The study involved four major activities in estimating the size for wearable AI market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, sources such as annual reports, press releases, investor presentations of companies, white papers, and articles by recognized authors were referred to. Secondary research was done to obtain key information about the market’s supply chain, the market's value chain, the pool of key market players, and market segmentation according to industry trends, region, and developments from both market and technology perspectives.

Primary Research

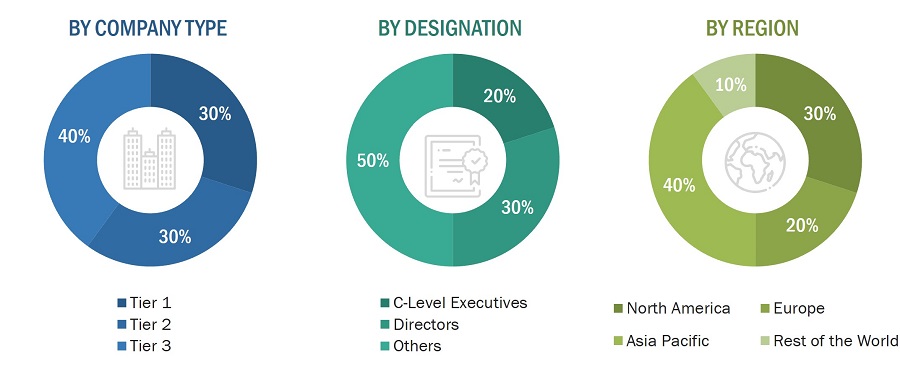

Extensive primary research has been conducted after understanding and analyzing the wearable AI market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 25% of primary interviews have been conducted with the demand side and 75% with the supply side. These primary data have been collected through telephonic interviews, questionnaires, and emails.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches, along with several data triangulation methods, have been used to perform the market size estimation and forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analyses have been performed on the complete market engineering process to list the key information/insights throughout the report. The following table explains the process flow of the market size estimation.

The key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top players as well as extensive interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative) on the wearable AI market. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

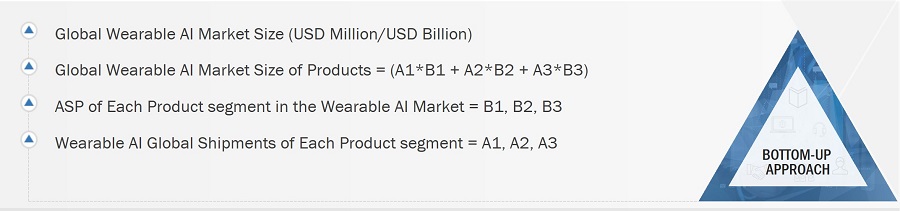

Wearable AI Market: Bottom-Up Approach

The bottom-up approach has been employed to arrive at the overall market size of the wearable AI market, in terms of products. The summation of all the products in all the regions is calculated to arrive at the overall market size.

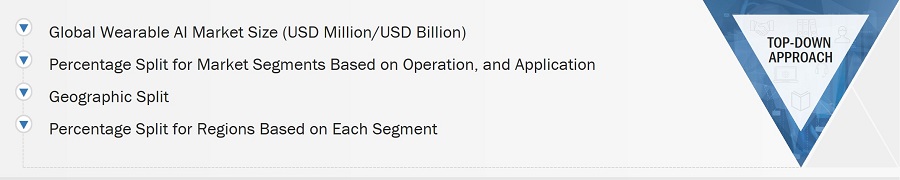

Wearable AI Market: Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of individual markets (mentioned in the market segmentation) through the percentage splits from secondary and primary research.

For the calculation of specific market segments, the most appropriate parent market size has been considered to implement the top-down approach. The bottom-up approach has also been implemented for the data extracted from the secondary research to validate the obtained market size of segments.

The market share of each company has been estimated to verify the revenue shares used earlier in the bottom-up approach. With the data triangulation procedure and the validation of data through primaries, the overall parent market size and each individual market size has been determined and confirmed in this study. The data triangulation procedure used for this study is explained in the next section.

Data Triangulation

After arriving at the overall market size through the process explained above, the overall market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Definition

Wearable AI refers to artificial intelligence integrated into wearable devices, which are typically worn on the body, such as smartwatches, fitness trackers, wearable camera, smart earwear, augmented reality/virtual reality (AR/VR) headsets, and other similar accessories. These devices are designed to collect data from the user's movements, activities, and surroundings, and then utilize AI algorithms to analyze and interpret that data in real-time.

The primary goal of wearable AI is to enhance the functionality of the wearable device by providing personalized and context-aware information, insights, and services to the user. This can include features like health and fitness tracking, notifications, voice recognition, gesture control, and more. Wearable AI leverages machine learning and other AI technologies to understand user behavior, preferences, and patterns, adapting to the individual's needs and delivering a more tailored and intuitive user experience.

Key Stakeholders

-

Wearable technology companies

-

Artificial Intelligence companies

-

Companies involved in the ecosystem of wearable technology and AI market

-

Key service providers

-

Software solution providers

-

Network providers

-

Retail distributor

-

Government, financial, and research institutions as well as investment communities

-

Analysts and strategic business planners

-

Research and consulting firms

Report Objectives

-

To define, describe, and forecast the wearable AI market, in terms of value, by product, operation, application, and region.

-

To describe and forecast the wearable AI market, in terms of volume, by product.

-

To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW).

-

To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

-

To offer an ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter’s Five Forces analysis, and regulations pertaining to the market.

-

To give a detailed overview of the value chain of the wearable AI market ecosystem

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

-

To strategically profile the key players and comprehensively analyze their market shares and core competencies

-

To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market

-

To study competitive developments such as collaborations, partnerships, product developments, and acquisitions in the market

-

To understand the impact of the recession on the wearable AI market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

-

Detailed analysis and profiling of additional market players (up to 7)

Growth opportunities and latent adjacency in Wearable AI Market