VSaaS Market Size, Share & Industry Growth Analysis by Type (Hosted, Managed, Hybrid), Feature (AI-enabled VSaaS, Non-AI VSaaS), AI Visual Analysis (Object Detection & Recognition, Intrusion Detection, Facial Recognition, Anomaly Detection), Vertical & Region - Global Forecast to 2029

Updated on : September 01, 2025

VSaaS Market Size & Trends

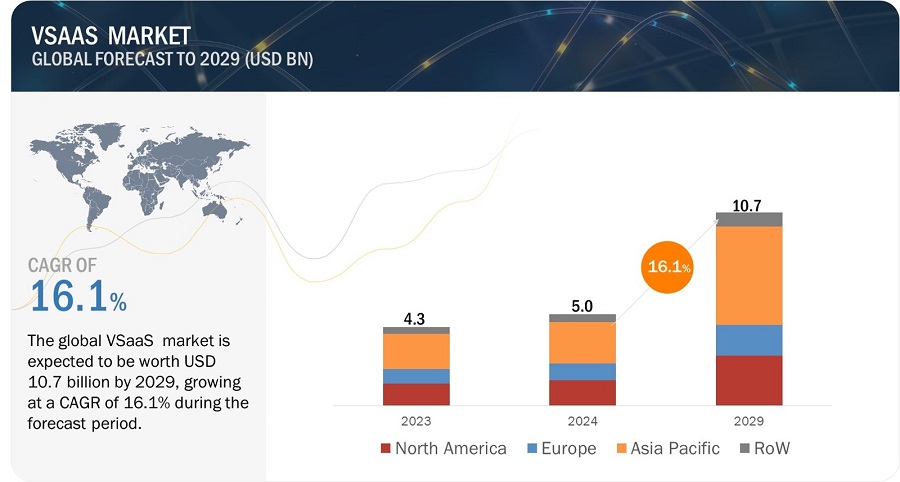

The global VSaaS Market Market was valued at USD 5.09 billion in 2024 and is projected to grow from USD 5.95 billion in 2025 to USD 10.74 billion by 2029, at a CAGR of 16.1% during the forecast period. The market is experiencing rapid growth driven by the increasing adoption of IoT remote monitoring technologies and substantial investments in hyperscale cloud computing infrastructure. The growing demand for intelligent security systems and the deployment of advanced video analytics technology are also pivotal in propelling the market forward.

Key Takeaways:

• The global VSaaS Industry was valued at USD 5.09 billion in 2024 and is projected to grow from USD 5.95 billion in 2025 to USD 10.74 billion by 2029, at a CAGR of 16.1% during the forecast period.

• By Product: The integration of AI-enabled VSaaS solutions is enhancing advanced analytics functionalities, significantly contributing to segmental growth.

• By Application: The adoption of VSaaS in the retail sector is accelerating as businesses focus on leveraging cloud-based solutions for enhanced theft prevention and operational efficiency.

• By Technology: Key technologies driving market expansion include cloud computing, video management software, and artificial intelligence, which are integral to augmenting video surveillance capabilities.

• By End User: The healthcare and retail sectors are rapidly adopting cloud-based surveillance systems, driven by the need for real-time monitoring and compliance with regulations.

• By Region: Asia Pacific is expected to grow fastest at an 18.8% CAGR, fueled by the proliferation of smart city initiatives and increasing investments in cloud infrastructure.

The VSaaS market is poised for substantial growth, with trends indicating a robust shift towards integrating advanced features such as AI-powered analytics and real-time alerts. These enhancements offer a compelling value proposition for businesses seeking to improve security and operational efficiency. As industries increasingly recognize the transformative potential of VSaaS in addressing evolving security and surveillance needs, significant growth opportunities emerge, especially in regions like Asia Pacific, where technological adoption and infrastructure development are accelerating.

VSaaS Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

VSaaS Market Trends

Drivers: Increasing adoption of IoT remote monitoring technologies

The VSaaS market is proliferating due to the increasing demand for remote monitoring across various industries. With the advancement of technology and the adoption of cloud-based solutions, businesses recognize the benefits of leveraging VSaaS for efficient surveillance and security management.

This is particularly true for the retail sector, where multiple store locations must be monitored simultaneously. The rise of remote work and the Internet of Things (IoT) has fueled the demand for VSaaS across various sectors, including healthcare. Hospitals and clinics are implementing this technology to monitor patient safety, track equipment, and ensure compliance with regulations.

Restraint: Concerns regarding data privacy and security

The VSaaS market faces significant challenges due to data privacy and security concerns. As more businesses and organizations turn to cloud-based surveillance solutions to monitor their premises and assets, there is a growing fear of potential risks associated with storing sensitive video data off-site and allowing third-party providers access to surveillance footage.

Data breaches, unauthorized access, and privacy violations are among the primary concerns that can deter organizations from adopting VSaaS solutions, particularly in industries dealing with confidential information or stringent regulatory requirements.

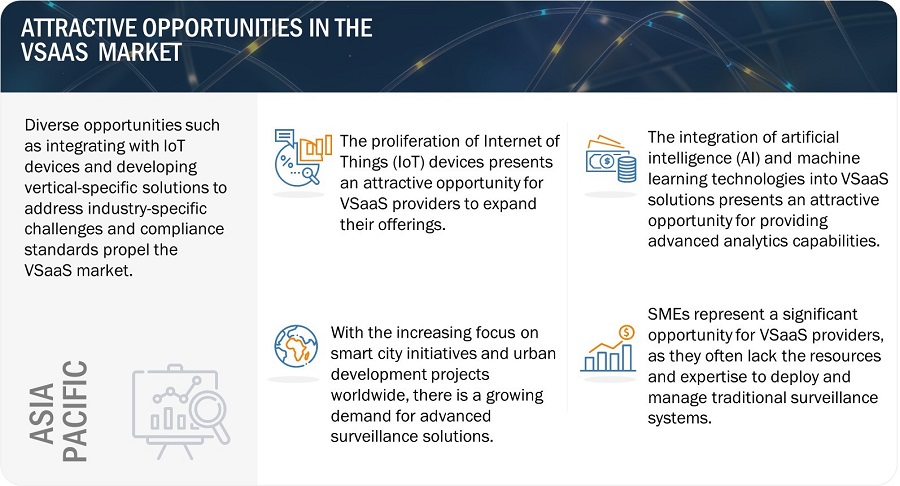

Opportunity: Rapid advancements in artificial intelligence technology

Integration with the Internet of Things (IoT) and artificial intelligence (AI) technologies provides a significant opportunity for the VSaaS market to enhance its capabilities and offer more sophisticated solutions. By integrating with IoT devices, such as sensors, smart cameras, and connected devices,

VSaaS platforms can collect rich contextual data from the physical environment, augmenting traditional video surveillance with additional sources of information. This integration enables VSaaS systems to offer advanced functionalities, such as environmental monitoring, asset tracking, and predictive maintenance, providing users with comprehensive insights into their operations and surroundings.

Challenge: Requirement for high-capacity storage and bandwidth

The VSaaS market faces significant challenges due to the need for high-capacity storage and bandwidth. This is especially true in environments with large-scale surveillance deployments or high-resolution cameras. To meet the storage requirements of VSaaS solutions, significant investments must be made in cloud infrastructure, data centers, and storage systems to handle the ever-increasing volumes of video footage.

Additionally, the cost of storing large amounts of video data in the cloud can quickly become prohibitively expensive, particularly for organizations with extensive surveillance networks or regulatory requirements for long-term data retention.

Impact of Smart Cities on the Video Surveillance as a Service Market

Vsaas Market Ecosystem

The VSaaS market is dominated by established and financially sound manufacturers with extensive experience in the industry. These companies have diversified product portfolios, cutting-edge technologies, and strong global sales and marketing networks. Leading players in the market include ADT from the US, Johnson Controls from Ireland, Axis Communication AB from Sweden, Motorola Solutions, Inc. from the US, and Securitas AB from Sweden.

Based on the type, Hosted in VSaaS market to hold the highest market share during the forecast period.

The VSaaS market for hosted services is growing due to several key factors. Firstly, hosted VSaaS solutions offer businesses a convenient and cost-effective alternative to traditional on-premises surveillance systems. With hosted services, companies can leverage cloud infrastructure for storage, processing, and management, eliminating the need for upfront investments in hardware and infrastructure.

Additionally, hosted VSaaS solutions provide scalability, allowing businesses to quickly expand their surveillance systems without physical hardware limitations. Moreover, hosted services offer flexibility, enabling enterprises to access video feeds and analytics from anywhere with an internet connection, facilitating remote monitoring and management.

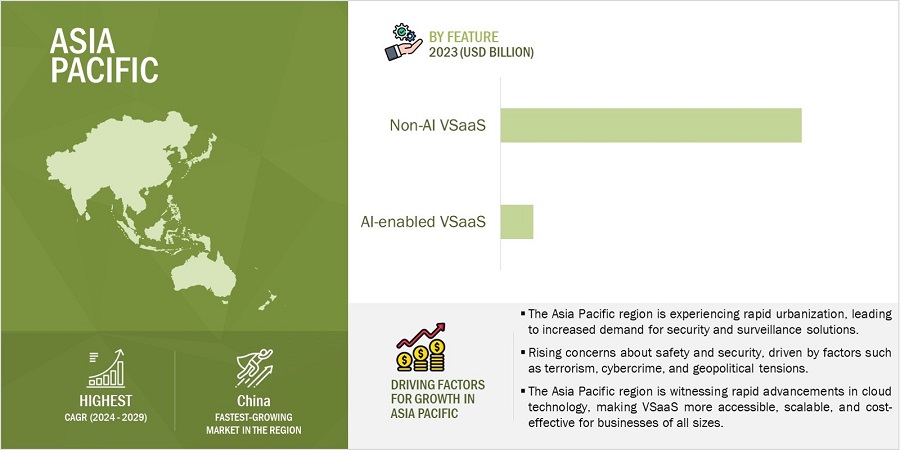

Based on the feature, the VSaaS market for Non-AI VSaaS to hold the highest market share during the forecast period.

The VSaaS market for non-AI solutions is growing for several reasons. Firstly, Non-AI VSaaS solutions offer reliability and simplicity, making them accessible to businesses that may not require or be ready for the advanced capabilities of AI-powered analytics.

These solutions provide essential video surveillance functionalities, such as remote monitoring, recording, and playback, without the complexities associated with AI algorithms. Additionally, Non-AI VSaaS solutions are often more affordable and more accessible to deploy than AI-enabled counterparts, making them attractive to small and medium-sized businesses with budget constraints or limited technical expertise.

Based on AI visual analysis, the VSaaS market for object detection & recognition to hold the highest market share during the forecast period.

The VSaaS market for object detection and recognition is experiencing significant growth due to its ability to enhance security, operational efficiency, and customer experience across various industries. Object detection and recognition technologies leverage advanced algorithms, such as deep learning and computer vision, to accurately identify and classify objects in real-time video streams.

This enables businesses to detect and respond to security threats more effectively, whether it's identifying unauthorized individuals, detecting intrusions, or recognizing suspicious behavior. Additionally, object detection and recognition can be applied to optimize operations in retail, manufacturing, transportation, and other sectors by tracking inventory, monitoring production processes, and analyzing customer behavior.

Based on vertical, the VSaaS for commercial holds the highest market share during the forecast period.

The VSaaS market for commercial verticals is experiencing notable growth due to several key factors. Firstly, businesses across various industries increasingly prioritize security and surveillance to safeguard assets, protect employees, and mitigate risks such as theft, vandalism, and liability claims.

VSaaS solutions offer commercial entities the flexibility to deploy and manage surveillance systems efficiently, regardless of their size or complexity, while also providing remote access and monitoring capabilities. Additionally, the scalability of VSaaS allows businesses to quickly expand their surveillance infrastructure as needed, accommodating growth and evolving security requirements.

VSaaS Industry Regional Analysis

VSaaS market in Asia Pacific to hold the highest market share during the forecast period

The VSaaS market in the Asia Pacific region is experiencing notable growth due to several key factors. Firstly, rapid urbanization and economic development in countries across the region drive the demand for security and surveillance solutions to address safety concerns and protect valuable assets.

Additionally, cloud technology and internet infrastructure advancements have made VSaaS more accessible and affordable for businesses of all sizes, particularly in emerging markets. Moreover, the increasing adoption of digital technologies and smart city initiatives further fuel the demand for advanced surveillance solutions in the region.

VSaaS Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top VSaaS Companies - Key Market Players

The VSaaS companies is dominated by players such as

- ADT (US),

- Johnson Controls (Ireland),

- Axis Communication AB (Sweden),

- Motorola Solutions, Inc. (US),

- Securitas AB (Sweden), and others.

VSaaS Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 5.0 billion in 2024 |

| Projected Market Size | USD 10.7 billion by 2029 |

| VSaaS Market Growth Rate | CAGR of 16.1% |

|

Market size available for years |

2020-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2029 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

By Type, By Feature, By AI Visual Analysis and By Vertical |

|

Geographies covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

The major market players include ADT (US), Johnson Controls (Ireland), Axis Communication AB (Sweden), Motorola Solutions, Inc. (US), Securitas AB (Sweden), Honeywell International Inc (US), Robert Bosch GmbH (Germany), Alarm.com (US), Hangzhou Hikvision Digital Technology Co., Ltd. (China), Arcules Inc (US). (Total 25 players are profiled) |

VSaaS Market Highlights

|

Segment |

Subsegment |

|

VSaaS Market, By Type |

|

|

VSaaS Market, By Feature |

|

|

VSaaS Market, By AI Visual Analysis |

|

|

VSaaS Market, By Vertical |

|

|

VSaaS Market, By Region |

|

Recent Developments in VSaaS Industry

- In November 2023, Johnson Controls announced a digital assessment tool for K-12 school districts to evaluate the physical security of their campuses, identify vulnerabilities and threats, and take appropriate action. With simplified access to data-driven insights, administrators can make more informed decisions to protect students and teachers from various threats.

- In September 2023, Johnson Controls announced its new OpenBlue Service: Ensuring Security Device Performance offering, designed to help customers enhance building safety, manage risk, and maximize the value of investments made in security technology. The offering combines the Johnson Controls OpenBlue suite of connected solutions, the ability to monitor and manage security devices across vendors with remote support services, meaningful insights from skilled engineers, and simplified integrated zero-trust cybersecurity protection.

- In March 2023, Johnson Controls announced the new IQ Pro Hybrid Security Panel, built for intrusion protection in commercial buildings, extensive residential facilities, campuses, and K-12 markets. The IQ Pro supports PowerG’s advanced sensor technology with an industry-leading wireless range and extensive life safety and security devices.

- In January 2023, ADT introduced new innovations in safety for home, mobile, and commercial applications with the ADT+ app. With it, customers can easily access and control their ADT devices, including motion sensors, door & window sensors, smart bulbs, smart locks, smoke/carbon monoxide detectors, and compatible Google Nest Cams, through an intuitive app experience.

- In January 2022, Robert Bosch GmbH launched the VSaaS service, which enables users to record, replay, monitor, and manage cloud video security footage from any place. VSaaS by Bosch is an open platform where it can be deployed with Bosch and third-party intelligent IP cameras to detect specific situations and trigger alarms.

Frequently Asked Questions:

What are the major driving factors and opportunities in the VSaaS market?

Some of the major driving factors for the growth of this market include Increasing adoption of IoT remote monitoring technologies, Rising investment in hyperscale cloud computing infrastructure, Growing emphasis on installing intelligent security systems, and Increasing popularity of video analytics solutions. Moreover, Rapid advancement in artificial intelligence technology, Proliferation of smart city initiatives, and Increased demand for cloud-based surveillance systems in healthcare and retail sectors are critical opportunities for the VSaaS market.

Which region is expected to hold the highest market share?

The growth of the VSaaS market in the Asia Pacific region is particularly pronounced due to several key factors. Firstly, the region's rapid urbanization and economic development have led to increased investments in security and surveillance infrastructure across various industries. Additionally, the widespread adoption of digital technologies, coupled with advancements in cloud computing and internet connectivity, has made VSaaS more accessible and cost-effective for businesses of all sizes. Furthermore, rising concerns about safety, security, and regulatory compliance drive demand for modern surveillance solutions, including VSaaS, to address evolving security threats and operational challenges.

Who are the leading players in the global VSaaS market?

Companies such as ADT (US), Johnson Controls (Ireland), Axis Communication AB (Sweden), Motorola Solutions, Inc. (US), and Securitas AB (Sweden) are the leading players in the market.

What are some of the technological advancements in the market?

Technological advancements in the VSaaS market are rapidly transforming the video surveillance landscape, enhancing security capabilities and operational efficiency. One significant advancement is integrating artificial intelligence (AI) and machine learning algorithms into VSaaS solutions. AI-powered analytics enable real-time object detection, facial recognition, and behavior analysis, allowing businesses to automate threat detection, reduce false alarms, and extract valuable insights from video data. Additionally, advancements in camera technology, such as higher resolution sensors, improved low-light performance, and edge computing capabilities, further enhance the accuracy and effectiveness of VSaaS solutions.

What is the impact of the global recession on the market?

The VSaaS market is expected to be adversely impacted by the recession and rising inflation in 2024. The market growth primarily depends on adopting video surveillance services, which rely on camera and cloud storage, the primary components of VSaaS. With the increased inflation, interest rates, and unemployment, the demand for VSaaS solutions from consumers and enterprises is bound to be less, affecting product development and investments. Due to the recession, verticals, such as industrial, military & defense, and commercial use VSaaS, would have low CAPEX spending. The demand for VSaaS across verticals depends primarily on CAPEX by organizations for constructing, rebuilding, or upgrading their technology solutions. The recession affects the amount of CAPEX spending and the company’s sales and profitability. There can be no assurance that existing capital spending will continue or that spending will not decrease during the economic downturn. This will hamper the adoption of VSaaS in commercial and residential applications.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing adoption of IoT remote monitoring technologies- Rising investment in hyperscale cloud computing infrastructure- Burgeoning demand for intelligent security systems- Increasing deployment of video analytics technologyRESTRAINTS- Concerns regarding data privacy and security- Complexities in integrating VSaaS into existing infrastructure- Delays in video transmission due to poor internet connectionOPPORTUNITIES- Rapid advancement in artificial intelligence technology- Proliferation of smart city initiatives- Increased demand for cloud-based surveillance systems in healthcare and retail sectorsCHALLENGES- High cost of cloud-based data storage- Interoperability and vendor lock-in issues

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.4 PRICING ANALYSISAVERAGE SELLING PRICE OF VSAAS SOLUTIONS OFFERED BY KEY PLAYERS, BY VERTICALAVERAGE SELLING PRICE OF VSAAS CAMERAS, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

-

5.8 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Cloud computing- Video management software (VMS)- Artificial intelligence (AI)- Video analyticsCOMPLEMENTARY TECHNOLOGIES- Access control systems- Alarm systems- Networking infrastructure- Storage solutionsADJACENT TECHNOLOGIES- Internet of Things (IoT)- Big data analytics- Cybersecurity solutions- Biometric authentication

-

5.9 PATENT ANALYSIS

-

5.10 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

- 5.11 KEY CONFERENCES AND EVENTS, 2024–2025

-

5.12 CASE STUDY ANALYSISAMAZON ADOPTS EAGLE EYE NETWORKS’ ADVANCED ANALYTICS SOLUTIONS TO ENHANCE REMOTE MONITORINGMCDONALD'S IMPLEMENTS VERKADA'S CLOUD-BASED SURVEILLANCE SYSTEMS TO STREAMLINE SECURITY OPERATIONSMARRIOTT INTERNATIONAL ADOPTS GENETEC’S INTEGRATED SURVEILLANCE PLATFORMS TO INCREASE SECURITY AND OPERATIONAL EFFICIENCYWALMART LEVERAGES AVIGILON CORPORATION'S CLOUD-BASED SURVEILLANCE SOLUTIONS TO PROTECT RETAIL STORES, DISTRIBUTION CENTERS, AND CORPORATE FACILITIESGOOGLE PARTNERS WITH CAMCLOUD TO DEPLOY CLOUD-BASED SURVEILLANCE PLATFORMS IN DATA CENTERS AND OFFICE CAMPUSES TO ENHANCE SECURITY

-

5.13 TARIFF AND REGULATORY LANDSCAPETARIFF ANALYSISREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDSGOVERNMENT REGULATIONS

-

5.14 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

- 6.2 GUN DETECTION

- 6.3 INDUSTRIAL TEMPERATURE MONITORING

- 6.4 SMOKE & FIRE DETECTION

- 6.5 FALSE ALARM FILTERING

- 6.6 VEHICLE IDENTIFICATION & NUMBER PLATE MONITORING

- 6.7 PARKING MONITORING

- 7.1 INTRODUCTION

-

7.2 HOSTEDDEPLOYMENT IN RETAIL STORES TO PREVENT THEFT TO FOSTER SEGMENTAL GROWTH

-

7.3 MANAGEDRELIANCE ON OUTSOURCING TO FOCUS MORE ON CORE OPERATIONS TO ACCELERATE SEGMENTAL GROWTH

-

7.4 HYBRIDADOPTION IN INDUSTRIES WITH BANDWIDTH LIMITATIONS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 8.1 INTRODUCTION

-

8.2 AI-ENABLED VSAASADVANCED ANALYTICS FUNCTIONALITIES TO BOOST SEGMENTAL GROWTH

-

8.3 NON-AI VSAASACCESSIBILITY AND EASE OF IMPLEMENTATION TO EXPEDITE SEGMENTAL GROWTH

- 9.1 INTRODUCTION

-

9.2 OBJECT DETECTION & RECOGNITIONRELIANCE ON AI-ENABLED VSAAS TO AUTOMATE SURVEILLANCE TASKS TO FUEL SEGMENTAL GROWTH

-

9.3 INTRUSION DETECTIONADOPTION OF ADVANCED ANALYTICS TECHNOLOGIES TO IDENTIFY UNAUTHORIZED ACCESS TO DRIVE MARKET

-

9.4 FACIAL RECOGNITIONUSE OF AI-ENABLED VSAAS SOLUTIONS IN TRANSPORTATION HUBS TO ENHANCE PASSENGER SAFETY TO EXPEDITE SEGMENTAL GROWTH

-

9.5 ANOMALY DETECTIONDEPLOYMENT OF VSAAS TECHNOLOGY TO DETECT UNUSUAL EVENTS OR PATTERNS IN VIDEO FEEDS TO PROPEL MARKET

- 10.1 INTRODUCTION

-

10.2 COMMERCIALRETAIL STORES & MALLS- Adoption of real-time monitoring solutions in retail sector to increase security and operational efficiency to drive marketENTERPRISES & DATA CENTERS- Reliance on AI-enabled surveillance tools to prevent unauthorized access across IT firms to boost segmental growthBANKING & FINANCE BUILDINGS- Regulatory requirements for continuous monitoring of ATMs to contribute to segmental growthHOSPITALITY CENTERS- Use of cloud video surveillance solutions to enhance guest safety and prevent theft to facilitate segmental growthWAREHOUSES- Adoption of video analytics solutions to track movement of goods and detect inventory anomalies to fuel segmental growth

-

10.3 RESIDENTIALINTRODUCTION OF SMART HOME DEVICES TO INCREASE SECURITY TO ACCELERATE SEGMENTAL GROWTH

-

10.4 INDUSTRIALMANUFACTURING FACILITIES- Installation of cutting-edge video surveillance solutions to detect production line anomalies to facilitate segmental growthCONSTRUCTION SITES- Increasing demand for hazard detection solutions in construction site to prevent accidents to expedite segmental growth

-

10.5 MILITARY & DEFENSEPRISON & CORRECTION FACILITIES- Use of intelligent video analytics solutions to detect suspicious behavior and inmate violence to fuel segmental growthLAW ENFORCEMENT- Adoption of surveillance systems to prevent vandalism and theft to segmental growthBORDER SURVEILLANCE- Employment of video analytics tools to ensure real-time border monitoring to drive marketCOASTAL SURVEILLANCE- Challenges associated with illegal immigration and smuggling to foster segmental growth

-

10.6 INFRASTRUCTURETRANSPORTATION & CITY SURVEILLANCE- Reliance on intelligent video analytics to reduce safety events among drivers to boost segmental growthPUBLIC PLACES- Need for real-time surveillance to identify and respond to security threats promptly to propel marketUTILITIES- Requirement for surveillance systems to ensure compliance with regulatory requirements to facilitate segmental growth

-

10.7 PUBLIC FACILITIESHEALTHCARE BUILDINGS- Need for patient remote monitoring solutions to drive marketEDUCATIONAL BUILDINGS- Adoption of comprehensive security measures to establish secure learning environments to boost segmental growthGOVERNMENT BUILDINGS- Need for surveillance solutions to protect sensitive government information to contribute to segmental growthRELIGIOUS BUILDINGS- Adoption of intelligent video analytics solutions to safeguard valuable religious artifacts to drive market

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICARECESSION IMPACT ON VSAAS MARKET IN NORTH AMERICAUS- Substantial investment in security infrastructure to contribute to market growthCANADA- Increased allocation of budgets to enhance remote monitoring capabilities to foster market growthMEXICO- High emphasis on combating crimes and improving public safety to accelerate market growth

-

11.3 EUROPERECESSION IMPACT ON VSAAS MARKET IN EUROPEUK- Increasing adoption of could-based monitoring systems to improve situational awareness to propel marketGERMANY- Rising emphasis on meeting stringent privacy and security standards to augment market growthFRANCE- Surging demand for advanced surveillance technologies to foster market growthREST OF EUROPE

-

11.4 ASIA PACIFICRECESSION IMPACT ON VSAAS MARKET IN ASIA PACIFICCHINA- Increasing development of smart cities to contribute to market growthJAPAN- Rising emphasis on crime prevention and disaster management to drive marketSOUTH KOREA- Growing adoption of AI video surveillance in smart city projects to fuel market growthINDIA- Increasing development of transportation networks to accelerate market growthREST OF ASIA PACIFIC

-

11.5 ROWRECESSION IMPACT ON VSAAS MARKET IN ROWMIDDLE EAST- Utilization of cloud-based monitoring solutions in urban areas to enhance public safety to facilitate market growthSOUTH AMERICA- Adoption of innovative surveillance solutions in smart cities and urban areas to drive marketAFRICA- Rise in terrorism and civil unrest to contribute to market growth

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2019–2023

- 12.3 REVENUE ANALYSIS, 2019–2023

- 12.4 MARKET SHARE ANALYSIS, 2023

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

-

12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2023- Overall footprint- Type footprint- AI visual analysis footprint- Feature footprint- Vertical footprint- Region footprint

-

12.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: START-UPS/SMES, 2023- List of key start-ups/SMEs- Competitive benchmarking of key start-ups/SMEs

-

12.9 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALS

-

13.1 KEY PLAYERSADT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewJOHNSON CONTROLS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAXIS COMMUNICATIONS AB- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMOTOROLA SOLUTIONS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSECURITAS AB- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewROBERT BOSCH GMBH- Business overview- Products/Solutions/Services offered- Recent developmentsHONEYWELL INTERNATIONAL INC.- Business overview- Products/Solutions/Services offered- Recent developmentsALARM.COM- Business overview- Products/Solutions/Services offered- Recent developmentsHANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsARCULES, INC.- Business overview- Products/solutions/services offered- Recent developments

-

13.2 OTHER PLAYERSDURANCEAGLE EYE NETWORKSGENETEC INC.PACIFIC CONTROLSARLOMOBOTIXMORPHEANVERKADA INC.VIVINT, INC.CAMIOLOG, INC.IVIDEONIRONYUN USA, INC.SOLINK CORP.3DEYECAMCLOUD

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

- TABLE 1 VSAAS MARKET: RISK ASSESSMENT

- TABLE 2 PARAMETERS CONSIDERED TO ANALYZE RECESSION IMPACT ON VSAAS MARKET

- TABLE 3 AVERAGE SELLING PRICE OF VSAAS SOLUTIONS OFFERED BY KEY PLAYERS, BY VERTICAL (USD)

- TABLE 4 AVERAGE SELLING PRICE OF VSAAS CAMERAS, BY REGION (USD)

- TABLE 5 ROLE OF COMPANIES IN VSAAS ECOSYSTEM

- TABLE 6 LIST OF PATENTS, 2021–2024

- TABLE 7 IMPORT DATA FOR HS CODE 852580-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023 (USD MILLION)

- TABLE 8 EXPORT DATA FOR HS CODE 852580-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023 (USD MILLION)

- TABLE 9 LIST OF KEY CONFERENCES AND EVENTS, 2024–2025

- TABLE 10 MFN TARIFF FOR HS CODE 852580-COMPLIANT PRODUCTS EXPORTED BY US

- TABLE 11 MFN TARIFF FOR HS CODE 852580-COMPLIANT PRODUCTS EXPORTED BY CHINA

- TABLE 12 MFN TARIFF FOR HS CODE 852580-COMPLIANT PRODUCTS EXPORTED BY JAPAN

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 VSAAS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR THREE KEY VERTICALS (%)

- TABLE 19 KEY BUYING CRITERIA FOR THREE KEY VERTICALS

- TABLE 20 VSAAS MARKET, BY TYPE, 2020–2023 (USD BILLION)

- TABLE 21 VSAAS MARKET, BY TYPE, 2024–2029 (USD BILLION)

- TABLE 22 HOSTED: VSAAS MARKET, BY FEATURE, 2020–2023 (USD BILLION)

- TABLE 23 HOSTED: VSAAS MARKET, BY FEATURE, 2024–2029 (USD BILLION)

- TABLE 24 MANAGED: VSAAS MARKET, BY FEATURE, 2020–2023 (USD BILLION)

- TABLE 25 MANAGED: VSAAS MARKET, BY FEATURE, 2024–2029 (USD BILLION)

- TABLE 26 HYBRID: VSAAS MARKET, BY FEATURE, 2020–2023 (USD BILLION)

- TABLE 27 HYBRID: VSAAS MARKET, BY FEATURE, 2024–2029 (USD BILLION)

- TABLE 28 VSAAS MARKET, BY FEATURE, 2020–2023 (USD BILLION)

- TABLE 29 VSAAS MARKET, BY FEATURE, 2024–2029 (USD BILLION)

- TABLE 30 AI-ENABLED VSAAS: VSAAS MARKET, BY TYPE, 2020–2023 (USD BILLION)

- TABLE 31 AI-ENABLED VSAAS: VSAAS MARKET, BY TYPE, 2024–2029 (USD BILLION)

- TABLE 32 AI-ENABLED VSAAS: VSAAS MARKET, BY REGION, 2020–2023 (USD BILLION)

- TABLE 33 AI-ENABLED VSAAS: VSAAS MARKET, BY REGION, 2024–2029 (USD BILLION)

- TABLE 34 AI-ENABLED VSAAS: VSAAS MARKET, BY VERTICAL, 2020–2023 (USD BILLION)

- TABLE 35 AI-ENABLED VSAAS: VSAAS MARKET, BY VERTICAL, 2024–2029 (USD BILLION)

- TABLE 36 NON-AI VSAAS: VSAAS MARKET, BY TYPE, 2020–2023 (USD BILLION)

- TABLE 37 NON-AI VSAAS: VSAAS MARKET, BY TYPE, 2024–2029 (USD BILLION)

- TABLE 38 NON-AI VSAAS: VSAAS MARKET, BY REGION, 2020–2023 (USD BILLION)

- TABLE 39 NON-AI VSAAS: VSAAS MARKET, BY REGION, 2024–2029 (USD BILLION)

- TABLE 40 NON-AI VSAAS: VSAAS MARKET, BY VERTICAL, 2020–2023 (USD BILLION)

- TABLE 41 NON-AI VSAAS: VSAAS MARKET, BY VERTICAL, 2024–2029 (USD BILLION)

- TABLE 42 VSAAS MARKET, BY AI VISUAL ANALYSIS, 2020–2023 (USD MILLION)

- TABLE 43 VSAAS MARKET, BY AI VISUAL ANALYSIS, 2024–2029 (USD MILLION)

- TABLE 44 VSAAS MARKET, BY VERTICAL, 2020–2023 (USD BILLION)

- TABLE 45 VSAAS MARKET, BY VERTICAL, 2024–2029 (USD BILLION)

- TABLE 46 COMMERCIAL: VSAAS MARKET, BY FEATURE, 2020–2023 (USD BILLION)

- TABLE 47 COMMERCIAL: VSAAS MARKET, BY FEATURE, 2024–2029 (USD BILLION)

- TABLE 48 COMMERCIAL: AI-ENABLED VSAAS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 49 COMMERCIAL: AI-ENABLED VSAAS MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 50 COMMERCIAL: NON-AI VSAAS MARKET, BY APPLICATION, 2020–2023 (USD BILLION)

- TABLE 51 COMMERCIAL: NON-AI VSAAS MARKET, BY APPLICATION, 2024–2029 (USD BILLION)

- TABLE 52 RESIDENTIAL: VSAAS MARKET, BY FEATURE, 2020–2023 (USD BILLION)

- TABLE 53 RESIDENTIAL: VSAAS MARKET, BY FEATURE, 2024–2029 (USD BILLION)

- TABLE 54 INDUSTRIAL: VSAAS MARKET, BY FEATURE, 2020–2023 (USD BILLION)

- TABLE 55 INDUSTRIAL: VSAAS MARKET, BY FEATURE, 2024–2029 (USD BILLION)

- TABLE 56 INDUSTRIAL: AI-ENABLED VSAAS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 57 INDUSTRIAL: AI-ENABLED VSAAS MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 58 INDUSTRIAL: NON-AI VSAAS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 59 INDUSTRIAL: NON-AI VSAAS MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 60 MILITARY & DEFENSE: VSAAS MARKET, BY FEATURE, 2020–2023 (USD BILLION)

- TABLE 61 MILITARY & DEFENSE: VSAAS MARKET, BY FEATURE, 2024–2029 (USD BILLION)

- TABLE 62 MILITARY & DEFENSE: AI-ENABLED VSAAS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 63 MILITARY & DEFENSE: AI-ENABLED VSAAS MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 64 MILITARY & DEFENSE: NON-AI VSAAS MARKET, BY APPLICATION, 2020–2023 (USD BILLION)

- TABLE 65 MILITARY & DEFENSE: NON-AI VSAAS MARKET, BY APPLICATION, 2024–2029 (USD BILLION)

- TABLE 66 INFRASTRUCTURE: VSAAS MARKET, BY FEATURE, 2020–2023 (USD BILLION)

- TABLE 67 INFRASTRUCTURE: VSAAS MARKET, BY FEATURE, 2024–2029 (USD BILLION)

- TABLE 68 INFRASTRUCTURE: AI-ENABLED VSAAS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 69 INFRASTRUCTURE: AI-ENABLED VSAAS MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 70 INFRASTRUCTURE: NON-AI VSAAS MARKET, BY APPLICATION, 2020–2023 (USD BILLION)

- TABLE 71 INFRASTRUCTURE: NON-AI VSAAS MARKET, BY APPLICATION, 2024–2029 (USD BILLION)

- TABLE 72 PUBLIC FACILITIES: VSAAS MARKET, BY FEATURE, 2020–2023 (USD BILLION)

- TABLE 73 PUBLIC FACILITIES: VSAAS MARKET, BY FEATURE, 2024–2029 (USD BILLION)

- TABLE 74 PUBLIC FACILITIES: AI-ENABLED VSAAS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 75 PUBLIC FACILITIES: AI-ENABLED VSAAS MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 76 PUBLIC FACILITIES: NON-AI VSAAS MARKET, BY APPLICATION, 2020–2023 (USD BILLION)

- TABLE 77 PUBLIC FACILITIES: NON-AI VSAAS MARKET, BY APPLICATION, 2024–2029 (USD BILLION)

- TABLE 78 VSAAS MARKET, BY REGION, 2020–2023 (USD BILLION)

- TABLE 79 VSAAS MARKET, BY REGION, 2024–2029 (USD BILLION)

- TABLE 80 NORTH AMERICA: VSAAS MARKET, BY COUNTRY, 2020–2023 (USD BILLION)

- TABLE 81 NORTH AMERICA: VSAAS MARKET, BY COUNTRY, 2024–2029 (USD BILLION)

- TABLE 82 NORTH AMERICA: VSAAS MARKET, BY FEATURE, 2020–2023 (USD BILLION)

- TABLE 83 NORTH AMERICA: VSAAS MARKET, BY FEATURE, 2024–2029 (USD BILLION)

- TABLE 84 EUROPE: VSAAS MARKET, BY COUNTRY, 2020–2023 (USD BILLION)

- TABLE 85 EUROPE: VSAAS MARKET, BY COUNTRY, 2024–2029 (USD BILLION)

- TABLE 86 EUROPE: VSAAS MARKET, BY FEATURE, 2020–2023 (USD BILLION)

- TABLE 87 EUROPE: VSAAS MARKET, BY FEATURE, 2024–2029 (USD BILLION)

- TABLE 88 ASIA PACIFIC: VSAAS MARKET, BY COUNTRY, 2020–2023 (USD BILLION)

- TABLE 89 ASIA PACIFIC: VSAAS MARKET, BY COUNTRY, 2024–2029 (USD BILLION)

- TABLE 90 ASIA PACIFIC: VSAAS MARKET, BY FEATURE, 2020–2023 (USD BILLION)

- TABLE 91 ASIA PACIFIC: VSAAS MARKET, BY FEATURE, 2024–2029 (USD BILLION)

- TABLE 92 ROW: VSAAS MARKET, BY REGION, 2020–2023 (USD BILLION)

- TABLE 93 ROW: VSAAS MARKET, BY REGION, 2024–2029 (USD BILLION)

- TABLE 94 ROW: VSAAS MARKET, BY FEATURE, 2020–2023 (USD BILLION)

- TABLE 95 ROW: VSAAS MARKET, BY FEATURE, 2024–2029 (USD BILLION)

- TABLE 96 VSAAS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2019–2023

- TABLE 97 VSAAS MARKET: DEGREE OF COMPETITION, 2023

- TABLE 98 VSAAS MARKET: TYPE FOOTPRINT

- TABLE 99 VSAAS MARKET: AI VISUAL ANALYSIS FOOTPRINT

- TABLE 100 VSAAS MARKET: FEATURE FOOTPRINT

- TABLE 101 VSAAS MARKET: VERTICAL FOOTPRINT

- TABLE 102 VSAAS MARKET: REGION FOOTPRINT

- TABLE 103 VSAAS MARKET: LIST OF KEY START-UPS/SMES

- TABLE 104 VSAAS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 105 VSAAS MARKET: PRODUCT LAUNCHES, JANUARY 2019–DECEMBER 2023

- TABLE 106 VSAAS MARKET: DEALS, JANUARY 2019–DECEMBER 2023

- TABLE 107 ADT: COMPANY OVERVIEW

- TABLE 108 ADT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 109 ADT: PRODUCT LAUNCHES

- TABLE 110 ADT: DEALS

- TABLE 111 JOHNSON CONTROLS: COMPANY OVERVIEW

- TABLE 112 JOHNSON CONTROLS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 113 JOHNSON CONTROLS: PRODUCT LAUNCHES

- TABLE 114 JOHNSON CONTROLS: DEALS

- TABLE 115 AXIS COMMUNICATIONS AB: COMPANY OVERVIEW

- TABLE 116 AXIS COMMUNICATIONS AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 117 AXIS COMMUNICATIONS AB: PRODUCT LAUNCHES

- TABLE 118 AXIS COMMUNICATIONS AB: DEALS

- TABLE 119 MOTOROLA SOLUTIONS, INC.: COMPANY OVERVIEW

- TABLE 120 MOTOROLA SOLUTIONS, INC.: PRODUCT/SOLUTION/SERVICE OFFERED

- TABLE 121 MOTOROLA SOLUTIONS, INC.: PRODUCT LAUNCHES

- TABLE 122 SECURITAS AB: COMPANY OVERVIEW

- TABLE 123 SECURITAS AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 124 SECURITAS AB: DEALS

- TABLE 125 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 126 ROBERT BOSCH GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 127 ROBERT BOSCH GMBH: PRODUCT LAUNCHES

- TABLE 128 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 129 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 130 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 131 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 132 ALARM.COM: COMPANY OVERVIEW

- TABLE 133 ALARM.COM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 134 ALARM.COM: PRODUCT LAUNCHES

- TABLE 135 ALARM.COM: DEALS

- TABLE 136 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 137 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 138 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES

- TABLE 139 ARCULES, INC.: COMPANY OVERVIEW

- TABLE 140 ARCULES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 ARCULES, INC.: PRODUCT LAUNCHES

- TABLE 142 ARCULES, INC.: EXPANSIONS

- FIGURE 1 VSAAS MARKET SEGMENTATION

- FIGURE 2 VSAAS MARKET: RESEARCH DESIGN

- FIGURE 3 VSAAS MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 4 VSAAS MARKET: REVENUE FROM SALES OF VSAAS PRODUCTS AND SOLUTIONS

- FIGURE 5 VSAAS MARKET: BOTTOM-UP APPROACH

- FIGURE 6 VSAAS MARKET: TOP-DOWN APPROACH

- FIGURE 7 VSAAS MARKET: DATA TRIANGULATION

- FIGURE 8 VSAAS MARKET: RESEARCH ASSUMPTIONS

- FIGURE 9 HOSTED TYPE TO HOLD LARGEST SHARE OF VSAAS MARKET IN 2029

- FIGURE 10 NON-AI VSAAS TO HOLD DOMINATE MARKET, BY FEATURE, DURING FORECAST PERIOD

- FIGURE 11 OBJECT DETECTION & RECOGNITION TO EXHIBIT HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 12 COMMERCIAL VERTICAL TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 13 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF VSAAS MARKET IN 2023

- FIGURE 14 INCREASING BURDEN OF SECURITY THREATS AND CRIMINAL ACTIVITIES TO CONTRIBUTE TO MARKET GROWTH

- FIGURE 15 CHINA AND NON-AI VSAAS TO HOLD LARGEST SHARES OF ASIA PACIFIC VSAAS MARKET IN 2024

- FIGURE 16 US TO HOLD LARGEST SHARE OF VSAAS MARKET IN 2029

- FIGURE 17 CHINA TO RECORD HIGHEST CAGR IN VSAAS MARKET FROM 2024 TO 2029

- FIGURE 18 VSAAS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 IMPACT ANALYSIS: DRIVERS

- FIGURE 20 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 21 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 22 IMPACT ANALYSIS: CHALLENGES

- FIGURE 23 VSAAS MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 24 AVERAGE SELLING PRICE OF VSAAS SOLUTIONS OFFERED BY KEY PLAYERS, BY VERTICAL (USD)

- FIGURE 25 AVERAGE SELLING PRICE OF VSAAS CAMERAS, BY REGION, 2020–2023 (USD)

- FIGURE 26 VSAAS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 27 VSAAS ECOSYSTEM

- FIGURE 28 INVESTMENT AND FUNDING SCENARIO, 2018–2023

- FIGURE 29 VSAAS MARKET: PATENTS APPLIED AND GRANTED, 2013–2023

- FIGURE 30 IMPORT DATA FOR HS CODE 852580-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023 (USD MILLION)

- FIGURE 31 EXPORT DATA FOR HS CODE 852580-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023 (USD MILLION)

- FIGURE 32 VSAAS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR THREE KEY VERTICALS

- FIGURE 34 KEY BUYING CRITERIA FOR THREE KEY VERTICALS

- FIGURE 35 HOSTED TYPE TO DOMINATE VSAAS MARKET DURING FORECAST PERIOD

- FIGURE 36 NON-AI VSAAS FEATURE TO CAPTURE LARGER MARKET SHARE THAN AI-ENABLED VSAAS FEATURE IN 2029

- FIGURE 37 OBJECT DETECTION & RECOGNITION SEGMENT TO DOMINATE MARKET, BY AI VISUAL ANALYSIS, DURING FORECAST PERIOD

- FIGURE 38 COMMERCIAL VERTICAL TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 39 VSAAS MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR BETWEEN 2024 AND 2029

- FIGURE 40 NORTH AMERICA: VSAAS MARKET SNAPSHOT

- FIGURE 41 EUROPE: VSAAS MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: VSAAS MARKET SNAPSHOT

- FIGURE 43 REVENUE ANALYSIS OF FOUR KEY PLAYERS, 2019–2023

- FIGURE 44 VSAAS MARKET SHARE ANALYSIS, 2023

- FIGURE 45 COMPANY VALUATION (USD MILLION), 2023

- FIGURE 46 FINANCIAL METRICS (EV/EBITDA), 2023

- FIGURE 47 BRAND/PRODUCT COMPARISON

- FIGURE 48 VSAAS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 49 VSAAS MARKET: OVERALL FOOTPRINT

- FIGURE 50 VSAAS MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- FIGURE 51 ADT: COMPANY SNAPSHOT

- FIGURE 52 JOHNSON CONTROLS: COMPANY SNAPSHOT

- FIGURE 53 MOTOROLA SOLUTIONS, INC.: COMPANY SNAPSHOT

- FIGURE 54 SECURITAS AB: COMPANY SNAPSHOT

- FIGURE 55 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 56 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 57 ALARM.COM: COMPANY SNAPSHOT

- FIGURE 58 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

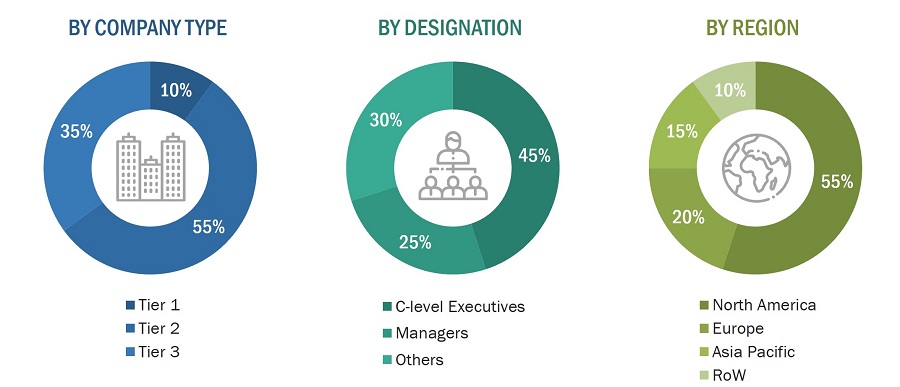

The study involved four major activities in estimating the current size of the VSaaS market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study included corporate filings (such as annual reports, investor presentations, and financial statements), trade, business, and professional associations, white papers, certified publications, articles by recognized authors, directories, and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of major secondary sources

|

SOURCE |

WEB LINK |

|

Federal Communications Commission (FCC) |

|

|

National Institute of Standards and Technology (NIST) |

|

|

Ministry of Electronics and Information Technology (MeitY) |

|

|

Ministry of Industry and Information Technology (MIIT) |

|

|

Ministry of Internal Affairs and Communications (MIC) |

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the VSaaS market through secondary research. Several primary interviews were conducted with experts from both demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the VSaaS market and its various dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire procedure involved the study of annual and financial reports of top players and extensive interviews with industry leaders such as chief executive officers (CEOs), vice presidents (VPs), directors, and marketing executives. All percentage shares and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Bottom-Up Approach

The bottom-up approach was used to arrive at the overall size of the VSaaS market from the revenues of the key players and their shares in the market. The overall market size was calculated based on the revenues of the key players identified in the market.

- Identifying various verticals using or expected to implement VSaaS

- Analyzing each vertical, along with the major related companies and VSaaS providers

- Estimating the VSaaS market for verticals

- Understanding the demand generated by companies operating across different verticals

- Tracking the ongoing and upcoming implementation of projects based on VSaaS technology by vertical and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to understand the type of VSaaS products designed and developed vertically, helping analyze the breakdown of the scope of work carried out by each major company in the VSaaS market

- Arriving at the market estimates by analyzing VSaaS companies as per their countries and subsequently combining this information to arrive at the market estimates by region

- Verifying and cross-checking the estimates at every level through discussions with the key opinion leaders, including CXOs, directors, and operations managers, and finally with domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research.

To calculate the market size of specific segments, the most appropriate immediate parent market size has been used to implement the top-down approach. The top-down approach was implemented for the data extracted from the secondary research to validate the market size obtained.

The market share of each company was estimated to verify the revenue shares used earlier in the top-down approach. The overall parent market size and individual market sizes were determined and confirmed in this study by the data triangulation method and the validation of data through primaries. The data triangulation method in this study is explained in the next section.

- Focusing on top-line investments and expenditures being made in the ecosystems of various verticals

- Building and developing the information related to the market revenue generated by key VSaaS manufacturers

- Conducting multiple on-field discussions with the key opinion leaders involved in the development of VSaaS products in various verticals

- Estimating geographic splits using secondary sources based on various factors, such as the number of players in a specific country and region, the offering of VSaaS, and the level of solutions offered in verticals

- Considering the impact of the recession on the steps mentioned above

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation procedure has been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size has been validated using top-down and bottom-up approaches.

Market Definition

VSaaS encompasses a comprehensive set of measures, technologies, and practices designed to protect physical assets, facilities, and individuals from unauthorized access, theft, vandalism, and other potential threats. These solutions often include hardware and software components such as access control systems, surveillance cameras, perimeter barriers (e.g., fences, gates), alarm systems, biometric identification systems, and visitor management systems. The primary goal is to create a secure environment that deters intrusions, monitors activities, and responds promptly to security incidents. By deploying tailored physical VSaaS, organizations can safeguard their premises, assets, and personnel, mitigating risks, ensuring safety compliance, and maintaining operational continuity.

Key Stakeholders

- VSaaS providers

- Hardware manufacturers

- Cloud service providers

- End users

- System Integrators

- Resellers and distributors

- Regulatory bodies and compliance agencies

- Research institutions

- Industry associations and organizations

- Investors and financial institutions

Report Objectives

- To define, describe, and forecast the VSaaS market by type, feature, AI visual analysis, vertical, and region

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro markets concerning individual growth trends, prospects, and contributions to the total market

- To provide a detailed overview of the VSaaS market’s value chain, the ecosystem, technology trends, use cases, regulatory environment, and Porter’s five forces analysis for the market.

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market

- To analyze competitive developments, such as collaborations, partnerships, product developments, and research & development (R&D), in the market

- To analyze the impact of the recession on the VSaaS market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the VSaaS market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the VSaaS market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in VSaaS Market

I am a trade journalist and needed some key information for video surveillance security market, global and stateside for Security Sales & Integration Magazine. I can attribute quotes to your report. Will you work with me on this or other magazine articles?

IP cameras are gaining traction in the market as it offer greater flexibility in terms of remote surveillance applications, hence rapidly replacing analog cameras in market. Do you have IP camera shipments data in APAC regions?

I am particularly interested to see if this report covers wireless surveillance (i.e. data sent over mobile networks).

Trying to get more info about VSaaS Market. How can I access your report with low budget?

I will need a major discount in order to get my manager's approval for purchasing the report.

We will launch our security services this year in Zimbabwe. So want to understand the market in this country.

Interested in the relative growth between commercial, residential and industrial segments, as well as what other sub-segments in video surveillance market.

As a General Manager, I'm focus at quality services to provide fine products to costumers and the news technologies for security market. What are other applications that would impact our revenues? Who are the leading manufacturers for security market?

Hello, I have seen this report is dated from 2015. Have you done a recent update with data from 2017?

Focusing into new company and looking for market info on VSaaS - size for technology and service types.