Secondary Macronutrients Market by Nutrient (Calcium, Magnesium, and Sulfur), Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables), Mode of Application (Solid and Liquid), Form and Region - Global Forecast to 2028

Secondary Macronutrients Market Overview

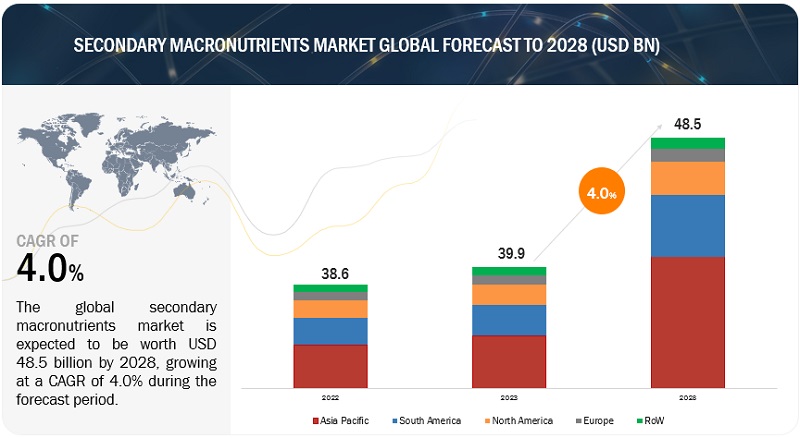

The global secondary macronutrients market size was valued at US$ 38.6 billion in 2022 and is poised to grow from US$ 39.9 billion in 2023 to US$ 48.5 billion by 2028, growing at a CAGR of 4.0% in the forecast period (2023-2028).

The growth of the market is driven by the increasing secondary macronutrient deficiency in the soil and the growing area under cultivation for high-value crops. The deficiency of secondary macronutrients causes yellowing of leaves, stunted growth, and a decrease in crop yield. To avoid these deficiencies, secondary macronutrients are applied to provide essential minerals to crops and soil, thereby maintaining crop and soil health. Intensive farming practices, such as monoculture and excessive use of fertilizers, can lead to soil depletion, which, in turn, reduces the availability of secondary nutrients in the soil. This has led to an increased need for supplementary secondary nutrient fertilizers. As consumers become more health-conscious, there is a growing demand for high-quality, nutrient-dense crops. Secondary nutrients play a critical role in the development and quality of crops, making them an essential component of modern agriculture. These are some of the key factors propelling the growth of secondary nutrients.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Secondary Macronutrients Market Dynamics

Drivers: Need for increasing crop production

The consumption of animal products increases as more people enter the middle class, which in turn drives up the demand for grains and other crops to feed the animals. The amount of arable land accessible for farming declines as more people move into urban areas, necessitating an increase in agricultural production on already-existing farmland. In order to supply the needs of the urban population, it is necessary to boost the productivity of already used agricultural land and to investigate novel approaches to food production, such as vertical farming and urban agriculture. The most effective use of secondary nutrients can significantly boost the productivity of currently used agricultural land and support sustainable and creative methods of food production.

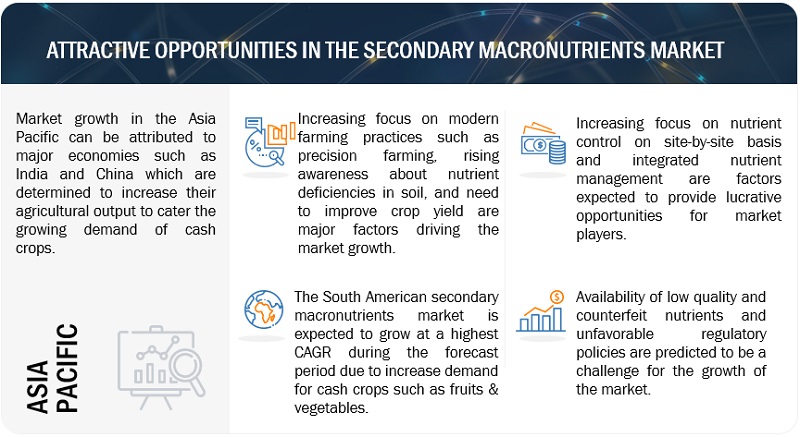

Restraints: Rising instances of counterfeit goods

The production of counterfeit items by several rivals decreases consumer loyalty as well as the product brand value. The secondary macronutrients market is expected to increase steadily, which must be capitalized on by manufacturing products that are authentic and effective on a wide range of crops. Counterfeit fertilizers may contain incorrect or insufficient amounts of secondary macronutrients or may be formulated with low-quality ingredients that are not effective in improving plant growth and crop yields. As a result, farmers may experience reduced yields or poor crop quality, and may be forced to purchase additional fertilizers to make up for the lack of effectiveness.

Opportunities: Precision agriculture for nutrient control on site-by-site basis

Precision agriculture includes site-specific nutrient management, which may be applied to any field or crop. It is a technology-based technique of growing crops effectively and on-site using specialized application equipment that can maintain water and nutrients in the root zone. Precision farming has the ability to enhance output and fertilizer usage efficiency by preventing nutrients from leaching from or accumulating in excessive amounts in specific areas of the field. Precision farming is gaining popularity in industrialized nations because of the efficient use of the fertigation method, which has the potential to be a successful instrument in the judicious delivery of secondary nutrients, resulting in decreased application costs. The kind of secondary nutrient and its formulation may be entered into the information system, which can then offer an accurate analysis of the crop's nutrient requirements, application rate, and mixing ratio inside the fertigation system.

Challenges: Utilization of agricultural biologicals in farming

The utilization of agricultural biologicals such as biofertilizers, biopesticides, PGRS, and inoculants is growing rapidly in the agricultural sector. This is because people are getting more concerned and conscious about their health and the environment. Agricultural biologicals are gaining popularity due to their potential to improve crop productivity, enhance soil health, and reduce the environmental impact compared to conventional chemical inputs. This could-be a challenge to the secondary macronutrients. The growing market for various biologicals is being an obstacle for the secondary macronutrients market. The demand for organic food such as organic fruits & vegetables is rising worldwide, which is reducing the demand for synthetic fertilizers.

According to the circular economy of the European Union, the new rules will apply to all types of fertilizers to guarantee the highest levels of soil protection. The Regulation introduces strict limits for cadmium in phosphate fertilizers. The limits will be tightened from 60 mg/kg to 40 mg/kg after 3 years and to 20 mg/kg after 12 years, reducing health and environmental risks. Soil protection will demand less application of fertilizers. The farmers have to apply limited fertilizers to the crops so that it will not affect the quality of the soil. Hence, it can also be a threat for applying the secondary nutrient more than the required amount.

Secondary Macronutrients Market Ecosystem

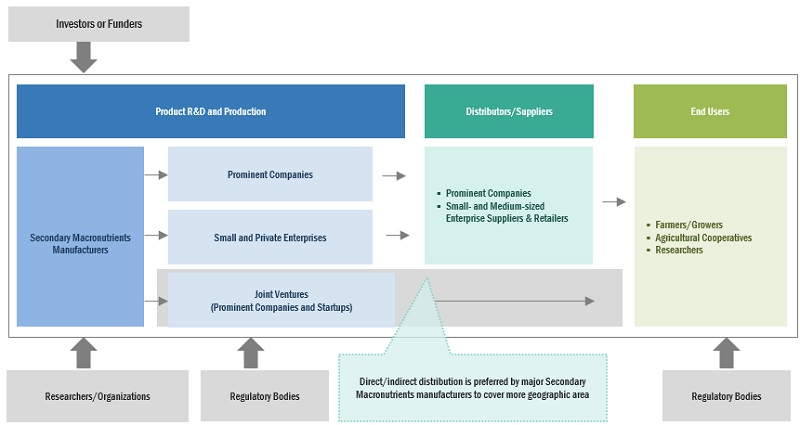

Key players in market have strong distribution network and have strong financial records. These firms have experience of several years, well established manufacturing facilities, r&d centers, and skilled workforce. Prominent players in this market include Nutrien Ltd. (Canada), Yara (Norway), The Mosaic Company (US), Israel Chemicals Limited (Israel), and K+S Aktiengesellschaft (Germany).

By nutrient, calcium is projected to gain largest share in the market during the study period

Adequate calcium intake is key to normal root system development, healthy fruit set, and high-quality fruit development. At the same time, it stimulates photosynthesis and ensures more efficient utilization of nitrogen. Calcium increases root mass, resulting in faster and better growth of plants in spring. It also helps promote crop uniformity, an important factor for row crops and forage growers. Optimal amounts of calcium help improve soil structure, ensuring healthy, aerated soils. Calcium is immobile in plants, so a continuous supply is essential. Thus, driving the growth of segment in the secondary macronutrients market.

By crop type, fruits & vegetables is forecasted to grow at highest CAGR in the market during the research period

With increasing health awareness across people of different age groups, the demand for fresh foods, fruits & vegetables in particular, is growing rapidly. In developed countries such as US, Canada, UK, Germany, among others, people are adopting veganism which makes fruits & vegetables major source of vitamins and mineral in their diet. Thus, production of these crops is predicted to increase with increased demand. Deficiency of secondary macronutrients can severely affect the yield quality as well as quantity of these crops. For instance, calcium deficiency produces small, thickened leaves and causes loss of vigor, thinning of foliage, and decreased fruit production.

By mode of application, liquid segment is anticipated to occupy major share in the secondary macronutrients market during the study period

Liquid spraying methods improve plant response in terms of accuracy and nutrient availability to plants. Liquid fertilizer is applied evenly and precisely to the edge of the field, unlike granular application. One advantage of liquid spraying is that the liquid penetrates the soil more quickly, allowing plants to access nutrients sooner. Some plants will see immediate results from this application. In fact, many growers use this type of fertilizer early in the season to ensure rapid root growth so that the plants can take root when they absolutely need to. Its precision allows farmers to aim their crops more efficiently, and the nutrients are used exactly where plants need them.

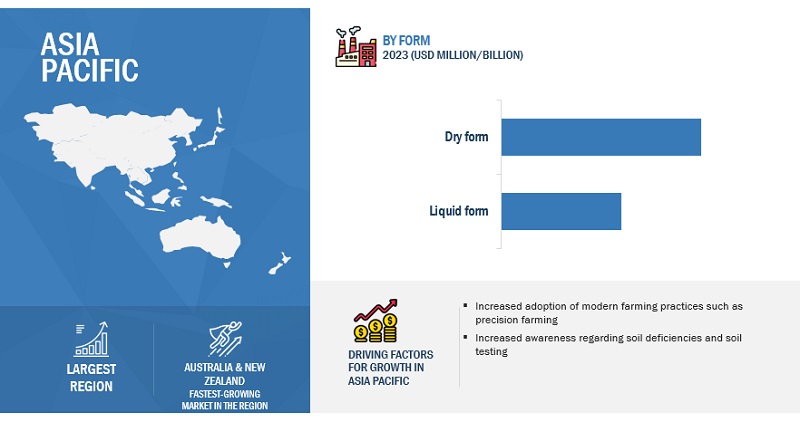

By form, dry segment is forecasted to gain the major share in the market during the review period

Dry fertilizers have the advantage of slow release of nutrients and can generally be stored longer than some liquid fertilizers without the danger of "settling" over time. It is usually inexpensive when purchased in bulk and has long-lasting nutrients, making it a good choice for fertilizing fields before planting. Dry fertilizers are usually formulated in granular form. Fertilizer blending is accomplished by blending individual granular fertilizers of known assay (e.g. 46-0-0, 18-46-0, and 0-0-60) in the correct proportions to obtain the desired blend. If farmers had access to custom-blended granular fertilizers, they could optimize crop fertility programs and improve crop production efficiency. This allows for more profitable crop production.

Several major countries in Asia Pacific region such as India are still agricultural economies with most of the population having agriculture as their main occupations. The governments in the region are promoting soil testing so that the farmers can supplement essential nutrients to crops which are not present in soil in sufficient quantities. The increasing modern agricultural practices and requirement of high-quality agricultural produce are expected to drive the market in the region.

Top Secondary Macronutrients Companies

Key players in this market include Nutrien Ltd. (Canada), Yara (Norway), The Mosaic Company (US), Israel Chemicals Limited (Israel), K+S Aktiengesellschaft (Germany), Nufarm (Australia), SPIC (India), Koch Industries, INC. (US), Coromandel International (India), Deepak Fertilisers and Petrochemicals Corporation Ltd. (India), Haifa Negev Technologies LTD (Israel), Kugler Company (USA), IFFCO (India), Western Nutrient Corporation (US), and Arise Agro Limited (India).

Secondary Macronutrients Market Scope

|

Report Metric |

Details |

|

Market Valuation in 2023 |

USD 39.9 billion |

|

Revenue Forecast in 2028 |

USD 48.5 billion |

|

Growth Rate |

CAGR of 4.0% from 2023 to 2028 |

|

Forecast Period Considered |

2023–2028 |

|

Geographies Covered |

North America, Asia Pacific, Europe, South America, and RoW |

|

Key Companies studied |

|

Secondary Macronutrients Market Segmentation

The study categorizes the secondary macronutrients market based on by nutrient, by crop type, by mode of application, by form, and region.

Market By Nutrient

- Calcium

- Sulfur

- Magnesium

Market By Crop type

-

Cereals & grains

- Corn

- Wheat

- Rice

- Other cereals & grains

-

Oilseeds & pulses

- Soybean

- Sunflower

- Other oilseeds & pulses

-

Fruits & vegetables

- Root & tuber vegetables

- Leafy vegetables

- Pome fruits

- Berries

- Citrus fruits

- Other fruits & vegetables

- Other crop types

Market By Application

-

Liquid application

- Fertigation

- Foliar

- Other liquid mode of applications

-

Solid application

- Broadcasting

- Deep Tillage

- Localized Placement

Market By Form

- Dry form

- Liquid form

Market By Region

- North America

- Europe

- Asia Pacific

- South America

- Row (Africa and Middle East)

Secondary Macronutrients Industry Developments

- In January 2023, K+S Aktiengesellschaft (Germany) accepted to acquire 75% of the agricultural input business of Industrial Commodities Holdings (Pty) Ltd (South Africa).

- In August 2022, Koch Industries, INC. (US) announced expansion of its production capacity with new manufacturing plant at Dodge City, Kansas, US. It will produce 35,000 tons of UAN per year.

- In March 2022, The Haifa Group signed with HORTICOOP BV a purchase agreement acquiring Horticoop Andina. Upon acquiring the brand, Haifa is expected to broaden its scope of activities in Ecuador and the surrounding Latin market and continue to establish its status as an international superbrand in advanced plant nutrition.

Frequently Asked Questions (FAQ):

Which are the major crop types considered in this study?

The major crop types considered in this study are cereals & grains, oilseeds & pulses, and fruits & vegetables. Fruits & vegetables segment is projected to have promising growth rate in the future followed by oilseeds & pulses.

Which countries are included in Asia Pacific region?

Exclusive insights on below Asia Pacific countries will be provided:

- China

- Japan

- India

- Australia & New Zealand

- Rest of Asia Pacific (South Korea, Malaysia, and Vietnam)

Which is the driving factor of the secondary macronutrients market?

Is mode of application segment further bifurcated in the report?

Yes, the liquid mode of application segment is bifurcated into foliar, fertigation, and other liquid mode of applications (aerial and soil injection). Similarly, solid mode of application segment is classified into broadcasting, deep tillage, and localized placement.

In competitive analysis section what kind of data is provided?

Information such as business overview along with financial analysis such as business and geographic revenue mix is provided for major players. Research & development expenditure of key players is provided for last three years. Detailed understanding of company’s key strengths and strategies is also included in this section.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORS INFLUENCING SECONDARY MACRONUTRIENTS MARKETPOPULATION GROWTH AND DEMAND FOR DIVERSE FOOD PRODUCTSARABLE LAND CONSTRAINTS

-

5.3 MARKET DYNAMICSDRIVERS- Need to increase crop production- Increased demand for high-value crops like fruits & vegetables- Soil degradation and deficiencies due to absence of secondary nutrients- Advancements in agricultural research and technology- Crop quality and market demandRESTRAINTS- Price volatility and fluctuations in global market- Rising instances of counterfeit goodsOPPORTUNITIES- Precision agriculture for nutrient control on site-by-site basis- Rising investments in agricultural enterprises from emerging economies- Integrated nutrient management (INM)CHALLENGES- Utilization of agricultural biologicals in farming- Lack of regulatory standards

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRESEARCH AND PRODUCT DEVELOPMENTSOURCINGMANUFACTURINGSALES & DISTRIBUTIONEND CONSUMERS

-

6.3 SUPPLY CHAIN ANALYSISPROMINENT COMPANIESSMALL AND MEDIUM ENTERPRISES (SMES)END USERSKEY INFLUENCERS

-

6.4 TECHNOLOGY ANALYSISNANOFERTILIZERSPRECISION FERTILIZATION OF SECONDARY MACRONUTRIENTS

-

6.5 PRICE TREND ANALYSISAVERAGE SELLING PRICE, BY NUTRIENT

-

6.6 MARKET MAPPING AND ECOSYSTEM ANALYSISSUPPLY-SIDE ANALYSISDEMAND-SIDE ANALYSIS

-

6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- 6.8 TRADE ANALYSIS

-

6.9 PATENT ANALYSIS

-

6.10 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

6.11 CASE STUDIES

- 6.12 KEY CONFERENCES AND EVENTS, 2023–2024

- 6.13 TARIFF AND REGULATORY LANDSCAPE

-

6.14 REGULATORY FRAMEWORKNORTH AMERICA- US- CanadaEUROPE- Germany- ItalyASIA PACIFIC- China- Australia- IndiaSOUTH AMERICA- Brazil

-

6.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 7.1 INTRODUCTION

-

7.2 CALCIUMINCREASED USAGE OF CALCIUM ON WIDE RANGE OF CROPS TO FUEL GROWTH

-

7.3 SULFURSULFUR’S IMPACT ON CROP YIELD AND QUALITY TO DRIVE GROWTH

-

7.4 MAGNESIUMMAGNESIUM’S ROLE IN PLANT RESILIENCE TO ENVIRONMENTAL STRESSES TO CONTRIBUTE TO GROWTH

- 8.1 INTRODUCTION

-

8.2 DRY FORMEASE OF STORAGE AND LONGER SHELF LIFE TO BOOST GROWTH

-

8.3 LIQUID FORMQUICK NUTRIENT SUPPLY TO CROPS TO DRIVE MARKET GROWTH

- 9.1 INTRODUCTION

-

9.2 LIQUID APPLICATIONFERTIGATION- Improved efficiency and customizable nutrient application to lead to increased crop yield and qualityFOLIAR- Targeted nutrient delivery with foliar method to lead to improved plant healthOTHER LIQUID MODES OF APPLICATION- Targeting of nutrients and reduced risk of nutrient loss to drive growth

-

9.3 SOLID APPLICATIONBROADCASTING- Easy adoption and ability to provide nutrients in wide areas to drive growthDEEP TILLAGE- Deep tillage to Improve fertility and texture of soilLOCALIZED PLACEMENT- Localized placement to provide nutrients to crops in optimum amount

- 10.1 INTRODUCTION

-

10.2 CEREALS & GRAINSCORN- Abundance of secondary macronutrients to drive production of cornWHEAT- Reputation of wheat as major staple food to drive demand for secondary macronutrientsRICE- Versatility of rice to drive usage of secondary macronutrientsOTHER CEREALS & GRAINS- Industrial uses of sorghum, barley, and oats to fuel demand for secondary macronutrients

-

10.3 OILSEEDS & PULSESSOYBEAN- Increased demand for soybean due to nutritional properties to drive growth of secondary macronutrientsSUNFLOWER- Economic importance and ornamental value of sunflower to drive demand for secondary macronutrientsOTHER OILSEEDS & PULSES- High nutritional value and drought resistance of these subtypes to contribute to market growth

-

10.4 FRUITS & VEGETABLESROOT & TUBER VEGETABLES- Secondary macronutrients to add value to root & tuber cropsLEAFY VEGETABLES- Versatility of leafy vegetables in culinary applications to drive demand for secondary macronutrientsPOME FRUITS- Convenience of pome fruits due to shelf life to fuel growth of secondary macronutrientsBERRIES- Increased yield and profitability in berry cultivation to drive market growthCITRUS FRUITS- Meeting export demand with high-quality citrus fruits to fuel growthOTHER FRUITS & VEGETABLES- Suitability for cultivation in diverse climates and soil types to drive growth

-

10.5 OTHER CROP TYPESORNAMENTALS, TURF, AND FORAGE CROPS FOR AESTHETICS, LIVESTOCK FEED, AND ENVIRONMENTAL BENEFITS TO DRIVE MARKET

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICARECESSION IMPACT ANALYSISUS- Increasing consumer demand for food to lead to higher usage of secondary macronutrients in US agricultureCANADA- Strong trading relationships and increasing crop exports to present opportunities in CanadaMEXICO- Rising cultivation of major crops in Mexico to drive market for secondary macronutrients

-

11.3 ASIA PACIFICRECESSION IMPACT ANALYSISINDIA- Changing cropping pattern and stress to drive market growthJAPAN- Increased efficiency and effectiveness of fertilizers containing secondary macronutrients to drive growthCHINA- Population growth and income increase to drive demand for nutrient-rich foodsAUSTRALIA & NEW ZEALAND- Improved crop quality and export opportunities to fuel market for secondary macronutrientsREST OF ASIA PACIFIC- Rising demand for premium food to drive market for secondary macronutrients

-

11.4 EUROPERECESSION IMPACT ANALYSISGERMANY- Diverse crop production and rising demand for different commodities to drive demand for secondary macronutrientsFRANCE- Greater demand for better agricultural production to propel growth of secondary macronutrientsITALY- Diverse cultivation of crops and different climate conditions to encourage farmers to use secondary macronutrientsSPAIN- Need for fruit production and food security to lead to secondary macronutrient usageUK- Increased production and expansion in acreage for crops to drive demand for secondary macronutrientsRUSSIA- Significance of cereals, wheat, and barley production in Russian agriculture to drive market growthREST OF EUROPE- Regional specialization in crop production to drive market for secondary macronutrients

-

11.5 SOUTH AMERICARECESSION IMPACT ANALYSISBRAZIL- Opportunities for innovation and technological advancements to fuel demand for secondary macronutrientsARGENTINA- High market penetration with help of local companies to contribute to market growthREST OF SOUTH AMERICA- Use of secondary macronutrients to enhance crop productivity to boost growth

-

11.6 REST OF THE WORLDRECESSION IMPACT ANALYSISAFRICA- Increasing demand for agricultural goods to drive secondary macronutrients market in AfricaMIDDLE EAST- Variations in usage of secondary macronutrients to propel market growth

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 COMPANY REVENUE ANALYSIS OF KEY PLAYERS, 2020–2022

- 12.6 KEY PLAYERS: ANNUAL REVENUE VS. GROWTH

- 12.7 EBITDA OF KEY PLAYERS

-

12.8 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSNUTRIENT FOOTPRINT

-

12.9 STARTUP/SME EVALUATION QUADRANT (OTHER PLAYERS)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF OTHER PLAYERS

-

12.10 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

13.1 KEY PLAYERSNUTRIEN LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewYARA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHE MOSAIC COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewISRAEL CHEMICALS LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewK+S AKTIENGESELLSCHAFT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNUFARM- Business overview- Products/Solutions/Services offered- MnM viewSPIC- Business overview- Products/Solutions/Services offered- MnM viewKOCH INDUSTRIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCOROMANDEL INTERNATIONAL LTD- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDEEPAK FERTILISERS AND PETROCHEMICALS CORPORATION LTD.- Business overview- Products/Solutions/Services offered- MnM viewHAIFA NEGEV TECHNOLOGIES LTD- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKUGLER COMPANY- Business overview- Products/Solutions/Services offered- MnM viewIFFCO- Business overview- Products/Solutions/Services offered- MnM viewWESTERN NUTRIENTS CORPORATION- Business overview- Products/Solutions/Services offered- MnM viewARIES AGRO LIMITED- Business overview- Products/Solutions/Services offered- MnM view

-

13.2 OTHER PLAYERSBMS MICRO-NUTRIENTS- Business overview- Products/Solutions/Services offeredBAICOR, LLC- Business overview- Products/Solutions/Services offeredPLANT FOOD COMPANY, INC.- Business overview- Products/Solutions/Services offeredAGROLIQUID- Business overview- Products/Solutions/Services offeredTERRALINK HORTICULTURE INC.- Business overview- Products/Solutions/Services offeredSTOLLER ENTERPRISESNACHURSMORRAL COMPANIES LLCADITYA MICRODYNAMICSMYTHREYI AGRI INPUTS

- 14.1 INTRODUCTION

- 14.2 RESEARCH LIMITATIONS

-

14.3 AGROCHEMICALS MARKETMARKET DEFINITIONMARKET OVERVIEW

-

14.4 AGRICULTURAL BIOLOGICALS MARKETMARKET DEFINITIONMARKET OVERVIEW

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018–2022

- TABLE 2 SECONDARY MACRONUTRIENTS MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 SECONDARY MACRONUTRIENTS: AVERAGE SELLING PRICE (ASP), BY REGION, 2020–2022 (USD/TON)

- TABLE 4 SECONDARY MACRONUTRIENTS: AVERAGE SELLING PRICE (ASP), BY NUTRIENT, 2020–2022 (USD/TON)

- TABLE 5 AVERAGE SELLING PRICE OF KEY MARKET PLAYERS, BY NUTRIENT, 2022 (USD/TON)

- TABLE 6 SECONDARY MACRONUTRIENTS MARKET: SUPPLY CHAIN ECOSYSTEM

- TABLE 7 EXPORT VALUE OF MINERAL OR CHEMICAL NITROGENOUS FERTILIZERS, BY KEY COUNTRY, 2021

- TABLE 8 IMPORT VALUE OF MINERAL OR CHEMICAL NITROGENOUS FERTILIZERS, BY KEY COUNTRY, 2021

- TABLE 9 EXPORT VALUE OF MINERAL OR CHEMICAL NITROGENOUS FERTILIZERS, BY KEY COUNTRY, 2020

- TABLE 10 IMPORT VALUE OF MINERAL OR CHEMICAL NITROGENOUS FERTILIZERS, BY KEY COUNTRY, 2020

- TABLE 11 EXPORT VALUE OF MINERAL OR CHEMICAL PHOSPHATIC FERTILIZERS, BY KEY COUNTRY, 2021

- TABLE 12 IMPORT VALUE OF MINERAL OR CHEMICAL PHOSPHATIC FERTILIZERS, BY KEY COUNTRY, 2021

- TABLE 13 EXPORT VALUE OF MINERAL OR CHEMICAL PHOSPHATIC FERTILIZERS, BY KEY COUNTRY, 2020

- TABLE 14 IMPORT VALUE OF MINERAL OR CHEMICAL PHOSPHATIC FERTILIZERS, BY KEY COUNTRY, 2020

- TABLE 15 EXPORT VALUE OF MINERAL OR CHEMICAL POTASSIC FERTILIZERS, BY KEY COUNTRY, 2021

- TABLE 16 IMPORT VALUE OF MINERAL OR CHEMICAL POTASSIC FERTILIZERS, BY KEY COUNTRY, 2021

- TABLE 17 EXPORT VALUE OF MINERAL OR CHEMICAL POTASSIC FERTILIZERS, BY KEY COUNTRY, 2020

- TABLE 18 IMPORT VALUE OF MINERAL OR CHEMICAL POTASSIC FERTILIZERS, BY KEY COUNTRY, 2020

- TABLE 19 EXPORT VALUE OF MINERAL OR CHEMICAL FERTILIZERS, BY KEY COUNTRY, 2021

- TABLE 20 IMPORT VALUE OF MINERAL OR CHEMICAL FERTILIZERS, BY KEY COUNTRY, 2021

- TABLE 21 EXPORT VALUE OF MINERAL OR CHEMICAL FERTILIZERS, BY KEY COUNTRY, 2020

- TABLE 22 IMPORT VALUE OF MINERAL OR CHEMICAL FERTILIZERS, BY KEY COUNTRY, 2020

- TABLE 23 PATENTS PERTAINING TO SECONDARY MACRONUTRIENTS, 2013–2022

- TABLE 24 SECONDARY MACRONUTRIENTS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 25 NUTRIEN LTD. LAUNCHED MAP+MST HOMOGENOUS FERTILIZER

- TABLE 26 INTRODUCTION OF CRF COATING BY ISRAEL CHEMICALS LIMITED

- TABLE 27 KEY CONFERENCES AND EVENTS IN SECONDARY MACRONUTRIENTS MARKET, 2023–2024

- TABLE 28 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 29 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 30 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 31 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE TYPES

- TABLE 33 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- TABLE 34 SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2018–2022 (USD BILLION)

- TABLE 35 MARKET, BY NUTRIENT, 2023–2028 (USD BILLION)

- TABLE 36 MARKET, BY NUTRIENT, 2018–2022 (KT)

- TABLE 37 MARKET, BY NUTRIENT, 2023–2028 (KT)

- TABLE 38 CALCIUM: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 39 CALCIUM: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 40 CALCIUM: MARKET, BY REGION, 2018–2022 (KT)

- TABLE 41 CALCIUM: MARKET, BY REGION, 2023–2028 (KT)

- TABLE 42 SULFUR: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 43 SULFUR: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 44 SULFUR: MARKET, BY REGION, 2018–2022 (KT)

- TABLE 45 SULFUR: MARKET, BY REGION, 2023–2028 (KT)

- TABLE 46 MAGNESIUM: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 47 MAGNESIUM: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 48 MAGNESIUM: MARKET, BY REGION, 2018–2022 (KT)

- TABLE 49 MAGNESIUM: MARKET, BY REGION, 2023–2028 (KT)

- TABLE 50 SECONDARY MACRONUTRIENTS MARKET, BY FORM, 2018–2022 (USD BILLION)

- TABLE 51 MARKET, BY FORM, 2023–2028 (USD BILLION)

- TABLE 52 DRY FORM: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 53 DRY FORM: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 54 LIQUID FORM: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 55 LIQUID FORM: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 56 SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018–2022 (USD BILLION)

- TABLE 57 MARKET, BY MODE OF APPLICATION, 2023–2028 (USD BILLION)

- TABLE 58 LIQUID APPLICATION: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 59 LIQUID APPLICATION: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 60 LIQUID APPLICATION: MARKET, BY SUBTYPE, 2018–2022 (USD BILLION)

- TABLE 61 LIQUID APPLICATION: MARKET, BY SUBTYPE, 2023–2028 (USD BILLION)

- TABLE 62 FOLIAR: SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2018–2022 (USD BILLION)

- TABLE 63 FOLIAR: MARKET, BY NUTRIENT, 2023–2028 (USD BILLION)

- TABLE 64 SOLID APPLICATION: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 65 SOLID APPLICATION: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 66 SOLID APPLICATION: MARKET, BY SUBTYPE, 2018–2022 (USD BILLION)

- TABLE 67 SOLID APPLICATION: MARKET, BY SUBTYPE, 2023–2028 (USD BILLION)

- TABLE 68 SECONDARY MACRONUTRIENTS MARKET, BY CROP TYPE, 2018–2022 (USD BILLION)

- TABLE 69 MARKET, BY CROP TYPE, 2023–2028 (USD BILLION)

- TABLE 70 CEREALS & GRAINS: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 71 CEREALS & GRAINS: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 72 CEREALS & GRAINS: MARKET, BY SUBTYPE, 2018–2022 (USD BILLION)

- TABLE 73 CEREALS & GRAINS: MARKET, BY SUBTYPE, 2023–2028 (USD BILLION)

- TABLE 74 OILSEEDS & PULSES: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 75 OILSEEDS & PULSES: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 76 OILSEEDS & PULSES: MARKET, BY SUBTYPE, 2018–2022 (USD BILLION)

- TABLE 77 OILSEEDS & PULSES: MARKET, BY SUBTYPE, 2023–2028 (USD BILLION)

- TABLE 78 FRUITS & VEGETABLES: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 79 FRUITS & VEGETABLES: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 80 FRUITS & VEGETABLES: MARKET, BY SUBTYPE, 2018–2022 (USD BILLION)

- TABLE 81 FRUITS & VEGETABLES: MARKET, BY SUBTYPE, 2023–2028 (USD BILLION)

- TABLE 82 OTHER CROP TYPES: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 83 OTHER CROP TYPES: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 84 SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 85 MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 86 MARKET, BY REGION, 2018–2022 (KT)

- TABLE 87 MARKET, BY REGION, 2023–2028 (KT)

- TABLE 88 NORTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 89 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 90 NORTH AMERICA: MARKET, BY NUTRIENT, 2018–2022 (USD BILLION)

- TABLE 91 NORTH AMERICA: MARKET, BY NUTRIENT, 2023–2028 (USD BILLION)

- TABLE 92 NORTH AMERICA: MARKET, BY NUTRIENT, 2018–2022 (KT)

- TABLE 93 NORTH AMERICA: MARKET, BY NUTRIENT, 2023–2028 (KT)

- TABLE 94 NORTH AMERICA: MARKET, BY MODE OF APPLICATION, 2018–2022 (USD BILLION)

- TABLE 95 NORTH AMERICA: MARKET, BY MODE OF APPLICATION, 2023–2028 (USD BILLION)

- TABLE 96 NORTH AMERICA: MARKET, BY FORM, 2018–2022 (USD BILLION)

- TABLE 97 NORTH AMERICA: MARKET, BY FORM, 2023–2028 (USD BILLION)

- TABLE 98 NORTH AMERICA:MARKET, BY CROP TYPE, 2018–2022 (USD BILLION)

- TABLE 99 NORTH AMERICA: MARKET, BY CROP TYPE, 2023–2028 (USD BILLION)

- TABLE 100 US: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018–2022 (USD BILLION)

- TABLE 101 US: MARKET, BY MODE OF APPLICATION, 2023–2028 (USD BILLION)

- TABLE 102 CANADA: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018–2022 (USD BILLION)

- TABLE 103 CANADA: MARKET, BY MODE OF APPLICATION, 2023–2028 (USD BILLION)

- TABLE 104 MEXICO: MARKET, BY MODE OF APPLICATION, 2018–2022 (USD BILLION)

- TABLE 105 MEXICO: MARKET, BY MODE OF APPLICATION, 2023–2028 (USD BILLION)

- TABLE 106 APAC: SECONDARY MACRONUTRIENTS MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 107 APAC: MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 108 APAC: MARKET, BY NUTRIENT, 2018–2022 (USD BILLION)

- TABLE 109 APAC: MARKET, BY NUTRIENT, 2023–2028 (USD BILLION)

- TABLE 110 APAC: MARKET, BY NUTRIENT, 2018–2022 (KT)

- TABLE 111 APAC: MARKET, BY NUTRIENT, 2023–2028 (KT)

- TABLE 112 APAC: MARKET, BY MODE OF APPLICATION, 2018–2022 (USD BILLION)

- TABLE 113 APAC: MARKET, BY MODE OF APPLICATION, 2023–2028 (USD BILLION)

- TABLE 114 APAC: MARKET, BY FORM, 2018–2022 (USD BILLION)

- TABLE 115 APAC: MARKET, BY FORM, 2023–2028 (USD BILLION)

- TABLE 116 APAC: MARKET, BY CROP TYPE, 2018–2022 (USD BILLION)

- TABLE 117 APAC: MARKET, BY CROP TYPE, 2023–2028 (USD BILLION)

- TABLE 118 INDIA: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018–2022 (USD BILLION)

- TABLE 119 INDIA: MARKET, BY MODE OF APPLICATION, 2023–2028 (USD BILLION)

- TABLE 120 JAPAN: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018–2022 (USD BILLION)

- TABLE 121 JAPAN: MARKET, BY MODE OF APPLICATION, 2023–2028 (USD BILLION)

- TABLE 122 CHINA: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018–2022 (USD BILLION)

- TABLE 123 CHINA: MARKET, BY MODE OF APPLICATION, 2023–2028 (USD BILLION)

- TABLE 124 AUSTRALIA & NEW ZEALAND: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018–2022 (USD BILLION)

- TABLE 125 AUSTRALIA & NEW ZEALAND: MARKET, BY MODE OF APPLICATION, 2023–2028 (USD BILLION)

- TABLE 126 REST OF ASIA PACIFIC: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018–2022 (USD BILLION)

- TABLE 127 REST OF ASIA PACIFIC: MARKET, BY MODE OF APPLICATION, 2023–2028 (USD BILLION)

- TABLE 128 EUROPE: SECONDARY MACRONUTRIENTS MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 129 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 130 EUROPE: MARKET, BY NUTRIENT, 2018–2022 (USD BILLION)

- TABLE 131 EUROPE: MARKET, BY NUTRIENT, 2023–2028 (USD BILLION)

- TABLE 132 EUROPE: MARKET, BY NUTRIENT, 2018–2022 (KT)

- TABLE 133 EUROPE: MARKET, BY NUTRIENT, 2023–2028 (KT)

- TABLE 134 EUROPE: MARKET, BY MODE OF APPLICATION, 2018–2022 (USD BILLION)

- TABLE 135 EUROPE: MARKET, BY MODE OF APPLICATION, 2023–2028 (USD BILLION)

- TABLE 136 EUROPE: MARKET, BY FORM, 2018–2022 (USD BILLION)

- TABLE 137 EUROPE: MARKET, BY FORM, 2023–2028 (USD BILLION)

- TABLE 138 EUROPE: MARKET, BY CROP TYPE, 2018–2022 (USD BILLION)

- TABLE 139 EUROPE: MARKET, BY CROP TYPE, 2023–2028 (USD BILLION)

- TABLE 140 GERMANY: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018–2022 (USD BILLION)

- TABLE 141 GERMANY: MARKET, BY MODE OF APPLICATION, 2023–2028 (USD BILLION)

- TABLE 142 FRANCE: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018–2022 (USD BILLION)

- TABLE 143 FRANCE: MARKET, BY MODE OF APPLICATION, 2023–2028 (USD BILLION)

- TABLE 144 ITALY: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018–2022 (USD BILLION)

- TABLE 145 ITALY: MARKET, BY MODE OF APPLICATION, 2023–2028 (USD BILLION)

- TABLE 146 SPAIN: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018–2022 (USD BILLION)

- TABLE 147 SPAIN: MARKET, BY MODE OF APPLICATION, 2023–2028 (USD BILLION)

- TABLE 148 UK: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018–2022 (USD BILLION)

- TABLE 149 UK: MARKET, BY MODE OF APPLICATION, 2023–2028 (USD BILLION)

- TABLE 150 RUSSIA: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018–2022 (USD BILLION)

- TABLE 151 RUSSIA: MARKET, BY MODE OF APPLICATION, 2023–2028 (USD BILLION)

- TABLE 152 REST OF EUROPE: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018–2022 (USD BILLION)

- TABLE 153 REST OF EUROPE: MARKET, BY MODE OF APPLICATION, 2023–2028 (USD BILLION)

- TABLE 154 SOUTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 155 SOUTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 156 SOUTH AMERICA: MARKET, BY NUTRIENT, 2018–2022 (USD BILLION)

- TABLE 157 SOUTH AMERICA: MARKET, BY NUTRIENT, 2023–2028 (USD BILLION)

- TABLE 158 SOUTH AMERICA: MARKET, BY NUTRIENT, 2018–2022 (KT)

- TABLE 159 SOUTH AMERICA: MARKET, BY NUTRIENT, 2023–2028 (KT)

- TABLE 160 SOUTH AMERICA: MARKET, BY MODE OF APPLICATION, 2018–2022 (USD BILLION)

- TABLE 161 SOUTH AMERICA: SATION, 2023–2028 (USD BILLION)

- TABLE 162 SOUTH AMERICA: MARKET, BY FORM, 2018–2022 (USD BILLION)

- TABLE 163 SOUTH AMERICA: MARKET, BY FORM, 2023–2028 (USD BILLION)

- TABLE 164 SOUTH AMERICA: MARKET, BY CROP TYPE, 2018–2022 (USD BILLION)

- TABLE 165 SOUTH AMERICA: MARKET, BY CROP TYPE, 2023–2028 (USD BILLION)

- TABLE 166 BRAZIL: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018–2022 (USD BILLION)

- TABLE 167 BRAZIL: MARKET, BY MODE OF APPLICATION, 2023–2028 (USD BILLION)

- TABLE 168 ARGENTINA: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018–2022 (USD BILLION)

- TABLE 169 ARGENTINA: MARKET, BY MODE OF APPLICATION, 2023–2028 (USD BILLION)

- TABLE 170 REST OF SOUTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018–2022 (USD BILLION)

- TABLE 171 REST OF SOUTH AMERICA: MARKET, BY MODE OF APPLICATION, 2023–2028 (USD BILLION)

- TABLE 172 ROW: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 173 ROW: MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 174 ROW: MARKET, BY NUTRIENT, 2018–2022 (USD BILLION)

- TABLE 175 ROW: MARKET, BY NUTRIENT, 2023–2028 (USD BILLION)

- TABLE 176 ROW: MARKET, BY NUTRIENT, 2018–2022 (KT)

- TABLE 177 ROW: MARKET, BY NUTRIENT, 2023–2028 (KT)

- TABLE 178 ROW: MARKET, BY MODE OF APPLICATION, 2018–2022 (USD BILLION)

- TABLE 179 ROW: MARKET, BY MODE OF APPLICATION, 2023–2028 (USD BILLION)

- TABLE 180 ROW: MARKET, BY FORM, 2018–2022 (USD BILLION)

- TABLE 181 ROW: MARKET, BY FORM, 2023–2028 (USD BILLION)

- TABLE 182 ROW: MARKET, BY CROP TYPE, 2018–2022 (USD BILLION)

- TABLE 183 ROW: MARKET, BY CROP TYPE, 2023–2028 (USD BILLION)

- TABLE 184 AFRICA: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018–2022 (USD BILLION)

- TABLE 185 AFRICA: MARKET, BY MODE OF APPLICATION, 2023–2028 (USD BILLION)

- TABLE 186 MIDDLE EAST: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018–2022 (USD BILLION)

- TABLE 187 MIDDLE EAST: MARKET, BY MODE OF APPLICATION, 2023–2028 (USD BILLION)

- TABLE 188 SECONDARY MACRONUTRIENTS MARKET: DEGREE OF COMPETITION

- TABLE 189 SECONDARY MACRONUTRIENTS: NUTRIENT FOOTPRINT OF KEY PLAYERS

- TABLE 190 SECONDARY MACRONUTRIENTS: FORM FOOTPRINT OF KEY PLAYERS

- TABLE 191 SECONDARY MACRONUTRIENTS: CROP TYPE FOOTPRINT OF KEY PLAYERS

- TABLE 192 SECONDARY MACRONUTRIENTS: REGIONAL FOOTPRINT OF KEY PLAYERS

- TABLE 193 SECONDARY MACRONUTRIENTS: OVERALL FOOTPRINT OF KEY PLAYERS

- TABLE 194 DETAILED LIST OF OTHER PLAYERS

- TABLE 195 COMPETITIVE BENCHMARKING (OTHER PLAYERS), 2021

- TABLE 196 SECONDARY MACRONUTRIENTS MARKET: PRODUCT LAUNCHES, 2018–2022

- TABLE 197 MARKET: DEALS, 2018- 2022

- TABLE 198 MARKET: OTHERS, 2018–2022

- TABLE 199 NUTRIEN LTD.: BUSINESS OVERVIEW

- TABLE 200 NUTRIEN LTD.: PRODUCT LAUNCHES

- TABLE 201 NUTRIEN LTD.: DEALS

- TABLE 202 NUTRIEN LTD.: DEALS

- TABLE 203 YARA: BUSINESS OVERVIEW

- TABLE 204 YARA: DEALS

- TABLE 205 THE MOSAIC COMPANY: BUSINESS OVERVIEW

- TABLE 206 THE MOSAIC COMPANY: DEALS

- TABLE 207 ISRAEL CHEMICAL LTD.: BUSINESS OVERVIEW

- TABLE 208 ISRAEL CHEMICALS LTD.: PRODUCT LAUNCHES

- TABLE 209 ISRAEL CHEMICALS LTD.: DEALS

- TABLE 210 K+S AKTIENGESELLSCHAFT: BUSINESS OVERVIEW

- TABLE 211 K+S AKTIENGESELLSCHAFT: DEALS

- TABLE 212 NUFARM: BUSINESS OVERVIEW

- TABLE 213 SPIC: BUSINESS OVERVIEW

- TABLE 214 KOCH INDUSTRIES, INC.: BUSINESS OVERVIEW

- TABLE 215 KOCH INDUSTRIES, INC.: DEALS

- TABLE 216 KOCH INDUSTRIES, INC.: OTHERS

- TABLE 217 COROMANDEL INTERNATIONAL LTD: BUSINESS OVERVIEW

- TABLE 218 COROMANDEL INTERNATIONAL LTD: OTHERS

- TABLE 219 DEEPAK FERTILISERS AND PETROCHEMICALS CORPORATION LTD.: BUSINESS OVERVIEW

- TABLE 220 HAIFA NEGEV TECHNOLOGIES LTD: BUSINESS OVERVIEW

- TABLE 221 HAIFA NEGEV TECHNOLOGIES LTD: DEALS

- TABLE 222 KUGLER COMPANY: BUSINESS OVERVIEW

- TABLE 223 IFFCO: BUSINESS OVERVIEW

- TABLE 224 WESTERN NUTRIENT CORPORATION: BUSINESS OVERVIEW

- TABLE 225 ARIES AGRO LIMITED: BUSINESS OVERVIEW

- TABLE 226 BMS MICRO-NUTRIENTS: BUSINESS OVERVIEW

- TABLE 227 BAICOR, LLC: BUSINESS OVERVIEW

- TABLE 228 PLANT FOOD COMPANY, INC.: BUSINESS OVERVIEW

- TABLE 229 AGROLIQUID: BUSINESS OVERVIEW

- TABLE 230 TERRALINK HORTICULTURE INC.: BUSINESS OVERVIEW

- TABLE 231 ADJACENT MARKETS

- TABLE 232 AGROCHEMICALS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 233 AGRICULTURAL BIOLOGICALS MARKET, BY FUNCTION, 2022–2027 (USD MILLION)

- FIGURE 1 SECONDARY MACRONUTRIENTS: MARKET SEGMENTATION

- FIGURE 2 SECONDARY MACRONUTRIENTS MARKET: RESEARCH DESIGN

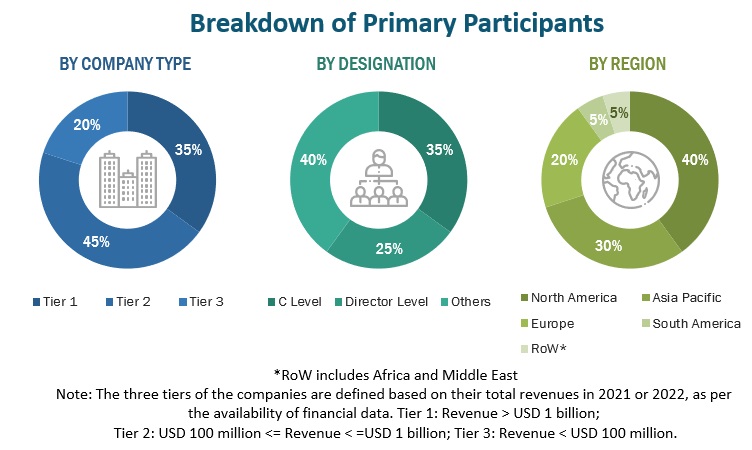

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 SECONDARY MACRONUTRIENTS MARKET: BOTTOM-UP APPROACH

- FIGURE 5 MARKET: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023 VS. 2028 (USD BILLION)

- FIGURE 8 MARKET, BY NUTRIENT, 2023 VS. 2028 (USD BILLION)

- FIGURE 9 MARKET, BY CROP TYPE, 2023 VS. 2028 (USD BILLION)

- FIGURE 10 MARKET, BY FORM, 2023 VS. 2028 (USD BILLION)

- FIGURE 11 MARKET SHARE AND GROWTH RATE (VALUE), BY REGION

- FIGURE 12 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 RUSSIA AND CEREALS & GRAINS ACCOUNTED FOR LARGEST SHARES IN 2022

- FIGURE 14 CALCIUM TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 15 CEREALS & GRAINS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 LIQUID APPLICATION TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 DRY FORM TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 18 ASIA PACIFIC AND CALCIUM TO DOMINATE DURING FORECAST PERIOD

- FIGURE 19 POPULATION GROWTH TREND, 1950–2050 (MILLION)

- FIGURE 20 MARKET DYNAMICS: SECONDARY MACRONUTRIENTS MARKET

- FIGURE 21 US: CEREAL PRODUCTION, 2017–2021 (MILLION METRIC TONS)

- FIGURE 22 WORLD FRUIT PRODUCTION, BY COUNTRY, 2017–2020 (HECTARES)

- FIGURE 23 VALUE CHAIN ANALYSIS OF SECONDARY MACRONUTRIENTS MARKET

- FIGURE 24 SECONDARY MACRONUTRIENTS MARKET: SUPPLY CHAIN

- FIGURE 25 GLOBAL AVERAGE SELLING PRICE, BY NUTRIENT

- FIGURE 26 SECONDARY MACRONUTRIENTS MARKET MAP

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 28 PATENTS GRANTED FOR SECONDARY MACRONUTRIENTS MARKET, 2013–2022

- FIGURE 29 REGIONAL ANALYSIS OF PATENTS GRANTED FOR SECONDARY MACRONUTRIENTS, 2013–2022

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY TYPES

- FIGURE 31 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 32 CALCIUM TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 33 DRY FORM TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 34 LIQUID APPLICATION PROJECTED TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 35 CEREALS & GRAINS PROJECTED TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 36 BRAZIL TO WITNESS HIGHEST GROWTH RATE AMONG COUNTRY-LEVEL MARKETS

- FIGURE 37 NORTH AMERICA: RECESSION IMPACT ANALYSIS SNAPSHOT

- FIGURE 38 APAC: SECONDARY MACRONUTRIENTS MARKET SNAPSHOT

- FIGURE 39 APAC: RECESSION IMPACT ANALYSIS SNAPSHOT

- FIGURE 40 EUROPE: SECONDARY MACRONUTRIENTS MARKET RECESSION IMPACT ANALYSIS SNAPSHOT

- FIGURE 41 SOUTH AMERICA: SNAPSHOT

- FIGURE 42 SOUTH AMERICA: SECONDARY MACRONUTRIENTS MARKET RECESSION IMPACT ANALYSIS SNAPSHOT

- FIGURE 43 ROW: SECONDARY MACRONUTRIENTS MARKET RECESSION IMPACT ANALYSIS SNAPSHOT

- FIGURE 44 GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2022

- FIGURE 45 REVENUE ANALYSIS OF KEY PLAYERS, 2020–2022 (USD BILLION)

- FIGURE 46 ANNUAL REVENUE, 2022 (USD BILLION) VS. REVENUE GROWTH, 2020–2022 (%)

- FIGURE 47 EBIDTA, 2022 (USD MILLION)

- FIGURE 48 SECONDARY MACRONUTRIENTS MARKET, COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- FIGURE 49 MARKET: COMPANY EVALUATION QUADRANT, 2022 (OTHER PLAYERS)

- FIGURE 50 NUTRIEN LTD.: COMPANY SNAPSHOT

- FIGURE 51 YARA: COMPANY SNAPSHOT

- FIGURE 52 THE MOSAIC COMPANY: COMPANY SNAPSHOT

- FIGURE 53 ISRAEL CHEMICALS LTD.: COMPANY SNAPSHOT

- FIGURE 54 K+S AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

- FIGURE 55 NUFARM: COMPANY SNAPSHOT

- FIGURE 56 SPIC: COMPANY SNAPSHOT

- FIGURE 57 COROMANDEL INTERNATIONAL LTD: COMPANY SNAPSHOT

- FIGURE 58 DEEPAK FERTILISERS AND PETROCHEMICALS CORPORATION LTD.: COMPANY SNAPSHOT

- FIGURE 59 IFFCO: COMPANY SNAPSHOT

- FIGURE 60 ARIES AGRO LIMITED: COMPANY SNAPSHOT

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the secondary macronutrients market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information and assess prospects.

Secondary Research

In the secondary research process, various sources, such as US Department of Agriculture (USDA), Food and Agriculture Organization (FAO), European Food Safety Authority (EFSA), The Fertilizer Institute (TFI), International Fertilizer Association (IFA), and The Fertilizer Association of India (FAI) were referred, to identify and collect information for this study. The secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, associations, regulatory bodies, trade directories, and paid databases.

Secondary research was mainly used to obtain vital information about the industry’s supply chain, the total pool of key players, the market classification & segmentation according to the industry trends to the bottom-most level, and geographical markets. It was also used to obtain information on the key developments from a market-oriented perspective.

Primary Research

The secondary macronutrients market comprises several stakeholders in the supply chain: suppliers, manufacturers, and end-use product manufacturers. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include growers/farmers, key opinion leaders, executives, vice presidents, and CEOs of the agriculture fertilizers industry. The primary sources from the supply side include research institutions involved in R&D activities, key opinion leaders, and manufacturers of secondary macronutrients.

Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

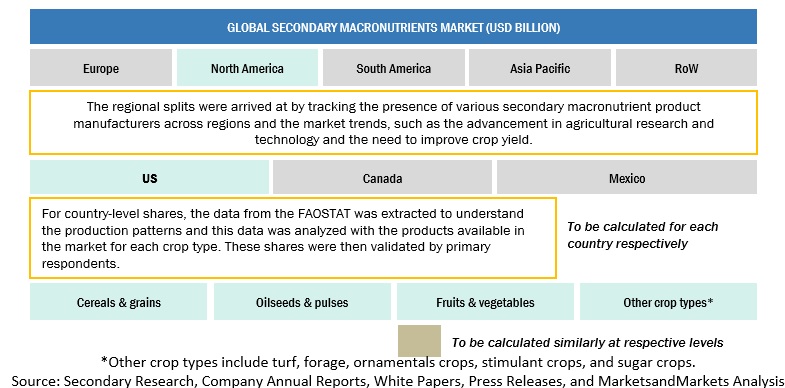

Secondary Macronutrients Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the markets were identified through extensive secondary research.

- The market was determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Global Secondary Macronutrients Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Secondary macronutrients Market Size: Top Down Approach

Data Triangulation

After arriving at the overall market size from the above estimation process using both top-down and bottom-up approaches, the total market was split into several segments and subsegments. To complete the overall secondary macronutrients market estimation and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

According to The Fertilizer Institute, calcium, magnesium, and sulfur are referred to as "secondary" not because they are less important, but because most crops require them in lower amounts. Calcium is utilized to minimize soil acidity and to improve nutrient absorption inside the plant. It also increases a plant's resistance to disease. Magnesium, like phosphorus, is a component of chlorophyll and so required for photosynthesis. It is also necessary to assist the plant in metabolizing that same phosphorus molecule. Sulfur is another element that is naturally present in soil, but in proportions that are inadequate for many crops. Sulfur is used by plants to synthesize essential amino acids and is beneficial in increasing winter hardiness.

Macronutrients are nutrients that are essential for plant development in high quantities. Secondary macronutrients (sulfur, magnesium, and calcium) are needed in smaller quantities than basic nutrients (N, P, and K). The most significant of these three secondary macronutrients is calcium, which serves to build the cell wall. Sulfur reduces leaf yellowing, whereas magnesium functions as an enzyme activator, promoting plant development and blooming.

Calcium carbonate, calcium ammonium nitrate, ammonium sulfate, mono ammonium phosphate, potassium sulfate, superphosphates, calcium sulfate, calcium nitrate, calcium chloride, magnesium chloride, magnesium oxide, magnesium hydroxide, magnesium sulfate, ammonium thiosulfate, ammonium polysulfide, and sulfur-coated urea are among the fertilizers studied. The secondary macronutrient composition of the fertilizers was utilized to calculate market usage.

Key Stakeholders

- Secondary macronutrients manufacturers

- Secondary macronutrients importers and exporters

- Secondary macronutrients traders, distributors, and suppliers

- Government and research organizations

-

Government regulatory agencies

- Food and Agriculture Organization (FAO)

- United States Department of Agriculture (USDA)

- European Food Safety Authority (EFSA)

- World Health Organization (WHO)

- Food and Drug Administration (FDA)

- Environmental Protection Agency (EPA)

- Department of Environment, Food and Rural Affairs (DEFRA)

Report Objectives

- To determine and project the size of the secondary macronutrients market with respect to by nutrient, by crop type, by mode of application, by form, and region

- To identify the attractive opportunities in the market by determining the largest and fastest growing segments across regions

- To provide detailed information about the key factors influencing the market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To provide the regulatory framework for major countries related to the market

- To analyze the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

- To understand the competitive landscape and identifying the major growth strategies adopted by players across the key regions.

- To analyze the value chain and products across the key regions and their impact on the prominent market players

- To provide insights on key product innovations and investments in the global market

Available Customizations

MarketsandMarkets offers customizations according to client-specific scientific needs with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe's secondary macronutrients market into Netherlands, Denmark, Belgium, and other EU and non-EU countries.

- Further breakdown of the Rest of Asia Pacific market into South Korea, Malaysia, and Vietnam.

- Further breakdown of the Rest of the South American market into Chile, Peru, Colombia, and Venezuela.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Secondary Macronutrients Market