Video Surveillance Market Size, Share & Analysis, 2025

Video Surveillance Market by Offering (Cameras, Monitors, Storage Devices, Accessories), Software (VMS, VAS), Camera (PTZ, Dome, Box & Bullet, Panoramic, Bodyworn, Fisheye), Storage (DVR, NVR, HVR, IP Storage, Direct), System - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

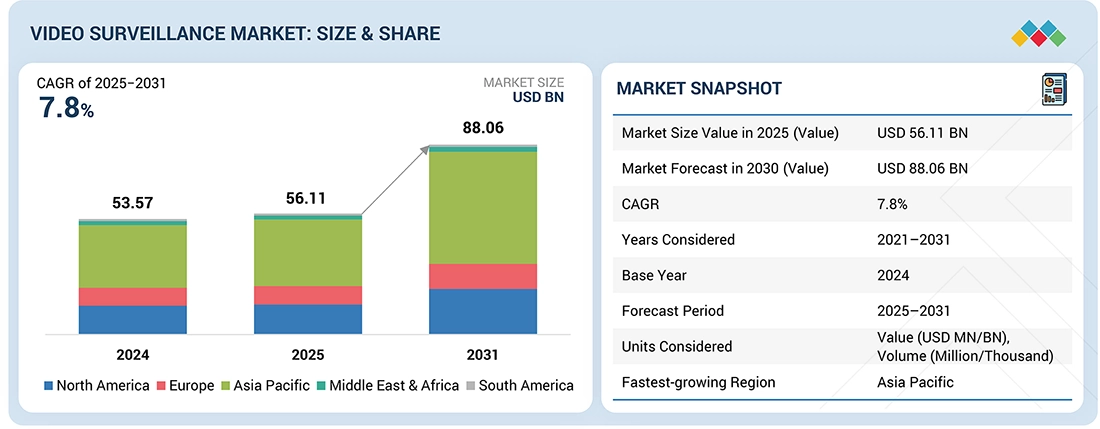

The video surveillance market is projected to reach USD 88.06 billion by 2031 from USD 56.11 billion in 2025, at a CAGR of 7.8% from 2025 to 2031. Advancements in cloud-based surveillance and edge computing are accelerating market growth.

KEY TAKEAWAYS

-

BY REGIONAsia Pacific is expected to grow at the fastest CAGR of 9.1% during the forecast period

-

BY OFFERINGBy offering, the hardware segment held 61.8% of the market in 2024. Hardware includes cameras, monitors, storage devices, and accessories.

-

BY SYSTEMBy system, the IP video surveillance systems segment is expected to grow at the highest CAGR of 9.3% during the forecast period.

-

BY VERTICALBy vertical, the commercial segment is expected to dominate the market. It is expected to grow at a CAGR of 8.6% during the forecast period.

-

COMPETITIVE LANDSCAPEHangzhou Hikvision Digital Technology, Dahua Technology, Honeywell International, and Hanwha Vision are key players in this market, boasting strong portfolios, a wide reach, and a well-established customer base.

The video surveillance industry is driven by increasing demand for enhanced public safety and asset protection across industries. Growing integration of AI and analytics enables real-time monitoring and proactive threat detection. Additionally, the shift toward cloud-based and edge surveillance solutions is improving scalability and operational efficiency, further fueling market growth.

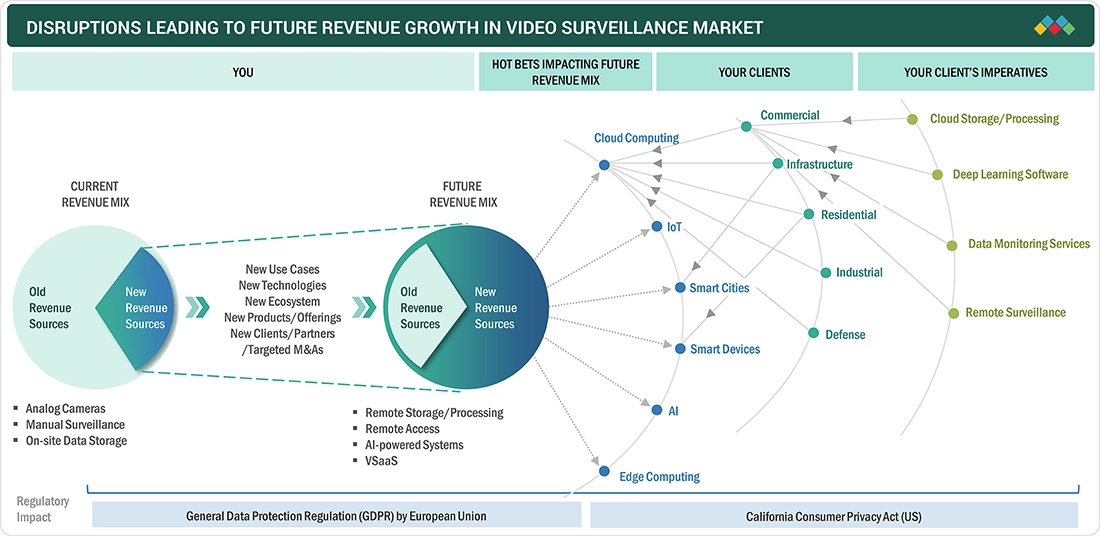

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customers’ business arises from evolving trends and disruptions in the video surveillance ecosystem. “Hot Bets” such as cloud computing, AI, IoT, edge computing, and smart devices represent the key clients of video surveillance manufacturers. Target applications include sectors like commercial, infrastructure, residential, industrial, defense, and smart cities. These shifts toward new technologies are reshaping revenue streams for end users, which influences the revenues of hot bets and ultimately drive the future revenue mix of video surveillance manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising adoption of edge AI to enhance data security and privacy

-

Rise of smart city initiatives

Level

-

Privacy concerns associated with cloud-based systems

-

High operational costs

Level

-

Emergence of AI- and ML-integrated video surveillance systems

-

Rise of smart home technologies

Level

-

Cybersecurity risks

-

Data compression issues

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising adoption of edge AI to enhance data security and privacy

Edge computing in video surveillance involves processing video data closer to its source, such as directly on cameras or local devices. This approach offers several advantages, including reduced latency, lower bandwidth usage, enhanced security, and improved privacy.

Restraint: Privacy associated with cloud-based systems

Privacy concerns in video surveillance data storage primarily revolve around the potential misuse of recorded footage and the risks associated with unauthorized access to sensitive information. Continuous monitoring, even in public areas, raises concerns about the extent of surveillance and the potential for misuse of footage.

Opportunity: Emergence of AI- and ML-integrated video surveillance systems

AI and ML-powered video analytics, also known as video content analysis (VCA), utilize artificial intelligence (AI) and machine learning (ML) techniques to extract actionable insights from video data. This technology enables systems to automatically process and analyze video footage, significantly reducing the need for manual monitoring.

Challenge: Cybersecurity risks

Cybercriminals can exploit vulnerabilities in video surveillance systems, particularly through the use of weak passwords or outdated firmware. This unauthorized access allows hackers to view live feeds, manipulate camera settings, or even disable the systems entirely, posing a direct threat to security.

Video Surveillance Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Hikvision deployed AI-powered surveillance for smart city infrastructure, integrating thermal cameras and facial recognition with cloud analytics for real-time threat detection.. | Enhances public safety through AI-driven analytics, reduces response times, and enables scalable urban security management |

|

Dahua Technology partnered with retail chains to deploy intelligent video systems with IoT sensors and behavioral analytics for customer insights and loss prevention. | Improves operational efficiency, reduces security incidents, and delivers actionable intelligence for customer experience |

|

Hanwha Vision implemented cybersecurity-enhanced cameras with encryption and secure boot for critical infrastructure, integrating with VMS for tamper detection and compliance. | Ensures end-to-end encrypted surveillance, protects against tampering, and maintains regulatory compliance for enterprises |

|

Honeywell integrated building management systems combining access control, surveillance, fire safety, and HVAC automation with cloud monitoring for commercial properties. | Enables unified facility management, reduces energy costs by 30%, and accelerates IoT-enabled digital transformation |

|

Motorola Solutions deployed unified command center technology for public safety, integrating mobile networks, AI video analytics, and interoperable radio for first responders. | Accelerates emergency response with real-time intelligence, improves officer safety, and enhances crime prevention |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

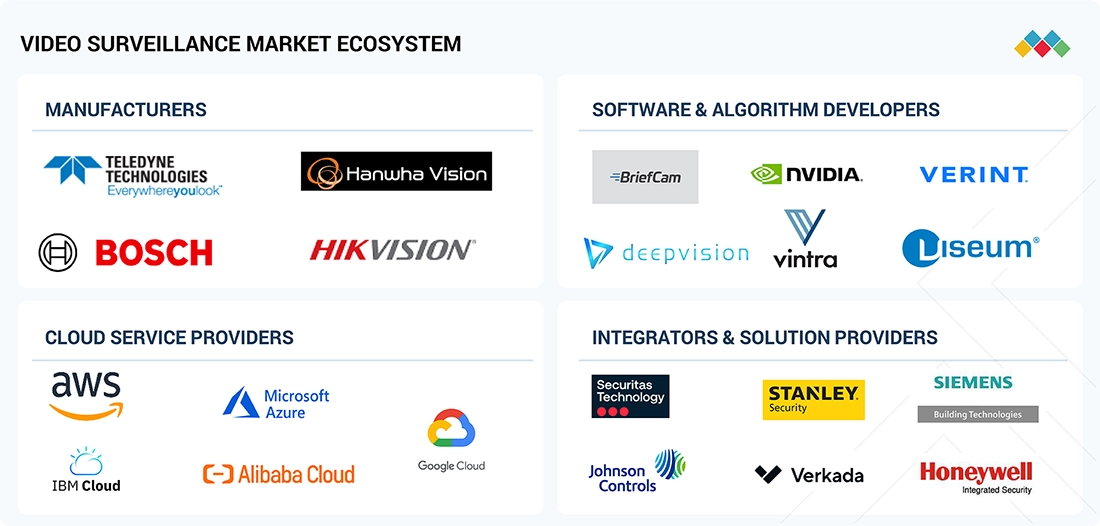

MARKET ECOSYSTEM

The video surveillance market ecosystem comprises manufacturers, software and algorithm developers, cloud service providers, and system integrators & solution providers. Manufacturers develop advanced surveillance hardware and devices that form the foundation of security infrastructure. Software and algorithm developers focus on AI-based analytics, video processing, and real-time monitoring capabilities. Cloud service providers enable scalable data storage, remote access, and processing for surveillance systems, allowing for efficient management and operation. System integrators and solution providers deliver complete end-to-end surveillance solutions, combining hardware, software, and cloud capabilities to meet the diverse security needs of end users across industries.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

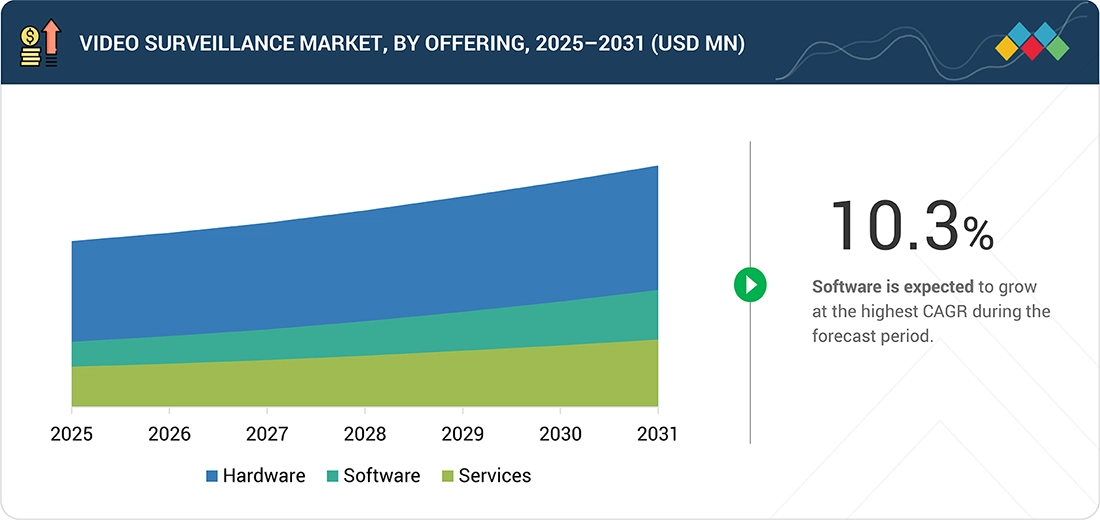

Video Surveillance Market, By Offering

The video surveillance market, categorized by offering into hardware, software, and services, continues to evolve with advancements in imaging, connectivity, and analytics technologies. The hardware segment, which includes cameras, storage devices, and monitors, dominates the market due to widespread adoption across commercial, industrial, and public sectors. Meanwhile, the software segment is projected to record the fastest CAGR during the forecast period, driven by the growing demand for AI-powered analytics, video management solutions, and cloud-based platforms that enhance surveillance efficiency and decision-making.

Video Surveillance Market, By System Type

The video surveillance market, by system, is segmented into IP, analog, and hybrid systems. The IP segment dominates the market due to its advanced features, including remote accessibility, high-resolution imaging, and seamless integration with AI and cloud platforms. Hybrid systems are gaining traction as organizations transition from legacy analog setups to modern IP-based infrastructure.

Video Surveillance Market, By Vertical

The video surveillance market, by vertical, is segmented into commercial, infrastructure, military and defense, residential, public facilities, and industrial. The commercial segment dominates the market due to rising security needs across retail, corporate offices, and financial institutions. The infrastructure segment is expected to record the fastest CAGR during the forecast period, driven by increasing investments in smart city projects, transportation networks, and critical infrastructure modernization initiatives.

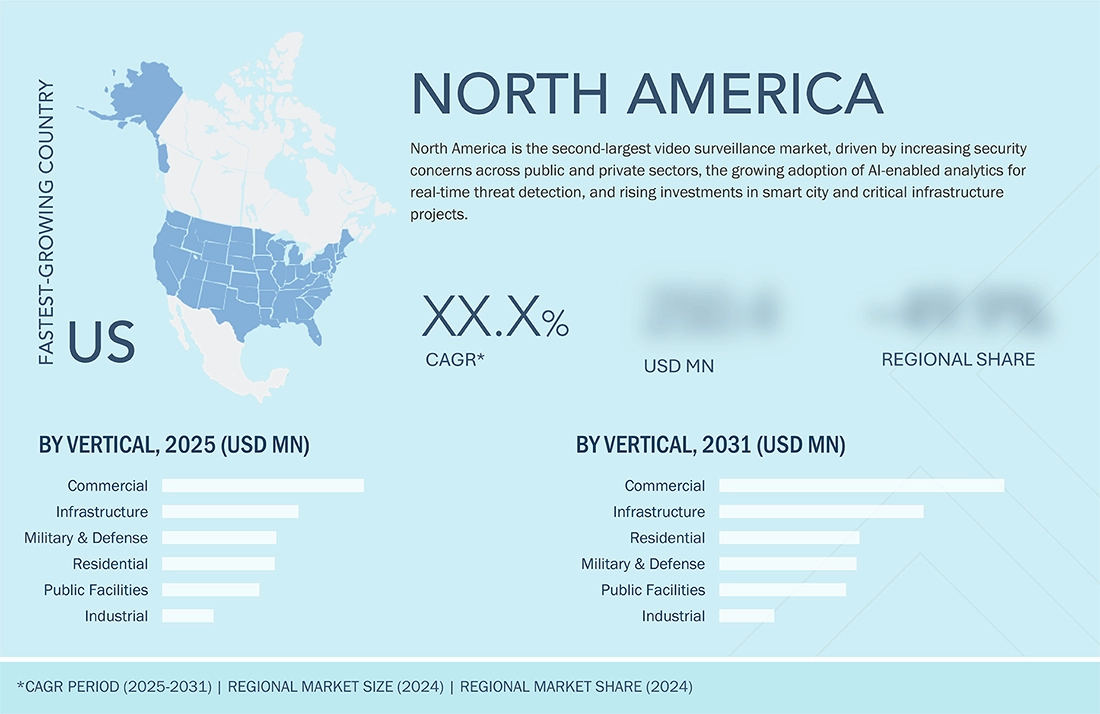

REGION

During the forecast period, US is expected to be the fastest-growing market in North America.

The North American video surveillance market, encompassing the US, Canada, and Mexico, is driven by growing security concerns, advanced digital infrastructure, and the widespread adoption of AI and analytics technologies. Enterprises across various sectors, including commercial, infrastructure, healthcare, and transportation, deploy video surveillance systems for real-time monitoring, threat detection, and enhanced operational efficiency. Supportive government initiatives, robust regulatory frameworks, and the presence of major technology providers all promote innovation and facilitate large-scale deployments. With the growing integration of cloud-based and edge surveillance solutions, North America remains a leading region for growth in the video surveillance market.

The video surveillance market in North America is projected to grow from USD 13.93 billion in 2025 to USD 21.19 billion by 2031, registering a CAGR of 7.2%. Market expansion is driven by the presence of leading technology vendors, and the early adoption of innovations such as edge computing, thermal imaging, and integrated security platforms continues to strengthen market growth across the US and Canada.

The Asia Pacific video surveillance market is projected to grow from USD 30.89 billion in 2025 to USD 52.00 billion by 2031, registering a CAGR of 9.1%. Market expansion is driven by rapid urbanization, smart city investments, and widespread adoption of AI-powered security technologies across public and commercial sectors.

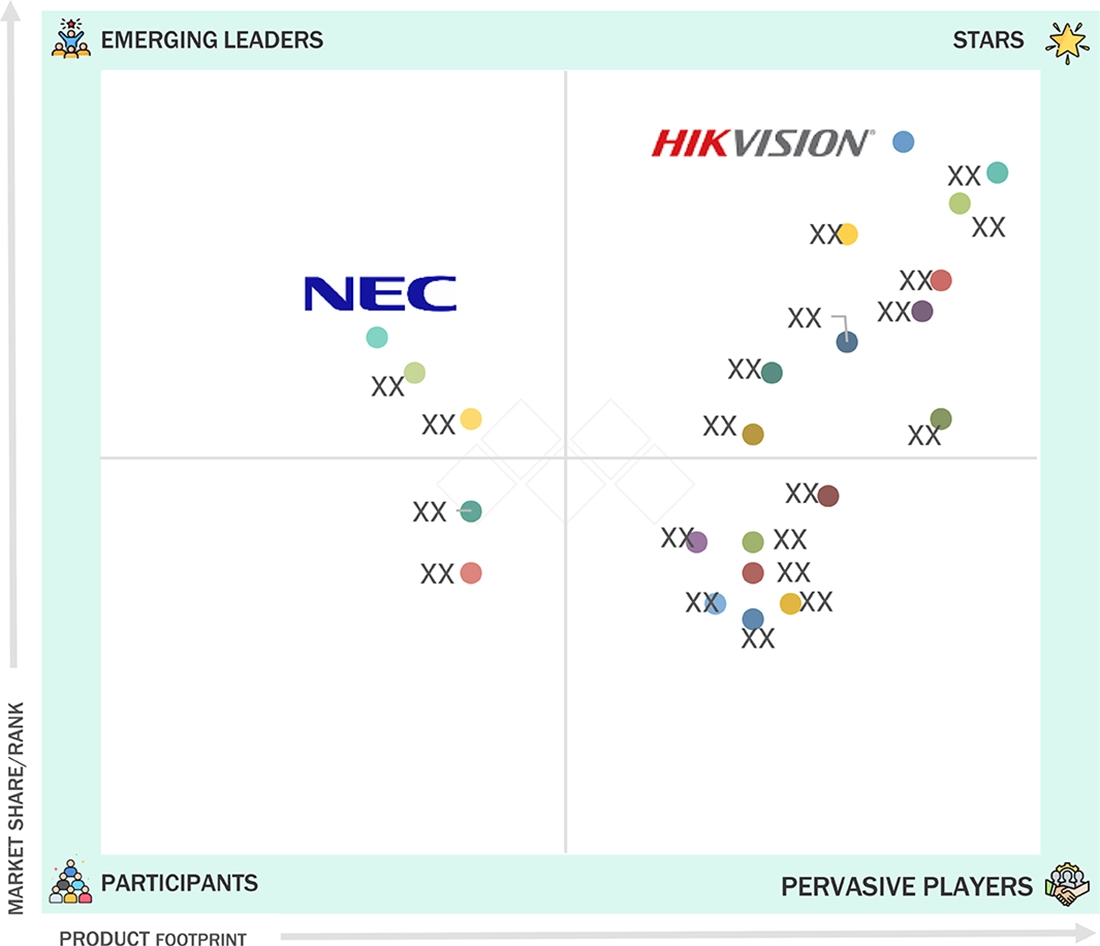

Video Surveillance Market: COMPANY EVALUATION MATRIX

In the Video Surveillance market matrix, Hangzhou Hikvision Digital Technology Co., Ltd. (China) leads the market with a strong service portfolio, a wide presence, and strategic growth initiatives, driving widespread adoption. NEC Corporation (Japan) is an emerging leader with a focused and innovative product portfolio, gradually expanding its influence despite having a smaller market share.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 53.57 Billion |

| Market Forecast in 2030 (Value) | USD 88.06 Billion |

| Growth Rate | CAGR of 7.8% from 2025-2031 |

| Years Considered | 2021-2031 |

| Base Year | 2024 |

| Forecast Period | 2025-2031 |

| Units Considered | Value (USD Million/Billion), Volume (Million/Thousand) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

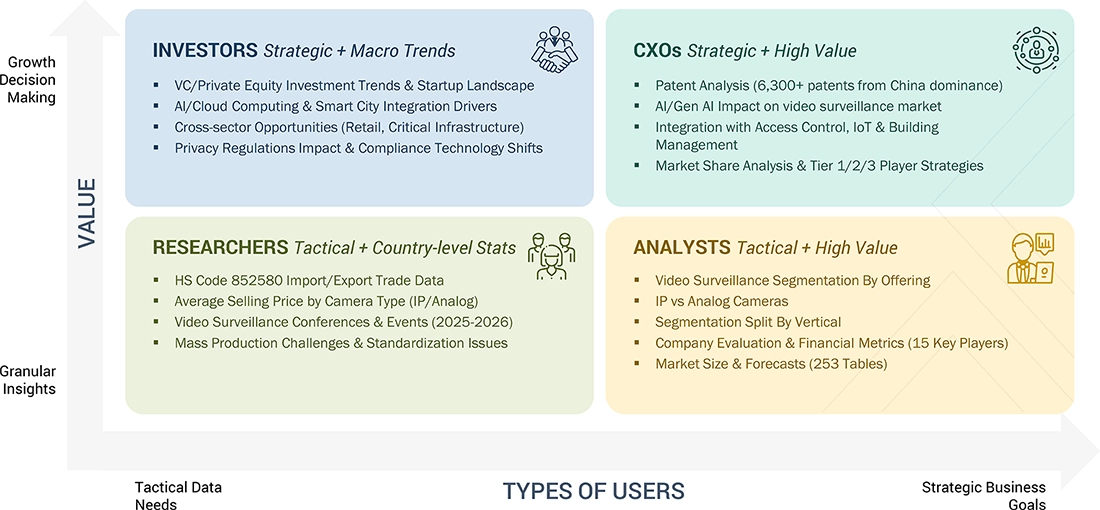

WHAT IS IN IT FOR YOU: Video Surveillance Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| IP Camera Manufacturer |

|

|

| Global VSaaS Provider |

|

|

| Security System Integrator |

|

|

| US-Based Video Analytics Startup |

|

|

| Europe-Based Surveillance Equipment Vendor |

|

|

RECENT DEVELOPMENTS

- October 2025 : PRAMA HIKVISION INDIA PRIVATE LIMITED introduced next-generation body-worn cameras and advanced storage solutions at the Traffic Infratech Expo held from October 7–9 at Bharat Mandapam, New Delhi. The launch highlights the company’s focus on enhancing transport security and road safety through cutting-edge technologies that help prevent accidents and protect lives and assets.

- October 2025 : Motorola Solutions Inc. launched Assist with Assisted Narrative, enabling AI-assisted writing of police reports. Officers can cross-check multiple data sources to generate accurate and verifiable reports.

- October 2025 : Eagle Eye Networks launched Gun Detection, a cloud-based AI feature that works with existing cameras to provide real-time detection of firearms, enhancing safety in schools and businesses without requiring new hardware.

- September 2025 : Dahua Technology launched the WITHS Series at IFA Berlin 2025, designed for SMBs. The plug-and-play wireless system provides AI-powered detection, real-time alerts, and easy remote management via the DMSS app, ensuring reliable indoor and outdoor surveillance for shops, offices, warehouses, and remote sites.

- September 2025 : Dahua Technology signed a strategic cooperation agreement with Halo Energy to develop solutions in EV charging, photovoltaic energy storage, and smart parking management. The partnership leverages Dahua’s AIoT technologies and Halo Energy’s new energy expertise to drive collaborative growth, support green energy initiatives, and enhance regional low-carbon development.

Table of Contents

Methodology

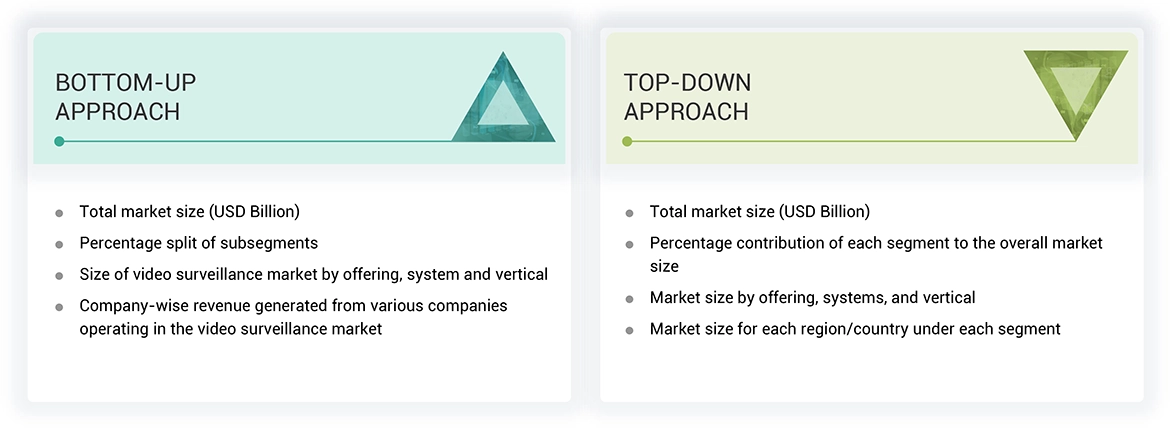

The study employed four primary activities to determine the market size of the video surveillance industry. Exhaustive secondary research was conducted to gather information on the market, as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the size of the video surveillance market began with the acquisition of data related to the revenues of key vendors in the market through secondary research. Various secondary sources were consulted during the secondary research process to identify and collect information for this study. Secondary sources include annual reports, press releases, and investor presentations of companies; white papers, journals, certified publications, and articles by recognized authors; websites; directories; and databases. Secondary research has primarily been utilized to gather key information about the value chain of the video surveillance market, including key players, market classification, and segmentation according to industry trends, as well as geographic markets and key developments from both market- and technology-oriented perspectives. The secondary research referred to for this research study involves various white papers, such as Video Analytics and Surveillance white paper by Hewlett Packard Enterprise Development LP., and other multiple sources Moreover, the study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect valuable information for a technical, market-oriented, and commercial study of the video surveillance market.

Primary Research

During the primary research process, various primary sources from both the supply and demand sides were interviewed to gather qualitative and quantitative information relevant to this report. Primary sources from the supply side include key industry participants, subject-matter experts (SMEs), and C-level executives and consultants from various key companies and organizations in the video surveillance ecosystem. After completing the market engineering process (including calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to verify and validate the critical market numbers obtained. Several primary interviews have been conducted with market experts from demand and supply-side players across key regions, including North America, Europe, the Asia Pacific, and the Rest of the World (comprising the Middle East, Africa, and South America).

Primary data has been collected through questionnaires, emails, and telephone interviews. During the canvassing of primaries, various departments within organizations, including sales, operations, and administration, were covered to provide a holistic perspective in our report. This, along with the opinions of in-house subject matter experts, has led us to the findings described in the remainder of this report.

Note: The three tiers of the companies are defined based on their total revenue in 2024: Tier 1 - revenue greater than or equal to USD 1 billion; Tier 2 - revenue between USD 100 million and USD 1 billion; and Tier 3 revenue less than or equal to USD 100 million. Other designations include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were utilized to estimate and validate the size of the video surveillance market and its submarkets. Secondary research was conducted to identify the key players in the market, and primary and secondary research were used to determine their market share in specific regions. The entire process involved studying the annual and financial reports of top players and conducting extensive interviews with industry leaders, including CEOs, VPs, directors, and marketing executives. Secondary sources were used to determine all percentage shares and breakdowns, which were verified through primary sources. All parameters that could impact the markets covered in this research study were accounted for, analyzed in detail, verified through primary research, and consolidated to obtain the final quantitative and qualitative data.

Video Surveillance Market: Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall size of the video surveillance market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. To triangulate the data, various factors and trends from the demand and supply sides were studied. The market was validated using both the top-down and bottom-up approaches.

Market Definition

Video surveillance systems utilize cameras to observe and record the behavior and activities of individuals, as well as to monitor specific areas, thereby enhancing safety and security. These systems help protect individuals, assets, and facilities cost-effectively. The video surveillance market involves the development, production, and distribution of technologies that capture, analyze, and manage visual data to support security and situational awareness. It includes products such as cameras, video management systems, analytics software, and storage solutions used across various sectors, including public safety, retail, and infrastructure. These systems provide real-time and recorded footage for incident prevention, detection, and investigation while also helping improve operational efficiency. Advances in AI analytics, high-resolution imaging, cloud-based storage, and smart device integration have enhanced system performance and automation. However, concerns around privacy, data protection, and ethical use of surveillance data highlight the need for clear regulations and responsible implementation practices.

Key Stakeholders

- Raw material vendors

- Component (image sensor, lens, and module) providers

- Software providers

- Video surveillance cameras and other hardware manufacturers

- Original equipment manufacturers (OEMs)

- Video surveillance system integrators

- Service providers

- Technology standards organizations, forums, alliances, and associations

- Governments, financial institutions, and investment communities

- Research organizations

- Analysts and strategic business planners

- Venture capitalists, private equity firms, and startup companies

- Distributors

- End users from different verticals, such as infrastructure, commercial, institutional, industrial, and residential

Report Objectives

- To describe and forecast the video surveillance market in terms of value based on offering, system type, and vertical

- To define and forecast the market size, in terms of value, with regard to four main regions: North America, Europe, Asia Pacific, and the RoW (Rest of the World)

- To describe and forecast the market size for video surveillance cameras in terms of volume

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To understand the impact of AI/GenAI on the market

- To provide a detailed overview of the supply chain of the video surveillance ecosystem

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities for various stakeholders by identifying high-growth segments of the market

- To benchmark players within the market using the proprietary competitive leadership mapping framework, which analyzes market players on different parameters within the broad categories of business strategy excellence and strength of product portfolio

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape of the market

- To analyze competitive developments, such as acquisitions, product launches, expansions, and partnerships, in the market

- To provide a detailed overview of the ecosystem analysis, case study analysis, patent analysis, trade analysis, technology analysis, average selling price (ASP) analysis, AI/gen AI impact analysis, Porter five forces analysis, macroeconomic outlook, regulations, and certifications

- To analyze the impact of the macroeconomic outlook on the video surveillance market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to five)

- Additional country-level analysis of the video surveillance market

Product Analysis

- Product matrix, which provides a detailed comparison of each company's product portfolio in the video surveillance market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Video Surveillance Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Video Surveillance Market

Sakid

Jul, 2019

I want to understand if there is any market research available for wireless backhaul of video surveillance such as via Mesh and PTP/PMP systems..

Elizabeth

Mar, 2015

Who are the key players in the market for transit, rail and school districts. Out of those markets who is buying?.

Lokesh

Dec, 2020

Present scenario and the growth prospects of the global Video Surveillance market 2018-2027.

Jim

Apr, 2016

We are only interested in the camera part of the market. We are not interested in other devices such as monitors, servers, storage devices and media. Could you provide the portions of the report that cover cameras at a discount..

Soichiro

Jan, 2014

I would like to know about the definition of "Video Management Systems" from the above study. Do they show revenue data for VMS(=Video Management Software)products, or, about whole revenue of Video Management Systems. .

Terrence

Feb, 2019

Trying to understand the potential market in anticipation of a job interview with a video surveillance analytics firm..

Tasker

Jan, 2019

I need to get a feel about the CCTV world what will be Camera production for IP Cameras from now until 2024 and what percentage of the world Market South Africa enjoys?.

angel

Mar, 2016

Interested in surveillance systems using specialized cameras. Also more focus in Infrastructure, Defense, Commercial, and institutional applications..

Dale

Jul, 2015

We are solution integrator and surveillance service provider. We service United States and Canada, currently. Very interested in sections 9.2. .

User

Sep, 2019

IP cameras are gaining traction in the market as it offer greater flexibilty in terms of remote surveillance applications, hence rapidly replacing analog cameras in market. Do you have IP camera shipments data in North America and APAC regions?.

Prayut

May, 2012

Rising number of smart homes propelling growth for DIY cameras. Availability of low cost cameras and ease of installation are important factors for growth of DIY cameras. Do you have DIY camera market in APAC region and its growth trend for next 5 years..

Ravi

Sep, 2018

I would like to know more details regarding research methodology and validation sources, especially as claimed in your Figure 4 & Figure 5. Further interested to know the extent of coverage on India based players and overall APAC region coverage strength. If you could share above, that would be helpful for my team to assess the usefulness of this report. .

jiang

Apr, 2019

Interested in market data to understand the opportunity in this industry, and which region has major opportunity for the industry considering overall market..

vectra3

Apr, 2015

IP cameras are gaining traction in the market as it offer greater flexibility in terms of remote surveillance applications, hence rapidly replacing analog cameras in market. Do you have IP camera shipments data in North America and APAC regions?.

Nitzan

Apr, 2015

There has been rising number of smart cities particularly in developing countries. Do you have video surveillance hardware, software and service market for smart cities at country level?.

Mindy

Feb, 2018

Hi, I am interested to understand how you sized the global addressable market (by country) and market share for leading companies..

Michael

Sep, 2019

I am developing at "AI Box" to convert the IP camera to AI Solution. I would like to know more of this segment. .

Kingsley

Apr, 2017

Interested to purchase this report as well as adjacent market studies. If you can include this in your proposal for a call on Monday please..

Laure

Apr, 2017

Dear team, please provide me a quote, ref SE 2873. Let me also know your international bank coordinates to organize payment. We do not pay by credit card. .

Hayley

Jun, 2019

I am interested to purchase a copy for single user, can I get any discount? .

Leo

Jun, 2019

Trying to understand the size and scope of the security live monitoring market/industry in North America. .

Sari

Mar, 2019

I'm looking for market data specifically on video surveillance, also trends in DACH countries. .

User

Sep, 2019

AI technologies bring superior face recognition, object recognition and event recognition capabilities, providing proactive and realtime security. Do you have data for artificial intelligence market in video surveillance for China?.

Brian

Oct, 2013

Rising importance of IoT in various applications makes VSaaS as important aspect in video surveillance market. VSaaS offers cost efficiency, remote access to data, secure data storage, high reliability, low capital investment making it as preferred option of video surveillance in various applications. Do you have in-depth market analysis for VSaaS including leading players' analysis..

User

Sep, 2019

Rising number of smarthomes propelling growth for DIY cameras. Availability of low cost cameras and ease of installation are important factors for growth of DIY cameras. Do you have DIY camera market in APAC region and its growth trend for next 5 years.

chetan

Dec, 2014

Do you have data for artificial intelligence market in video surveillance for China?.

Sumathi

Oct, 2014

Competitor teardown report on video surveillance products from key companies. Can I get a brief competitive landscape for the video surveillance solutions with respect to your research?.

Paula

Jun, 2016

please let me know the lowest/best price you can offer for purchasing this study. .

Atul

Dec, 2017

Increasing importance of city surveillance for various applications such as traffic monitoring, operations monitoring, surveillance activities in public places to detect unlawful activities, creating opportunity areas for video surveillance. Do you have video surveillance hardware, software and service market for smart cities?.

Andrew

Dec, 2012

Can you provide the information regarding camera video surveillance business for government sales/bidding process and best practices for business development among global leading companies? .

Saurabh

Dec, 2019

I just need to get an overview of the report. If it has the details I need, I can convince my team to provide funding..

Sissia

Dec, 2013

very interested in residential surveillance market trend. Also would like to know the key players in this market with their strength and weakness..

Brenda

Nov, 2018

Looking for market sizing information in US and what segments specifically Federal and State government. Unable to purchase entire report but hoping sample might provide insights to warrant requesting funds to purchase..

Suhas

Nov, 2017

Hi, I would love to see if I can get some information for an article from MNM's perspective on the video surveillance industry. I am specifically interested in getting an overview on the industry via verticals and region and would interest to shoot some questions or request for any reports that can be made available for the media..

User

Nov, 2019

There has been rising number of smart cities particularly in developing countries. Increasing importance of city surveillance for various applications such as traffic monitoring, operations monitoring, surveillance activities in public places to detect unlawful activities, creating opportunity areas for video surveillance. Do you have video surveillance hardware, software and service market for smartcities?.

Christopher

Nov, 2019

We are looking at the global market for Smart Edge IP Cameras and Video Analytics such as facial recognition and various video metadata forensic search. .

Cheryl

Nov, 2020

I am working on a video analytics software for IP cameras, I would like to know the market trend and demand for this solution in APAC, US, and Europe..

Daniel

Oct, 2019

My name is Daniel and I am interested in an article or sample to understand video surveillance market..

Rick

Oct, 2019

I want to better understand this market opportunity to determine a partner strategy for our solutions..

gururaj

Oct, 2019

AI technologies bring superior face recognition, object recognition and event recognition capabilities, providing proactive and real-time security. Do you have data for artificial intelligence market in video surveillance for China?.

santhosh

Aug, 2016

would like to receive a detailed information for new invention and technology in CCTV and security field. as well as trend in current scenarios. .

Bri

Aug, 2016

What pricing offerings are there for Start-ups? I am at very beginning stage and learning more through Market Research first. This report sounds great; but initial cost for a single user license is a barrier for me. Happy to explain more via email. Perhaps a customization for specific areas I need could work; just not sure..

Tasker

Aug, 2019

We are trying to convince our client that the CCTV market in South Africa has substance. We understand the South African Market is between 2 to 3% of the global market and that in 2017 just under 130 million CCTV cameras were produced of which 98 million were IP. We anticipate the number of IP Cameras produced globally last year must have been in the order of 150 million. We would like to get a feel for Camera production predictions in the market up to 2023? .

Miguel

Jul, 2014

Do you have in-depth market analysis for VSaaS including leading players' analysis..

Daniel

Jul, 2014

Interested in following topics such as building management systems, room control, BMS as a Service, VSaaS and manager services within the video surveillance market..

Sam

Jul, 2019

We have a 'model city program' in a foreign country (AFRICA) that will have 5G Communication Technology and it will need a variety of Wireless Video surveillance solutions from transportation, plate identification, government, campus video surveillance, schools, and business parks and banking institutions surveillance, commercial applications, as well as residential neighborhoods. We will need training on the latest products and the installation thereof. .

chetan

Jun, 2014

AI technologies bring superior face recognition, object recognition and event recognition capabilities, providing proactive and real-time security. Do you have data for artificial intelligence market in video surveillance for European countries? .

Yukiko

Jun, 2018

We have purchased previous versions of this report and received discounts in the past. Would you offer any discount for this latest report? .

Uwe

May, 2016

we are interested in market studies and forecasts about the IP video surveillance market, especially IP cameras above 1MP, defined by region, type of camera and competitor. Also within the IP video surveillance market, we are interested in certain vertical market studies like: Retail, Transportation, Industrial, Logistics, and Residential. We would appreciate an offer by email and a contact person if we have further questions..

Steve

Apr, 2016

The government mandates is one of the major factor influencing the growth of security and surveillance market. What would be impact of government mandates in long term like after 3 years and 5 years? .

User

Mar, 2019

Rising importance of IoT in various applications makes VSaaS as important aspect in video surveillance market. VSaaS offers cost efficiency, remote access to data, secure data storage, high reliablity, low capital investment making it as preffered option of video surveillance in various applications. Do you have in-depth market analysis for VSaaS including leading players' analysis..

BAYO

Mar, 2019

How much surveillance can help prevent crimes in the urban areas. Emphasis should also be on protection of public and private facilities. .

Mariano

Jan, 2014

How to increase ROI, market share , and sales to current customers. How to implement all these in limited time period with minimal cost and high efficiency?.