develop nutrient-efficient fertilizer products using a proprietary blend of bio-inspired chemistry and key micronutrients, aimed at improving crop yields and enhancing soil health across major crops.

- May 2024 : Yara International ASA (Norway) and BASF SE (Germany) announced a strategic partnership to co-develop and commercialize next-generation micronutrient fertilizers, with a focus on sustainable, high-efficiency solutions for global agricultural applications.

Table of Contents

Methodology

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the agricultural micronutrient market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

The secondary sources referred for this research study include government sources, such as the Food and Agriculture Organization (FAO), International Fertilizer Association (IFA), Micronutrient Manufacturers Association (MMA), the ministries of the agricultural department in various countries, corporate filings (such as annual reports, press releases, investor presentations, and financial statements), and trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research and manufacturers' annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and paid databases.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research. It was also used to obtain information on the key developments from a market-oriented perspective.

Primary Research

The agricultural micronutrients market comprises multiple stakeholders, including raw material suppliers, and regulatory organizations in the supply chain. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply side include research institutions involved in R&D to introduce to the manufacturers, and importers & exporters of agricultural micronutrients from the demand side including distributors, wholesalers, and key opinion leaders through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

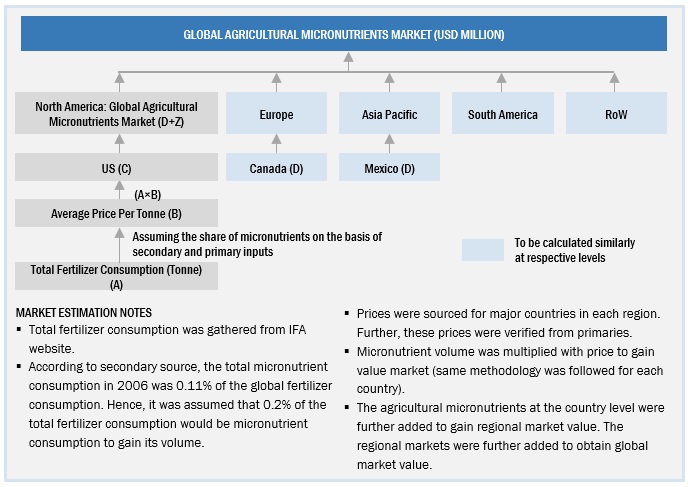

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the agricultural micronutrients market. These approaches were also used extensively to estimate the size of various dependent submarkets.

The following figure represents the overall market size estimation process employed for the purpose of this study.

Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Through the bottom-up approach, the data extracted from secondary research was utilized to validate the market segment sizes obtained. The approach was employed to arrive at the overall size of the agricultural micronutrients market in particular regions, and its share in the market was validated through primary interviews conducted with fungicide manufacturers, suppliers, dealers, and distributors.

With the data triangulation procedure and validation of data through primaries, the overall size of the parent market and each segmental market were determined.

Top-Down Approach

For the estimation of the agricultural micronutrients market, the size of the most appropriate immediate parent market was considered to implement the top-down approach. For the agricultural micronutrients market, the specialty fertilizers market was considered as the parent market to arrive at the market size, which was again used to estimate the size of individual markets (mentioned in the market segmentation) through percentage shares arrived from secondary and primary research.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To estimate the overall agricultural micronutrient market and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides.

Market Definition

Agricultural micronutrients can be defined as nutrients required in small amounts, which are necessary for plant growth. Due to their requirement in limited quantities, micronutrients are also known as trace elements. These micronutrients, also known as trace elements, play a crucial role in various physiological processes within plants, including enzyme activation, photosynthesis, and nutrient uptake. The primary agricultural micronutrients include iron (Fe), manganese (Mn), zinc (Zn), copper (Cu), molybdenum (Mo), and boron (B).

Stakeholders

- Agricultural micronutrient manufacturers, formulators, and blenders

- Fertilizer traders, suppliers, distributors, importers, and exporters

- Raw material suppliers and technology providers to agricultural micronutrient manufacturers

- Agricultural co-operative societies

- Fertilizer associations and industry bodies:

- Food and Agriculture Organization (FAO)

- International Fertilizer Association (IFA)

- Micronutrient Manufacturers Association (MMA)

- The Fertilizer Institute (TFI)

- Government agricultural departments and regulatory bodies:

- US Environmental Protection Agency (EPA)

- Association of American Plant Food Control Officials (AAFCO)

- European Commission

- Ministry of Agriculture (MOA), China

- Department of Agriculture, Forestry, and Fisheries (DAFF), South Africa

- US Department of Agriculture (USDA)

Report Objectives

Market Intelligence

Determining and projecting the size of the agricultural micronutrients market, based on type, form, crop type, mode of application, and regional markets, over a five-year period, ranging from 2023 to 2028

Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across regions

Analyzing the demand-side factors based on the following:

- Impact of macro- and microeconomic factors on the market

- Shift in demand patterns across different subsegments and regions

Competitive Intelligence

- Identifying and profiling the key players in the agricultural micronutrientss market.

- Determining the share of key players operating in the agricultural micronutrients market

-

Providing a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions.

- Analyzing the value chain and products across the key regions and their impact on the prominent market players.

- Analyzing the market dynamics, competitive situations, and trends across the regions, and their impact on prominent market players.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the rest of the Asia Pacific agricultural micronutrients market into the Philippines, Vietnam, South Korea, Malaysia, and Australia & New Zealand.

- Further breakdown of the rest of Europe's agricultural micronutrients market into Netherlands, Poland, other EU, and non-EU countries.

- Further breakdown of the rest of South America's agricultural micronutrients market into Peru, Chile, and Venezuela.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Agricultural Micronutrients Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Agricultural Micronutrients Market